Rapid7 (RPD)

We wouldn’t recommend Rapid7. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think Rapid7 Will Underperform

With its name inspired by the need for quick responses to cyber threats, Rapid7 (NASDAQ:RPD) provides cybersecurity software and services that help organizations detect vulnerabilities, monitor threats, and respond to security incidents.

- ARR growth averaged a weak 2.1% over the last year, suggesting that competition is pulling some attention away from its software

- Projected sales decline of 2.5% for the next 12 months points to a tough demand environment ahead

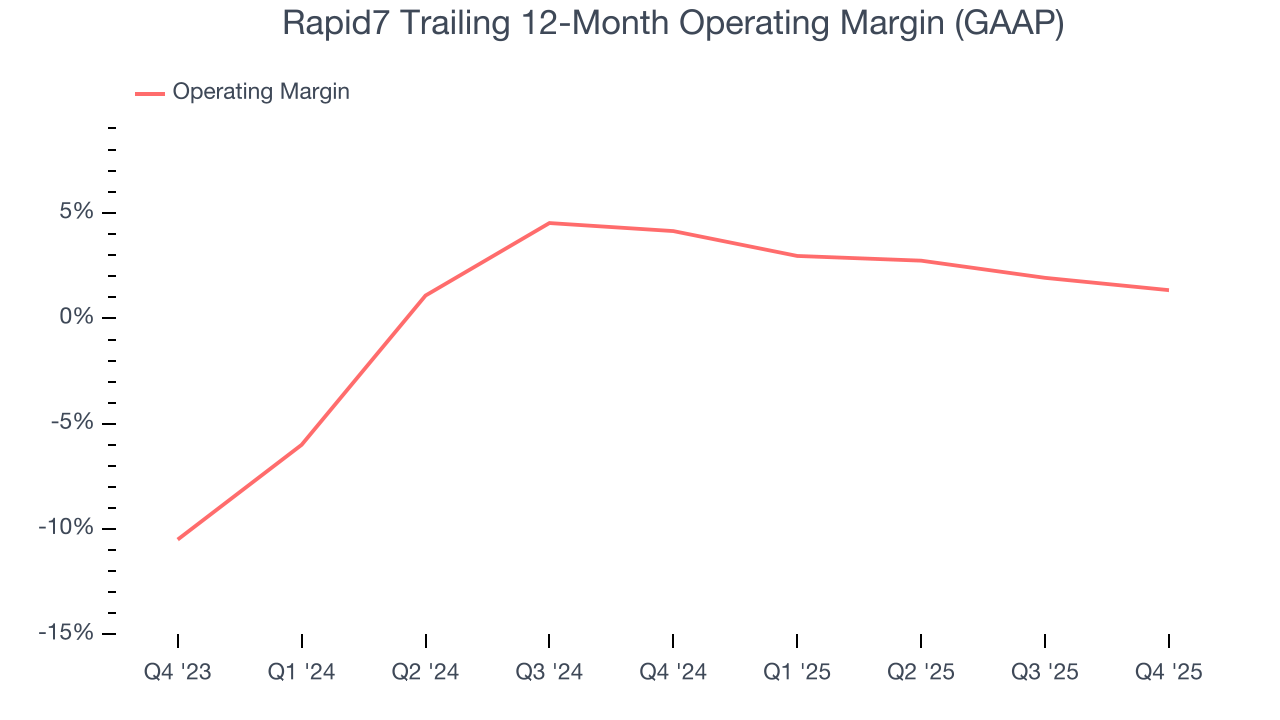

- Expenses have increased as a percentage of revenue over the last year as its operating margin fell by 2.8 percentage points

Rapid7 doesn’t meet our quality criteria. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Rapid7

Why There Are Better Opportunities Than Rapid7

Rapid7 is trading at $7.42 per share, or 0.8x forward price-to-sales. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Rapid7 (RPD) Research Report: Q4 CY2025 Update

Cybersecurity software provider Rapid7 (NASDAQ:RPD) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $217.4 million. On the other hand, next quarter’s revenue guidance of $208 million was less impressive, coming in 2.5% below analysts’ estimates. Its non-GAAP profit of $0.44 per share was 5.9% above analysts’ consensus estimates.

Rapid7 (RPD) Q4 CY2025 Highlights:

- Revenue: $217.4 million vs analyst estimates of $214.9 million (flat year on year, 1.2% beat)

- Adjusted EPS: $0.44 vs analyst estimates of $0.42 (5.9% beat)

- Adjusted Operating Income: $30.13 million vs analyst estimates of $27.92 million (13.9% margin, 7.9% beat)

- Revenue Guidance for Q1 CY2026 is $208 million at the midpoint, below analyst estimates of $213.4 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.55 at the midpoint, missing analyst estimates by 21.8%

- Operating Margin: 1%, down from 3.4% in the same quarter last year

- Free Cash Flow Margin: 14.9%, up from 13.8% in the previous quarter

- Annual Recurring Revenue: $840,000 vs analyst estimates of $837.9 million (99.9% year-on-year decline, miss)

- Market Capitalization: $704.6 million

Company Overview

With its name inspired by the need for quick responses to cyber threats, Rapid7 (NASDAQ:RPD) provides cybersecurity software and services that help organizations detect vulnerabilities, monitor threats, and respond to security incidents.

Rapid7's platform focuses on Security Operations (SecOps) consolidation, bringing together various security functions to simplify the complex task of protecting modern IT environments. The company's solutions include vulnerability management, cloud security, threat detection and response, and application security testing, all designed to provide visibility across an organization's attack surface.

At the core of Rapid7's technology is its ability to collect and analyze data from diverse sources including endpoints, networks, and cloud environments. The company's universal Insight Agent can be installed on assets to monitor for vulnerabilities and threats, while its Network Sensor analyzes network traffic to detect suspicious activity. For cloud environments, Rapid7 offers real-time monitoring of resources and configuration changes.

A healthcare organization might use Rapid7's platform to scan for vulnerabilities in patient record systems, monitor for unauthorized access attempts, and automatically contain threats before patient data is compromised. Rapid7 generates revenue through subscription-based software licenses and managed services, where its security experts provide 24/7 monitoring and response capabilities for customers who lack in-house resources or expertise.

Beyond technology, Rapid7 maintains active research initiatives through Rapid7 Labs, which contributes to open-source security projects like Metasploit, a widely-used penetration testing framework that helps security professionals identify weaknesses in their systems.

4. Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

Rapid7 competes with cybersecurity providers like CrowdStrike (NASDAQ:CRWD), Palo Alto Networks (NASDAQ:PANW), Tenable (NASDAQ:TENB), and Qualys (NASDAQ:QLYS), as well as large technology companies offering security solutions such as Microsoft (NASDAQ:MSFT) and IBM (NYSE:IBM).

5. Revenue Growth

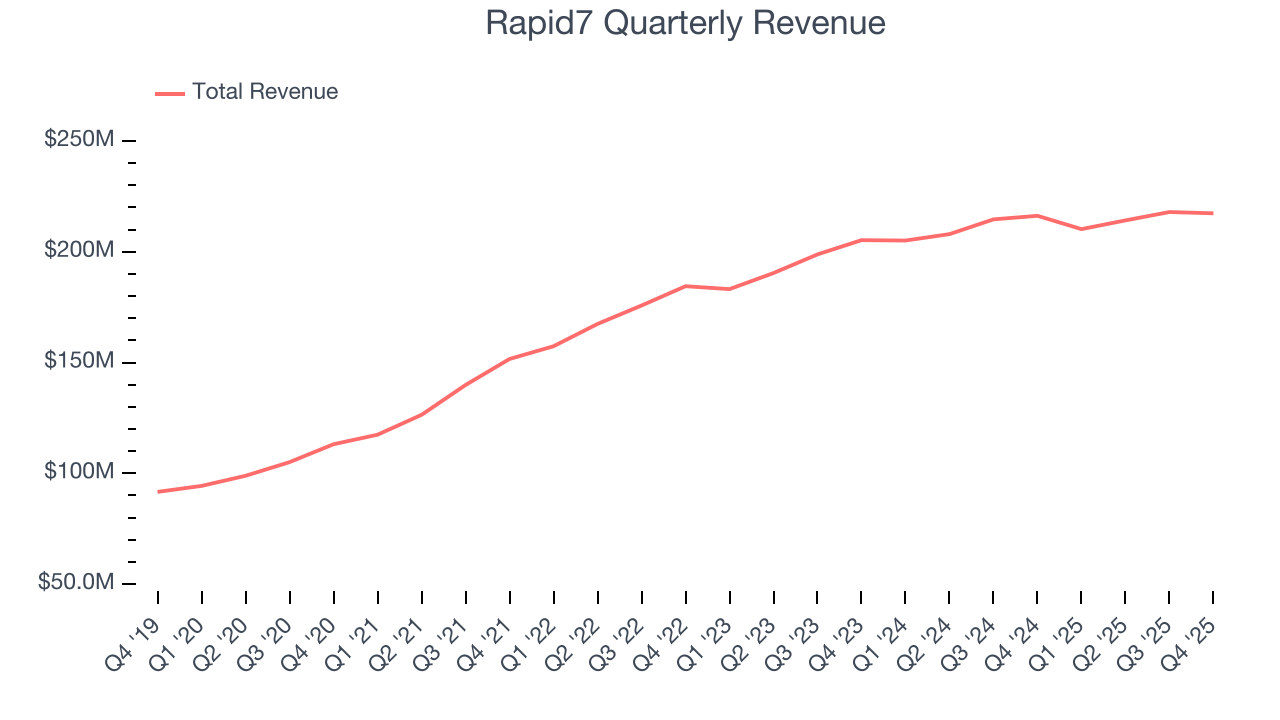

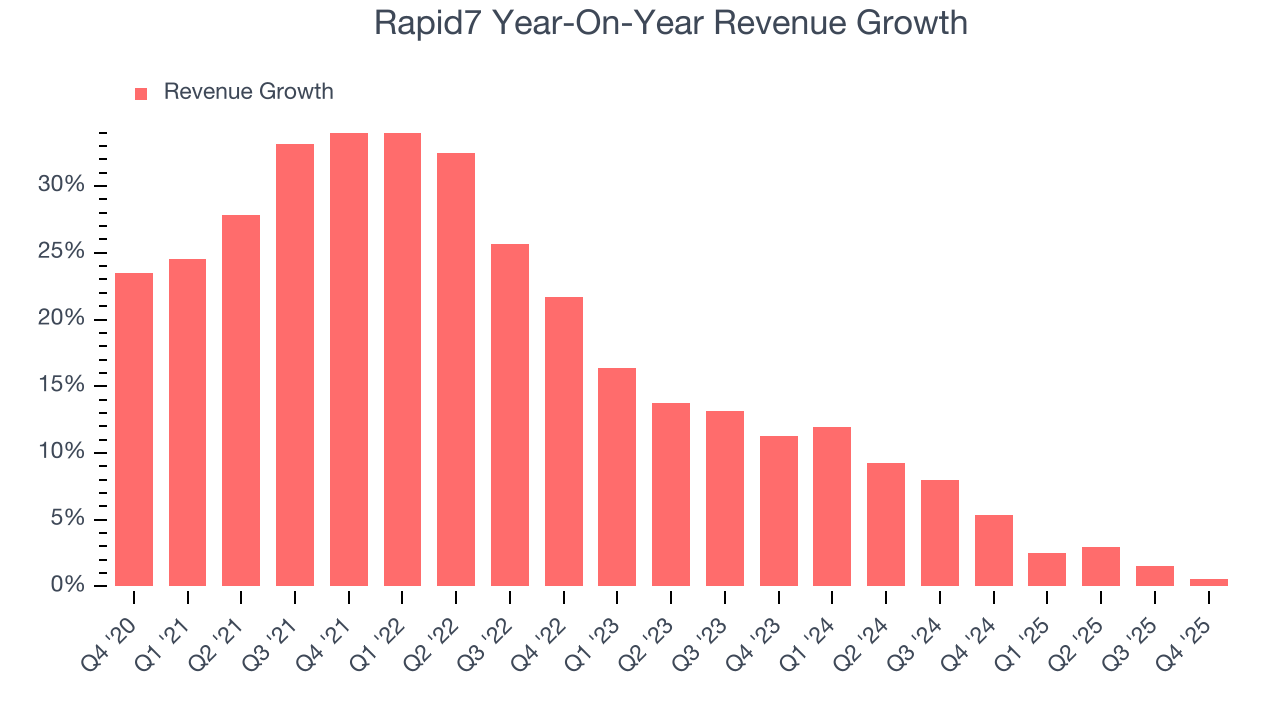

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Rapid7 grew its sales at a 15.9% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Rapid7’s recent performance shows its demand has slowed as its annualized revenue growth of 5.1% over the last two years was below its five-year trend.

This quarter, Rapid7’s $217.4 million of revenue was flat year on year but beat Wall Street’s estimates by 1.2%. Company management is currently guiding for a 1.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

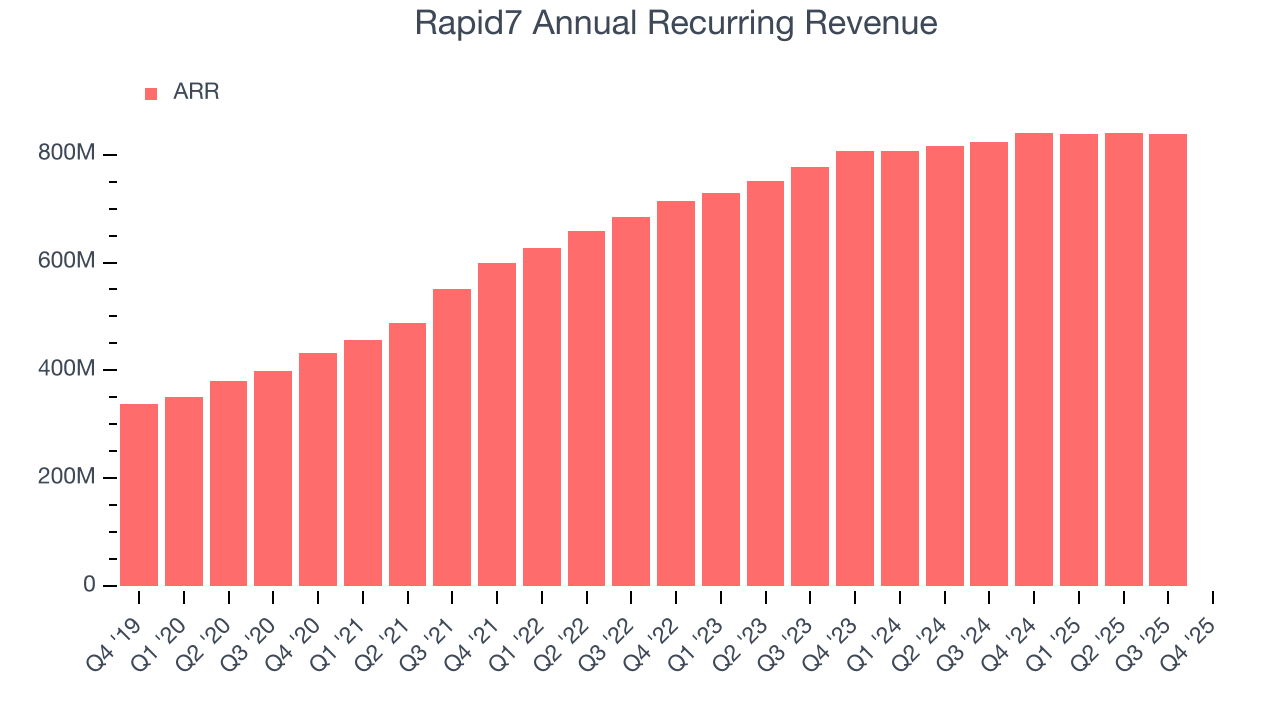

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Rapid7’s ARR came in at $840,000 in Q4, and it averaged 22.8% year-on-year declines over the last four quarters. This alternate topline metric underperformed its total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Rapid7’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Rapid7’s products and its peers.

8. Gross Margin & Pricing Power

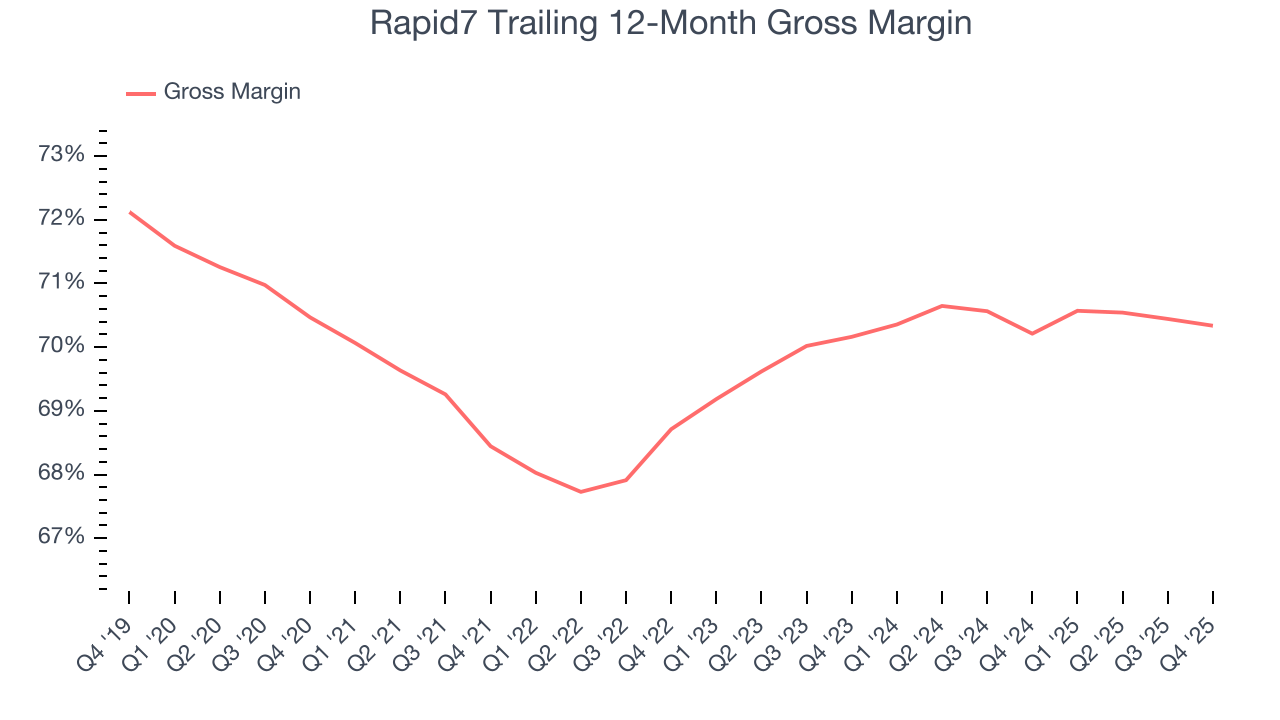

For software companies like Rapid7, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Rapid7’s gross margin is slightly below the average software company, giving it less room than its competitors to invest in areas such as product and sales. As you can see below, it averaged a 70.3% gross margin over the last year. That means Rapid7 paid its providers a lot of money ($29.66 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Rapid7 has seen gross margins improve by 0.2 percentage points over the last 2 year, which is slightly better than average for software.

Rapid7’s gross profit margin came in at 68.9% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Rapid7 has done a decent job managing its cost base over the last year. The company has produced an average operating margin of 1.3%, higher than the broader software sector.

Looking at the trend in its profitability, Rapid7’s operating margin decreased by 2.8 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Rapid7 generated an operating margin profit margin of 1%, down 2.3 percentage points year on year. Since Rapid7’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

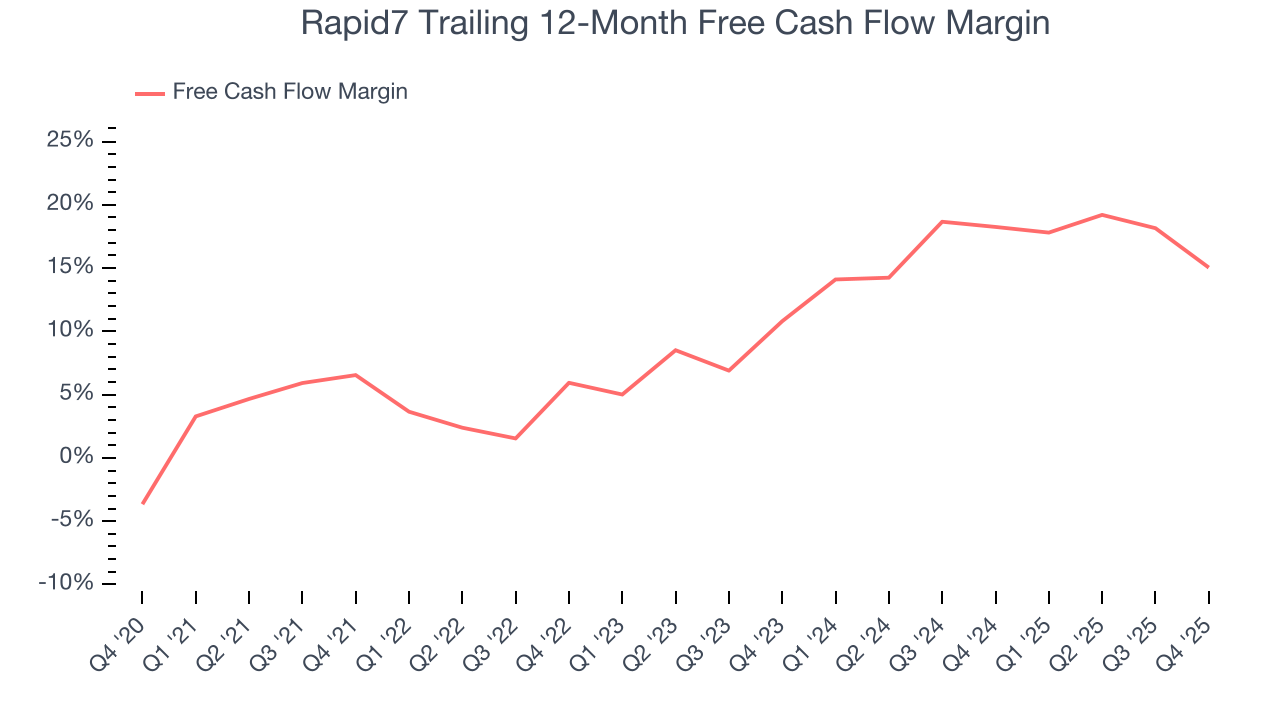

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Rapid7 has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 15% over the last year, slightly better than the broader software sector.

Rapid7’s free cash flow clocked in at $32.3 million in Q4, equivalent to a 14.9% margin. The company’s cash profitability regressed as it was 12.4 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Rapid7’s free cash flow margin of 15% for the last 12 months to remain the same.

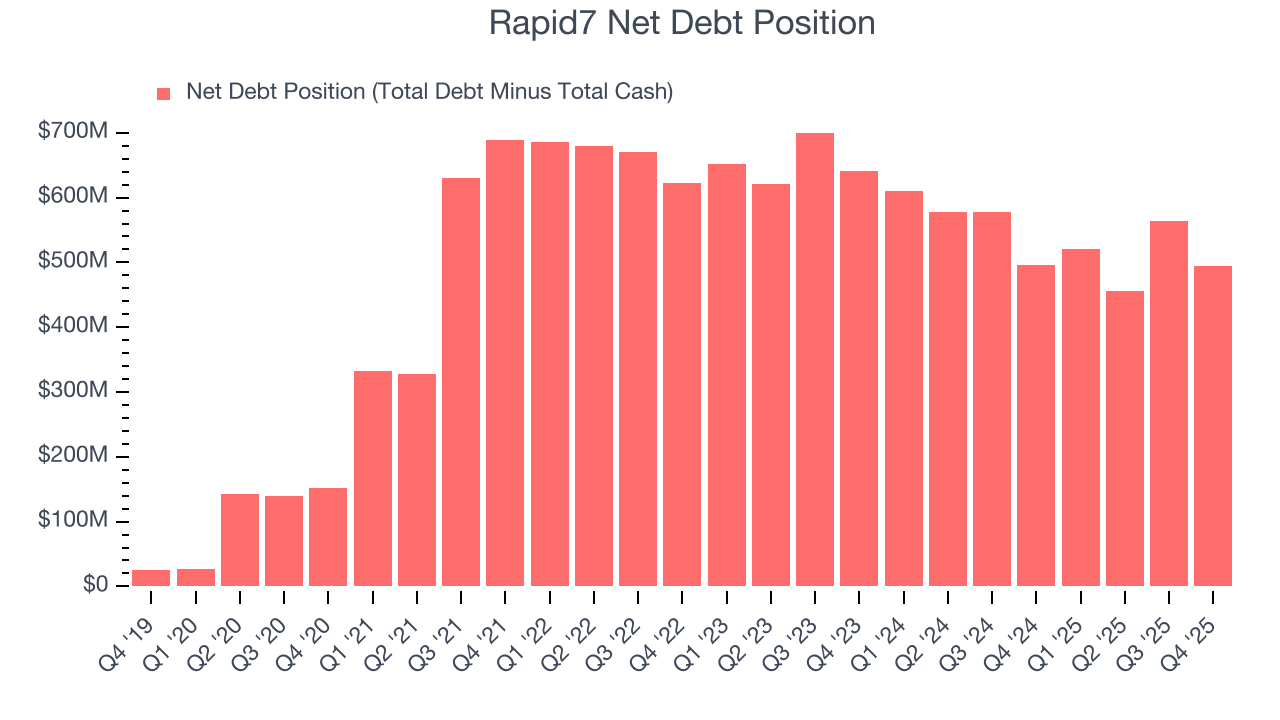

11. Balance Sheet Assessment

Rapid7 reported $474.7 million of cash and $968.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $161.9 million of EBITDA over the last 12 months, we view Rapid7’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $12.58 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Rapid7’s Q4 Results

We enjoyed seeing Rapid7 beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.3% to $9.75 immediately after reporting.

13. Is Now The Time To Buy Rapid7?

Updated: February 11, 2026 at 9:14 PM EST

Before investing in or passing on Rapid7, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Rapid7 doesn’t pass our quality test. First off, its revenue growth was a little slower over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Rapid7’s ARR has disappointed and shows the company is having difficulty retaining customers and their spending, and its declining operating margin shows it’s becoming less efficient at building and selling its software.

Rapid7’s price-to-sales ratio based on the next 12 months is 0.8x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $11.75 on the company (compared to the current share price of $7.42).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.