Monolithic Power Systems (MPWR)

Monolithic Power Systems is in a league of its own. Its rare ability to win market share while pumping out profits is a feature many competitors envy.― StockStory Analyst Team

1. News

2. Summary

Why We Like Monolithic Power Systems

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ:MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

- Market share has increased this cycle as its 27.9% annual revenue growth over the last five years was exceptional

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- Earnings per share have massively outperformed its peers over the last five years, increasing by 29.1% annually

Monolithic Power Systems is a top-tier company. The valuation looks fair based on its quality, and we think now is a favorable time to buy.

Why Is Now The Time To Buy Monolithic Power Systems?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Monolithic Power Systems?

At $1,147 per share, Monolithic Power Systems trades at 58.6x forward P/E. While the stock’s optically high multiple could cause short-term volatility, we think the valuation is reasonable given its quality characteristics.

Entry price may seem important in the moment, but our work shows that time and again, long-term market outperformance is determined by business quality rather than getting an absolute bargain on a stock.

3. Monolithic Power Systems (MPWR) Research Report: Q4 CY2025 Update

Power management chips maker Monolithic Power Systems (NASDAQ:MPWR) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 20.8% year on year to $751.2 million. On top of that, next quarter’s revenue guidance ($780 million at the midpoint) was surprisingly good and 5.7% above what analysts were expecting. Its non-GAAP profit of $4.79 per share was 1.1% above analysts’ consensus estimates.

Monolithic Power Systems (MPWR) Q4 CY2025 Highlights:

- Revenue: $751.2 million vs analyst estimates of $742.4 million (20.8% year-on-year growth, 1.2% beat)

- Adjusted EPS: $4.79 vs analyst estimates of $4.74 (1.1% beat)

- Adjusted Operating Income: $269 million vs analyst estimates of $263.7 million (35.8% margin, 2% beat)

- Revenue Guidance for Q1 CY2026 is $780 million at the midpoint, above analyst estimates of $738 million

- Operating Margin: 26.6%, in line with the same quarter last year

- Inventory Days Outstanding: 152, up from 139 in the previous quarter

- Market Capitalization: $54.46 billion

Company Overview

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ:MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

The company's power management solutions are essential components in a wide range of electronic products, from cloud servers and data centers to automotive systems, industrial equipment, and consumer devices. These integrated circuits (ICs) efficiently convert, control, and distribute power within electronic systems, helping customers achieve higher performance, smaller form factors, and improved energy efficiency.

Monolithic Power Systems differentiates itself through highly integrated single-chip designs that combine multiple functions into compact packages. Its Direct Current (DC) to DC converters are particularly valued for their high voltage operation, fast switching speeds, and energy efficiency—critical features for modern electronics that need to balance performance with power consumption. The company also produces lighting control ICs used in LCD backlighting systems for computers, televisions, and automotive displays.

When a smartphone manufacturer designs a new device, they might use Monolithic's power management ICs to efficiently distribute power from the battery to various components while minimizing heat generation and extending battery life. Similarly, data center operators rely on the company's solutions to power servers while reducing energy costs and improving reliability.

The company generates revenue by selling its semiconductor products through a combination of distributors, value-added resellers, and direct sales to original equipment manufacturers. With a global presence spanning Asia, Europe, and the United States, Monolithic maintains a technical sales force that works closely with customers' engineers to integrate its solutions into their designs. Asia represents its largest market, accounting for the majority of sales.

Monolithic Power Systems’ peers and competitors include Analog Devices (NASDAQ:ADI), Texas Instruments (NASDAQ:TXN), Skyworks (NASDAQ:SWKS), Infineon (XTRA:IFX), NXP Semiconductors NV (NASDAQ:NXPI), ON Semi (NASDAQ:ON), Marvell Technology (NASDAQ:MRVL), and Microchip (NASDAQ:MCHP).

4. Analog Semiconductors

Longer manufacturing duration allows analog chip makers to generate greater efficiencies, leading to structurally higher gross margins than their fabless digital peers. The downside of vertical integration is that cyclicality can be more pronounced for analog chipmakers, as capacity utilization upsides work in reverse during down periods.

5. Revenue Growth

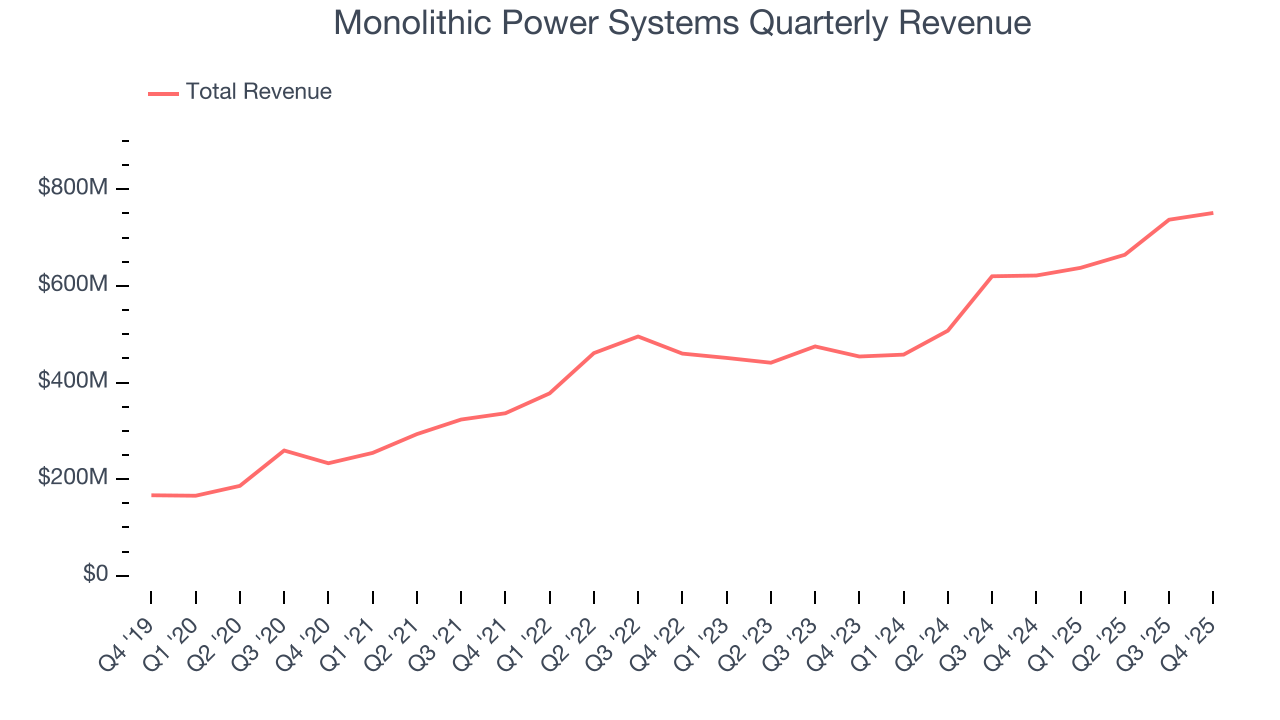

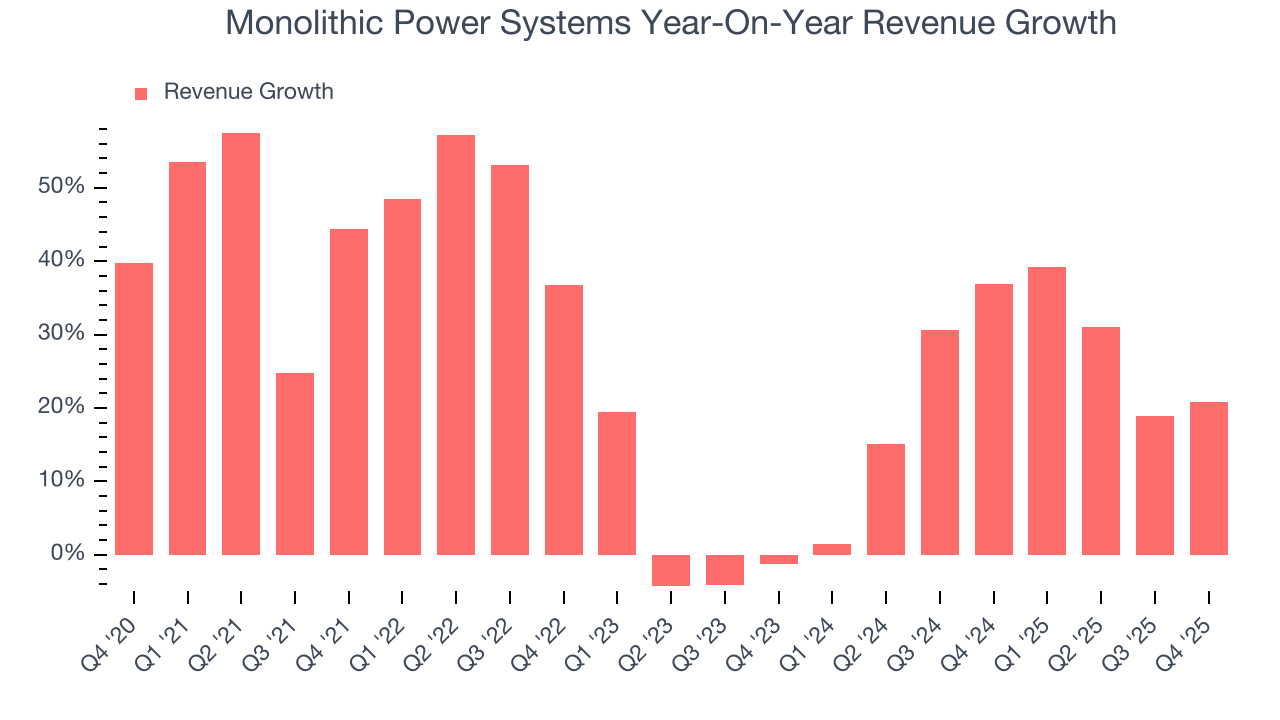

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Monolithic Power Systems’s sales grew at an incredible 27% compounded annual growth rate over the last five years. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Monolithic Power Systems’s annualized revenue growth of 23.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Monolithic Power Systems reported robust year-on-year revenue growth of 20.8%, and its $751.2 million of revenue topped Wall Street estimates by 1.2%. Beyond the beat, this marks 8 straight quarters of growth, showing that the current upcycle has had a good run - a typical upcycle usually lasts 8-10 quarters. Company management is currently guiding for a 22.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and implies the market is baking in some success for its newer products and services.

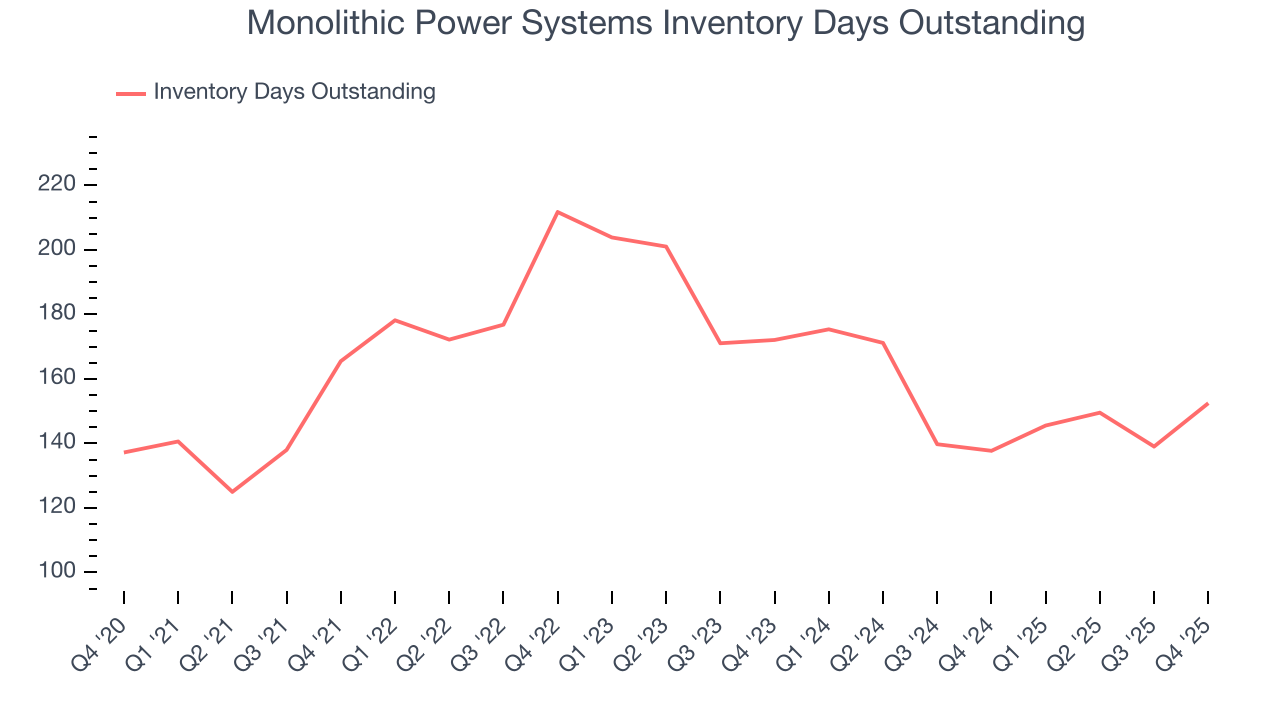

6. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Monolithic Power Systems’s DIO came in at 152, which is 11 days below its five-year average. These numbers show that despite the recent increase, there’s no indication of an excessive inventory buildup.

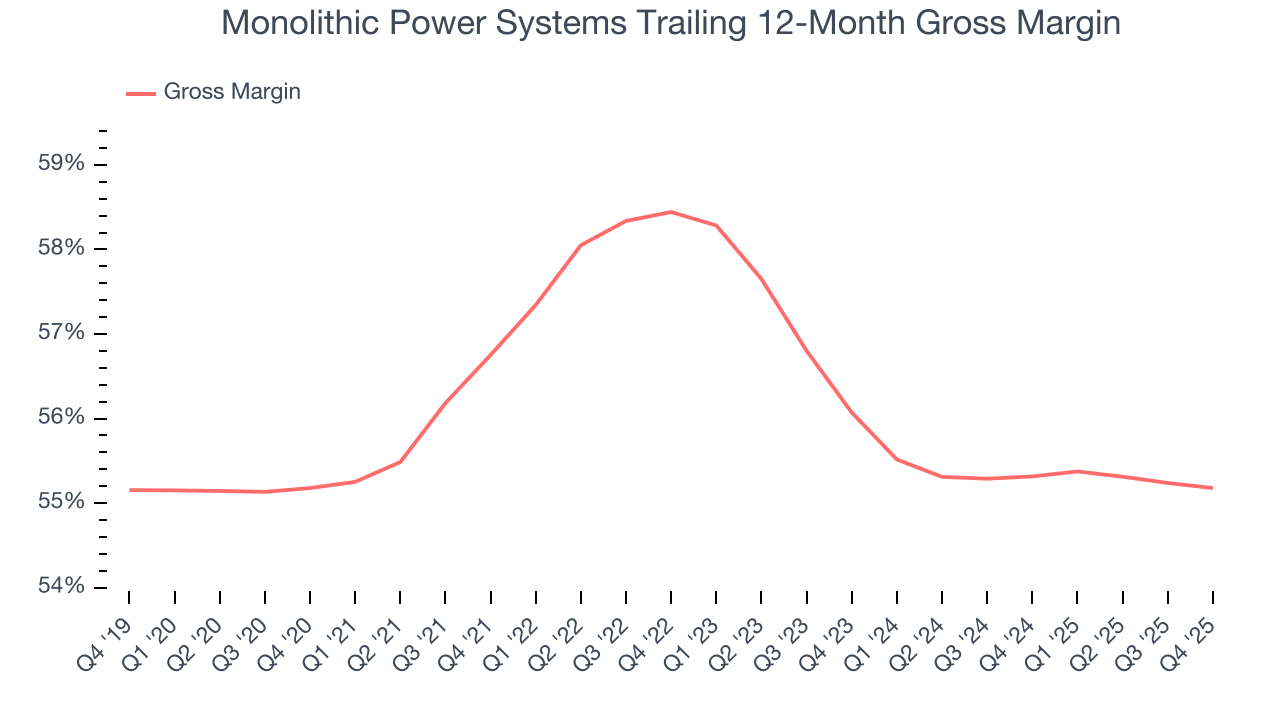

7. Gross Margin & Pricing Power

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Monolithic Power Systems’s gross margin is well ahead of its semiconductor peers, and its strong pricing power is an output of its differentiated, value-add products. As you can see below, it averaged an excellent 55.2% gross margin over the last two years. That means Monolithic Power Systems only paid its suppliers $44.76 for every $100 in revenue.

Monolithic Power Systems’s gross profit margin came in at 55.1% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

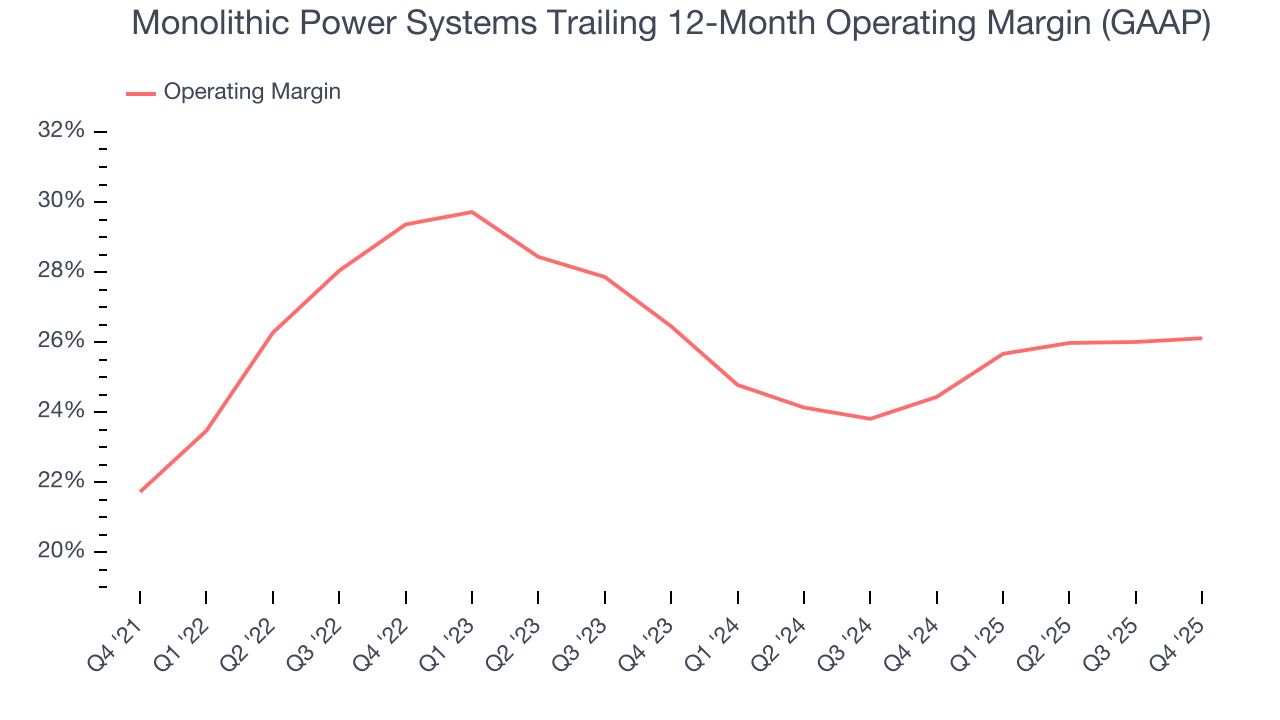

8. Operating Margin

Monolithic Power Systems has been an efficient company over the last two years. It was one of the more profitable businesses in the semiconductor sector, boasting an average operating margin of 25.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Monolithic Power Systems’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Monolithic Power Systems generated an operating margin profit margin of 26.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

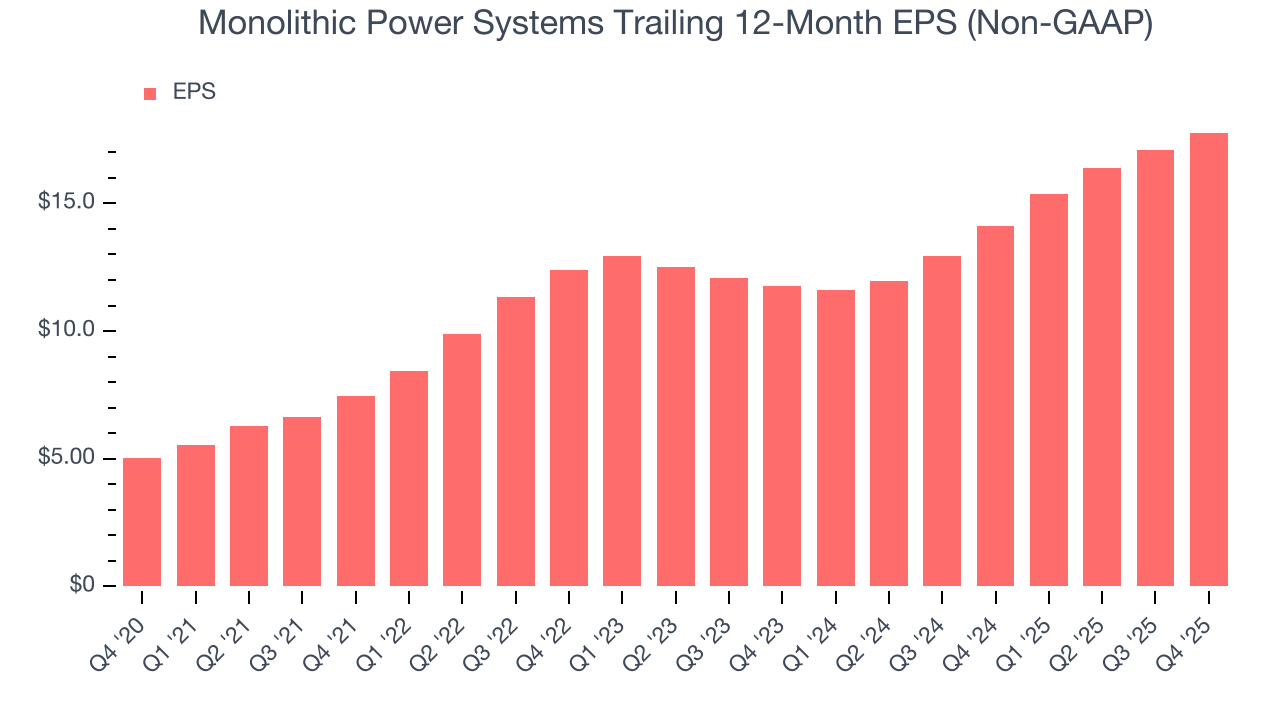

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Monolithic Power Systems’s spectacular 28.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q4, Monolithic Power Systems reported adjusted EPS of $4.79, up from $4.09 in the same quarter last year. This print beat analysts’ estimates by 1.1%. Over the next 12 months, Wall Street expects Monolithic Power Systems’s full-year EPS of $17.77 to grow 17.3%.

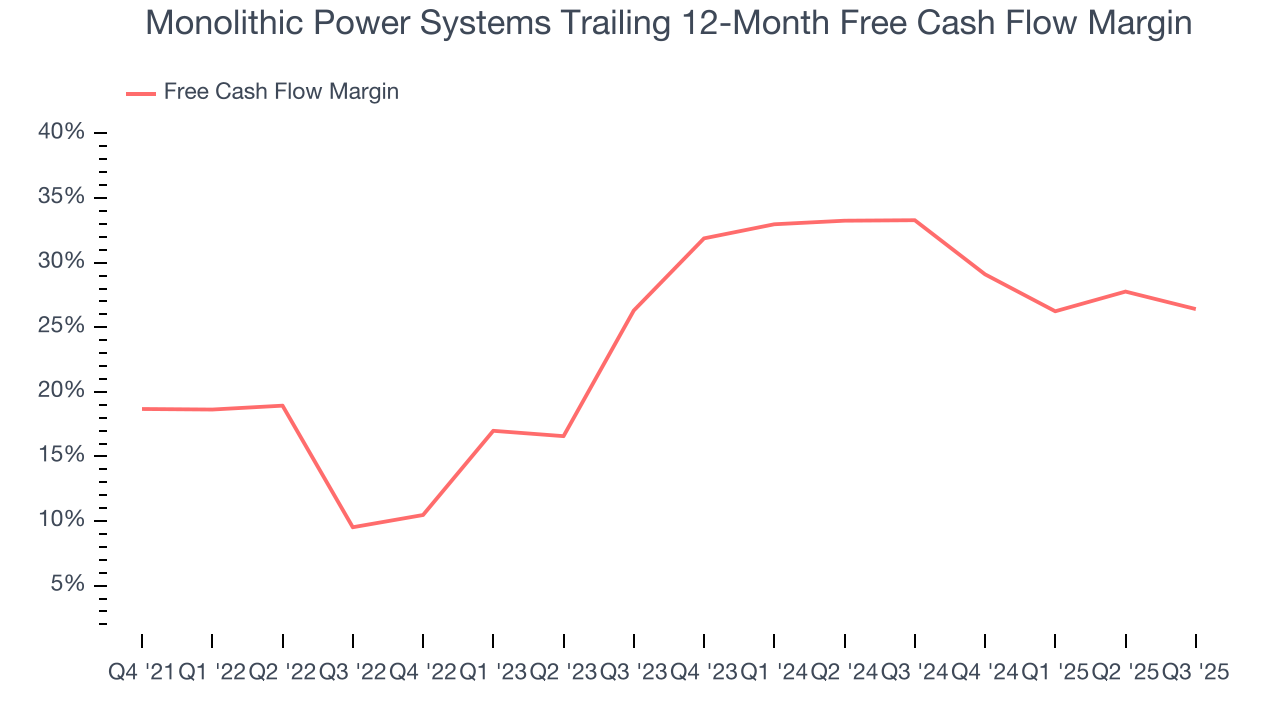

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Monolithic Power Systems has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging 29.3% over the last two years.

Taking a step back, we can see that Monolithic Power Systems’s margin expanded by 4.7 percentage points over the last five years. This is encouraging because it gives the company more optionality.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Monolithic Power Systems’s five-year average ROIC was 48.2%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

12. Key Takeaways from Monolithic Power Systems’s Q4 Results

It was great to see Monolithic Power Systems’s revenue guidance for next quarter top analysts’ expectations. We were also happy its adjusted operating income outperformed Wall Street’s estimates. On the other hand, its inventory levels materially increased. Overall, this print had some key positives. The stock traded up 1.5% to $1,175 immediately following the results.

13. Is Now The Time To Buy Monolithic Power Systems?

Updated: February 5, 2026 at 9:18 PM EST

Are you wondering whether to buy Monolithic Power Systems or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Monolithic Power Systems is truly a cream-of-the-crop semiconductor company. For starters, its revenue growth was exceptional over the last five years. On top of that, its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, and its stellar ROIC suggests it has been a well-run company historically.

Monolithic Power Systems’s P/E ratio based on the next 12 months is 54.5x. You get what you pay for, and in this case, the higher valuation is warranted because Monolithic Power Systems’s fundamentals clearly illustrate it’s a special business. We think the stock is attractive here.

Wall Street analysts have a consensus one-year price target of $1,221 on the company (compared to the current share price of $1,162), implying they see 5.1% upside in buying Monolithic Power Systems in the short term.