Atmus Filtration Technologies (ATMU)

We aren’t fans of Atmus Filtration Technologies. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think Atmus Filtration Technologies Will Underperform

Spun out of Cummins in 2023 after 65 years as part of the engine maker, Atmus Filtration Technologies (NYSE:ATMU) manufactures filters for trucks, construction equipment, and agriculture machinery to reduce emissions and protect engines.

- Annual revenue growth of 5.2% over the last four years was below our standards for the industrials sector

- Gross margin of 26.4% is below its competitors, leaving less money to invest in areas like marketing and R&D

- A positive is that its successful business model is illustrated by its impressive operating margin, and it turbocharged its profits by achieving some fixed cost leverage

Atmus Filtration Technologies’s quality is not up to our standards. There are better opportunities in the market.

Why There Are Better Opportunities Than Atmus Filtration Technologies

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Atmus Filtration Technologies

At $64.14 per share, Atmus Filtration Technologies trades at 21.3x forward P/E. Atmus Filtration Technologies’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Atmus Filtration Technologies (ATMU) Research Report: Q4 CY2025 Update

Filtration products manufacturer Atmus Filtration Technologies (NYSE:ATMU) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 9.8% year on year to $446.6 million. Its GAAP profit of $0.58 per share was 4.4% above analysts’ consensus estimates.

Atmus Filtration Technologies (ATMU) Q4 CY2025 Highlights:

- Revenue: $446.6 million vs analyst estimates of $423.5 million (9.8% year-on-year growth, 5.5% beat)

- EPS (GAAP): $0.58 vs analyst estimates of $0.56 (4.4% beat)

- Adjusted EBITDA: $85.2 million vs analyst estimates of $77.72 million (19.1% margin, 9.6% beat)

- Operating Margin: 15.8%, up from 13.4% in the same quarter last year

- Free Cash Flow Margin: 14.3%, up from 2.5% in the same quarter last year

- Market Capitalization: $5.06 billion

Company Overview

Spun out of Cummins in 2023 after 65 years as part of the engine maker, Atmus Filtration Technologies (NYSE:ATMU) manufactures filters for trucks, construction equipment, and agriculture machinery to reduce emissions and protect engines.

Operating primarily under the Fleetguard brand, Atmus produces a comprehensive range of filtration products including fuel filters, lube filters, air filters, crankcase ventilation systems, hydraulic filters, and coolants. These products serve two distinct channels: first-fit, where filters are installed on new vehicles during manufacturing, and aftermarket, where customers purchase replacement filters throughout the vehicle's lifespan. The company's filters work by trapping contaminants before they can damage engines or violate environmental regulations—for instance, a fuel filter on a diesel truck removes impurities from diesel before it enters the engine, while air filters prevent dust and debris from entering the combustion chamber.

Atmus sells to original equipment manufacturers (OEMs) like PACCAR and Traton Group, who install Atmus filters on trucks and heavy equipment during production. The aftermarket channel reaches fleet operators, independent repair shops, and distributors who need replacement filters for maintenance. A trucking company operating a fleet of semi-trucks might purchase Atmus fuel and oil filters every 15,000 to 25,000 miles as part of routine maintenance schedules, with Atmus earning revenue from each filter sold.

The company operates manufacturing facilities and distribution centers across multiple continents, with roughly half of its sales coming from outside the United States and Canada. Cummins remains Atmus's largest customer, accounting for approximately 18% of sales through long-term supply agreements established during the separation, while other major customers include truck manufacturers who rely on Atmus's one-stop-shop approach for various filtration needs across their product lines.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Atmus competes with Donaldson Company (NYSE:DCI) and Parker-Hannifin (NYSE:PH) in filtration products, along with Mann+Hummel and other regional filter manufacturers.

5. Revenue Growth

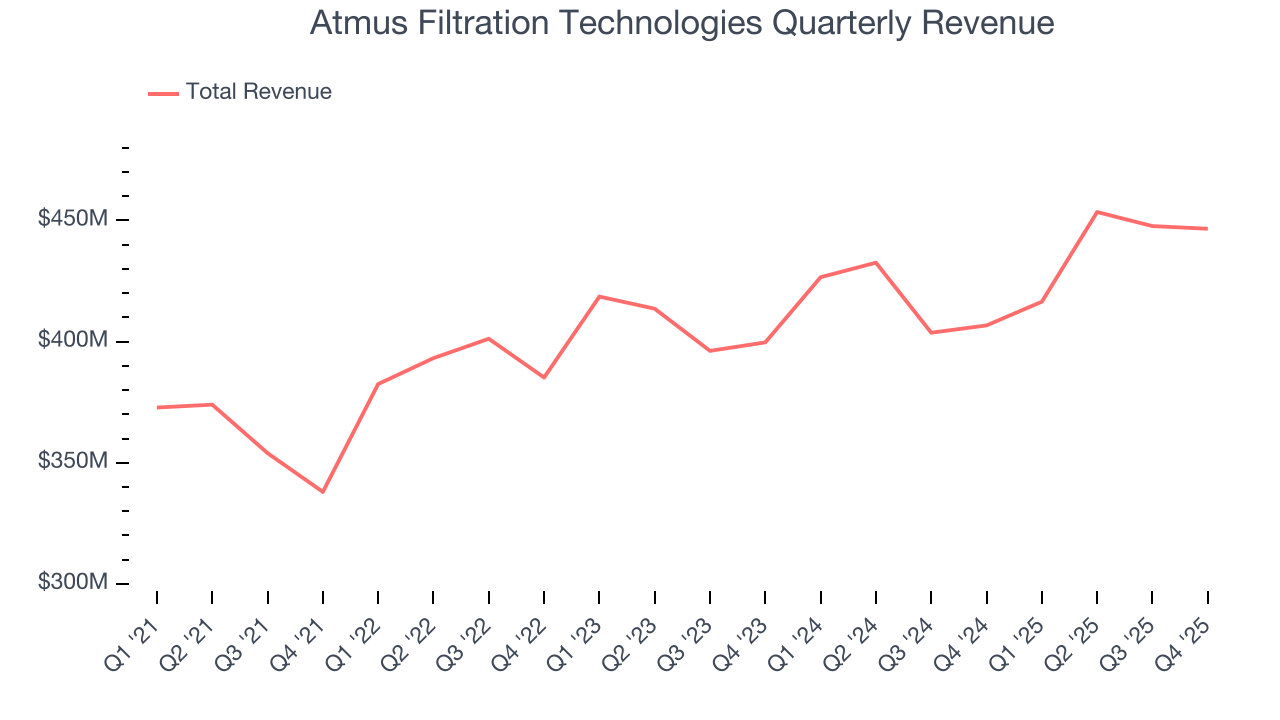

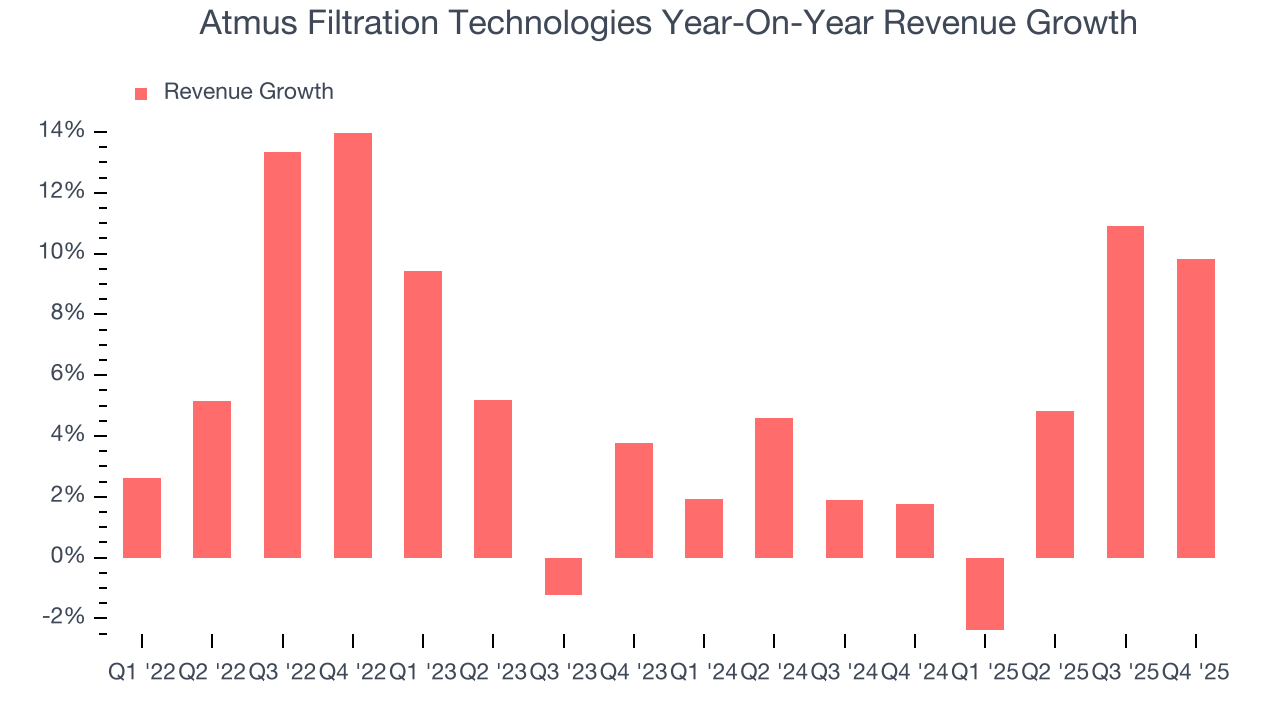

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Atmus Filtration Technologies’s 5.2% annualized revenue growth over the last four years was tepid. This was below our standard for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Atmus Filtration Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 4.1% over the last two years was below its four-year trend.

This quarter, Atmus Filtration Technologies reported year-on-year revenue growth of 9.8%, and its $446.6 million of revenue exceeded Wall Street’s estimates by 5.5%.

Looking ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

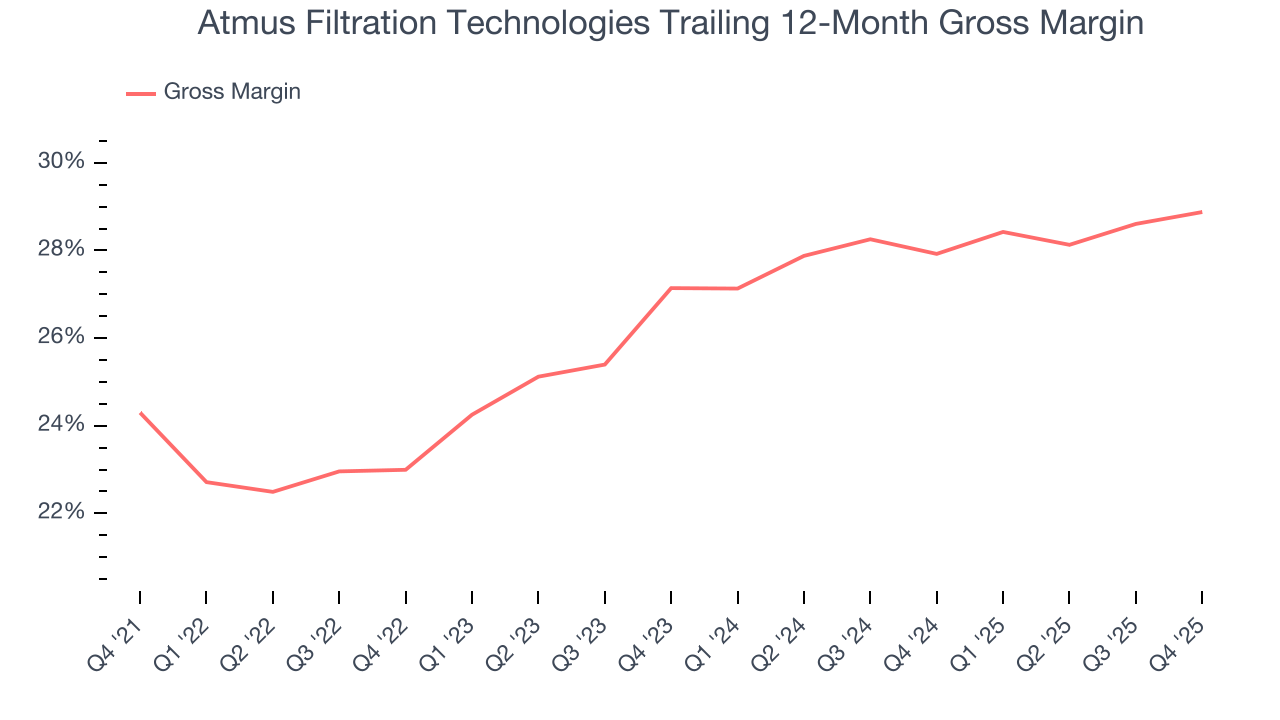

Atmus Filtration Technologies has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26.4% gross margin over the last five years. That means Atmus Filtration Technologies paid its suppliers a lot of money ($73.63 for every $100 in revenue) to run its business.

In Q4, Atmus Filtration Technologies produced a 28.5% gross profit margin, marking a 1.2 percentage point increase from 27.3% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

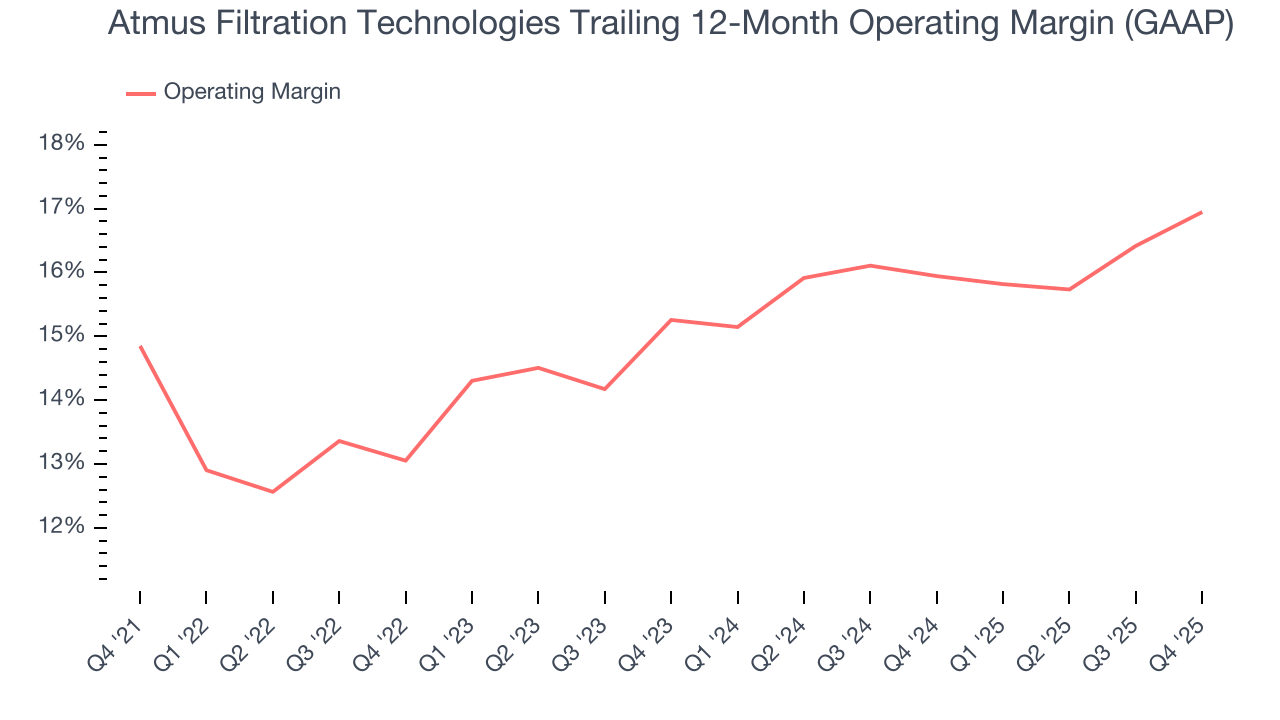

Atmus Filtration Technologies has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Atmus Filtration Technologies’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Atmus Filtration Technologies generated an operating margin profit margin of 15.8%, up 2.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

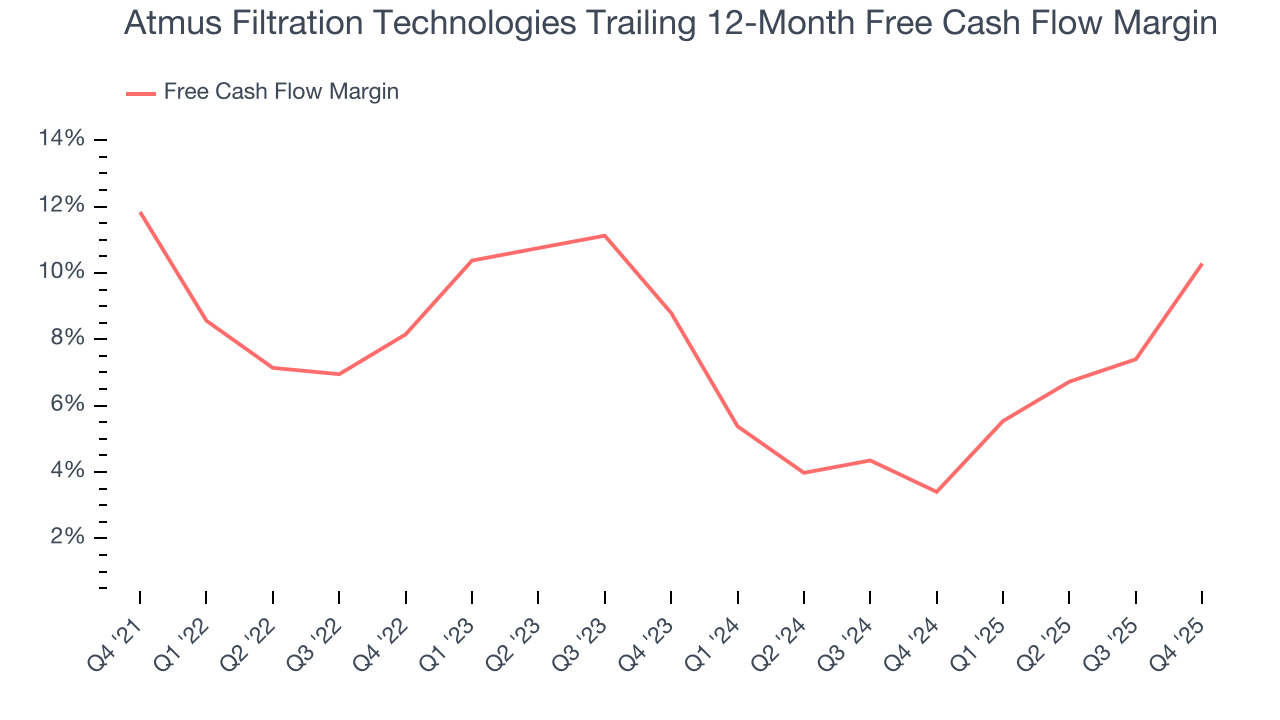

Atmus Filtration Technologies has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.4% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Atmus Filtration Technologies’s margin dropped by 1.6 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Atmus Filtration Technologies’s free cash flow clocked in at $63.8 million in Q4, equivalent to a 14.3% margin. This result was good as its margin was 11.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

9. Balance Sheet Assessment

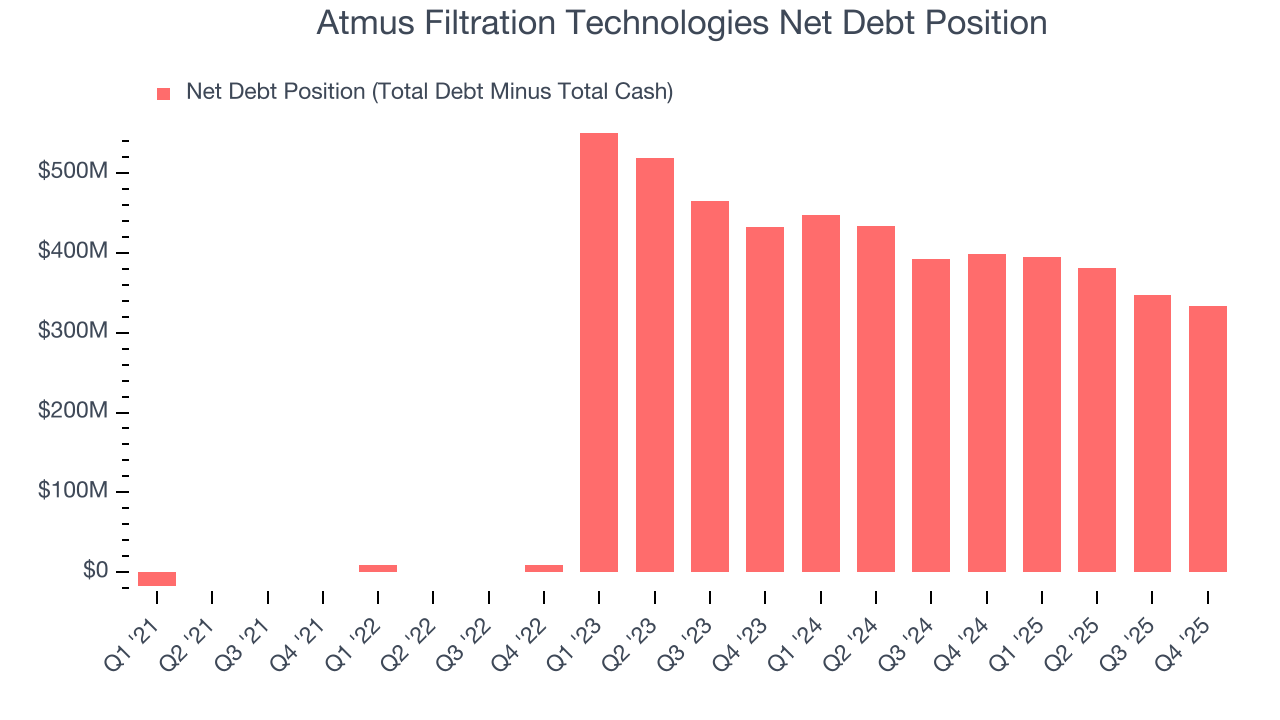

Atmus Filtration Technologies reported $236.4 million of cash and $570 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $353.5 million of EBITDA over the last 12 months, we view Atmus Filtration Technologies’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $17.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Atmus Filtration Technologies’s Q4 Results

We were impressed by how significantly Atmus Filtration Technologies blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.2% to $64.70 immediately after reporting.

11. Is Now The Time To Buy Atmus Filtration Technologies?

Updated: February 14, 2026 at 11:40 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Atmus Filtration Technologies, you should also grasp the company’s longer-term business quality and valuation.

Atmus Filtration Technologies isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue growth was uninspiring over the last four years. While its impressive operating margins show it has a highly efficient business model, the downside is its cash profitability fell over the last five years. On top of that, its gross margins are lower than its industrials peers.

Atmus Filtration Technologies’s P/E ratio based on the next 12 months is 21.3x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $61.80 on the company (compared to the current share price of $64.14).