Qualys (QLYS)

We’re cautious of Qualys. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think Qualys Will Underperform

Originally developed to address the growing complexity of IT security in the cloud era, Qualys (NASDAQ:QLYS) provides a cloud-based platform that helps organizations identify, manage, and protect their IT assets from cyber threats across on-premises, cloud, and mobile environments.

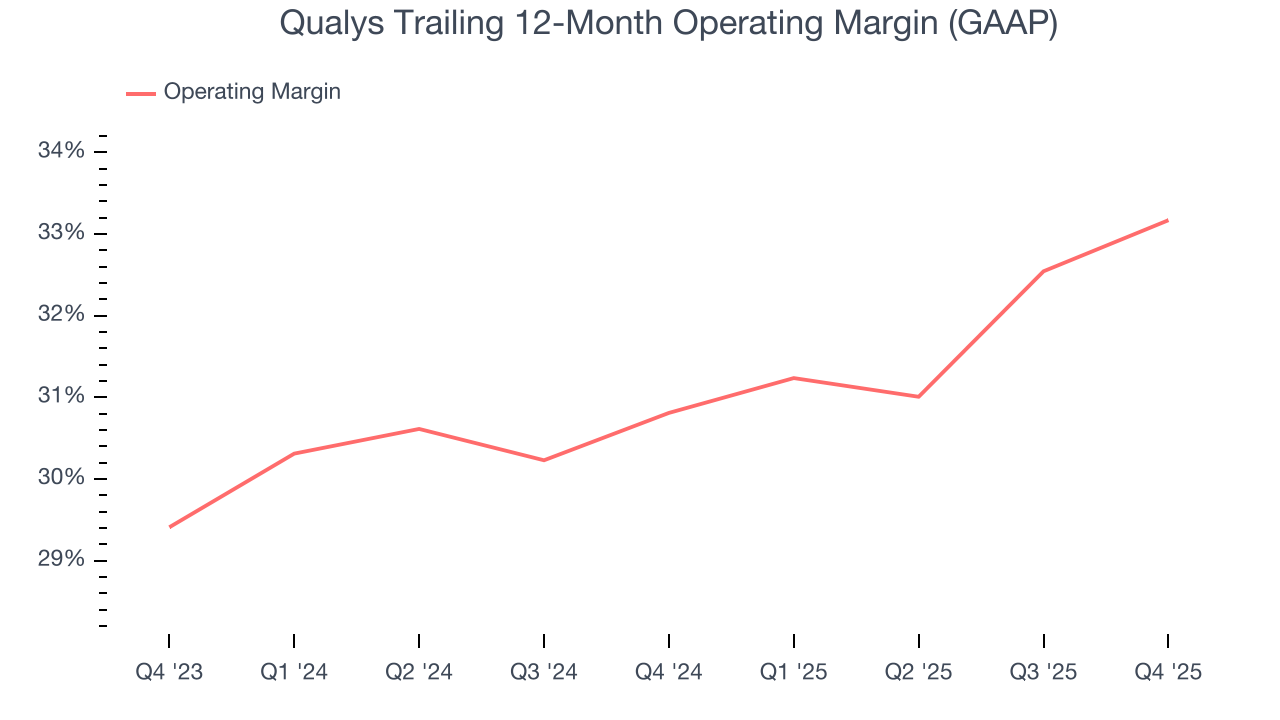

- Operating profits and efficiency rose over the last year as it benefited from some fixed cost leverage

- Estimated sales growth of 8.1% for the next 12 months implies demand will slow from its two-year trend

- On the plus side, its excellent operating margin highlights the strength of its business model, and its profits increased over the last year as it scaled

Qualys’s quality doesn’t meet our bar. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Qualys

Why There Are Better Opportunities Than Qualys

Qualys is trading at $129.23 per share, or 6.6x forward price-to-sales. This multiple is quite expensive for the quality you get.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Qualys (QLYS) Research Report: Q4 CY2025 Update

Cybersecurity cloud platform provider Qualys (NASDAQ:QLYS) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 10.1% year on year to $175.3 million. The company expects next quarter’s revenue to be around $173.5 million, close to analysts’ estimates. Its non-GAAP profit of $1.87 per share was 4.9% above analysts’ consensus estimates.

Qualys (QLYS) Q4 CY2025 Highlights:

- Revenue: $175.3 million vs analyst estimates of $173.2 million (10.1% year-on-year growth, 1.2% beat)

- Adjusted EPS: $1.87 vs analyst estimates of $1.78 (4.9% beat)

- Adjusted Operating Income: $80.13 million vs analyst estimates of $76.61 million (45.7% margin, 4.6% beat)

- Revenue Guidance for Q1 CY2026 is $173.5 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.31 at the midpoint, missing analyst estimates by 1.3%

- Operating Margin: 33.6%, up from 31% in the same quarter last year

- Billings: $204.9 million at quarter end, up 5.6% year on year

- Market Capitalization: $4.63 billion

Company Overview

Originally developed to address the growing complexity of IT security in the cloud era, Qualys (NASDAQ:QLYS) provides a cloud-based platform that helps organizations identify, manage, and protect their IT assets from cyber threats across on-premises, cloud, and mobile environments.

Qualys' Enterprise TruRisk Platform serves as a central hub for IT security and compliance, enabling customers to continuously monitor their entire digital footprint. The platform uses a variety of sensors – including physical scanners, virtual scanners, and lightweight agents – to collect data from assets throughout an organization's infrastructure. This collected data is then processed, analyzed, and correlated in Qualys' cloud backend to identify vulnerabilities, compliance issues, and potential threats.

The company's solution suite consists of over 20 integrated Cloud Apps covering critical security functions like vulnerability management, patch management, compliance monitoring, and threat detection and response. For example, a healthcare organization might use Qualys to discover all devices on its network, identify those running outdated software with known security flaws, prioritize which vulnerabilities pose the greatest risk, and automatically deploy necessary patches.

Qualys generates revenue through subscription-based pricing, with customers paying annual fees to access its cloud platform. Its flexible deployment options include a multi-tenant shared cloud infrastructure or a Private Cloud Platform for organizations with specific security or regulatory requirements. The company serves over 10,000 customers worldwide across various industries, including financial services, healthcare, manufacturing, and government, with both direct sales teams and channel partners helping to distribute its solutions globally.

4. Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

Qualys competes with established cybersecurity providers like CrowdStrike (NASDAQ:CRWD), Palo Alto Networks (NASDAQ:PANW), Tenable Holdings (NASDAQ:TENB), and Rapid7 (NASDAQ:RPD), as well as private companies such as Tanium, Wiz, and Axonius that offer various aspects of vulnerability management and security operations solutions.

5. Revenue Growth

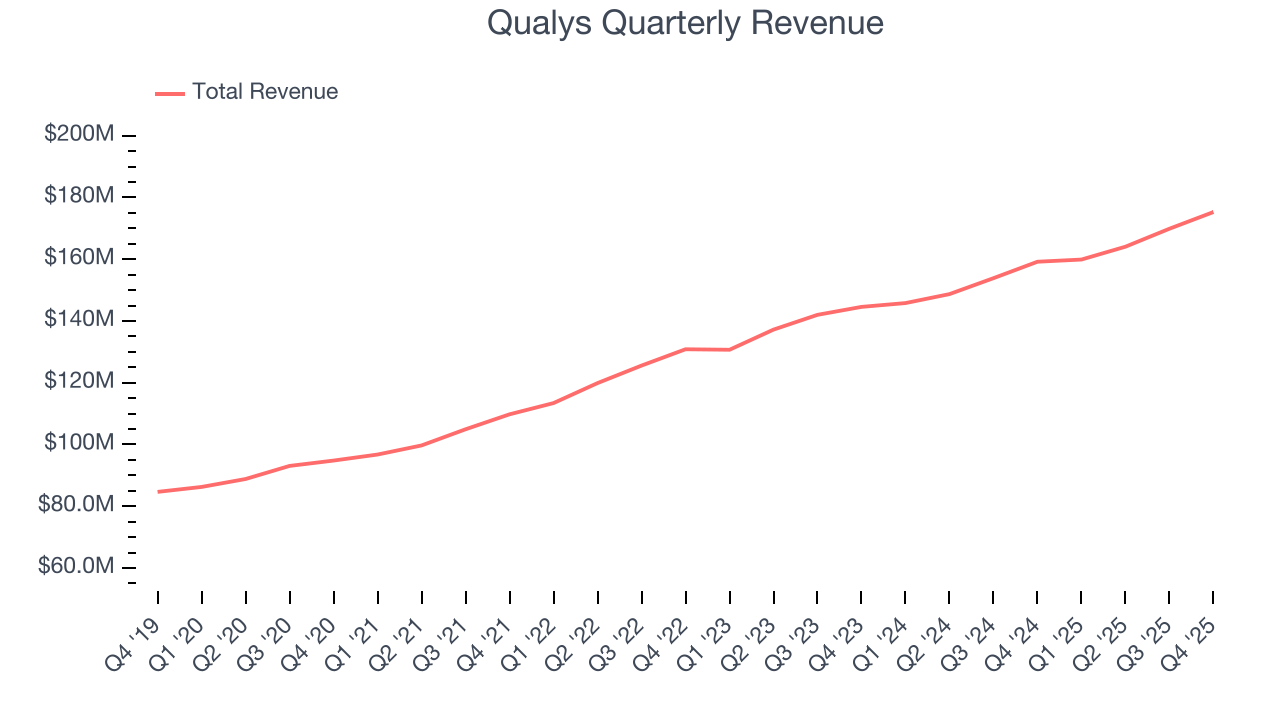

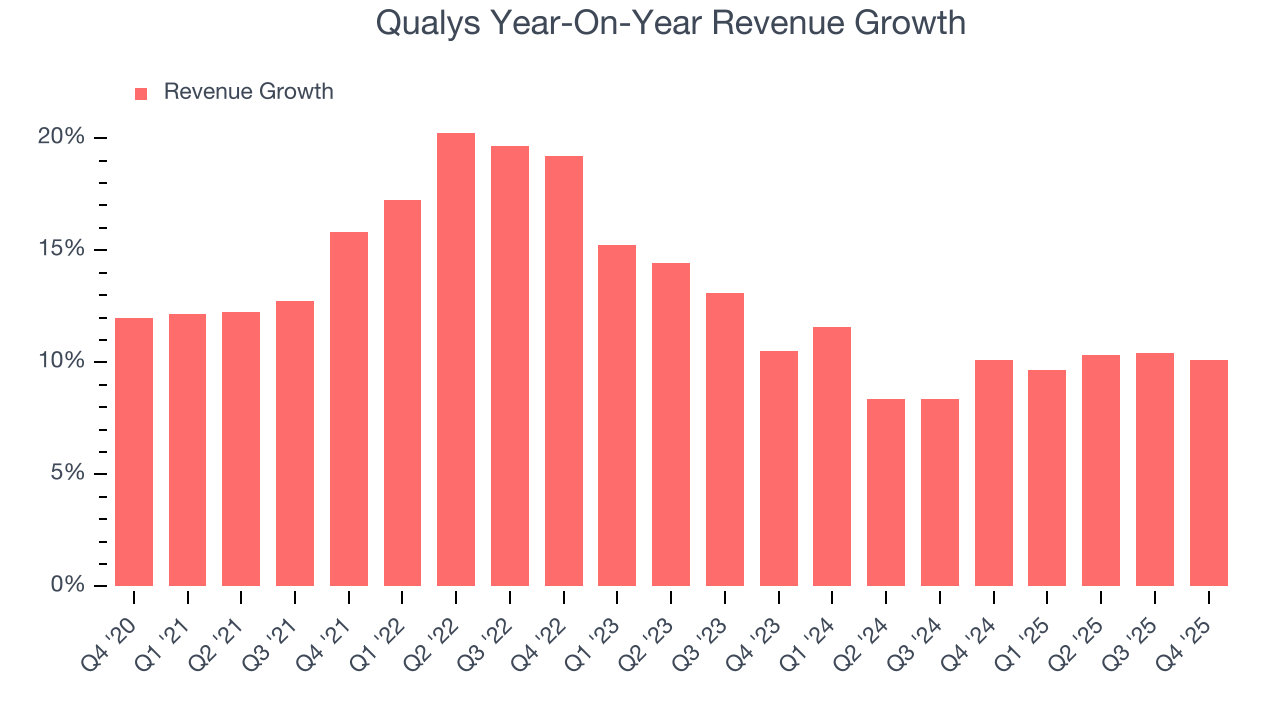

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Qualys grew its sales at a 13% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Qualys’s recent performance shows its demand has slowed as its annualized revenue growth of 9.9% over the last two years was below its five-year trend.

This quarter, Qualys reported year-on-year revenue growth of 10.1%, and its $175.3 million of revenue exceeded Wall Street’s estimates by 1.2%. Company management is currently guiding for a 8.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

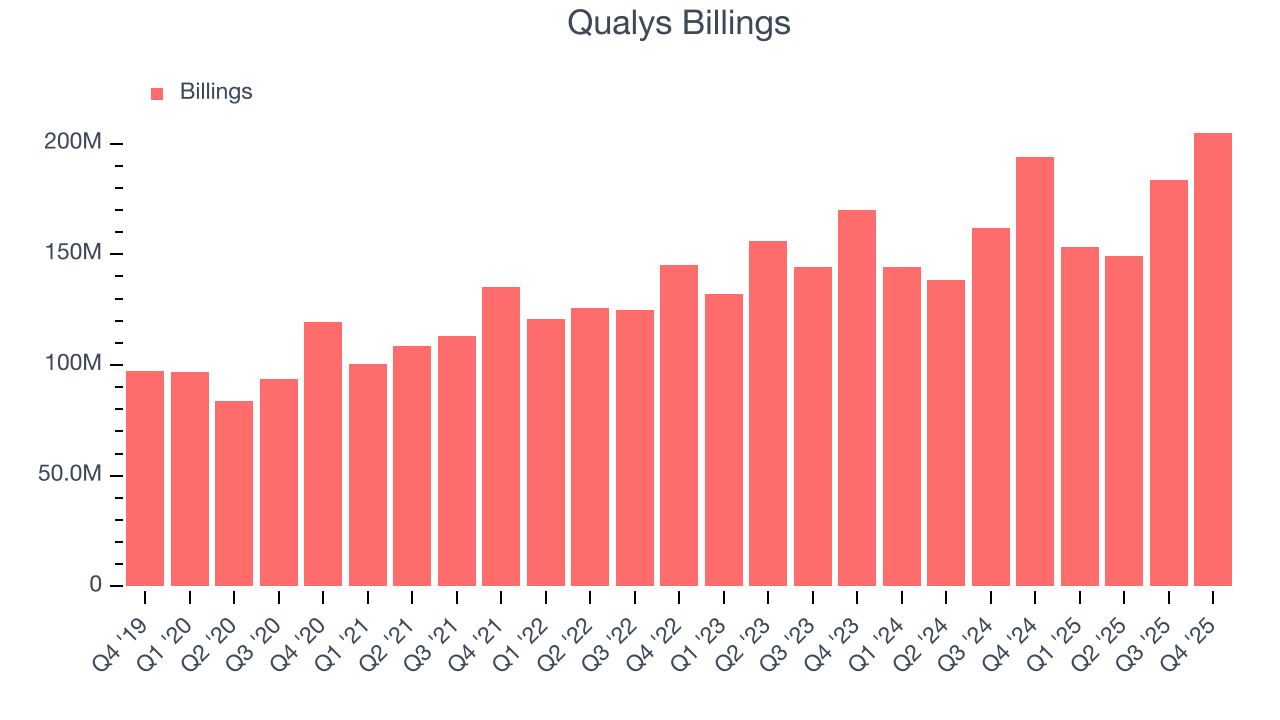

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Qualys’s billings came in at $204.9 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 8.3% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s expensive for Qualys to acquire new customers as its CAC payback period checked in at 62.6 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

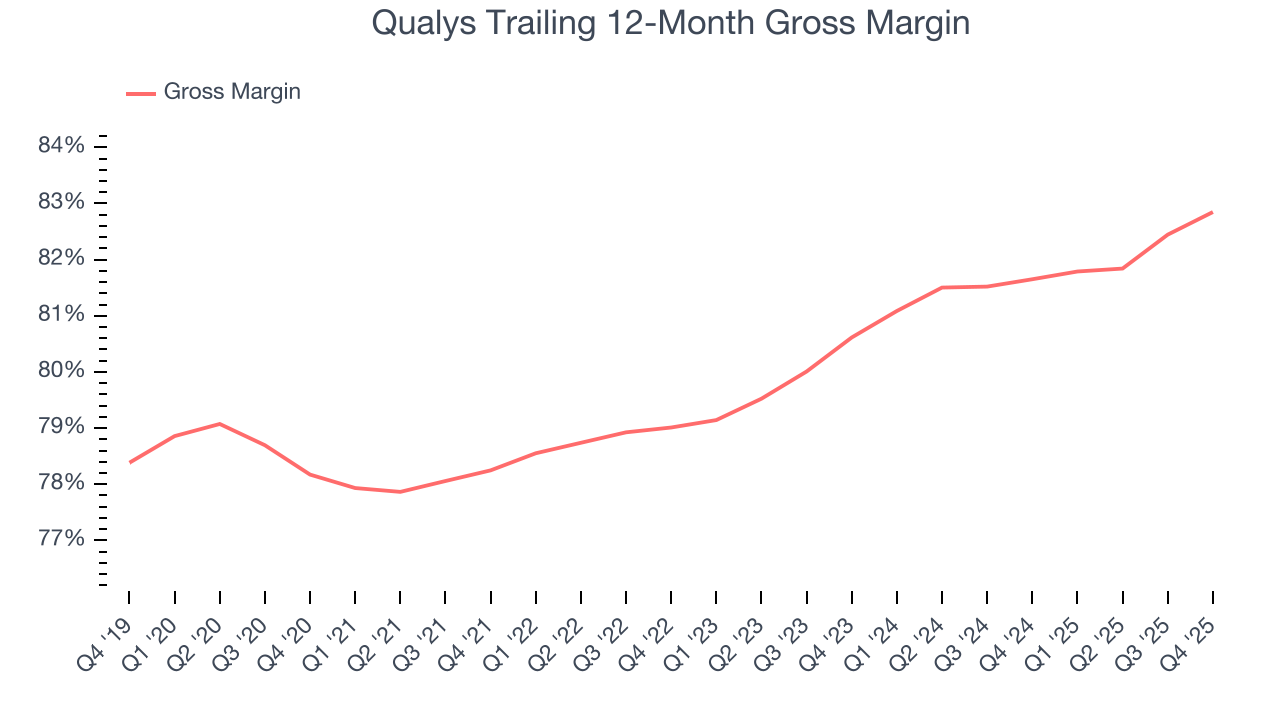

8. Gross Margin & Pricing Power

For software companies like Qualys, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Qualys’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 82.8% gross margin over the last year. Said differently, roughly $82.85 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Qualys has seen gross margins improve by 2.2 percentage points over the last 2 year, which is solid in the software space.

Qualys’s gross profit margin came in at 83.4% this quarter, marking a 1.6 percentage point increase from 81.8% in the same quarter last year. Qualys’s full-year margin has also been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

9. Operating Margin

Qualys has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 33.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Qualys’s operating margin rose by 2.4 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, Qualys generated an operating margin profit margin of 33.6%, up 2.5 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Cash Is King

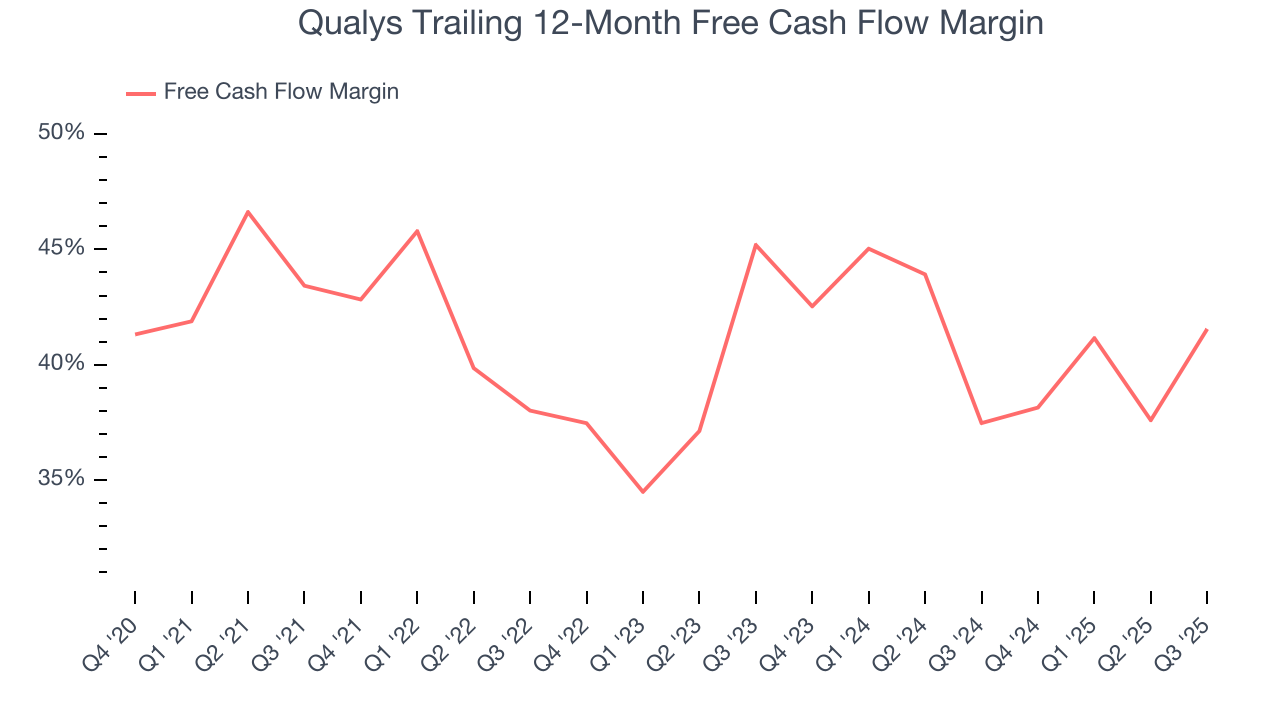

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Qualys has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 46.5% over the last year.

11. Balance Sheet Assessment

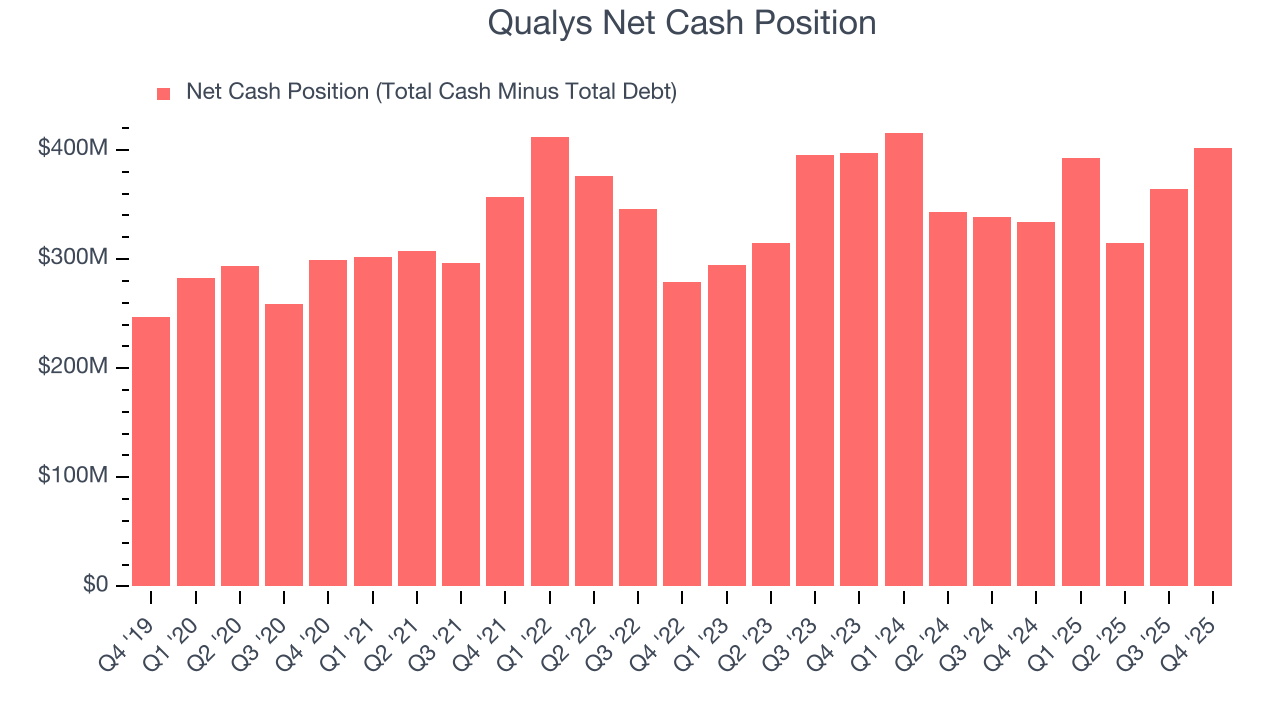

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Qualys is a well-capitalized company with $447.1 million of cash and $44.96 million of debt on its balance sheet. This $402.2 million net cash position is 8.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Qualys’s Q4 Results

It was encouraging to see Qualys beat analysts’ EBITDA expectations this quarter. We were also glad its EPS guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed and its revenue guidance for next year suggests growth will stall. Zooming out, we think this was a mixed quarter. The stock remained flat at $126.91 immediately after reporting.

13. Is Now The Time To Buy Qualys?

Updated: February 5, 2026 at 4:20 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Qualys isn’t a terrible business, but it doesn’t pass our bar. To kick things off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its bountiful generation of free cash flow empowers it to invest in growth initiatives, the downside is its expanding operating margin shows it’s becoming more efficient at building and selling its software. On top of that, its ARR has disappointed and shows the company is having difficulty retaining customers and their spending.

Qualys’s price-to-sales ratio based on the next 12 months is 6.4x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $143.37 on the company (compared to the current share price of $126.91).