Sprouts (SFM)

Sprouts is a sound business. Its demand is through the roof, as seen by its rapid growth in same-store sales and physical locations.― StockStory Analyst Team

1. News

2. Summary

Why Sprouts Is Interesting

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ:SFM) is a grocery store chain emphasizing natural and organic products.

- Fast expansion of new stores to reach markets with few or no locations is justified by its same-store sales growth

- Forecasted revenue growth of 8.1% for the next 12 months indicates its momentum over the last three years is sustainable

- On a dimmer note, its gross margin of 38.7% is below its competitors, leaving less money for marketing and promotions

Sprouts is close to becoming a high-quality business. If you believe in the company, the valuation looks fair.

Why Is Now The Time To Buy Sprouts?

Why Is Now The Time To Buy Sprouts?

Sprouts’s stock price of $79.90 implies a valuation ratio of 13.8x forward P/E. Scanning the consumer retail peers, we conclude that Sprouts’s valuation is warranted for the business quality.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Sprouts (SFM) Research Report: Q4 CY2025 Update

Grocery store chain Sprouts Farmers Market (NASDAQ:SFM) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.6% year on year to $2.15 billion. Its GAAP profit of $0.92 per share was 3.8% above analysts’ consensus estimates.

Sprouts (SFM) Q4 CY2025 Highlights:

- Revenue: $2.15 billion vs analyst estimates of $2.15 billion (7.6% year-on-year growth, in line)

- EPS (GAAP): $0.92 vs analyst estimates of $0.89 (3.8% beat)

- Adjusted EBITDA: $164.8 million vs analyst estimates of $154.9 million (7.7% margin, 6.4% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $5.36 at the midpoint, missing analyst estimates by 5.8%

- Operating Margin: 5.7%, in line with the same quarter last year

- Free Cash Flow Margin: 3.1%, similar to the same quarter last year

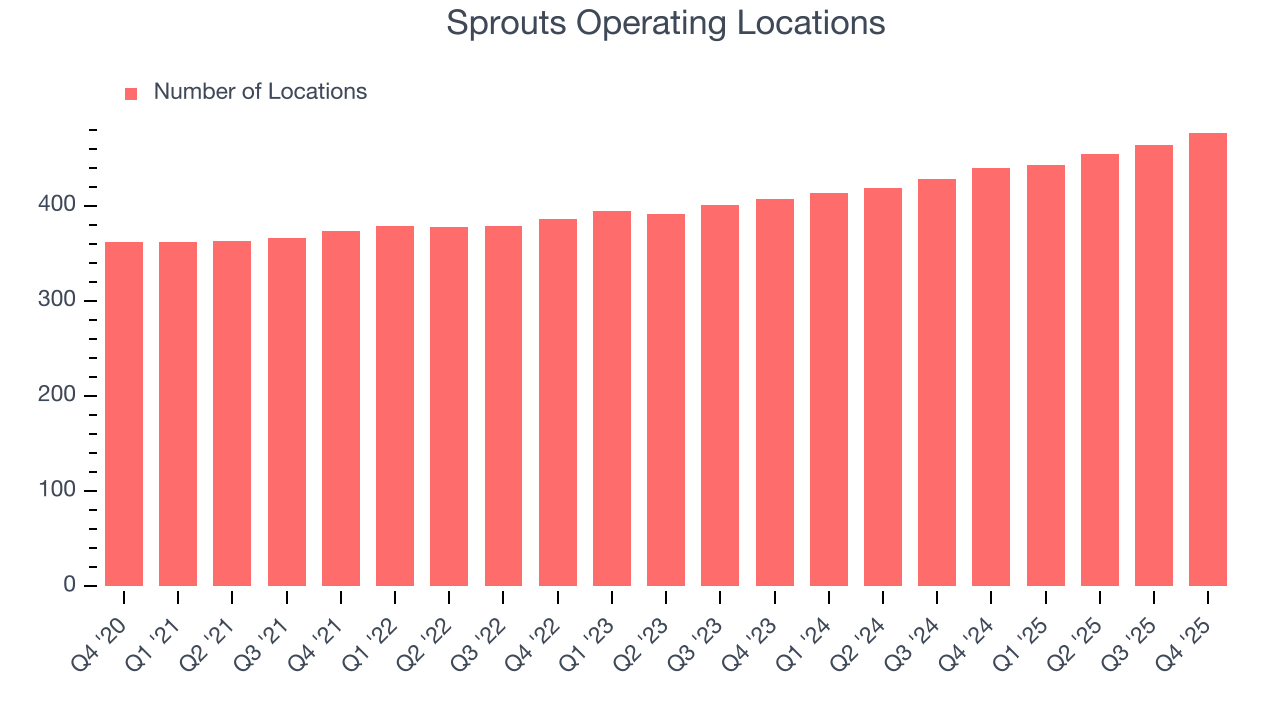

- Locations: 477 at quarter end, up from 440 in the same quarter last year

- Same-Store Sales rose 1.6% year on year (11.5% in the same quarter last year)

- Market Capitalization: $6.59 billion

Company Overview

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ:SFM) is a grocery store chain emphasizing natural and organic products.

Because of this focus on health, a shopper at Sprouts can find more depth and breadth in areas like organic produce, meats free from added hormones, natural foods such as cereals and juices, and vitamins. In addition to a focus on healthy foods, Sprouts also offers reasonable prices. The company does this by sourcing directly from farmers and other producers, which minimizes middlemen and the costs associated with them. In addition, Sprouts emphasizes its private label products, which are produced by contracted manufacturers and cheaper than brand-name products.

The average size of a Sprouts Farmers Market store is around 30,000 square feet, and most stores are located in suburban areas. The stores are laid out in a farmer's market style, with fresh produce and bakery items prominently displayed at the front of the store. The perimeter and back of the store typically has refrigerators and freezers with items like milk, yogurt, frozen vegetables, and packaged meat.

Sprouts Farmers Market launched its e-commerce presence in 2020, which was expedited due to the COVID-19 pandemic. Customers can now order groceries online and either pick them up in-store or have them delivered.

4. Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Grocery competitors with a total or partial focus on healthier options include Amazon.com’s Whole Foods market (NASDAQ:AMZN), Kroger (NYSE:KR), and private company Trader Joe’s.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $8.81 billion in revenue over the past 12 months, Sprouts is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Sprouts’s 11.2% annualized revenue growth over the last three years was decent as it opened new stores and increased sales at existing, established locations.

This quarter, Sprouts grew its revenue by 7.6% year on year, and its $2.15 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, a slight deceleration versus the last three years. Still, this projection is commendable and implies the market sees success for its products.

6. Store Performance

Number of Stores

Sprouts operated 477 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 7.4% annual growth, much faster than the broader consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Sprouts has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 7.5%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Sprouts multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Sprouts’s same-store sales rose 1.6% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Sprouts can reaccelerate growth.

7. Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Sprouts’s gross margin is slightly below the average retailer, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 38.6% gross margin over the last two years.

When compared to other non-discretionary retailers, however, it’s a step above. That’s because non-discretionary retailers have structurally lower gross margins; they compete on the lowest price, sell products easily found elsewhere, and have high transportation costs to move goods. We believe the best metrics to assess these companies are free cash flow margin, operating leverage, and profit volatility, which account for their scale advantages and non-cyclical demand.

Sprouts’s gross profit margin came in at 38% this quarter , marking a 1.1 percentage point decrease from 39.1% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Sprouts was profitable over the last two years but held back by its large cost base. Its average operating margin of 7.2% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Sprouts’s operating margin rose by 1.3 percentage points over the last year, as its sales growth gave it operating leverage.

This quarter, Sprouts generated an operating margin profit margin of 5.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sprouts’s EPS grew at a remarkable 30.4% compounded annual growth rate over the last three years, higher than its 11.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Sprouts reported EPS of $0.92, up from $0.79 in the same quarter last year. This print beat analysts’ estimates by 3.8%. Over the next 12 months, Wall Street expects Sprouts’s full-year EPS of $5.30 to grow 6.6%.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Sprouts has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.3% over the last two years, better than the broader consumer retail sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Sprouts’s free cash flow clocked in at $66.34 million in Q4, equivalent to a 3.1% margin. This cash profitability was in line with the comparable period last year but below its two-year average. We wouldn’t read too much into it because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Sprouts has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 13.9%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

12. Balance Sheet Assessment

Sprouts reported $257.3 million of cash and $1.94 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $843.9 million of EBITDA over the last 12 months, we view Sprouts’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $1.46 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Sprouts’s Q4 Results

We enjoyed seeing Sprouts beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its gross margin fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 1.3% to $68.78 immediately after reporting.

14. Is Now The Time To Buy Sprouts?

Updated: March 8, 2026 at 10:49 PM EDT

Before deciding whether to buy Sprouts or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Sprouts possesses a number of positive attributes. To kick things off, its revenue growth was decent over the last three years. And while its gross margins indicate a mediocre starting point for the overall profitability of the business, its marvelous same-store sales growth is on another level. On top of that, its new store openings have increased its brand equity.

Sprouts’s P/E ratio based on the next 12 months is 13.8x. When scanning the consumer retail space, Sprouts trades at a fair valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $92.07 on the company (compared to the current share price of $79.90), implying they see 15.2% upside in buying Sprouts in the short term.