Deere (DE)

Deere is in for a bumpy ride. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Deere Will Underperform

Revolutionizing agriculture with the first self-polishing cast-steel plow in the 1800s, Deere (NYSE:DE) manufactures and distributes advanced agricultural, construction, forestry, and turf care equipment.

- Annual sales declines of 13.6% for the past two years show its products and services struggled to connect with the market during this cycle

- Performance over the past two years shows each sale was less profitable as its earnings per share dropped by 27.5% annually, worse than its revenue

- High net-debt-to-EBITDA ratio of 7× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Deere’s quality doesn’t meet our bar. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Deere

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Deere

At $591.56 per share, Deere trades at 36.1x forward P/E. This multiple is higher than that of industrials peers; it’s also rich for the top-line growth of the company. Not a great combination.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Deere (DE) Research Report: Q4 CY2025 Update

Agricultural and construction machinery company Deere (NYSE:DE) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 13% year on year to $9.61 billion. Its GAAP profit of $2.42 per share was 15.4% above analysts’ consensus estimates.

Deere (DE) Q4 CY2025 Highlights:

- Revenue: $9.61 billion vs analyst estimates of $9.08 billion (13% year-on-year growth, 5.9% beat)

- EPS (GAAP): $2.42 vs analyst estimates of $2.10 (15.4% beat)

- Operating Margin: 8%, down from 9.3% in the same quarter last year

- Free Cash Flow was -$1.58 billion compared to -$1.48 billion in the same quarter last year

- Market Capitalization: $160.8 billion

Company Overview

Revolutionizing agriculture with the first self-polishing cast-steel plow in the 1800s, Deere (NYSE:DE) manufactures and distributes advanced agricultural, construction, forestry, and turf care equipment.

It may have been started by a blacksmith who focused on simple tools, but the company has come a long way since its humble beginnings. Deere’s product portfolio now includes tractors, combines, planters, loaders, excavators, and precision agriculture technologies. More recently, Deere has invested in autonomous machinery to capitalize on digitization trends.

Deere serves all types of farmers and field workers, including construction contractors, government entities, and individual landowners. The company also provides comprehensive aftermarket support services like machinery upgrades and components that increase customer retention.

Deere's revenue largely stems from sales of its heavy equipment. There may be list prices, but longtime customers who purchase in higher volumes can receive discounts. The company also makes money from aftermarket parts and support services that smooth out its topline because while an economic cycle may dampen demand for excavators, for example, the existing Deere excavators out there will still need to be maintained and repaired.

4. Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

Deere’s peers and competitors include Caterpillar (NYSE:CAT), Eaton (NYSE:ETN), and AGCO (NYSE:AGCO).

5. Revenue Growth

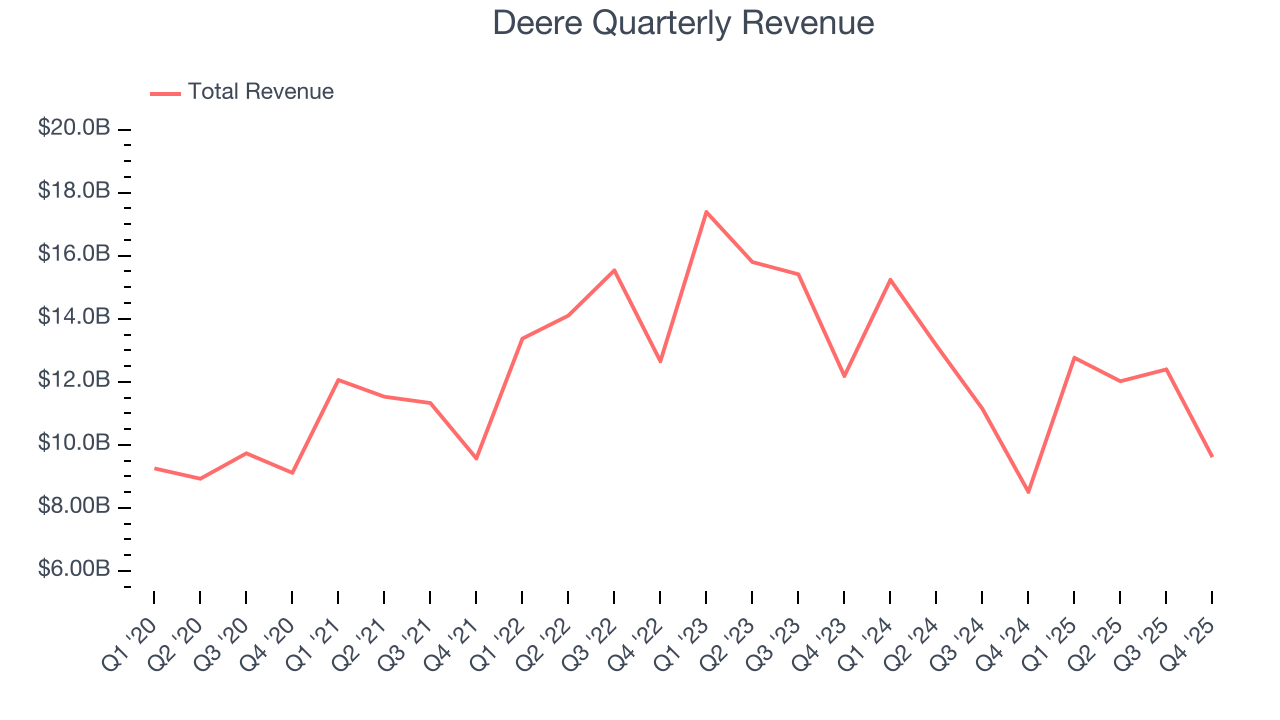

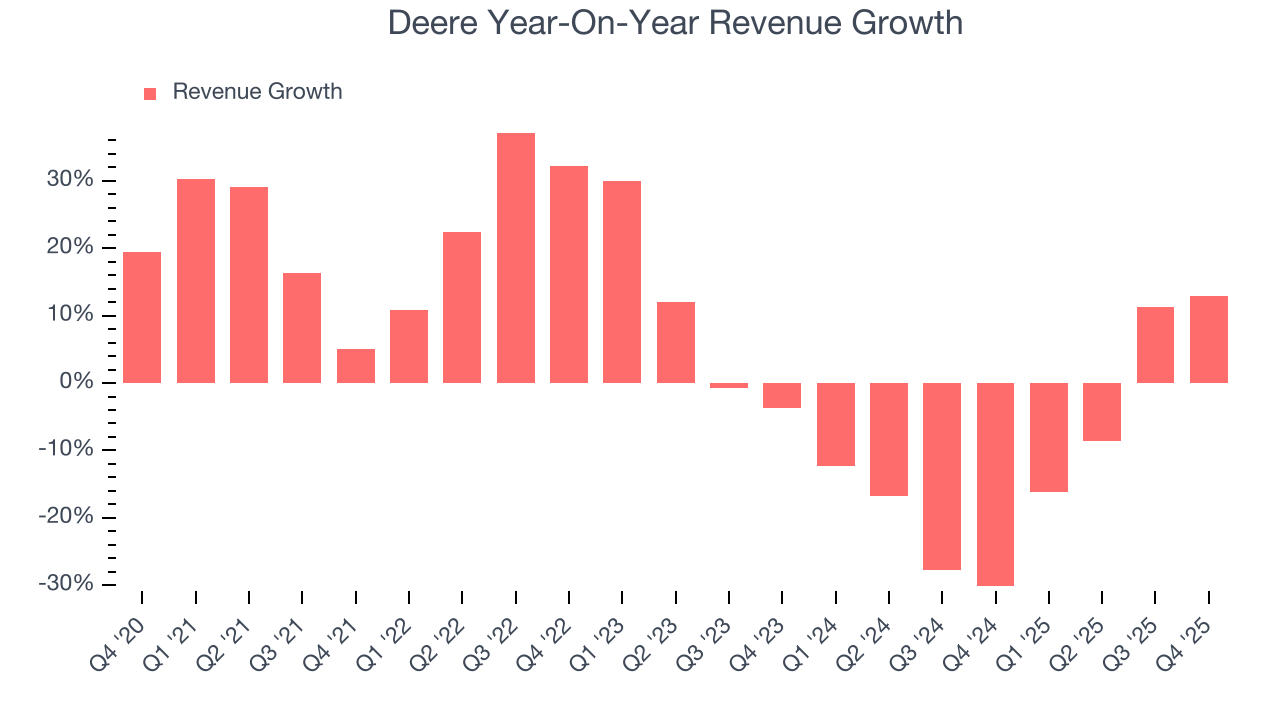

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Deere grew its sales at a tepid 4.8% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Deere’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 12.3% annually. Deere isn’t alone in its struggles as the Agricultural Machinery industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

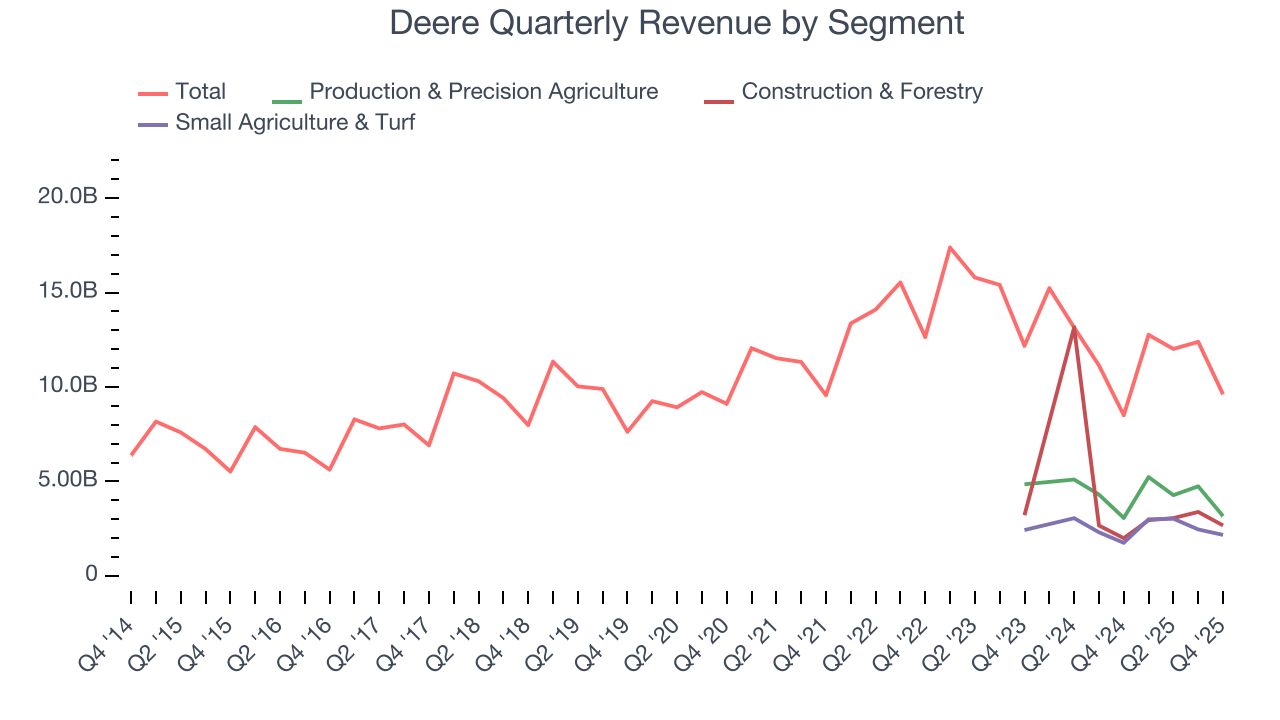

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Production & Precision Agriculture , Construction & Forestry , and Small Agriculture & Turf, which are 32.9%, 27.8%, and 22.6% of revenue. Over the last two years, Deere’s Production & Precision Agriculture (tractors, harvesters, tillage) and Construction & Forestry (loaders, excavators, dump trucks) revenues averaged year-on-year declines of 9.9% and 13.5% while its Small Agriculture & Turf revenue (mowers and other small vehicles) was flat.

This quarter, Deere reported year-on-year revenue growth of 13%, and its $9.61 billion of revenue exceeded Wall Street’s estimates by 5.9%.

Looking ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

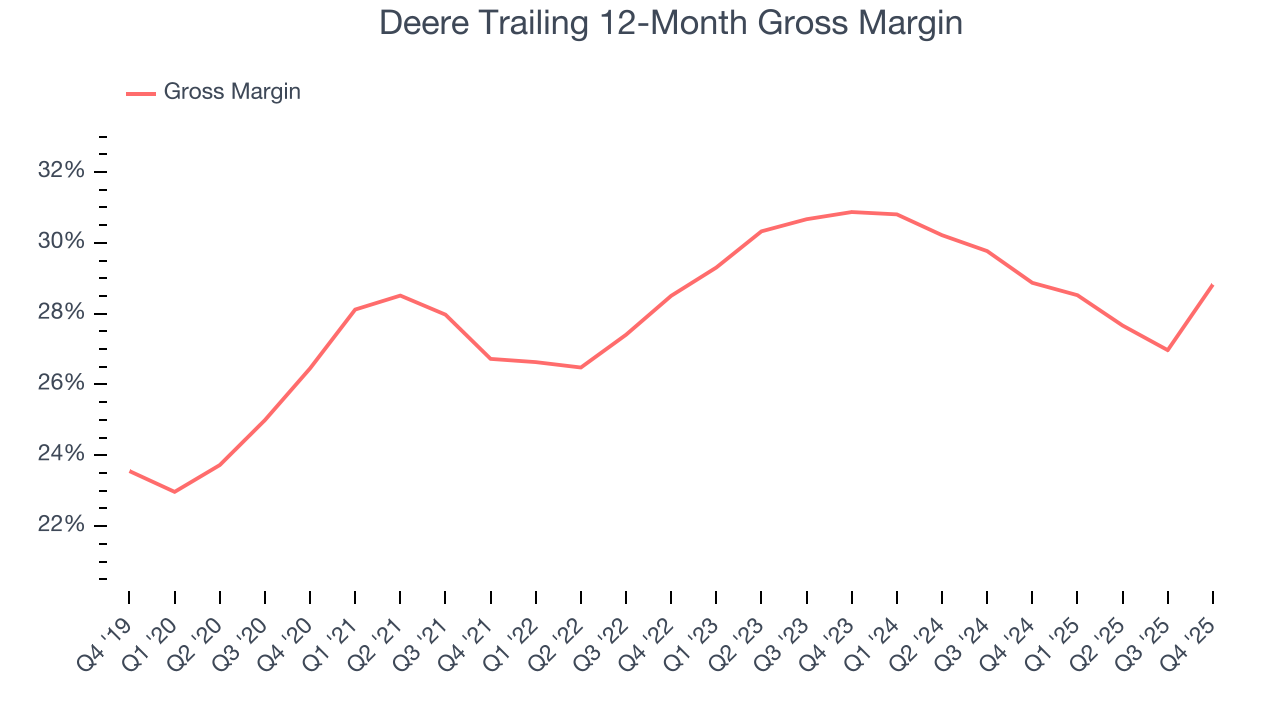

Deere’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 28.9% gross margin over the last five years. That means Deere paid its suppliers a lot of money ($71.12 for every $100 in revenue) to run its business.

Deere’s gross profit margin came in at 34.7% this quarter, up 9.2 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

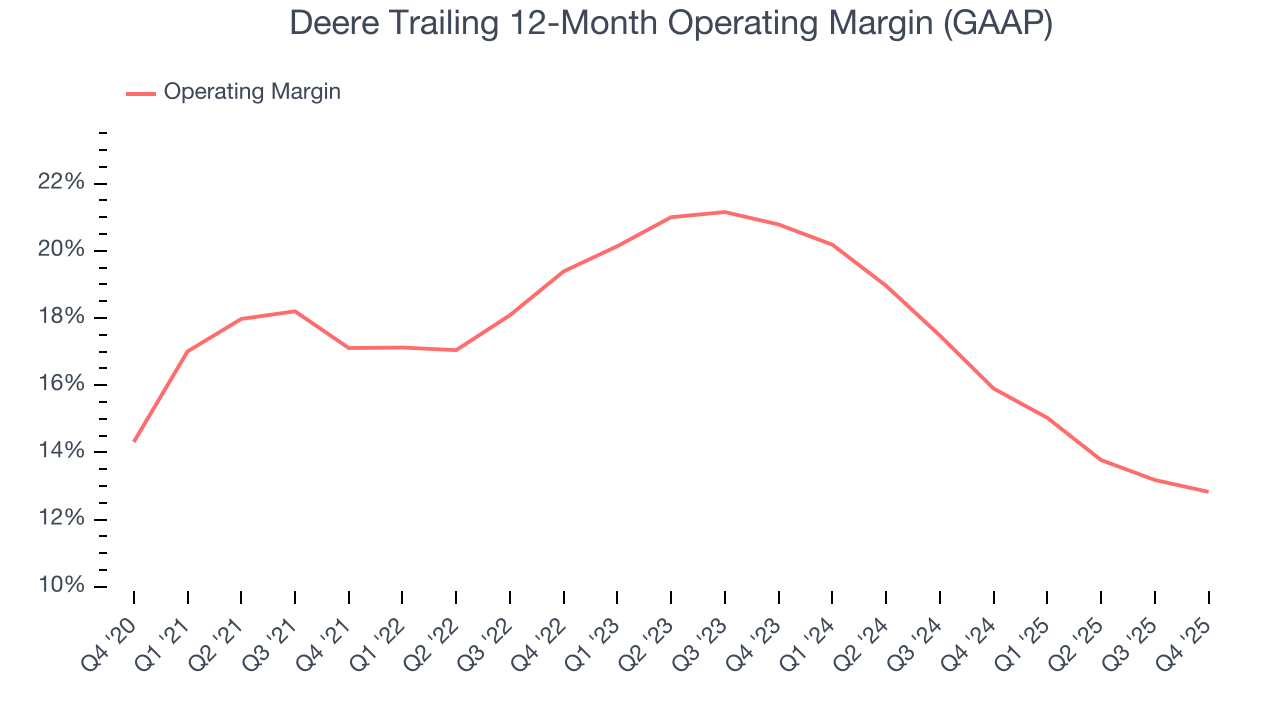

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Deere has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.5%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Deere’s operating margin decreased by 4.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Deere generated an operating margin profit margin of 8%, down 1.3 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

8. Earnings Per Share

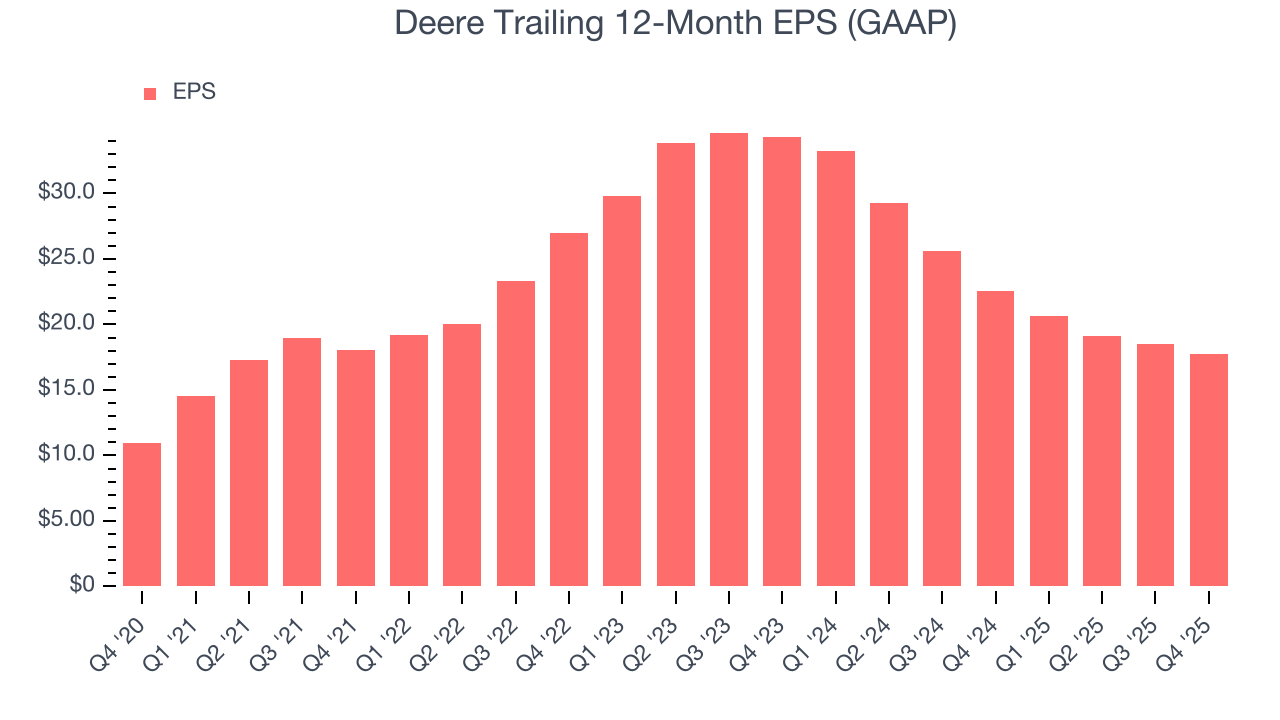

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

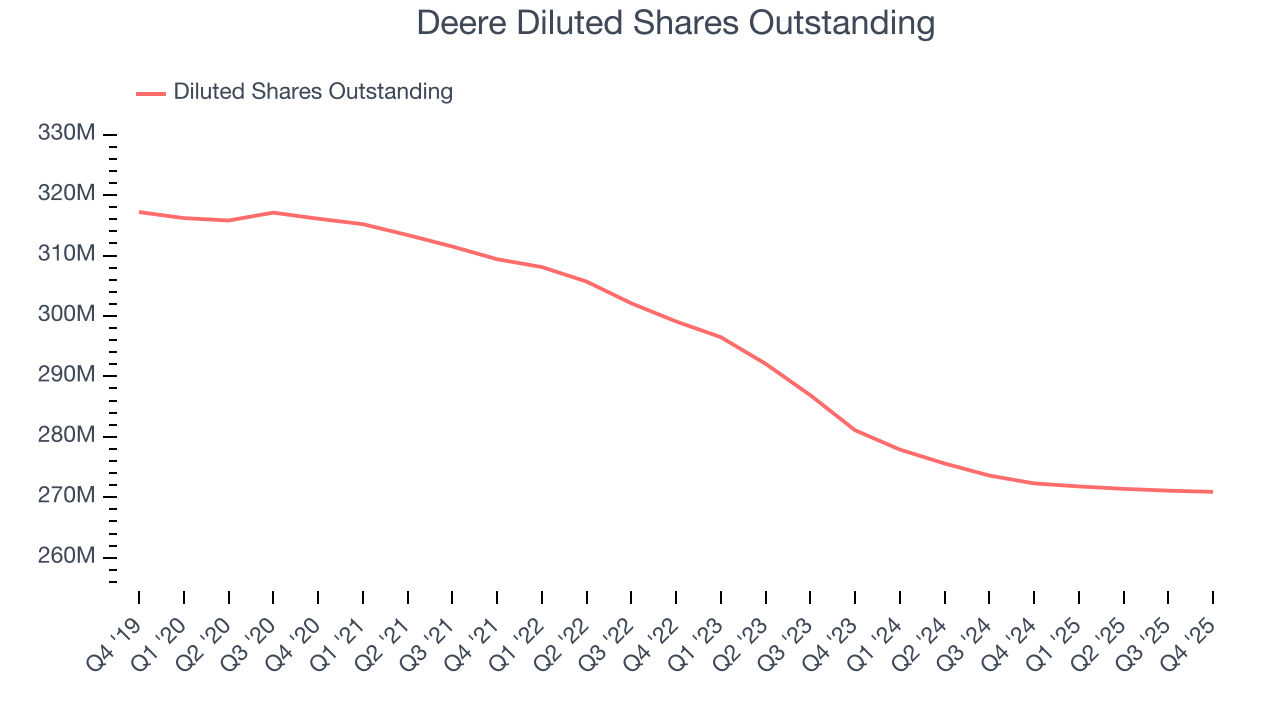

Deere’s EPS grew at a solid 10.2% compounded annual growth rate over the last five years, higher than its 4.8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Diving into Deere’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Deere has repurchased its stock, shrinking its share count by 14.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Deere, its two-year annual EPS declines of 28.1% mark a reversal from its (seemingly) healthy five-year trend. We hope Deere can return to earnings growth in the future.

In Q4, Deere reported EPS of $2.42, down from $3.19 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Deere’s full-year EPS of $17.74 to stay about the same.

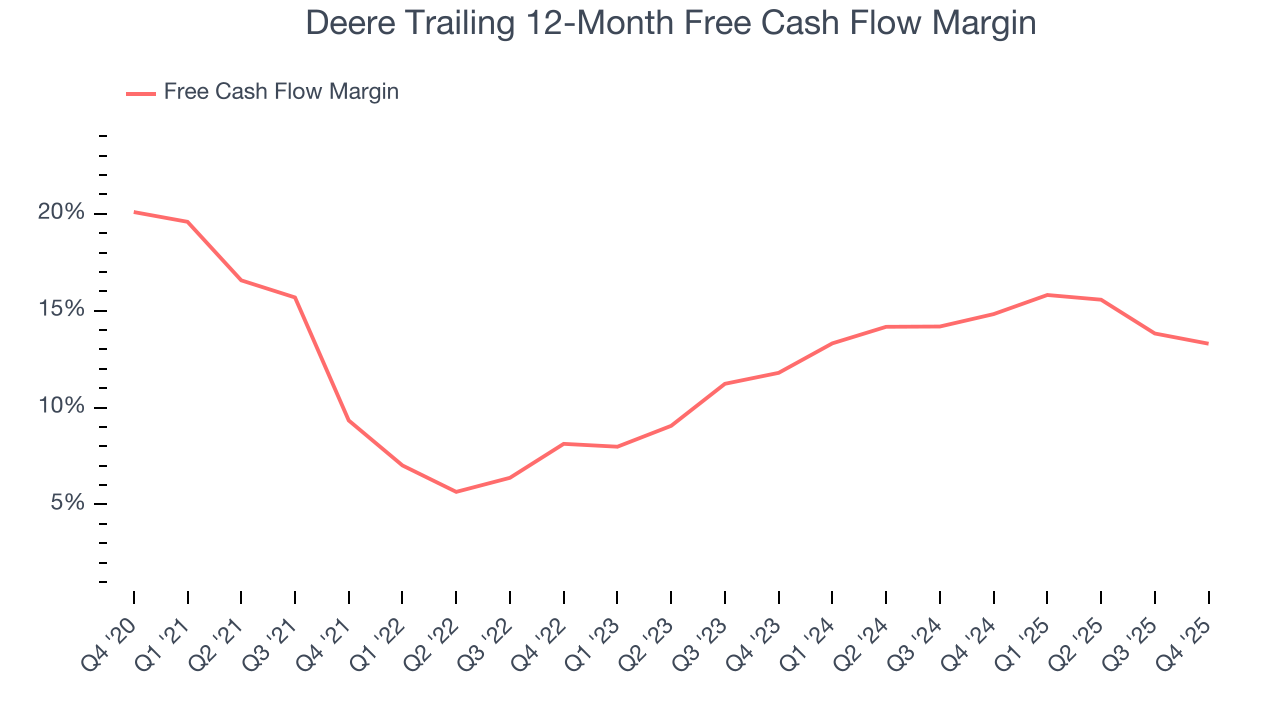

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Deere has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.4% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Deere’s margin expanded by 4 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Deere burned through $1.58 billion of cash in Q4, equivalent to a negative 16.4% margin. The company’s cash burn increased from $1.48 billion of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

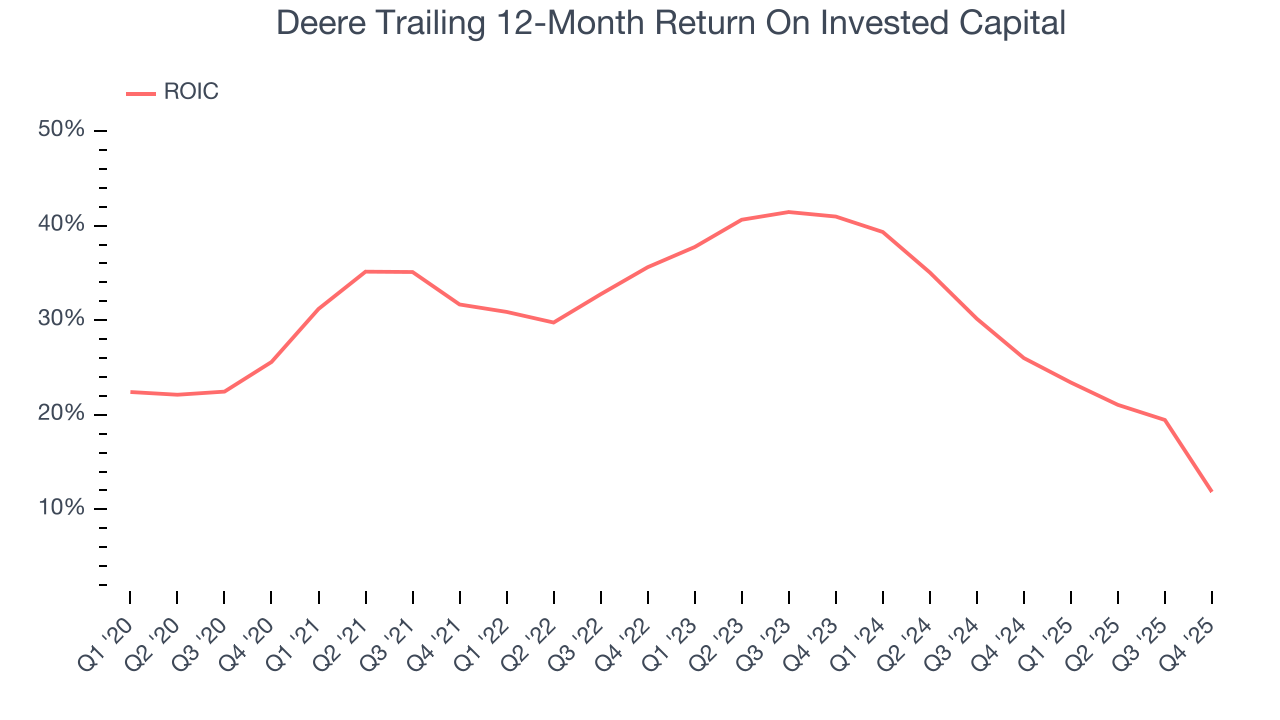

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Deere hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 29.2%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Deere’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

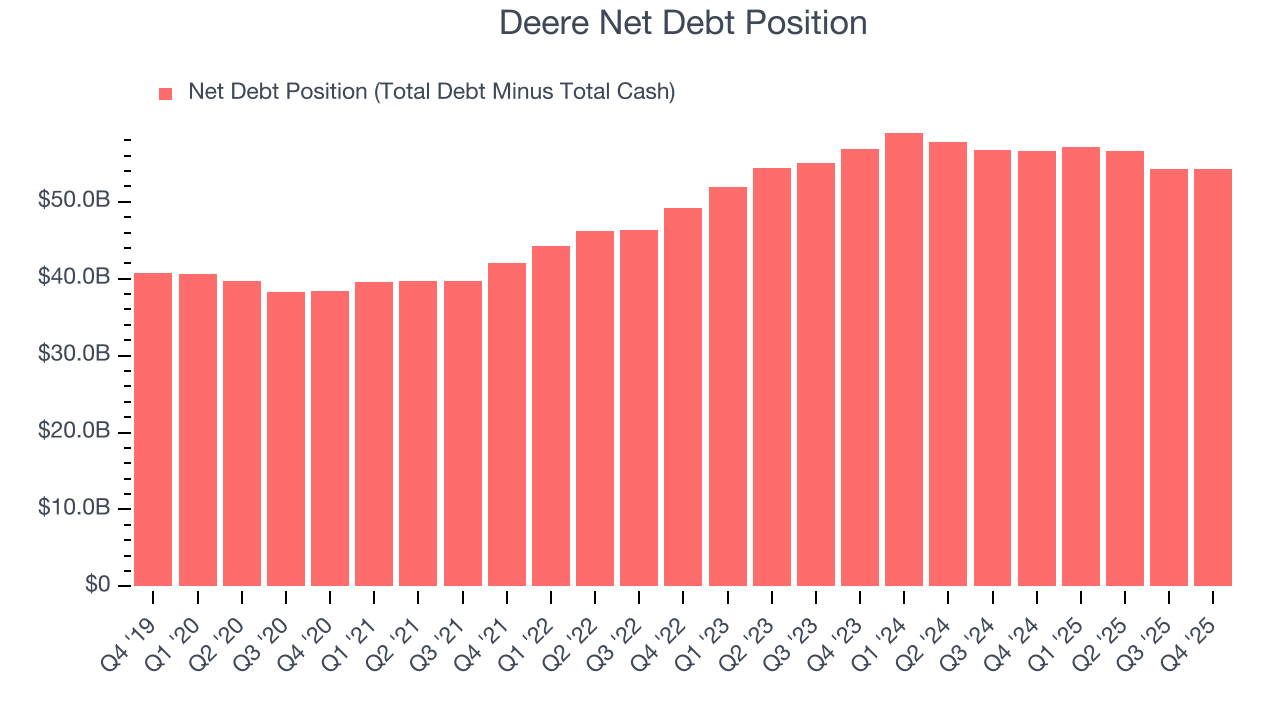

11. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Deere’s $62.48 billion of debt exceeds the $8.20 billion of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $8.31 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Deere could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Deere can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Deere’s Q4 Results

We were impressed by how significantly Deere blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 4.4% to $619.50 immediately after reporting.

13. Is Now The Time To Buy Deere?

Updated: February 19, 2026 at 6:28 AM EST

Before making an investment decision, investors should account for Deere’s business fundamentals and valuation in addition to what happened in the latest quarter.

Deere doesn’t pass our quality test. First off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its stellar ROIC suggests it has been a well-run company historically, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its projected EPS for the next year is lacking.

Deere’s P/E ratio based on the next 12 months is 33.5x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $528.26 on the company (compared to the current share price of $619.50), implying they don’t see much short-term potential in Deere.