Oaktree Specialty Lending (OCSL)

Oaktree Specialty Lending is up against the odds. Its weak returns on capital indicate management was inefficient with its resources and missed opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Oaktree Specialty Lending Will Underperform

Managed by Oaktree Capital Management, one of the world's premier alternative investment firms, Oaktree Specialty Lending (NASDAQ:OCSL) is a business development company that provides customized financing solutions to mid-market companies across various industries.

- Annual sales declines of 8.6% for the past two years show its products and services struggled to connect with the market during this cycle

- Earnings per share decreased by more than its revenue over the last two years, showing each sale was less profitable

- Tangible book value per share tumbled by 3.1% annually over the last five years, showing financials sector trends are working against its favor during this cycle

Oaktree Specialty Lending doesn’t fulfill our quality requirements. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Oaktree Specialty Lending

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Oaktree Specialty Lending

Oaktree Specialty Lending is trading at $12.18 per share, or 8.2x forward P/E. This sure is a cheap multiple, but you get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Oaktree Specialty Lending (OCSL) Research Report: Q4 CY2025 Update

Business development company Oaktree Specialty Lending (NASDAQ:OCSL) met Wall Streets revenue expectations in Q4 CY2025, but sales fell by 13.3% year on year to $75.1 million. Its non-GAAP profit of $0.06 per share was 84.1% below analysts’ consensus estimates.

Oaktree Specialty Lending (OCSL) Q4 CY2025 Highlights:

- Assets Under Management: $2.95 billion vs analyst estimates of $2.9 billion (4% year-on-year growth, 1.7% beat)

- Revenue: $75.1 million vs analyst estimates of $75.19 million (13.3% year-on-year decline, in line)

- Pre-tax Profit: $36.72 million (48.9% margin)

- Adjusted EPS: $0.06 vs analyst expectations of $0.38 (84.1% miss)

- Market Capitalization: $1.07 billion

Company Overview

Managed by Oaktree Capital Management, one of the world's premier alternative investment firms, Oaktree Specialty Lending (NASDAQ:OCSL) is a business development company that provides customized financing solutions to mid-market companies across various industries.

As a business development company (BDC), Oaktree Specialty Lending operates under regulations that require it to distribute at least 90% of its taxable income to shareholders. The company primarily focuses on providing debt financing to established middle-market companies, typically with annual EBITDA between $10 million and $250 million. These loans generally range from $5 million to $75 million, filling a crucial financing gap for businesses that may be too large for traditional bank loans but too small for public debt offerings.

The company's investment portfolio spans multiple sectors including software, healthcare, financial services, and manufacturing. A typical transaction might involve providing growth capital to a healthcare technology company expanding its operations, or financing for a manufacturing business making strategic acquisitions. Oaktree employs a rigorous due diligence process, analyzing potential borrowers' financial health, competitive positioning, and growth prospects before extending credit.

Oaktree Specialty Lending generates revenue primarily through interest income on its debt investments, which often feature floating rates that can adjust with market conditions. The company also occasionally takes equity positions in portfolio companies, which can provide additional returns through capital appreciation. As a publicly traded BDC, it offers retail investors access to private credit investments that would typically be available only to institutional investors. The company benefits from the extensive resources and expertise of its investment advisor, Oaktree Capital Management, which brings decades of experience in credit markets and distressed investing.

4. Specialty Finance

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

Oaktree Specialty Lending competes with other publicly traded business development companies including Ares Capital Corporation (NASDAQ:ARCC), FS KKR Capital Corp. (NYSE:FSK), and Main Street Capital Corporation (NYSE:MAIN), as well as private credit funds managed by large asset managers.

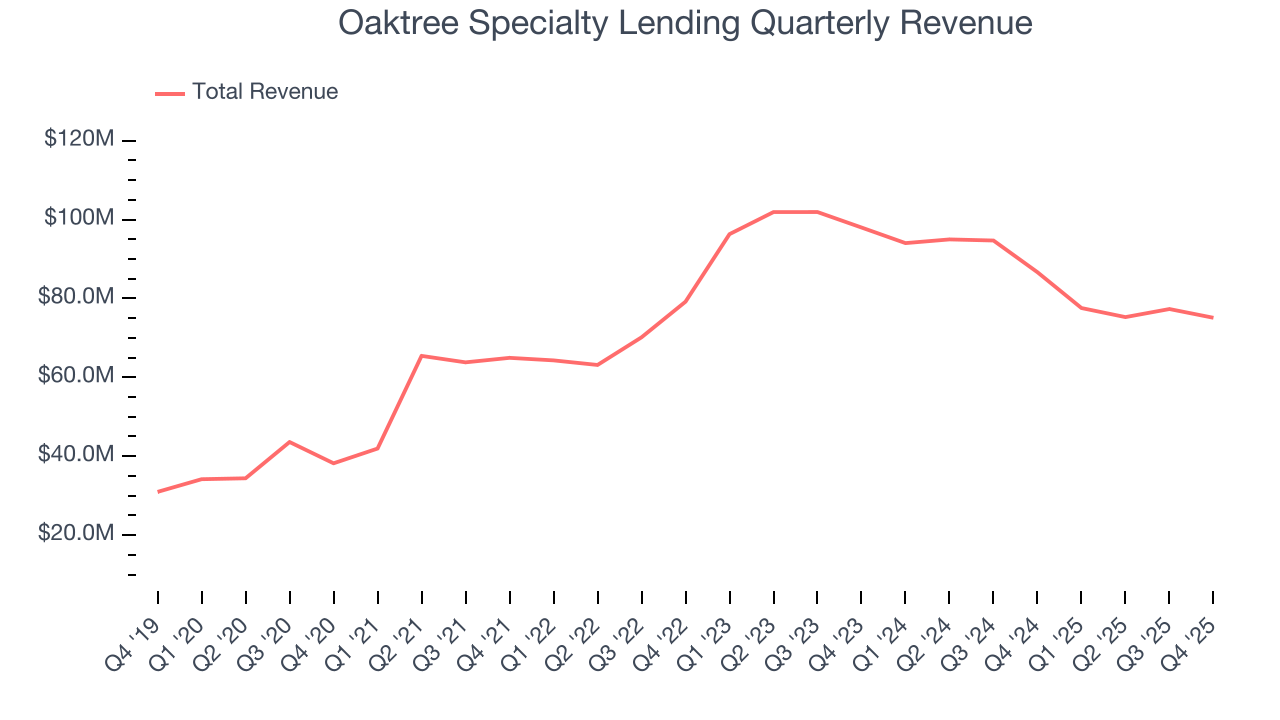

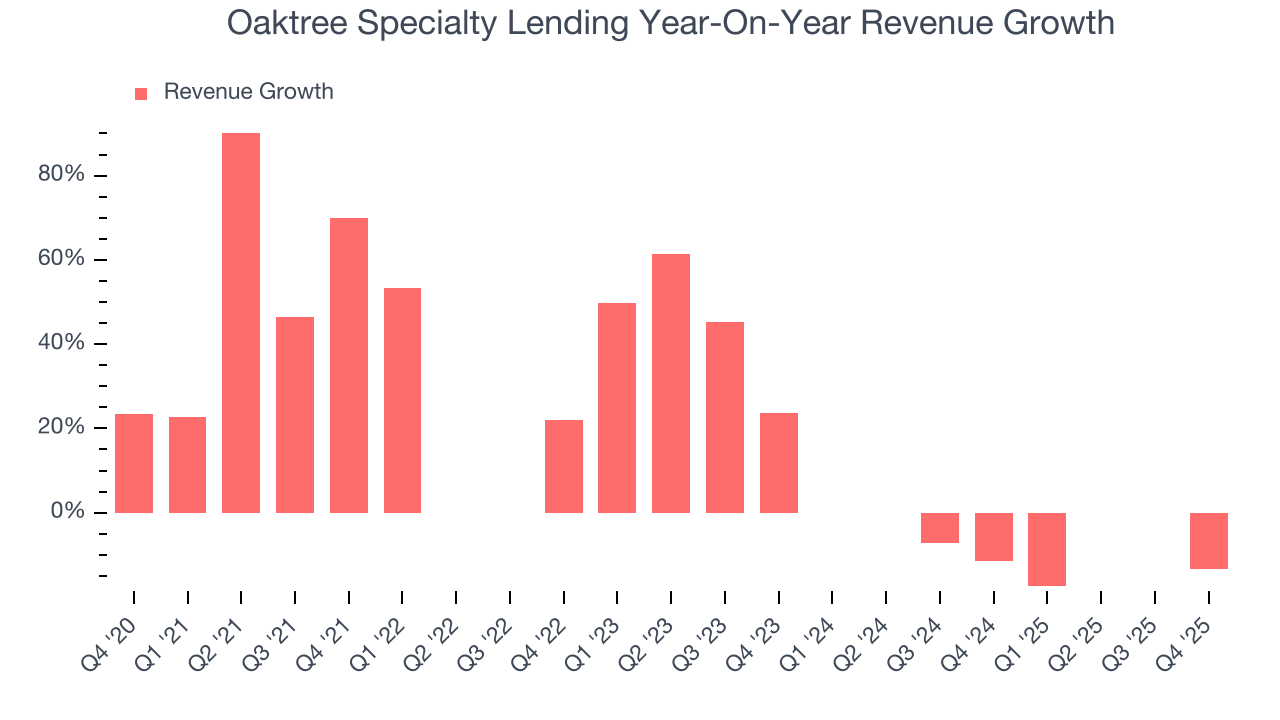

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Oaktree Specialty Lending’s revenue grew at an impressive 15.2% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Oaktree Specialty Lending’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 12.4% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Oaktree Specialty Lending reported a rather uninspiring 13.3% year-on-year revenue decline to $75.1 million of revenue, in line with Wall Street’s estimates.

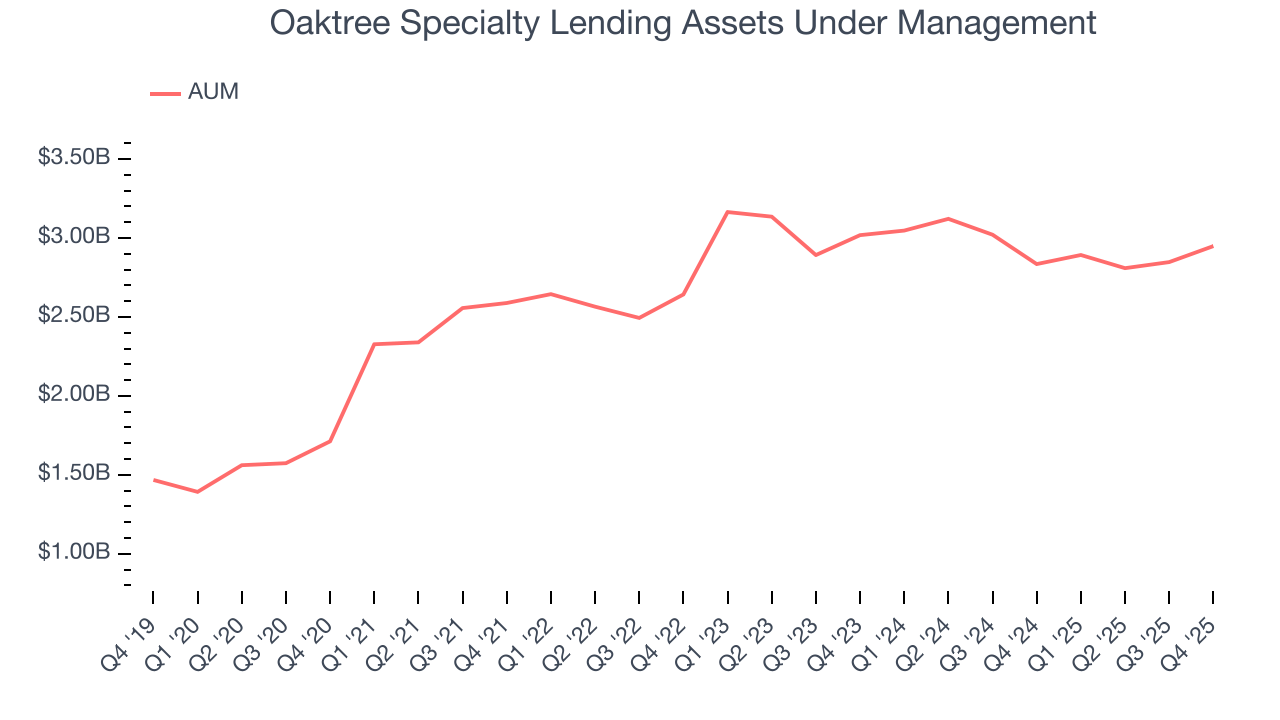

6. Assets Under Management (AUM)

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

Oaktree Specialty Lending’s AUM has grown at an annual rate of 13% over the last five years, a step above the broader financials industry but slower than its total revenue. When analyzing Oaktree Specialty Lending’s AUM over the last two years, we can see its assets dropped by 3% annually. Other parts of the business were even bigger detractors of growth than fundraising or short-term investment performance over this shorter period since assets outperformed total revenue. That said, assets aren't the be-all and end-all due to their unpredictable and cyclical nature.

Oaktree Specialty Lending’s AUM punched in at $2.95 billion this quarter, beating analysts’ expectations by 1.7%. This print was 4% higher than the same quarter last year.

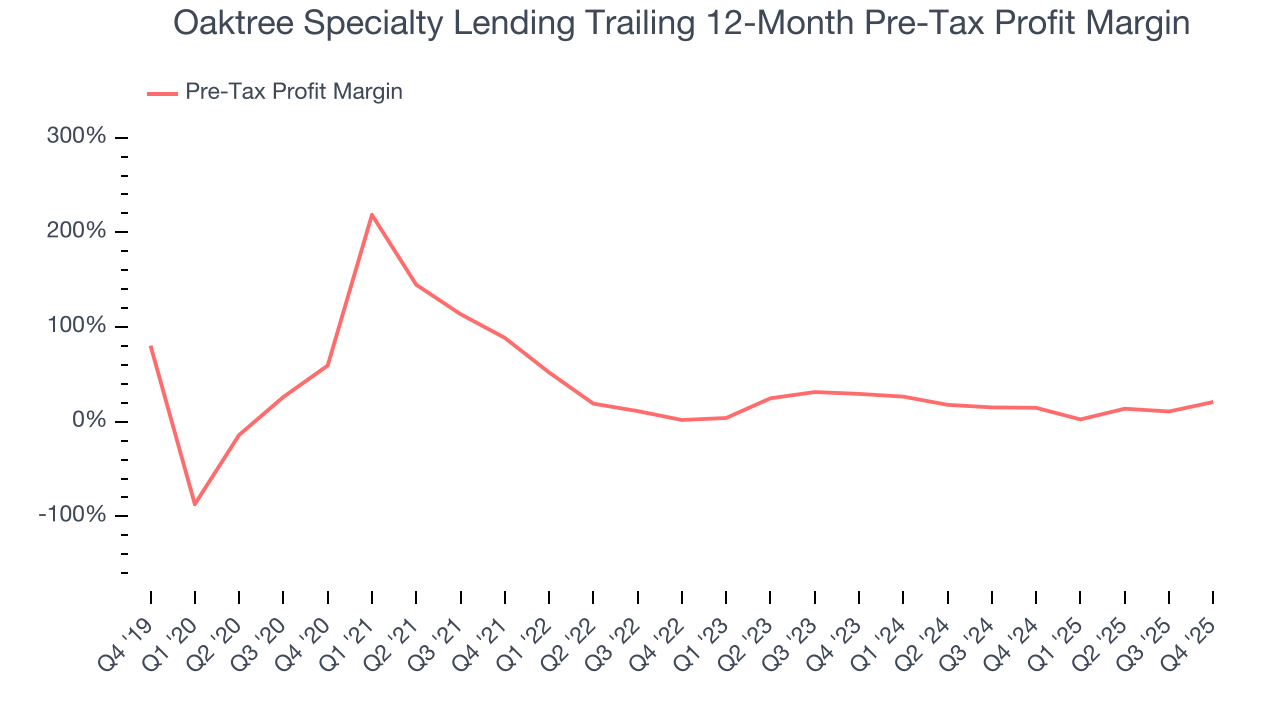

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Specialty Finance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, Oaktree Specialty Lending’s pre-tax profit margin has risen by 38.5 percentage points, going from 88.6% to 20.9%. It has also declined by 8.6 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q4, Oaktree Specialty Lending’s pre-tax profit margin was 48.9%. This result was 40.4 percentage points better than the same quarter last year.

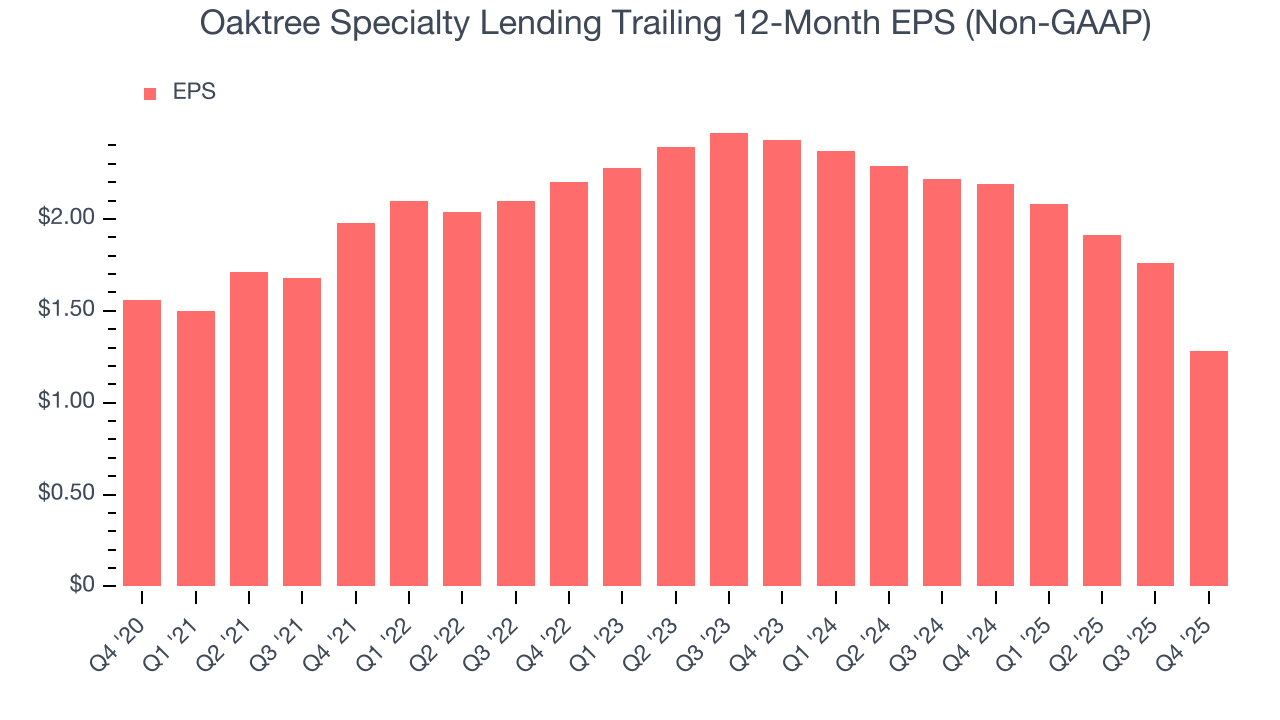

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Oaktree Specialty Lending, its EPS declined by 3.9% annually over the last five years while its revenue grew by 15.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Oaktree Specialty Lending, its two-year annual EPS declines of 27.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Oaktree Specialty Lending reported adjusted EPS of $0.06, down from $0.54 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Oaktree Specialty Lending’s full-year EPS of $1.28 to grow 17.4%.

9. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Oaktree Specialty Lending has averaged an ROE of 6.5%, uninspiring for a company operating in a sector where the average shakes out around 10%.

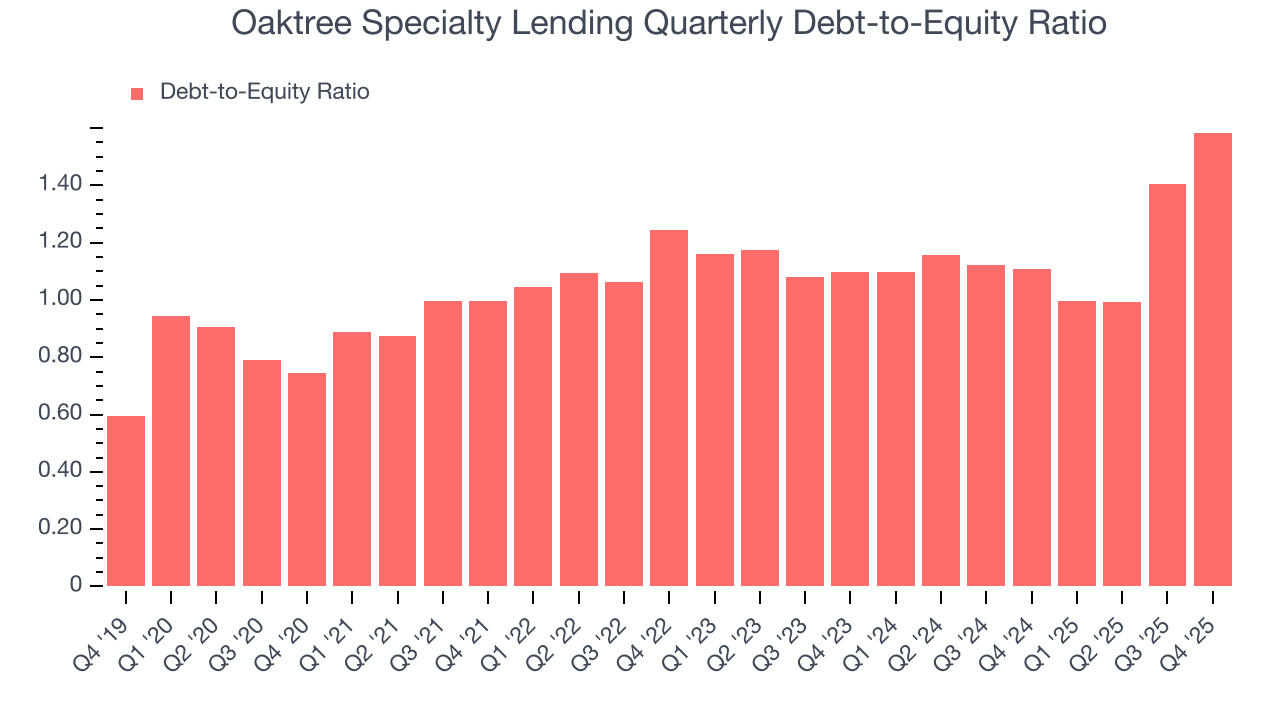

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Oaktree Specialty Lending currently has $2.28 billion of debt and $1.44 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Oaktree Specialty Lending’s Q4 Results

It was encouraging to see Oaktree Specialty Lending beat analysts’ AUM expectations this quarter. On the other hand, its EPS missed. Overall, this quarter could have been better. The stock remained flat at $12.12 immediately after reporting.

12. Is Now The Time To Buy Oaktree Specialty Lending?

Updated: February 4, 2026 at 6:32 AM EST

Before investing in or passing on Oaktree Specialty Lending, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We see the value of companies driving economic growth, but in the case of Oaktree Specialty Lending, we’re out. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its declining pre-tax profit margin shows the business has become less efficient. And while the company’s AUM growth was solid over the last five years, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets.

Oaktree Specialty Lending’s P/E ratio based on the next 12 months is 8.1x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $13.71 on the company (compared to the current share price of $12.12).