Power Integrations (POWI)

Power Integrations faces an uphill battle. Its flat sales show demand is soft and its weak profitability limits how much it can reinvest to ignite growth.― StockStory Analyst Team

1. News

2. Summary

Why We Think Power Integrations Will Underperform

A leading supplier of parts for electronics such as home appliances, Power Integrations (NASDAQ:POWI) is a semiconductor designer and developer specializing in products used for high-voltage power conversion.

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 1.9%

- Sales stagnated over the last five years and signal the need for new growth strategies

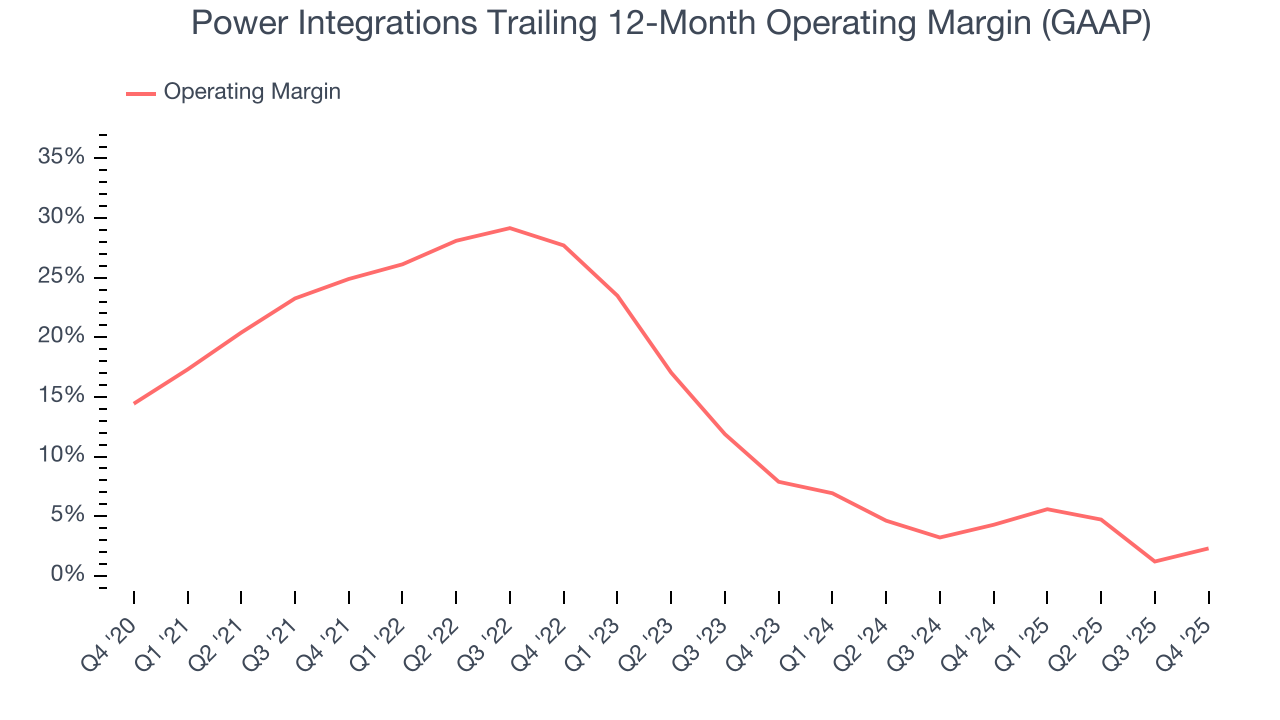

- Operating margin has deteriorated over the last five years from an already low base, hampering its adaptability and competitive positioning

Power Integrations’s quality is lacking. There are more appealing investments to be made.

Why There Are Better Opportunities Than Power Integrations

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Power Integrations

At $47.52 per share, Power Integrations trades at 40.6x forward P/E. The current multiple is quite expensive, especially for the tepid revenue growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Power Integrations (POWI) Research Report: Q4 CY2025 Update

Semiconductor designer Power Integrations (NASDAQ:POWI) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 1.9% year on year to $103.2 million. The company expects next quarter’s revenue to be around $106.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.23 per share was 19.5% above analysts’ consensus estimates.

Power Integrations (POWI) Q4 CY2025 Highlights:

- Revenue: $103.2 million vs analyst estimates of $103 million (1.9% year-on-year decline, in line)

- Adjusted EPS: $0.23 vs analyst estimates of $0.19 (19.5% beat)

- Adjusted Operating Income: $10.02 million vs analyst estimates of $8.13 million (9.7% margin, 23.2% beat)

- Revenue Guidance for Q1 CY2026 is $106.5 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 8.5%, up from 3.7% in the same quarter last year

- Free Cash Flow Margin: 18.6%, up from 11.1% in the same quarter last year

- Inventory Days Outstanding: 313, up from 277 in the previous quarter

- Market Capitalization: $2.61 billion

Company Overview

A leading supplier of parts for electronics such as home appliances, Power Integrations (NASDAQ:POWI) is a semiconductor designer and developer specializing in products used for high-voltage power conversion.

Power Integrations was founded in 1988 by Ray Orr and Steven Sharp. The company went public in December of 1997 and is currently headquartered in San Jose, California.

Almost all electronic devices that plug into a wall socket require a power supply to convert the high-voltage alternating current provided by electric utilities into the low-voltage direct current required by most electronic devices. POWI’s products address this need by converting alternating current (AC) to direct current (DC) or vice versa, reducing or increasing the voltage, and regulating the output voltage/current according to customer specifications.

POWI serves customers in four end-market groups: Consumer (e.g. manufacturers of home appliances, TVs), Communications (e.g. mobile phone chargers, adapters for routers), Industrial (e.g. motor controls, battery-powered tools), and Computer (smart home devices, wearables). POWI then contracts with three foundries for the manufacture of most of its silicon wafers.

Competitors in the market for high-voltage ICs include ON Semiconductor (NASDAQ:ON) STMicroelectronics (NYSE:STM), NXP Semiconductors (NASDAQ:NXPI), and Infineon.

4. Revenue Growth

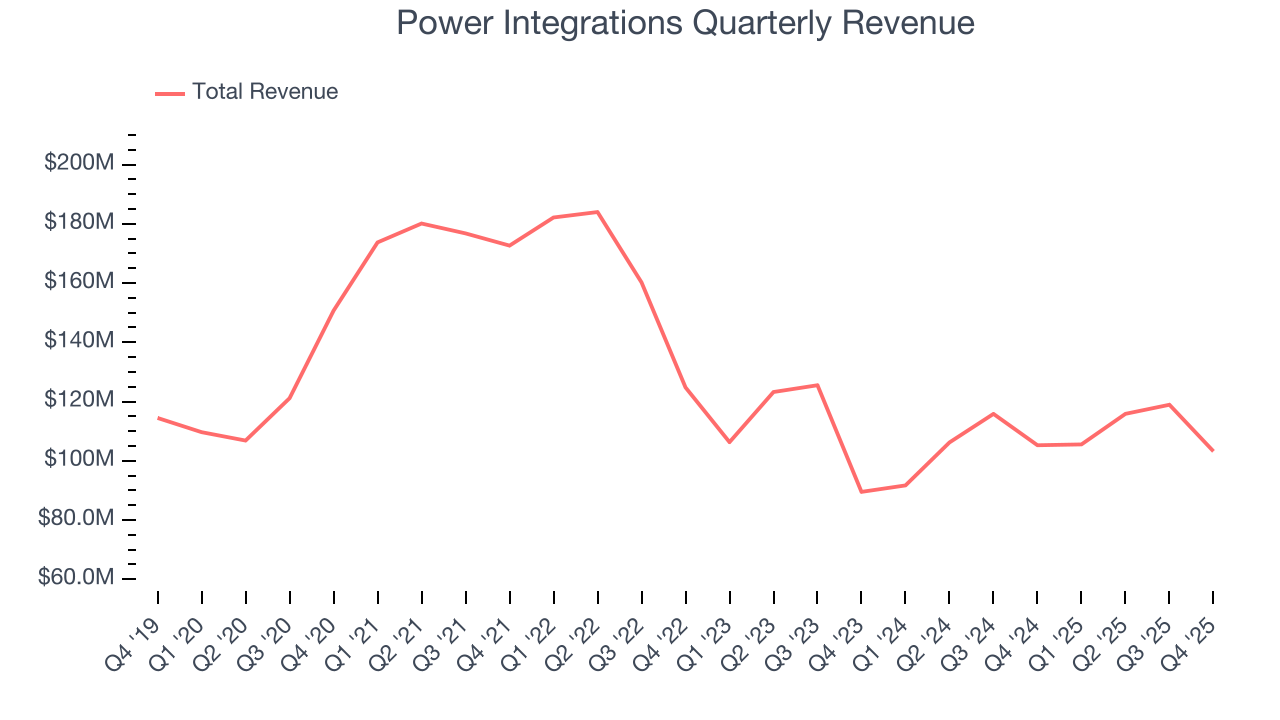

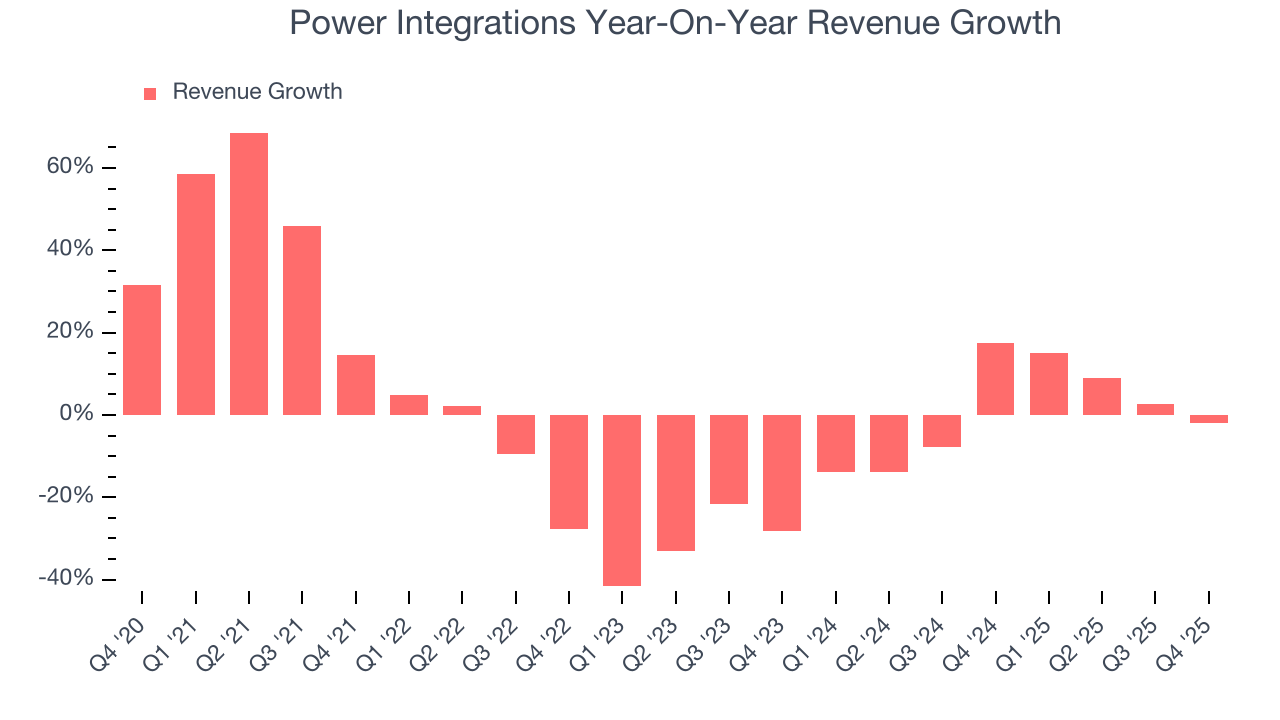

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Power Integrations’s demand was weak over the last five years as its sales fell at a 1.9% annual rate. This was below our standards and is a sign of poor business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Power Integrations’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.

This quarter, Power Integrations reported a rather uninspiring 1.9% year-on-year revenue decline to $103.2 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

5. Product Demand & Outstanding Inventory

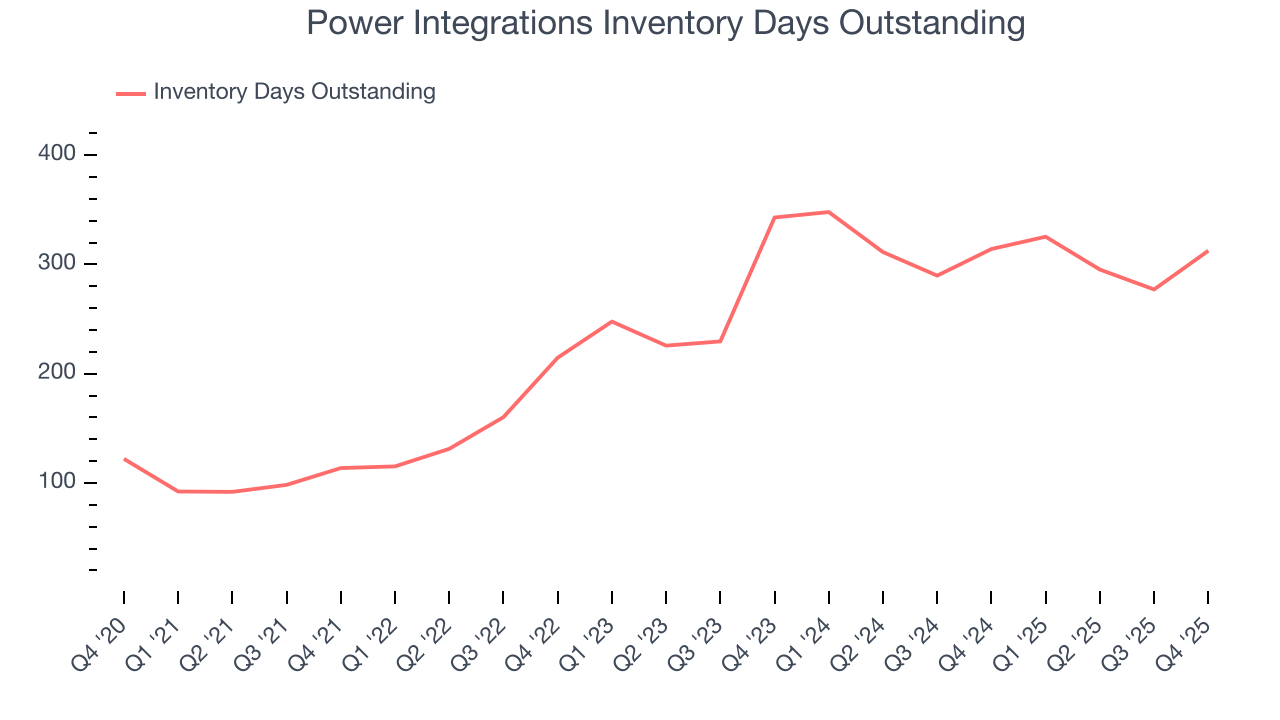

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Power Integrations’s DIO came in at 313, which is 86 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

6. Gross Margin & Pricing Power

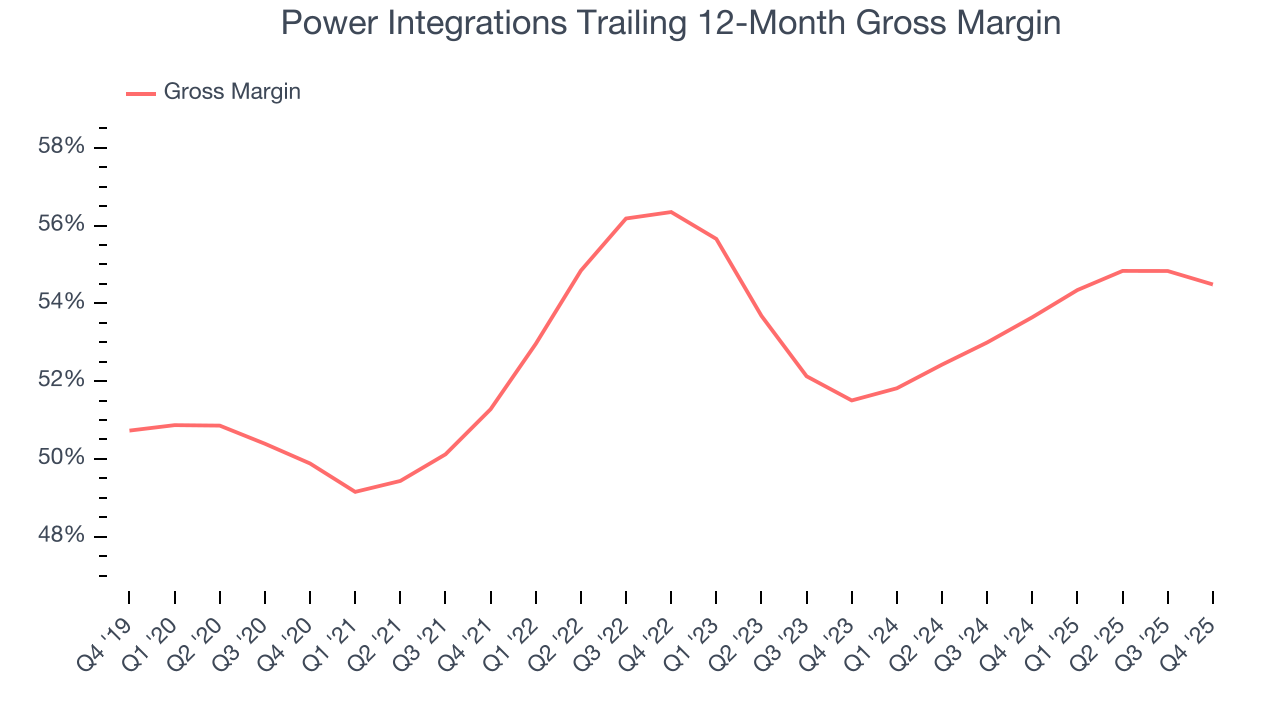

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Power Integrations’s gross margin is well ahead of its semiconductor peers, and its strong pricing power is an output of its differentiated, value-add products. As you can see below, it averaged an excellent 54.1% gross margin over the last two years. Said differently, roughly $54.08 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

In Q4, Power Integrations produced a 52.9% gross profit margin, marking a 1.5 percentage point decrease from 54.4% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Power Integrations was profitable over the last two years but held back by its large cost base. Its average operating margin of 3.3% was weak for a semiconductor business. This result is surprising given its high gross margin as a starting point.

Looking at the trend in its profitability, Power Integrations’s operating margin decreased by 22.6 percentage points over the last five years. Power Integrations’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Power Integrations generated an operating margin profit margin of 8.5%, up 4.8 percentage points year on year. The increase was encouraging, and because its revenue and gross margin actually decreased, we can assume it was more efficient because it trimmed its operating expenses like marketing, R&D, and administrative overhead.

8. Earnings Per Share

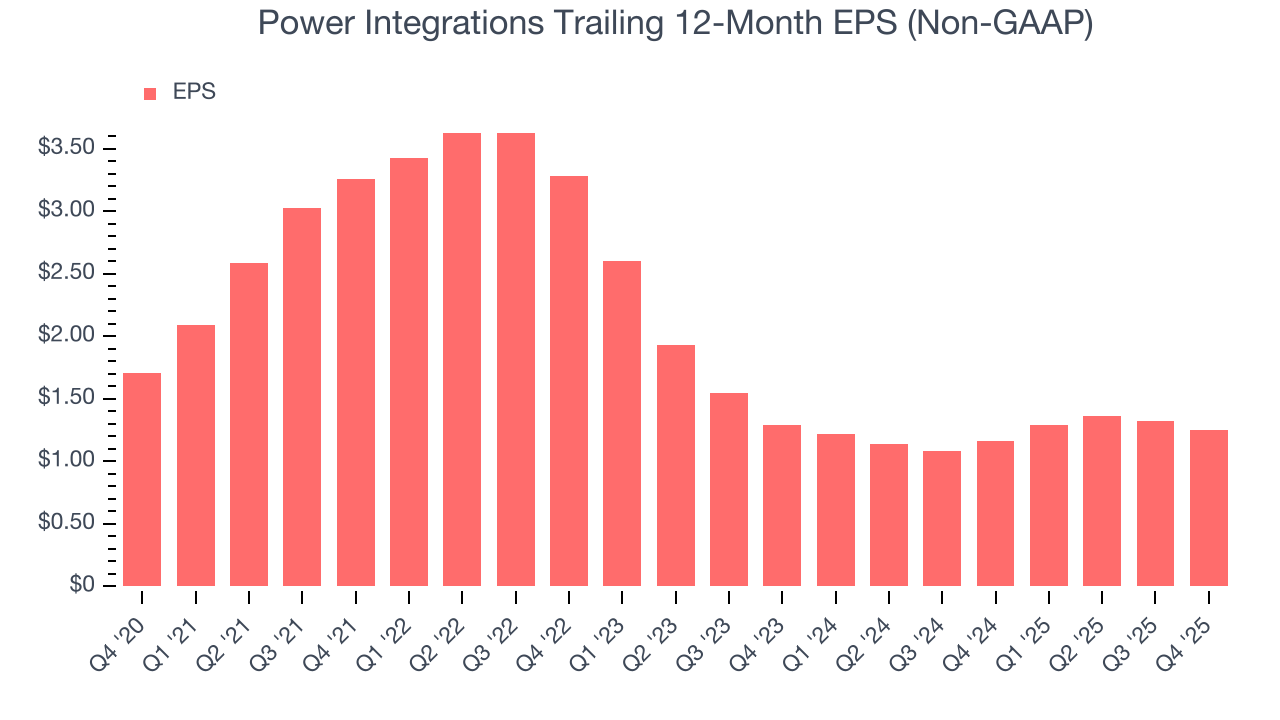

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Power Integrations, its EPS declined by 6.1% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Power Integrations’s earnings to better understand the drivers of its performance. As we mentioned earlier, Power Integrations’s operating margin expanded this quarter but declined by 22.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Power Integrations reported adjusted EPS of $0.23, down from $0.30 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Power Integrations’s full-year EPS of $1.25 to grow 4.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

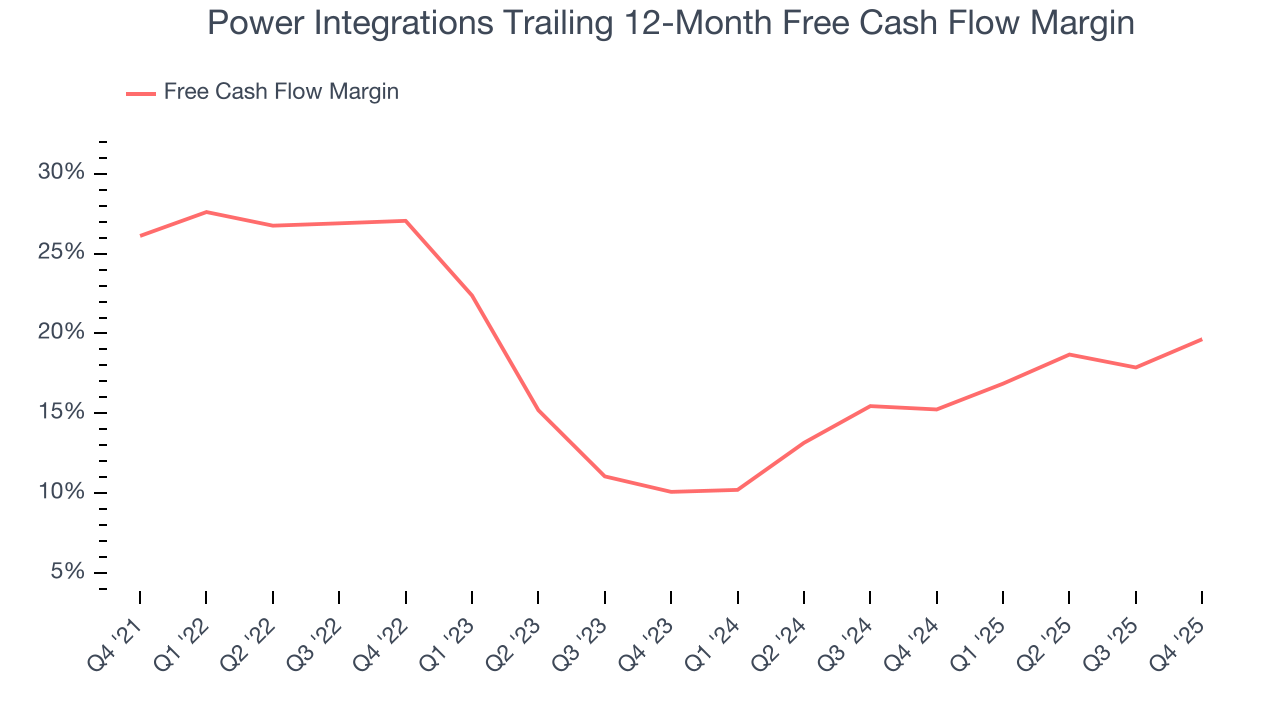

Power Integrations has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 17.5% over the last two years, slightly better than the broader semiconductor sector.

Taking a step back, we can see that Power Integrations’s margin dropped by 6.5 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it is in the middle of an investment cycle.

Power Integrations’s free cash flow clocked in at $19.16 million in Q4, equivalent to a 18.6% margin. This result was good as its margin was 7.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

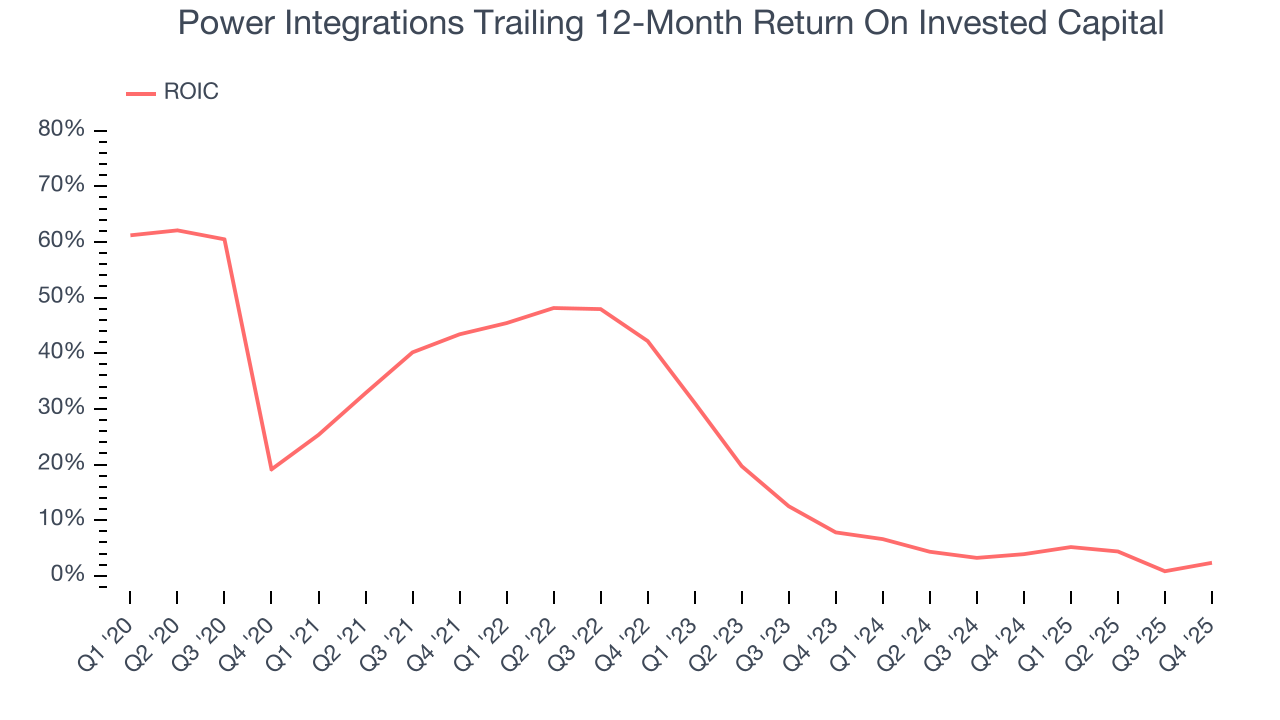

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Power Integrations’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 19.9%, slightly better than typical semiconductor business.

11. Key Takeaways from Power Integrations’s Q4 Results

It was good to see Power Integrations beat analysts’ EPS expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. On the other hand, its inventory levels materially increased. Overall, we think this was still a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 3.3% to $45.84 immediately after reporting.

12. Is Now The Time To Buy Power Integrations?

Updated: February 5, 2026 at 4:34 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Power Integrations falls short of our quality standards. For starters, its revenue has declined over the last five years. And while its gross margins indicate it has pricing power, the downside is its declining operating margin shows the business has become less efficient. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Power Integrations’s P/E ratio based on the next 12 months is 36.1x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $51 on the company (compared to the current share price of $45.84).