Carter's (CRI)

Carter's keeps us up at night. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Carter's Will Underperform

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE:CRI) is an American designer and marketer of children's apparel.

- Products and services have few die-hard fans as sales have declined by 2% annually over the last five years

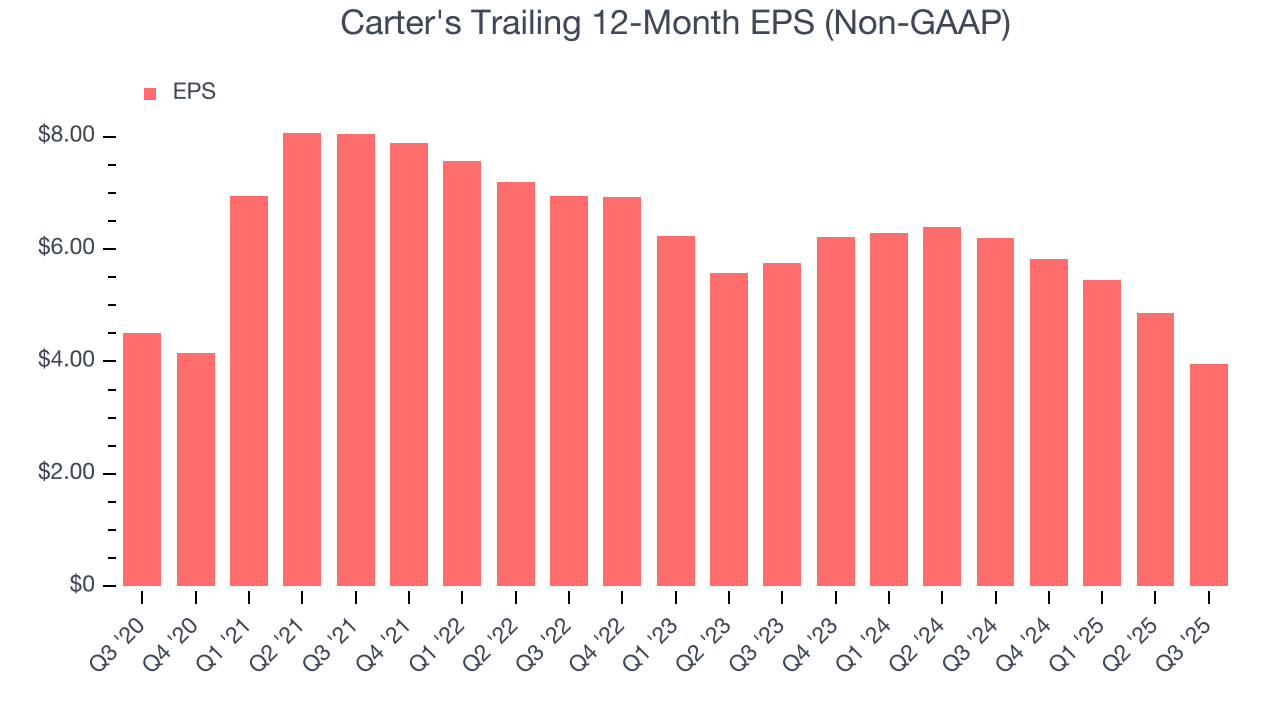

- Earnings per share have dipped by 2.5% annually over the past five years, which is concerning because stock prices follow EPS over the long term

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

Carter’s quality doesn’t meet our bar. There are more appealing investments to be made.

Why There Are Better Opportunities Than Carter's

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Carter's

At $42.03 per share, Carter's trades at 14.8x forward P/E. Yes, this valuation multiple is lower than that of other consumer discretionary peers, but we’ll remind you that you often get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Carter's (CRI) Research Report: Q3 CY2025 Update

Children’s apparel manufacturer Carter’s (NYSE:CRI) fell short of the market’s revenue expectations in Q3 CY2025, with sales flat year on year at $757.8 million. Its non-GAAP profit of $0.74 per share was in line with analysts’ consensus estimates.

Carter's (CRI) Q3 CY2025 Highlights:

- Revenue: $757.8 million vs analyst estimates of $772.4 million (flat year on year, 1.9% miss)

- Adjusted EPS: $0.74 vs analyst estimates of $0.74 (in line)

- Operating Margin: 3.8%, down from 10.2% in the same quarter last year

- Free Cash Flow was -$179 million compared to -$95.69 million in the same quarter last year

- Same-Store Sales rose 2% year on year (-7.1% in the same quarter last year)

- Market Capitalization: $1.18 billion

Company Overview

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE:CRI) is an American designer and marketer of children's apparel.

The company's flagship brand, Carter's, caters to parents and caregivers seeking reliable children's clothes including bodysuits, pajamas, outerwear, and swimwear.

Since its founding in 1865, it has acquired two other brands to expand its offerings: OshKosh B'gosh (2005) and Skip Hop (2017). OshKosh B'gosh is a fashion-forward clothing brand focusing on denim products while Skip Hop provides lifestyle goods such as diaper bags, toys, baby gear, and home essentials.

Carter's sells its products through retail stores in the United States, Canada, and Mexico, as well as online and in department stores, national chains, specialty retailers, and distributors internationally. Its multi-channel approach reflects the company’s vision that parents should be able to access children’s clothing in the most convenient way possible.

4. Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Carter's primary competitors include The Children's Place (NASDAQ:PLCE), Gap (NYSE:GPS), Gymboree (owned by Hanesbrands NYSE:HBI), and Zara Kids (owned by Inditex BME:ITX).

5. Revenue Growth

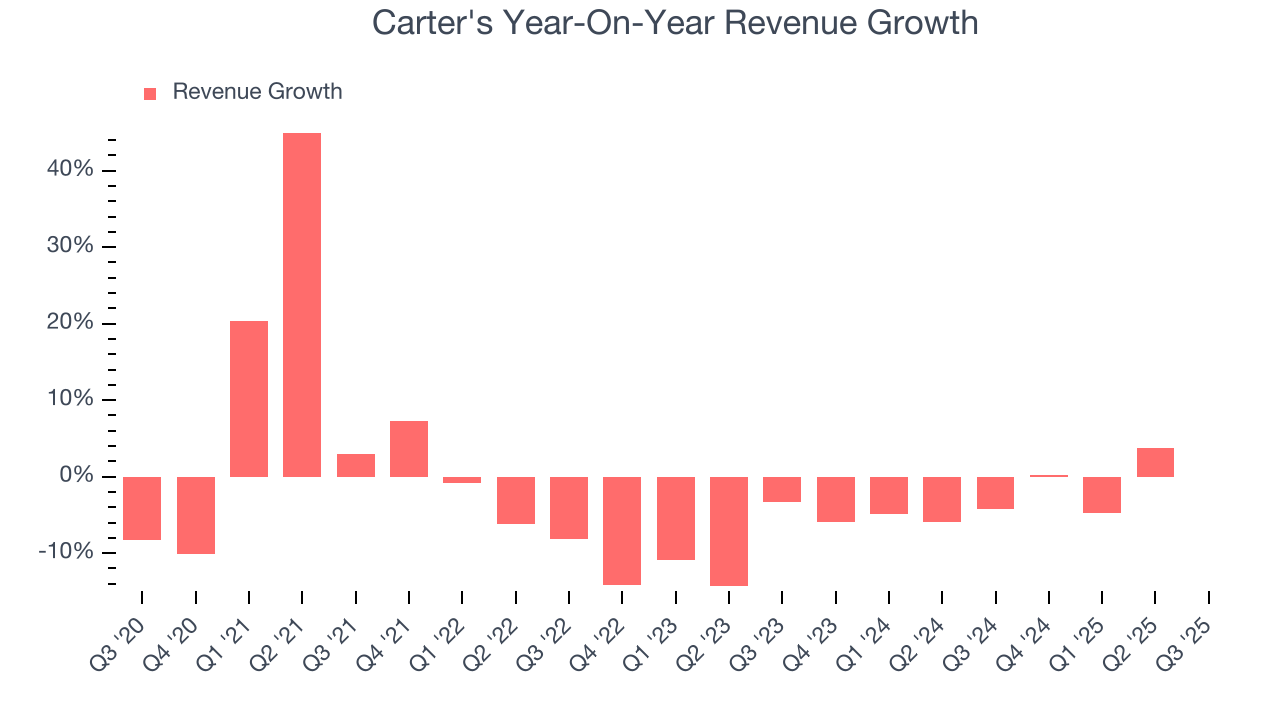

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Carter's struggled to consistently generate demand over the last five years as its sales dropped at a 2% annual rate. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Carter’s annualized revenue declines of 2.8% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Carter’s same-store sales averaged 5.1% year-on-year declines. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Carter's missed Wall Street’s estimates and reported a rather uninspiring 0.1% year-on-year revenue decline, generating $757.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

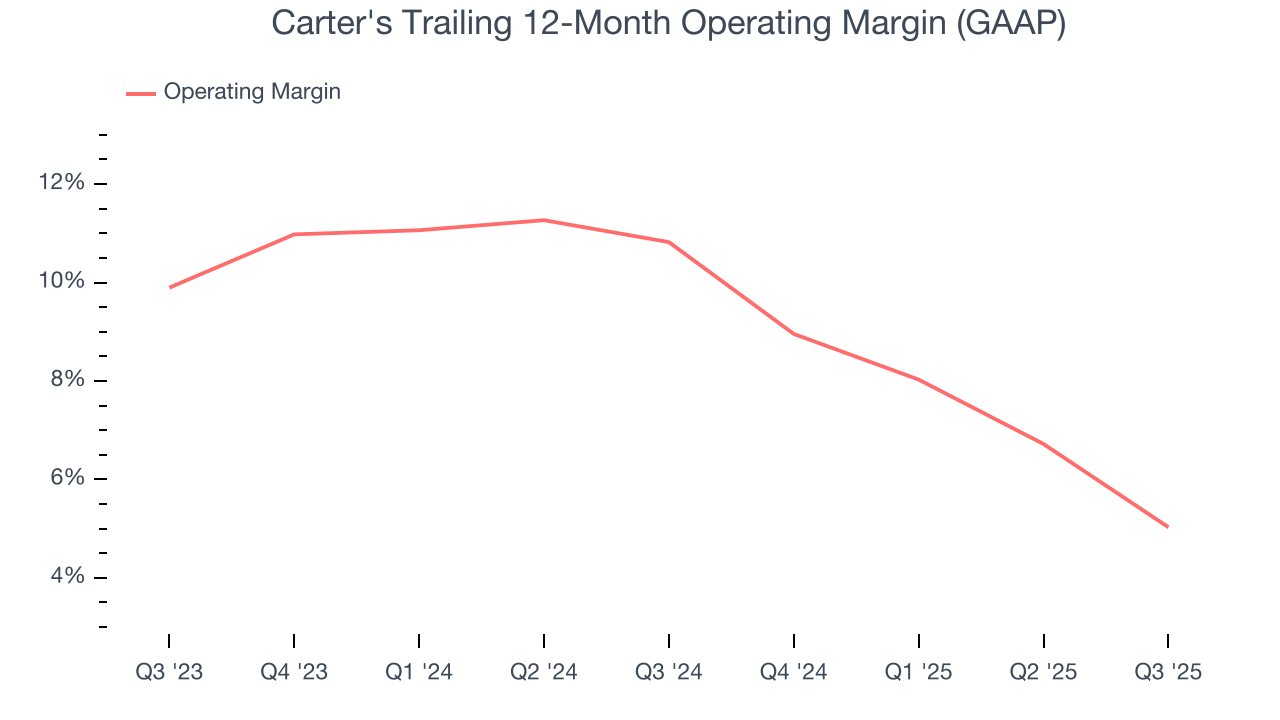

Carter’s operating margin has been trending down over the last 12 months and averaged 7.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Carter's generated an operating margin profit margin of 3.8%, down 6.3 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Carter's, its EPS and revenue declined by 2.5% and 2% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Carter’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Carter's reported adjusted EPS of $0.74, down from $1.64 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Carter’s full-year EPS of $3.96 to shrink by 43.3%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Carter's has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.9%, subpar for a consumer discretionary business.

Carter's burned through $179 million of cash in Q3, equivalent to a negative 23.6% margin. The company’s cash burn increased from $95.69 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

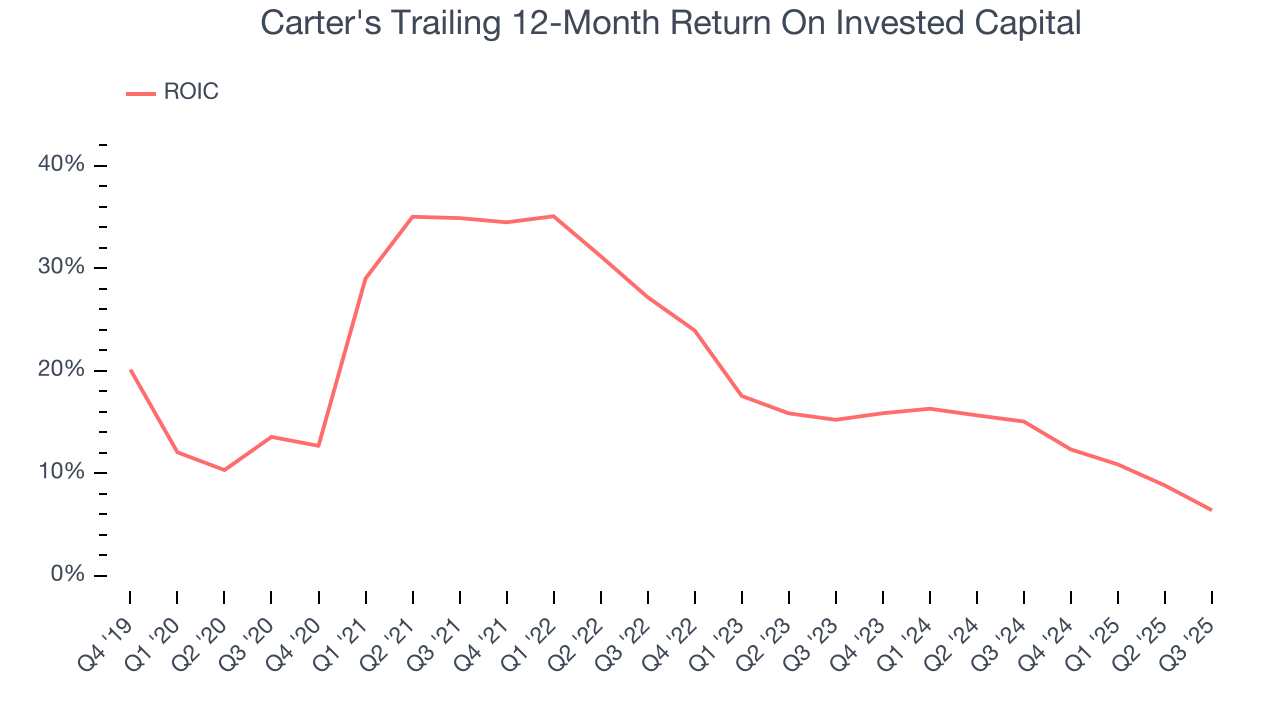

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Carter's hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 19.8%, impressive for a consumer discretionary business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Carter’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

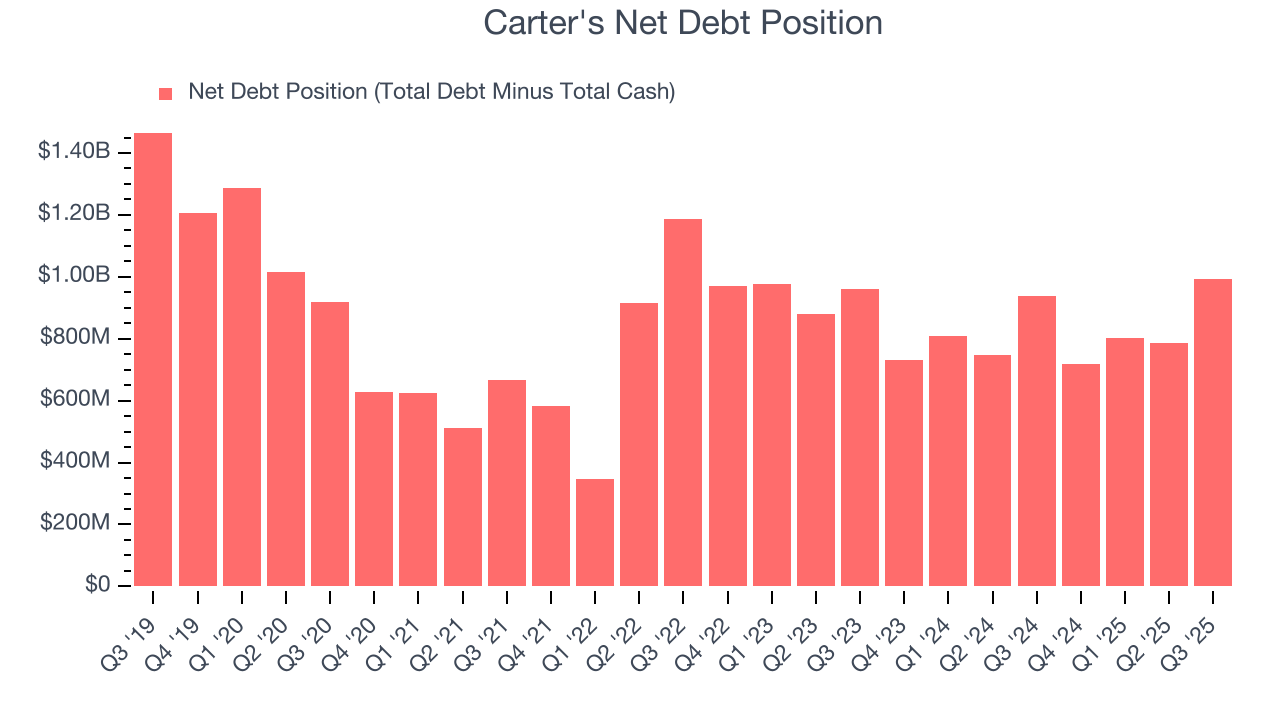

10. Balance Sheet Assessment

Carter's reported $184.2 million of cash and $1.18 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $255 million of EBITDA over the last 12 months, we view Carter’s 3.9× net-debt-to-EBITDA ratio as safe. We also see its $9.42 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Carter’s Q3 Results

Same-store sales narrowly outperformed Wall Street’s estimates, but revenue missed. Operating margin was also down year on year. Zooming out, we think this quarter could have been better. The stock traded down 10.4% to $29 immediately following the results.

12. Is Now The Time To Buy Carter's?

Updated: February 19, 2026 at 9:48 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Carter's.

Carter's falls short of our quality standards. On top of that, Carter’s same-store sales performance has disappointed, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

Carter’s P/E ratio based on the next 12 months is 14.8x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $34.80 on the company (compared to the current share price of $42.03).