Alta (ALTG)

We wouldn’t buy Alta. Its sales have recently flopped and its historical cash burn means it has few resources to reignite growth.― StockStory Analyst Team

1. News

2. Summary

Why We Think Alta Will Underperform

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

- Annual sales declines of 1.1% for the past two years show its products and services struggled to connect with the market during this cycle

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 40% annually while its revenue grew

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

Alta falls short of our quality standards. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Alta

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Alta

Alta is trading at $6.90 per share, or 6.1x forward EV-to-EBITDA. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Alta (ALTG) Research Report: Q4 CY2025 Update

Equipment distribution company Alta Equipment Group (NYSE:ALTG) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 2.2% year on year to $509.1 million. Its non-GAAP loss of $0.27 per share was significantly below analysts’ consensus estimates.

Alta (ALTG) Q4 CY2025 Highlights:

- Revenue: $509.1 million vs analyst estimates of $493.9 million (2.2% year-on-year growth, 3.1% beat)

- Adjusted EPS: -$0.27 vs analyst estimates of $0.10 (significant miss)

- Adjusted EBITDA: $40.6 million vs analyst estimates of $44.23 million (8% margin, 8.2% miss)

- EBITDA guidance for the upcoming financial year 2026 is $180 million at the midpoint, above analyst estimates of $176.1 million

- Operating Margin: 1%, in line with the same quarter last year

- Free Cash Flow Margin: 13.4%, up from 4.3% in the same quarter last year

- Market Capitalization: $212.4 million

Company Overview

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

The company specializes in the sale, rental, and servicing of equipment including lift trucks, cranes, and heavy construction machinery. For example, Alta provides forklifts for warehouse operations, aerial lifts for construction sites, and cranes for large-scale industrial projects.

Alta Equipment Group generates revenue through equipment rentals but also through equipment sales and maintenance services. The company markets these offerings to a client base comprised of construction companies, industrial operations, and logistics providers.

Sales strategies include direct sales teams, online marketing, and client service operations, but the crux of the Alta’s go-to-market strategy is a trusted reputation of having the right equipment, getting it to clients in a timely manner, and being there to maintain and repair this equipment when needed. Alta's rentals and services provide more predictable, recurring revenue streams. On the other hand, equipment sales can be lumpy, as they are one-time in nature and can require large capital outlays from customers.

4. Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Public competitors in the industrial and construction equipment industry include United Rentals (NYSE:URI), Caterpillar (NYSE:CAT), and H&E Equipment Services (NASDAQ:HEES).

5. Revenue Growth

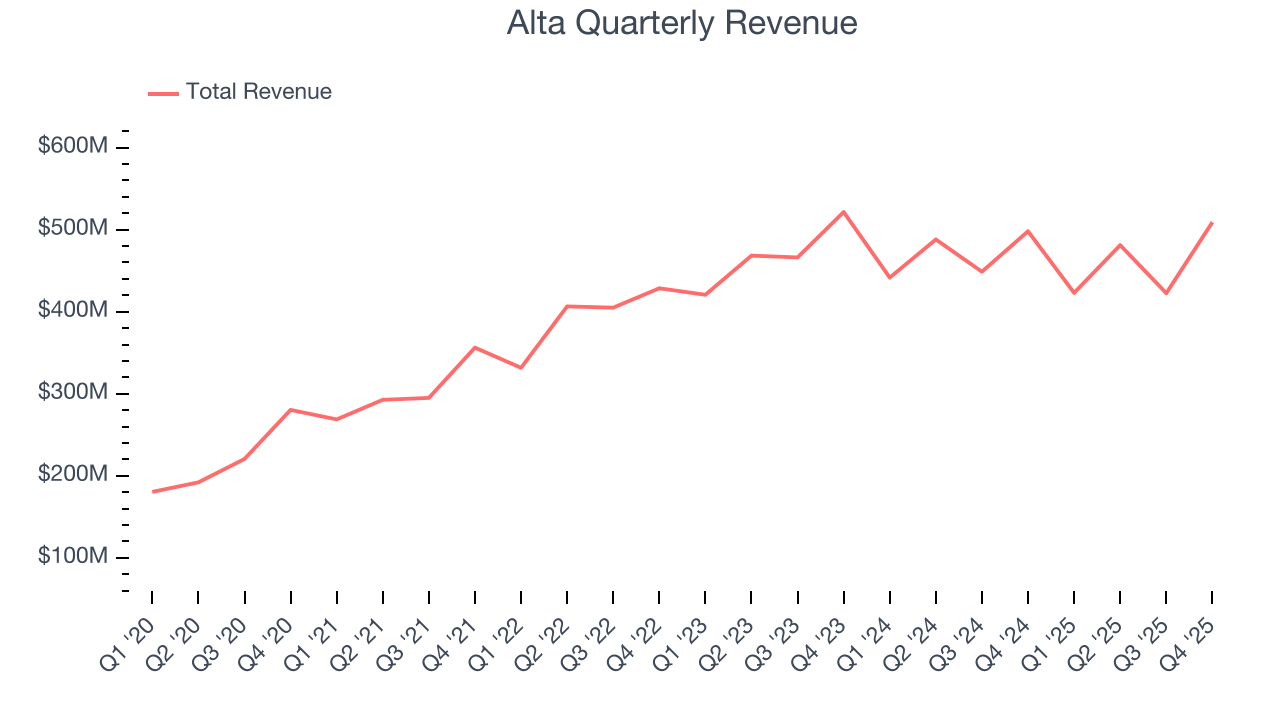

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Alta’s 16% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Alta’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.1% over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Equipment and Parts, which are 59.1% and 13.4% of revenue. Over the last two years, Alta’s Equipment revenue (new and used) was flat while its Parts revenue (maintenance and repair products) averaged 1.2% year-on-year declines.

This quarter, Alta reported modest year-on-year revenue growth of 2.2% but beat Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Alta has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26.4% gross margin over the last five years. Said differently, Alta had to pay a chunky $73.61 to its suppliers for every $100 in revenue.

Alta produced a 23.5% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

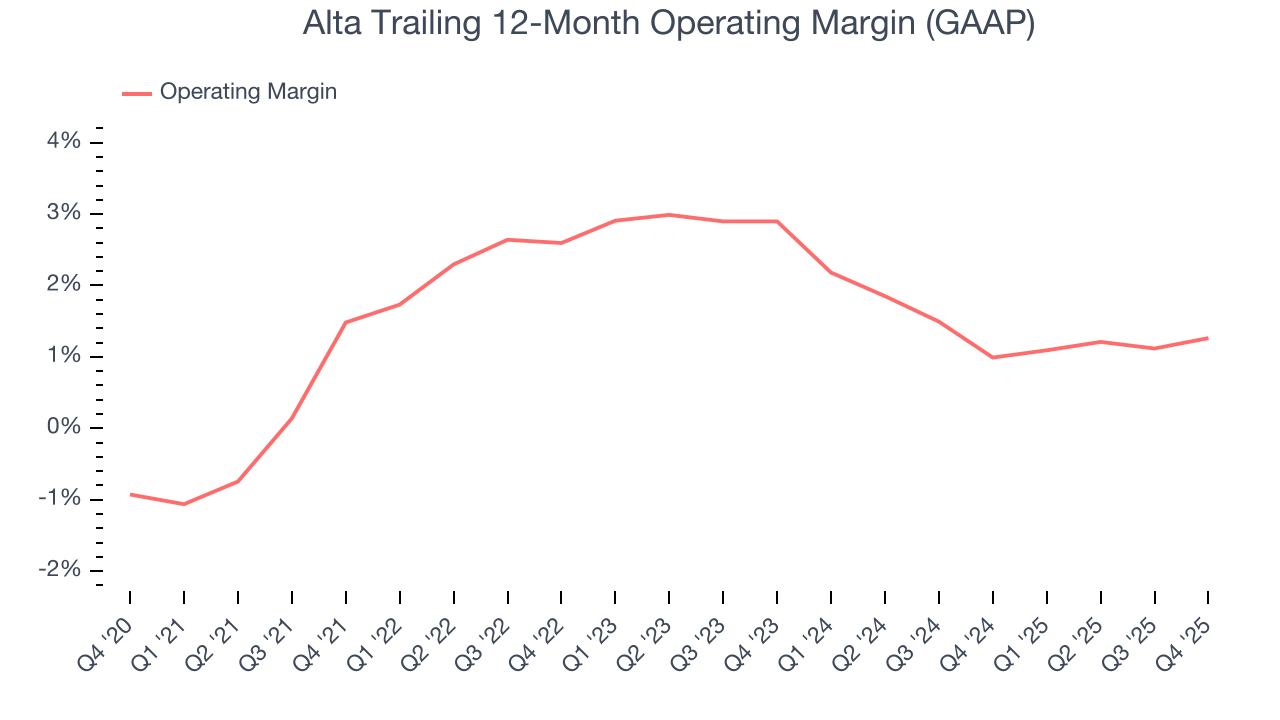

7. Operating Margin

Alta’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 1.9% over the last five years. This profitability was lousy for an industrials business and caused by its suboptimal cost structureand low gross margin.

Looking at the trend in its profitability, Alta’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Alta generated an operating margin profit margin of 1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

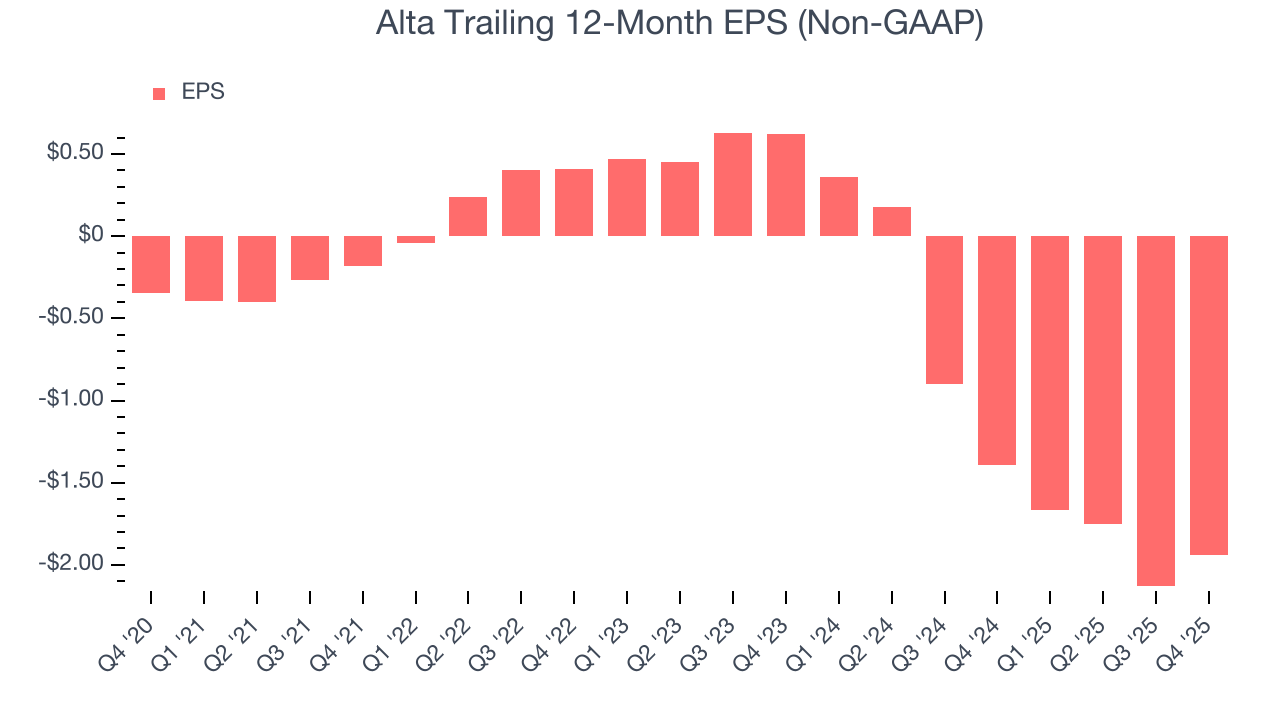

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Alta’s earnings losses deepened over the last five years as its EPS dropped 41% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Alta’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Alta, its EPS declined by more than its revenue over the last two years, dropping 127%. This tells us the company struggled to adjust to shrinking demand.

We can take a deeper look into Alta’s earnings to better understand the drivers of its performance. While we mentioned earlier that Alta’s operating margin was flat this quarter, a two-year view shows its margin has declined. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Alta reported adjusted EPS of negative $0.27, up from negative $0.46 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Alta to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.94 will advance to negative $0.51.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Alta broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Alta’s margin expanded by 2.9 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Alta’s free cash flow clocked in at $68 million in Q4, equivalent to a 13.4% margin. This result was good as its margin was 9.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Alta’s $850.1 million of debt exceeds the $18.6 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $164.4 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Alta could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Alta can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Alta’s Q4 Results

We enjoyed seeing Alta beat analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $6.50 immediately following the results.

12. Is Now The Time To Buy Alta?

Updated: February 27, 2026 at 10:18 PM EST

Are you wondering whether to buy Alta or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies making their customers lives easier, but in the case of Alta, we’ll be cheering from the sidelines. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

Alta’s EV-to-EBITDA ratio based on the next 12 months is 6.1x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $9.95 on the company (compared to the current share price of $6.90).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.