Visteon (VC)

Visteon is interesting. Its superior and growing returns on capital suggest its competitive advantages are expanding.― StockStory Analyst Team

1. News

2. Summary

Why Visteon Is Interesting

Originally spun off from Ford Motor Company in 2000, Visteon (NYSE:VC) designs and manufactures cockpit electronics for vehicles, including digital instrument clusters, displays, infotainment systems, and battery management systems.

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures, and its returns are climbing as it finds even more attractive growth opportunities

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 55% annually, topping its revenue gains

- On the flip side, its high input costs result in an inferior gross margin of 11.9% that must be offset through higher volumes

Visteon has some noteworthy aspects. If you’re a believer, the price looks fair.

Why Is Now The Time To Buy Visteon?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Visteon?

At $105 per share, Visteon trades at 11.3x forward P/E. Many industrials companies feature higher valuation multiples than Visteon. Regardless, we think Visteon’s current price is appropriate given the quality you get.

It could be a good time to invest if you see something the market doesn’t.

3. Visteon (VC) Research Report: Q3 CY2025 Update

Automotive technology company Visteon (NYSE:VC) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 6.4% year on year to $917 million. The company’s full-year revenue guidance of $3.78 billion at the midpoint came in 0.8% below analysts’ estimates. Its non-GAAP profit of $2.15 per share was 1.2% above analysts’ consensus estimates.

Visteon (VC) Q3 CY2025 Highlights:

- Revenue: $917 million vs analyst estimates of $957.8 million (6.4% year-on-year decline, 4.3% miss)

- Adjusted EPS: $2.15 vs analyst estimates of $2.12 (1.2% beat)

- Adjusted EBITDA: $119 million vs analyst estimates of $118.5 million (13% margin, in line)

- EBITDA guidance for the full year is $490 million at the midpoint, below analyst estimates of $496.2 million

- Operating Margin: 8.2%, up from 5.3% in the same quarter last year

- Free Cash Flow Margin: 12%, up from 7.4% in the same quarter last year

- Market Capitalization: $2.64 billion

Company Overview

Originally spun off from Ford Motor Company in 2000, Visteon (NYSE:VC) designs and manufactures cockpit electronics for vehicles, including digital instrument clusters, displays, infotainment systems, and battery management systems.

Visteon operates at the intersection of digital innovation and automotive manufacturing, creating the technology that powers modern vehicle cockpits. Its product range spans from basic analog gauge clusters to sophisticated digital displays with curved surfaces and microZone technology that rivals smartphone visual quality. The company's SmartCore platform serves as a central brain for vehicle cockpits, allowing a single computer chip to manage multiple displays and functions simultaneously—reducing complexity and power consumption while enabling a more unified user experience.

As vehicles become increasingly electrified, Visteon has expanded into battery management systems that monitor and control the complex power systems in electric vehicles. Their wireless battery management technology eliminates the need for traditional wiring between battery modules, reducing weight and improving packaging efficiency—critical factors in EV design. A typical Visteon customer might be an automaker like Toyota or Volkswagen that needs high-resolution, customizable digital dashboards integrated with their infotainment systems.

Visteon generates revenue by selling these systems directly to global automakers through purchase orders based on vehicle production schedules. With manufacturing and engineering operations across ten countries including Brazil, China, India, and Mexico, Visteon maintains a global footprint aligned with the international nature of the automotive supply chain.

4. Automobile Manufacturing

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

Visteon competes with established automotive suppliers like Continental AG, Denso Corporation, Forvia (formerly Faurecia), Aptiv PLC, and Harman International (a Samsung subsidiary), as well as electronics companies expanding into automotive markets such as LG Electronics and Panasonic Corporation.

5. Revenue Growth

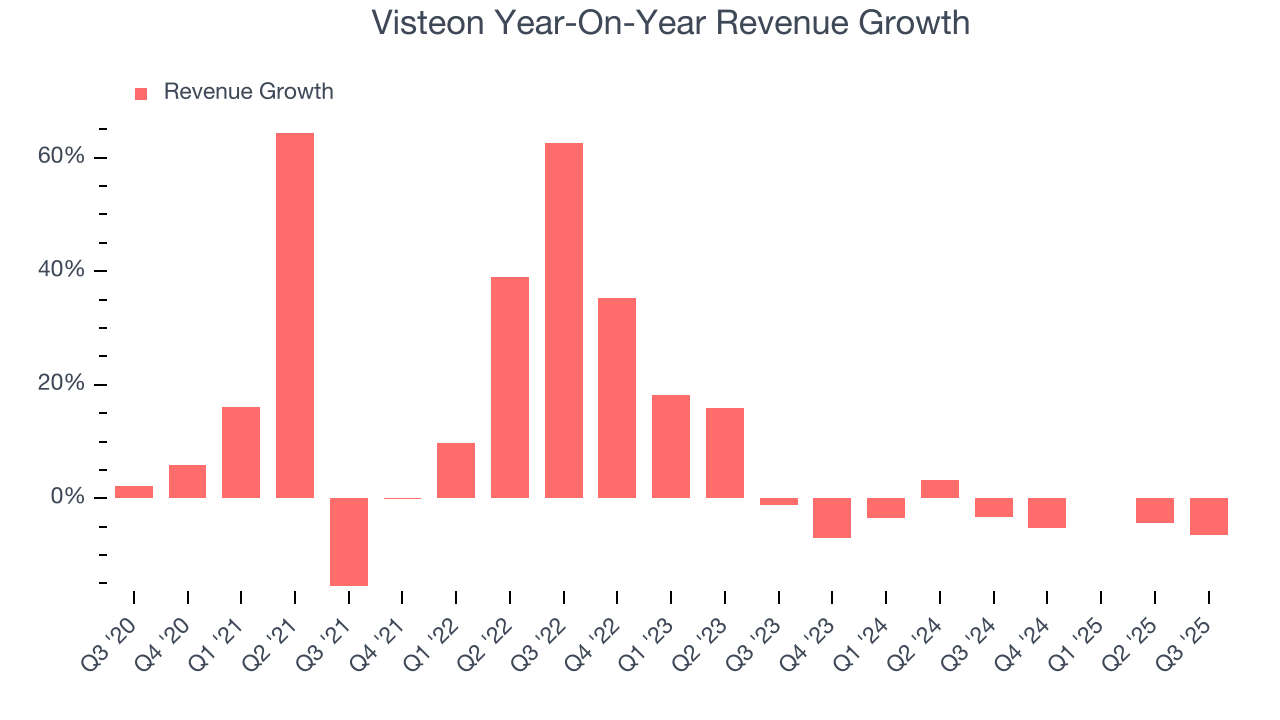

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Visteon’s sales grew at a decent 8.5% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Visteon’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.4% over the last two years. Visteon isn’t alone in its struggles as the Automobile Manufacturing industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Visteon missed Wall Street’s estimates and reported a rather uninspiring 6.4% year-on-year revenue decline, generating $917 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

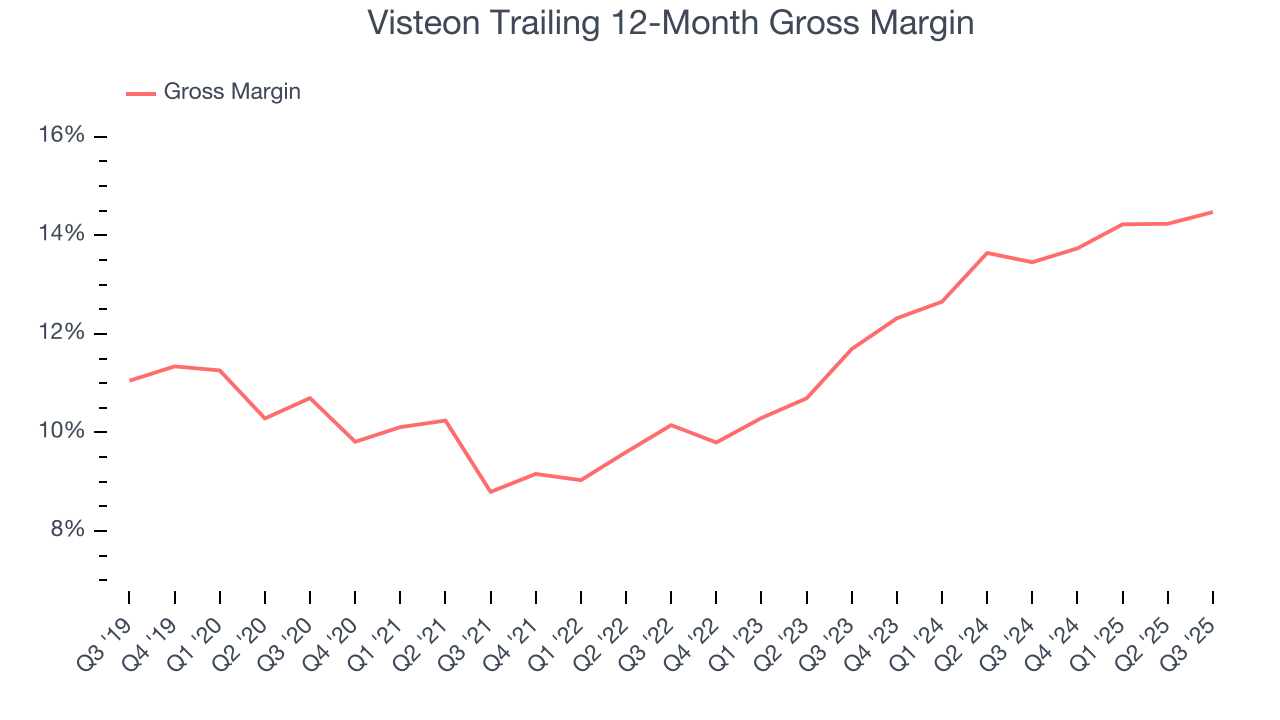

Visteon has bad unit economics for an industrials business, signaling it operates in a competitive market. This is also because it’s an automobile manufacturer.

Automobile manufacturers have structurally lower profitability as they often break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years later - this explains why new entrants such as Rivian, Lucid, and Nikola have negative gross margins. As you can see below, these dynamics culminated in an average 11.9% gross margin for Visteon over the last five years.

Visteon’s gross profit margin came in at 14.3% this quarter, in line with the same quarter last year. On a wider time horizon, Visteon’s full-year margin has been trending up over the past 12 months, increasing by 1 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

Visteon was profitable over the last five years but held back by its large cost base. Its average operating margin of 6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Visteon’s operating margin rose by 7 percentage points over the last five years, as its sales growth gave it immense operating leverage. We’ll take Visteon’s improvement as many Automobile Manufacturing companies saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction.

This quarter, Visteon generated an operating margin profit margin of 8.2%, up 2.9 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

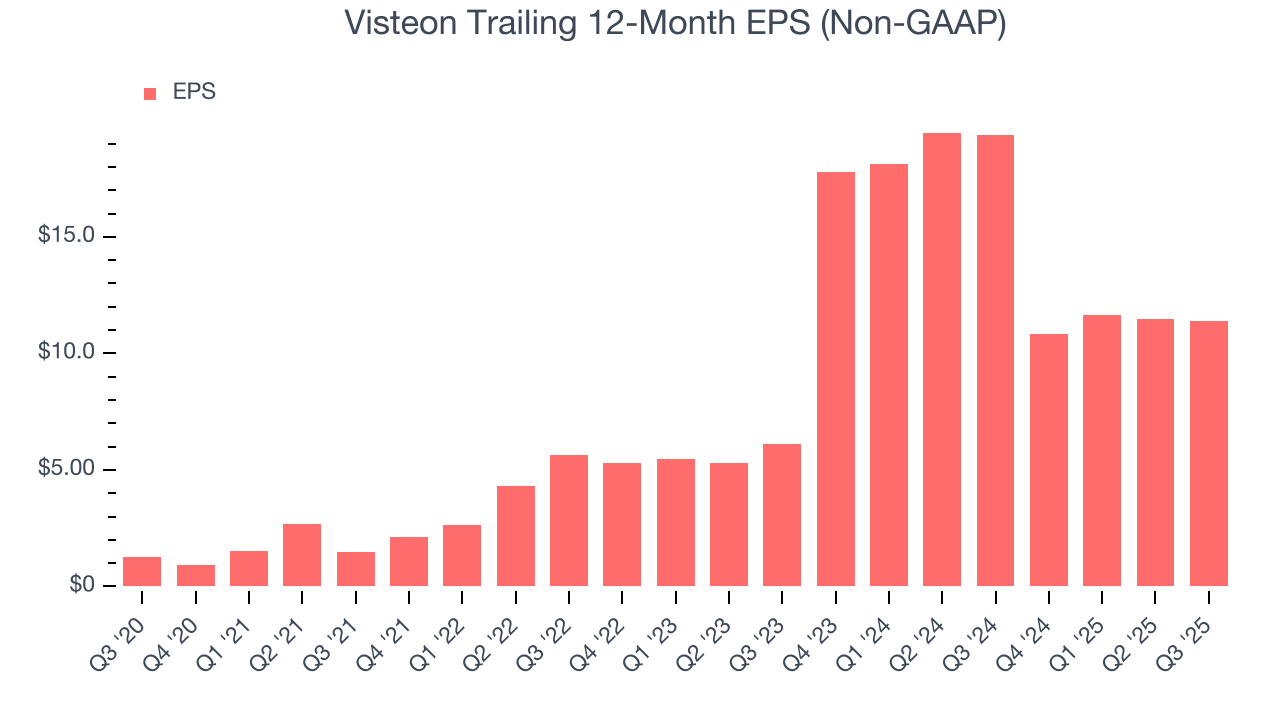

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Visteon’s EPS grew at an astounding 55% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Visteon’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Visteon’s operating margin expanded by 7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Visteon, its two-year annual EPS growth of 36.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Visteon reported adjusted EPS of $2.15, down from $2.26 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Visteon’s full-year EPS of $11.38 to shrink by 20%.

9. Cash Is King

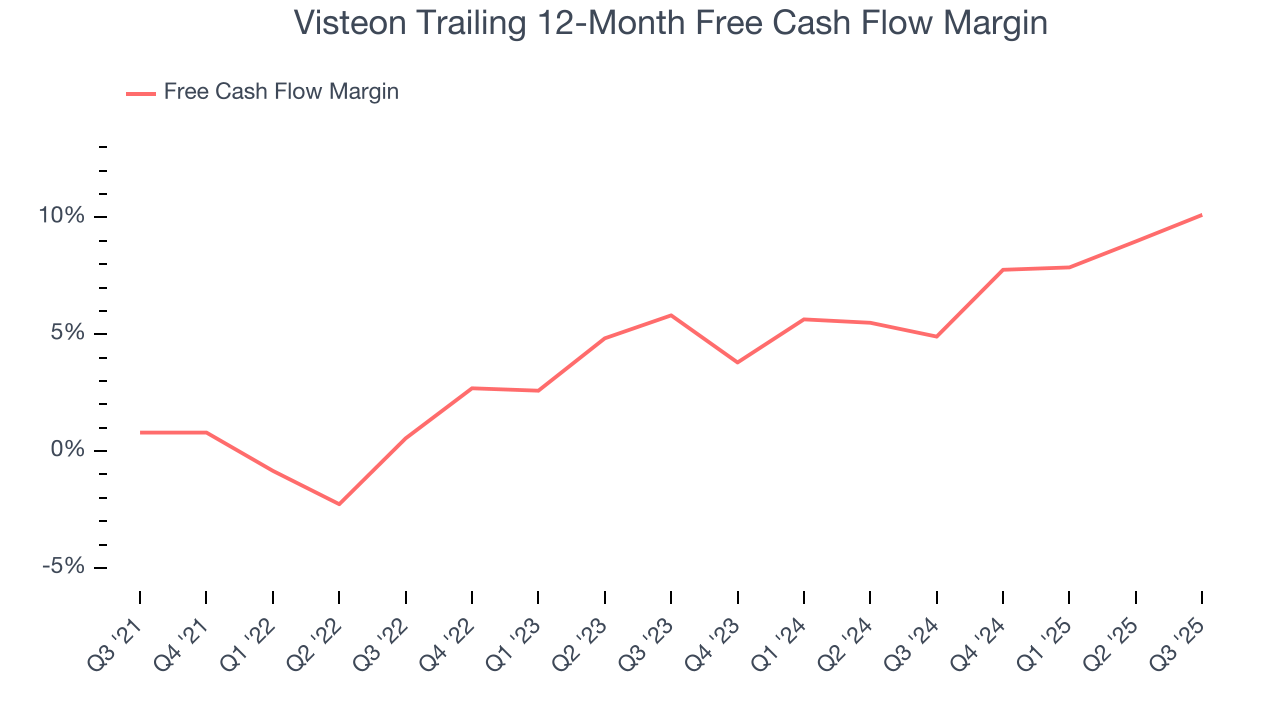

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Visteon has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.7%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Visteon’s margin expanded by 9.3 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Visteon’s free cash flow clocked in at $110 million in Q3, equivalent to a 12% margin. This result was good as its margin was 4.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

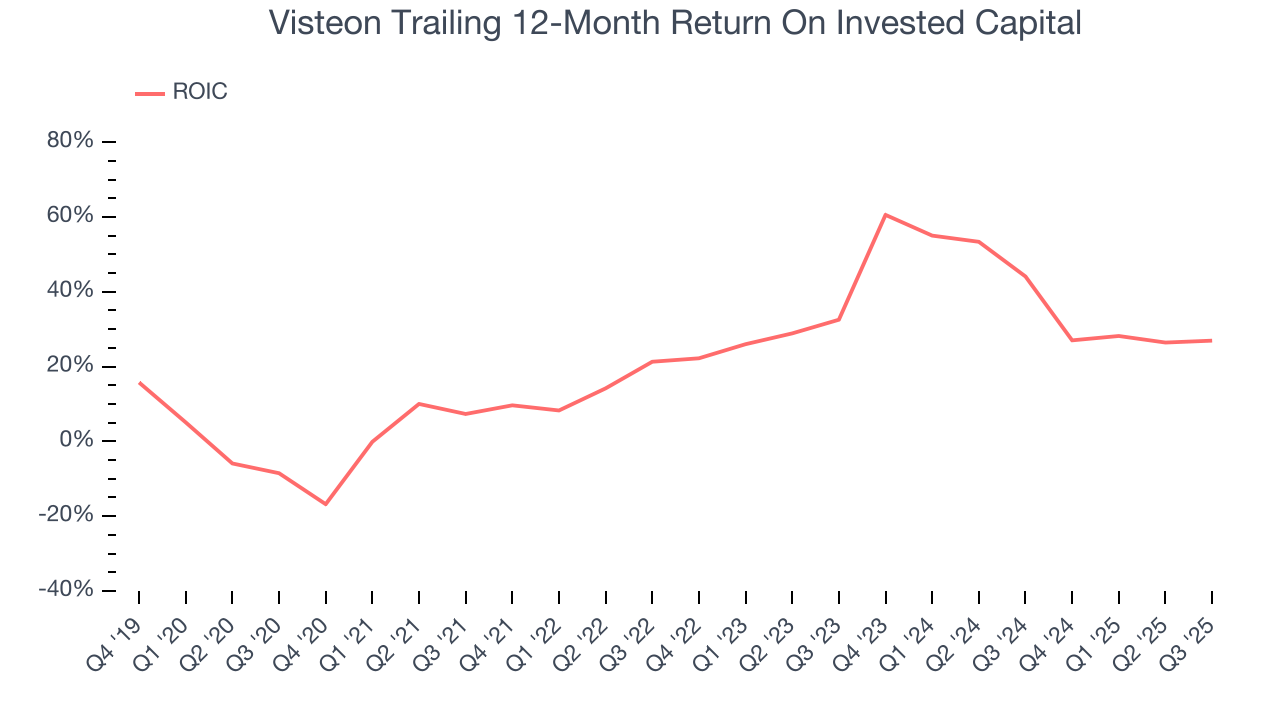

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Visteon’s five-year average ROIC was 26.4%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Visteon’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

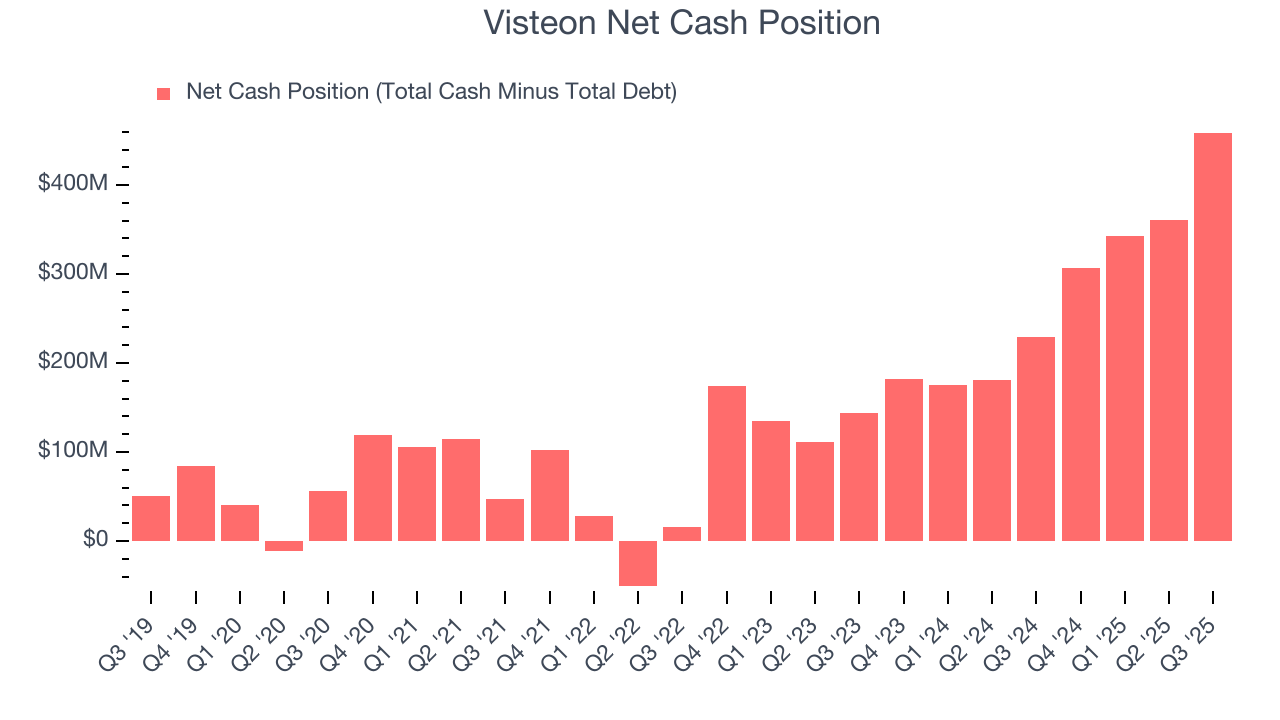

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Visteon is a profitable, well-capitalized company with $765 million of cash and $306 million of debt on its balance sheet. This $459 million net cash position is 17.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Visteon’s Q3 Results

We enjoyed seeing Visteon beat analysts’ adjusted operating income expectations this quarter. On the other hand, its revenue missed and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $96.75 immediately after reporting.

13. Is Now The Time To Buy Visteon?

Updated: February 16, 2026 at 11:42 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Visteon, you should also grasp the company’s longer-term business quality and valuation.

There are things to like about Visteon. First off, its revenue growth was good over the last five years. And while its projected EPS for the next year is lacking, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

Visteon’s P/E ratio based on the next 12 months is 11.3x. When scanning the industrials space, Visteon trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $126.36 on the company (compared to the current share price of $105), implying they see 20.3% upside in buying Visteon in the short term.