Opendoor (OPEN)

Opendoor faces an uphill battle. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Opendoor Will Underperform

Founded by real estate guru Eric Wu, Opendoor (NASDAQ:OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

- Muted 11.1% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Historically negative EPS is a worrisome sign for conservative investors and obscures its long-term earnings potential

- Unprofitable operations could lead to additional rounds of dilutive equity financing if the credit window closes

Opendoor falls below our quality standards. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Opendoor

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Opendoor

Opendoor is trading at $4.72 per share, or 1x forward price-to-sales. The market typically values companies like Opendoor based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Opendoor (OPEN) Research Report: Q4 CY2025 Update

Technology real estate company Opendoor (NASDAQ:OPEN) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, but sales fell by 32.1% year on year to $736 million. Its non-GAAP loss of $0.07 per share was 25.3% above analysts’ consensus estimates.

Opendoor (OPEN) Q4 CY2025 Highlights:

- Revenue: $736 million vs analyst estimates of $595 million (32.1% year-on-year decline, 23.7% beat)

- Adjusted EPS: -$0.07 vs analyst estimates of -$0.09 (25.3% beat)

- Adjusted EBITDA: -$43 million (-5.8% margin, 12.2% year-on-year growth)

- EBITDA guidance for Q1 CY2026 is $30 million at the midpoint, above analyst estimates of -$37.4 million

- Operating Margin: -20.4%, down from -8.7% in the same quarter last year

- Free Cash Flow was $67 million, up from -$83 million in the same quarter last year

- Homes Sold: 1,978, down 844 year on year

- Market Capitalization: $4.41 billion

Company Overview

Founded by real estate guru Eric Wu, Opendoor (NASDAQ:OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

Opendoor's core business is its iBuying service, allowing homeowners to quickly sell their homes directly to Opendoor at a competitive price, bypassing the traditional real estate market's complexities and uncertainties. Homeowners can request an offer online, receive a data-driven valuation, and, if they accept, sell their home to Opendoor in a matter of days. This model has been appealing for its speed, convenience, and certainty.

After purchasing homes, Opendoor makes necessary renovations, lists the properties for sale, and provides a streamlined buying experience for new homeowners. The company’s digital platform enables buyers to browse listings, schedule tours, and purchase homes directly online, further simplifying the home-buying process.

The company leverages data analytics, machine learning algorithms, and market insights to value homes and streamline operations. This technology-first approach allows Opendoor to efficiently manage a large inventory of homes.

In addition to buying and selling homes, Opendoor provides ancillary services that complement its primary business. These include Opendoor Home Loans for financing, Opendoor-backed home warranties, and other services aimed at simplifying the transaction process.

4. Consumer Discretionary - Real Estate Services

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Real estate services companies provide brokerage, property management, appraisal, and advisory services, earning transaction-based commissions and recurring management fees. Tailwinds include long-term housing demand driven by demographic growth, technology platforms that expand market access, and commercial real estate complexity that sustains advisory needs. Headwinds are pronounced: rising interest rates directly suppress transaction volumes by reducing housing affordability and commercial deal activity. Commission-rate compression, driven by discount brokerages and regulatory changes, erodes per-transaction revenue. The industry is highly cyclical, with revenue swings amplified by leverage. PropTech (property technology) disruptors threaten traditional intermediary models.

Opendoor's primary competitors include Zillow (NASDAQ:ZG), Redfin (NASDAQ:RDFN), Offerpad Solutions (NYSE:OPAD), and eXp World (NASDAQ:EXPI).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Opendoor grew its sales at a 11.1% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Opendoor’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 20.7% annually.

We can dig further into the company’s revenue dynamics by analyzing its number of homes sold, which reached 1,978 in the latest quarter. Over the last two years, Opendoor’s homes sold averaged 7.7% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Opendoor’s revenue fell by 32.1% year on year to $736 million but beat Wall Street’s estimates by 23.7%.

Looking ahead, sell-side analysts expect revenue to grow 7% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

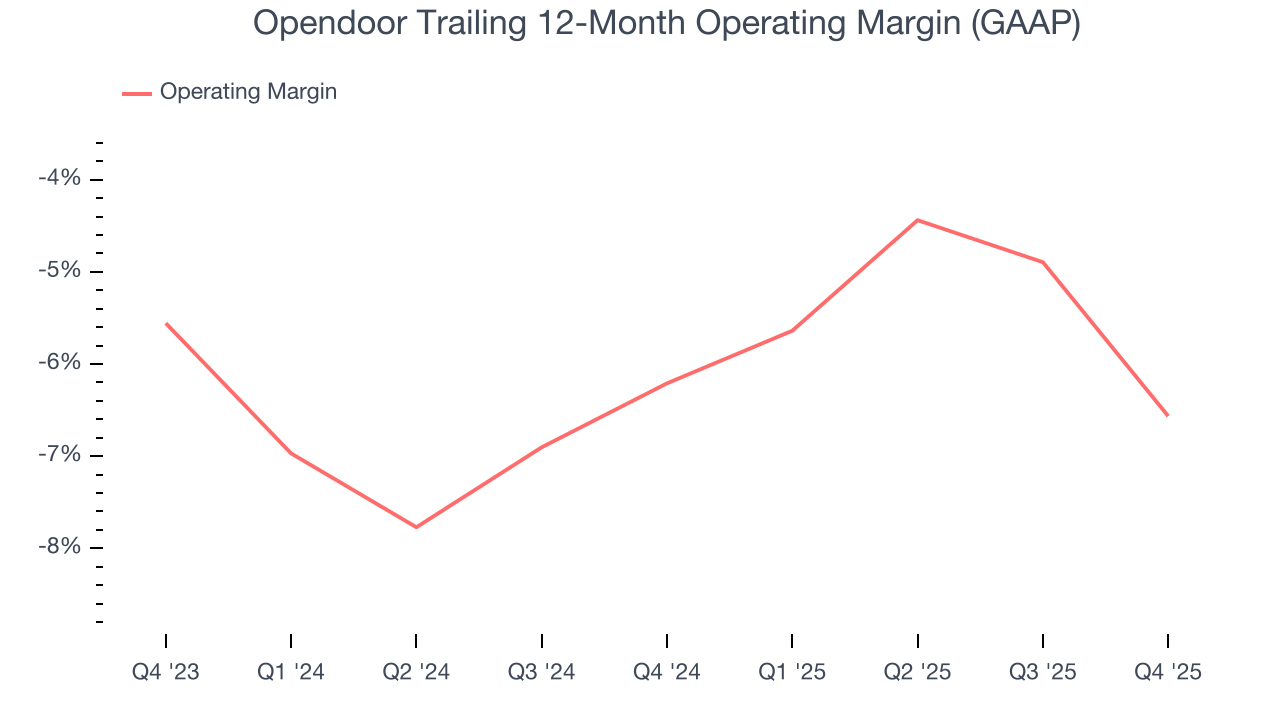

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Opendoor’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging negative 6.4% over the last two years. Unprofitable consumer discretionary companies that fail to improve their losses or grow sales rapidly deserve extra scrutiny. For the time being, it’s unclear if Opendoor’s business model is sustainable.

Opendoor’s operating margin was negative 20.4% this quarter. The company's consistent lack of profits raise a flag.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Opendoor’s earnings losses deepened over the last four years as its EPS dropped 7% annually. However, it’s bucked its trend as of late, increasing its EPS over the last two years. We’ll see if it can maintain its growth.

In Q4, Opendoor reported adjusted EPS of negative $0.07, up from negative $0.11 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Opendoor to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.25 will advance to negative $0.21.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Opendoor has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.4%, lousy for a consumer discretionary business.

Opendoor’s free cash flow clocked in at $67 million in Q4, equivalent to a 9.1% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

Over the next year, analysts predict Opendoor will flip from cash-producing to cash-burning. Their consensus estimates imply its free cash flow margin of 23.7% for the last 12 months will decrease to negative 3.7%.

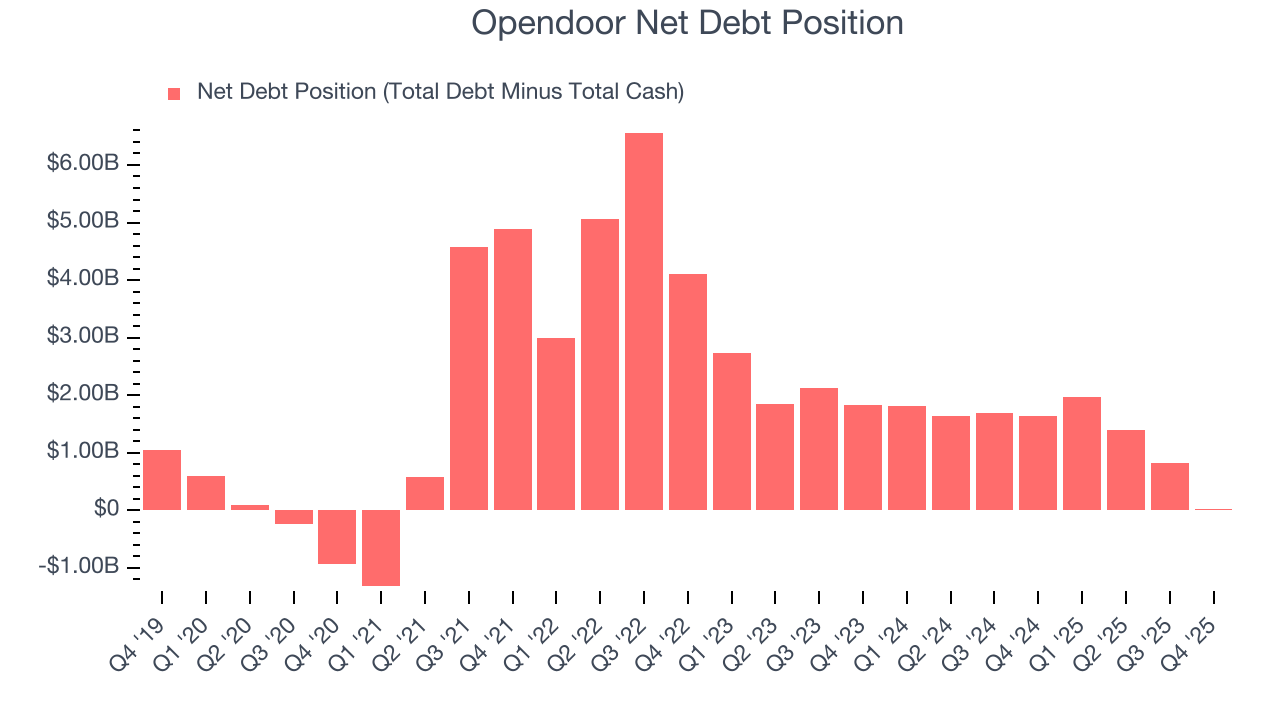

9. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Opendoor posted negative $83 million of EBITDA over the last 12 months, and its $1.32 billion of debt exceeds the $1.3 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Opendoor if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Opendoor can improve its profitability and remain cautious until then.

10. Key Takeaways from Opendoor’s Q4 Results

We were impressed by Opendoor’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 16.1% to $5.34 immediately following the results.

11. Is Now The Time To Buy Opendoor?

Updated: February 24, 2026 at 9:38 PM EST

Before making an investment decision, investors should account for Opendoor’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Opendoor, we’ll be cheering from the sidelines. On top of that, Opendoor’s number of homes sold has disappointed, and its Forecasted free cash flow margin suggests the company will ramp up its investments next year.

Opendoor’s forward price-to-sales ratio is 1x. The market typically values companies like Opendoor based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $4.33 on the company (compared to the current share price of $5.03).