Brookdale (BKD)

Brookdale doesn’t excite us. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Brookdale Will Underperform

With a network of over 650 communities serving approximately 59,000 residents across 41 states, Brookdale Senior Living (NYSE:BKD) operates senior living communities across the United States, offering independent living, assisted living, memory care, and continuing care retirement communities.

- Sales are projected to tank by 4.8% over the next 12 months as demand evaporates

- Low returns on capital reflect management’s struggle to allocate funds effectively

- High net-debt-to-EBITDA ratio of 12× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Brookdale’s quality doesn’t meet our bar. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Brookdale

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Brookdale

Brookdale’s stock price of $16.52 implies a valuation ratio of 18.5x forward EV-to-EBITDA. Not only does Brookdale trade at a premium to companies in the healthcare space, but this multiple is also high for its top-line growth.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Brookdale (BKD) Research Report: Q4 CY2025 Update

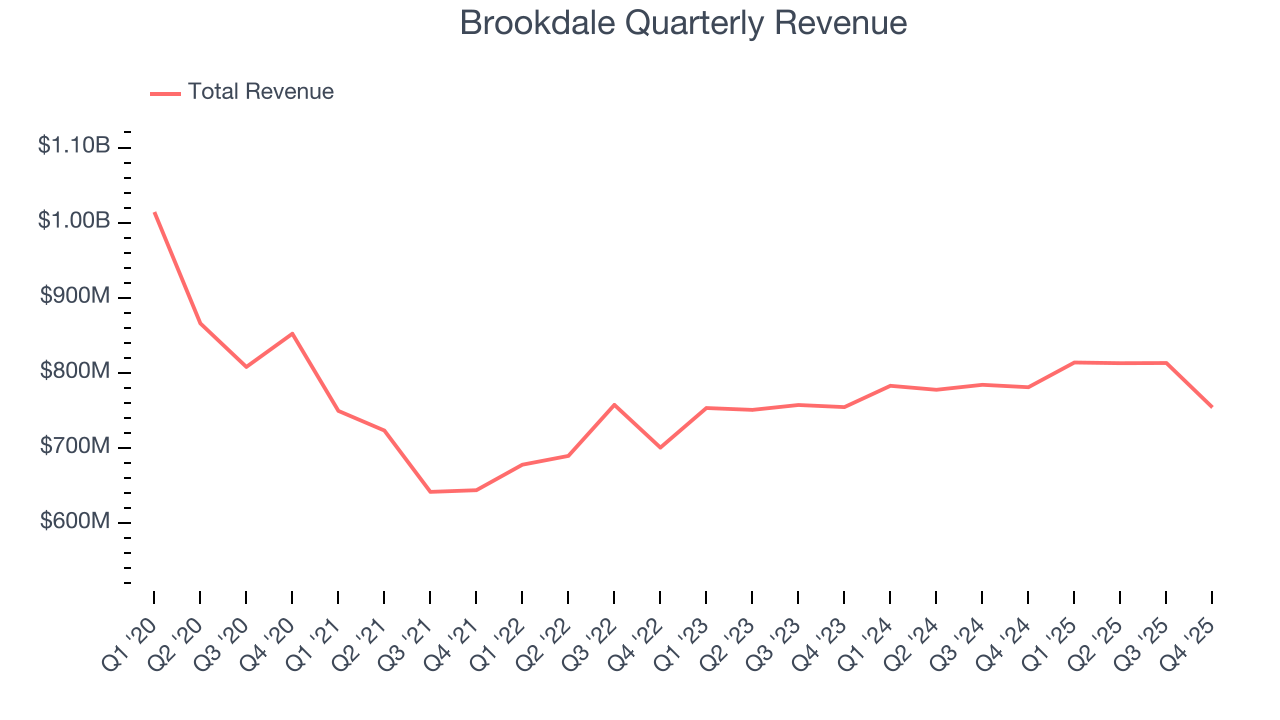

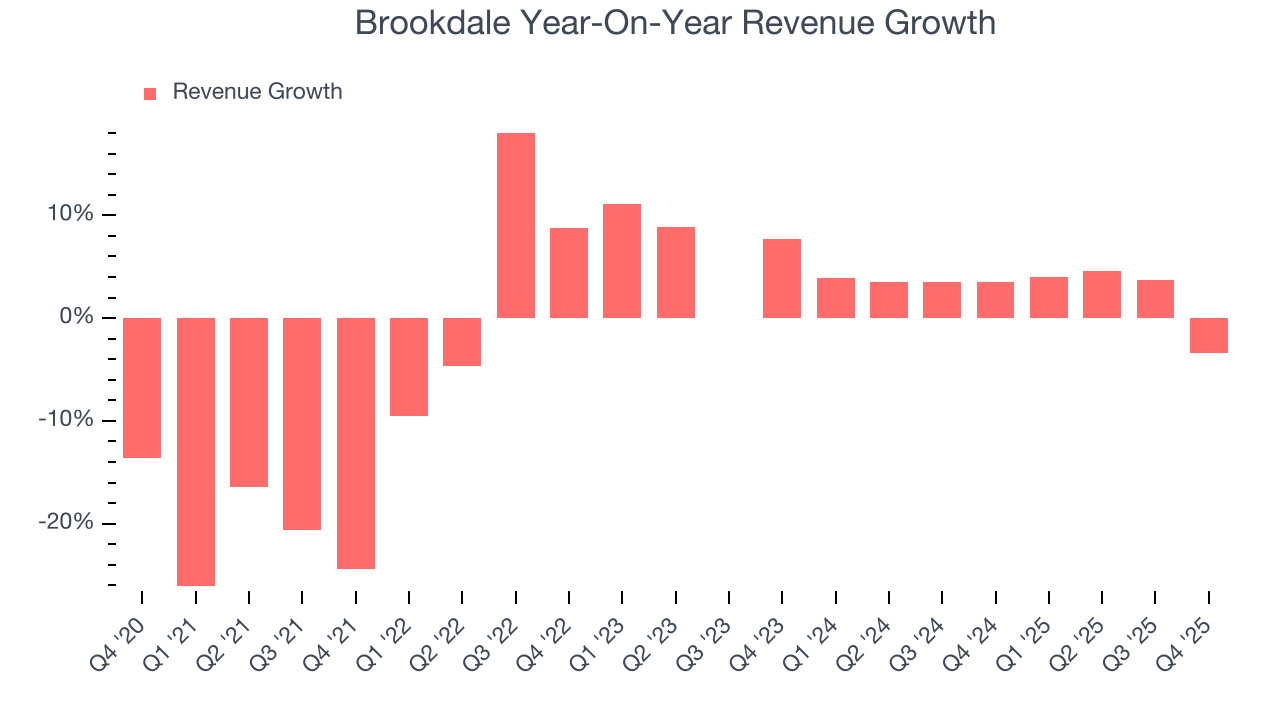

Senior living provider Brookdale Senior Living (NYSE:BKD) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 3.4% year on year to $754.1 million. Its GAAP loss of $0.17 per share was in line with analysts’ consensus estimates.

Brookdale (BKD) Q4 CY2025 Highlights:

- Revenue: $754.1 million vs analyst estimates of $767 million (3.4% year-on-year decline, 1.7% miss)

- EPS (GAAP): -$0.17 vs analyst estimates of -$0.17 (in line)

- Adjusted EBITDA: $105.6 million vs analyst estimates of $105.5 million (14% margin, in line)

- EBITDA guidance for the upcoming financial year 2026 is $509 million at the midpoint, in line with analyst expectations

- Operating Margin: 3%, up from 0.5% in the same quarter last year

- Free Cash Flow was -$7.78 million compared to -$5.11 million in the same quarter last year

- Market Capitalization: $3.95 billion

Company Overview

With a network of over 650 communities serving approximately 59,000 residents across 41 states, Brookdale Senior Living (NYSE:BKD) operates senior living communities across the United States, offering independent living, assisted living, memory care, and continuing care retirement communities.

Brookdale's communities are designed to provide seniors with a continuum of care that allows them to "age in place" as their needs change over time. The company's facilities range from large multi-story buildings with extensive amenities for more independent seniors to specialized memory care neighborhoods designed specifically for residents with dementia and Alzheimer's disease.

Independent living residents at Brookdale receive basic services like dining options, emergency alert systems, housekeeping, and recreational activities while maintaining their autonomy. As residents require more assistance, they can transition to assisted living, where 24-hour staff help with activities of daily living (ADLs) such as bathing, dressing, and medication management. For those with cognitive impairments, Brookdale's memory care units provide specialized environments with higher levels of supervision and tailored activities.

Continuing Care Retirement Communities (CCRCs) represent Brookdale's most comprehensive offering, with multiple levels of care available on a single campus. A resident might initially move into independent living and later transfer to assisted living or skilled nursing as health needs evolve, all without leaving the community.

Brookdale generates revenue primarily through monthly service fees paid by residents, with rates varying based on the level of care provided. The company also manages properties on behalf of third-party owners, collecting management fees typically calculated as a percentage of the community's gross revenue.

The senior living industry experiences some seasonality, with occupancy often declining in winter months due to illness and weather concerns before rebounding in spring and summer. Brookdale's operations are subject to extensive regulation, including healthcare laws governing financial arrangements and privacy requirements for handling resident health information.

4. Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

Brookdale's main competitors in the senior living industry include Atria Senior Living, Life Care Services, Sunrise Senior Living, Discovery Senior Living, and Erickson Senior Living. The company also competes with major healthcare REITs like Ventas and Welltower for property acquisitions.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.19 billion in revenue over the past 12 months, Brookdale has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Brookdale struggled to consistently generate demand over the last five years as its sales dropped at a 2% annual rate. This was below our standards and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Brookdale’s annualized revenue growth of 2.9% over the last two years is above its five-year trend, which is encouraging.

This quarter, Brookdale missed Wall Street’s estimates and reported a rather uninspiring 3.4% year-on-year revenue decline, generating $754.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 4.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

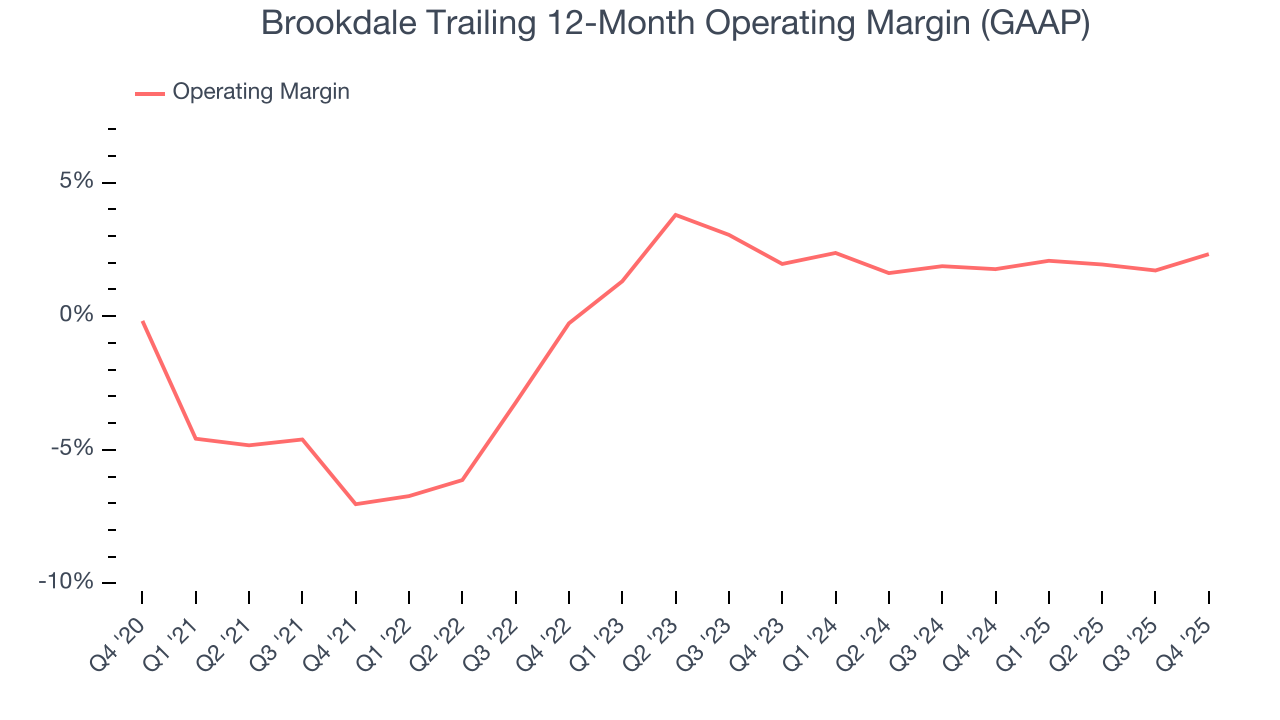

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Brookdale was roughly breakeven when averaging the last five years of quarterly operating profits, lousy for a healthcare business.

On the plus side, Brookdale’s operating margin rose by 9.4 percentage points over the last five years.

This quarter, Brookdale generated an operating margin profit margin of 3%, up 2.5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

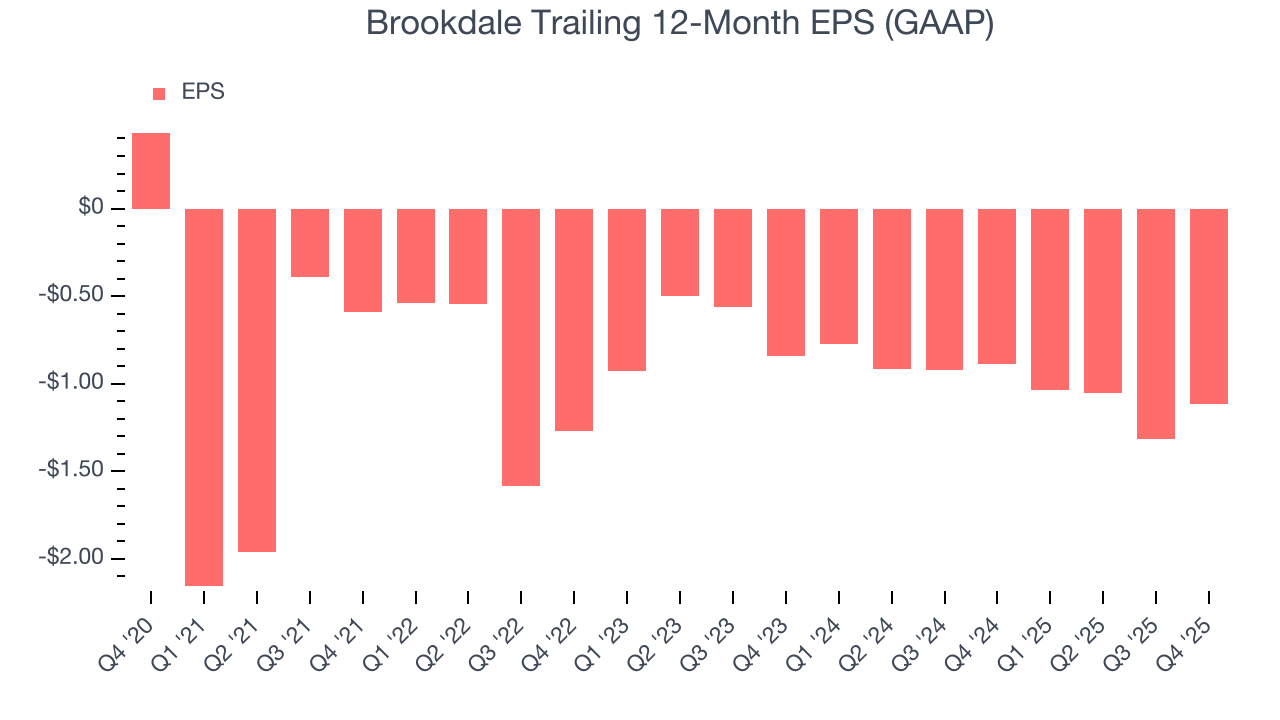

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

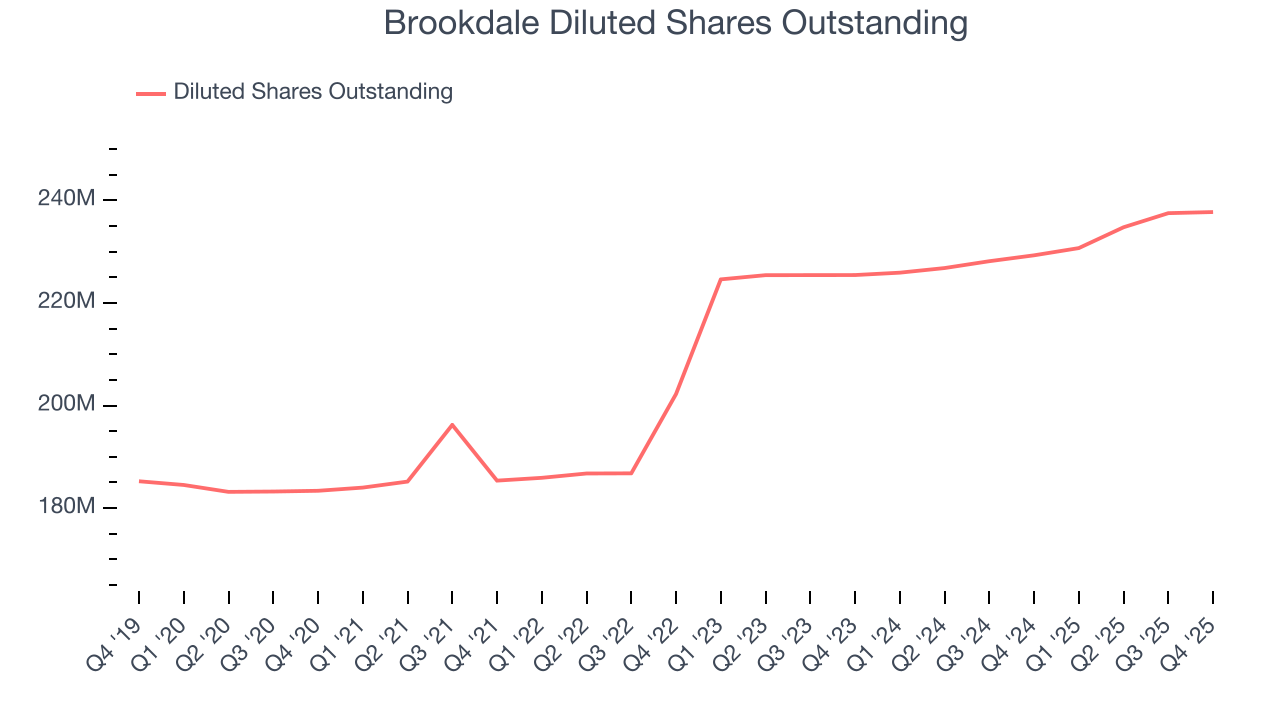

Sadly for Brookdale, its EPS declined by 35.6% annually over the last five years, more than its revenue. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

Diving into the nuances of Brookdale’s earnings can give us a better understanding of its performance. A five-year view shows Brookdale has diluted its shareholders, growing its share count by 29.6%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Brookdale reported EPS of negative $0.17, up from negative $0.37 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Brookdale to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.12 will advance to negative $0.37.

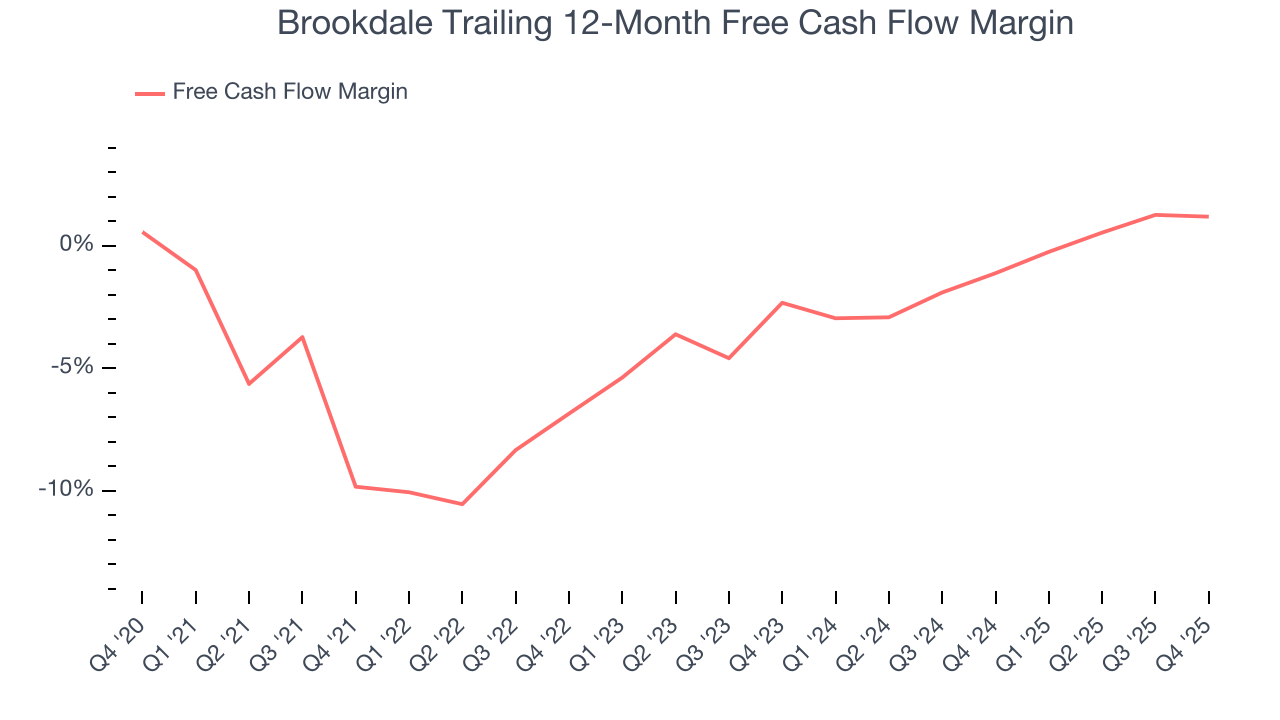

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Brookdale’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 3.6%. This means it lit $3.57 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Brookdale’s margin expanded by 11 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise.

Brookdale burned through $7.78 million of cash in Q4, equivalent to a negative 1% margin. The company’s cash burn was similar to its $5.11 million of lost cash in the same quarter last year.

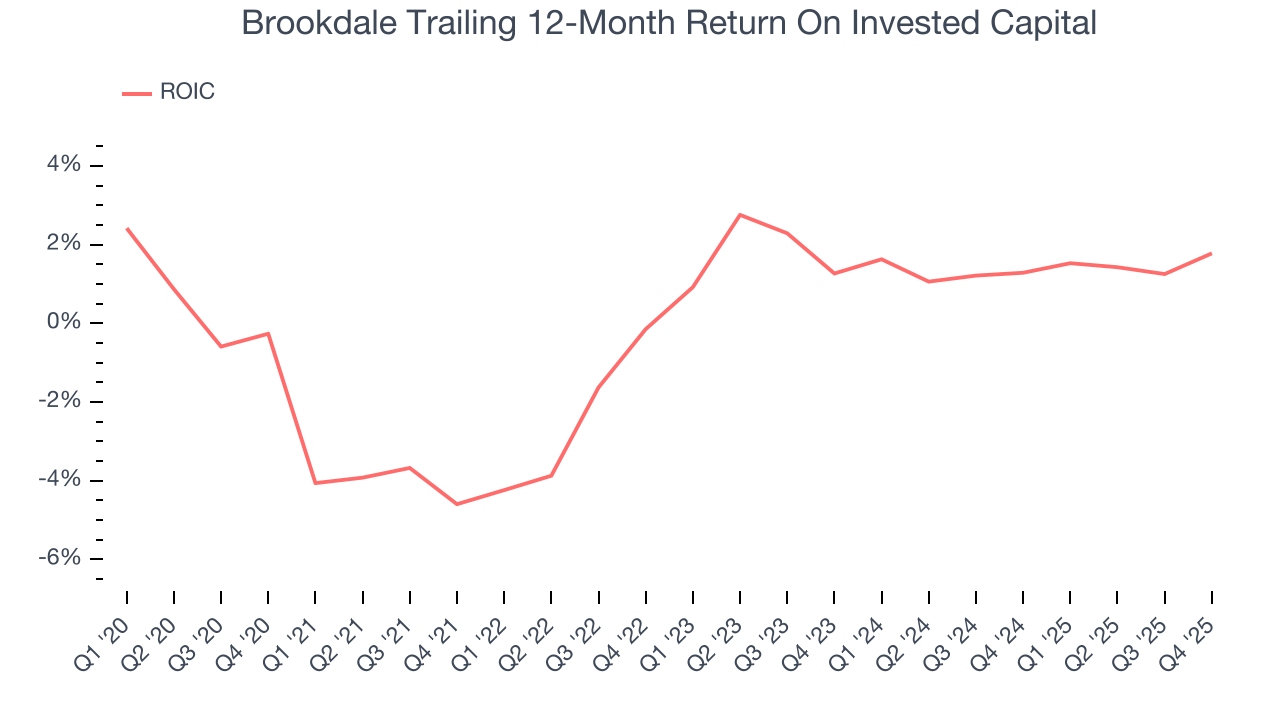

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Brookdale’s five-year average ROIC was negative 0.1%, meaning management lost money while trying to expand the business. Investors are likely hoping for a change soon.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Brookdale’s ROIC averaged 3.9 percentage point increases each year over the last few years. This is a good sign, and we hope the company can continue improving.

11. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

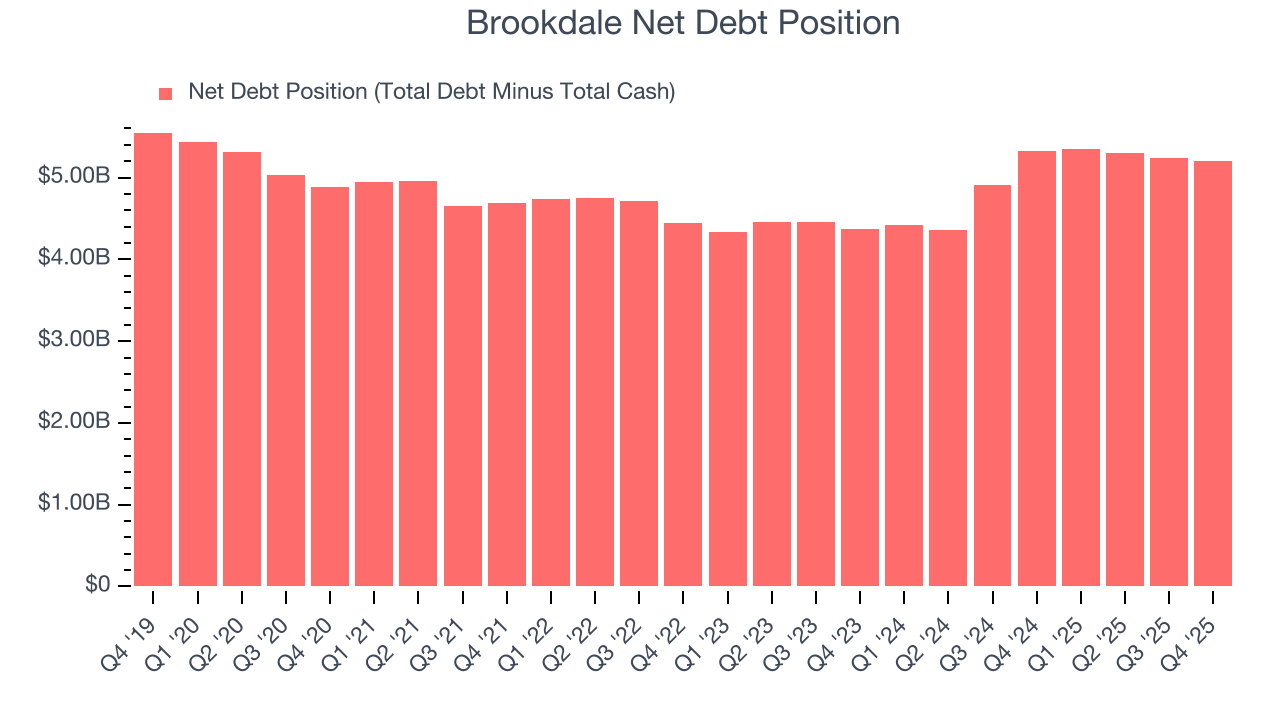

Brookdale’s $5.52 billion of debt exceeds the $312.3 million of cash on its balance sheet. Furthermore, its 11× net-debt-to-EBITDA ratio (based on its EBITDA of $457.9 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Brookdale could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Brookdale can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Brookdale’s Q4 Results

We struggled to find many positives in these results. Overall, this quarter could have been better. The stock traded down 3.4% to $15.99 immediately following the results.

13. Is Now The Time To Buy Brookdale?

Updated: February 18, 2026 at 4:50 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Brookdale.

Brookdale isn’t a terrible business, but it doesn’t pass our quality test. First off, its revenue has declined over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its rising cash profitability gives it more optionality, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Brookdale’s EV-to-EBITDA ratio based on the next 12 months is 18x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $19 on the company (compared to the current share price of $15.99).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.