Atmus Filtration Technologies (ATMU)

We’re skeptical of Atmus Filtration Technologies. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think Atmus Filtration Technologies Will Underperform

Spun out of Cummins in 2023 after 65 years as part of the engine maker, Atmus Filtration Technologies (NYSE:ATMU) manufactures filters for trucks, construction equipment, and agriculture machinery to reduce emissions and protect engines.

- 4.6% annual revenue growth over the last four years was slower than its industrials peers

- Competitive supply chain dynamics and steep production costs are reflected in its low gross margin of 26.2%

- On the bright side, its disciplined cost controls and effective management have materialized in a strong operating margin, and its profits increased over the last five years as it scaled

Atmus Filtration Technologies doesn’t pass our quality test. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Atmus Filtration Technologies

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Atmus Filtration Technologies

Atmus Filtration Technologies is trading at $63.48 per share, or 14.7x forward EV-to-EBITDA. This multiple is quite expensive for the quality you get.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Atmus Filtration Technologies (ATMU) Research Report: Q4 CY2025 Update

Filtration products manufacturer Atmus Filtration Technologies (NYSE:ATMU) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 9.8% year on year to $446.6 million. Its GAAP profit of $0.58 per share was 4.4% above analysts’ consensus estimates.

Atmus Filtration Technologies (ATMU) Q4 CY2025 Highlights:

- Revenue: $446.6 million vs analyst estimates of $423.5 million (9.8% year-on-year growth, 5.5% beat)

- EPS (GAAP): $0.58 vs analyst estimates of $0.56 (4.4% beat)

- Adjusted EBITDA: $85.2 million vs analyst estimates of $77.72 million (19.1% margin, 9.6% beat)

- Operating Margin: 15.8%, up from 13.4% in the same quarter last year

- Free Cash Flow Margin: 14.3%, up from 2.5% in the same quarter last year

- Market Capitalization: $5.06 billion

Company Overview

Spun out of Cummins in 2023 after 65 years as part of the engine maker, Atmus Filtration Technologies (NYSE:ATMU) manufactures filters for trucks, construction equipment, and agriculture machinery to reduce emissions and protect engines.

Operating primarily under the Fleetguard brand, Atmus produces a comprehensive range of filtration products including fuel filters, lube filters, air filters, crankcase ventilation systems, hydraulic filters, and coolants. These products serve two distinct channels: first-fit, where filters are installed on new vehicles during manufacturing, and aftermarket, where customers purchase replacement filters throughout the vehicle's lifespan. The company's filters work by trapping contaminants before they can damage engines or violate environmental regulations—for instance, a fuel filter on a diesel truck removes impurities from diesel before it enters the engine, while air filters prevent dust and debris from entering the combustion chamber.

Atmus sells to original equipment manufacturers (OEMs) like PACCAR and Traton Group, who install Atmus filters on trucks and heavy equipment during production. The aftermarket channel reaches fleet operators, independent repair shops, and distributors who need replacement filters for maintenance. A trucking company operating a fleet of semi-trucks might purchase Atmus fuel and oil filters every 15,000 to 25,000 miles as part of routine maintenance schedules, with Atmus earning revenue from each filter sold.

The company operates manufacturing facilities and distribution centers across multiple continents, with roughly half of its sales coming from outside the United States and Canada. Cummins remains Atmus's largest customer, accounting for approximately 18% of sales through long-term supply agreements established during the separation, while other major customers include truck manufacturers who rely on Atmus's one-stop-shop approach for various filtration needs across their product lines.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Atmus competes with Donaldson Company (NYSE:DCI) and Parker-Hannifin (NYSE:PH) in filtration products, along with Mann+Hummel and other regional filter manufacturers.

5. Revenue Growth

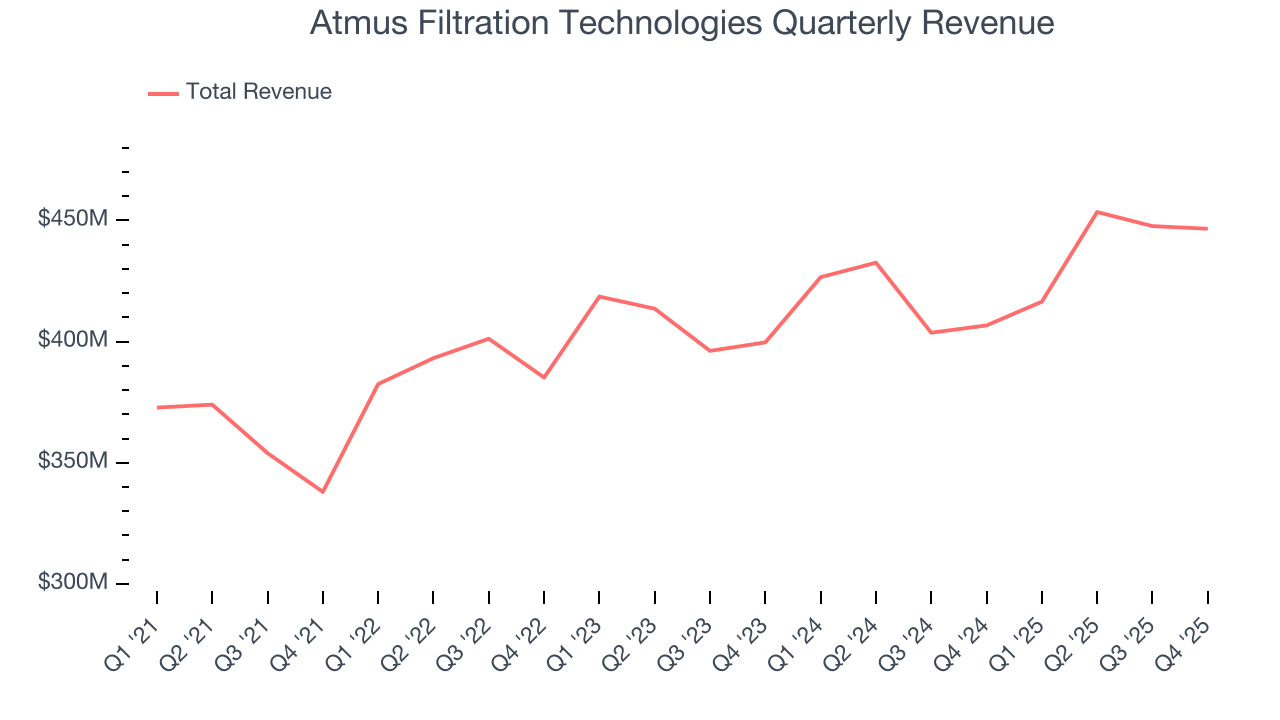

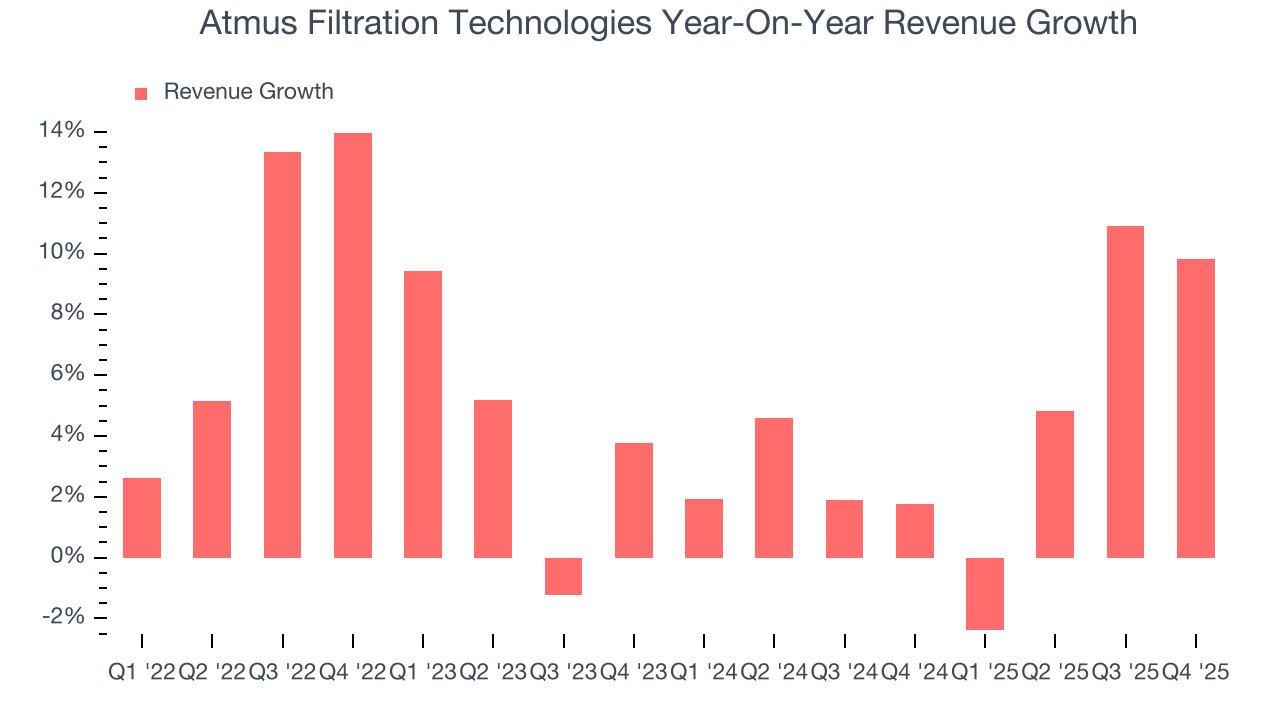

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Atmus Filtration Technologies’s 5.2% annualized revenue growth over the last four years was tepid. This was below our standard for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Atmus Filtration Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 4.1% over the last two years was below its four-year trend.

This quarter, Atmus Filtration Technologies reported year-on-year revenue growth of 9.8%, and its $446.6 million of revenue exceeded Wall Street’s estimates by 5.5%.

Looking ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

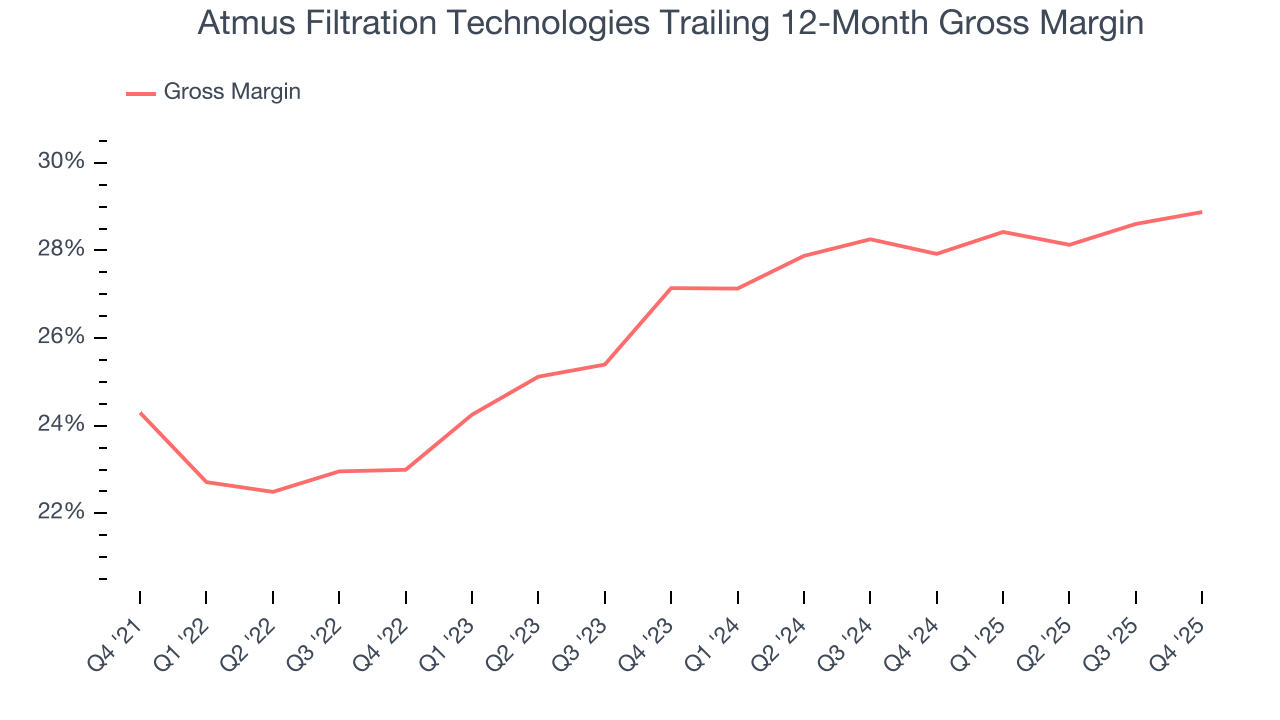

Atmus Filtration Technologies has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26.4% gross margin over the last five years. That means Atmus Filtration Technologies paid its suppliers a lot of money ($73.63 for every $100 in revenue) to run its business.

In Q4, Atmus Filtration Technologies produced a 28.5% gross profit margin, marking a 1.2 percentage point increase from 27.3% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

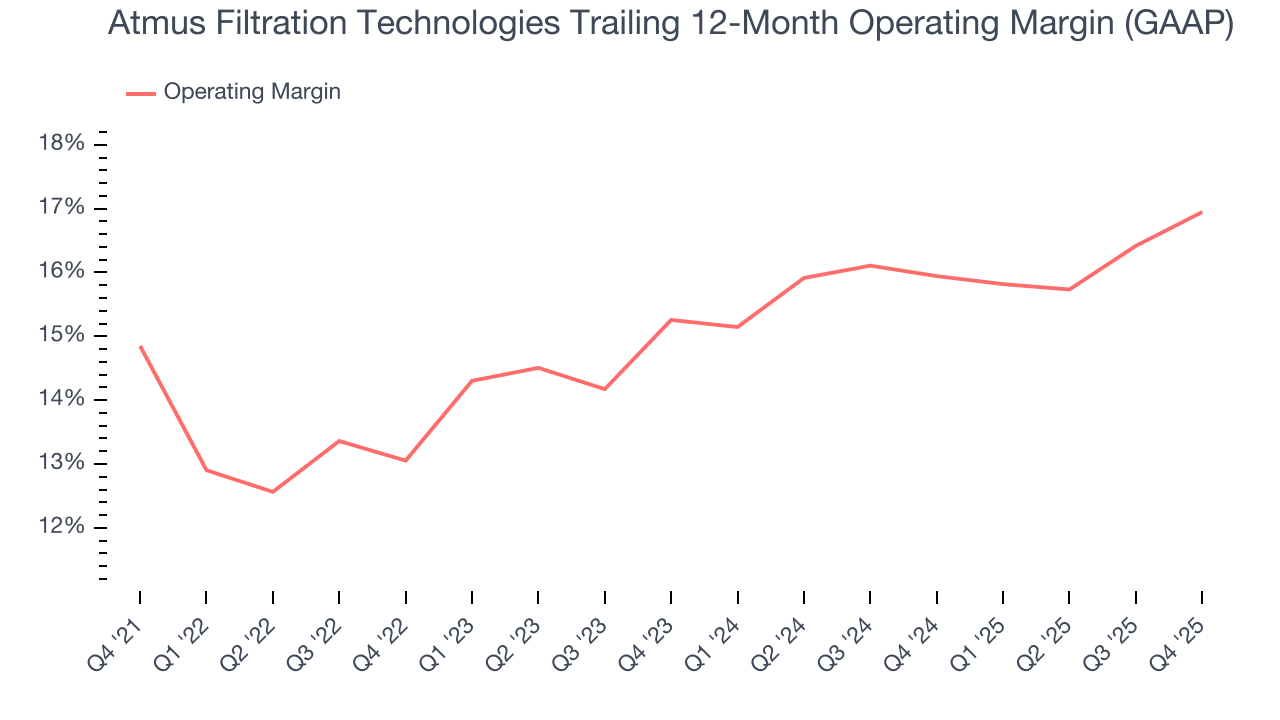

Atmus Filtration Technologies has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Atmus Filtration Technologies’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Atmus Filtration Technologies generated an operating margin profit margin of 15.8%, up 2.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

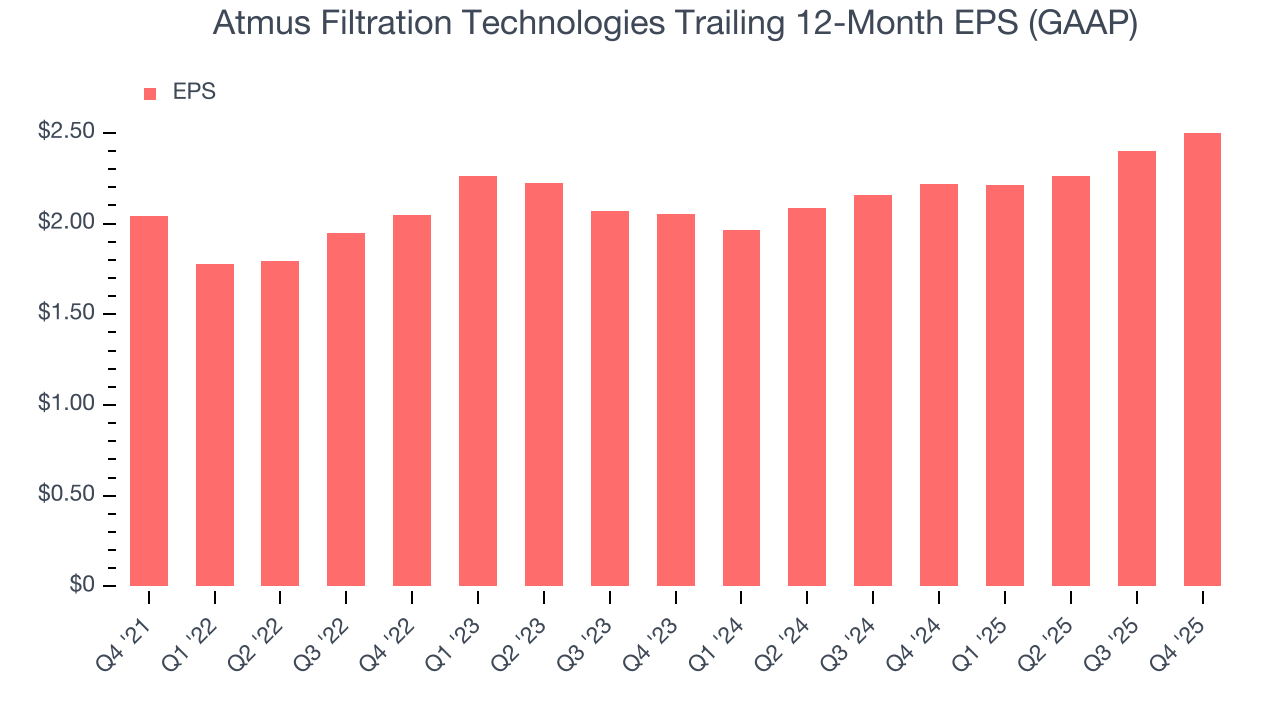

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Atmus Filtration Technologies’s unimpressive 5.2% annual EPS growth over the last four years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Atmus Filtration Technologies’s two-year annual EPS growth of 10.3% was good and topped its 4.1% two-year revenue growth.

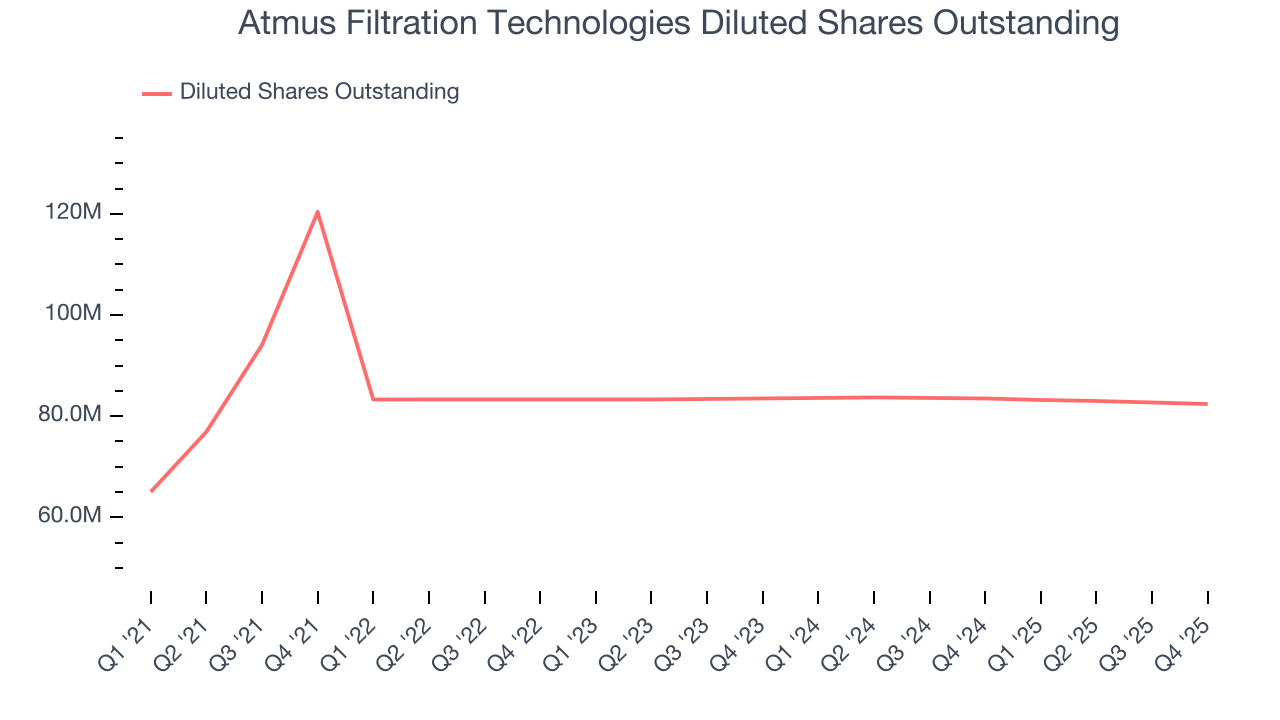

Diving into Atmus Filtration Technologies’s quality of earnings can give us a better understanding of its performance. Atmus Filtration Technologies’s operating margin has expanded over the last two yearswhile its share count has shrunk 1.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Atmus Filtration Technologies reported EPS of $0.58, up from $0.48 in the same quarter last year. This print beat analysts’ estimates by 4.4%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

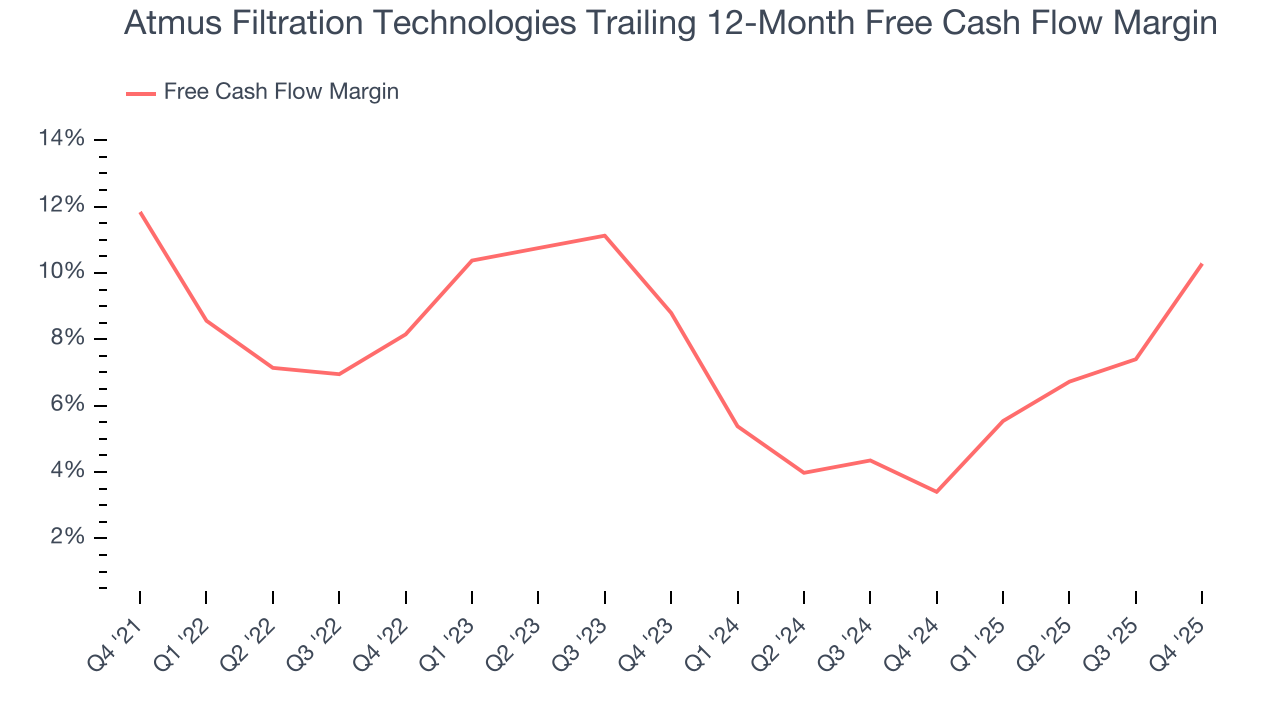

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Atmus Filtration Technologies has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.4% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Atmus Filtration Technologies’s margin dropped by 1.6 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Atmus Filtration Technologies’s free cash flow clocked in at $63.8 million in Q4, equivalent to a 14.3% margin. This result was good as its margin was 11.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

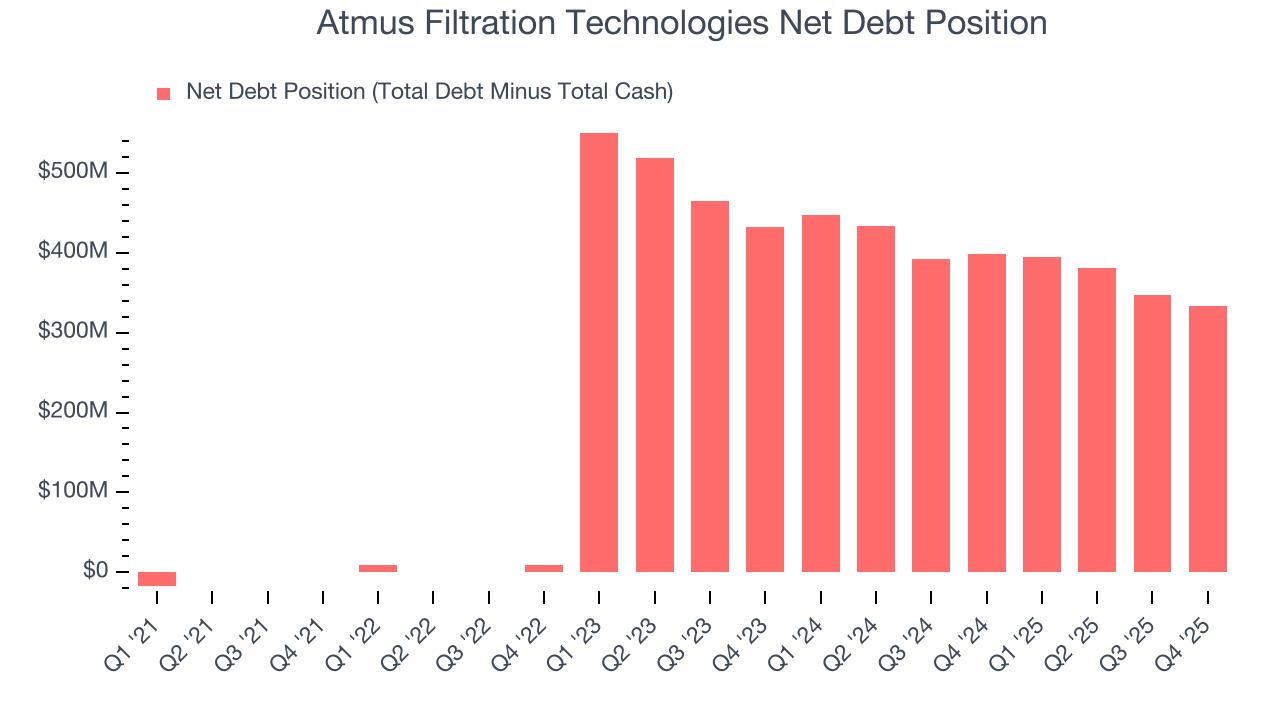

10. Balance Sheet Assessment

Atmus Filtration Technologies reported $236.4 million of cash and $570 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $353.5 million of EBITDA over the last 12 months, we view Atmus Filtration Technologies’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $17.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Atmus Filtration Technologies’s Q4 Results

We were impressed by how significantly Atmus Filtration Technologies blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.2% to $64.70 immediately after reporting.

12. Is Now The Time To Buy Atmus Filtration Technologies?

When considering an investment in Atmus Filtration Technologies, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Atmus Filtration Technologies’s business quality ultimately falls short of our standards. For starters, its revenue growth was uninspiring over the last four years. And while its impressive operating margins show it has a highly efficient business model, the downside is its unimpressive EPS growth over the last four years shows it’s failed to produce meaningful profits for shareholders. On top of that, its gross margins are lower than its industrials peers.

Atmus Filtration Technologies’s forward price-to-sales ratio is 2.7x. The market typically values companies like Atmus Filtration Technologies based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $60 on the company (compared to the current share price of $64.70), implying they don’t see much short-term potential in Atmus Filtration Technologies.