Berkshire Hathaway (BRK.A)

Berkshire Hathaway catches our eye. Its impressive TBVPS growth indicates strong capital accumulation.― StockStory Analyst Team

1. News

2. Summary

Why Berkshire Hathaway Is Interesting

Led by legendary investor Warren Buffett since 1965, transforming it from a struggling textile manufacturer into a corporate giant, Berkshire Hathaway (NYSE:BRK.A) is a diversified holding company that owns businesses across insurance, railroads, utilities, manufacturing, retail, and services sectors.

- Impressive 15.2% annual tangible book value per share growth over the last two years indicates it’s building equity value this cycle

- Incremental sales over the last five years boosted profitability as its annual earnings per share growth of 16.7% outstripped its revenue performance

- On the flip side, its annual sales growth of 3.1% over the last five years lagged behind its financials peers as its large revenue base made it difficult to generate incremental demand

Berkshire Hathaway almost passes our quality test. This company is certainly worth watching.

Why Should You Watch Berkshire Hathaway

High Quality

Investable

Underperform

Why Should You Watch Berkshire Hathaway

Berkshire Hathaway’s stock price of $754,994 implies a valuation ratio of 22.9x forward P/E. Berkshire Hathaway’s valuation represents a premium to other names in the financials sector.

Berkshire Hathaway could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Berkshire Hathaway (BRK.A) Research Report: Q2 CY2025 Update

Diversified holding company Berkshire Hathaway (NYSE:BRK.A) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, but sales fell by 15.9% year on year to $98.88 billion. Its non-GAAP profit of $7,760 per share was 3.3% above analysts’ consensus estimates.

Berkshire Hathaway (BRK.A) Q2 CY2025 Highlights:

- Revenue: $98.88 billion vs analyst estimates of $93.61 billion (15.9% year-on-year decline, 5.6% beat)

- Pre-tax Profit: $14.75 billion (14.9% margin, 61.3% year-on-year decline)

- Adjusted EPS: $7,760 vs analyst estimates of $7,514 (3.3% beat)

- Tangible Book Value per Share: $381,300 (13.9% year-on-year growth)

- Market Capitalization: $1.07 trillion

Company Overview

Led by legendary investor Warren Buffett since 1965, transforming it from a struggling textile manufacturer into a corporate giant, Berkshire Hathaway (NYSE:BRK.A) is a diversified holding company that owns businesses across insurance, railroads, utilities, manufacturing, retail, and services sectors.

Berkshire's business empire spans more than 60 wholly-owned subsidiaries across multiple industries. Its insurance operations, including GEICO, General Re, and Berkshire Hathaway Reinsurance Group, form the financial foundation of the company, generating substantial "float" (premiums collected before claims are paid) that Buffett deploys into investments. This insurance float has helped fund Berkshire's growth for decades.

Beyond insurance, Berkshire owns BNSF Railway, one of North America's largest freight rail networks, operating over 32,500 route miles across 28 states. Its energy subsidiary, Berkshire Hathaway Energy, controls utilities serving 5.3 million customers, along with natural gas pipelines and renewable energy assets.

Berkshire's manufacturing operations are divided into industrial products (Precision Castparts, Lubrizol, IMC), building products (Clayton Homes, Shaw Industries, Johns Manville), and consumer products (Forest River, Fruit of the Loom, Duracell). Its service businesses include McLane (grocery distribution), NetJets (fractional aircraft ownership), and FlightSafety (aviation training).

In retail, Berkshire owns furniture retailers like Nebraska Furniture Mart, jewelry chains including Borsheims and Helzberg Diamonds, and automotive dealerships through Berkshire Hathaway Automotive. The company also maintains significant minority investments in public companies, with major stakes in Apple, Bank of America, American Express, and Coca-Cola.

Berkshire's decentralized management approach allows subsidiary CEOs considerable autonomy while maintaining minimal corporate overhead at its modest Omaha headquarters. This operational philosophy, combined with a focus on acquiring businesses with durable competitive advantages at reasonable prices, has been central to Berkshire's long-term success.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

As a diversified conglomerate, Berkshire Hathaway competes with different companies across its various business segments rather than having direct competitors at the corporate level. Its insurance operations compete with companies like Progressive (NYSE: PGR), Allstate (NYSE: ALL), and Chubb (NYSE: CB), while BNSF Railway competes with Union Pacific (NYSE: UNP) and other Class I railroads.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Berkshire Hathaway’s 3.1% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Berkshire Hathaway.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Berkshire Hathaway’s recent performance shows its demand has slowed as its revenue was flat over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Berkshire Hathaway’s revenue fell by 15.9% year on year to $98.88 billion but beat Wall Street’s estimates by 5.4%.

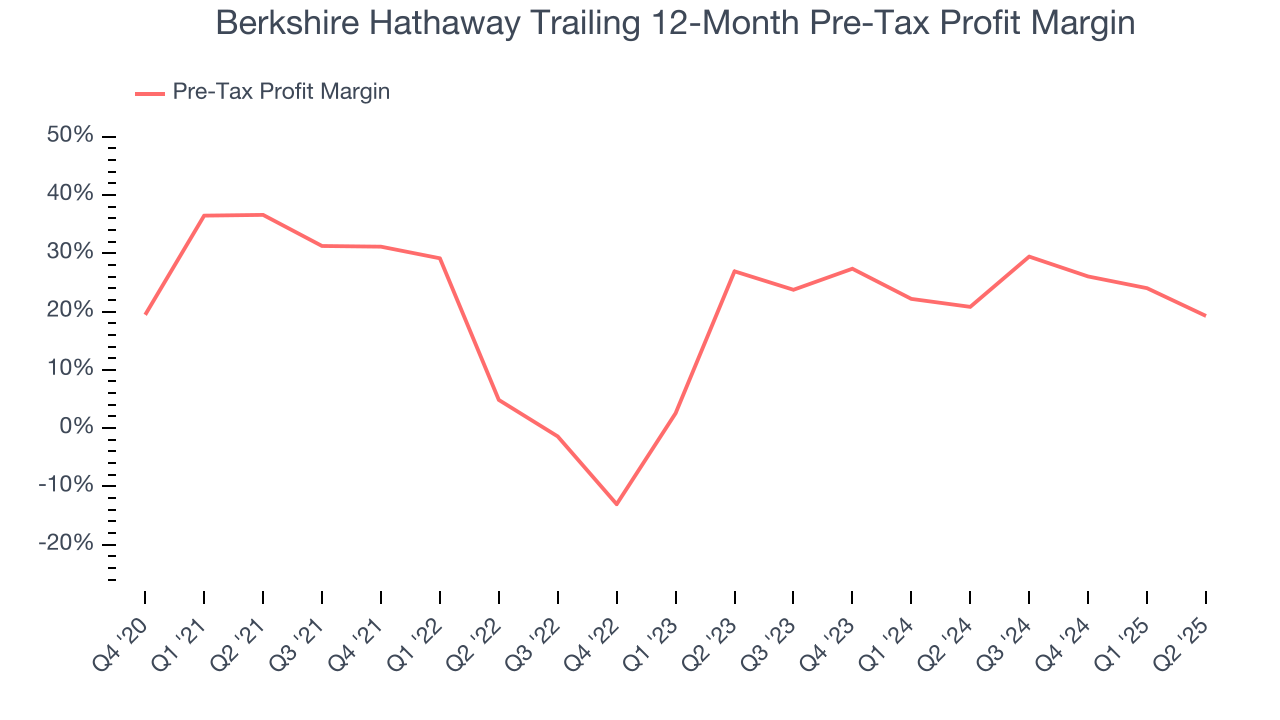

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last four years, Berkshire Hathaway’s pre-tax profit margin has fallen by 17.3 percentage points, going from 36.6% to 19.2%. It has also declined by 7.7 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

Berkshire Hathaway’s pre-tax profit margin came in at 14.9% this quarter. This result was 17.5 percentage points worse than the same quarter last year.

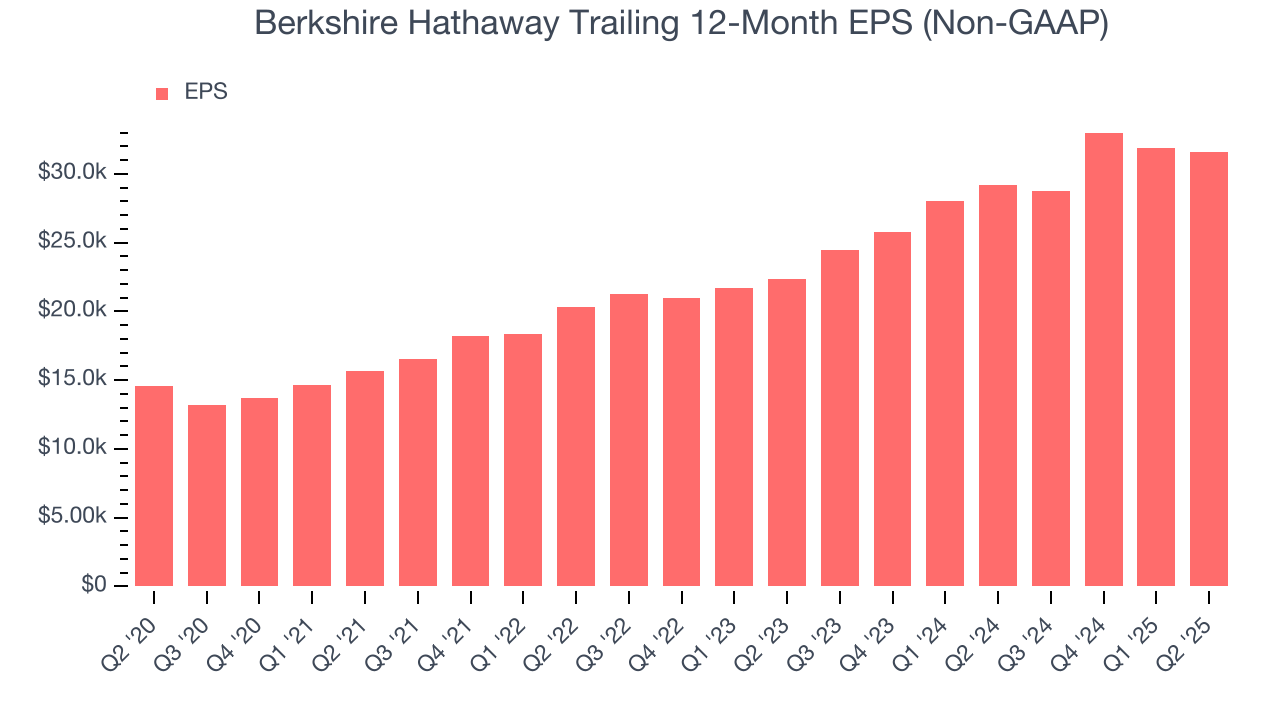

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Berkshire Hathaway’s EPS grew at a remarkable 16.7% compounded annual growth rate over the last five years, higher than its 3.1% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its pre-tax profit margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Berkshire Hathaway, its two-year annual EPS growth of 18.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Berkshire Hathaway reported adjusted EPS of $7,760, down from $8,072 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects Berkshire Hathaway’s full-year EPS of $31,588 to grow 3.5%.

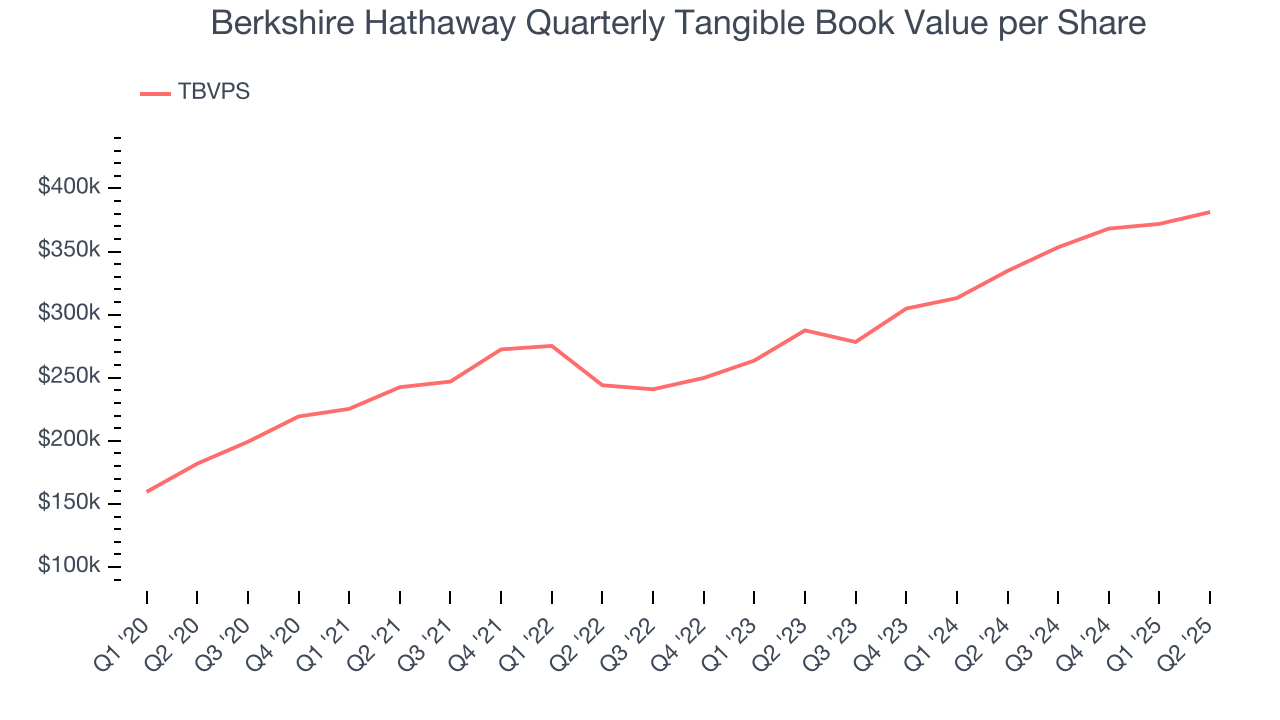

8. Tangible Book Value Per Share (TBVPS)

The balance sheet drives profitability for financial firms since earnings flow from managing diverse assets and liabilities across multiple business lines. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential across their varied operations.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to the complexity of multiple business lines, M&A activity, or accounting rules that vary across different financial services segments.

Berkshire Hathaway’s TBVPS grew at an excellent 15.9% annual clip over the last five years. The last two years show a similar trajectory as TBVPS grew by 15.2% annually from $287,549 to $381,300 per share.

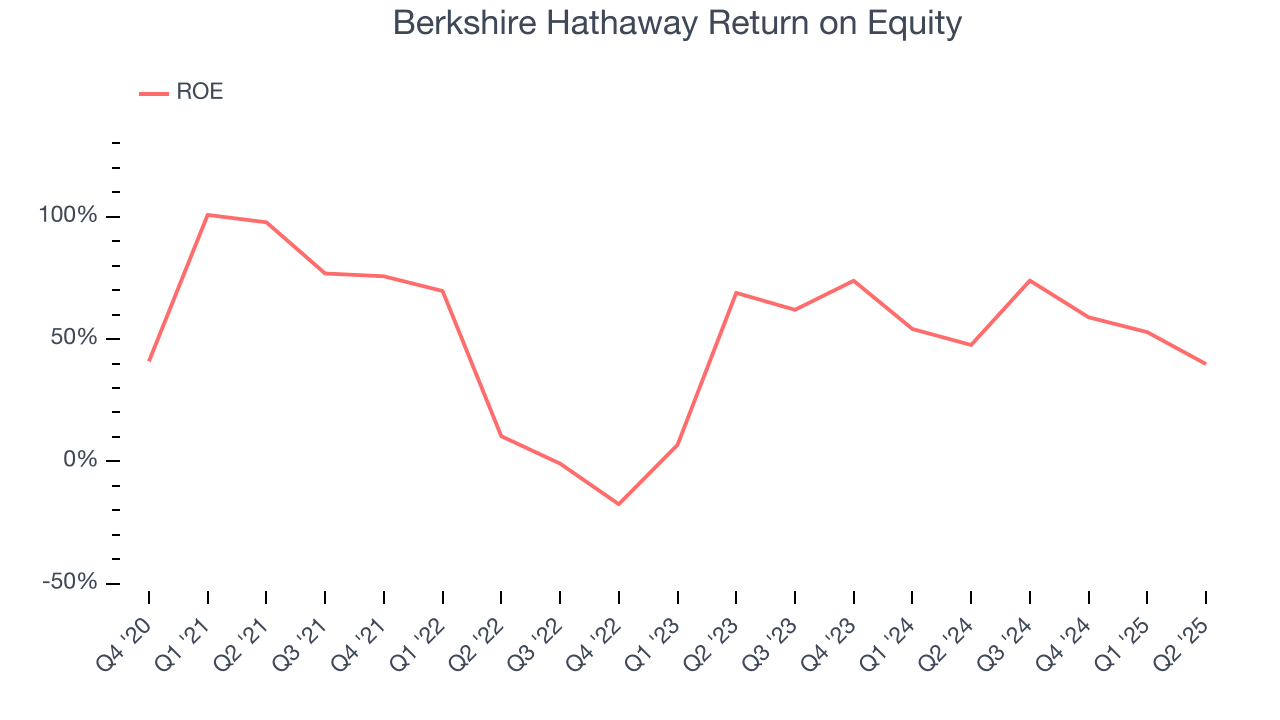

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Berkshire Hathaway has averaged an ROE of 13.2%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Berkshire Hathaway has a decent competitive moat.

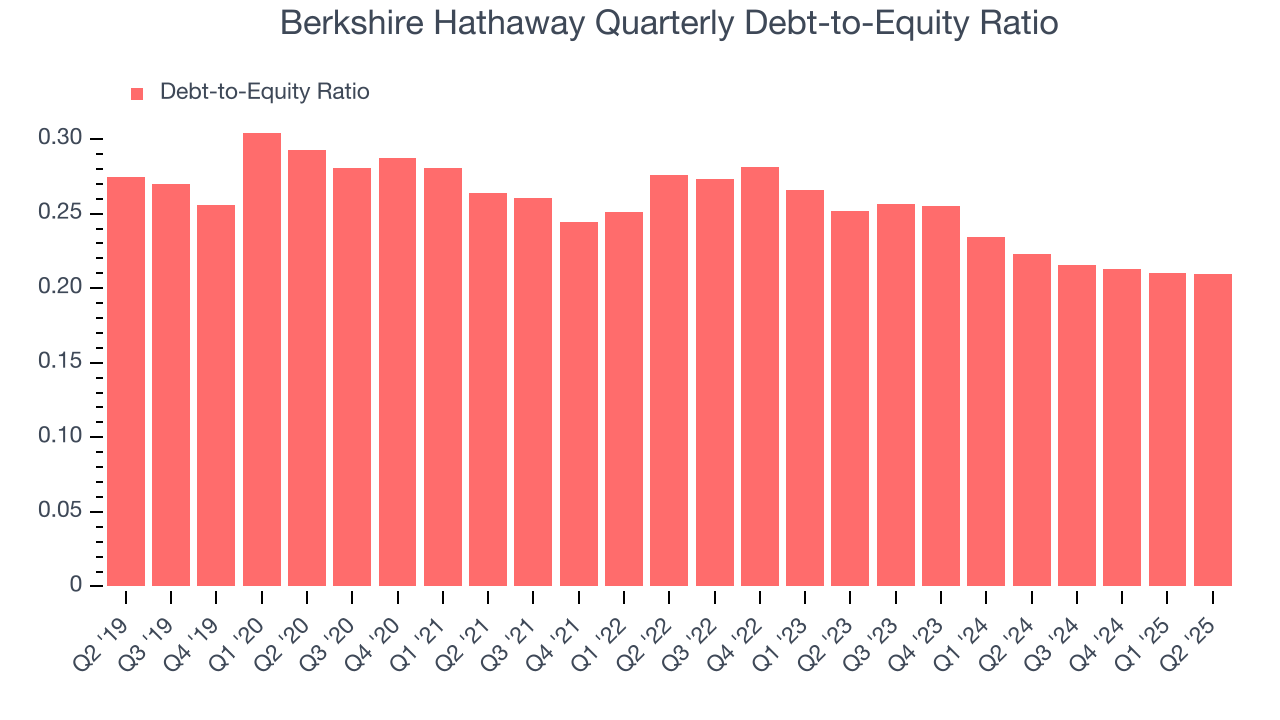

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Berkshire Hathaway currently has $139.8 billion of debt and $668 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Berkshire Hathaway’s Q2 Results

We enjoyed seeing Berkshire Hathaway beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $745,326 immediately after reporting.

12. Is Now The Time To Buy Berkshire Hathaway?

Updated: December 3, 2025 at 12:01 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Berkshire Hathaway, you should also grasp the company’s longer-term business quality and valuation.

There are things to like about Berkshire Hathaway. Although its revenue growth was weak over the last five years and analysts expect growth to slow over the next 12 months, its expanding pre-tax profit margin shows the business has become more efficient. Plus, Berkshire Hathaway’s TBVPS growth was impressive over the last five years.

Berkshire Hathaway’s P/E ratio based on the next 12 months is 22.9x. This multiple tells us that a lot of good news is priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $768,440 on the company (compared to the current share price of $760,106).