Caterpillar (CAT)

Caterpillar doesn’t excite us. Its low gross margin indicates weak unit economics and its declining sales suggest its offerings are unpopular.― StockStory Analyst Team

1. News

2. Summary

Why Caterpillar Is Not Exciting

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE:CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

- Competitive supply chain dynamics and steep production costs are reflected in its low gross margin of 29.3%

- A silver lining is that its market-beating returns on capital illustrate that management has a knack for investing in profitable ventures, and its returns are growing as it capitalizes on even better market opportunities

Caterpillar’s quality doesn’t meet our bar. There are better opportunities in the market.

Why There Are Better Opportunities Than Caterpillar

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Caterpillar

At $644.65 per share, Caterpillar trades at 30.6x forward P/E. This multiple is higher than most industrials companies, and we think it’s quite expensive for the quality you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Caterpillar (CAT) Research Report: Q4 CY2025 Update

Construction equipment company Caterpillar (NYSE:CAT) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 18% year on year to $19.13 billion. Its non-GAAP profit of $5.16 per share was 9.5% above analysts’ consensus estimates.

Caterpillar (CAT) Q4 CY2025 Highlights:

- Revenue: $19.13 billion vs analyst estimates of $17.75 billion (18% year-on-year growth, 7.8% beat)

- Adjusted EPS: $5.16 vs analyst estimates of $4.71 (9.5% beat)

- Operating Margin: 13.9%, down from 18% in the same quarter last year

- Free Cash Flow Margin: 11.8%, down from 16.5% in the same quarter last year

- Market Capitalization: $301 billion

Company Overview

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE:CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

The company generates revenue through the sale of this heavy machinery, which includes big-rig loaders, mining equipment, diesel and natural gas engines, and industrial gas turbines. It also generates secondary income streams by renting out its products, financing them, providing insurance for them, selling aftermarket parts, and providing maintenance services for its equipment.

Caterpillar’s equipment is sold to customers in a range of industries including construction, mining, agriculture, industrials manufacturing, and companies throughout the value chain in the oil and gas sectors. Mining company giants like Glencore and Rio Tinto have been customers of Caterpillar historically.

Caterpillar sells its products through a global network of independent dealers, considered one of the largest in the world for the construction and mining industry, allowing the company to reach a variety of customers in a variety of geographic locations. These dealers, some of which may specialize in certain end markets or machinery types, not only stock and sell the company's products but advise customers on what may best fit their needs.

4. Construction Machinery

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new sales opportunities for construction machinery companies. On the other hand, construction machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

Competitors of Caterpillar include Deere (NYSE:DE), Volvo Construction Equipment (STO:VOLV-B), and Japanese multinational corporation Komatsu (TYO:6301).

5. Revenue Growth

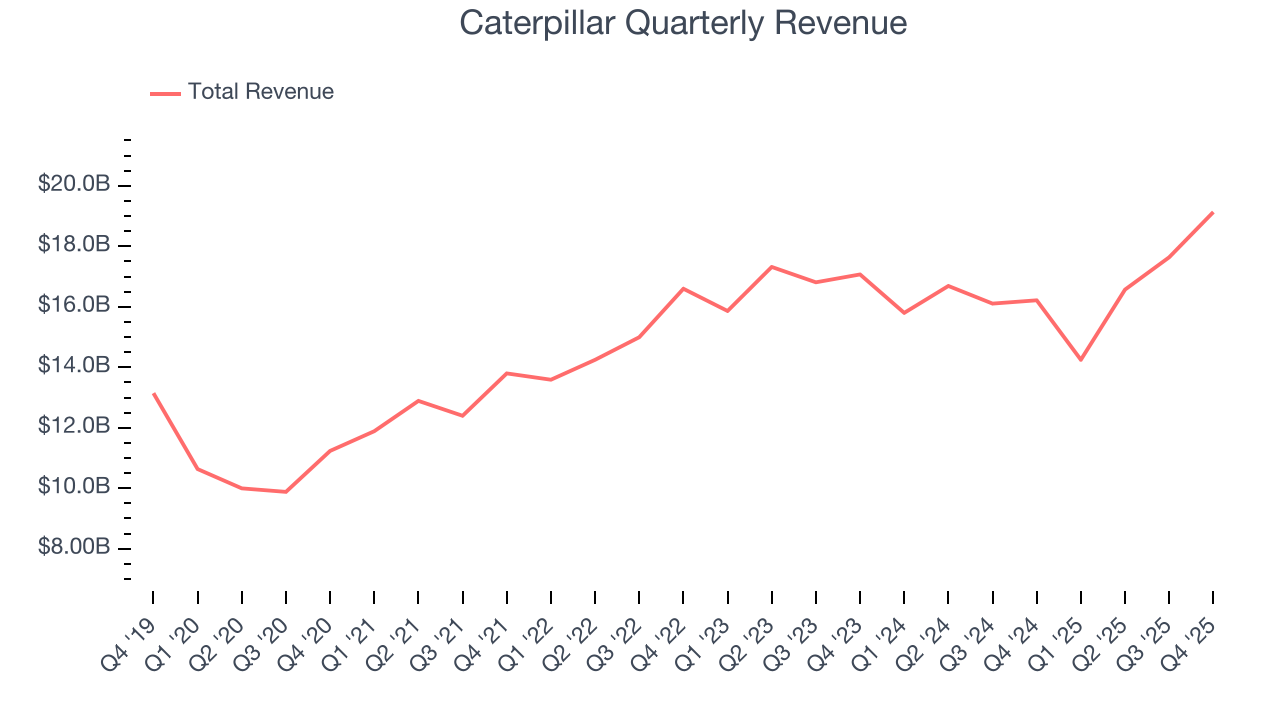

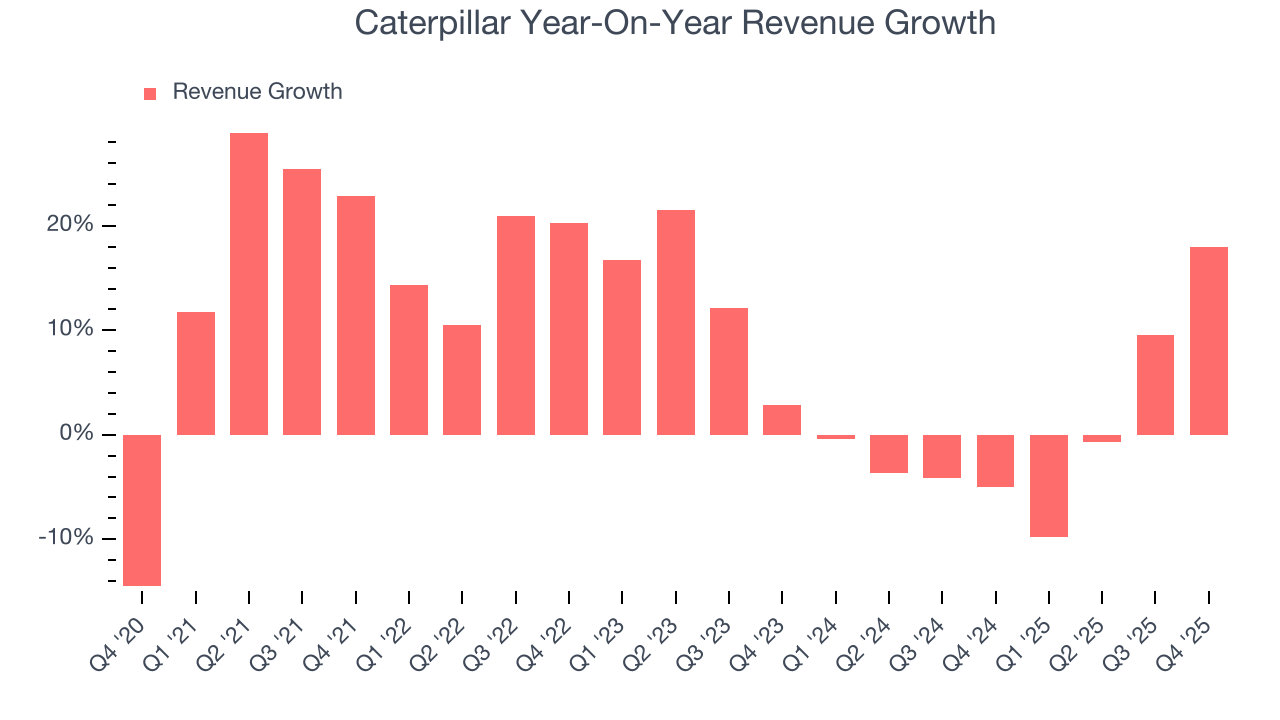

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Caterpillar grew its sales at a solid 10.1% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Caterpillar’s recent performance shows its demand has slowed as its revenue was flat over the last two years. We also note many other Construction Machinery businesses have faced declining sales because of cyclical headwinds. While Caterpillar’s growth wasn’t the best, it did do better than its peers.

This quarter, Caterpillar reported year-on-year revenue growth of 18%, and its $19.13 billion of revenue exceeded Wall Street’s estimates by 7.8%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

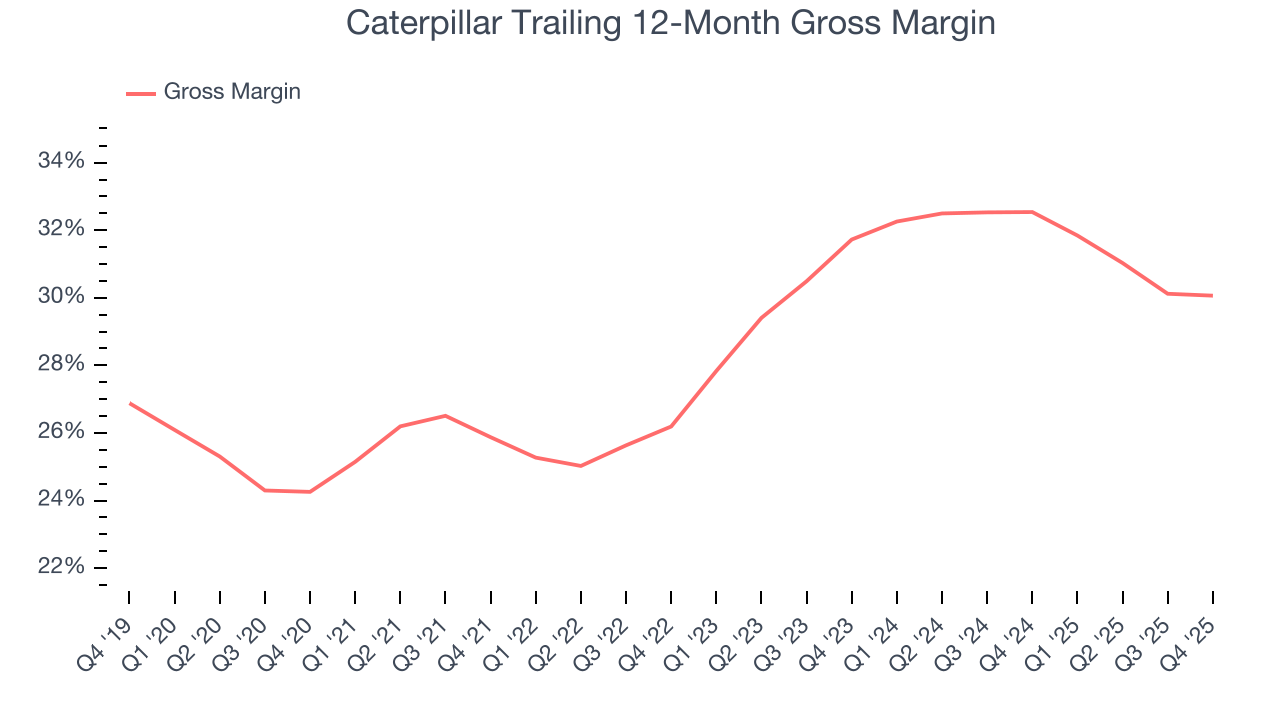

Caterpillar’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 29.5% gross margin over the last five years. Said differently, Caterpillar had to pay a chunky $70.49 to its suppliers for every $100 in revenue.

Caterpillar produced a 30.5% gross profit margin in Q4, in line with the same quarter last year. Zooming out, Caterpillar’s full-year margin has been trending down over the past 12 months, decreasing by 2.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

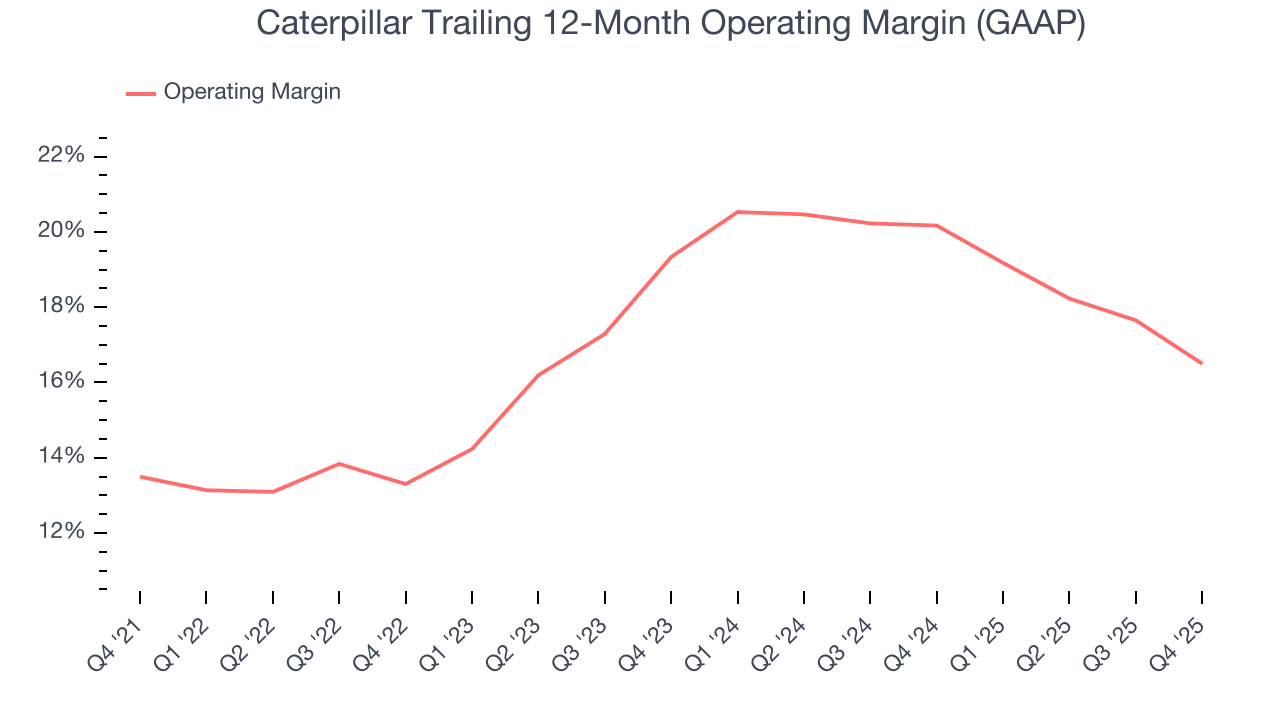

Caterpillar has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Caterpillar’s operating margin rose by 3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Caterpillar generated an operating margin profit margin of 13.9%, down 4.1 percentage points year on year. Since Caterpillar’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

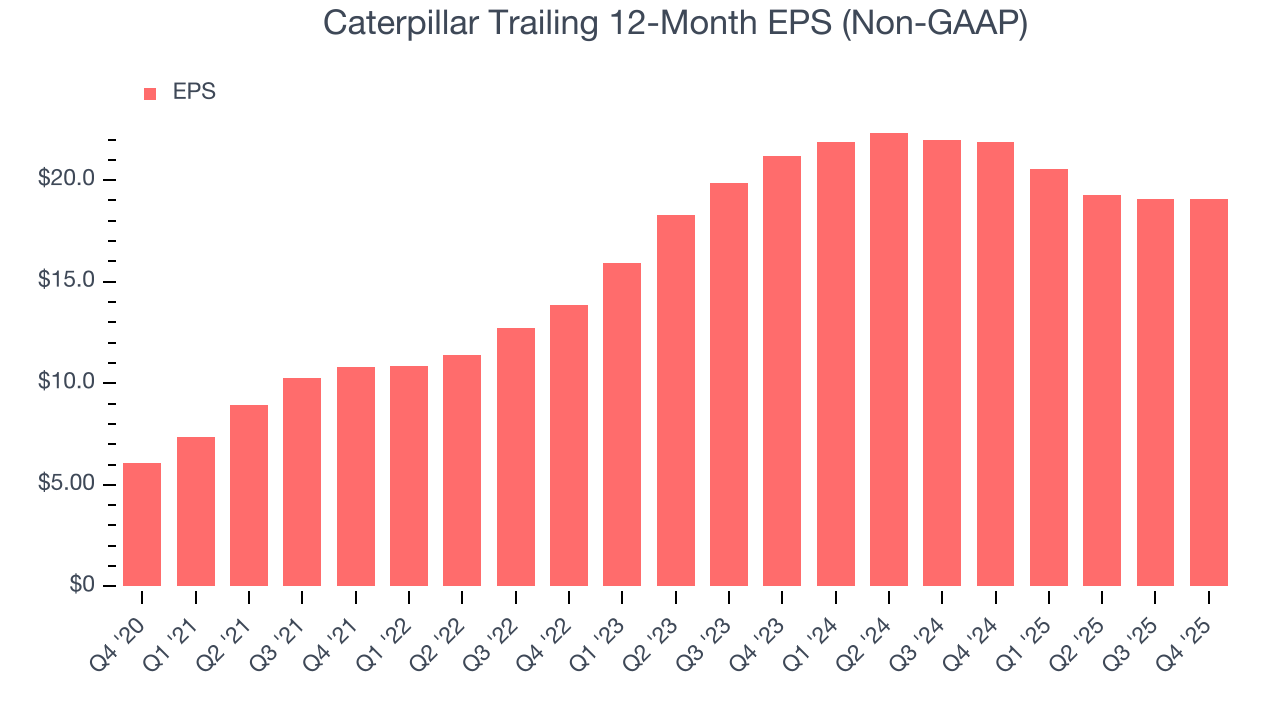

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

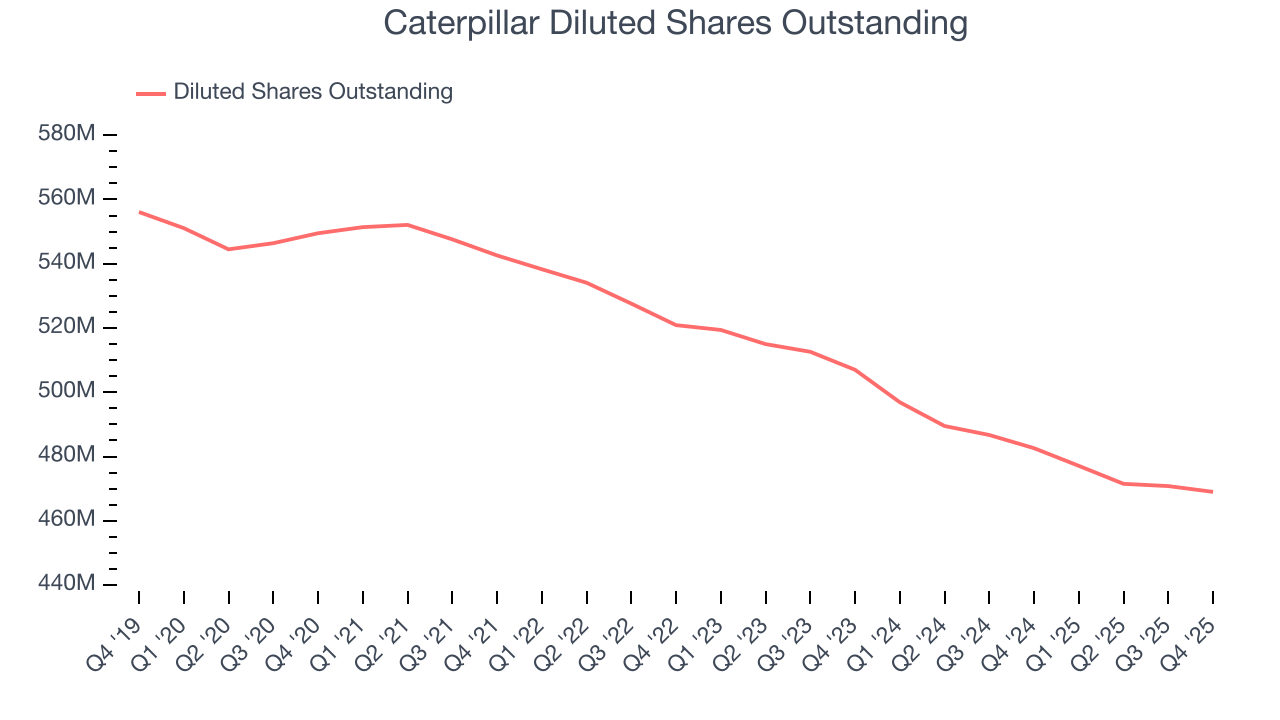

Caterpillar’s EPS grew at an astounding 25.7% compounded annual growth rate over the last five years, higher than its 10.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Caterpillar’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Caterpillar’s operating margin declined this quarter but expanded by 3 percentage points over the last five years. Its share count also shrank by 14.6%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Caterpillar, its two-year annual EPS declines of 5.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Caterpillar can return to earnings growth in the future.

In Q4, Caterpillar reported adjusted EPS of $5.16, up from $5.14 in the same quarter last year. This print beat analysts’ estimates by 9.5%. Over the next 12 months, Wall Street expects Caterpillar’s full-year EPS of $19.08 to grow 15%.

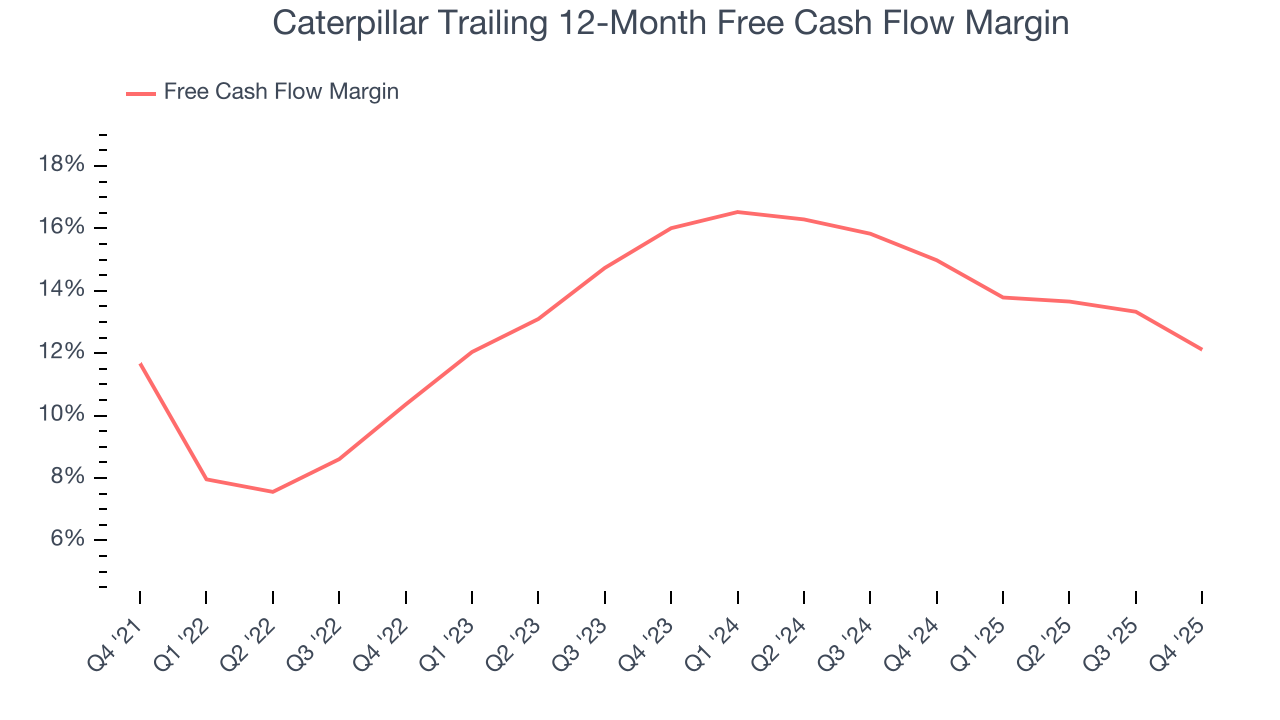

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Caterpillar has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 13.1% over the last five years, quite impressive for an industrials business.

Caterpillar’s free cash flow clocked in at $2.25 billion in Q4, equivalent to a 11.8% margin. The company’s cash profitability regressed as it was 4.8 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

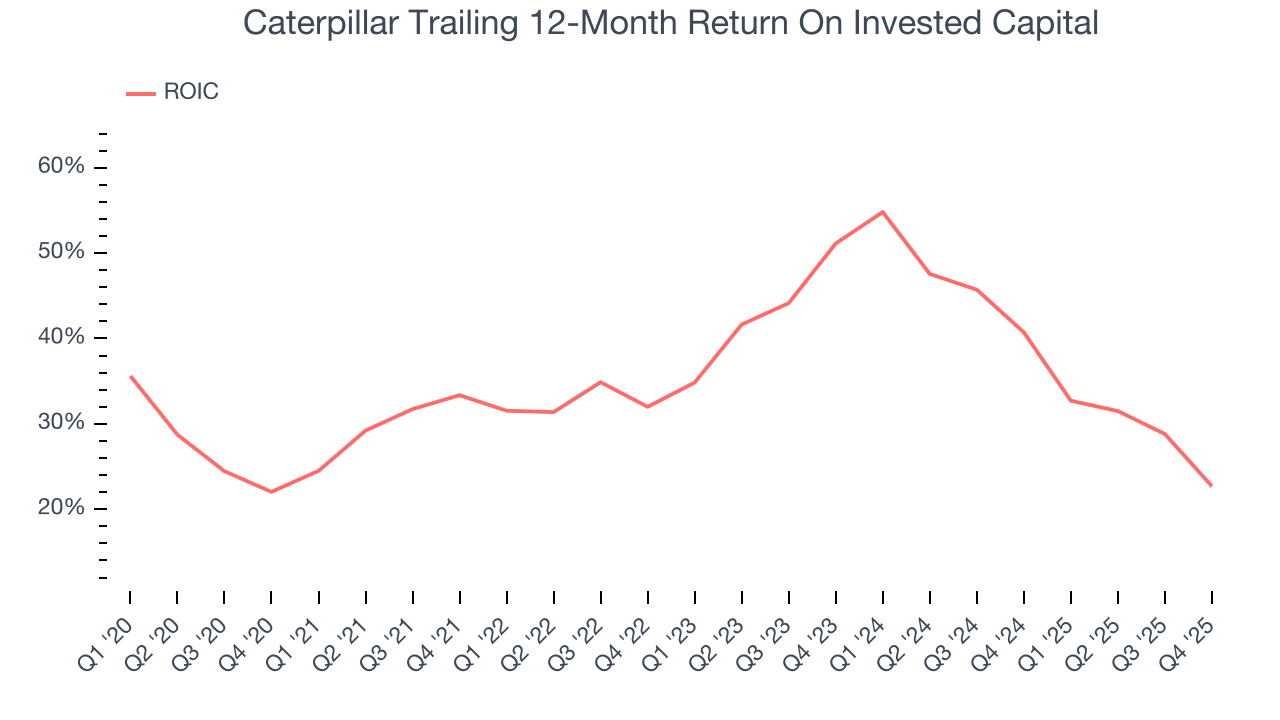

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Caterpillar hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 36%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Caterpillar’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

11. Balance Sheet Assessment

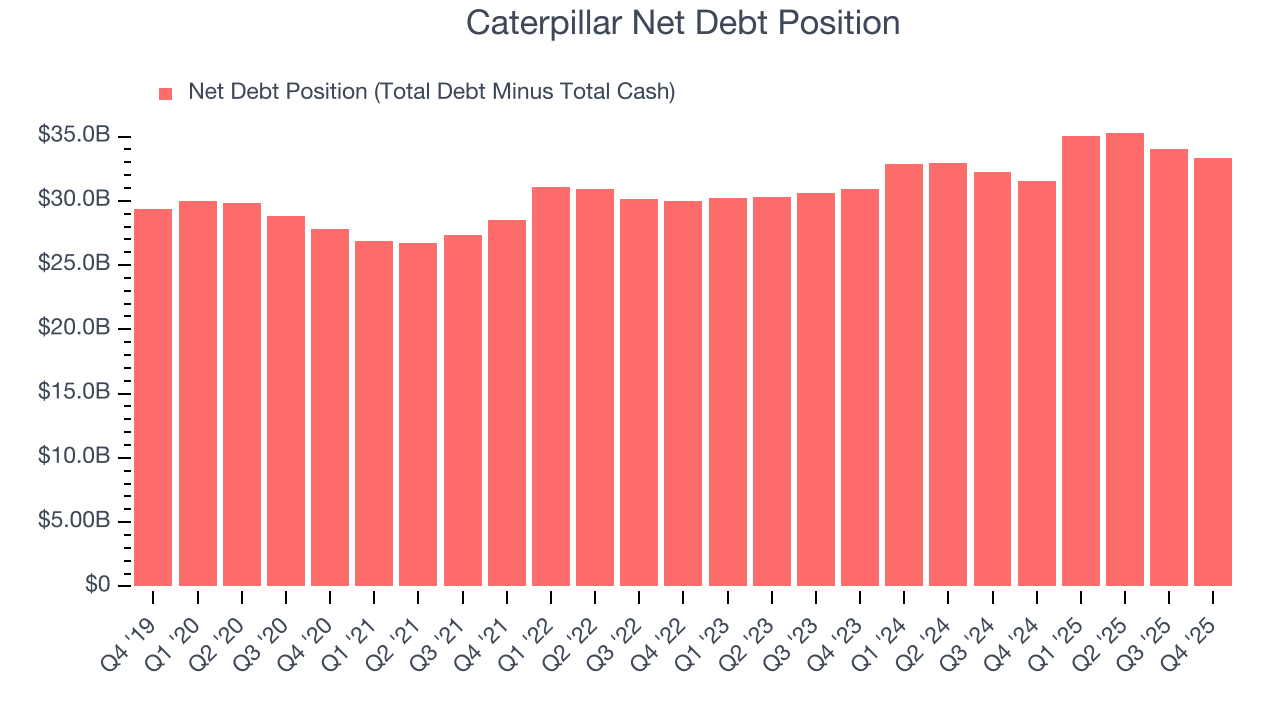

Caterpillar reported $9.98 billion of cash and $43.33 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $13.41 billion of EBITDA over the last 12 months, we view Caterpillar’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $256 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Caterpillar’s Q4 Results

We were impressed by how significantly Caterpillar blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates handily as well. Overall, this print was solid. The stock traded up 2.4% to $658.58 immediately after reporting.

13. Is Now The Time To Buy Caterpillar?

Updated: January 29, 2026 at 9:13 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Caterpillar.

Caterpillar isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its organic revenue declined.

Caterpillar’s P/E ratio based on the next 12 months is 29.3x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $625.99 on the company (compared to the current share price of $658.58), implying they don’t see much short-term potential in Caterpillar.