Richardson Electronics (RELL)

Richardson Electronics is up against the odds. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Richardson Electronics Will Underperform

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

- Annual sales declines of 3% for the past two years show its products and services struggled to connect with the market during this cycle

- Falling earnings per share over the last two years has some investors worried as stock prices ultimately follow EPS over the long term

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

Richardson Electronics fails to meet our quality criteria. There are more appealing investments to be made.

Why There Are Better Opportunities Than Richardson Electronics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Richardson Electronics

Richardson Electronics is trading at $11.88 per share, or 38.7x forward P/E. This multiple is higher than most industrials companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Richardson Electronics (RELL) Research Report: Q4 CY2025 Update

Electronics distributor Richardson Electronics (NASDAQ:RELL) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 5.7% year on year to $52.29 million. Its GAAP loss of $0.01 per share was in line with analysts’ consensus estimates.

Richardson Electronics (RELL) Q4 CY2025 Highlights:

- Revenue: $52.29 million vs analyst estimates of $49.9 million (5.7% year-on-year growth, 4.8% beat)

- EPS (GAAP): -$0.01 vs analyst estimates of -$0.01 (in line)

- Adjusted EBITDA: $741,000 vs analyst estimates of $720,000 (1.4% margin, relatively in line)

- Operating Margin: 0.3%, up from -1.4% in the same quarter last year

- Free Cash Flow was -$1.71 million, down from $4.95 million in the same quarter last year

- Backlog: $135.7 million at quarter end, down 4.8% year on year

- Market Capitalization: $167.2 million

Company Overview

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics offers products including high-voltage capacitors, microwave tubes, and custom displays. For example, the company supplies specialized components used in MRI machines within the healthcare sector, power control systems for wind turbines in renewable energy, and broadcast transmission equipment in the communications industry. The company also operates Canvys, which provides customized displays as well as EDAC Power America, which specializes in power management systems.

Revenue for Richardson Electronics is generated from the sale of these products and related components. The company sells its products worldwide through direct sales forces, other distributors, and an e-commerce platform. Richardson Electronics mainly targets original equipment manufacturers (OEMs) and end users in high-tech sectors.

While some of the company’s revenue is project-based, the company also benefits from recurring sales through maintenance, replacement parts, and upgrades. This can somewhat lessen the impact of macroeconomic swings on the appetite for projects in end markets such as telecom and healthcare, providing a more predictable and steady source of revenues.

4. Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Competitors in the electronic distribution industry include Arrow Electronics (NYSE:ARW), Avnet (NASDAQ:AVT), and TTM Technologies (NASDAQ:TTMI).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Richardson Electronics grew its sales at a mediocre 6.3% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Richardson Electronics’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3% annually.

Richardson Electronics also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Richardson Electronics’s backlog reached $135.7 million in the latest quarter and averaged 3.4% year-on-year declines over the last two years. Because this number is in line with its revenue growth, we can see the company effectively balanced its new order intake and fulfillment processes.

This quarter, Richardson Electronics reported year-on-year revenue growth of 5.7%, and its $52.29 million of revenue exceeded Wall Street’s estimates by 4.8%.

Looking ahead, sell-side analysts expect revenue to grow 8.2% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Richardson Electronics’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand. As you can see below, it averaged a decent 31.4% gross margin over the last five years. Said differently, Richardson Electronics paid its suppliers $68.60 for every $100 in revenue.

Richardson Electronics’s gross profit margin came in at 30.7% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

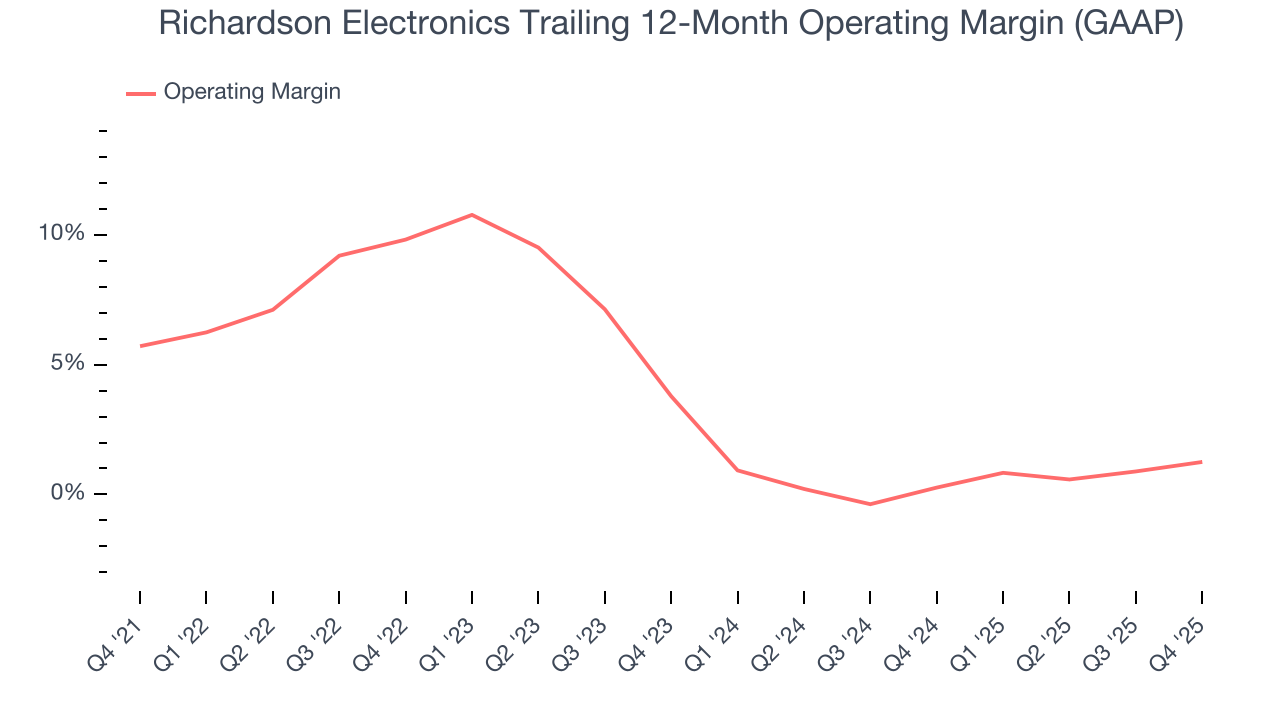

Richardson Electronics was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.4% was weak for an industrials business.

Analyzing the trend in its profitability, Richardson Electronics’s operating margin decreased by 4.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Richardson Electronics’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Richardson Electronics’s breakeven margin was up 1.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

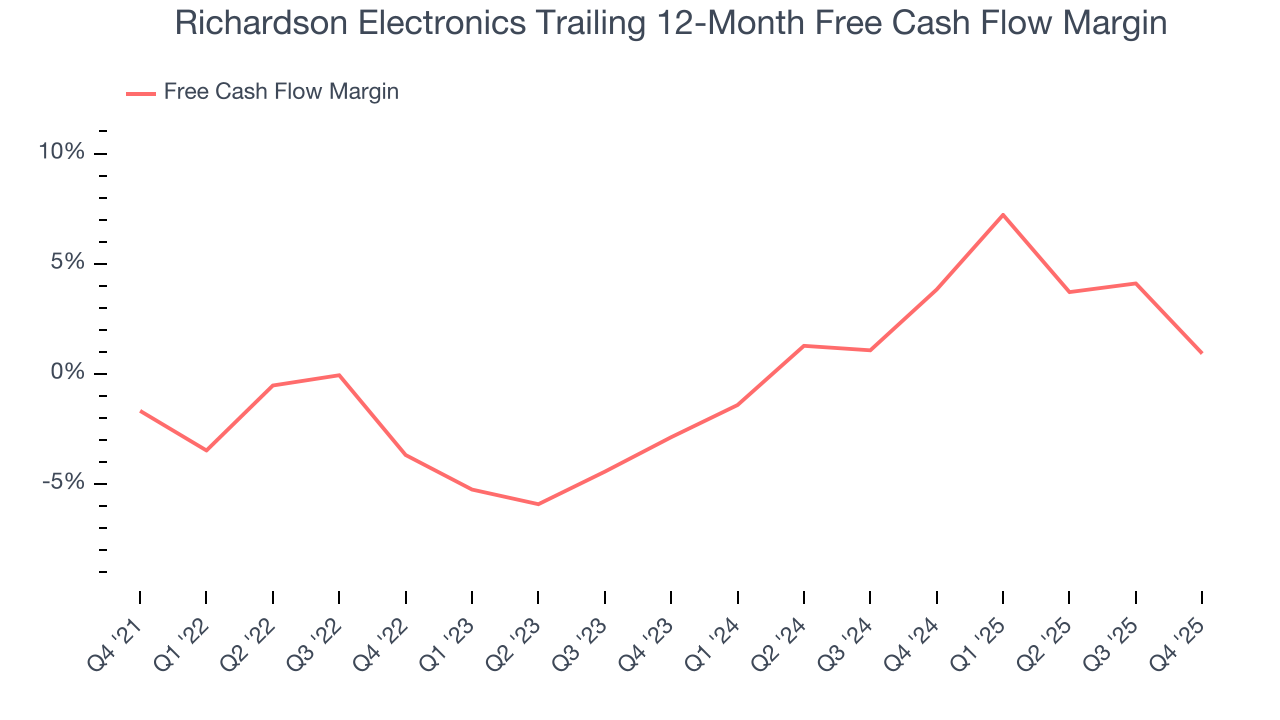

Richardson Electronics broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Richardson Electronics’s margin expanded by 2.6 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Richardson Electronics burned through $1.71 million of cash in Q4, equivalent to a negative 3.3% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

9. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

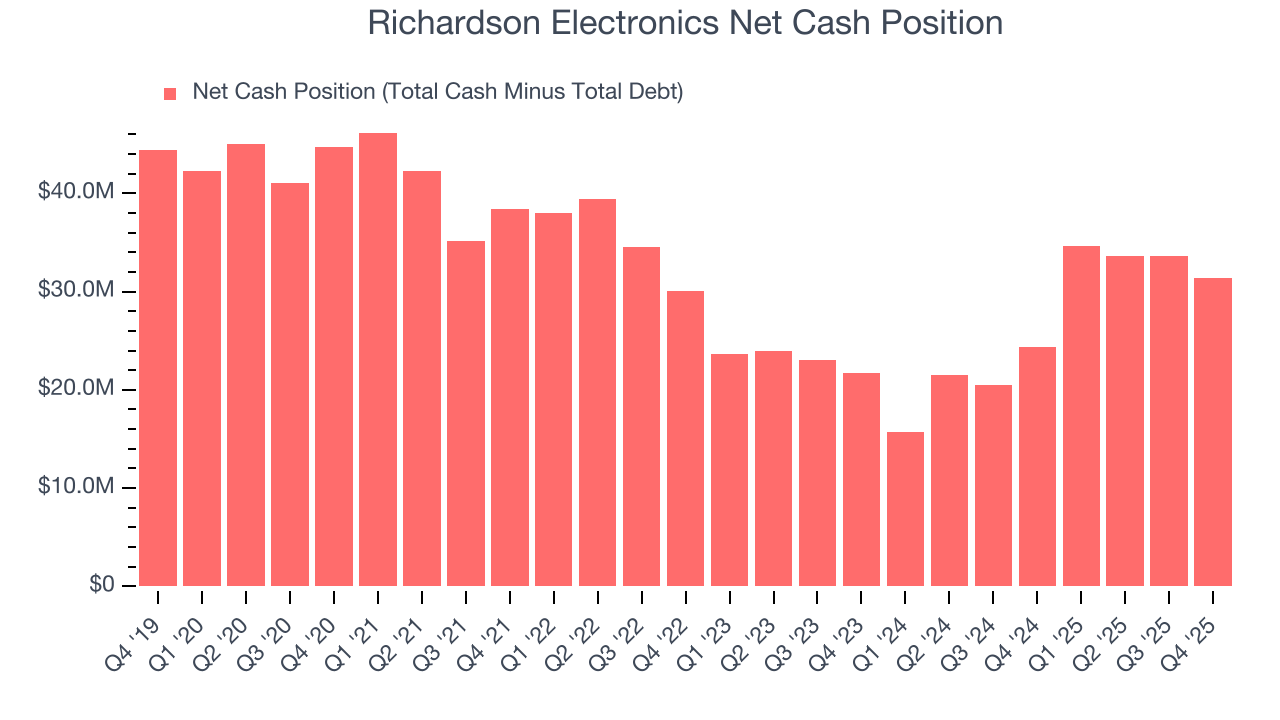

Richardson Electronics is a profitable, well-capitalized company with $33.14 million of cash and $1.74 million of debt on its balance sheet. This $31.4 million net cash position is 18.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from Richardson Electronics’s Q4 Results

We were impressed by how significantly Richardson Electronics blew past analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. Investors were likely hoping for more, and shares traded down 10.5% to $10.45 immediately after reporting.

11. Is Now The Time To Buy Richardson Electronics?

Updated: March 6, 2026 at 10:41 PM EST

Before making an investment decision, investors should account for Richardson Electronics’s business fundamentals and valuation in addition to what happened in the latest quarter.

We see the value of companies helping their customers, but in the case of Richardson Electronics, we’re out. To kick things off, its revenue growth was mediocre over the last five years. While its rising cash profitability gives it more optionality, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its projected EPS for the next year is lacking.

Richardson Electronics’s P/E ratio based on the next 12 months is 37.2x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $12 on the company (compared to the current share price of $10.90).