Allison Transmission (ALSN)

Allison Transmission is interesting. Its robust cash flows and returns on capital showcase its management team’s strong investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why Allison Transmission Is Interesting

Helping build race cars at one point, Allison Transmission (NYSE:ALSN) offers transmissions to original equipment manufacturers and fleet operators.

- Market share is on track to rise over the next 12 months as its 40.9% projected revenue growth implies demand will accelerate from its two-year trend

- Superior product capabilities and pricing power lead to a best-in-class gross margin of 47.9%

- A blemish is its annual revenue growth of 7.2% over the last five years was below our standards for the industrials sector

Allison Transmission shows some potential. If you’ve been itching to buy the stock, the valuation looks fair.

Why Is Now The Time To Buy Allison Transmission?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Allison Transmission?

Allison Transmission’s stock price of $109.55 implies a valuation ratio of 8x forward EV-to-EBITDA. When stacked up against other industrials companies, we think Allison Transmission’s multiple is fair for the fundamentals you get.

This could be a good time to invest if you believe in the long-term prospects of the business and its offerings.

3. Allison Transmission (ALSN) Research Report: Q3 CY2025 Update

Transmission provider Allison Transmission (NYSE:ALSN) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 15.9% year on year to $693 million. The company’s full-year revenue guidance of $3 billion at the midpoint came in 2.2% below analysts’ estimates. Its GAAP profit of $1.63 per share was 11.5% below analysts’ consensus estimates.

Allison Transmission (ALSN) Q3 CY2025 Highlights:

- Revenue: $693 million vs analyst estimates of $764.1 million (15.9% year-on-year decline, 9.3% miss)

- EPS (GAAP): $1.63 vs analyst expectations of $1.84 (11.5% miss)

- Adjusted EBITDA: $256 million vs analyst estimates of $279 million (36.9% margin, 8.2% miss)

- The company dropped its revenue guidance for the full year to $3 billion at the midpoint from $3.13 billion, a 4% decrease

- EBITDA guidance for the full year is $1.11 billion at the midpoint, below analyst estimates of $1.13 billion

- Operating Margin: 29.4%, down from 31.6% in the same quarter last year

- Free Cash Flow Margin: 26.6%, up from 25.5% in the same quarter last year

- Market Capitalization: $6.87 billion

Company Overview

Helping build race cars at one point, Allison Transmission (NYSE:ALSN) offers transmissions to original equipment manufacturers and fleet operators.

Allison Transmission was established in 1915 and originally focused on developing aircraft engines during World War I. The company would transition to offer transmissions in the 1940s and by the 1950s the company expanded into commercial and vocational vehicles.

The company has focused on acquiring companies that complement its core business in automatic transmissions, often targeting smaller firms with new technology or capabilities that can be integrated into Allison Transmission’s existing product lines. For example, the acquisition of companies specializing in hybrid and electric propulsion systems. Specifically, the acquisitions of Walker Die Casting and C&R Tool and Engineering in 2019 enhanced Allison's capabilities in manufacturing critical components for its transmissions.

Today, Allison Transmission specializes in fully automatic transmissions for buses, refuse trucks, construction equipment, and military vehicles, primarily catering to industries where vehicles operate under harsh conditions and heavy loads. Allison's customers include original equipment manufacturers (OEMs) such as truck and bus manufacturers, who incorporate the transmission into vehicles during the production process. Additionally, fleet operators rely on its transmissions to ensure vehicles perform properly.

Allison Transmission engages in long-term supply agreements with OEMs and fleet operators that typically range from three to five years. Additionally, service contracts are offered which typically span the lifecycle of the vehicle. It provides volume discounts typically structured based on the quantity of transmissions purchased within a specified period, encouraging OEMs and fleet operators to commit to larger volumes and longer contract durations.

The company has continued to make acquisitions and fund research & development for hybrid and electric transmission systems.

4. Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Competitors offering similar products include Cummins (NYSE:CMI), Eaton (NYSE:ETN), and BorgWarner (NYSE:BWA).

5. Revenue Growth

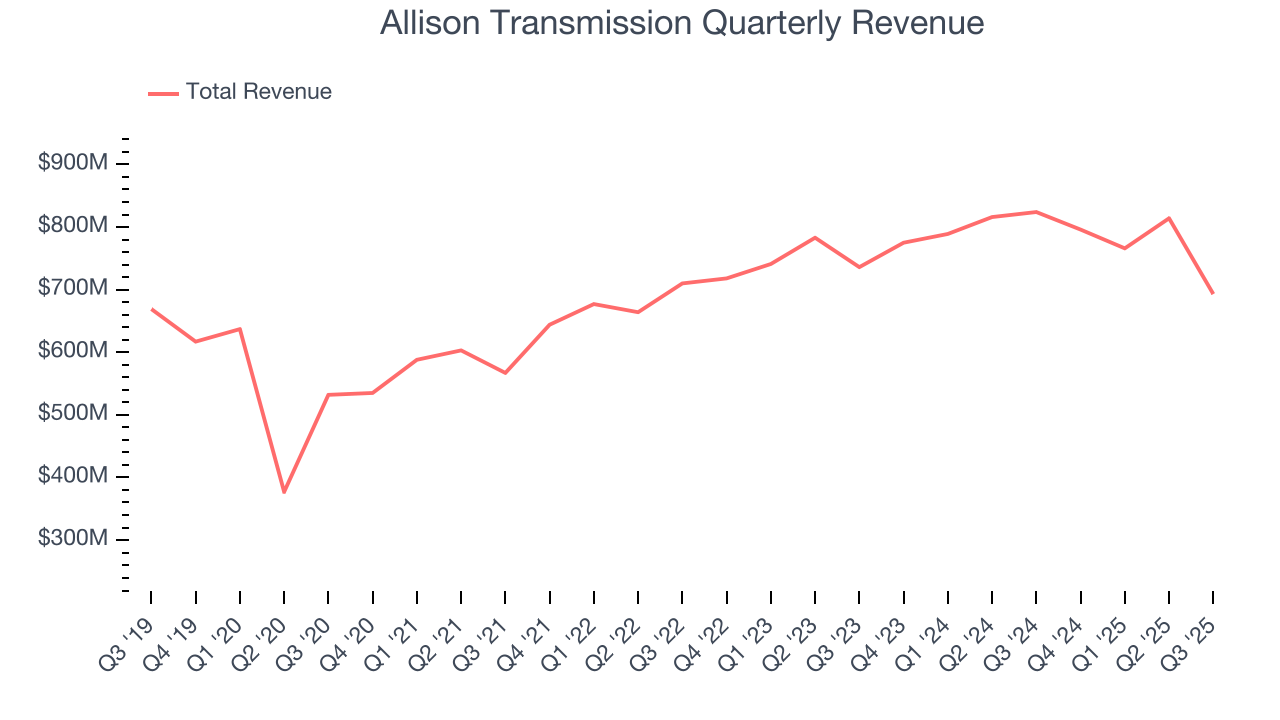

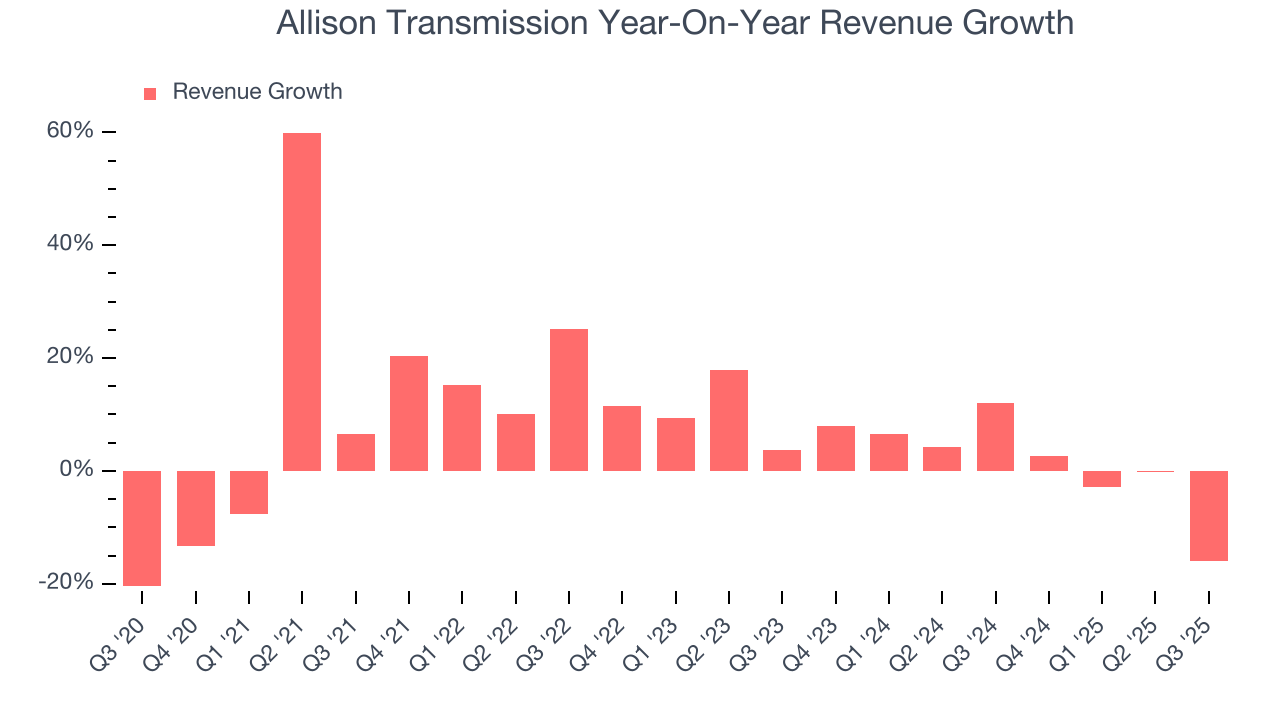

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Allison Transmission’s 7.2% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Allison Transmission.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Allison Transmission’s recent performance shows its demand has slowed as its annualized revenue growth of 1.5% over the last two years was below its five-year trend. We also note many other Heavy Transportation Equipment businesses have faced declining sales because of cyclical headwinds. While Allison Transmission grew slower than we’d like, it did do better than its peers.

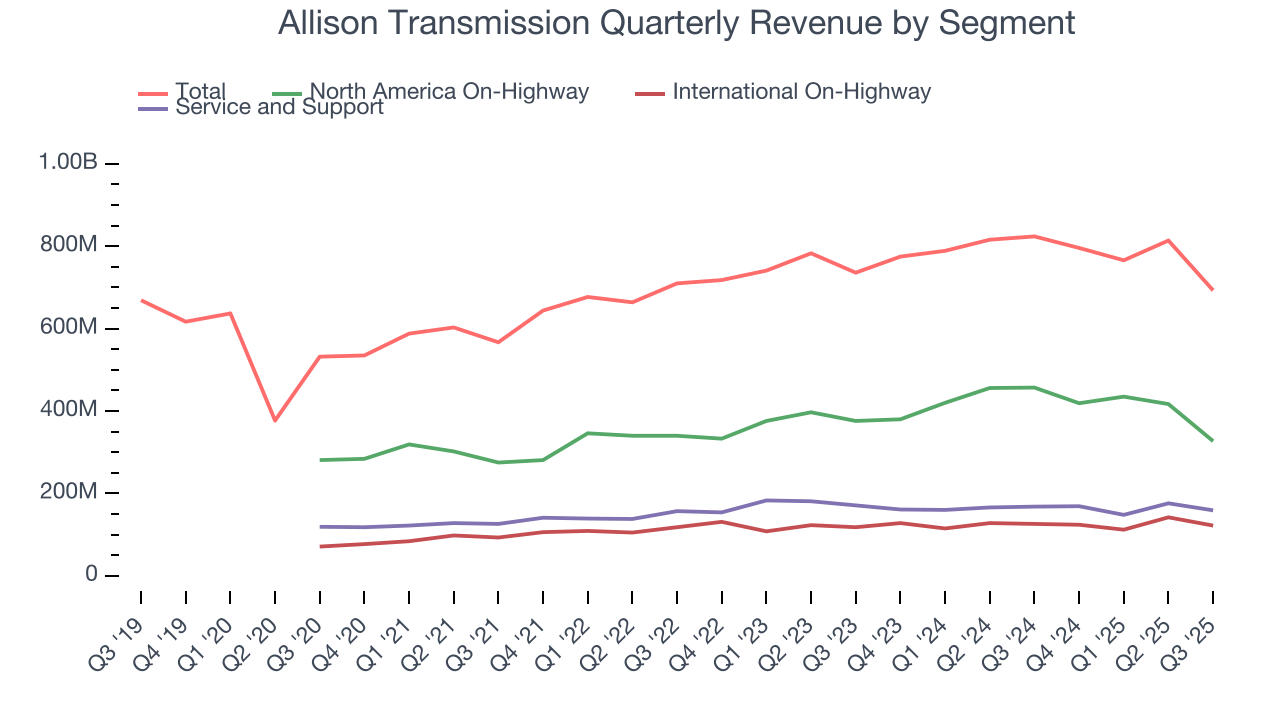

Allison Transmission also breaks out the revenue for its three most important segments: North America On-Highway, International On-Highway, and Service and Support, which are 47.2%, 17.6%, and 22.9% of revenue. Over the last two years, Allison Transmission’s North America On-Highway (propulsion solutions) and International On-Highway (propulsion solutions) revenues averaged year-on-year growth of 4.9% and 2.1% while its Service and Support revenue (parts and equipment) averaged 2.5% declines.

This quarter, Allison Transmission missed Wall Street’s estimates and reported a rather uninspiring 15.9% year-on-year revenue decline, generating $693 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

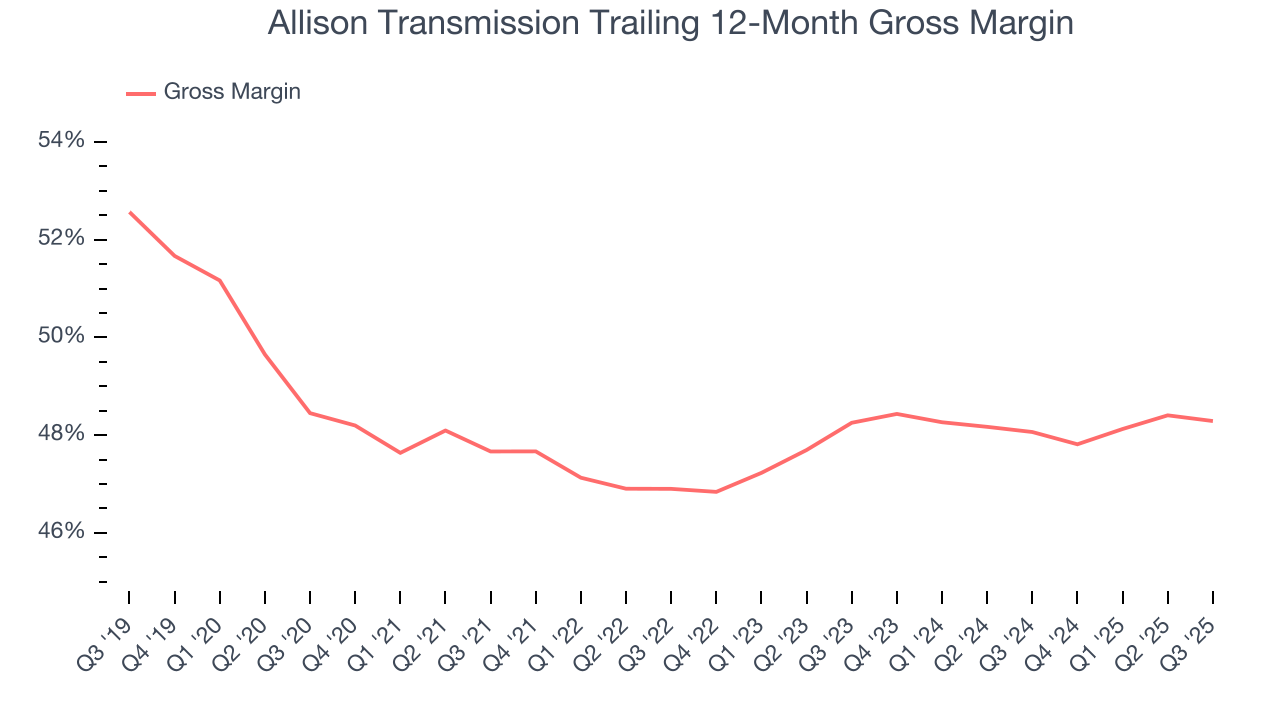

Allison Transmission has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 47.9% gross margin over the last five years. Said differently, roughly $47.87 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

In Q3, Allison Transmission produced a 47.5% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

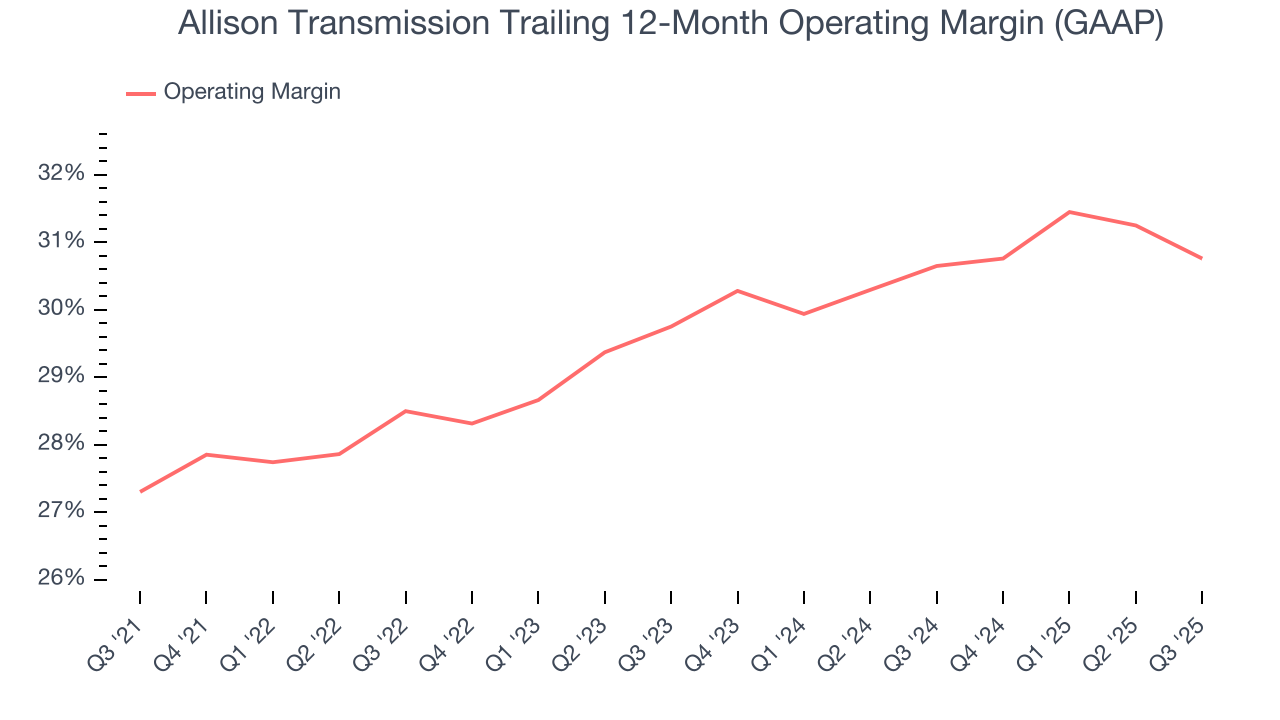

7. Operating Margin

Allison Transmission has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 29.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Allison Transmission’s operating margin rose by 3.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Allison Transmission generated an operating margin profit margin of 29.4%, down 2.1 percentage points year on year. Since Allison Transmission’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

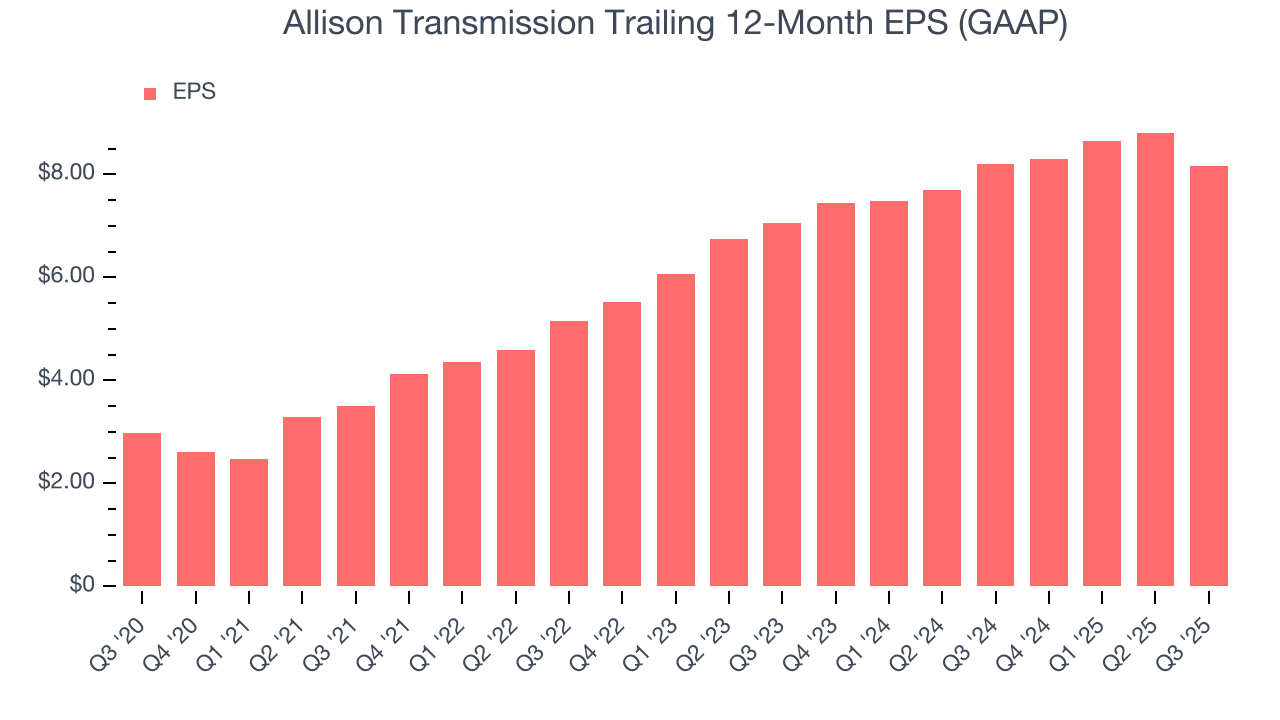

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

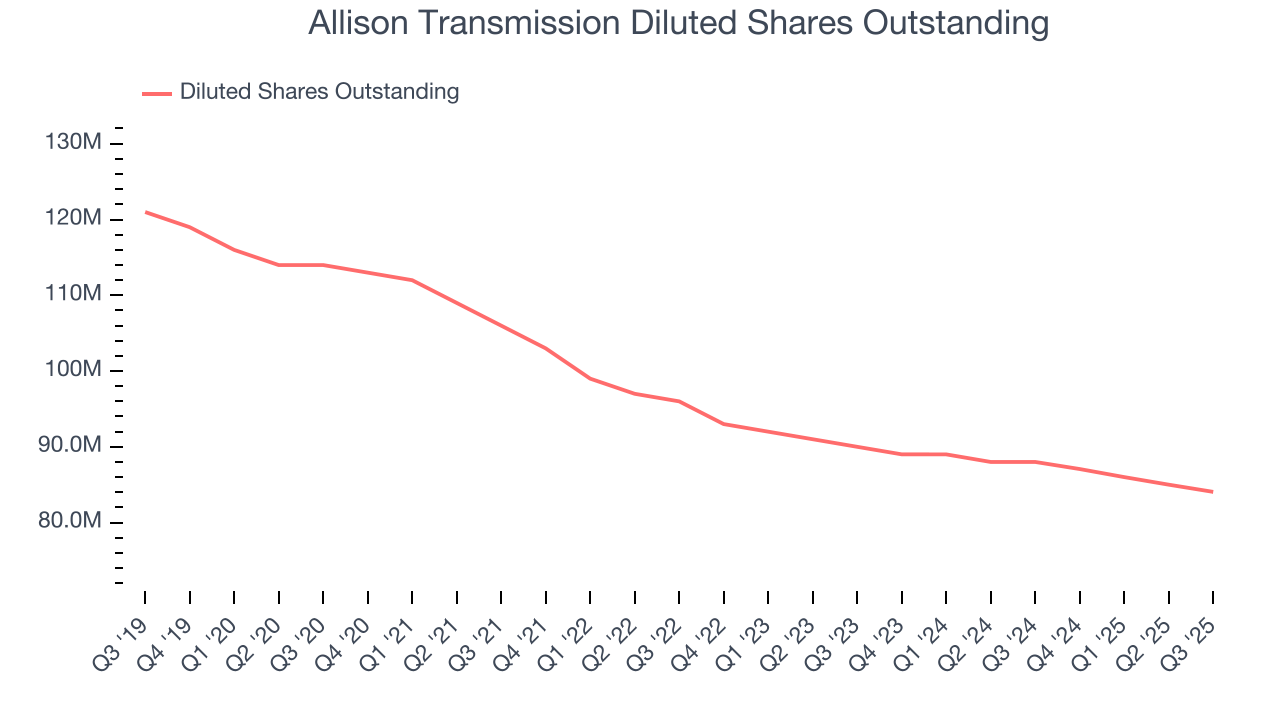

Allison Transmission’s EPS grew at an astounding 22.4% compounded annual growth rate over the last five years, higher than its 7.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Allison Transmission’s earnings can give us a better understanding of its performance. As we mentioned earlier, Allison Transmission’s operating margin declined this quarter but expanded by 3.5 percentage points over the last five years. Its share count also shrank by 26.3%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Allison Transmission, its two-year annual EPS growth of 7.7% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q3, Allison Transmission reported EPS of $1.63, down from $2.27 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Allison Transmission’s full-year EPS of $8.17 to shrink by 1.5%.

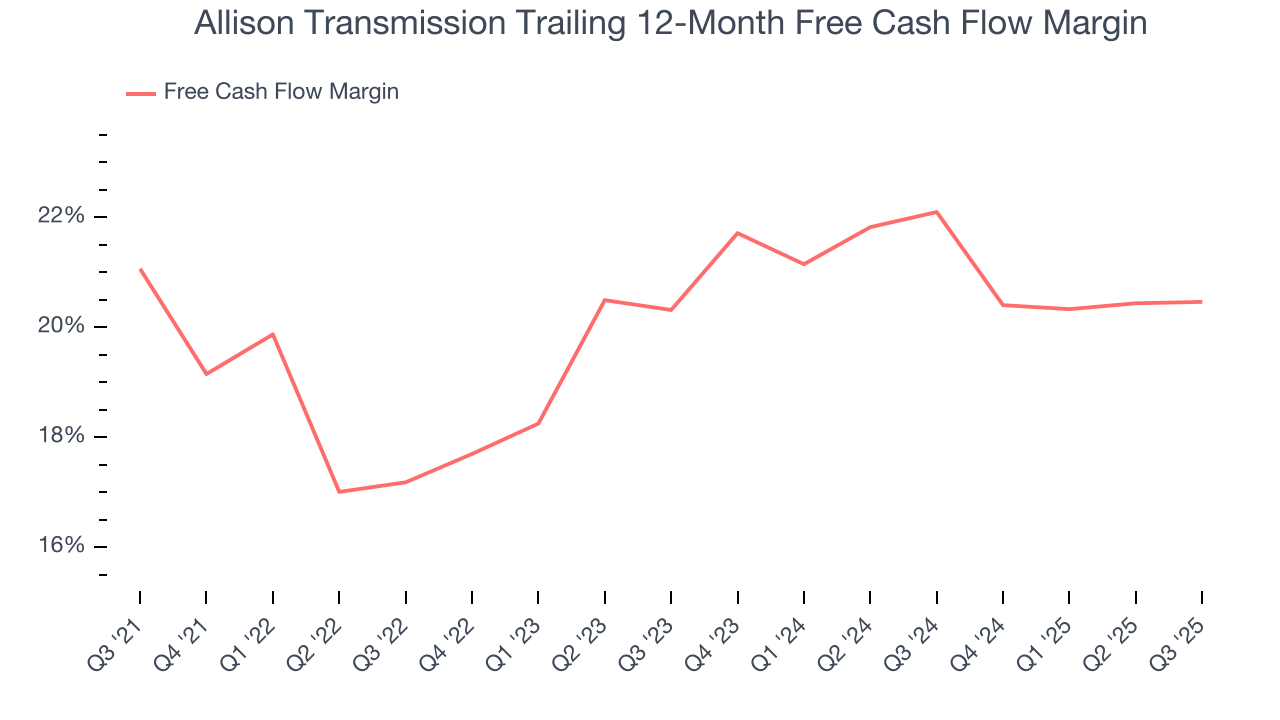

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Allison Transmission has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 20.3% over the last five years.

Allison Transmission’s free cash flow clocked in at $184 million in Q3, equivalent to a 26.6% margin. This result was good as its margin was 1.1 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

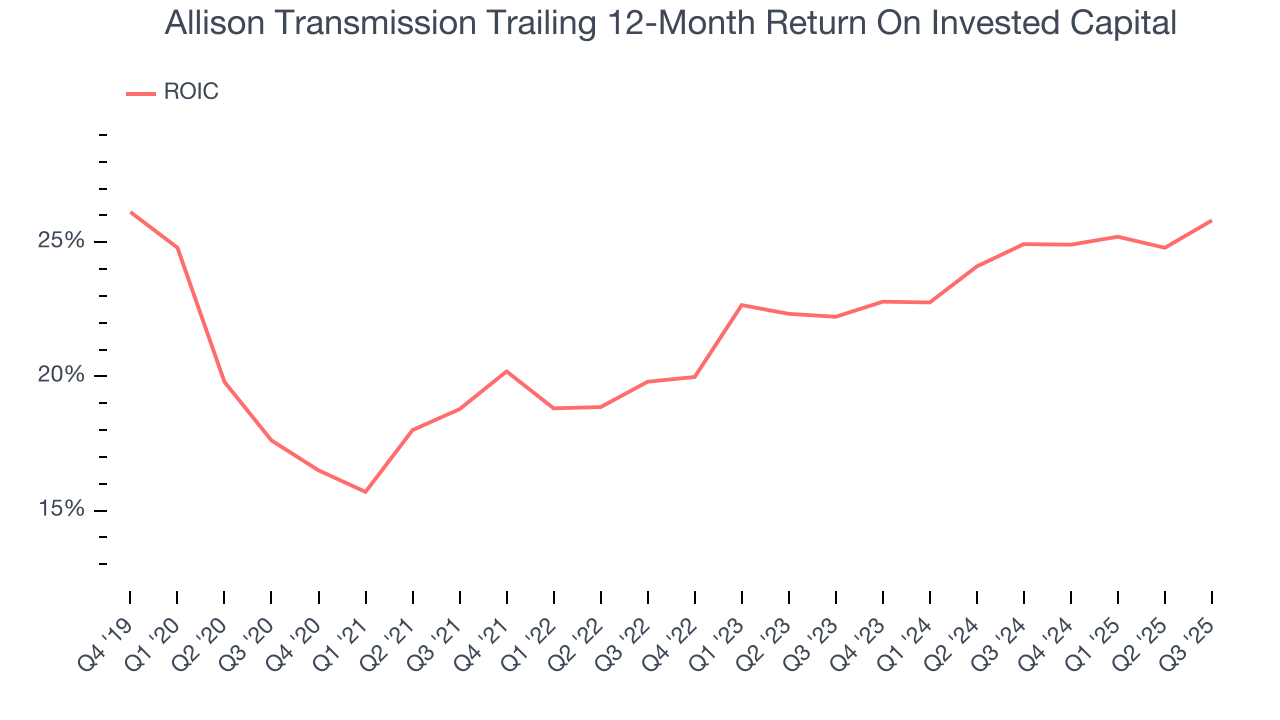

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Allison Transmission’s five-year average ROIC was 22.3%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Allison Transmission’s ROIC has increased. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

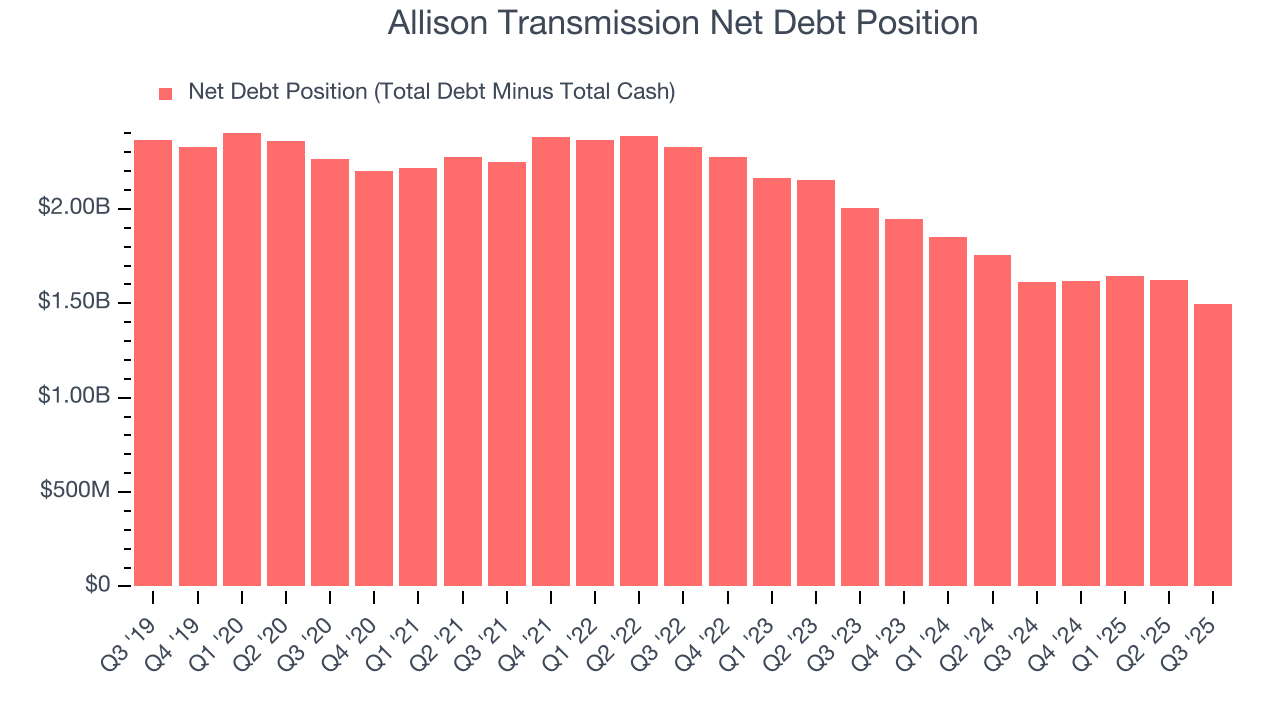

11. Balance Sheet Assessment

Allison Transmission reported $902 million of cash and $2.40 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.13 billion of EBITDA over the last 12 months, we view Allison Transmission’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $88 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Allison Transmission’s Q3 Results

We struggled to find many positives in these results. Its revenue and EPS both missed. To add insult to injury, Allison Transmission lowered its full-year revenue guidance. Overall, this was a weaker quarter. The stock traded down 5.2% to $77.32 immediately following the results.

13. Is Now The Time To Buy Allison Transmission?

Updated: January 24, 2026 at 10:21 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Allison Transmission, you should also grasp the company’s longer-term business quality and valuation.

There are a lot of things to like about Allison Transmission. Although its revenue growth was mediocre over the last five years, its growth over the next 12 months is expected to be higher. On top of that, Allison Transmission’s admirable gross margins indicate the mission-critical nature of its offerings, and the company’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Allison Transmission’s EV-to-EBITDA ratio based on the next 12 months is 8x. Looking at the industrials space right now, Allison Transmission trades at a compelling valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $114.80 on the company (compared to the current share price of $109.55), implying they see 4.8% upside in buying Allison Transmission in the short term.