Diebold Nixdorf (DBD)

We aren’t fans of Diebold Nixdorf. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Diebold Nixdorf Will Underperform

With roots dating back to 1859 and a presence in over 100 countries, Diebold Nixdorf (NYSE:DBD) provides automated self-service technology, software, and services that help banks and retailers digitize their customer transactions.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 1.3% annually over the last five years

- Cash burn makes us question whether it can achieve sustainable long-term growth

- On the plus side, its earnings per share have outperformed its peers over the last five years, increasing by 18.7% annually

Diebold Nixdorf’s quality doesn’t meet our hurdle. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Diebold Nixdorf

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Diebold Nixdorf

Diebold Nixdorf is trading at $72.44 per share, or 14.9x forward P/E. This multiple is cheaper than most business services peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Diebold Nixdorf (DBD) Research Report: Q4 CY2025 Update

Banking and retail technology provider Diebold Nixdorf (NYSE:DBD) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.7% year on year to $1.10 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $3.9 billion at the midpoint. Its non-GAAP profit of $3.02 per share was 83% above analysts’ consensus estimates.

Diebold Nixdorf (DBD) Q4 CY2025 Highlights:

- Revenue: $1.10 billion vs analyst estimates of $1.11 billion (11.7% year-on-year growth, in line)

- Adjusted EPS: $3.02 vs analyst estimates of $1.65 (83% beat)

- Adjusted EBITDA: $164.3 million vs analyst estimates of $164.2 million (14.9% margin, in line)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5.50 at the midpoint, beating analyst estimates by 9.6%

- EBITDA guidance for the upcoming financial year 2026 is $522.5 million at the midpoint, above analyst estimates of $513.9 million

- Operating Margin: 7.5%, up from 4.2% in the same quarter last year

- Free Cash Flow Margin: 17.7%, down from 18.8% in the same quarter last year

- Market Capitalization: $2.60 billion

Company Overview

With roots dating back to 1859 and a presence in over 100 countries, Diebold Nixdorf (NYSE:DBD) provides automated self-service technology, software, and services that help banks and retailers digitize their customer transactions.

Diebold Nixdorf operates at the intersection of physical and digital commerce, primarily through two business segments: Banking and Retail. The company's hardware includes ATMs, cash recyclers, self-checkout systems, point-of-sale terminals, and kiosks that consumers interact with daily when withdrawing cash or checking out at stores.

Beyond hardware, the company has evolved into a solutions provider with its DN Vynamic software suite, which powers both banking and retail operations. This cloud-native platform connects legacy systems and enables financial institutions to offer more services through their self-service channels. For retailers, the software facilitates omnichannel experiences like click-and-collect or in-store ordering.

Services represent Diebold Nixdorf's largest operational component, ranging from basic maintenance to comprehensive managed services. When an ATM malfunctions at a bank, Diebold Nixdorf technicians are often dispatched to repair it. The company's AllConnect Data Engine connects hundreds of thousands of devices, enabling predictive maintenance and reducing downtime.

A bank might deploy Diebold Nixdorf's DN Series ATMs to reduce branch operating costs while expanding self-service capabilities. These machines can recycle cash (accepting deposits and using those same bills for withdrawals), reducing the frequency of cash replenishment visits. Similarly, a retailer might implement self-checkout systems to improve efficiency and reduce labor costs.

The company partners with many of the world's largest financial institutions and retailers, serving as both a technology provider and ongoing operational partner. Diebold Nixdorf has also expanded into adjacent markets, including electric vehicle charging station services, leveraging its global field service capabilities.

4. Hardware & Infrastructure

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

Diebold Nixdorf's main competitors in the banking technology space include NCR Voyix, while in retail it competes with NCR Voyix, Toshiba, and Fujitsu. In the software segment, it faces competition from specialized players like KAL, Fiserv, GK Software, Oracle, and Aptos.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $3.81 billion in revenue over the past 12 months, Diebold Nixdorf is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Diebold Nixdorf to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

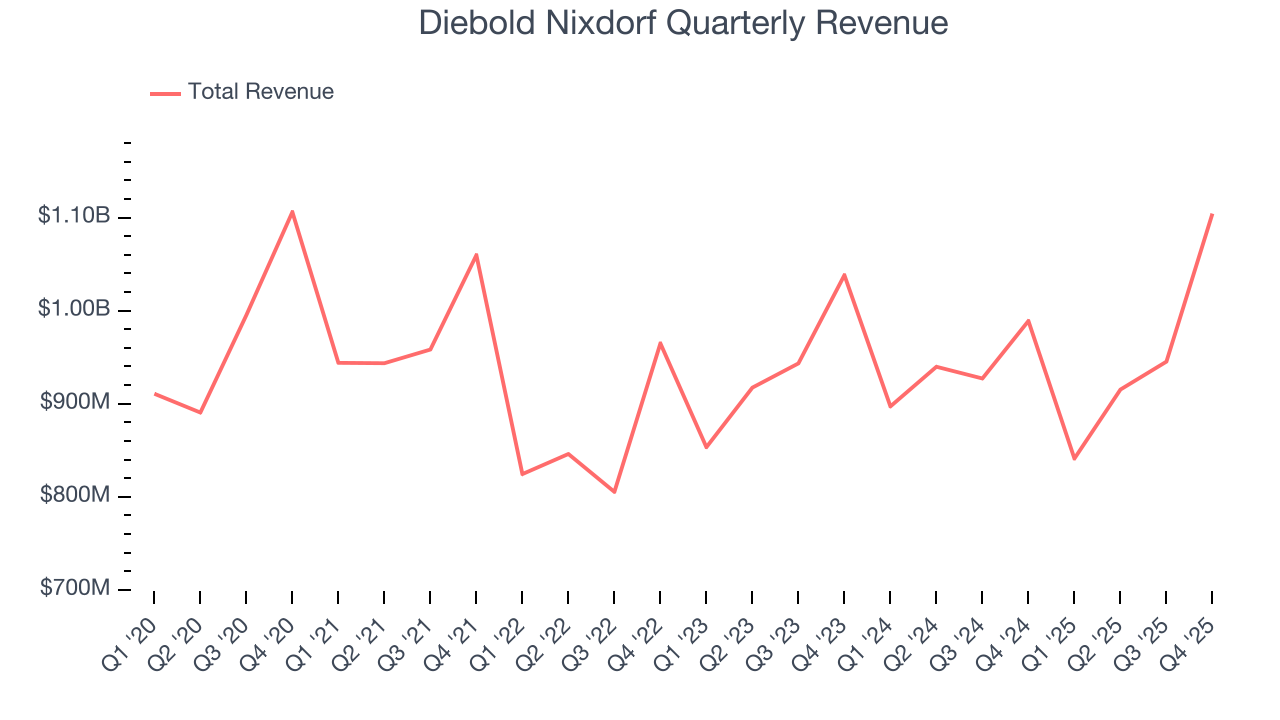

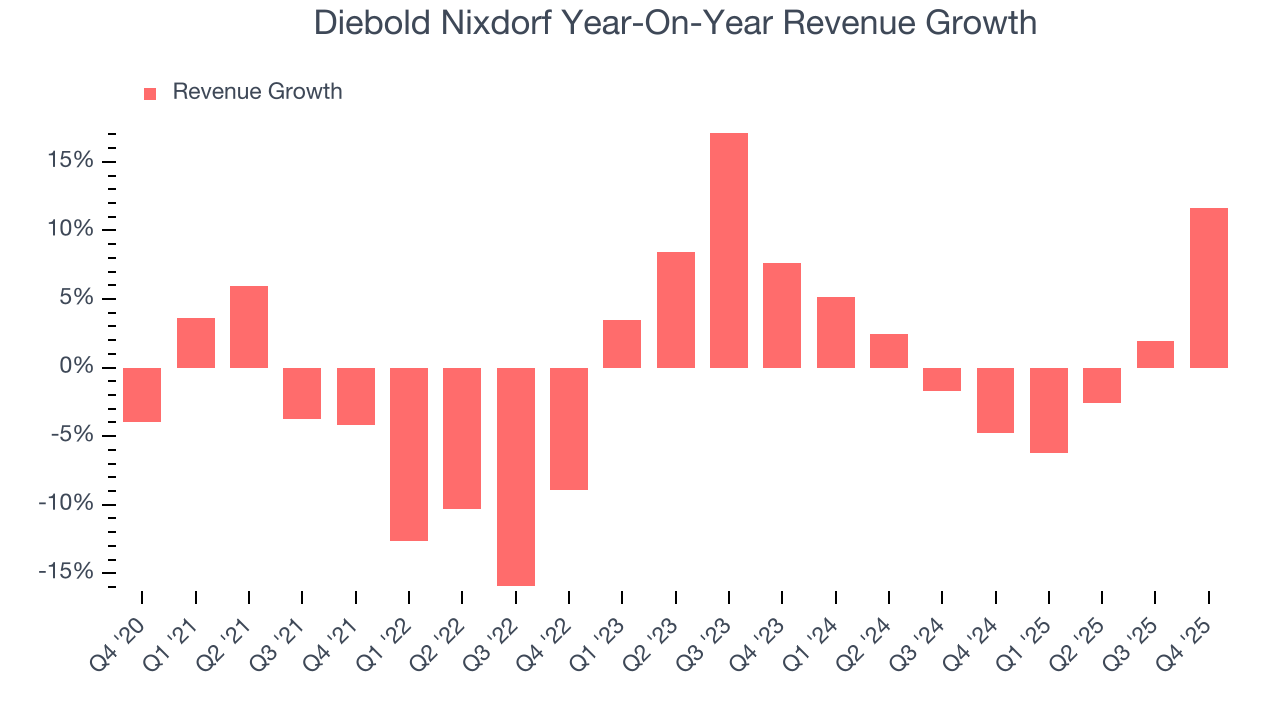

As you can see below, Diebold Nixdorf struggled to increase demand as its $3.81 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Just like its five-year trend, Diebold Nixdorf’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, Diebold Nixdorf’s year-on-year revenue growth was 11.7%, and its $1.10 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

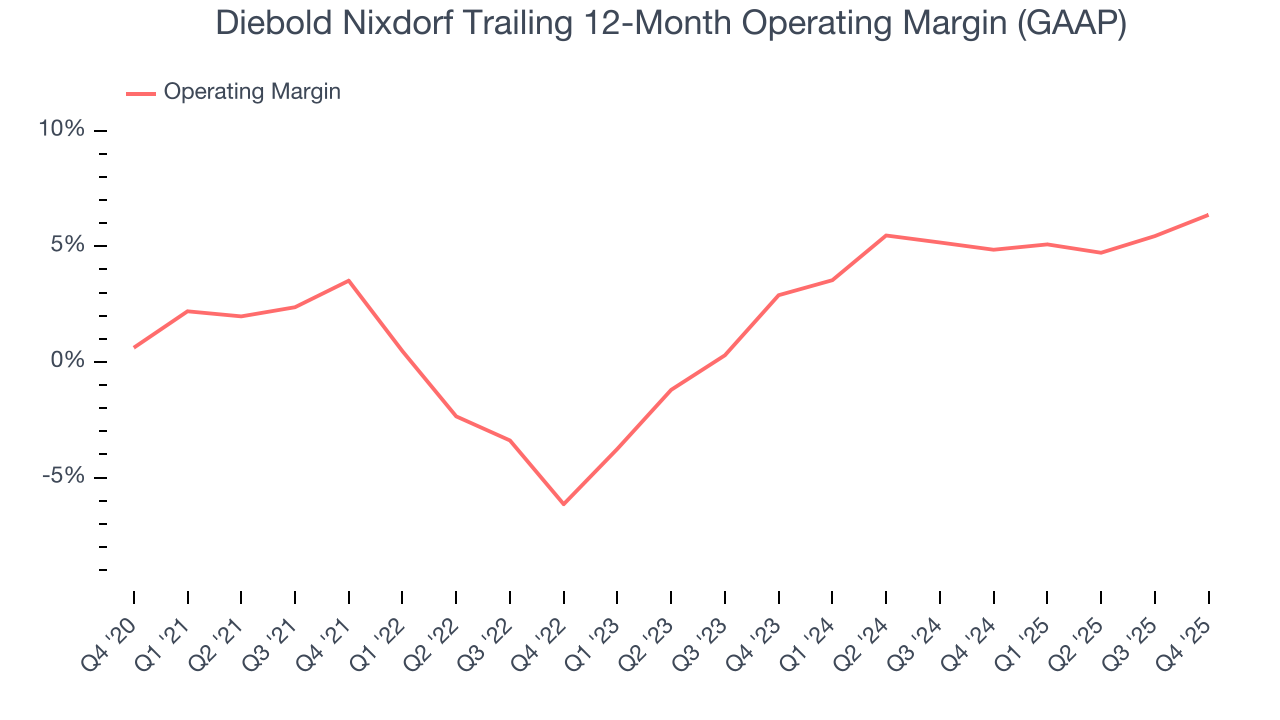

Diebold Nixdorf was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.5% was weak for a business services business.

On the plus side, Diebold Nixdorf’s operating margin rose by 2.8 percentage points over the last five years.

In Q4, Diebold Nixdorf generated an operating margin profit margin of 7.5%, up 3.3 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

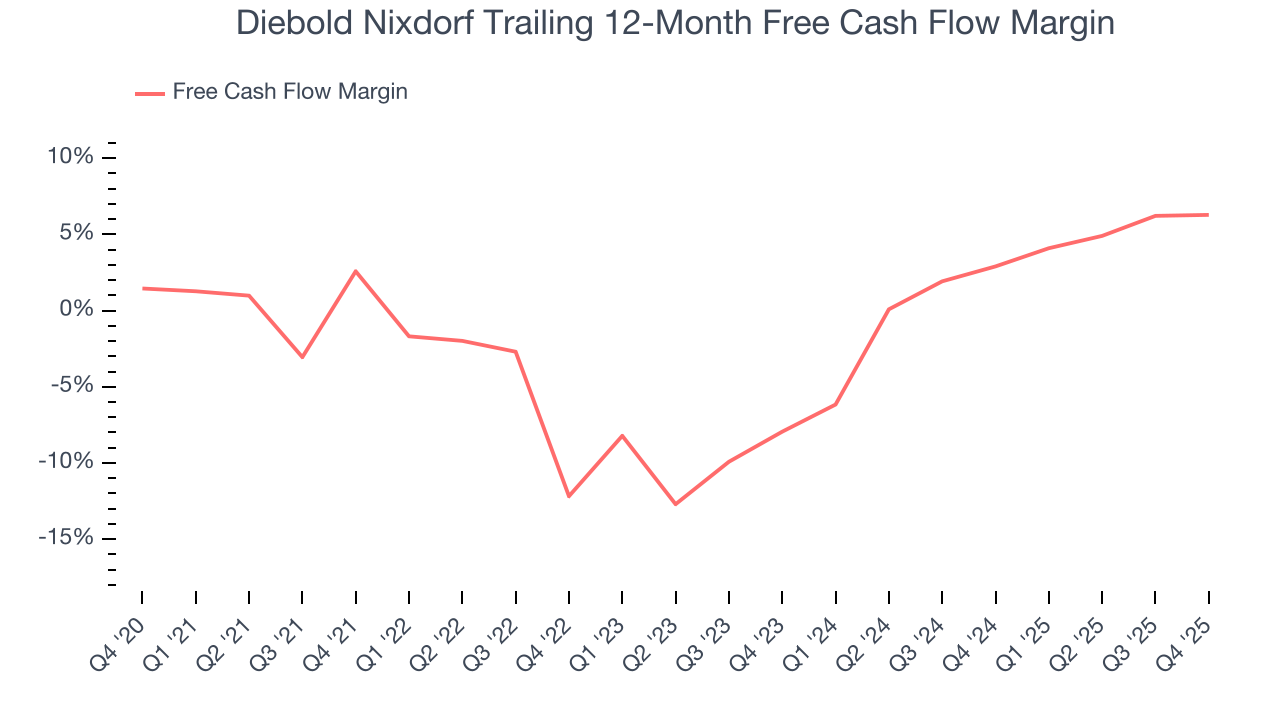

While Diebold Nixdorf posted positive free cash flow this quarter, the broader story hasn’t been so clean. Diebold Nixdorf’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.4%, meaning it lit $1.44 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Diebold Nixdorf’s margin expanded by 3.7 percentage points during that time. Despite its improvement and recent free cash flow generation, we’d like to see more quarters of positive cash flow before recommending the stock.

Diebold Nixdorf’s free cash flow clocked in at $195.8 million in Q4, equivalent to a 17.7% margin. The company’s cash profitability regressed as it was 1.1 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

8. Balance Sheet Assessment

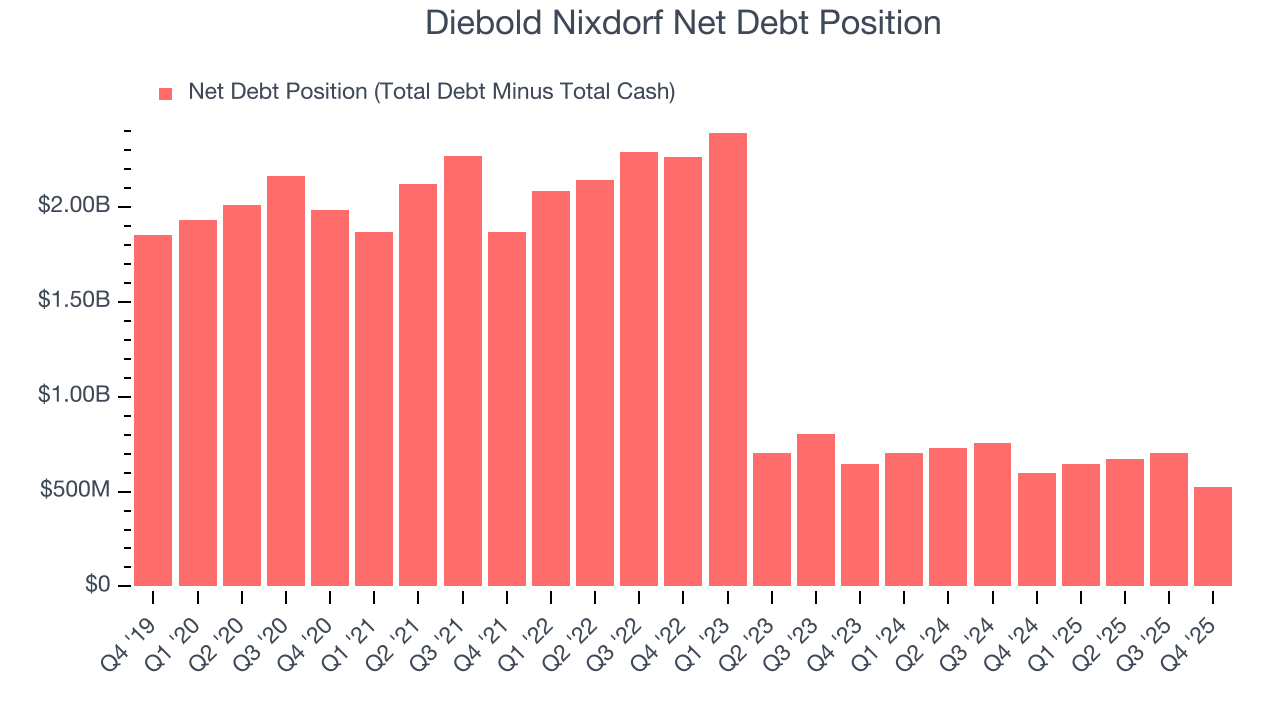

Diebold Nixdorf reported $416.4 million of cash and $938.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $484.7 million of EBITDA over the last 12 months, we view Diebold Nixdorf’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $41.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

9. Key Takeaways from Diebold Nixdorf’s Q4 Results

It was good to see Diebold Nixdorf beat analysts’ EPS expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue was in line. Zooming out, we think this quarter featured some important positives. The stock traded up 5% to $76 immediately following the results.

10. Is Now The Time To Buy Diebold Nixdorf?

Updated: February 12, 2026 at 8:34 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Diebold Nixdorf doesn’t pass our quality test. First off, its revenue growth was weak over the last five years. While its rising cash profitability gives it more optionality, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last one years makes it a less attractive asset to the public markets.

Diebold Nixdorf’s P/E ratio based on the next 12 months is 13.8x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $79 on the company (compared to the current share price of $76).