Custom Truck One Source (CTOS)

We’re skeptical of Custom Truck One Source. Its weak returns on capital indicate management was inefficient with its resources and missed opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Custom Truck One Source Will Underperform

Inspired by a family gas station, Custom Truck One Source (NYSE:CTOS) is a distributor of trucks and heavy equipment.

- Cash burn makes us question whether it can achieve sustainable long-term growth

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- On the bright side, its earnings growth has beaten its peers over the last four years as its EPS has compounded at 43.9% annually

Custom Truck One Source’s quality doesn’t meet our bar. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Custom Truck One Source

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Custom Truck One Source

Custom Truck One Source’s stock price of $7.07 implies a valuation ratio of 8.1x forward EV-to-EBITDA. The current valuation may be fair, but we’re still passing on this stock due to better alternatives out there.

We’d rather pay up for companies with elite fundamentals than get a bargain on poor ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Custom Truck One Source (CTOS) Research Report: Q3 CY2025 Update

Heavy equipment distributor Custom Truck One Source (NYSE:CTOS) fell short of the market’s revenue expectations in Q3 CY2025, but sales rose 7.8% year on year to $482.1 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $2.02 billion at the midpoint. Its GAAP loss of $0.03 per share was in line with analysts’ consensus estimates.

Custom Truck One Source (CTOS) Q3 CY2025 Highlights:

- Revenue: $482.1 million vs analyst estimates of $489.5 million (7.8% year-on-year growth, 1.5% miss)

- EPS (GAAP): -$0.03 vs analyst estimates of -$0.02 (in line)

- Adjusted EBITDA: $95.96 million vs analyst estimates of $93.02 million (19.9% margin, 3.2% beat)

- The company reconfirmed its revenue guidance for the full year of $2.02 billion at the midpoint

- EBITDA guidance for the full year is $380 million at the midpoint, above analyst estimates of $374.6 million

- Operating Margin: 6.8%, up from 5.2% in the same quarter last year

- Free Cash Flow was -$42.17 million compared to -$96.77 million in the same quarter last year

- Backlog: $279.8 million at quarter end

- Market Capitalization: $1.50 billion

Company Overview

Inspired by a family gas station, Custom Truck One Source (NYSE:CTOS) is a distributor of trucks and heavy equipment.

The company provides equipment for sectors such as construction, utility, forestry, and rail. For example, Custom Truck One Source supplies utility companies with bucket trucks and digger derricks, while construction firms rely on their specialized cranes and heavy equipment. Additionally, the company offers custom modifications to tailor equipment to unique project needs for optimal performance.

The primary revenue sources for Custom Truck One Source include equipment sales, rental fees, and service charges for custom modifications. Its business model focuses on providing its offerings through a network of locations across the United States.

Recurring revenue is a meaningful part of the revenue base and generated through long-term rental agreements that include maintenance. Sales and ongoing custom modification services are more one-time in nature.

4. Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Competitors in the equipment rental industry include WillScot (NASDAQ:WSC), Herc Holdings (NYSE:HRI), and United Rentals (NYSE:URI).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Custom Truck One Source’s sales grew at an excellent 13.5% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Custom Truck One Source’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2.9% over the last two years was well below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Equipment Rental and Aftermarket Parts and Services, which are 35.1% and 7.8% of revenue. Over the last two years, Custom Truck One Source’s Equipment Rental revenue ( lifts, cranes, trucks) averaged 3.5% year-on-year declines. On the other hand, its Aftermarket Parts and Services revenue (maintenance and repair) averaged 1.1% growth.

This quarter, Custom Truck One Source’s revenue grew by 7.8% year on year to $482.1 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Custom Truck One Source’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 27.7% gross margin over the last five years. Said differently, Custom Truck One Source had to pay a chunky $72.30 to its suppliers for every $100 in revenue.

Custom Truck One Source produced a 20.9% gross profit margin in Q3, in line with the same quarter last year. Zooming out, Custom Truck One Source’s full-year margin has been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Custom Truck One Source was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Custom Truck One Source’s operating margin rose by 9.3 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Custom Truck One Source generated an operating margin profit margin of 6.8%, up 1.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

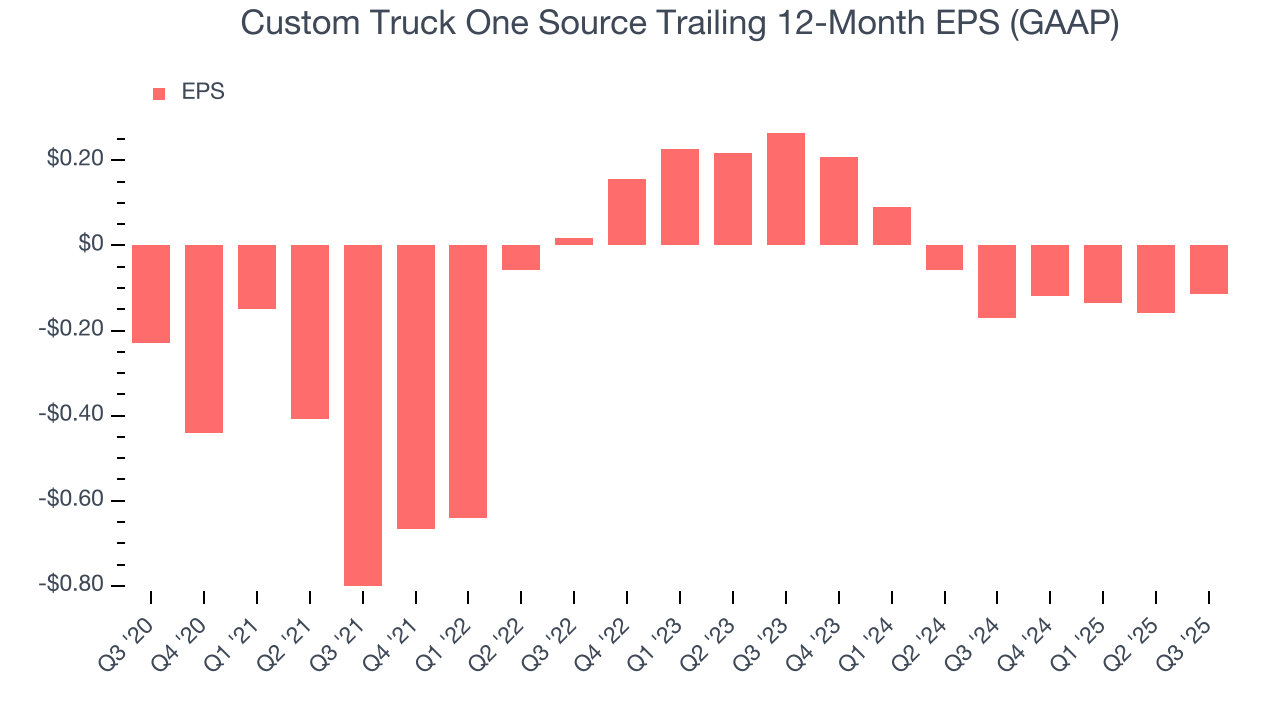

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Custom Truck One Source’s full-year earnings are still negative, it reduced its losses and improved its EPS by 12.9% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Custom Truck One Source, its EPS declined by 56% annually over the last two years while its revenue grew by 2.9%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Custom Truck One Source’s earnings can give us a better understanding of its performance. While we mentioned earlier that Custom Truck One Source’s operating margin expanded this quarter, a two-year view shows its margin has declined. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Custom Truck One Source reported EPS of negative $0.03, up from negative $0.07 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Custom Truck One Source’s full-year EPS of negative $0.12 will flip to positive $0.04.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Custom Truck One Source’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10.3%, meaning it lit $10.31 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Custom Truck One Source’s margin dropped by 19.4 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business.

Custom Truck One Source burned through $42.17 million of cash in Q3, equivalent to a negative 8.7% margin. The company’s cash burn slowed from $96.77 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Custom Truck One Source historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.3%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Custom Truck One Source’s ROIC averaged 4.3 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

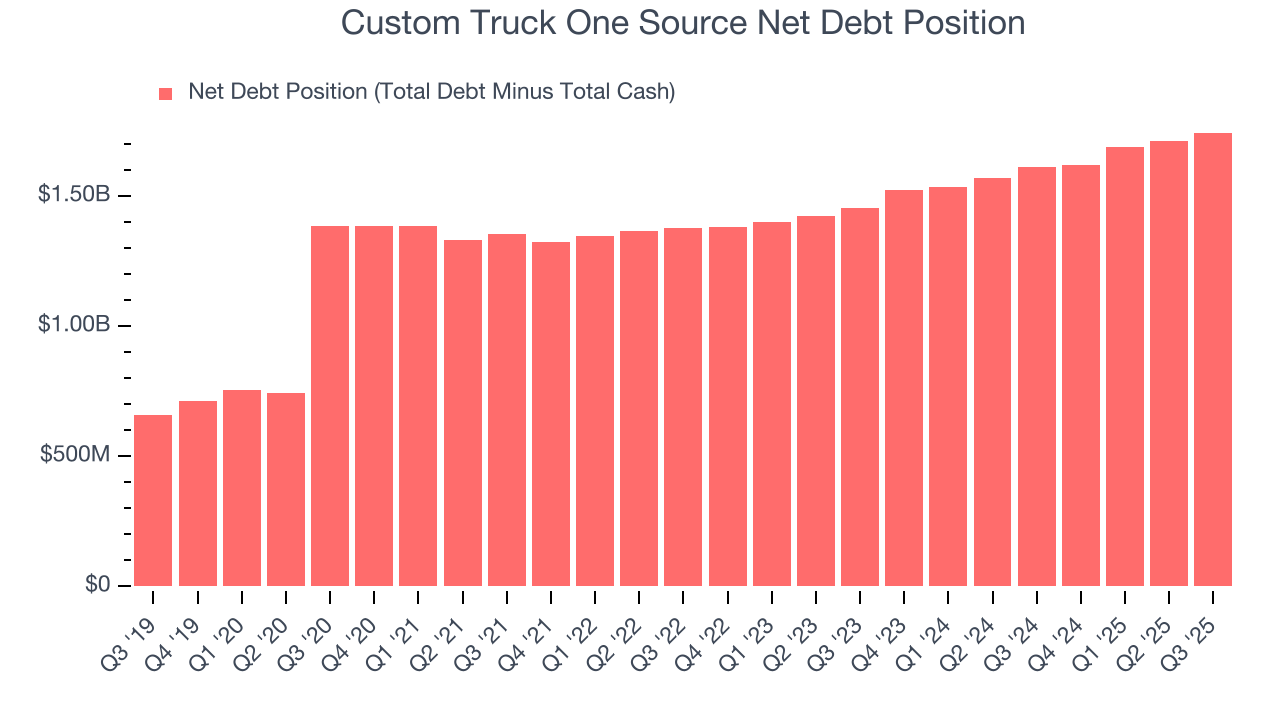

11. Balance Sheet Assessment

Custom Truck One Source reported $13.06 million of cash and $1.76 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $364.8 million of EBITDA over the last 12 months, we view Custom Truck One Source’s 4.8× net-debt-to-EBITDA ratio as safe. We also see its $81.78 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Custom Truck One Source’s Q3 Results

It was good to see Custom Truck One Source provide full-year EBITDA guidance that slightly beat analysts’ expectations. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS was in line and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.1% to $6.35 immediately following the results.

13. Is Now The Time To Buy Custom Truck One Source?

Updated: March 4, 2026 at 10:40 PM EST

When considering an investment in Custom Truck One Source, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Custom Truck One Source isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s expanding operating margin shows the business has become more efficient, the downside is its cash profitability fell over the last five years.

Custom Truck One Source’s EV-to-EBITDA ratio based on the next 12 months is 8.1x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $7.75 on the company (compared to the current share price of $7.07).