Bristol-Myers Squibb (BMY)

We’re wary of Bristol-Myers Squibb. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Bristol-Myers Squibb Will Underperform

With roots dating back to 1887 and a transformative merger in 1989 that gave the company its current name, Bristol-Myers Squibb (NYSE:BMY) discovers, develops, and markets prescription medications for serious diseases including cancer, blood disorders, immunological conditions, and cardiovascular diseases.

- Forecasted revenue decline of 6.9% for the upcoming 12 months implies demand will fall off a cliff

- Incremental sales over the last five years were less profitable as its earnings per share were flat while its revenue grew

- A bright spot is that its large revenue base of $48.19 billion gives it negotiating leverage and staying power in an industry with high barriers to entry

Bristol-Myers Squibb’s quality isn’t great. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Bristol-Myers Squibb

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bristol-Myers Squibb

Bristol-Myers Squibb is trading at $59.67 per share, or 9.7x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Bristol-Myers Squibb (BMY) Research Report: Q4 CY2025 Update

Biopharmaceutical company Bristol Myers Squibb (NYSE:BMY) announced better-than-expected revenue in Q4 CY2025, with sales up 1.4% year on year to $12.5 billion. The company’s full-year revenue guidance of $46.75 billion at the midpoint came in 5.7% above analysts’ estimates. Its non-GAAP profit of $1.26 per share was 4.6% above analysts’ consensus estimates.

Bristol-Myers Squibb (BMY) Q4 CY2025 Highlights:

- Revenue: $12.5 billion vs analyst estimates of $11.93 billion (1.4% year-on-year growth, 4.8% beat)

- Adjusted EPS: $1.26 vs analyst estimates of $1.20 (4.6% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $6.20 at the midpoint, beating analyst estimates by 2.7%

- Operating Margin: 11.8%, up from 3.9% in the same quarter last year

- Market Capitalization: $117.3 billion

Company Overview

With roots dating back to 1887 and a transformative merger in 1989 that gave the company its current name, Bristol-Myers Squibb (NYSE:BMY) discovers, develops, and markets prescription medications for serious diseases including cancer, blood disorders, immunological conditions, and cardiovascular diseases.

Bristol-Myers Squibb operates at the intersection of pharmaceutical scale and biotech innovation, focusing on creating transformational medicines for patients with serious diseases. The company's portfolio spans several therapeutic areas, with particularly strong positions in oncology, hematology, immunology, cardiovascular, and neuroscience.

Among its key products is Eliquis, an oral anticoagulant used to reduce stroke risk in patients with atrial fibrillation and treat blood clots. In oncology, Opdivo is a cornerstone immunotherapy that works by helping the immune system detect and fight cancer cells across multiple tumor types. For autoimmune conditions, Orencia treats rheumatoid arthritis and psoriatic arthritis by modulating immune system activity.

The company's business model involves extensive research and development, with annual R&D investments of billions of dollars to fuel its pipeline of potential new treatments. When a physician prescribes a Bristol-Myers Squibb medication for a patient with advanced melanoma, for instance, the drug is typically distributed through specialty pharmacies or wholesalers before reaching the patient.

Bristol-Myers Squibb generates revenue primarily through prescription drug sales to wholesalers, specialty distributors, and pharmacies. The company employs a global sales force that educates healthcare professionals about its products, while also working to secure placement on insurance formularies and reimbursement plans.

The company has expanded its portfolio through strategic acquisitions, including Celgene in 2019, which brought the multiple myeloma treatment Revlimid into its lineup, and more recently Turning Point Therapeutics, which added precision oncology capabilities. Bristol-Myers Squibb maintains significant manufacturing operations across the United States, Puerto Rico, and several European countries, with products sold worldwide.

4. Branded Pharmaceuticals

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Bristol-Myers Squibb competes with other major pharmaceutical companies including Merck (NYSE:MRK), Pfizer (NYSE:PFE), Novartis (NYSE:NVS), AstraZeneca (NASDAQ:AZN), and Roche (OTCQX:RHHBY), particularly in oncology and immunology therapeutic areas.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $48.2 billion in revenue over the past 12 months, Bristol-Myers Squibb boasts impressive economies of scale. It may not be as large as heavyweights such as UnitedHealth Group and The Cigna Group from a topline perspective, but its heft is still an important advantage in a healthcare industry that is heavily regulated, complex, and resource-intensive.

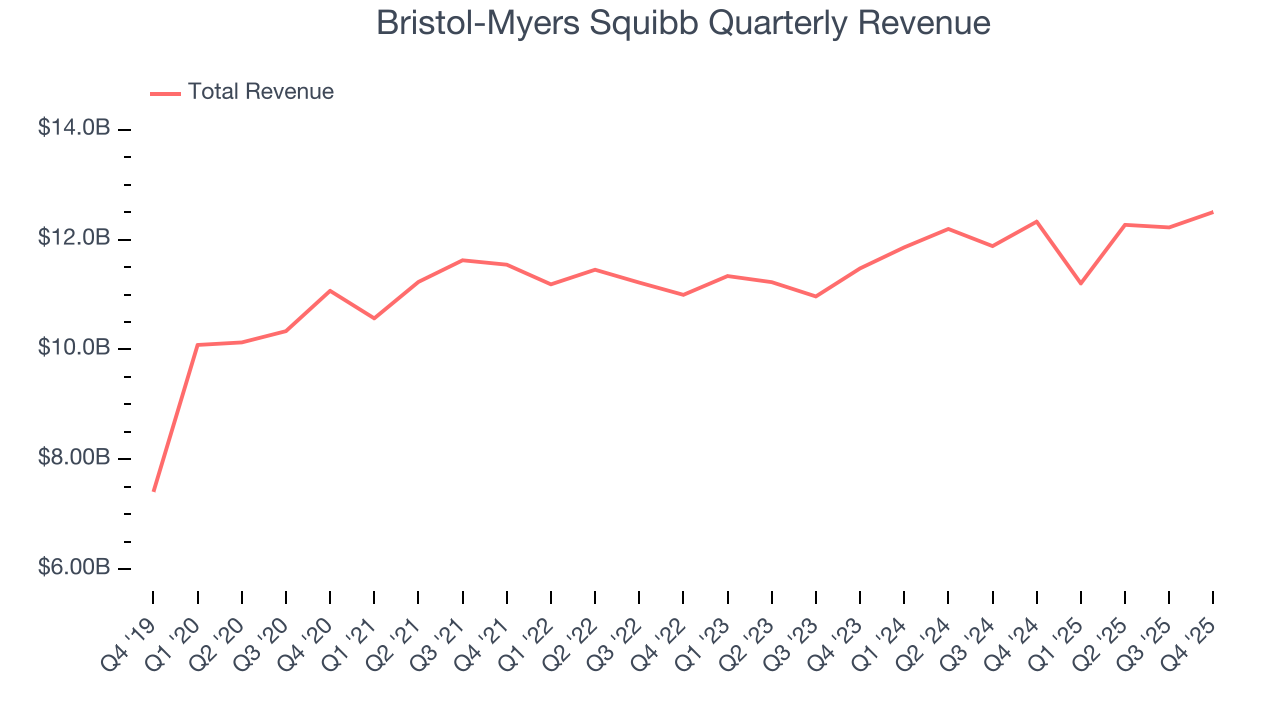

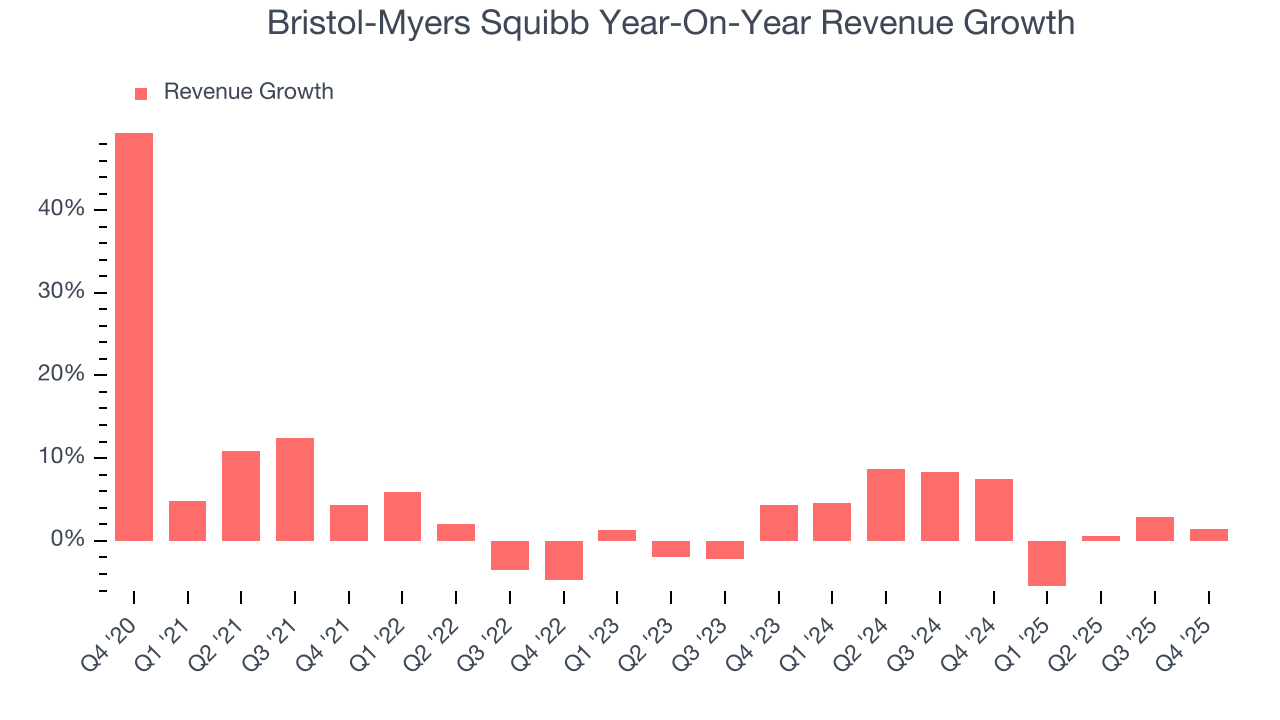

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Bristol-Myers Squibb grew its sales at a tepid 3% compounded annual growth rate. This fell short of our benchmarks and is a rough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Bristol-Myers Squibb’s annualized revenue growth of 3.5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

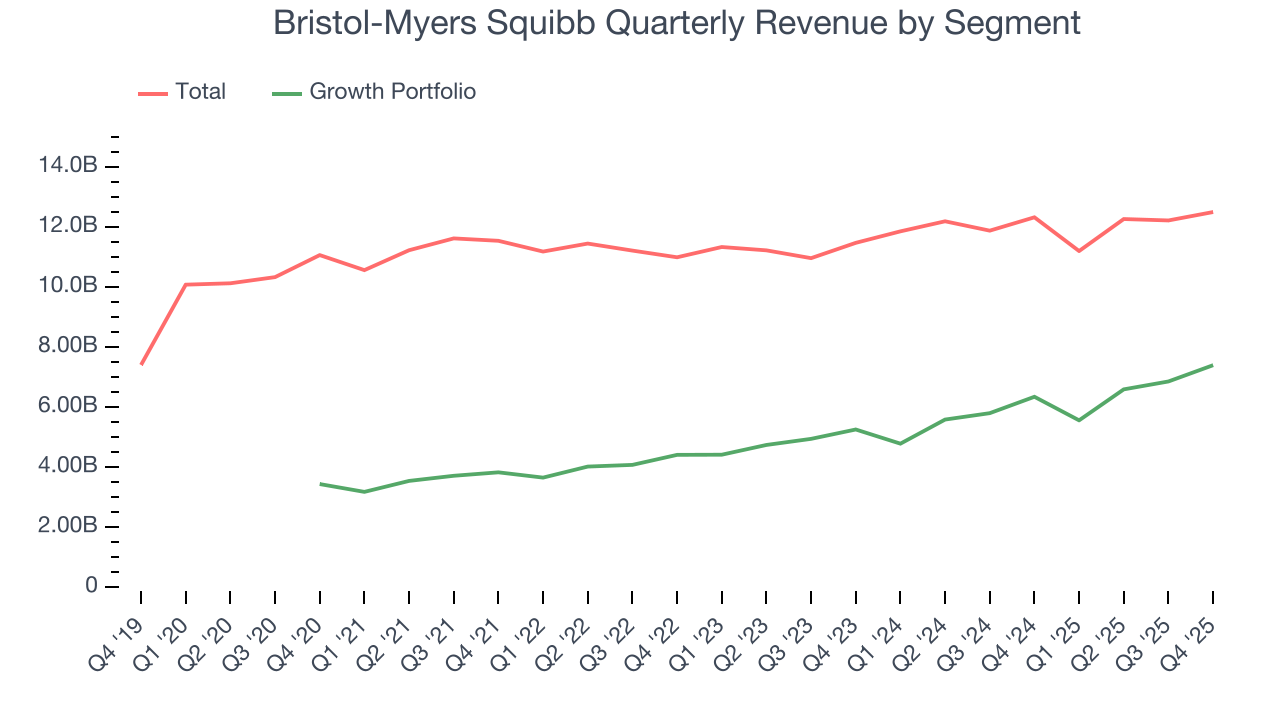

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Growth Portfolio. Over the last two years, Bristol-Myers Squibb’s Growth Portfolio revenue averaged 16.7% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Bristol-Myers Squibb reported modest year-on-year revenue growth of 1.4% but beat Wall Street’s estimates by 4.8%.

Looking ahead, sell-side analysts expect revenue to decline by 7.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

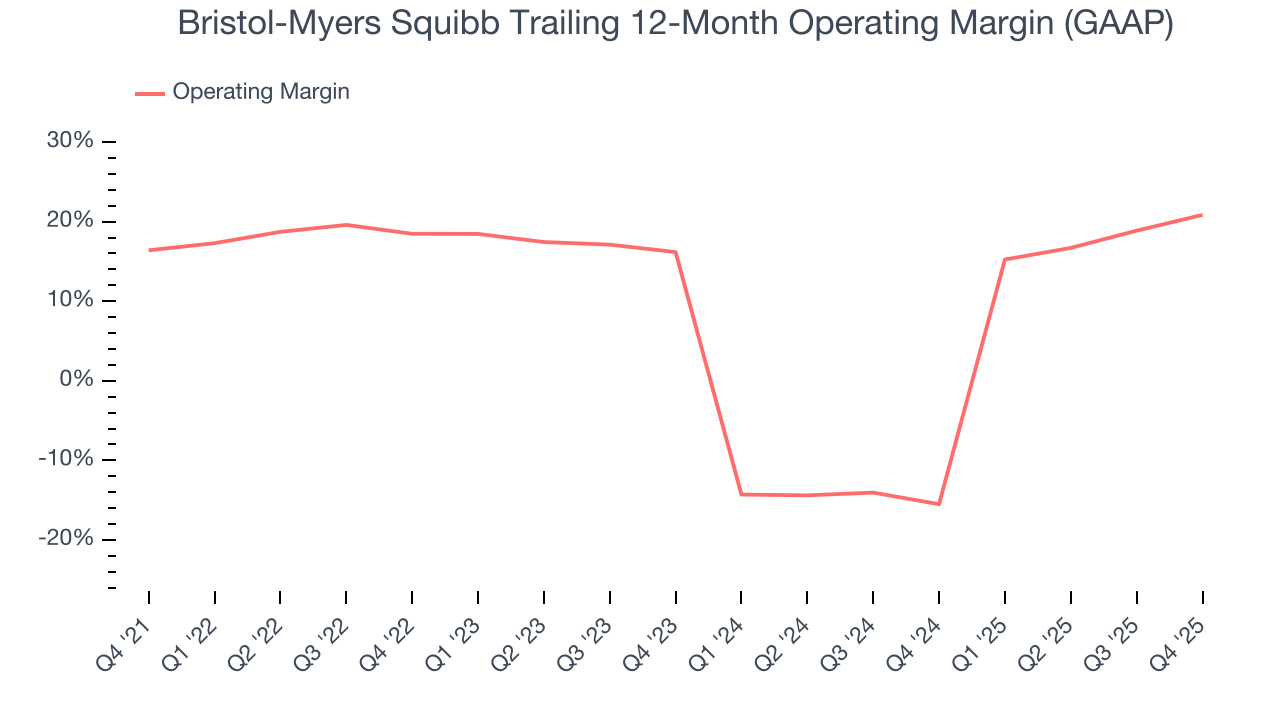

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Bristol-Myers Squibb has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Bristol-Myers Squibb’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

In Q4, Bristol-Myers Squibb generated an operating margin profit margin of 11.8%, up 7.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

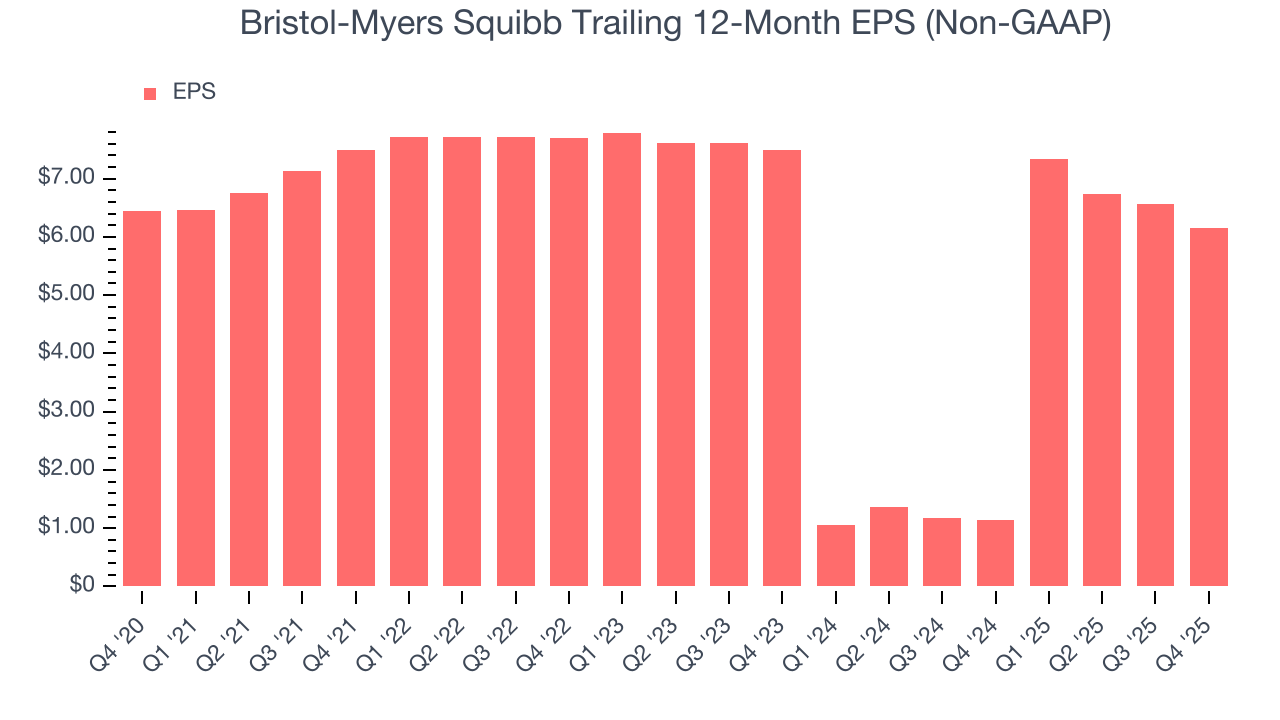

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Bristol-Myers Squibb’s flat EPS over the last five years was below its 3% annualized revenue growth. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

In Q4, Bristol-Myers Squibb reported adjusted EPS of $1.26, down from $1.67 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.6%. Over the next 12 months, Wall Street expects Bristol-Myers Squibb’s full-year EPS of $6.15 to shrink by 3%.

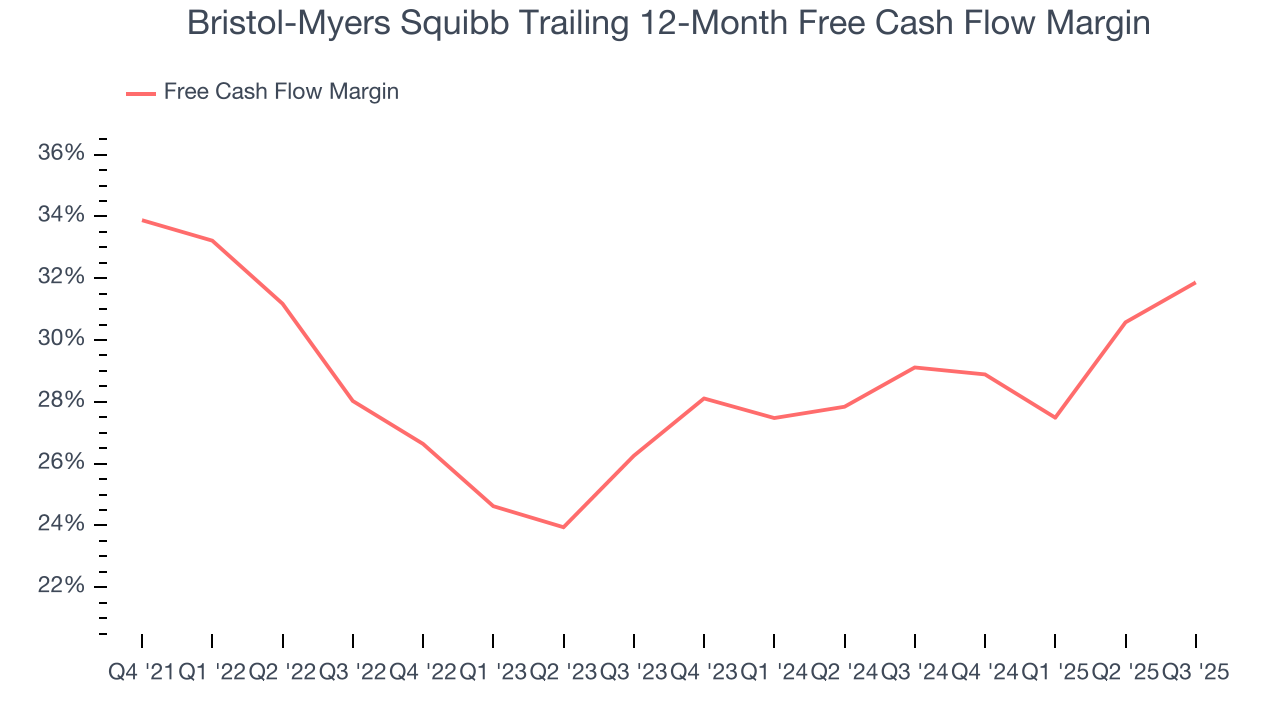

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Bristol-Myers Squibb has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging 29.7% over the last five years.

Taking a step back, we can see that Bristol-Myers Squibb’s margin dropped by 2.9 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

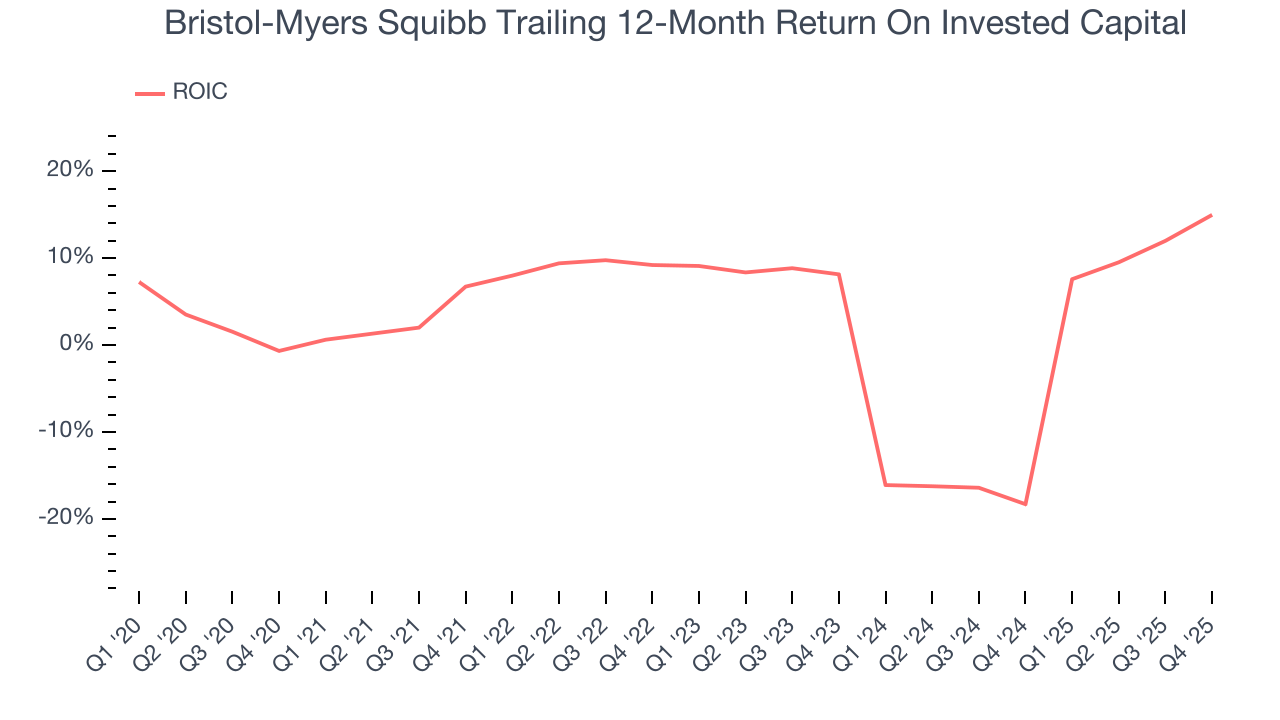

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Bristol-Myers Squibb historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.1%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Bristol-Myers Squibb’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

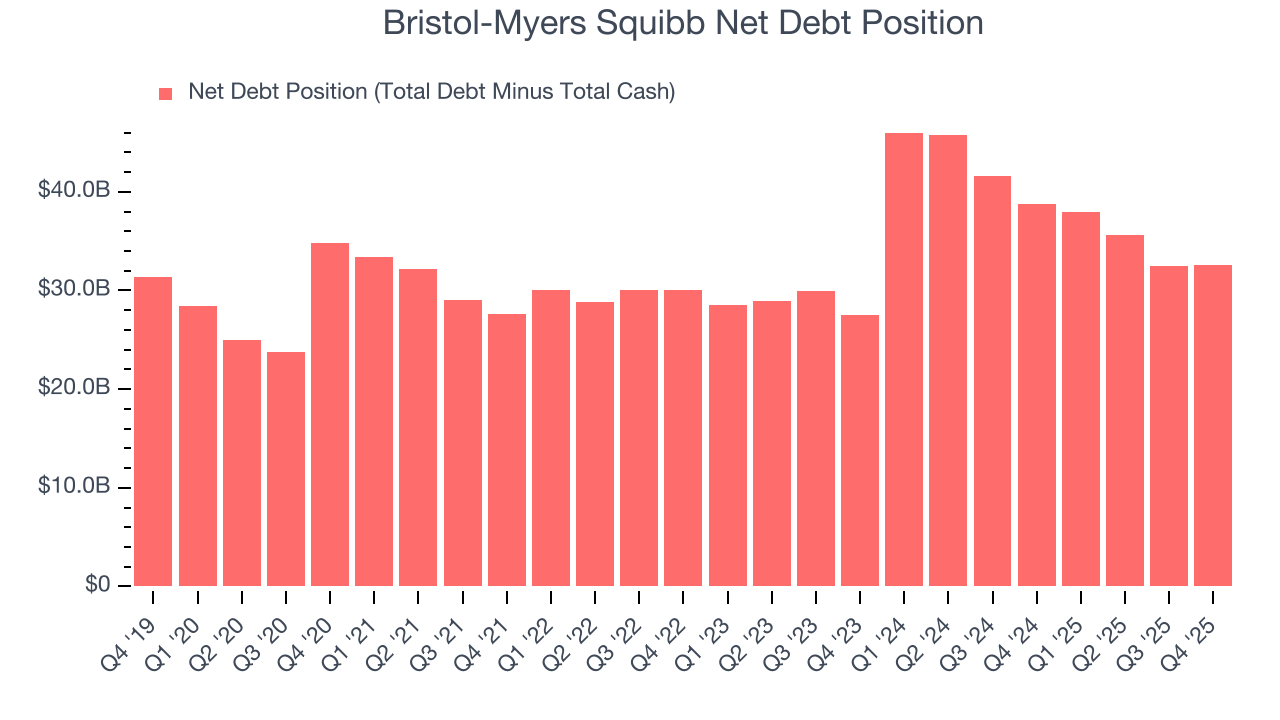

Bristol-Myers Squibb reported $15.35 billion of cash and $47.95 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $18.83 billion of EBITDA over the last 12 months, we view Bristol-Myers Squibb’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $1.02 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Bristol-Myers Squibb’s Q4 Results

We were impressed by Bristol-Myers Squibb’s optimistic full-year revenue guidance, which blew past analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.6% to $58.54 immediately after reporting.

13. Is Now The Time To Buy Bristol-Myers Squibb?

Updated: February 18, 2026 at 11:26 PM EST

Before investing in or passing on Bristol-Myers Squibb, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Bristol-Myers Squibb isn’t a terrible business, but it doesn’t pass our bar. For starters, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its scale makes it a trusted partner with negotiating leverage, the downside is its declining adjusted operating margin shows the business has become less efficient. On top of that, its diminishing returns show management's prior bets haven't worked out.

Bristol-Myers Squibb’s P/E ratio based on the next 12 months is 9.7x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $59.91 on the company (compared to the current share price of $59.67).