Nordson (NDSN)

We’re wary of Nordson. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Nordson Is Not Exciting

Founded in 1954, Nordson Corporation (NASDAQ:NDSN) manufactures dispensing equipment and industrial adhesives, sealants and coatings.

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 3.2%

- A consolation is that its offerings are difficult to replicate at scale and result in a best-in-class gross margin of 55.2%

Nordson’s quality doesn’t meet our bar. There are more promising alternatives.

Why There Are Better Opportunities Than Nordson

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Nordson

At $299.50 per share, Nordson trades at 25.8x forward P/E. This multiple is quite expensive for the quality you get.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Nordson (NDSN) Research Report: Q4 CY2025 Update

Manufacturing company Nordson (NASDAQ:NDSN) announced better-than-expected revenue in Q4 CY2025, with sales up 8.8% year on year to $669.5 million. Guidance for next quarter’s revenue was better than expected at $725 million at the midpoint, 1.8% above analysts’ estimates. Its non-GAAP profit of $2.37 per share was in line with analysts’ consensus estimates.

Nordson (NDSN) Q4 CY2025 Highlights:

- Revenue: $669.5 million vs analyst estimates of $652.8 million (8.8% year-on-year growth, 2.6% beat)

- Adjusted EPS: $2.37 vs analyst estimates of $2.37 (in line)

- Adjusted EBITDA: $203 million vs analyst estimates of $206.6 million (30.3% margin, 1.7% miss)

- The company lifted its revenue guidance for the full year to $2.92 billion at the midpoint from $2.89 billion, a 1% increase

- Management raised its full-year Adjusted EPS guidance to $11.30 at the midpoint, a 1.3% increase

- Operating Margin: 24.9%, up from 22.9% in the same quarter last year

- Free Cash Flow Margin: 18.4%, down from 22.4% in the same quarter last year

- Organic Revenue rose 6.5% year on year (miss)

- Market Capitalization: $16.54 billion

Company Overview

Founded in 1954, Nordson Corporation (NASDAQ:NDSN) manufactures dispensing equipment and industrial adhesives, sealants and coatings.

Nordson Corporation was established by brothers Eric and Evan Nord, evolving from the U.S. Automatic Company, which began in 1909. Initially focusing on screw machine parts for the automotive industry, the company shifted to producing high-precision parts during World War II. Post-war, the brothers sought a proprietary product, finding it in the "hot airless" method of spraying paint, leading to the creation of Nordson as a division of U.S. Automatic Corporation.

In 1966, U.S. Automatic merged into Nordson Corporation, continuing its development of spray painting and powder coating technologies. In 1986, Nordson acquired companies such as Industriell Coating Aktiebolag and Meltex, enhancing its adhesive dispensing capabilities. The company expanded into high technology and electronics industries in the late 1990s, acquiring firms such as Asymtek and EFD, which are integral to Nordson’s Advanced Technology segment today. In the 2010s, Nordson strengthened its position in precision technology and entered the medical, test and inspection, and polymer processing areas through acquisitions, including Micromedics and Value Plastics.

Today, Nordson Corporation produces a variety of advanced products and systems that serve diverse industries. Its offerings range from precision dispensing equipment and coating systems for the electronics and packaging sectors to medical devices such as catheters and medical tubing for the healthcare industry. The company generates revenue from the sale of these products, as well as from contracts for related software, maintenance services, and aftermarket parts, which generate a source of recurring revenue.

The company continues an acquisition strategy of selectively focusing on companies that offer strong operational value and enhance its product. For instance, in August 2023, Nordson acquired the ARAG Group, a leader in precision control systems and smart fluid components for agricultural spraying. This strategic acquisition aligns with Nordson’s objective to enhance its offerings in precision technology and expand its presence in the growing agriculture market.

4. Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Graco (NYSE:GGG), Illinois Tool Works (NYSE:ITW), and Sono-Tek (OTCMKTS: SOTK).

5. Revenue Growth

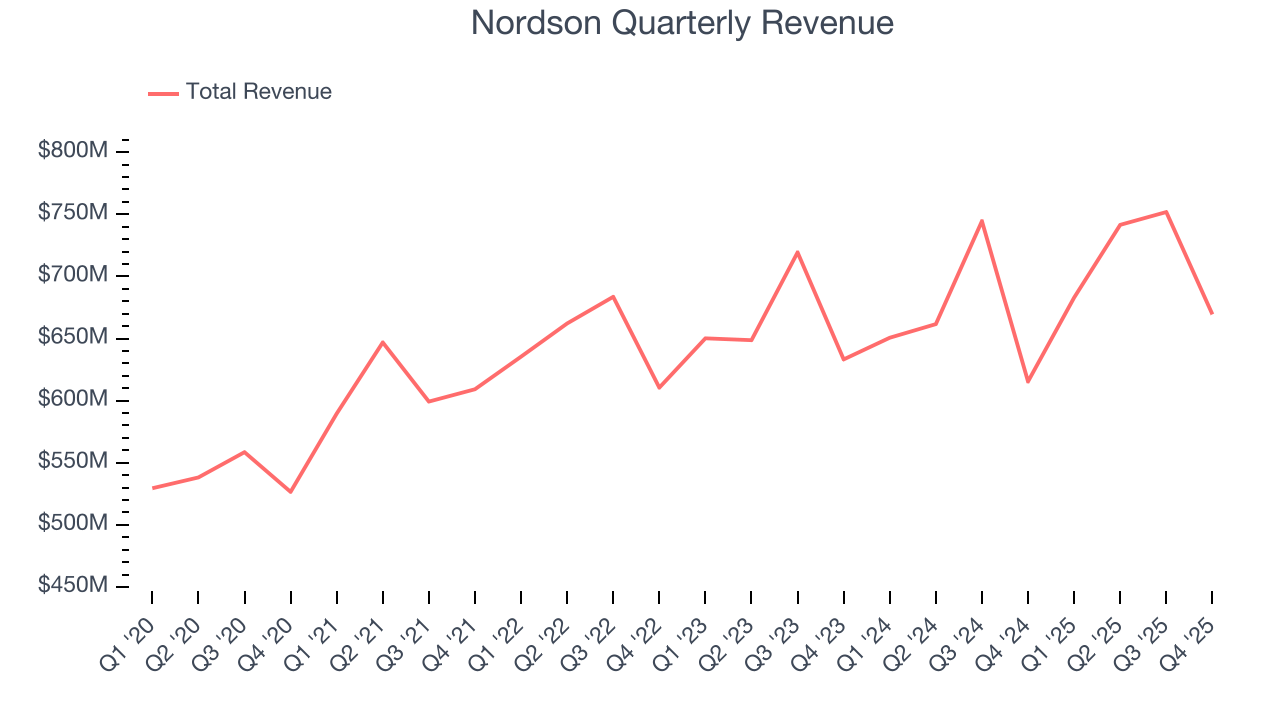

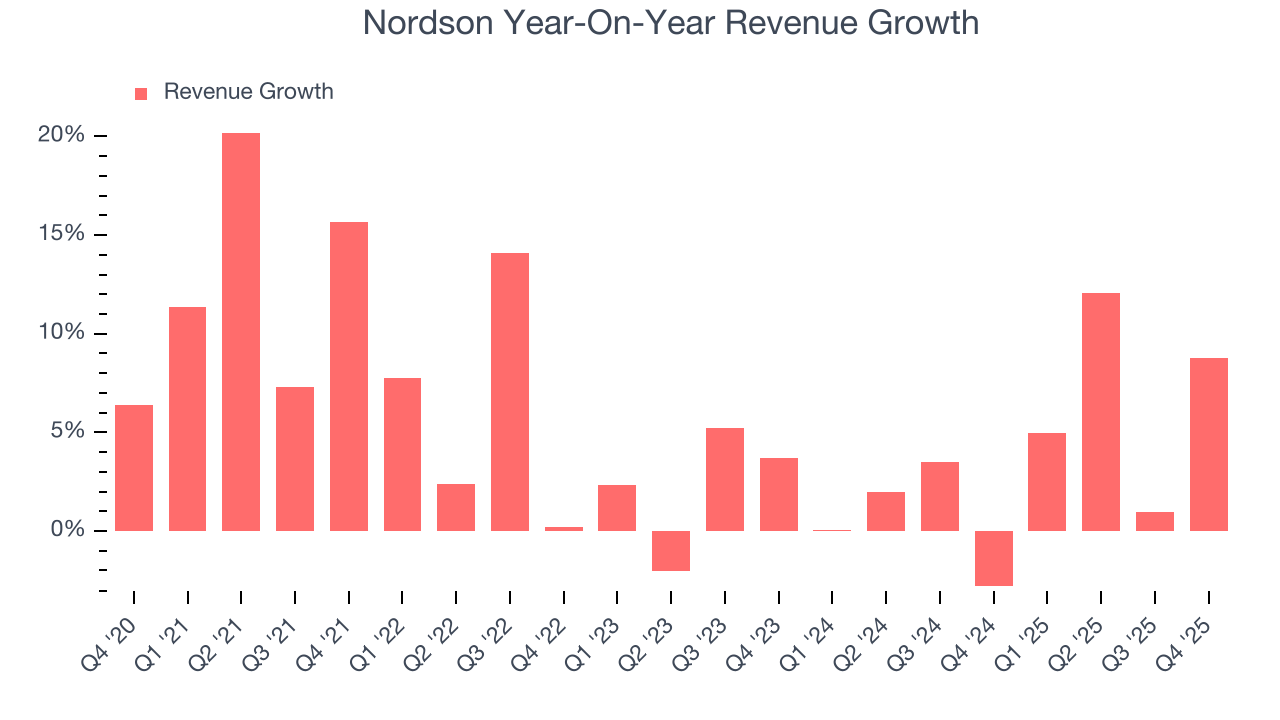

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Nordson’s sales grew at a tepid 5.7% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Nordson’s recent performance shows its demand has slowed as its annualized revenue growth of 3.6% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

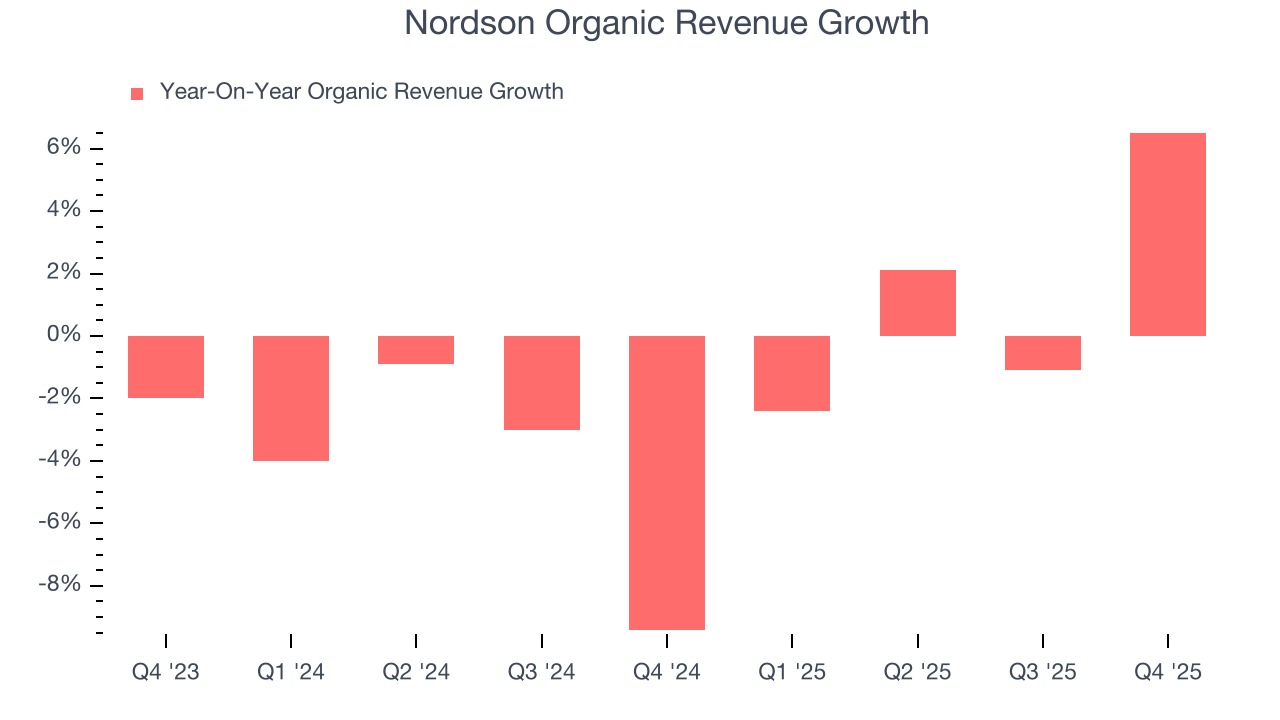

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Nordson’s organic revenue averaged 1.5% year-on-year declines. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Nordson reported year-on-year revenue growth of 8.8%, and its $669.5 million of revenue exceeded Wall Street’s estimates by 2.6%. Company management is currently guiding for a 6.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

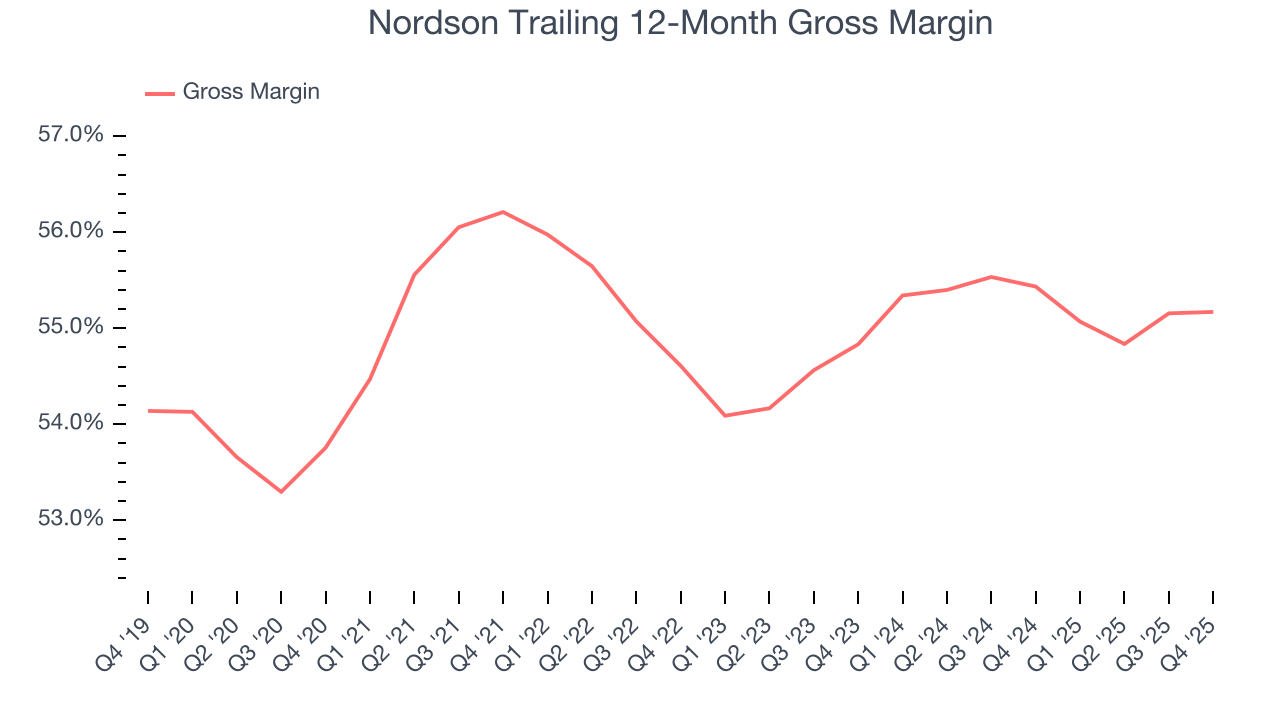

Nordson has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 55.2% gross margin over the last five years. That means Nordson only paid its suppliers $44.76 for every $100 in revenue.

Nordson’s gross profit margin came in at 54.7% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

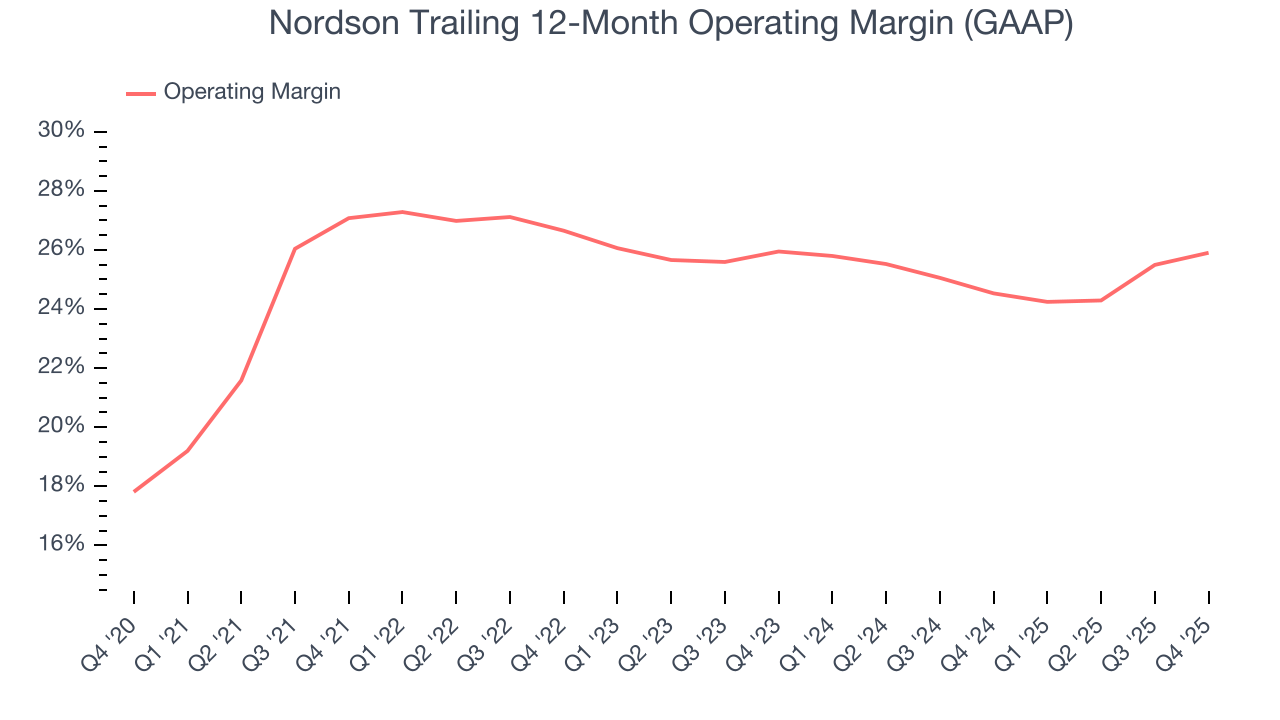

7. Operating Margin

Nordson has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 26%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Nordson’s operating margin decreased by 1.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Nordson generated an operating margin profit margin of 24.9%, up 2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

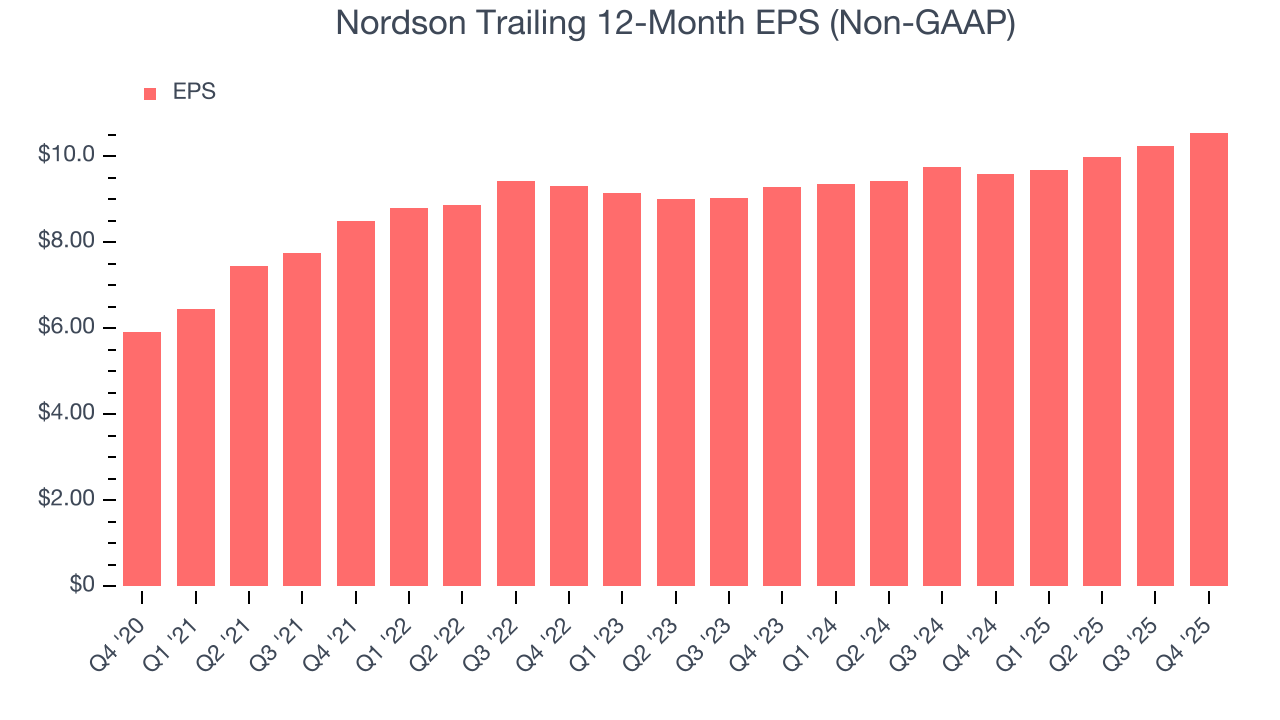

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

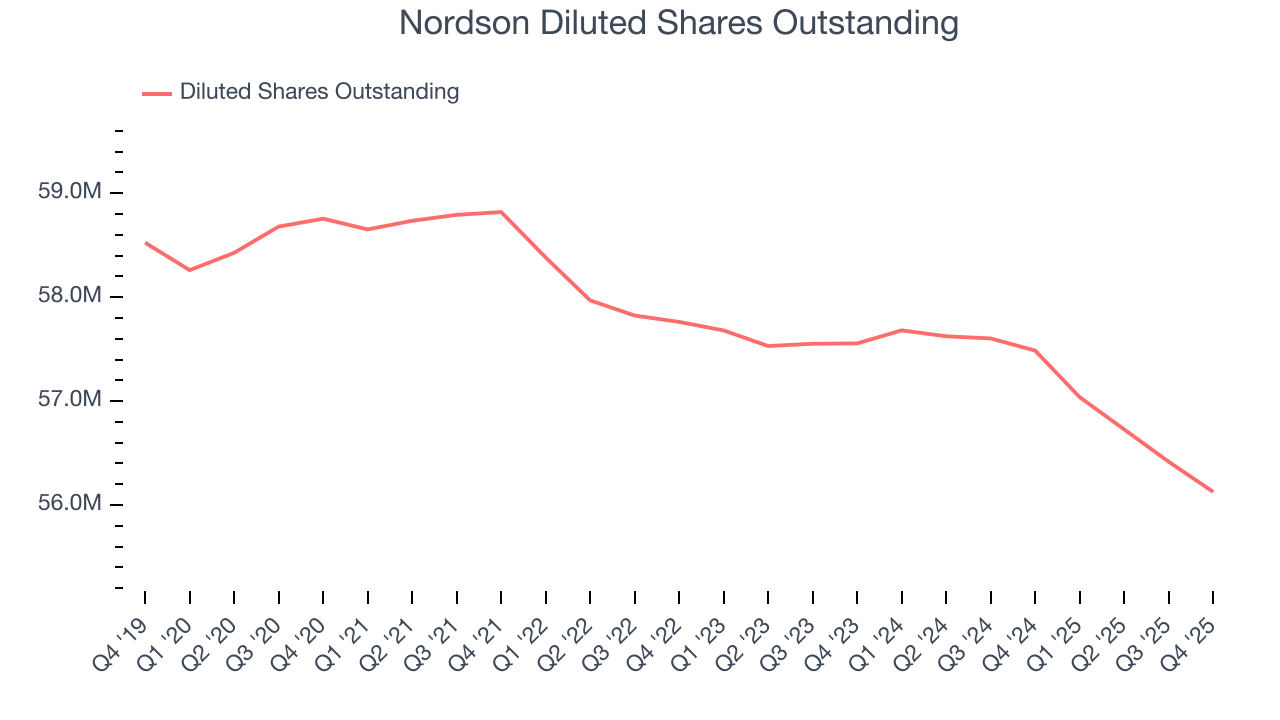

Nordson’s EPS grew at a remarkable 12.3% compounded annual growth rate over the last five years, higher than its 5.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Nordson’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Nordson has repurchased its stock, shrinking its share count by 4.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Nordson, its two-year annual EPS growth of 6.6% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Nordson reported adjusted EPS of $2.37, up from $2.06 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Nordson’s full-year EPS of $10.55 to grow 8.6%.

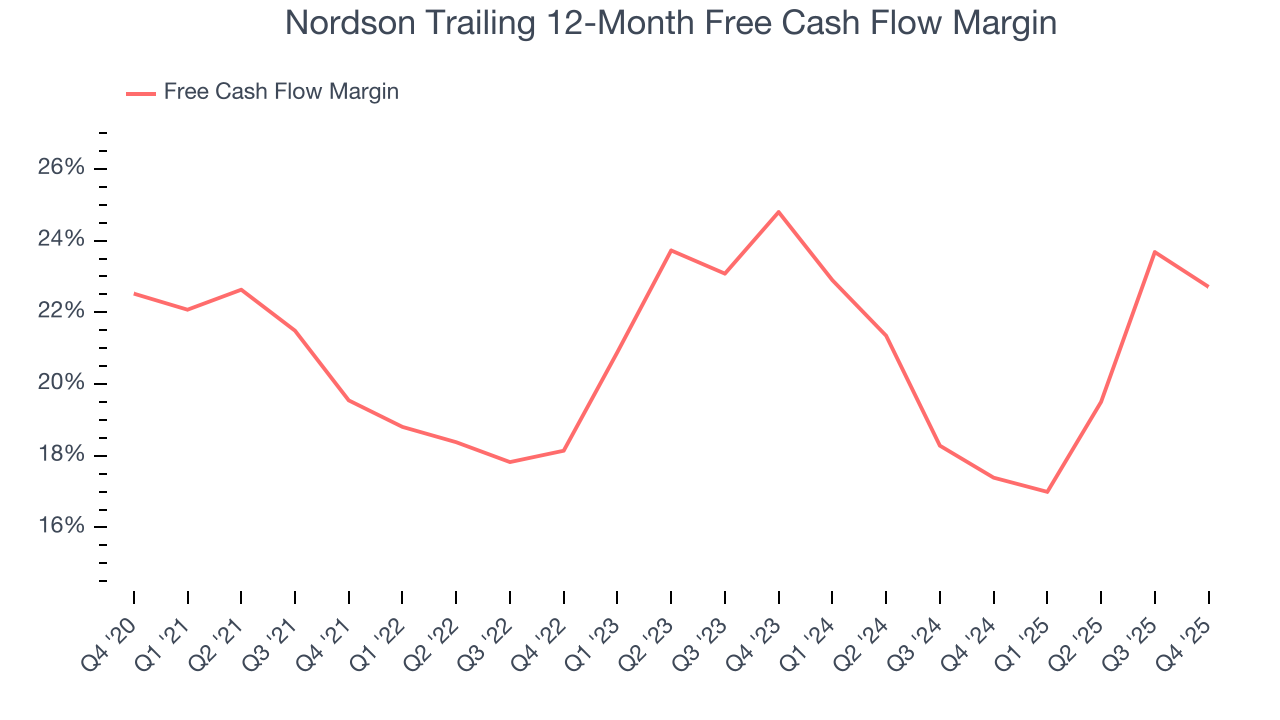

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Nordson has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 20.6% over the last five years.

Taking a step back, we can see that Nordson’s margin expanded by 3.2 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Nordson’s free cash flow clocked in at $122.9 million in Q4, equivalent to a 18.4% margin. The company’s cash profitability regressed as it was 4 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

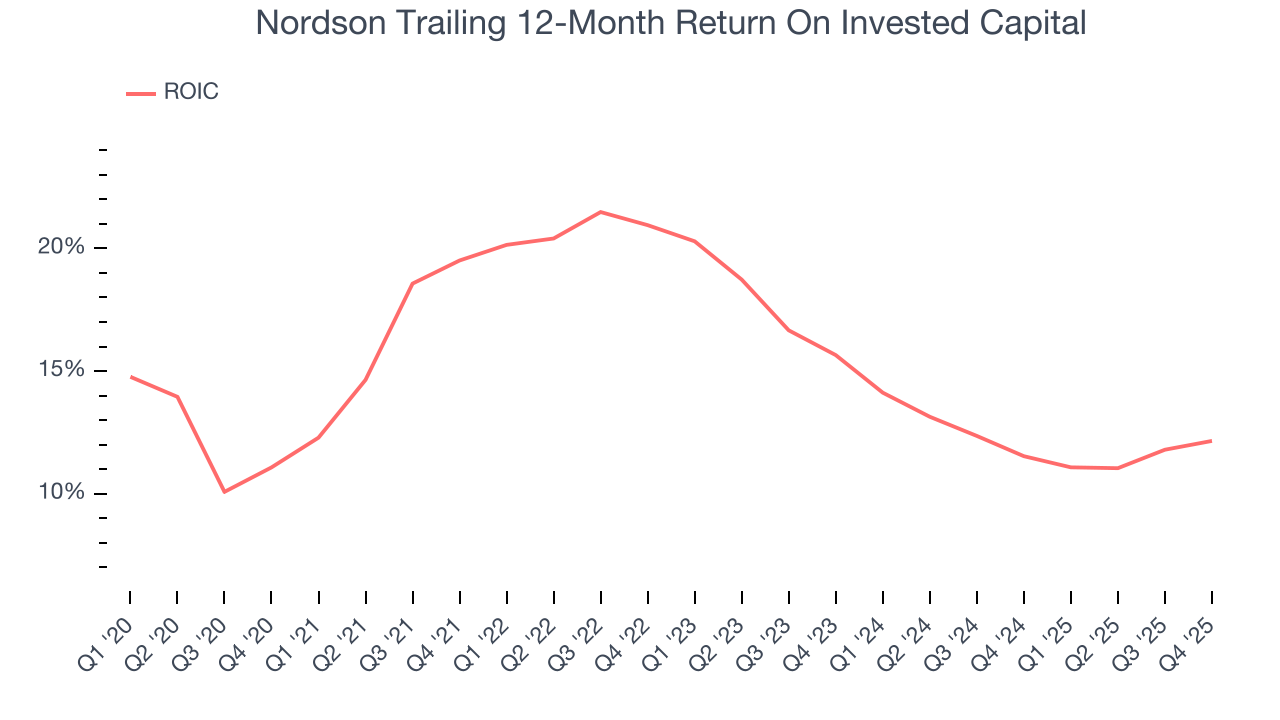

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Nordson hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 16%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Nordson’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

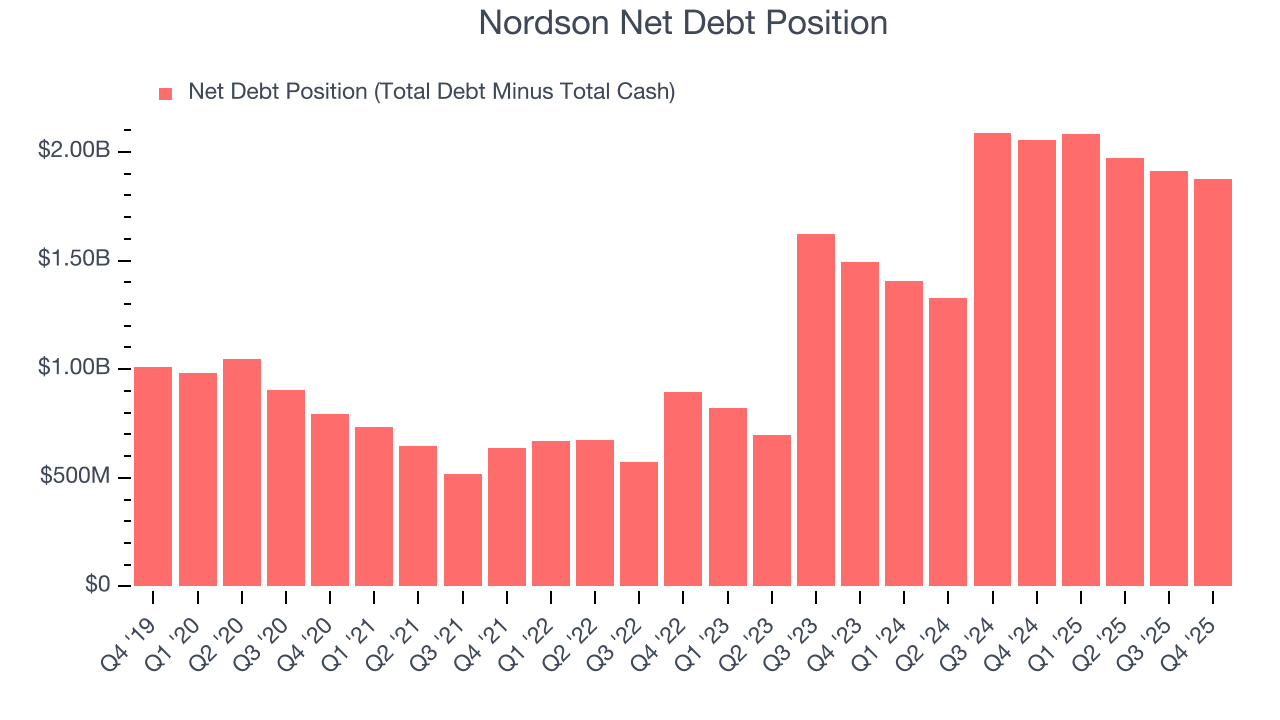

11. Balance Sheet Assessment

Nordson reported $120.4 million of cash and $2.00 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $914.4 million of EBITDA over the last 12 months, we view Nordson’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $98.23 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Nordson’s Q4 Results

We enjoyed seeing Nordson beat analysts’ revenue expectations this quarter. We were also glad its EPS guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its organic revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded up 1.5% to $303.64 immediately after reporting.

13. Is Now The Time To Buy Nordson?

Updated: February 18, 2026 at 10:25 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Nordson isn’t a terrible business, but it doesn’t pass our bar. To kick things off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its admirable gross margins indicate the mission-critical nature of its offerings, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its organic revenue declined.

Nordson’s P/E ratio based on the next 12 months is 25.8x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $275.82 on the company (compared to the current share price of $299.50), implying they don’t see much short-term potential in Nordson.