Compass (COMP)

Compass is up against the odds. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Compass Will Underperform

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE:COMP) is a digital-first company operating a residential real estate brokerage in the United States.

- Annual revenue growth of 16% over the last five years was below our standards for the consumer discretionary sector

- Poor expense management has led to operating margin losses

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 1.9% for the last two years

Compass is in the penalty box. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Compass

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Compass

Compass’s stock price of $13.26 implies a valuation ratio of 21.3x forward P/E. While valuation is appropriate for the quality you get, we’re still on the sidelines for now.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Compass (COMP) Research Report: Q3 CY2025 Update

Real estate technology company Compass (NYSE:COMP) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 23.6% year on year to $1.85 billion. The company expects next quarter’s revenue to be around $1.64 billion, close to analysts’ estimates. Its GAAP loss of $0.01 per share was $0.01 above analysts’ consensus estimates.

Compass (COMP) Q3 CY2025 Highlights:

- Revenue: $1.85 billion vs analyst estimates of $1.79 billion (23.6% year-on-year growth, 3.2% beat)

- EPS (GAAP): -$0.01 vs analyst estimates of -$0.02 ($0.01 beat)

- Adjusted EBITDA: $93.6 million vs analyst estimates of $69.37 million (5.1% margin, 34.9% beat)

- Revenue Guidance for Q4 CY2025 is $1.64 billion at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for Q4 CY2025 is $42 million at the midpoint, above analyst estimates of $29.68 million

- Operating Margin: -0.4%, in line with the same quarter last year

- Free Cash Flow Margin: 4%, up from 2.2% in the same quarter last year

- Transactions: 67,886, up 12,014 year on year

- Market Capitalization: $4.34 billion

Company Overview

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE:COMP) is a digital-first company operating a residential real estate brokerage in the United States.

While the company operates like a traditional real estate brokerage on the surface by hiring agents and holding physical offices, Compass prides itself on its proprietary software platform designed to increase the productivity of its agents. Its integrated suite of software applications, from marketing and client relationship management tools to data analytics and workflow automation, aims to simplify the various stages of the real estate transaction process.

Compass’s agent-centric philosophy extends to its support and development programs. The company invests in the professional development of its agents, offering training and support that emphasize real estate expertise and technology utilization. This approach along with the increased efficiency from its software platform has historically attracted agents to the company (which, in theory, should lead to more transactions).

Compass generates revenue from transaction fees and supplements its core brokerage business with title, escrow, and financing services.

4. Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Compass's primary competitors include Zillow (NASDAQ:ZG), Redfin (NASDAQ:RDFN), and eXp World (NASDAQ:EXPI).

5. Revenue Growth

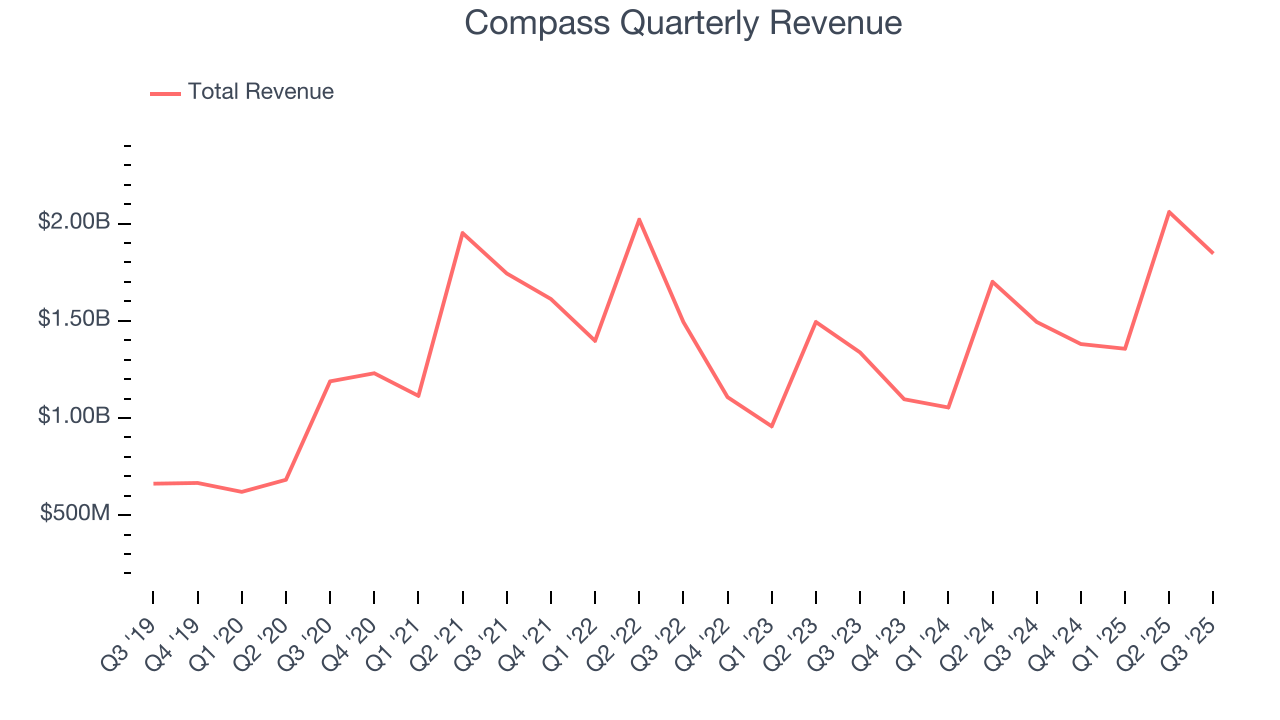

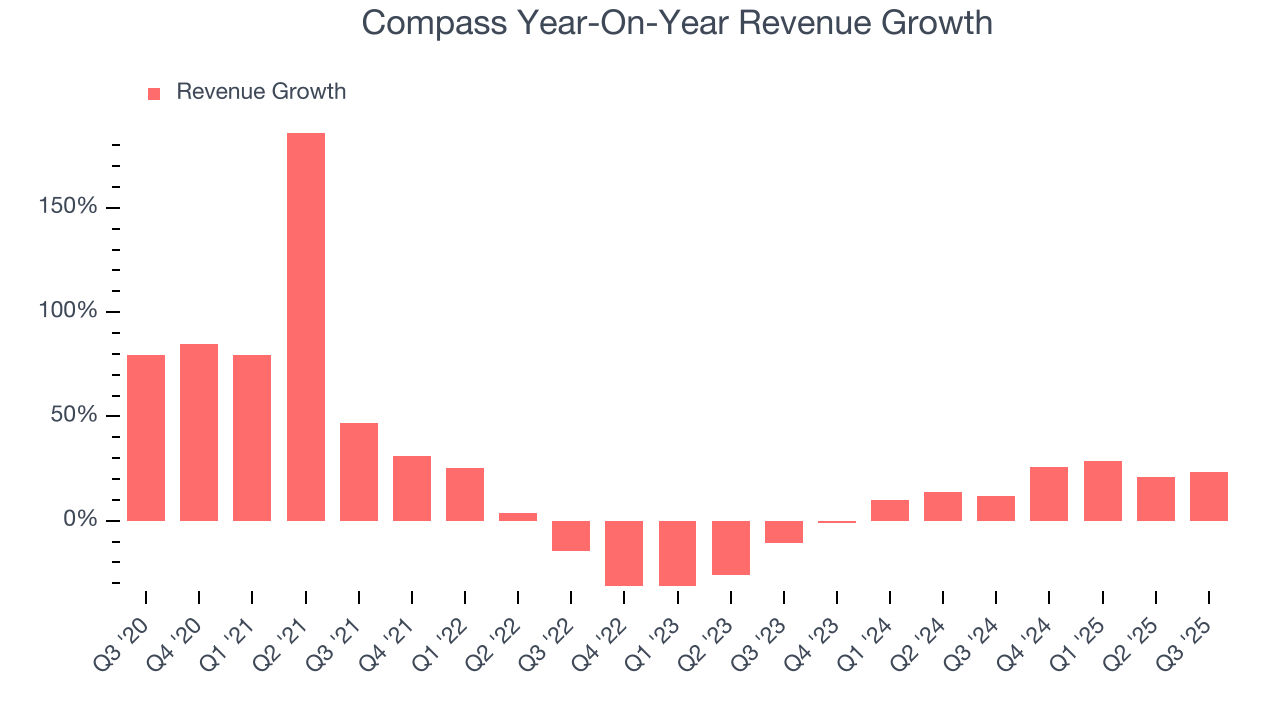

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Compass’s 16% annualized revenue growth over the last five years was decent. Its growth was slightly above the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Compass’s annualized revenue growth of 16.5% over the last two years aligns with its five-year trend, suggesting its demand was stable.

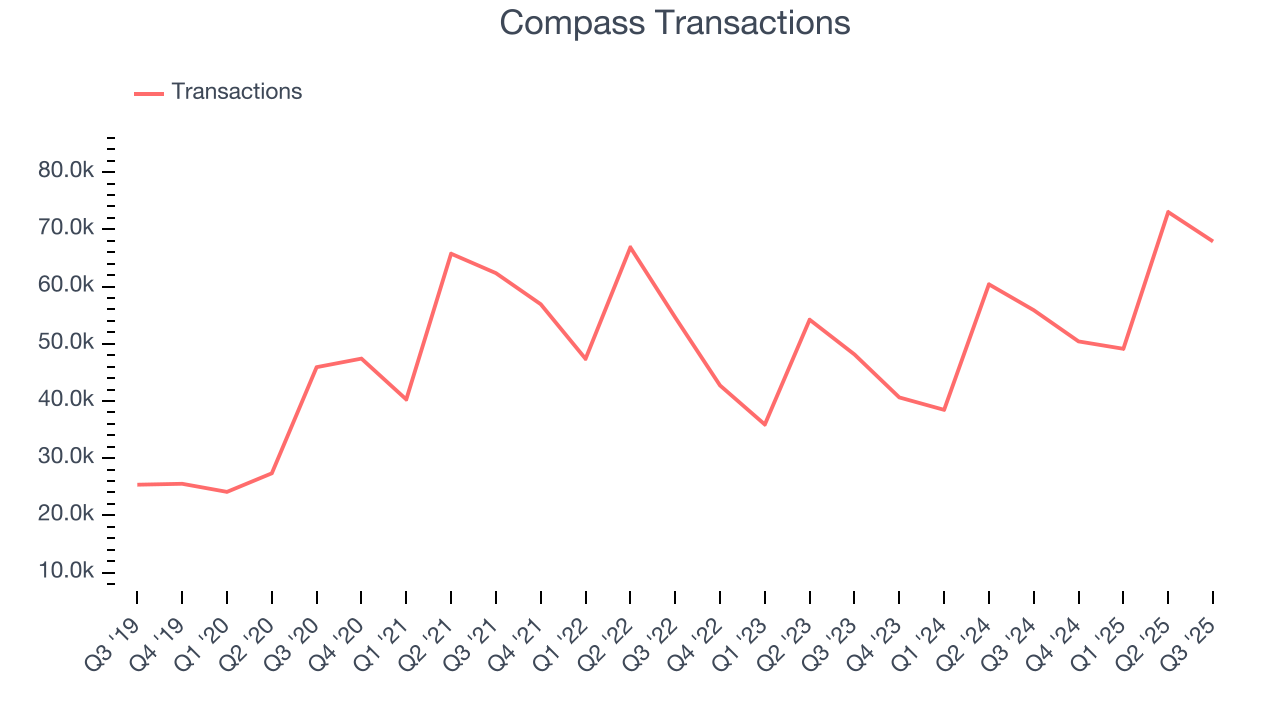

Compass also discloses its number of transactions, which reached 67,886 in the latest quarter. Over the last two years, Compass’s transactions averaged 15.5% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Compass reported robust year-on-year revenue growth of 23.6%, and its $1.85 billion of revenue topped Wall Street estimates by 3.2%. Company management is currently guiding for a 18.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is above the sector average and indicates the market is baking in some success for its newer products and services.

6. Operating Margin

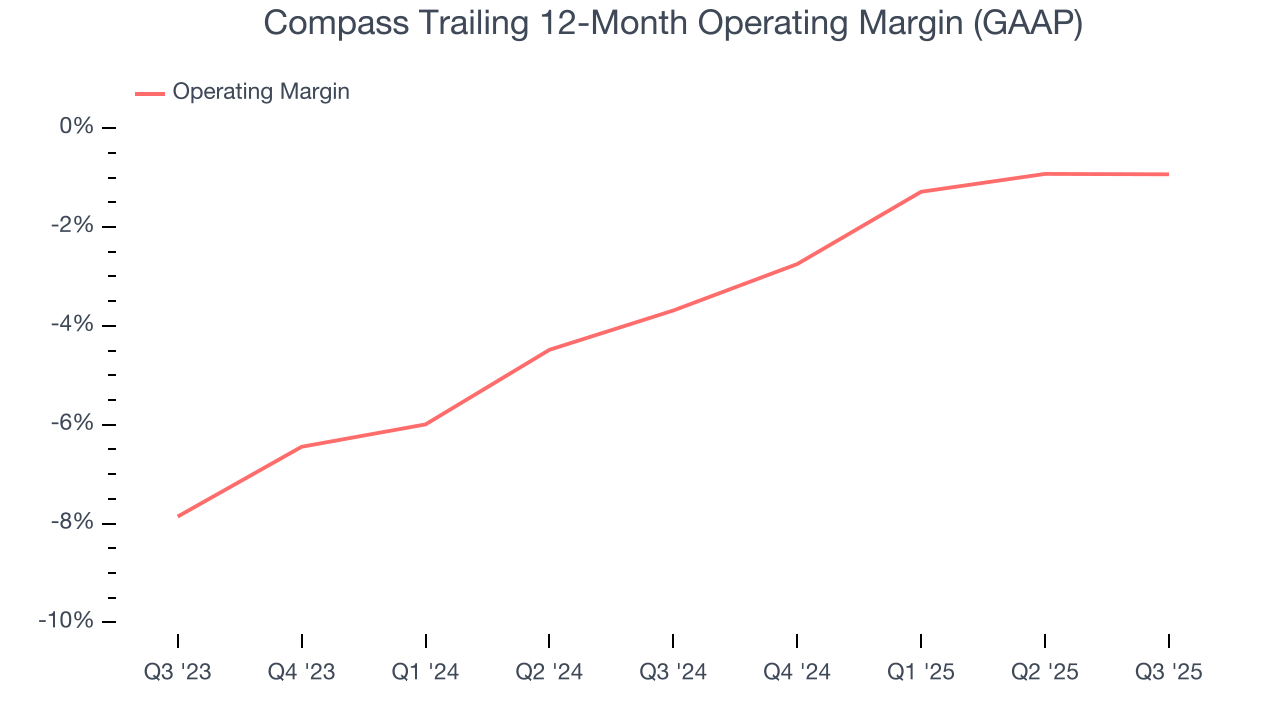

Compass’s operating margin has risen over the last 12 months, but it still averaged negative 2.2% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Compass generated a negative 0.4% operating margin.

7. Earnings Per Share

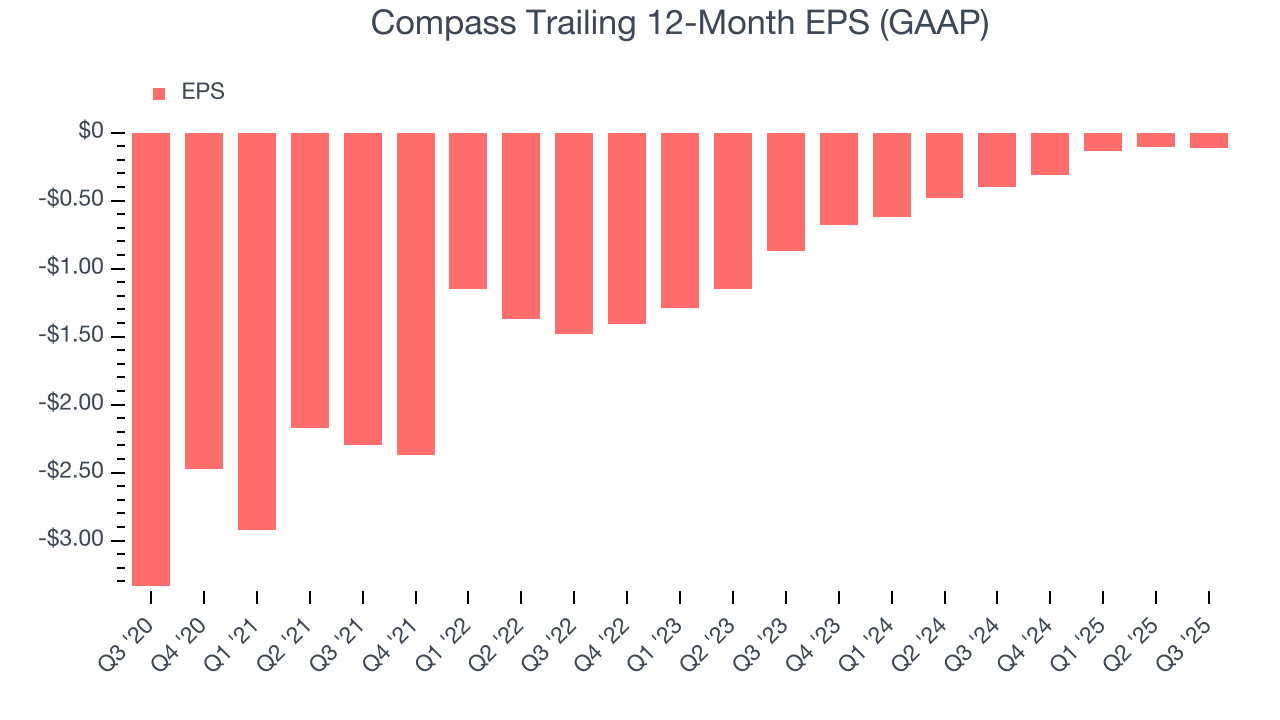

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Compass’s full-year earnings are still negative, it reduced its losses and improved its EPS by 49.5% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q3, Compass reported EPS of negative $0.01, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Compass’s full-year EPS of negative $0.11 will flip to positive $0.10.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

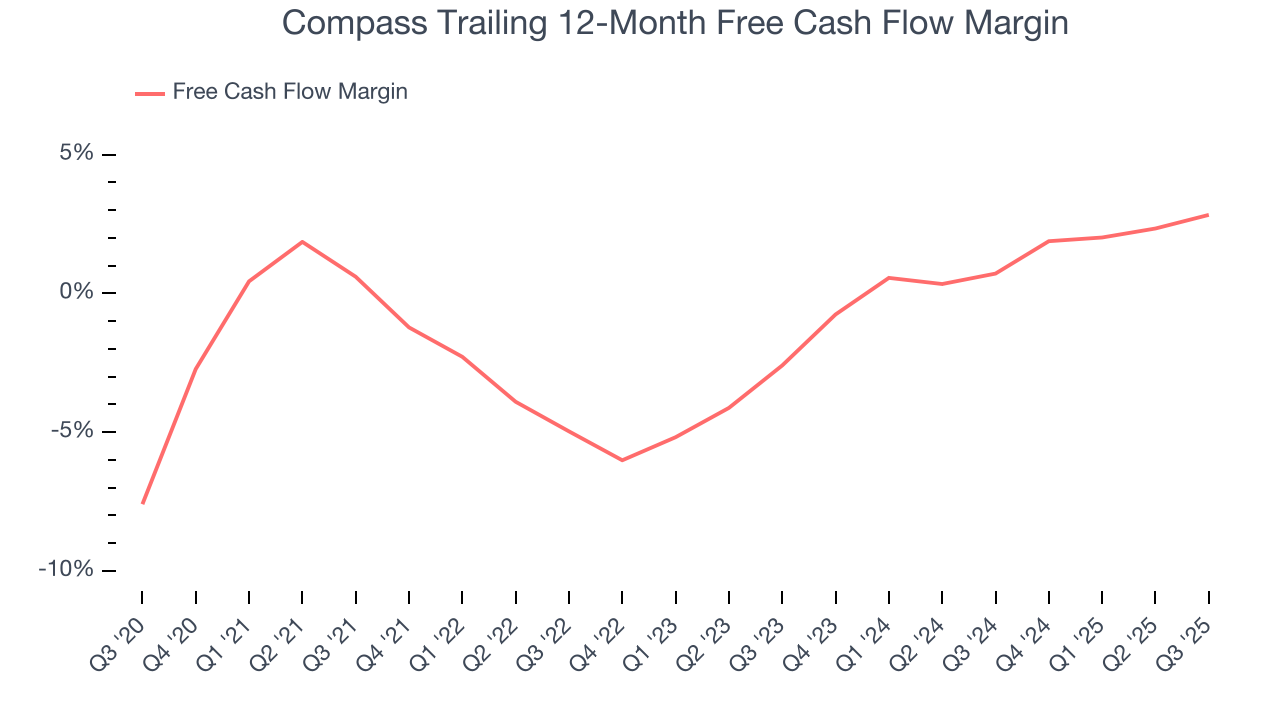

Compass has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.9%, lousy for a consumer discretionary business.

Compass’s free cash flow clocked in at $73.6 million in Q3, equivalent to a 4% margin. This result was good as its margin was 1.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

9. Balance Sheet Assessment

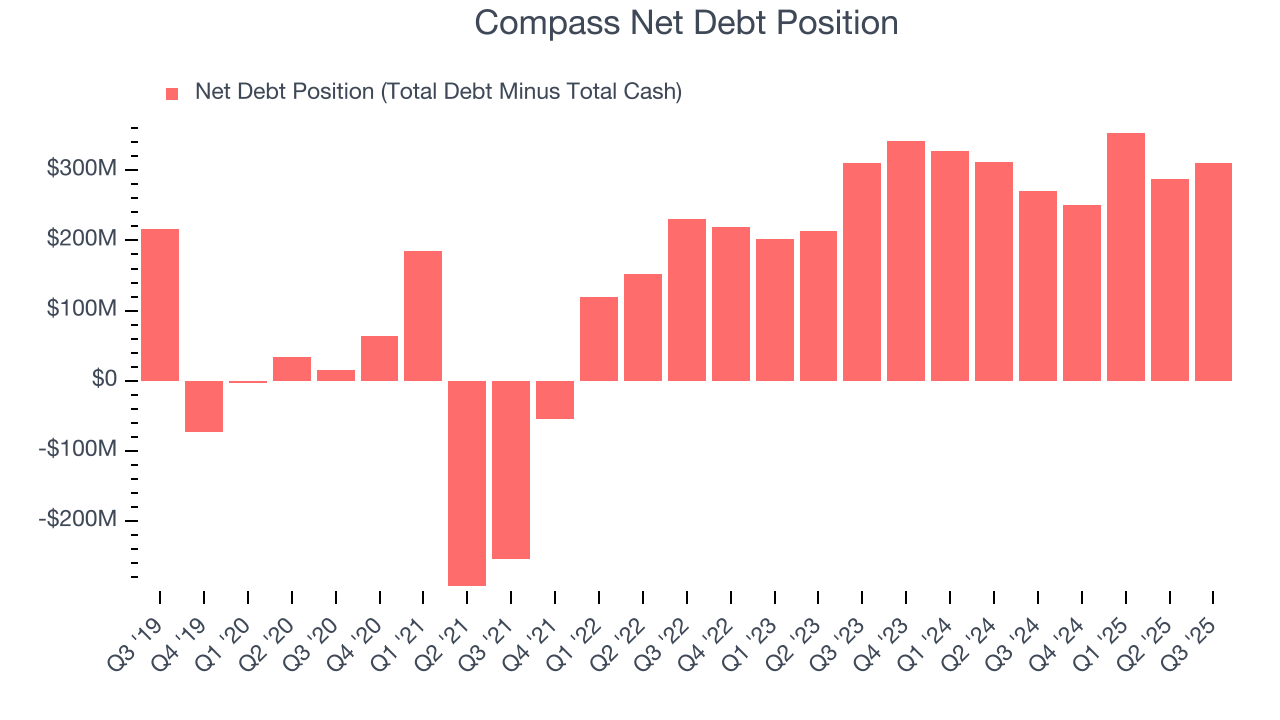

Compass reported $170.3 million of cash and $481 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $251.8 million of EBITDA over the last 12 months, we view Compass’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $500,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Compass’s Q3 Results

We were impressed by Compass’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.5% to $7.90 immediately following the results.

11. Is Now The Time To Buy Compass?

Updated: January 21, 2026 at 10:15 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Compass.

Compass doesn’t pass our quality test. To kick things off, its revenue growth was weak over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its low free cash flow margins give it little breathing room. On top of that, its operating margins reveal poor profitability compared to other consumer discretionary companies.

Compass’s P/E ratio based on the next 12 months is 21.3x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $13.78 on the company (compared to the current share price of $13.26).