Farmer Mac (AGM)

Farmer Mac piques our interest, but the state of its balance sheet makes us slightly uncomfortable.― StockStory Analyst Team

1. News

2. Summary

Why Farmer Mac Is Not Exciting

Created by Congress in 1987 to build a bridge between Wall Street and rural America, Farmer Mac (NYSE:AGM) provides a secondary market for agricultural and rural loans, helping lenders increase their liquidity and lending capacity to serve rural America.

Farmer Mac shows some potential. However, we wouldn’t buy the stock until its EBITDA can comfortably support its debt.

Why There Are Better Opportunities Than Farmer Mac

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Farmer Mac

At $174.63 per share, Farmer Mac trades at 9.4x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Farmer Mac (AGM) Research Report: Q4 CY2025 Update

Agricultural finance company Farmer Mac (NYSE:AGM) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 10.2% year on year to $107.9 million. Its non-GAAP profit of $3.66 per share was 19.1% below analysts’ consensus estimates.

Farmer Mac (AGM) Q4 CY2025 Highlights:

- Revenue: $107.9 million vs analyst estimates of $107.5 million (10.2% year-on-year growth, in line)

- Pre-tax Profit: $60.47 million (56% margin)

- Adjusted EPS: $3.66 vs analyst expectations of $4.53 (19.1% miss)

- Market Capitalization: $1.86 billion

Company Overview

Created by Congress in 1987 to build a bridge between Wall Street and rural America, Farmer Mac (NYSE:AGM) provides a secondary market for agricultural and rural loans, helping lenders increase their liquidity and lending capacity to serve rural America.

Farmer Mac operates at the intersection of agriculture, finance, and government policy, serving as a vital link between capital markets and rural lenders. The company purchases eligible loans from lenders, issues guarantees on securities backed by these loans, and provides long-term standby purchase commitments. This creates liquidity for lenders, allowing them to make more loans to farmers, ranchers, and rural infrastructure providers.

The company's business is organized into two main lines: Agricultural Finance and Rural Infrastructure Finance. The Agricultural Finance segment includes Farm & Ranch loans secured by agricultural real estate and Corporate AgFinance loans to larger, more complex agricultural operations. The Rural Infrastructure Finance segment focuses on loans to rural electric cooperatives, telecommunications providers, and renewable energy projects.

For example, a local bank might originate a $2 million mortgage loan to a family farm operation but be concerned about concentration risk in its portfolio. The bank could sell this loan to Farmer Mac or obtain a guarantee, freeing up capital to make additional loans while maintaining its customer relationship.

Farmer Mac funds its operations primarily by issuing debt in the capital markets. The company earns revenue through interest income on assets held on its balance sheet and through fees for its guarantees and commitments. As a government-sponsored enterprise (GSE), Farmer Mac benefits from an implied government backing that helps it access funding at favorable rates, though its obligations are not explicitly guaranteed by the federal government.

Farmer Mac is regulated by the Farm Credit Administration through its Office of Secondary Market Oversight, which conducts annual examinations to ensure safety, soundness, and mission achievement. Unlike some other GSEs, Farmer Mac is required to file regular reports with the SEC and comply with securities regulations.

4. Specialty Finance

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

Farmer Mac's competitors include other entities that provide financing to agricultural and rural markets, such as the Farm Credit System institutions, commercial banks with agricultural lending divisions, agricultural credit associations, and insurance companies that invest in agricultural mortgages.

5. Revenue Growth

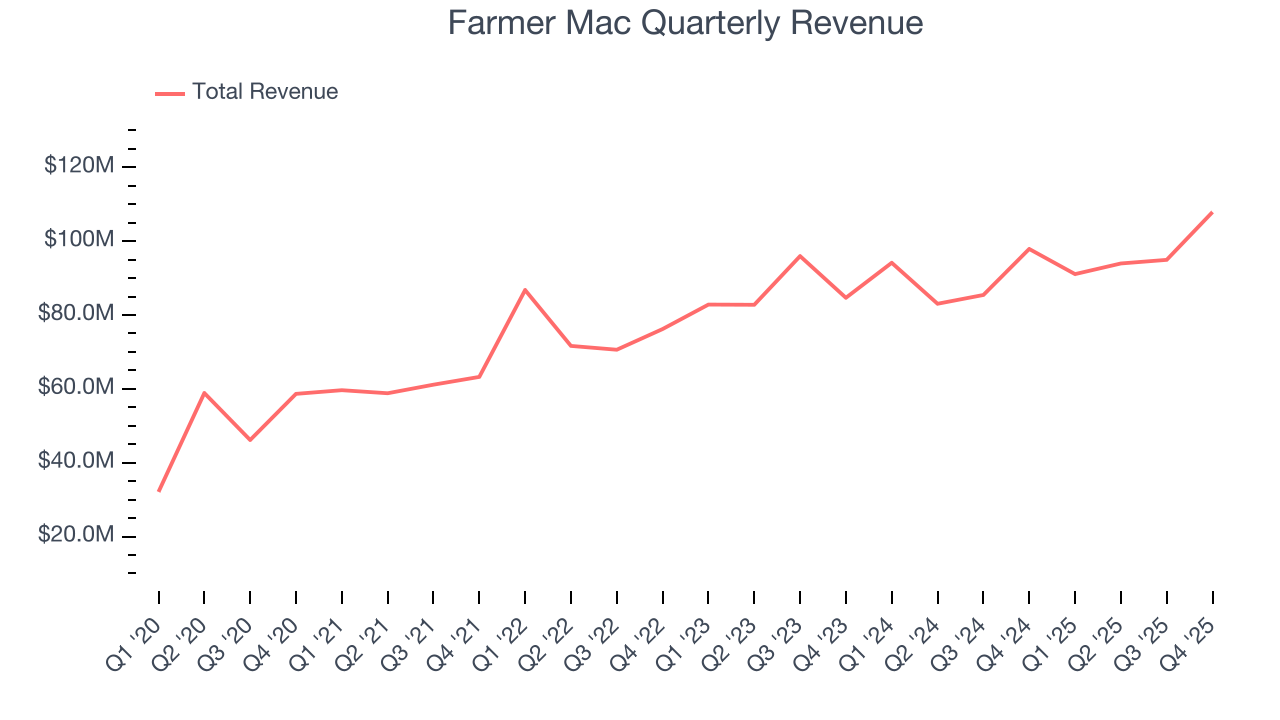

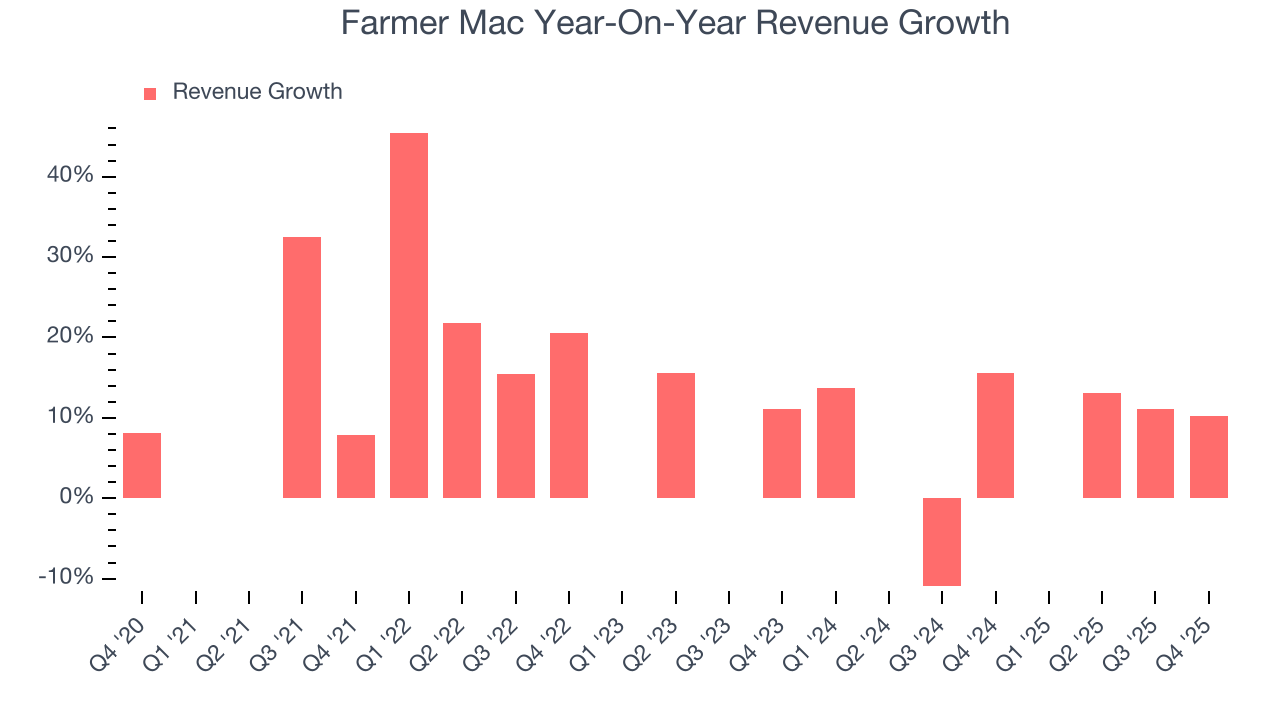

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Farmer Mac grew its revenue at an impressive 14.7% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Farmer Mac’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 5.8% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Farmer Mac’s year-on-year revenue growth was 10.2%, and its $107.9 million of revenue was in line with Wall Street’s estimates.

6. Pre-Tax Profit Margin

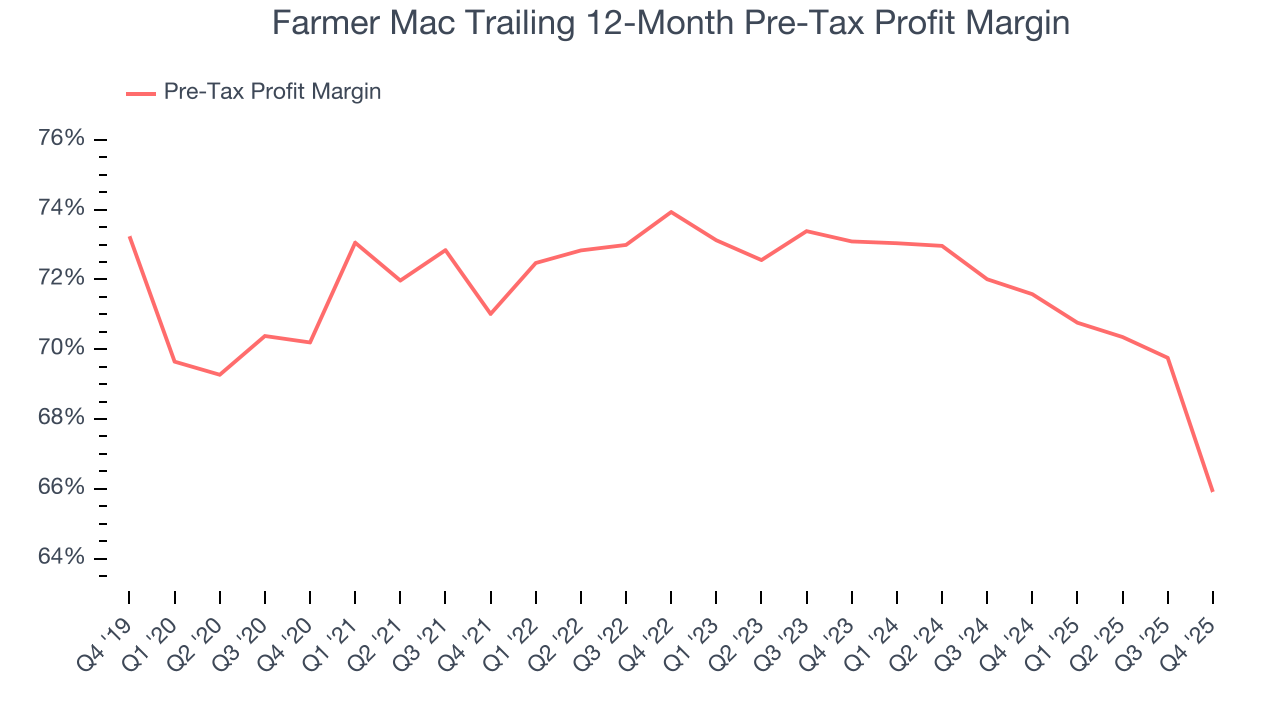

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Specialty Finance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Farmer Mac’s pre-tax profit margin has risen by 4.3 percentage points, going from 71% to 65.9%. It has also declined by 7.2 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q4, Farmer Mac’s pre-tax profit margin was 56%. This result was 13.8 percentage points worse than the same quarter last year.

7. Earnings Per Share

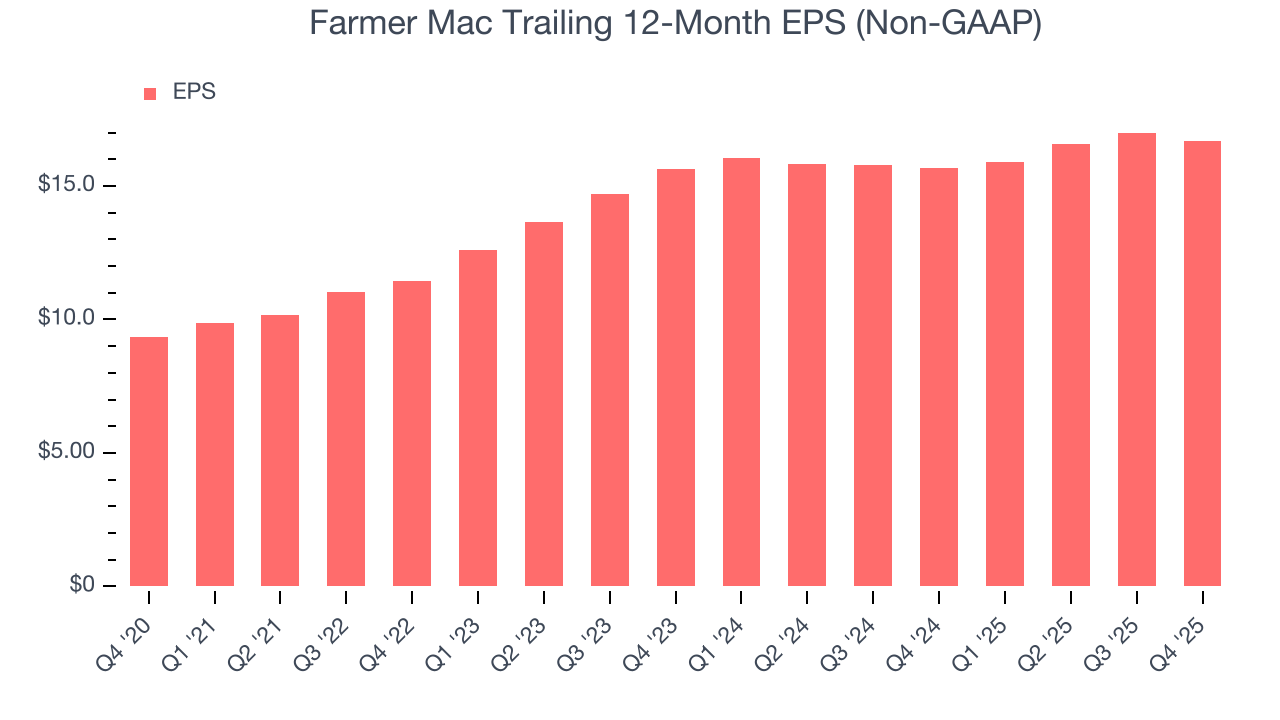

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Farmer Mac’s EPS grew at a decent 12.3% compounded annual growth rate over the last five years. However, this performance was lower than its 14.7% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Farmer Mac, its two-year annual EPS growth of 3.3% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Farmer Mac reported adjusted EPS of $3.66, down from $3.97 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Farmer Mac’s full-year EPS of $16.69 to grow 13.1%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Farmer Mac has averaged an ROE of 13.9%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Farmer Mac.

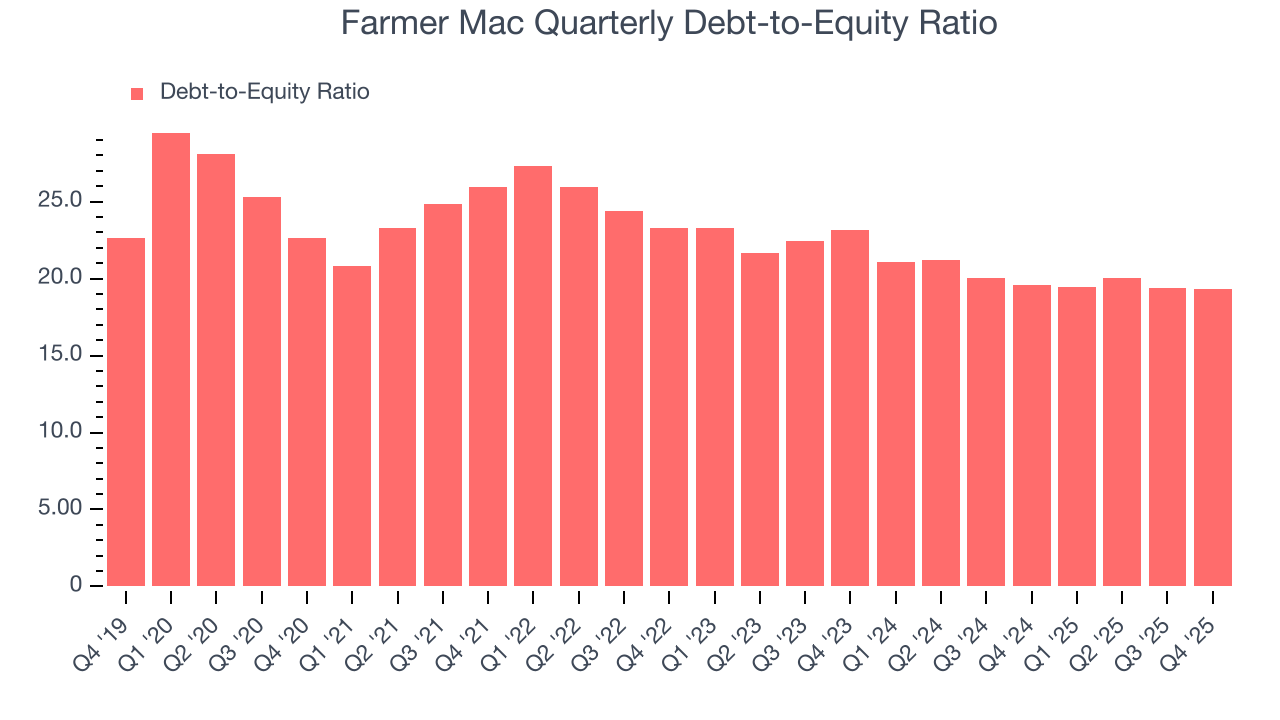

9. Balance Sheet Risk

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Farmer Mac currently has $33.19 billion of debt and $1.72 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 19.6×. We think this is dangerous - for a financials business, anything above 3.5× raises red flags.

10. Key Takeaways from Farmer Mac’s Q4 Results

We struggled to find many positives in these results. Overall, this quarter could have been better. The stock traded down 3.1% to $168.50 immediately following the results.

11. Is Now The Time To Buy Farmer Mac?

Updated: February 19, 2026 at 4:33 PM EST

When considering an investment in Farmer Mac, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Farmer Mac’s business quality ultimately falls short of our standards. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its declining pre-tax profit margin shows the business has become less efficient.

Farmer Mac’s P/E ratio based on the next 12 months is 9.2x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $226.67 on the company (compared to the current share price of $168.50).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.