The ONE Group (STKS)

The ONE Group faces an uphill battle. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think The ONE Group Will Underperform

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ:STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

- Poor same-store sales performance over the past two years indicates it’s having trouble bringing new diners into its restaurants

- Performance over the past six years shows its incremental sales were much less profitable, as its earnings per share fell by 54.6% annually

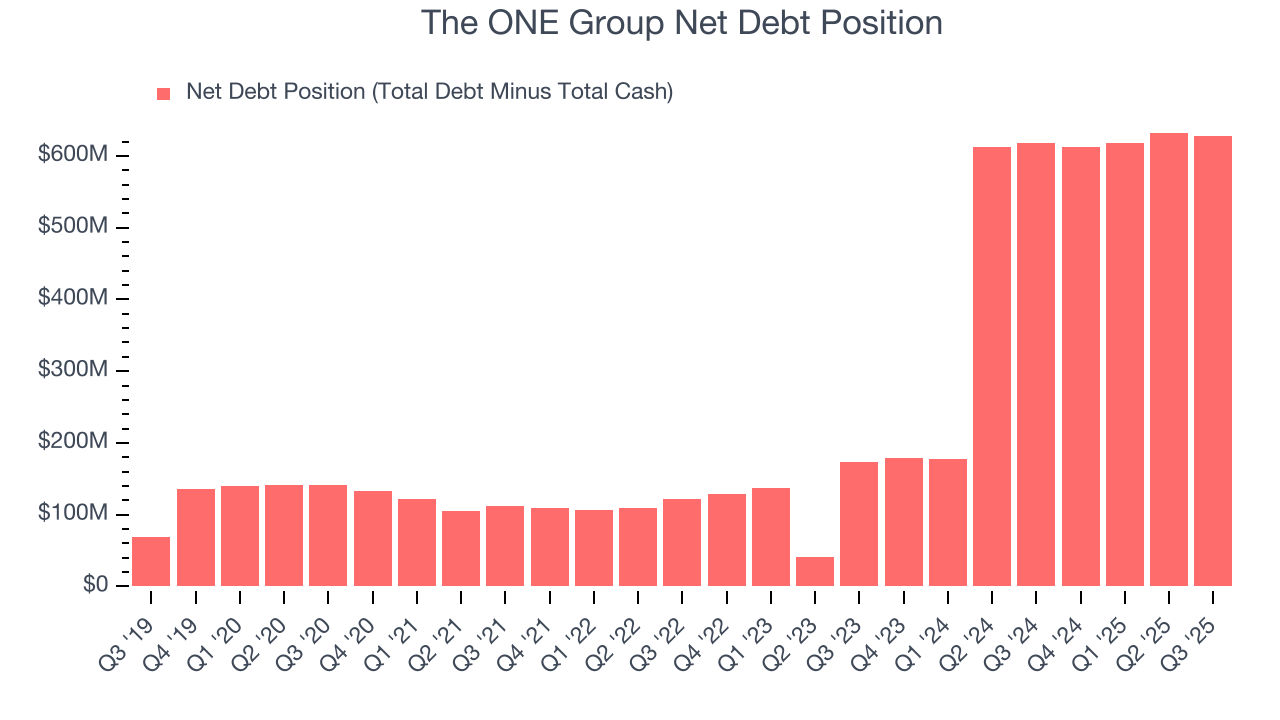

- 7× net-debt-to-EBITDA ratio makes lenders less willing to extend additional capital, potentially necessitating dilutive equity offerings

The ONE Group’s quality is not up to our standards. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than The ONE Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than The ONE Group

The ONE Group is trading at $1.94 per share, or 5.1x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. The ONE Group (STKS) Research Report: Q3 CY2025 Update

Upscale restaurant company The One Group Hospitality (NASDAQ:STKS) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 7.1% year on year to $180.2 million. The company’s full-year revenue guidance of $822.5 million at the midpoint came in 1.5% below analysts’ estimates. Its GAAP loss of $2.75 per share was significantly below analysts’ consensus estimates.

The ONE Group (STKS) Q3 CY2025 Highlights:

- Revenue: $180.2 million vs analyst estimates of $191.1 million (7.1% year-on-year decline, 5.7% miss)

- EPS (GAAP): -$2.75 vs analyst estimates of -$0.44 (significant miss)

- Adjusted EBITDA: $10.56 million vs analyst estimates of $16.75 million (5.9% margin, 37% miss)

- The company dropped its revenue guidance for the full year to $822.5 million at the midpoint from $852.5 million, a 3.5% decrease

- EBITDA guidance for the full year is $97.5 million at the midpoint, in line with analyst expectations

- Operating Margin: -4.4%, down from 2.1% in the same quarter last year

- Same-Store Sales fell 5.9% year on year (8.8% in the same quarter last year)

- Market Capitalization: $65.01 million

Company Overview

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ:STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

STK, with locations in Downtown Manhattan and Dubai’s JBR Marina, has Japanese and Australian Wagyu steak dishes that will run you hundreds of dollars. You can complement these with some of the finest wines as well. Dark interiors featuring elevated art and plush seating give STK locations a luxurious feeling.

Kona Grill’s menu has much overlap with STK’s menu and features seafood, steak, and sushi. While prices are not as high as STK, Kona menu items are priced at a premium to the typical neighborhood chain of family restaurants. The Kona Grill ambiance is not as dark and intimate as STK, but it still exudes luxury.

In addition to owning and operating STK and Kona Grill, The One Group provides food and beverage services to hotels and casinos. The company generates management and incentive fee revenue from the restaurants and lounges it serves.

4. Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

While no publicly-traded companies are as upscale in their restaurant offerings as The One Group, competitors include Darden (NYSE:DRI), Brinker International (NYSE:EAT), The Cheesecake Factory (NASDAQ:CAKE), and all the privately-owned luxury restaurants that have geographic overlap with STK Steakhouse and Kona Grill.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $820.6 million in revenue over the past 12 months, The ONE Group is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

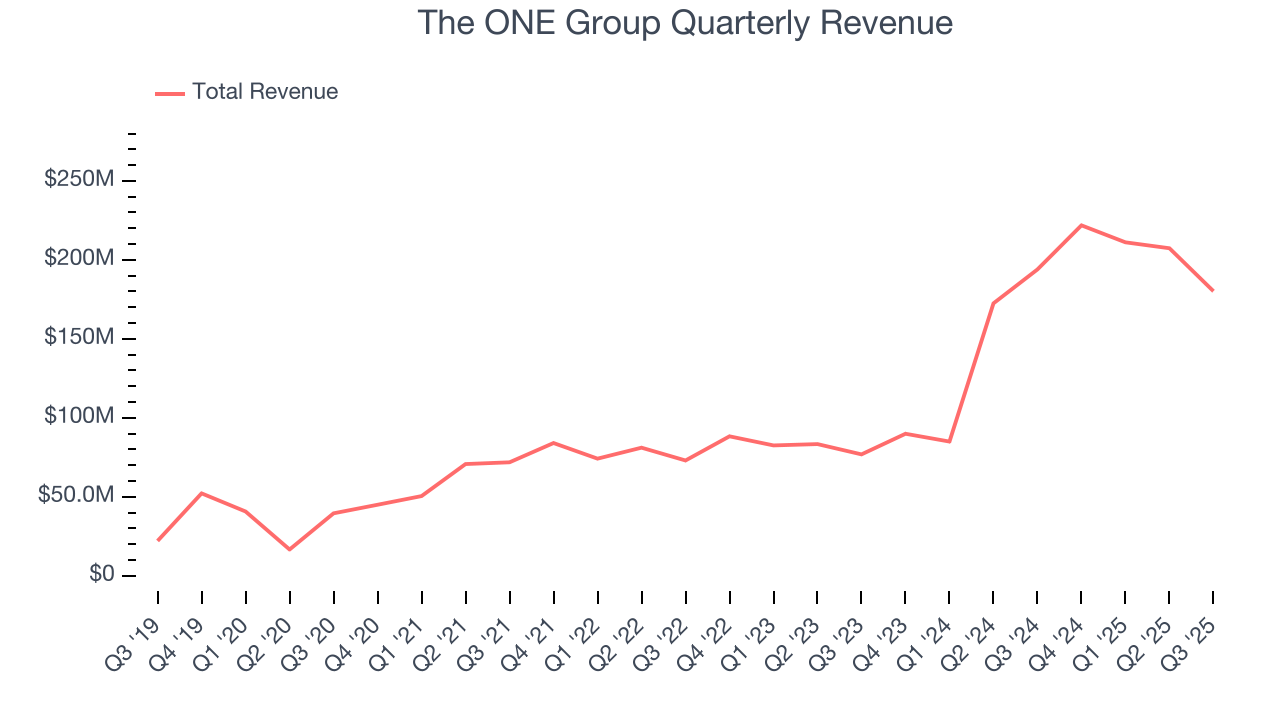

As you can see below, The ONE Group’s 43.4% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was incredible. This shows it had high demand, a useful starting point for our analysis.

This quarter, The ONE Group missed Wall Street’s estimates and reported a rather uninspiring 7.1% year-on-year revenue decline, generating $180.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its menu offerings will see some demand headwinds.

6. Restaurant Performance

Number of Restaurants

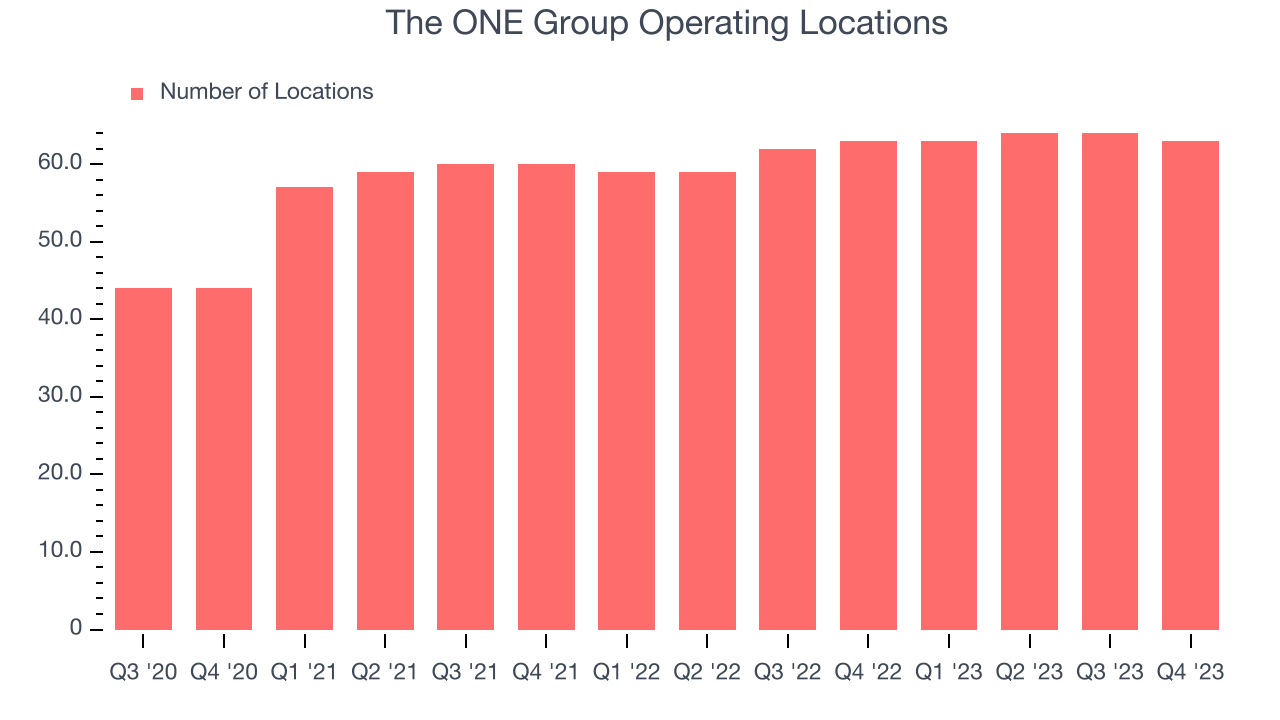

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

The ONE Group has kept its restaurant count flat over the last two years while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

Note that The ONE Group reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

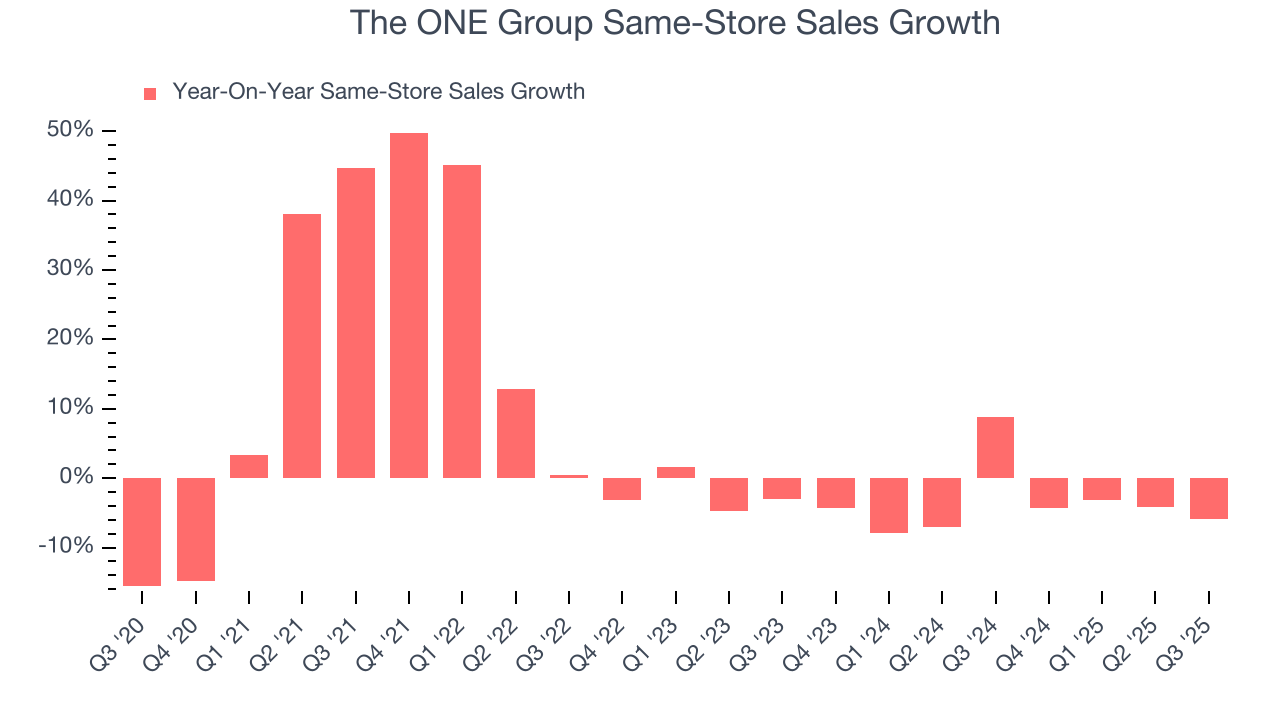

The ONE Group’s demand has been shrinking over the last two years as its same-store sales have averaged 3.5% annual declines. This performance isn’t ideal, and we’d be concerned if The ONE Group starts opening new restaurants to artificially boost revenue growth.

In the latest quarter, The ONE Group’s same-store sales fell by 5.9% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

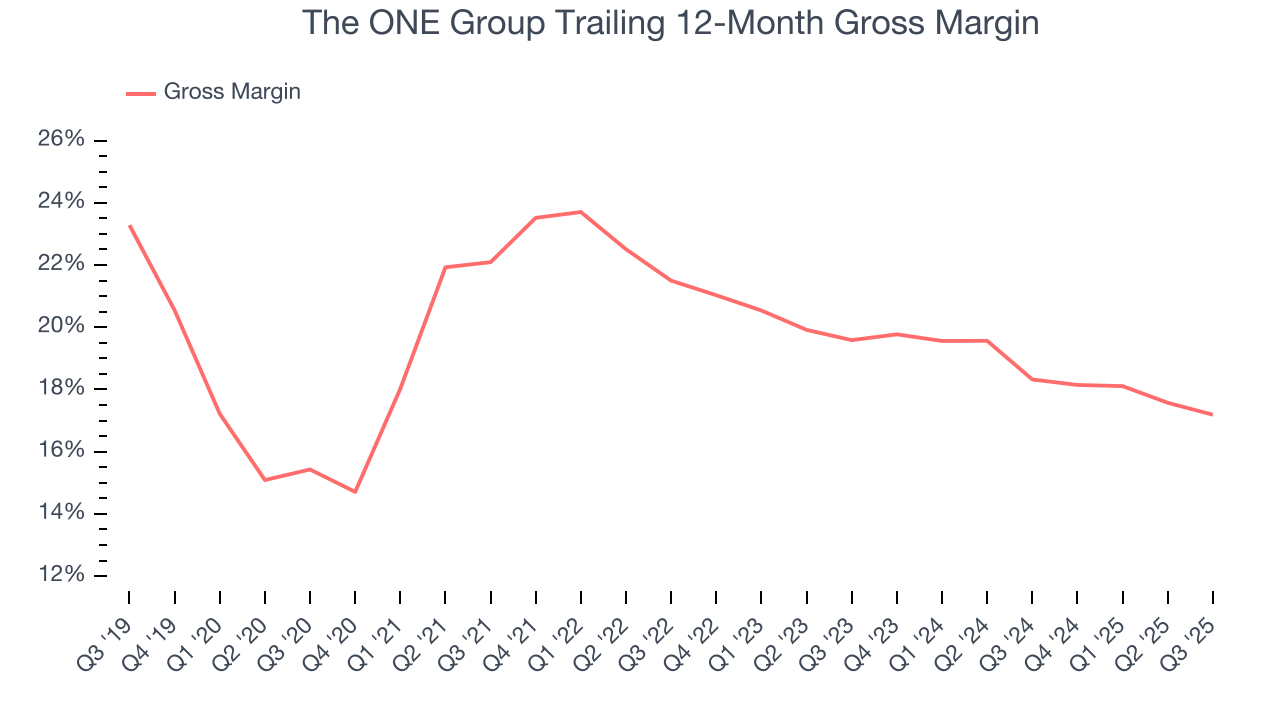

The ONE Group has bad unit economics for a restaurant company, signaling it operates in a competitive market and has little room for error if demand unexpectedly falls. As you can see below, it averaged a 17.6% gross margin over the last two years. That means The ONE Group paid its suppliers a lot of money ($82.36 for every $100 in revenue) to run its business.

This quarter, The ONE Group’s gross profit margin was 12.7%, down 2 percentage points year on year. The ONE Group’s full-year margin has also been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as ingredients and transportation expenses).

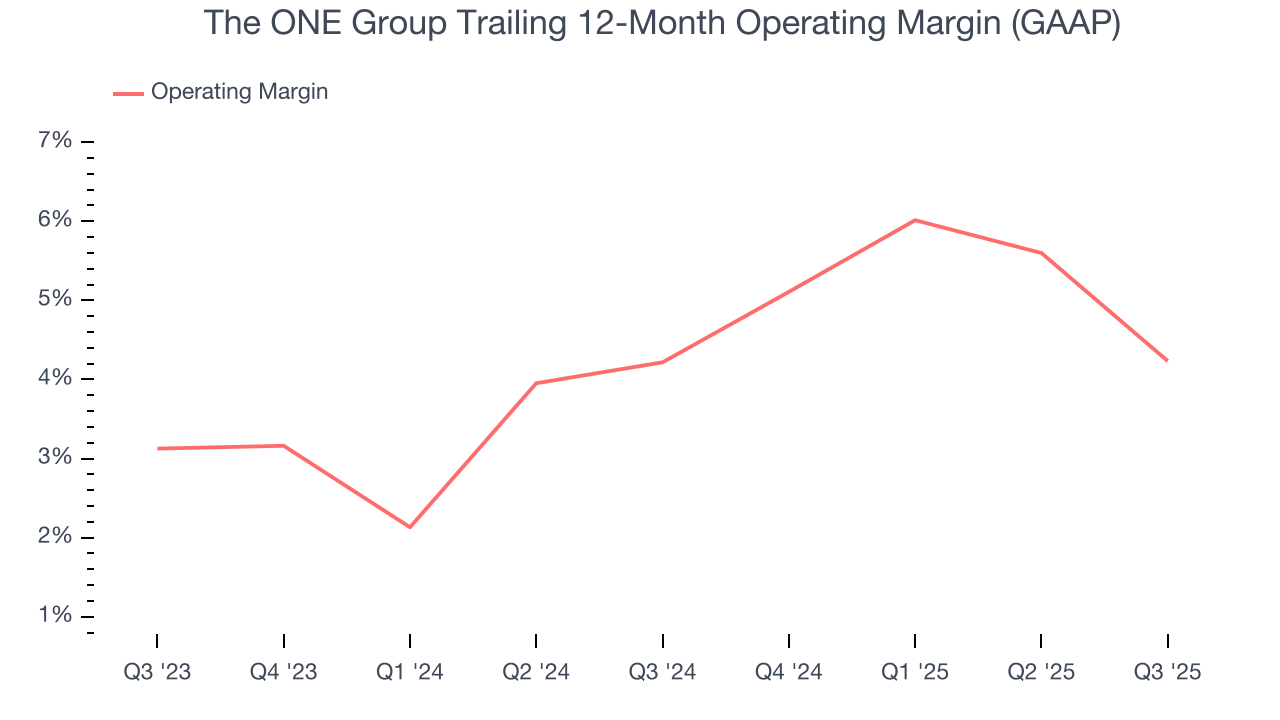

8. Operating Margin

The ONE Group’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4.2% over the last two years. This profitability was lousy for a restaurant business and caused by its suboptimal cost structureand low gross margin.

Looking at the trend in its profitability, The ONE Group’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, The ONE Group generated an operating margin profit margin of negative 4.4%, down 6.5 percentage points year on year. Since The ONE Group’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

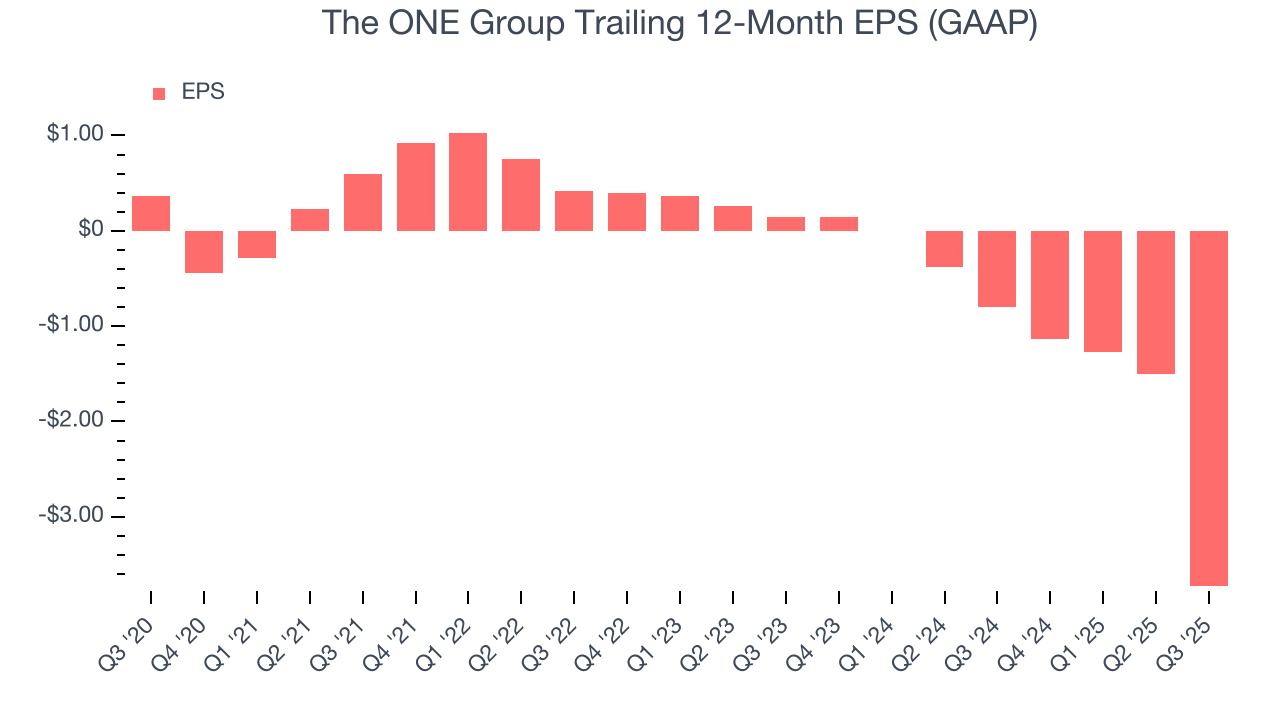

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for The ONE Group, its EPS declined by 73% annually over the last six years while its revenue grew by 43.4%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, The ONE Group reported EPS of negative $2.75, down from negative $0.52 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects The ONE Group to improve its earnings losses. Analysts forecast its full-year EPS of negative $3.73 will advance to negative $0.57.

10. Return on Invested Capital (ROIC)

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

The ONE Group’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 8.5%, slightly better than typical restaurant business.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

The ONE Group’s $632.9 million of debt exceeds the $5.55 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $89.4 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. The ONE Group could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope The ONE Group can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from The ONE Group’s Q3 Results

We struggled to find many positives in these results, as its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. The company also lowered its full-year revenue guidance. Overall, this quarter could have been better, but the stock traded up 2.1% to $1.99 immediately after reporting.

13. Is Now The Time To Buy The ONE Group?

Updated: December 4, 2025 at 9:48 PM EST

Before deciding whether to buy The ONE Group or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We cheer for all companies serving everyday consumers, but in the case of The ONE Group, we’ll be cheering from the sidelines. Although its revenue growth was exceptional over the last six years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last six years makes it a less attractive asset to the public markets. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its shrinking same-store sales tell us it will need to change its strategy to succeed.

The ONE Group’s P/E ratio based on the next 12 months is 5.1x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $5.05 on the company (compared to the current share price of $1.94).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.