Caleres (CAL)

We wouldn’t buy Caleres. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Caleres Will Underperform

The owner of Dr. Scholl's, Caleres (NYSE:CAL) is a footwear company offering a range of styles.

- 3.8% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Poor expense management has led to an operating margin that is below the industry average

- High net-debt-to-EBITDA ratio of 7× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Caleres doesn’t pass our quality test. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Caleres

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Caleres

Caleres is trading at $12.83 per share, or 12.8x forward P/E. Caleres’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Caleres (CAL) Research Report: Q3 CY2025 Update

Footwear company Caleres (NYSE:CAL) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 6.6% year on year to $790.1 million. Its non-GAAP profit of $0.38 (Adjusted excluding Stuart Weitzman: $0.67) per share was below analysts’ consensus estimates.

Caleres (CAL) Q3 CY2025 Highlights:

- Revenue: $790.1 million vs analyst estimates of $768.6 million (6.6% year-on-year growth, 2.8% beat)

- Adjusted EPS: $0.38 vs analyst expectations of $0.85 (Adjusted excluding Stuart Weitzman: $0.67)

- Adjusted EPS guidance for the full year is $0.58 at the midpoint, missing analyst estimates by 66.7%

- Operating Margin: 1.5%, down from 8% in the same quarter last year

- Free Cash Flow was -$13.93 million compared to -$57.37 million in the same quarter last year

- Market Capitalization: $456.5 million

Company Overview

The owner of Dr. Scholl's, Caleres (NYSE:CAL) is a footwear company offering a range of styles.

The company started as a niche footwear manufacturer and retailer, Bryan-Brown Shoe Company, and has expanded over time by acquiring numerous brands including Naturalizer, Buster Brown, and LifeStride. In 2015, the company rebranded itself as Caleres in a strategic shift for global expansion and product diversification.

Caleres's brand acquisitions over its 100+ year history made it a major player in the shoe industry. Today, Caleres owns and operates Vince, Allen Edmonds, Dr. Scholls, and many other household names. The company's portfolio approach allows it to cater to a wide range of consumer preferences and market segments, from fashion-forward footwear to comfort and orthopedic options.

In addition to its shoemakers, Caleres owns Famous Footwear, a large retailer of popular athletic and casual shoes. Along with its own line of shoes, Famous Footwear carries popular brands like Nike and Adidas through its expansive retail store network and e-commerce platform.

4. Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Caleres's shoe brands compete with Deckers Outdoor (NYSE:DECK) and VF Corp (NYSE:VFC) while Famous Footwear competes with retailers such as Foot Locker (NYSE:FL) and Designer Brands (NYSE:DBI).

5. Revenue Growth

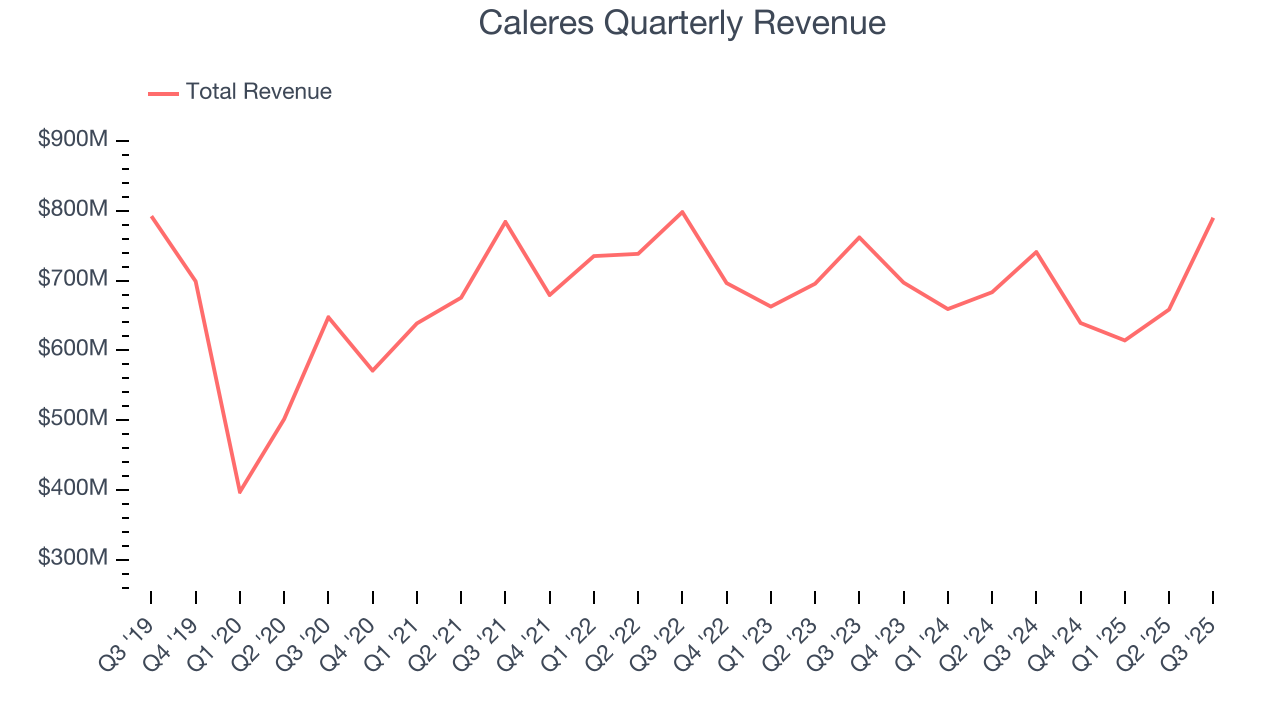

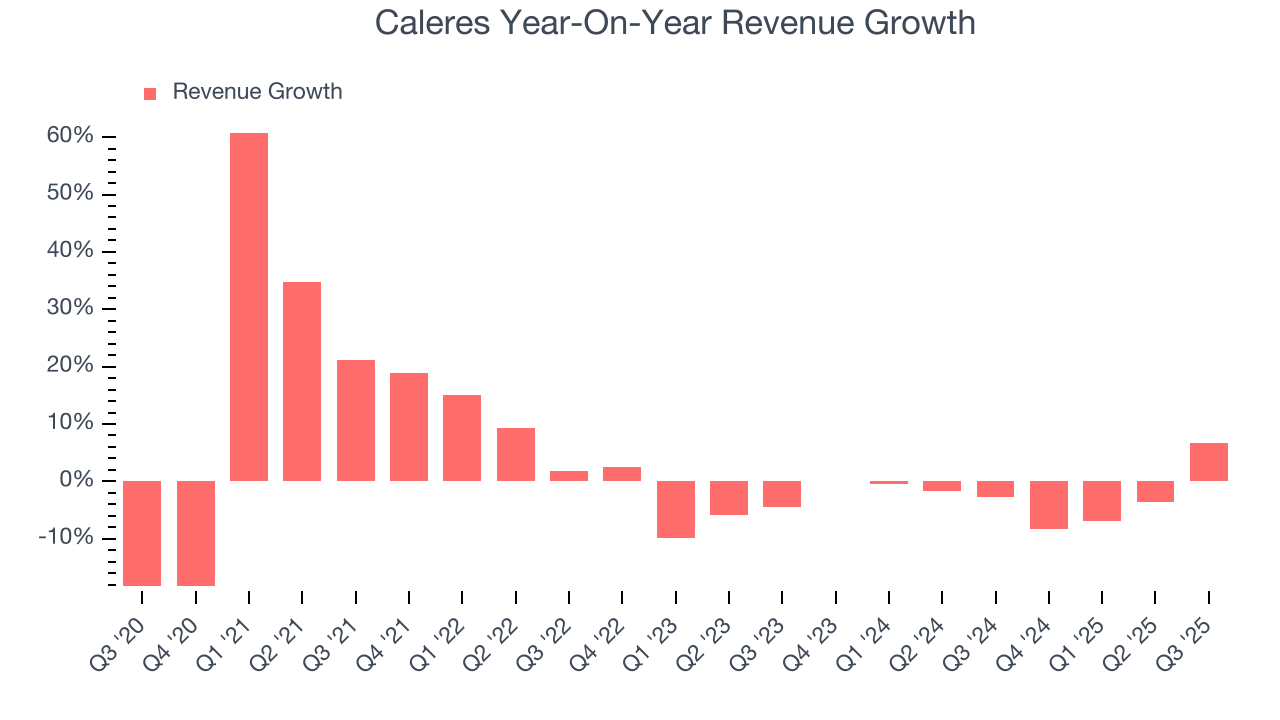

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Caleres’s 3.8% annualized revenue growth over the last five years was weak. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Caleres’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.1% annually.

This quarter, Caleres reported year-on-year revenue growth of 6.6%, and its $790.1 million of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

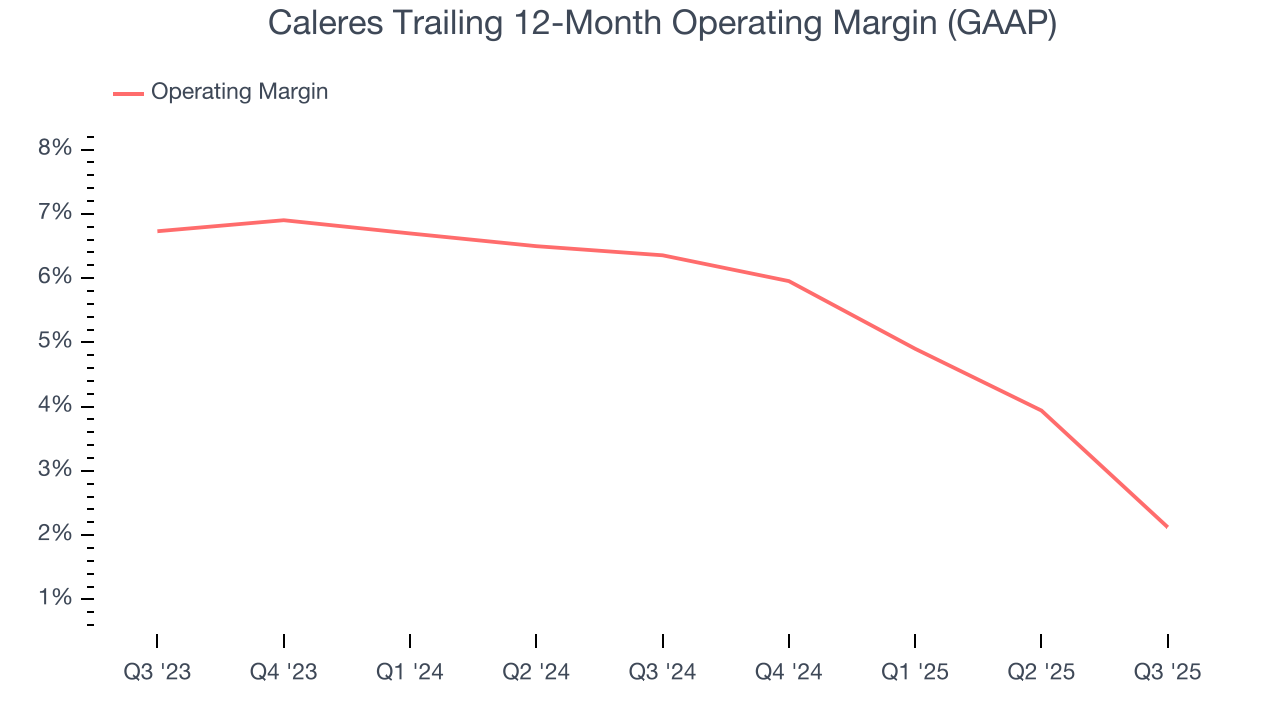

Caleres’s operating margin has shrunk over the last 12 months and averaged 4.3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Caleres generated an operating margin profit margin of 1.5%, down 6.5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

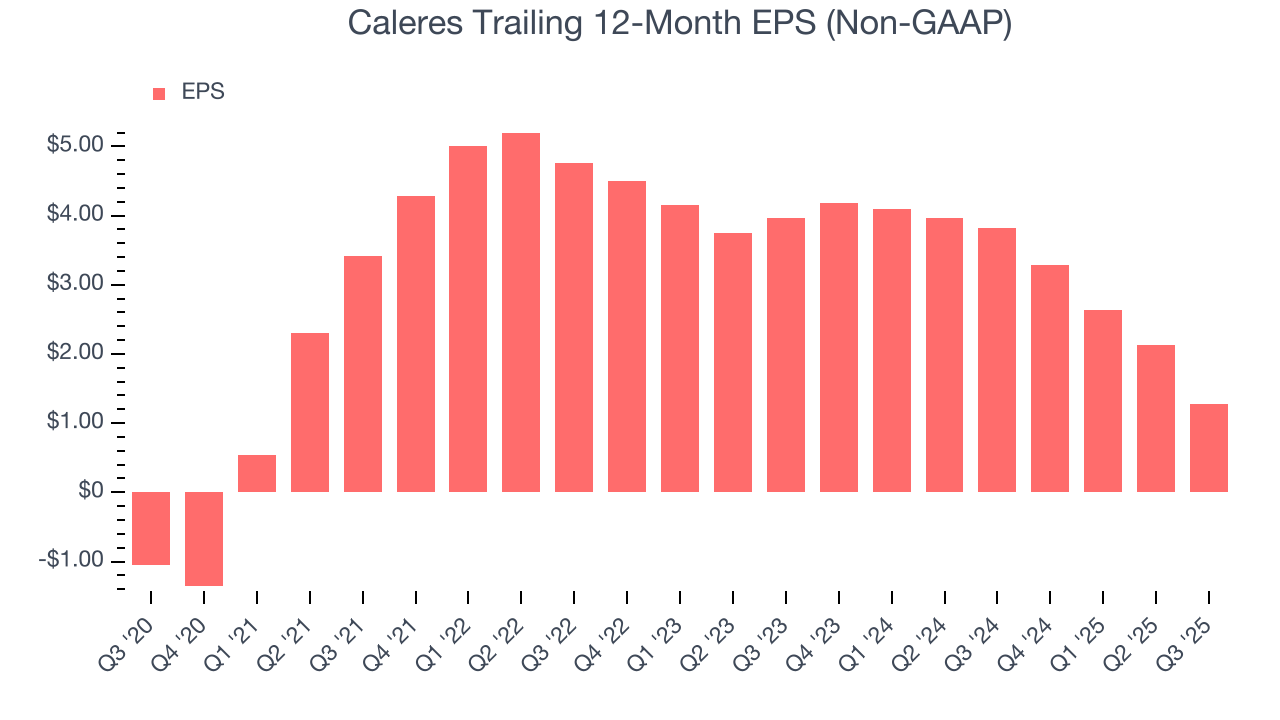

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Caleres’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Caleres reported adjusted EPS of $0.38, down from $1.23 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Caleres’s full-year EPS of $1.28 to grow 86.2%.

8. Cash Is King

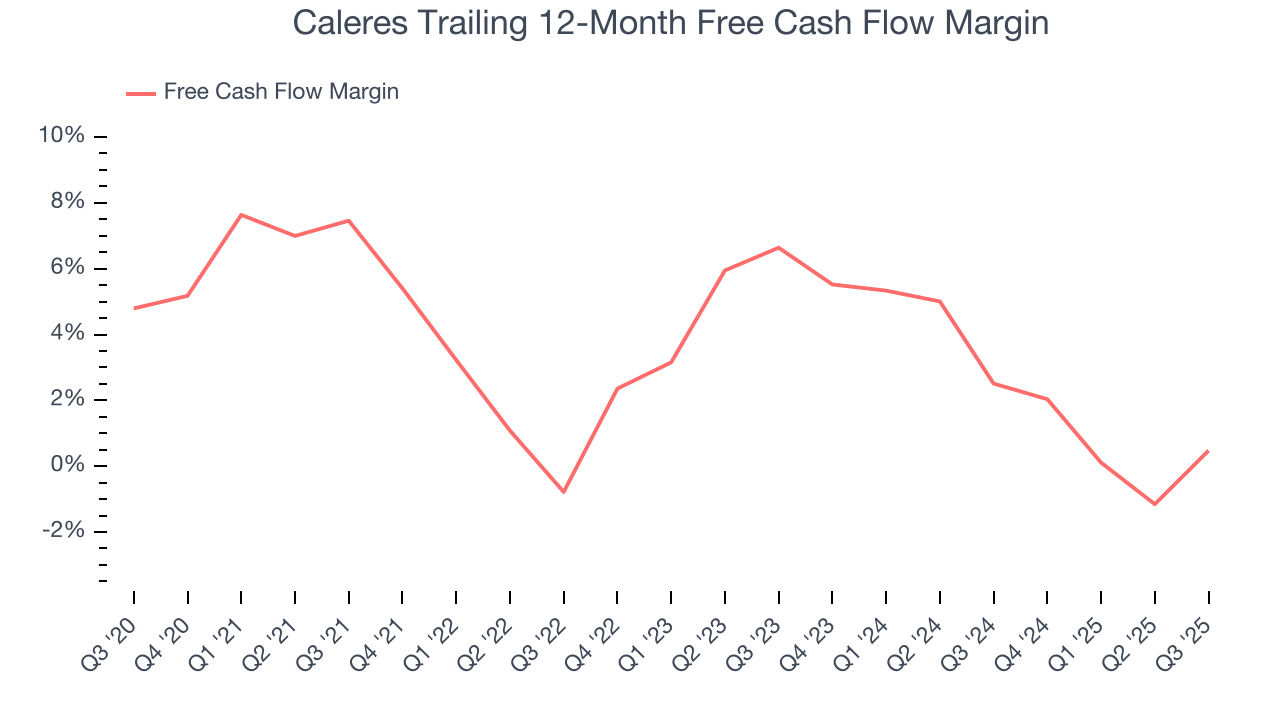

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Caleres has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.5%, lousy for a consumer discretionary business.

Caleres burned through $13.93 million of cash in Q3, equivalent to a negative 1.8% margin. The company’s cash burn slowed from $57.37 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

9. Return on Invested Capital (ROIC)

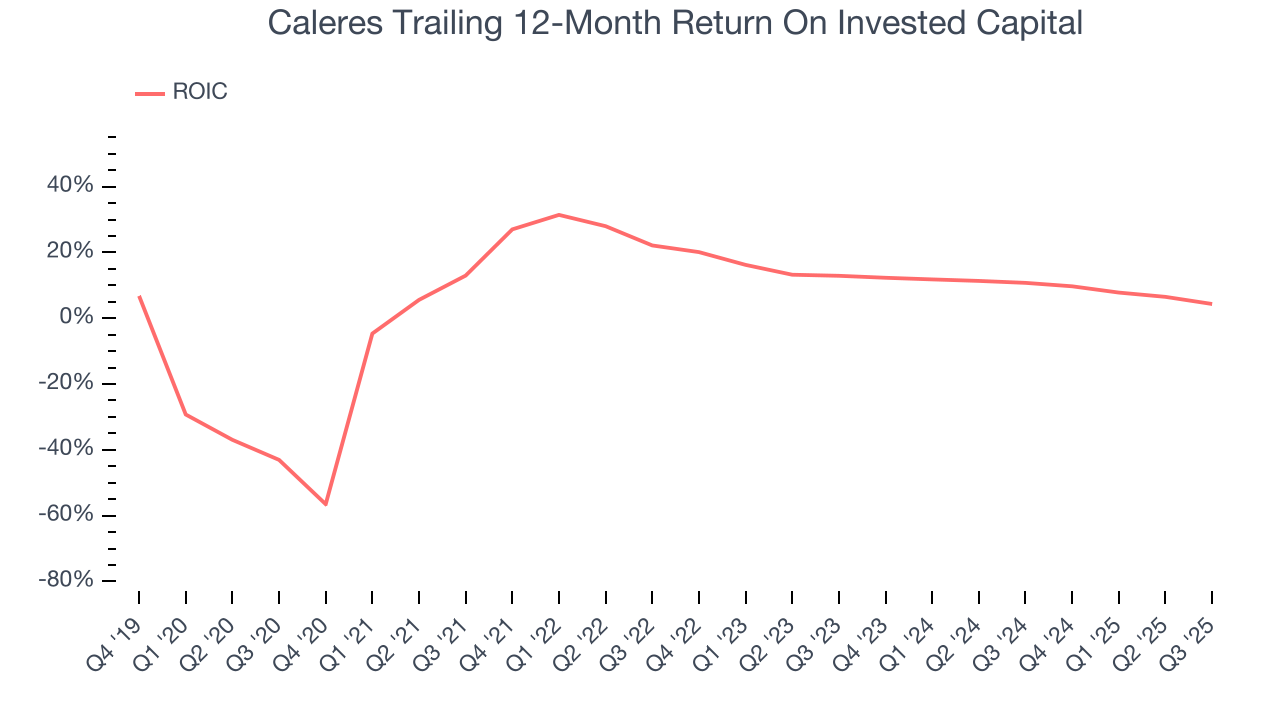

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Caleres historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 12.6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Caleres’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

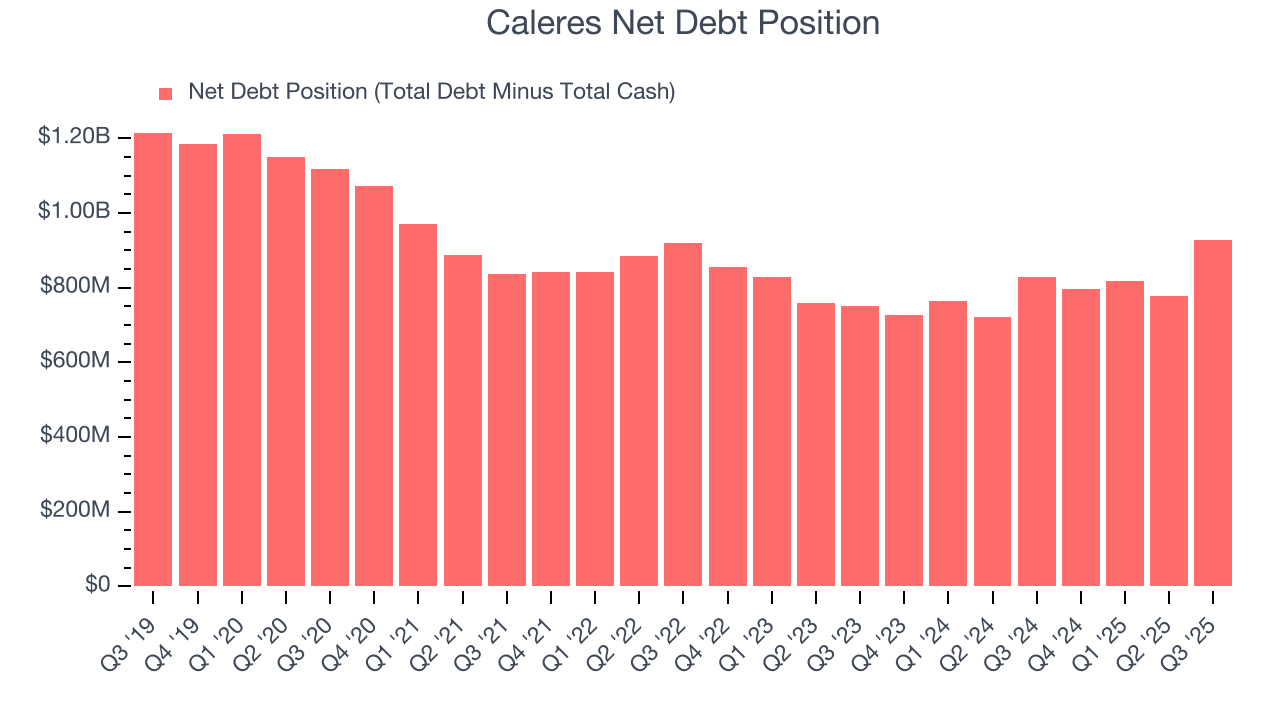

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Caleres’s $961.1 million of debt exceeds the $33.96 million of cash on its balance sheet. Furthermore, its 8× net-debt-to-EBITDA ratio (based on its EBITDA of $119.8 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Caleres could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Caleres can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Caleres’s Q3 Results

It was encouraging to see Caleres beat analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 18.5% to $11.02 immediately following the results.

12. Is Now The Time To Buy Caleres?

Updated: January 22, 2026 at 9:59 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Caleres, you should also grasp the company’s longer-term business quality and valuation.

Caleres doesn’t pass our quality test. To kick things off, its revenue growth was weak over the last five years. On top of that, Caleres’s projected EPS for the next year is lacking, and its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Caleres’s P/E ratio based on the next 12 months is 12.8x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $17 on the company (compared to the current share price of $12.83).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.