Autoliv (ALV)

Autoliv doesn’t excite us. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why Autoliv Is Not Exciting

With products estimated to save over 30,000 lives annually in traffic accidents worldwide, Autoliv (NYSE:ALV) develops and manufactures passive safety systems for vehicles, including airbags, seatbelts, and steering wheels that protect occupants during crashes.

- High input costs result in an inferior gross margin of 17.9% that must be offset through higher volumes

- Estimated sales growth of 2.1% for the next 12 months is soft and implies weaker demand

- A consolation is that its performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 25.7% outpaced its revenue gains

Autoliv is in the penalty box. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Autoliv

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Autoliv

Autoliv’s stock price of $124.97 implies a valuation ratio of 11.8x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Autoliv (ALV) Research Report: Q4 CY2025 Update

Automotive safety systems provider Autoliv (NYSE:ALV) announced better-than-expected revenue in Q4 CY2025, with sales up 7.7% year on year to $2.82 billion. Its non-GAAP profit of $3.19 per share was 10.7% above analysts’ consensus estimates.

Autoliv (ALV) Q4 CY2025 Highlights:

- Revenue: $2.82 billion vs analyst estimates of $2.78 billion (7.7% year-on-year growth, 1.2% beat)

- Adjusted EPS: $3.19 vs analyst estimates of $2.88 (10.7% beat)

- Adjusted EBITDA: $427 million vs analyst estimates of $434.6 million (15.2% margin, 1.8% miss)

- Operating Margin: 11.3%, down from 13.5% in the same quarter last year

- Free Cash Flow Margin: 15.4%, up from 11% in the same quarter last year

- Market Capitalization: $9.44 billion

Company Overview

With products estimated to save over 30,000 lives annually in traffic accidents worldwide, Autoliv (NYSE:ALV) develops and manufactures passive safety systems for vehicles, including airbags, seatbelts, and steering wheels that protect occupants during crashes.

The company's portfolio is divided into two main product categories: airbag and steering wheel products (approximately 68% of sales) and seatbelt products (approximately 32%). Autoliv's airbag systems include frontal-impact protection, side-impact protection, and inflatable curtains designed to shield occupants during various collision scenarios. Their advanced seatbelt technologies feature pretensioners that tighten during a crash and load limiters that reduce chest injuries.

Autoliv serves virtually every major global automaker, with production facilities across 23 countries to support worldwide manufacturing operations. When a car manufacturer designs a new vehicle model, Autoliv engineers work closely with them to develop safety systems specifically calibrated for that vehicle's unique characteristics, crash test performance, and occupant protection requirements.

The company maintains a significant global market presence with approximately 45% share in seatbelts and 44% in airbags and steering wheels. This market leadership stems from Autoliv's continuous innovation in safety technology, such as active seatbelts that can tighten before a collision and specialized airbags like knee and center airbags that protect against specific injury patterns.

Beyond traditional vehicle safety, Autoliv has expanded into Mobility Safety Solutions, developing technologies for pedestrian protection, battery safety systems for electric vehicles, and safety solutions for motorcyclists and other powered two-wheeler riders.

4. Automobile Manufacturing

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

Autoliv's major competitors include ZF AG, Joyson Safety Systems (a subsidiary of Ningbo Joyson Electronic Corp), as well as regional players such as Nihon Plast and Ashimori in Japan, Yanfeng and Jinheng in China, Samsong in South Korea, and Chris Cintos de Seguranca in South America.

5. Revenue Growth

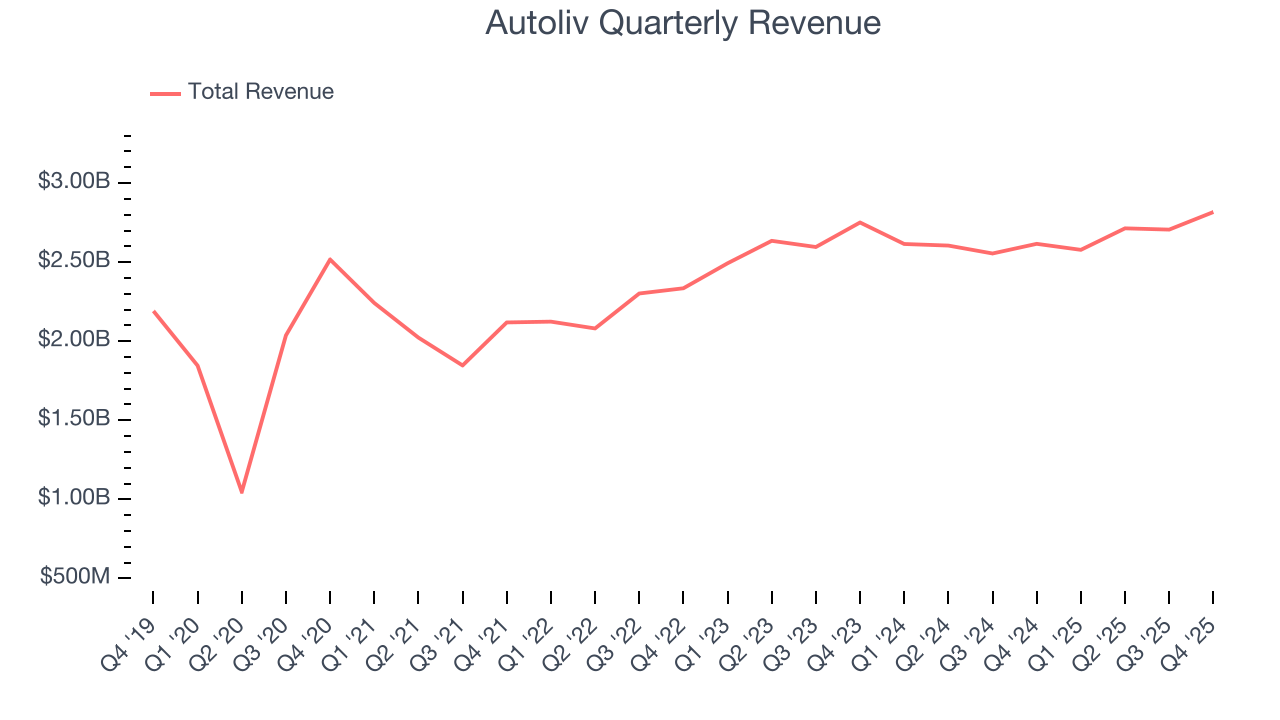

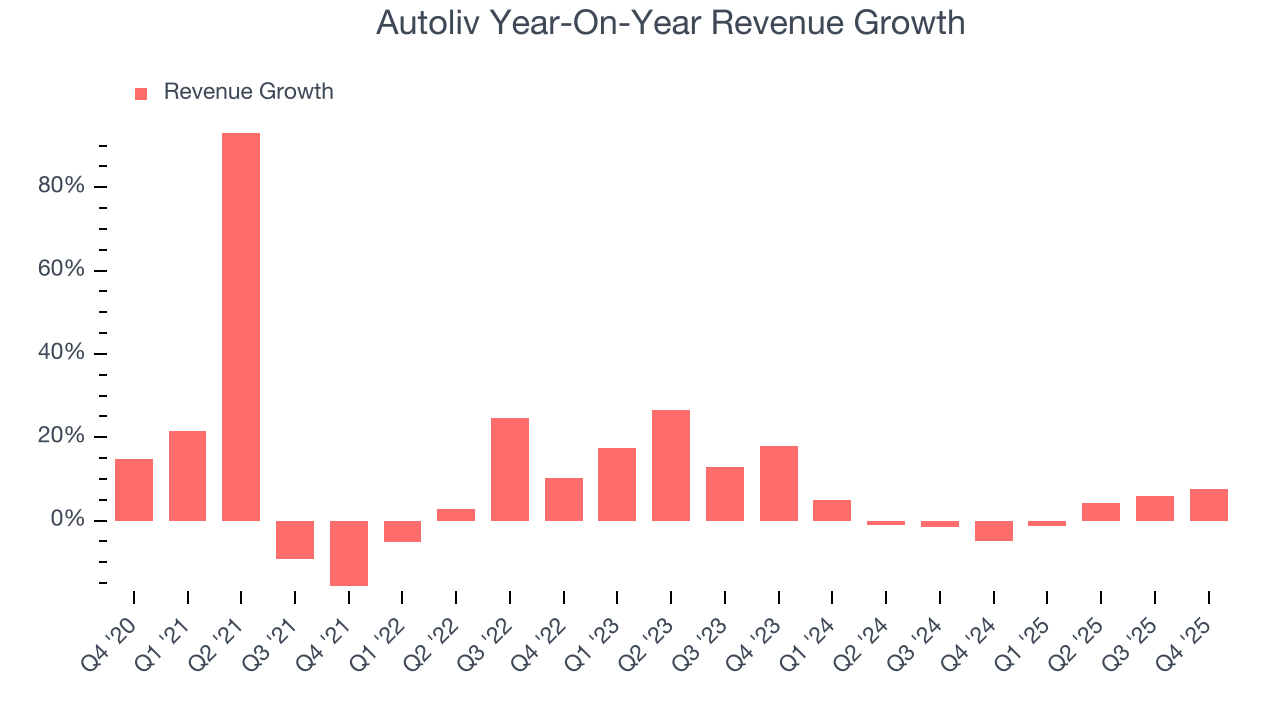

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Autoliv’s sales grew at a decent 7.7% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Autoliv’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend. We also note many other Automobile Manufacturing businesses have faced declining sales because of cyclical headwinds. While Autoliv grew slower than we’d like, it did do better than its peers.

This quarter, Autoliv reported year-on-year revenue growth of 7.7%, and its $2.82 billion of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

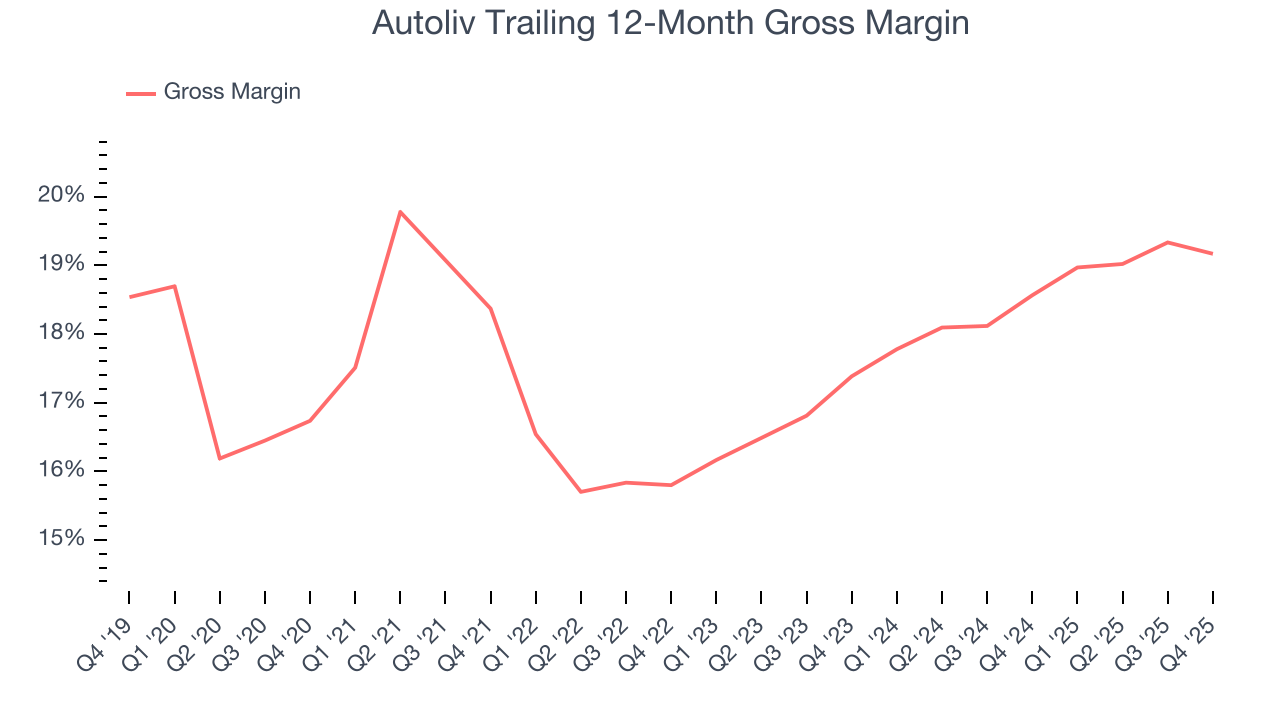

Autoliv has bad unit economics for an industrials business, signaling it operates in a competitive market. This is also because it’s an automobile manufacturer.

Automobile manufacturers have structurally lower profitability as they often break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years later - this explains why new entrants such as Rivian, Lucid, and Nikola have negative gross margins. As you can see below, these dynamics culminated in an average 17.9% gross margin for Autoliv over the last five years.

In Q4, Autoliv produced a 20.3% gross profit margin, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

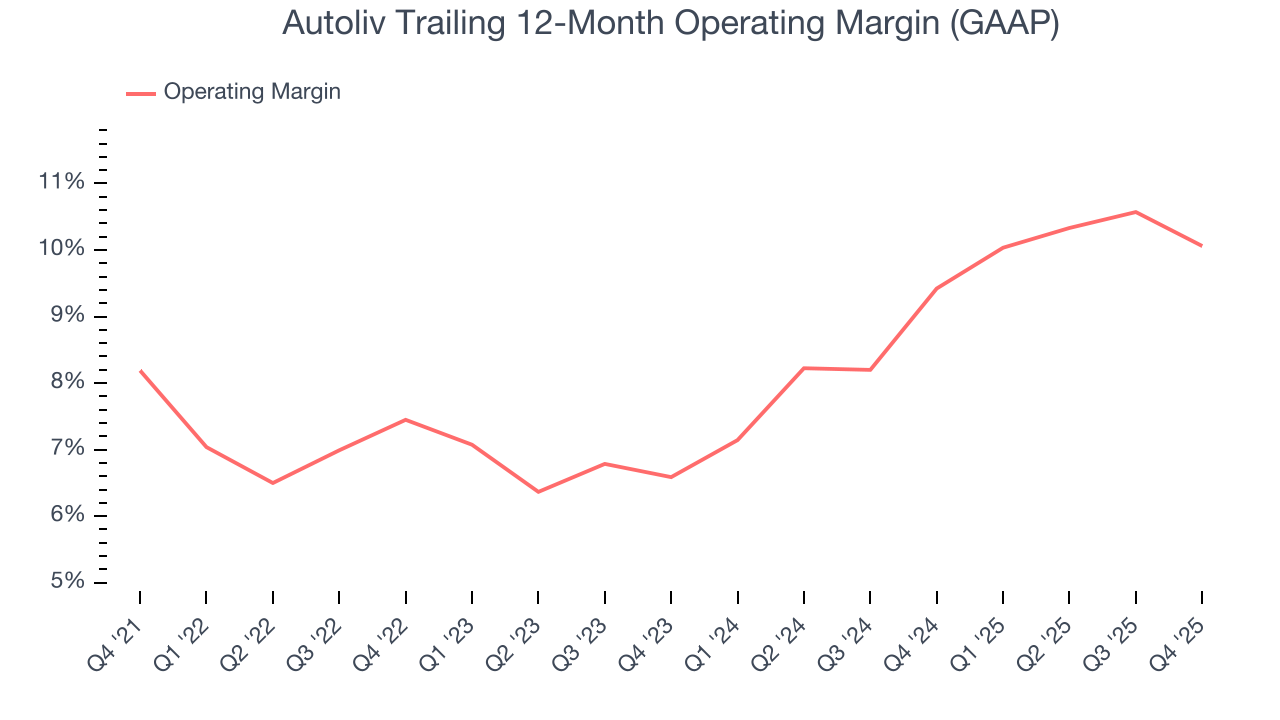

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Autoliv has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.4%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Autoliv’s operating margin rose by 1.9 percentage points over the last five years, as its sales growth gave it operating leverage. Its expansion was impressive, especially when considering the cycle turned in the wrong direction and most of its Automobile Manufacturing peers observed plummeting revenue and margins.

This quarter, Autoliv generated an operating margin profit margin of 11.3%, down 2.2 percentage points year on year. Since Autoliv’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

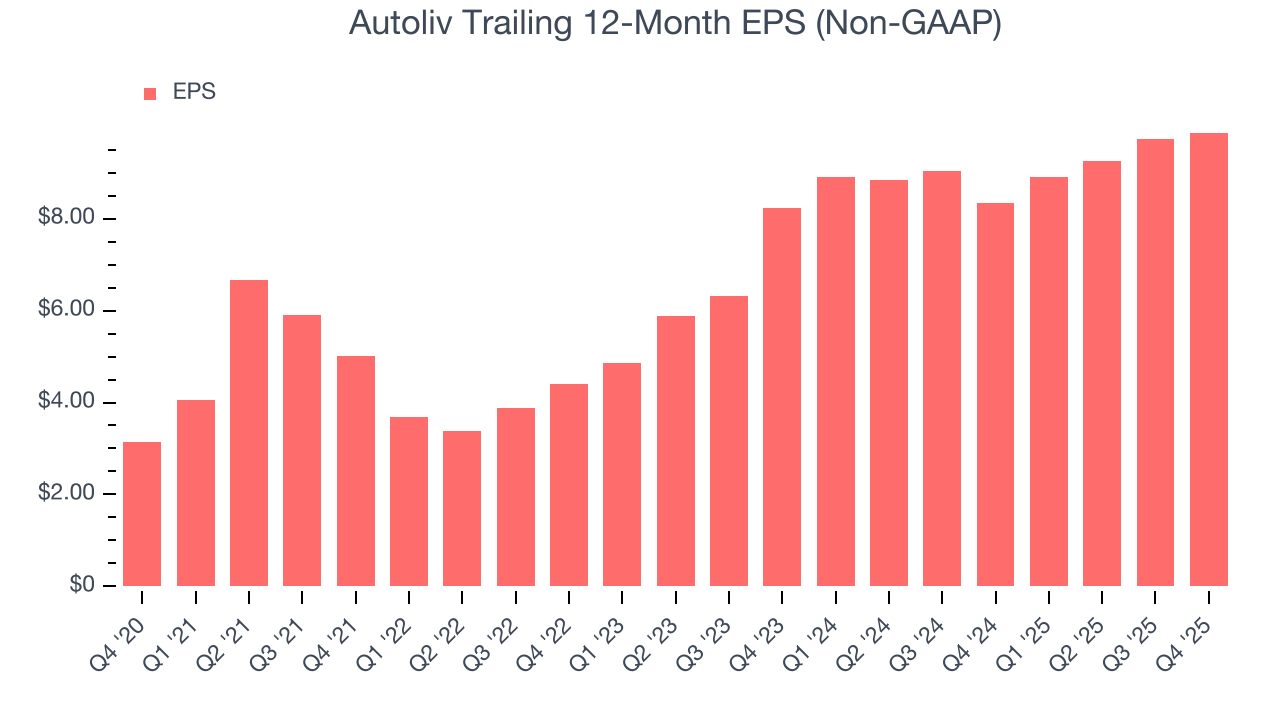

Autoliv’s EPS grew at an astounding 25.7% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

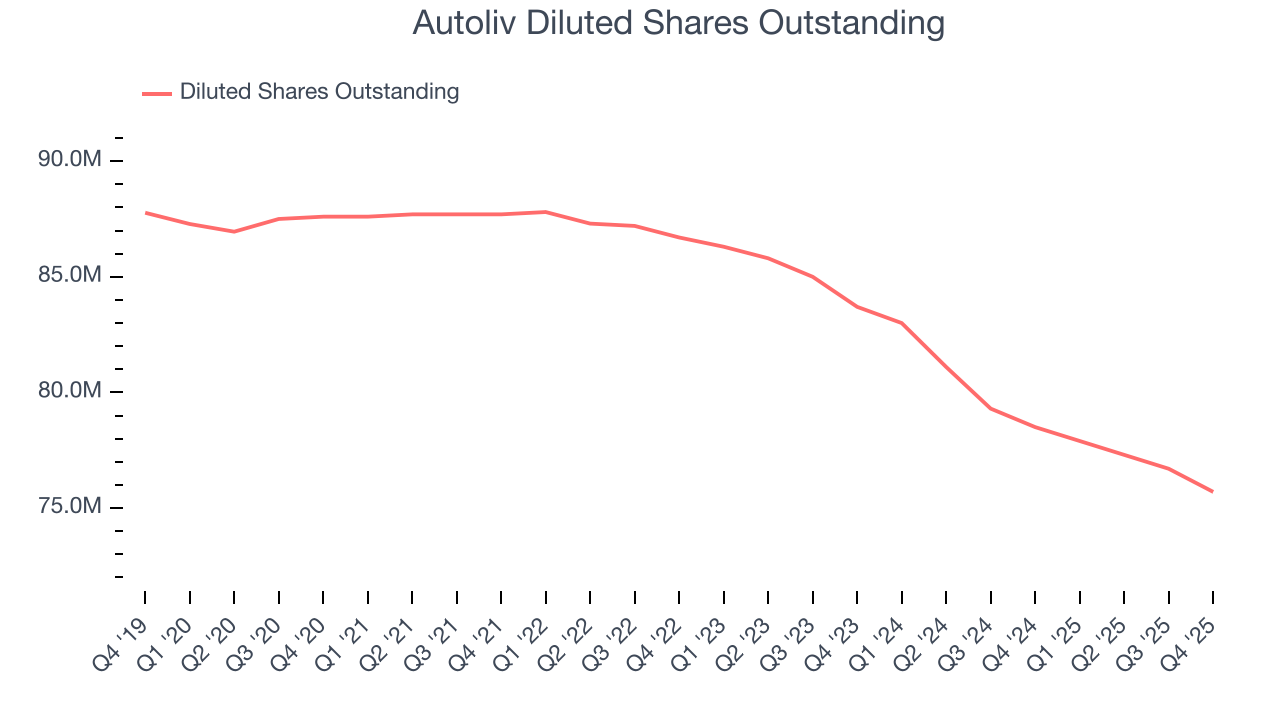

We can take a deeper look into Autoliv’s earnings to better understand the drivers of its performance. As we mentioned earlier, Autoliv’s operating margin declined this quarter but expanded by 1.9 percentage points over the last five years. Its share count also shrank by 13.6%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Autoliv, its two-year annual EPS growth of 9.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Autoliv reported adjusted EPS of $3.19, up from $3.05 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Autoliv’s full-year EPS of $9.87 to grow 10.4%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

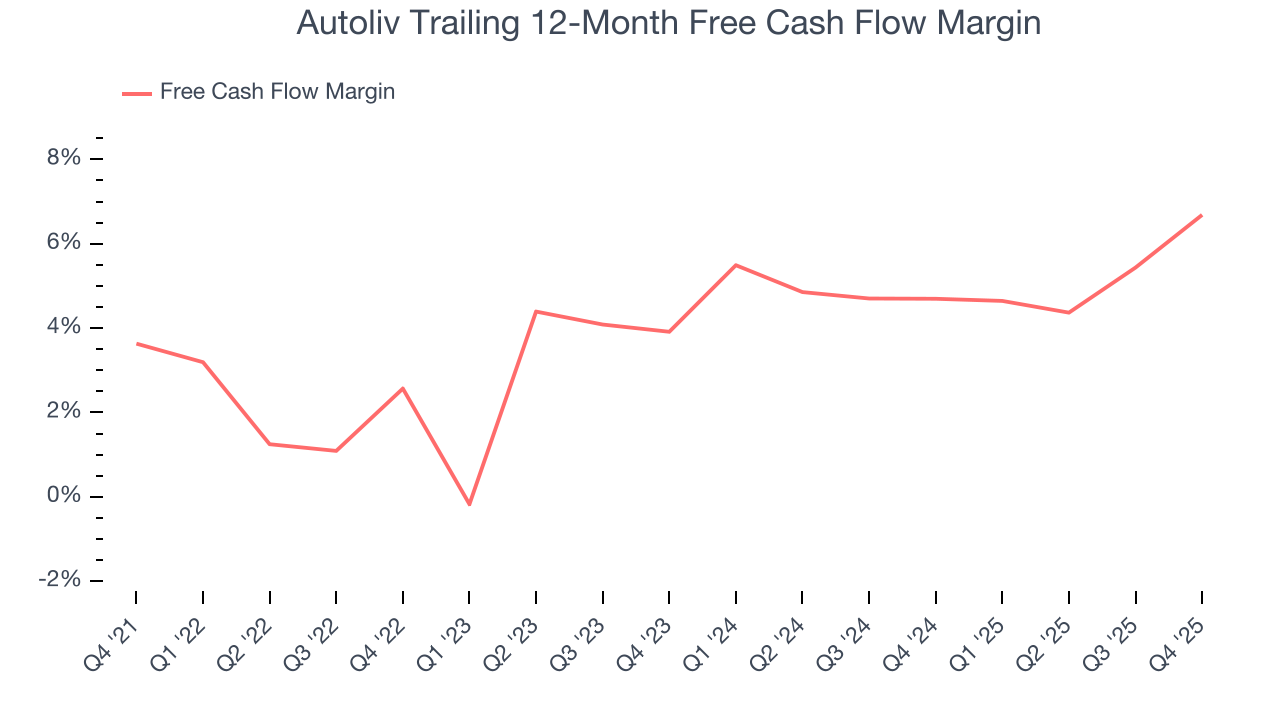

Autoliv has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.4%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Autoliv’s margin expanded by 3.1 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Autoliv’s free cash flow clocked in at $434 million in Q4, equivalent to a 15.4% margin. This result was good as its margin was 4.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

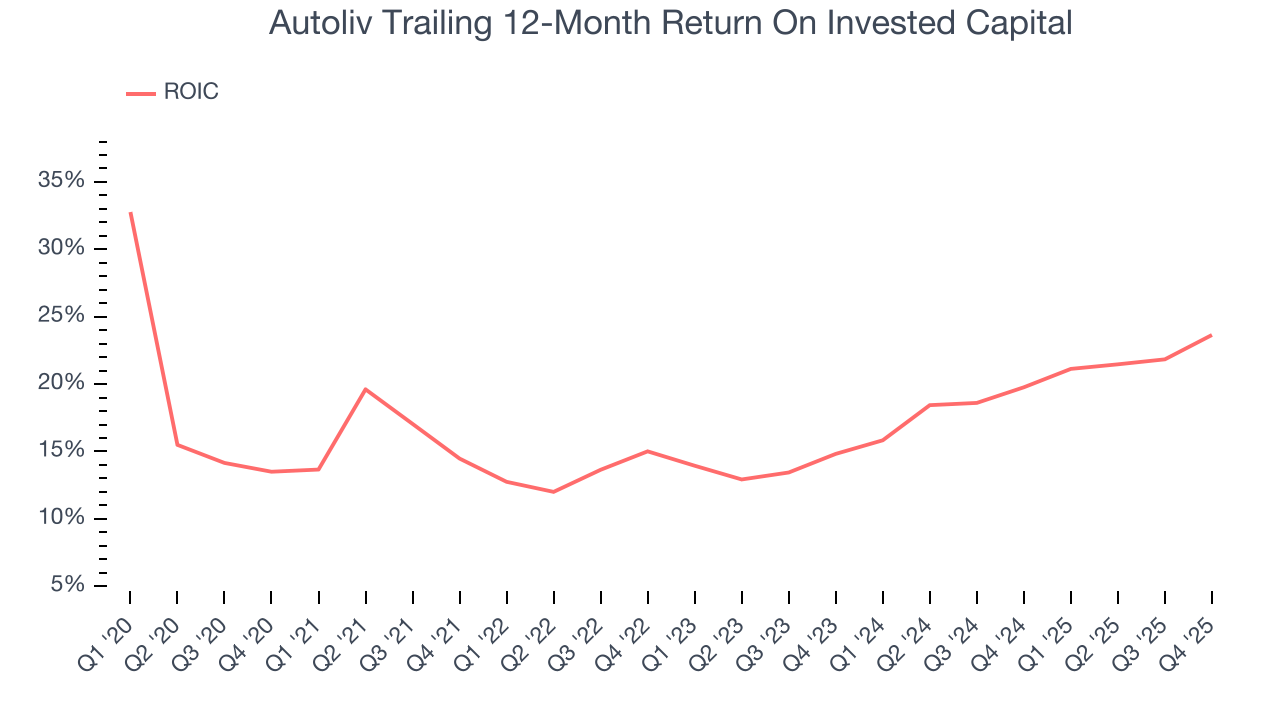

Although Autoliv hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 17.5%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Autoliv’s has increased over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

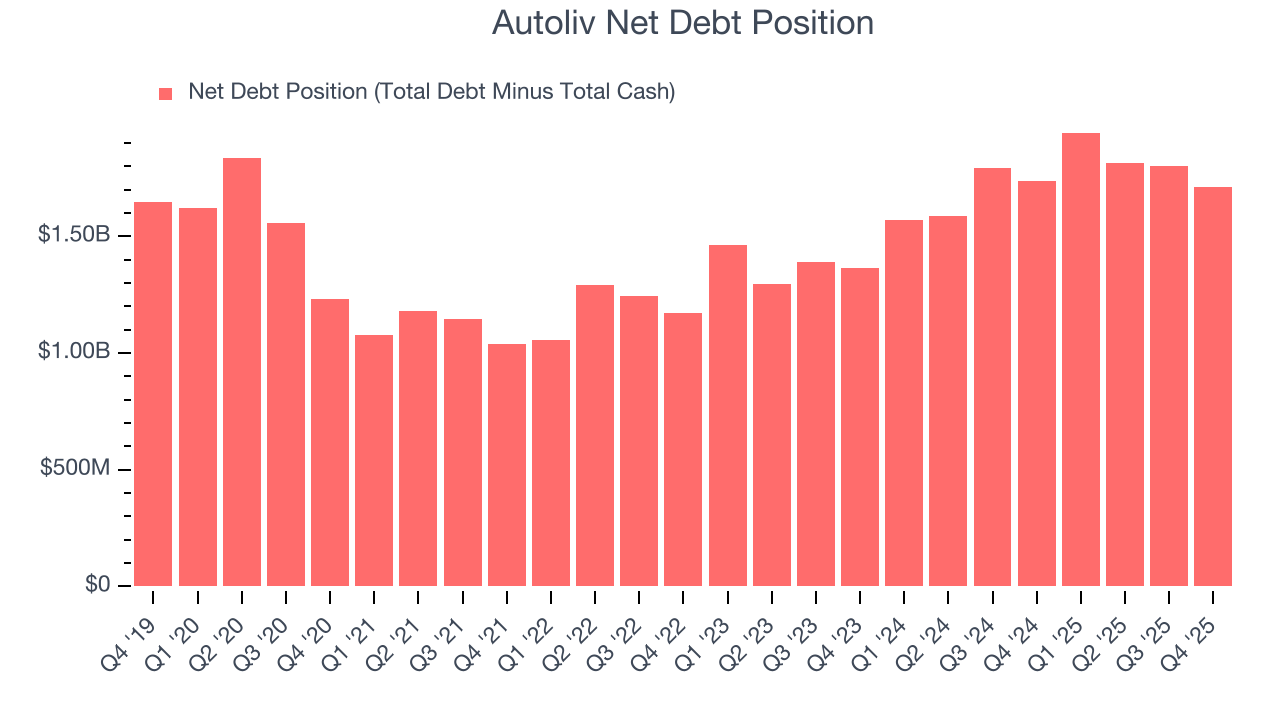

Autoliv reported $604 million of cash and $2.32 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.50 billion of EBITDA over the last 12 months, we view Autoliv’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $96 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Autoliv’s Q4 Results

It was good to see Autoliv beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 6.8% to $117.90 immediately after reporting.

13. Is Now The Time To Buy Autoliv?

Updated: February 13, 2026 at 11:54 PM EST

Before making an investment decision, investors should account for Autoliv’s business fundamentals and valuation in addition to what happened in the latest quarter.

Autoliv isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its low gross margins indicate some combination of competitive pressures and high production costs. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its low free cash flow margins give it little breathing room.

Autoliv’s P/E ratio based on the next 12 months is 11.8x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $135.79 on the company (compared to the current share price of $124.97).