Palo Alto Networks (PANW)

Palo Alto Networks catches our eye. Although its forecasted growth is weak, its strong margins enable it to navigate pockets of soft demand.― StockStory Analyst Team

1. News

2. Summary

Why Palo Alto Networks Is Interesting

Founded in 2005 by security visionary Nir Zuk who sought to reimagine firewall technology, Palo Alto Networks (NASDAQ:PANW) provides AI-powered cybersecurity platforms that protect organizations' networks, clouds, and endpoints from sophisticated threats.

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently

- Well-designed software integrates seamlessly with other workflows, enabling swift payback periods on marketing expenses and customer growth at scale

- A drawback is its operating margin improvement of 3.4 percentage points over the last year demonstrates its ability to scale efficiently

Palo Alto Networks is close to becoming a high-quality business. If you’re a believer, the price seems fair.

Why Is Now The Time To Buy Palo Alto Networks?

Why Is Now The Time To Buy Palo Alto Networks?

Palo Alto Networks’s stock price of $149.75 implies a valuation ratio of 10.6x forward price-to-sales. Palo Alto Networks’s valuation multiple is higher than that of many software peers, but we think this is appropriate when considering fundamentals.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Palo Alto Networks (PANW) Research Report: Q4 CY2025 Update

Cybersecurity platform provider Palo Alto Networks (NASDAQ:PANW) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 14.9% year on year to $2.59 billion. The company expects next quarter’s revenue to be around $2.94 billion, coming in 13.1% above analysts’ estimates. Its GAAP profit of $0.61 per share was 32.2% above analysts’ consensus estimates.

Palo Alto Networks (PANW) Q4 CY2025 Highlights:

- Revenue: $2.59 billion vs analyst estimates of $2.58 billion (14.9% year-on-year growth, in line)

- EPS (GAAP): $0.61 vs analyst estimates of $0.46 (32.2% beat)

- The company lifted its revenue guidance for the full year to $11.3 billion at the midpoint from $10.52 billion, a 7.4% increase

- Full year guidance for Next-Generation Security ARR and Remaining performance obligations beat

- Operating Margin: 15.3%, up from 10.6% in the same quarter last year

- Market Capitalization: $116.4 billion

Company Overview

Founded in 2005 by security visionary Nir Zuk who sought to reimagine firewall technology, Palo Alto Networks (NASDAQ:PANW) provides AI-powered cybersecurity platforms that protect organizations' networks, clouds, and endpoints from sophisticated threats.

The company's comprehensive security approach spans four key areas. Its network security offerings include next-generation firewalls and secure access service edge (SASE) solutions that protect remote workforces and branch offices. For cloud environments, Palo Alto Networks delivers its Prisma Cloud platform, which secures applications throughout their lifecycle from code development to deployment, protecting against vulnerabilities across multi-cloud infrastructures.

In security operations, the company's Cortex platform combines analytics, automation, and threat intelligence to help organizations detect, investigate, and respond to complex attacks. This includes capabilities like extended detection and response (XDR) and security orchestration, automation, and response (SOAR). The company's Unit 42 team provides threat intelligence, incident response, and consulting services.

A typical customer might be a financial services company using Palo Alto Networks' next-generation firewalls to protect their network perimeter, Prisma Cloud to secure their cloud applications, and Cortex XSIAM to automate security operations. The company generates revenue through hardware sales, software licenses, and recurring subscriptions for cloud-delivered services and support.

Palo Alto Networks employs a two-tier sales model, selling primarily through distributors and channel partners who then sell to end customers across industries including finance, healthcare, government, education, and telecommunications. The company has positioned itself strategically by focusing on consolidating security functions that would otherwise require multiple point products, simplifying security architecture for its customers.

4. Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

Palo Alto Networks faces competition from large tech companies that incorporate security features into their products, such as Cisco, Microsoft, and Google. It also competes with independent security vendors including Check Point Software, Fortinet, CrowdStrike, Zscaler, and Wiz, which offer various specialized security products.

5. Revenue Growth

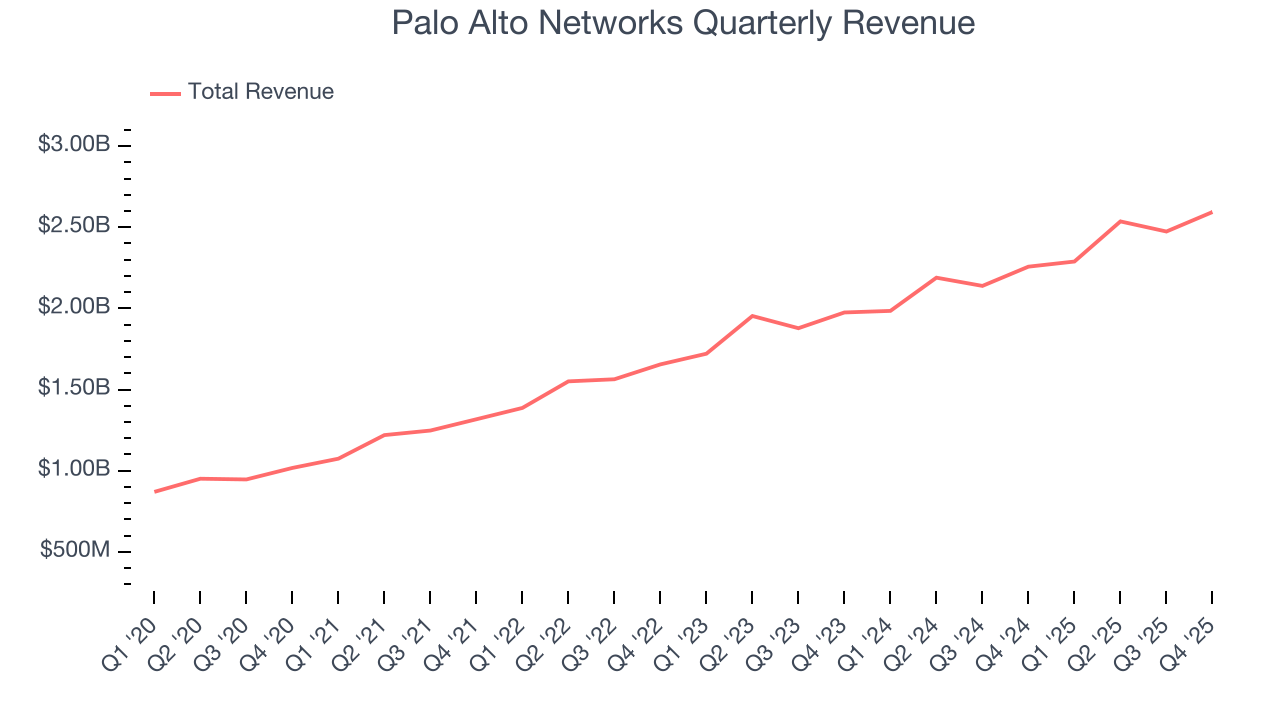

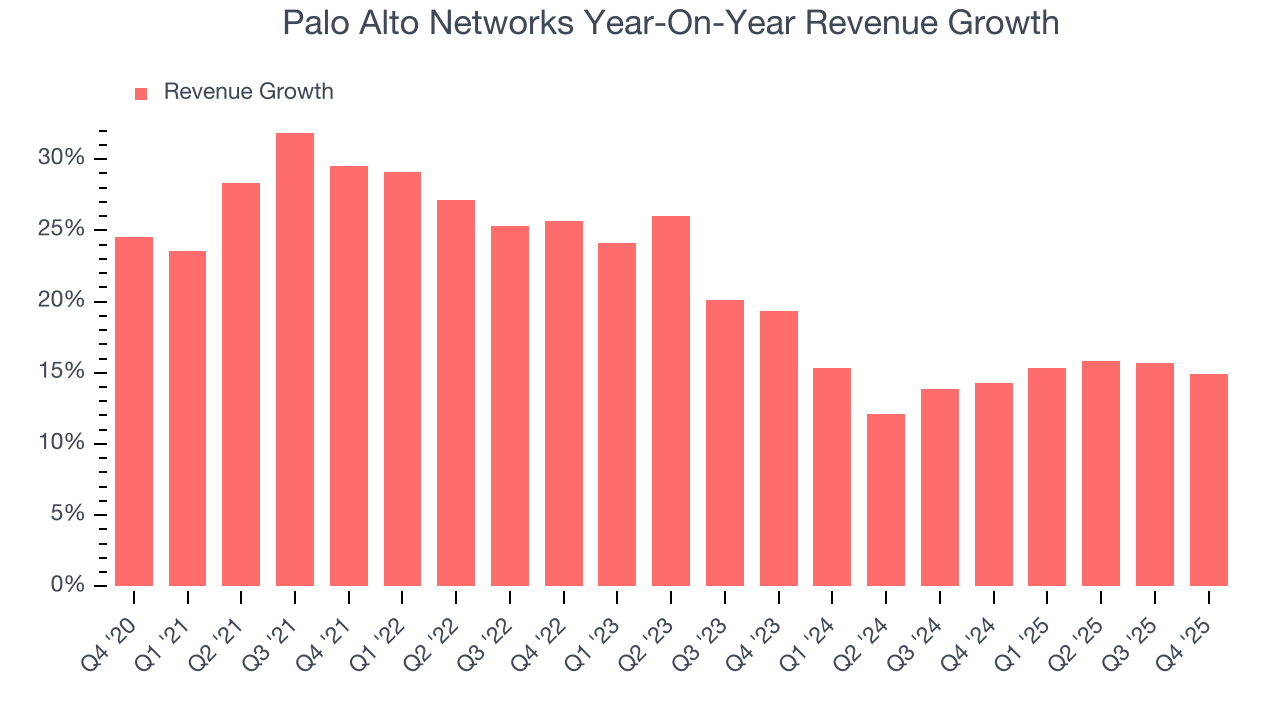

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Palo Alto Networks’s sales grew at a decent 21.2% compounded annual growth rate over the last five years. Its growth was slightly above the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Palo Alto Networks’s recent performance shows its demand has slowed as its annualized revenue growth of 14.6% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Palo Alto Networks’s year-on-year revenue growth was 14.9%, and its $2.59 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 28.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.1% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Palo Alto Networks is extremely efficient at acquiring new customers, and its CAC payback period checked in at 21.5 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

7. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

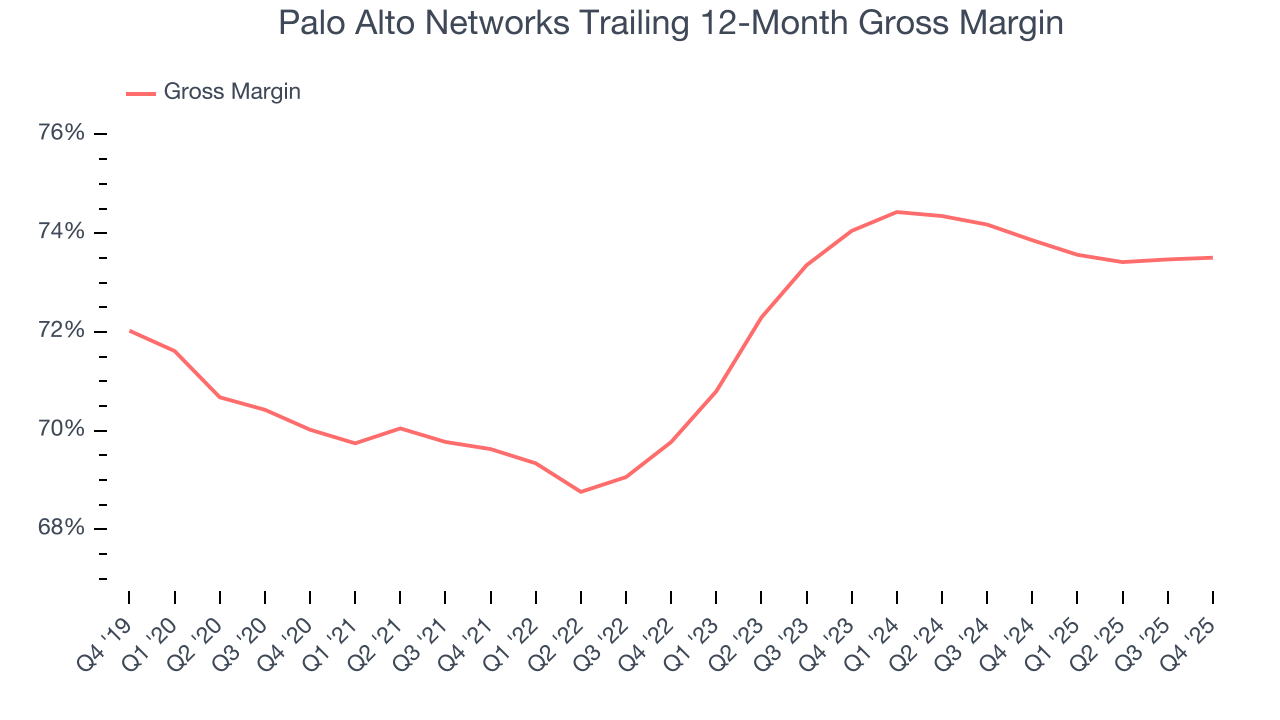

Palo Alto Networks’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 73.5% gross margin over the last year. Said differently, Palo Alto Networks paid its providers $26.50 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Palo Alto Networks has seen gross margins decline by 0.5 percentage points over the last 2 year, which is slightly worse than average for software.

This quarter, Palo Alto Networks’s gross profit margin was 73.6%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

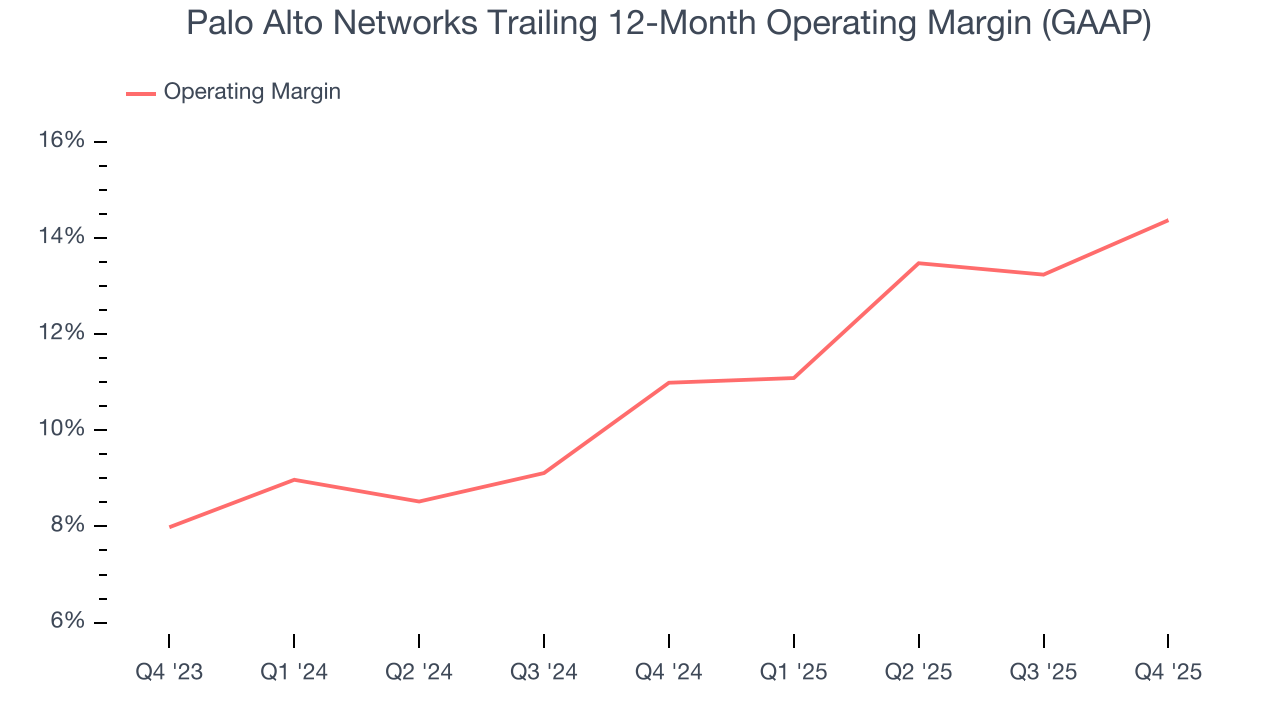

Palo Alto Networks has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 14.4%.

Looking at the trend in its profitability, Palo Alto Networks’s operating margin rose by 3.4 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Palo Alto Networks generated an operating margin profit margin of 15.3%, up 4.7 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

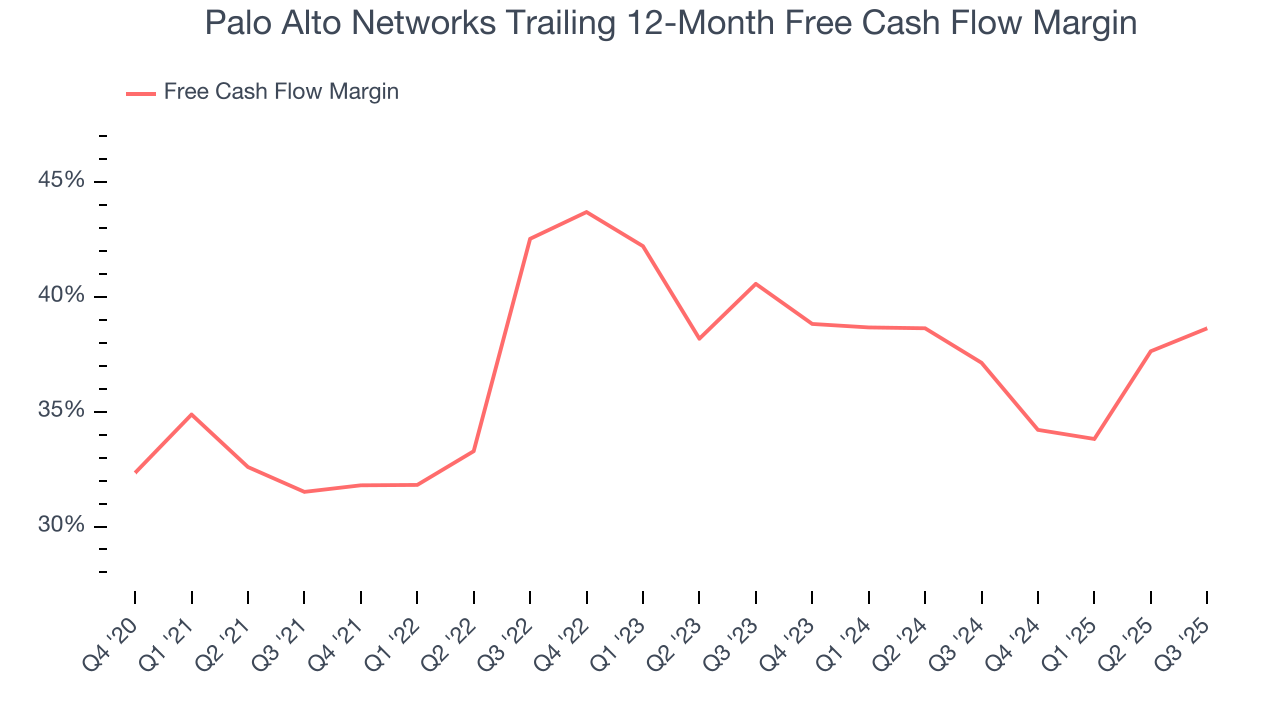

Palo Alto Networks has shown terrific cash profitability, driven by its cost-effective customer acquisition strategy that enables it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 43.6% over the last year.

10. Key Takeaways from Palo Alto Networks’s Q4 Results

We were impressed by Palo Alto Networks’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. Investors were likely hoping for more, and shares traded down 5.2% to $155.09 immediately following the results.

11. Is Now The Time To Buy Palo Alto Networks?

Updated: February 17, 2026 at 9:17 PM EST

Before investing in or passing on Palo Alto Networks, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Palo Alto Networks possesses a number of positive attributes. First off, its revenue growth was solid over the last five years. And while Palo Alto Networks’s expanding operating margin shows it’s becoming more efficient at building and selling its software, its bountiful generation of free cash flow empowers it to invest in growth initiatives.

Palo Alto Networks’s price-to-sales ratio based on the next 12 months is 10.6x. When scanning the software space, Palo Alto Networks trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $223.91 on the company (compared to the current share price of $149.75), implying they see 49.5% upside in buying Palo Alto Networks in the short term.