Chemed (CHE)

We’re not sold on Chemed. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Chemed Is Not Exciting

With a unique business model combining end-of-life care and household services, Chemed (NYSE:CHE) operates two distinct businesses: VITAS, which provides hospice care for terminally ill patients, and Roto-Rooter, which offers plumbing and water restoration services.

- Annual revenue growth of 4% over the last five years was below our standards for the healthcare sector

- Earnings per share lagged its peers over the last five years as they only grew by 3.6% annually

- On the bright side, its market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

Chemed doesn’t fulfill our quality requirements. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Chemed

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Chemed

Chemed’s stock price of $413.91 implies a valuation ratio of 17.1x forward P/E. Chemed’s valuation may seem like a bargain, especially when stacked up against other healthcare companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Chemed (CHE) Research Report: Q4 CY2025 Update

Healthcare services company Chemed Corporation (NYSE:CHE) missed Wall Street’s revenue expectations in Q4 CY2025, with sales flat year on year at $639.3 million. Its non-GAAP profit of $6.42 per share was 8.7% below analysts’ consensus estimates.

Chemed (CHE) Q4 CY2025 Highlights:

- Revenue: $639.3 million vs analyst estimates of $659.1 million (flat year on year, 3% miss)

- Adjusted EPS: $6.42 vs analyst expectations of $7.03 (8.7% miss)

- Adjusted EBITDA: $132.6 million vs analyst estimates of $144.2 million (20.7% margin, 8% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $23.75 at the midpoint, missing analyst estimates by 6.5%

- Operating Margin: 15.7%, down from 17.8% in the same quarter last year

- Free Cash Flow Margin: 18.3%, down from 23.8% in the same quarter last year

- Sales Volumes rose 1.3% year on year (14.6% in the same quarter last year)

- Market Capitalization: $6.61 billion

Company Overview

With a unique business model combining end-of-life care and household services, Chemed (NYSE:CHE) operates two distinct businesses: VITAS, which provides hospice care for terminally ill patients, and Roto-Rooter, which offers plumbing and water restoration services.

Chemed's VITAS segment is one of America's largest providers of hospice services, delivering palliative care through teams of physicians, nurses, home health aides, social workers, clergy, and volunteers. These professionals provide medical services and emotional support to terminal patients and their families, primarily in home settings but also in inpatient facilities when necessary. VITAS generates revenue mainly through Medicare and Medicaid reimbursements, which are paid on a per diem basis depending on the level of care provided.

The company's Roto-Rooter segment serves both residential and commercial customers across the United States through company-owned branches, independent contractors, and franchisees. When a homeowner discovers a backed-up toilet or a business faces a flooded basement, they might call Roto-Rooter for services ranging from routine drain cleaning to complex plumbing repairs and water damage restoration. For example, a restaurant with a grease-clogged kitchen drain might require Roto-Rooter's specialized equipment and expertise to avoid business disruption.

Roto-Rooter's business model includes direct service provision through company-owned operations and revenue from independent contractors and franchisees who pay fees to use the well-established Roto-Rooter brand and trademarks. The Roto-Rooter name has been in use since 1935 and has become one of the most recognized service brands in America.

While these two business segments operate independently and serve entirely different markets, they both provide essential services that customers need regardless of economic conditions. This diversification helps Chemed maintain stability through various market cycles, though both segments experience some seasonal fluctuations based on weather patterns and population movements.

4. Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

In the hospice care segment, Chemed's VITAS competes with Amedisys (NASDAQ:AMED), LHC Group (owned by UnitedHealth Group, NYSE:UNH), and Encompass Health (NYSE:EHC). Roto-Rooter's competitors include ServiceMaster (NYSE:SERV), Mr. Rooter (owned by Neighborly, private), and numerous regional and local plumbing service providers.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $2.53 billion in revenue over the past 12 months, Chemed has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Chemed’s sales grew at a tepid 4% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Chemed’s annualized revenue growth of 5.7% over the last two years is above its five-year trend, which is encouraging.

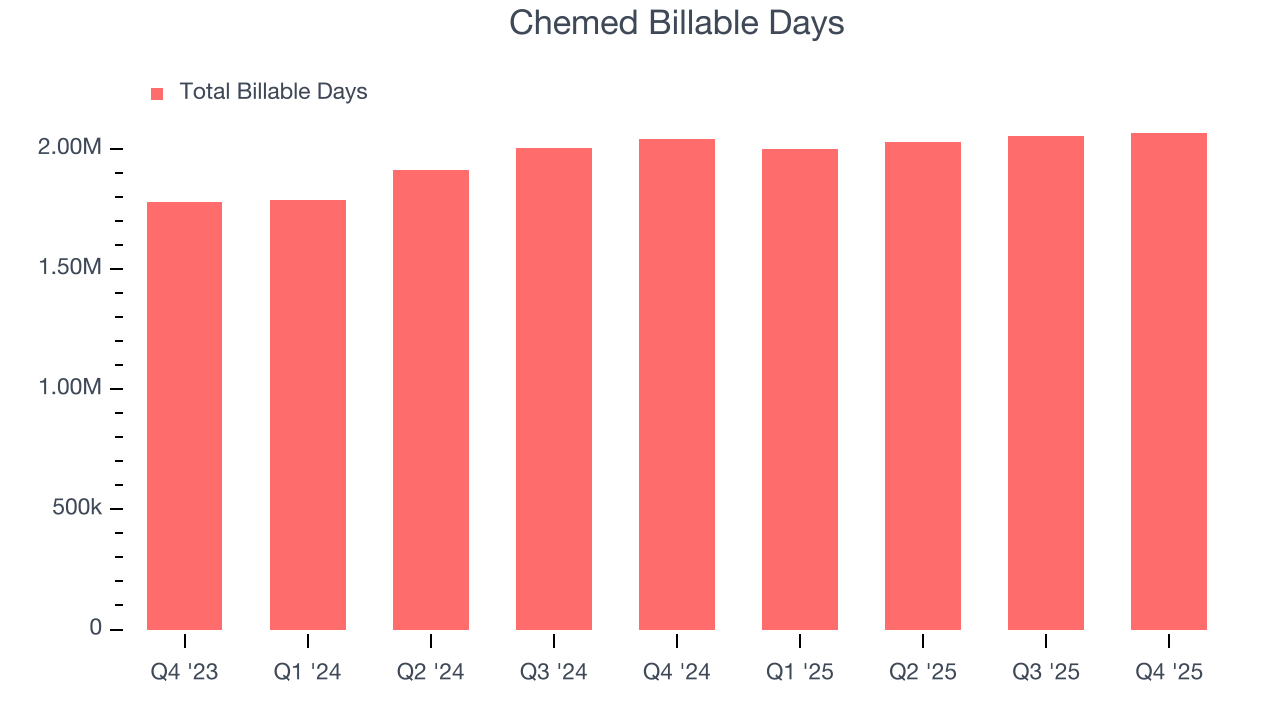

We can dig further into the company’s revenue dynamics by analyzing its number of billable days, which reached 2.07 million in the latest quarter. Over the last two years, Chemed’s billable days averaged 7.3% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Chemed missed Wall Street’s estimates and reported a rather uninspiring 0.1% year-on-year revenue decline, generating $639.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, similar to its two-year rate. This projection is above the sector average and suggests its newer products and services will catalyze better top-line performance.

7. Operating Margin

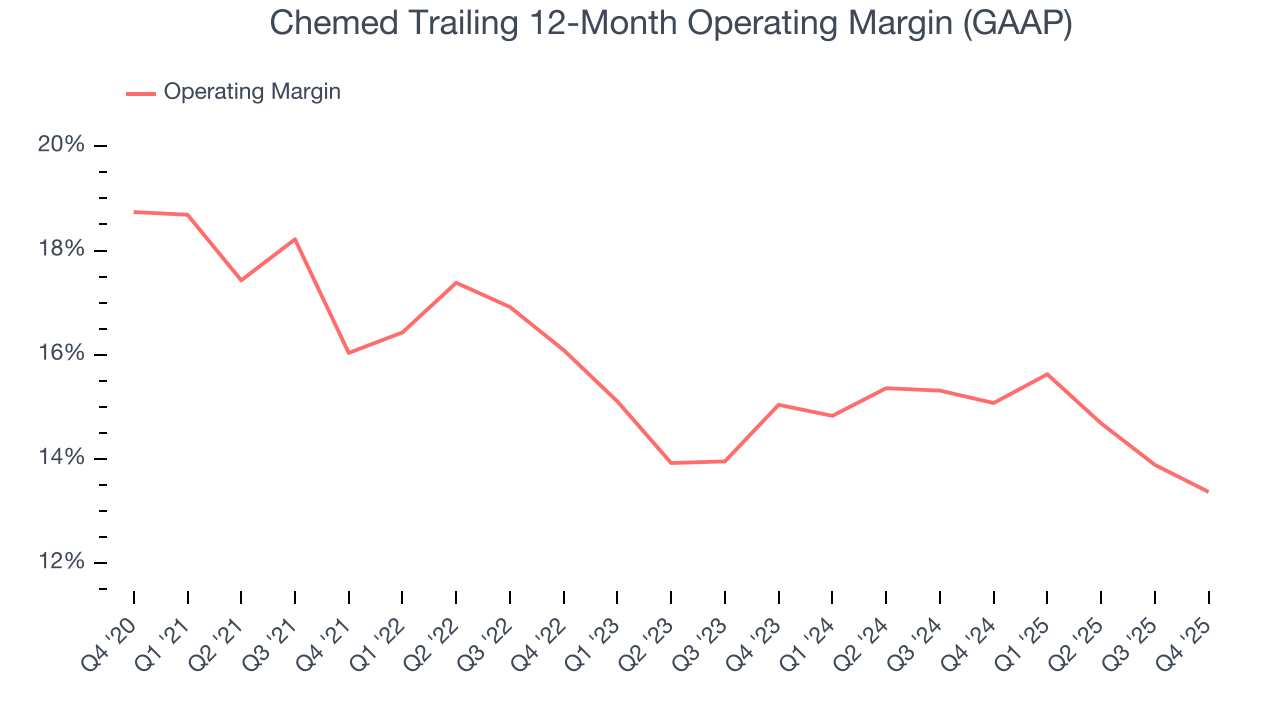

Chemed has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 15.1%.

Looking at the trend in its profitability, Chemed’s operating margin decreased by 2.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 1.7 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Chemed generated an operating margin profit margin of 15.7%, down 2.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

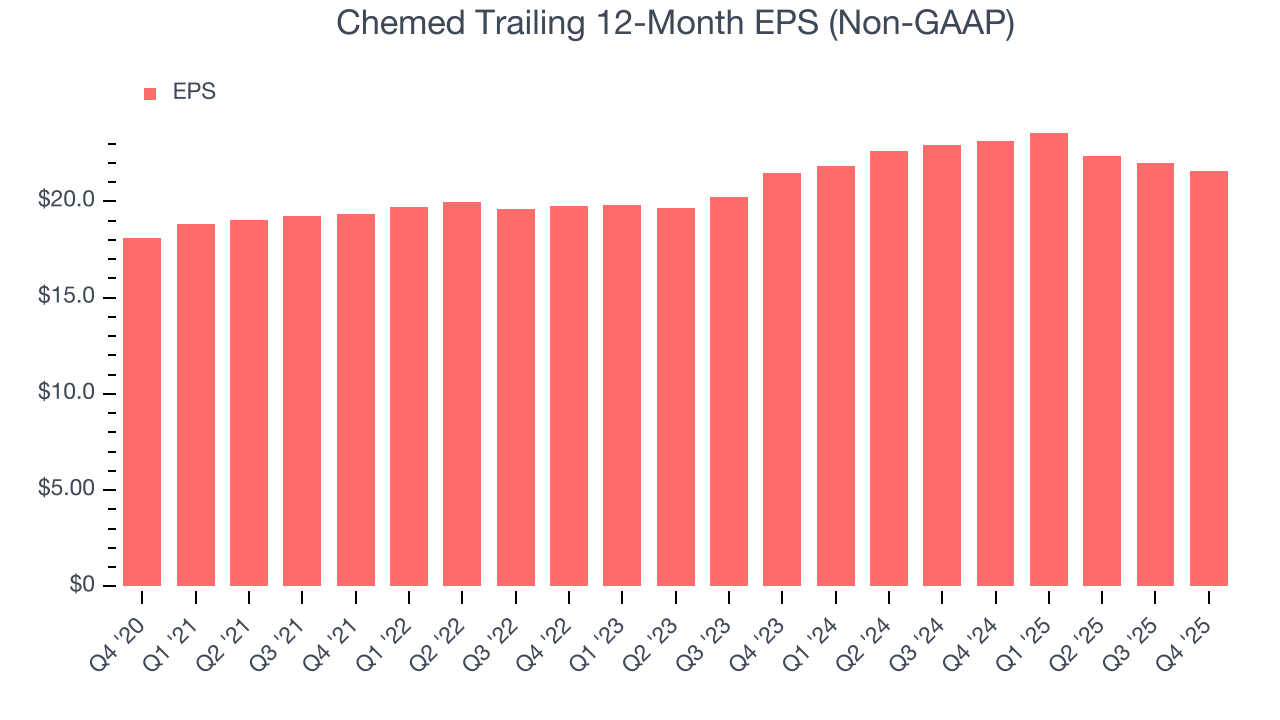

Chemed’s unimpressive 3.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Chemed reported adjusted EPS of $6.42, down from $6.83 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Chemed’s full-year EPS of $21.59 to grow 15.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Chemed has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.8% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that Chemed’s margin expanded by 1.2 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Chemed’s free cash flow clocked in at $117.2 million in Q4, equivalent to a 18.3% margin. The company’s cash profitability regressed as it was 5.4 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Chemed hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 27.9%, splendid for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Chemed’s ROIC decreased by 3.9 percentage points annually each year over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

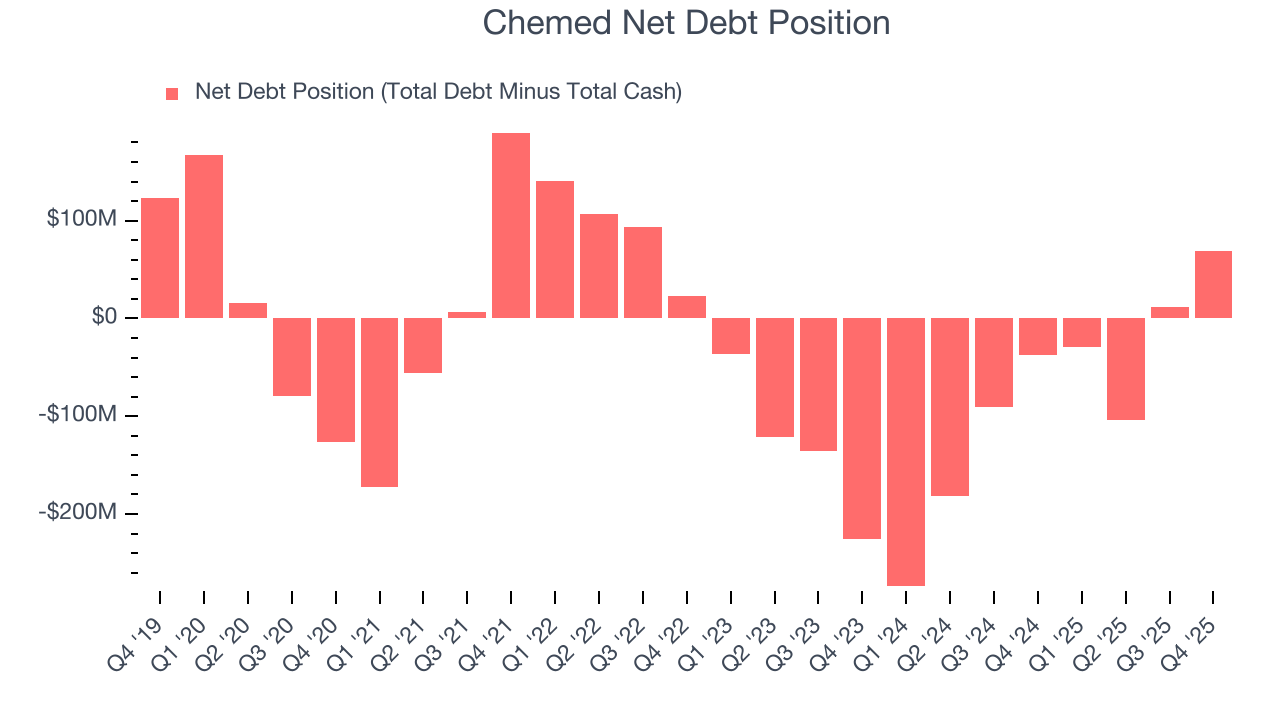

Chemed reported $74.52 million of cash and $143.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $458.7 million of EBITDA over the last 12 months, we view Chemed’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $4.92 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Chemed’s Q4 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 14.7% to $397.97 immediately following the results.

13. Is Now The Time To Buy Chemed?

Updated: March 5, 2026 at 11:30 PM EST

Before deciding whether to buy Chemed or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Chemed has a few positive attributes, but it doesn’t top our wishlist. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Chemed’s diminishing returns show management's prior bets haven't worked out, its stellar ROIC suggests it has been a well-run company historically.

Chemed’s P/E ratio based on the next 12 months is 17.1x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $443 on the company (compared to the current share price of $413.91).