Grocery Outlet (GO)

Grocery Outlet is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Grocery Outlet Will Underperform

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ:GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

- ROIC of 2.1% reflects management’s challenges in identifying attractive investment opportunities, and its decreasing returns suggest its historical profit centers are aging

- Commoditized inventory, bad unit economics, and high competition are reflected in its low gross margin of 30.3%

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

Grocery Outlet fails to meet our quality criteria. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Grocery Outlet

Why There Are Better Opportunities Than Grocery Outlet

Grocery Outlet is trading at $9.82 per share, or 12.5x forward P/E. We acknowledge that the current valuation is justified, but we’re passing on this stock for the time being.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Grocery Outlet (GO) Research Report: Q3 CY2025 Update

Discount grocery store chain Grocery Outlet (NASDAQ:GO) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 5.4% year on year to $1.17 billion. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $4.71 billion at the midpoint. Its non-GAAP profit of $0.21 per share was 11.5% above analysts’ consensus estimates.

Grocery Outlet (GO) Q3 CY2025 Highlights:

- Revenue: $1.17 billion vs analyst estimates of $1.18 billion (5.4% year-on-year growth, 0.8% miss)

- Adjusted EPS: $0.21 vs analyst estimates of $0.19 (11.5% beat)

- Adjusted EBITDA: $66.67 million vs analyst estimates of $67.47 million (5.7% margin, 1.2% miss)

- The company dropped its revenue guidance for the full year to $4.71 billion at the midpoint from $4.75 billion, a 0.8% decrease

- Management raised its full-year Adjusted EPS guidance to $0.79 at the midpoint, a 1.9% increase

- EBITDA guidance for the full year is $260 million at the midpoint, below analyst estimates of $264.7 million

- Operating Margin: 2%, down from 3.6% in the same quarter last year

- Free Cash Flow was -$21.57 million compared to -$19.34 million in the same quarter last year

- Locations: 563 at quarter end, up from 529 in the same quarter last year

- Same-Store Sales rose 1.2% year on year, in line with the same quarter last year

- Market Capitalization: $1.40 billion

Company Overview

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ:GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

Specifically, the company purchases closeout merchandise, excess inventory, and discontinued items from manufacturers and other retailers. The result is prices up to 60% less than regular supermarkets. The positive of this approach is low prices whereas the negative is less reliable selection. The core Grocery Outlet customer is a shopper who therefore values the savings and doesn’t mind some inventory inconsistency.

The size of the average Grocery Outlet store is around 18,000 square feet, which is much smaller than the traditional supermarket. The stores are typically located in strip malls or standalone buildings in suburban areas. Overall, the layout of a Grocery Outlet store is similar to a traditional supermarket, just smaller. Fresh produce is towards the front, meat and dairy is towards the back, and the center aisles of packaged goods fill the middle.

A unique feature of Grocery Outlet's layout is the "treasure hunt" section, located towards the front of the store. This section features unique and unusual products at even deeper discounts than the rest of the store. The selection in this section changes regularly, so customers may find potato chips one week and canned soup the next.

4. Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Grocery competitors with offering brand-name products at competitive prices include Walmart (NYSE:WMT), Dollar General (NYSE:DG), and Kroger (NYSE:KR)

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.57 billion in revenue over the past 12 months, Grocery Outlet is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

As you can see below, Grocery Outlet grew its sales at a decent 10.7% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, Grocery Outlet’s revenue grew by 5.4% year on year to $1.17 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a slight deceleration versus the last six years. Still, this projection is commendable and indicates the market sees success for its products.

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Grocery Outlet operated 563 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 10.8% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Grocery Outlet’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2% per year. This performance gives it the confidence to meaningfully expand its store base.

In the latest quarter, Grocery Outlet’s same-store sales rose 1.2% year on year. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Grocery Outlet has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 30.3% gross margin over the last two years.

When compared to other non-discretionary retailers, however, it’s a step above. That’s because non-discretionary retailers have structurally lower gross margins; they compete on the lowest price, sell products easily found elsewhere, and have high transportation costs to move goods. We believe the best metrics to assess these companies are free cash flow margin, operating leverage, and profit volatility, which account for their scale advantages and non-cyclical demand.

This quarter, Grocery Outlet’s gross profit margin was 30.4%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Grocery Outlet was profitable over the last two years but held back by its large cost base. Its average operating margin of 1.2% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Grocery Outlet’s operating margin decreased by 1.5 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Grocery Outlet’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Grocery Outlet generated an operating margin profit margin of 2%, down 1.7 percentage points year on year. Since Grocery Outlet’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

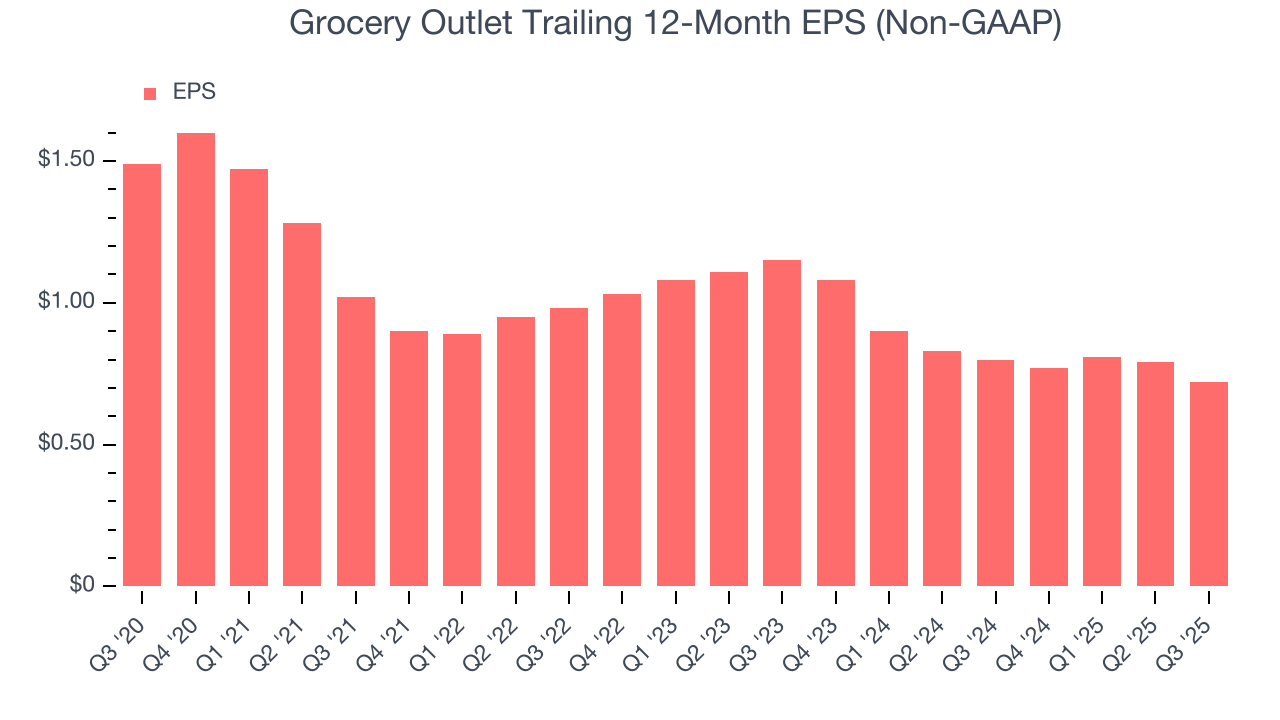

Sadly for Grocery Outlet, its EPS declined by 9.8% annually over the last three years while its revenue grew by 10%. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

In Q3, Grocery Outlet reported adjusted EPS of $0.21, down from $0.28 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Grocery Outlet’s full-year EPS of $0.72 to grow 12.6%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Grocery Outlet’s capital-intensive business model and investments in new physical locations have consumed many resources. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.27 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Grocery Outlet’s margin expanded by 1.3 percentage points over the last year. We have no doubt shareholders would like to continue seeing its cash conversion rise.

Grocery Outlet burned through $21.57 million of cash in Q3, equivalent to a negative 1.8% margin. The company’s cash burn was similar to its $19.34 million of lost cash in the same quarter last year.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Grocery Outlet historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Grocery Outlet burned through $28.29 million of cash over the last year, and its $1.81 billion of debt exceeds the $52.13 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Grocery Outlet’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Grocery Outlet until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

13. Key Takeaways from Grocery Outlet’s Q3 Results

It was good to see Grocery Outlet beat analysts’ EPS expectations this quarter. On the other hand, it lowered its full-year revenue and EBITDA guidance, falling short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.9% to $13.50 immediately following the results.

14. Is Now The Time To Buy Grocery Outlet?

Updated: February 26, 2026 at 9:54 PM EST

Are you wondering whether to buy Grocery Outlet or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Grocery Outlet falls short of our quality standards. Although its revenue growth was decent over the last three years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s new store openings have increased its brand equity, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses.

Grocery Outlet’s P/E ratio based on the next 12 months is 12.5x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $13.23 on the company (compared to the current share price of $9.82).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.