Deckers (DECK)

Deckers keeps us up at night. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Deckers Will Underperform

Established in 1973, Deckers (NYSE:DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

- Annual revenue growth of 17.9% over the last five years was below our standards for the consumer discretionary sector

- Weak constant currency growth over the past two years indicates challenges in maintaining its market share

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 18.9% for the last two years

Deckers doesn’t fulfill our quality requirements. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Deckers

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Deckers

Deckers’s stock price of $113.95 implies a valuation ratio of 14.6x forward P/E. Deckers’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Deckers (DECK) Research Report: Q4 CY2025 Update

Footwear and apparel conglomerate Deckers (NYSE:DECK) announced better-than-expected revenue in Q4 CY2025, with sales up 7.1% year on year to $1.96 billion. The company’s full-year revenue guidance of $5.41 billion at the midpoint came in 0.9% above analysts’ estimates. Its GAAP profit of $3.33 per share was 20.5% above analysts’ consensus estimates.

Deckers (DECK) Q4 CY2025 Highlights:

- Revenue: $1.96 billion vs analyst estimates of $1.87 billion (7.1% year-on-year growth, 4.7% beat)

- EPS (GAAP): $3.33 vs analyst estimates of $2.76 (20.5% beat)

- The company lifted its revenue guidance for the full year to $5.41 billion at the midpoint from $5.35 billion, a 1.2% increase

- EPS (GAAP) guidance for the full year is $6.82 at the midpoint, beating analyst estimates by 6.5%

- Operating Margin: 31.4%, in line with the same quarter last year

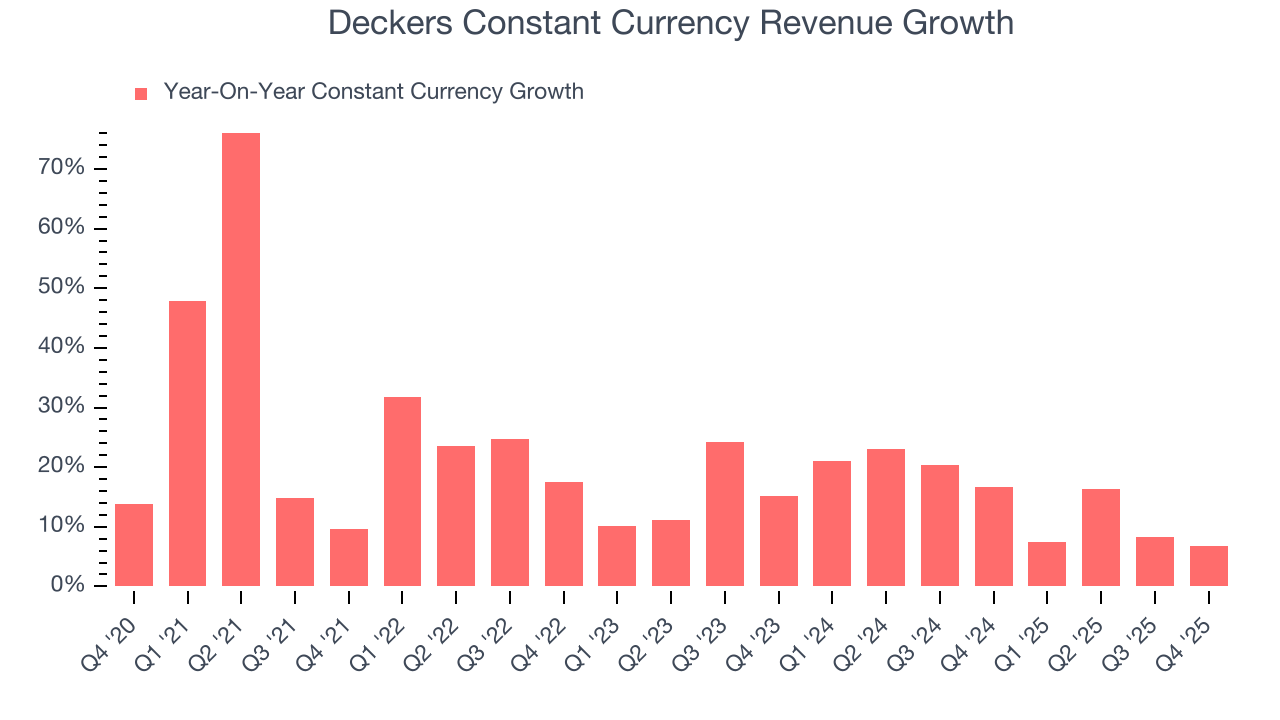

- Constant Currency Revenue rose 6.8% year on year (16.6% in the same quarter last year)

- Market Capitalization: $14.23 billion

Company Overview

Established in 1973, Deckers (NYSE:DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

The company's most famous brand, UGG, is a household name known for its sheepskin boots that blend luxury and comfort. These boots have amassed international recognition and are synonymous with a casual, relaxed style.

Deckers also owns Hoka, a brand that has gained popularity in the running community for its innovative approach. Hoka’s running shoes emphasize enhanced cushioning and a unique sole design that provides a distinctive running experience. This brand has captured a customer base beyond the running niche, appealing to people seeking comfortable, performance-oriented footwear.

In the outdoor footwear market, Teva offers a variety of sandals and shoes that combine durability, functionality, and environmental consciousness. The brand appeals to outdoor enthusiasts who value adventure and an active lifestyle, aligning with a growing trend towards outdoor recreation and eco-friendly products.

In addition to these flagship brands, Deckers operates other smaller lines that contribute to its diversified brand portfolio including Sanuk and Koolaburra.

Deckers' success is rooted in its commitment to quality, innovation, and understanding of consumer preferences. The company invests heavily in research and development, ensuring that its products exceed customer expectations in terms of comfort, durability, and style.

4. Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Deckers primary competitors include Nike (NYSE:NKE), Vans and Timberland (owned by VF Corporation NYSE:VFC), Columbia Sportswear Company (NASDAQ:COLM), Merrell (owned by Wolverine World WideNYSE:WWW), and Skechers (NYSE:SKX).

5. Revenue Growth

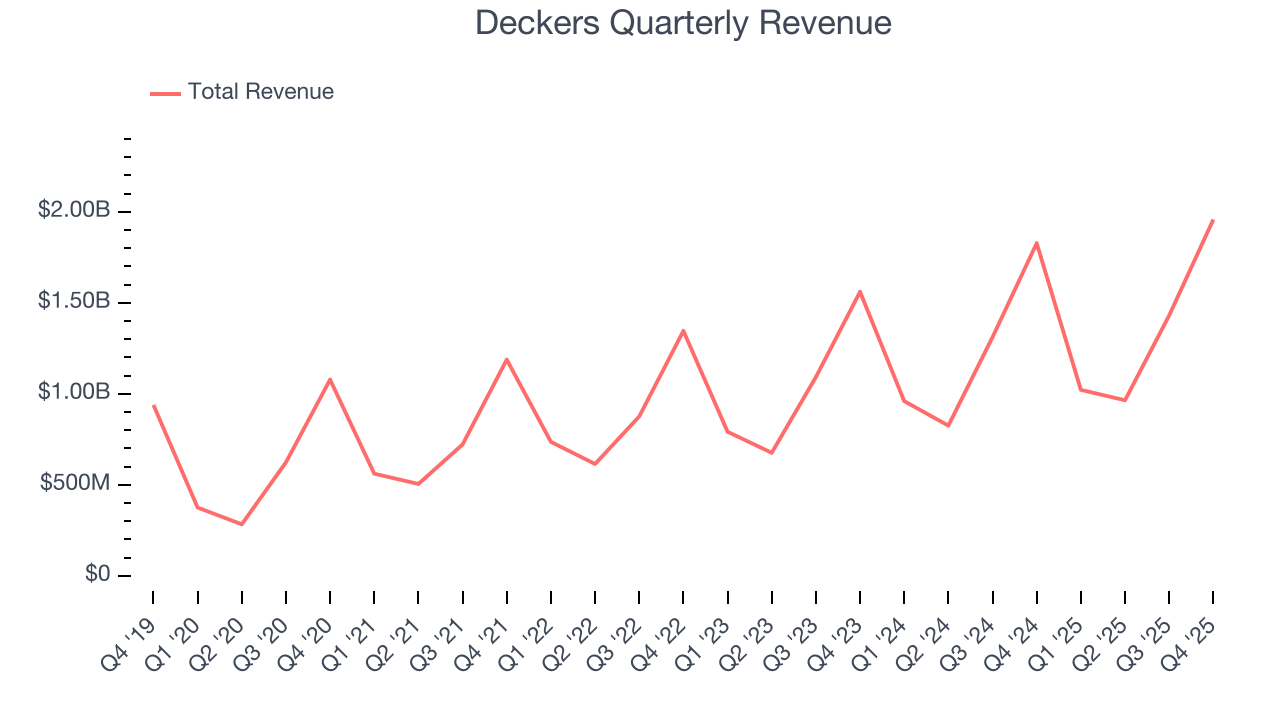

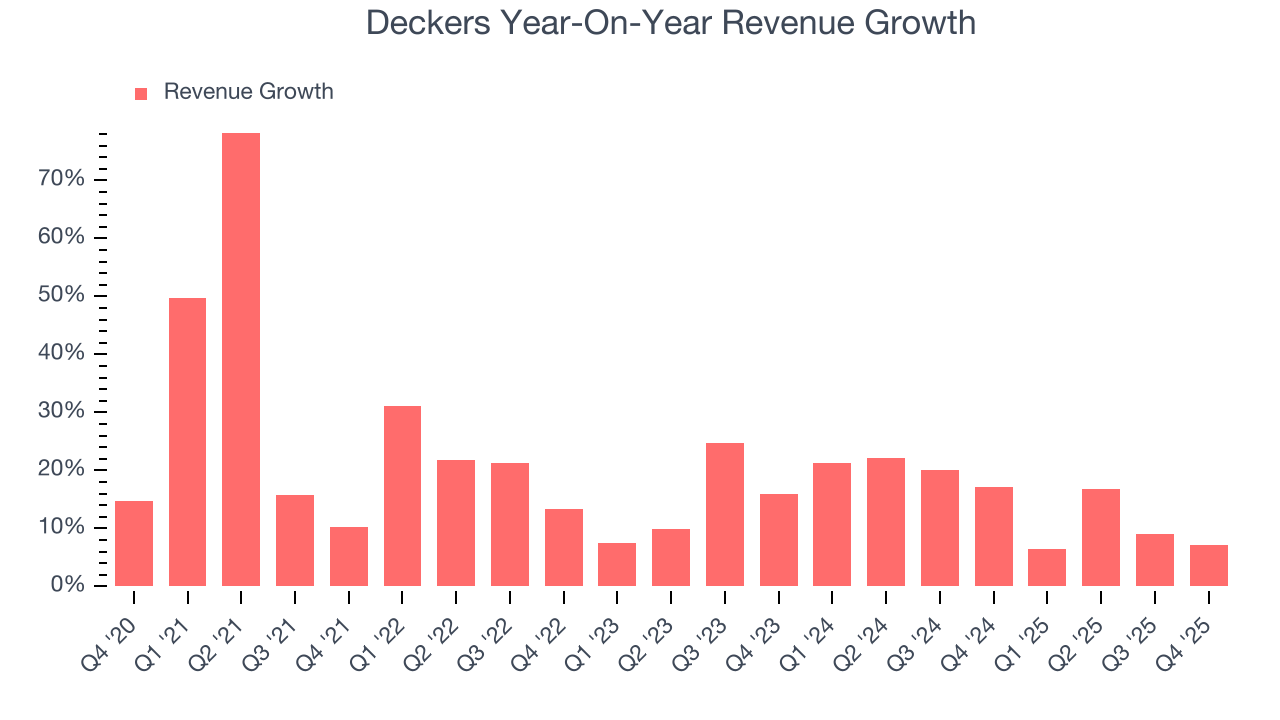

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Deckers grew its sales at a 17.9% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Deckers’s recent performance shows its demand has slowed as its annualized revenue growth of 14.2% over the last two years was below its five-year trend.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 15% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Deckers has properly hedged its foreign currency exposure.

This quarter, Deckers reported year-on-year revenue growth of 7.1%, and its $1.96 billion of revenue exceeded Wall Street’s estimates by 4.7%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

6. Operating Margin

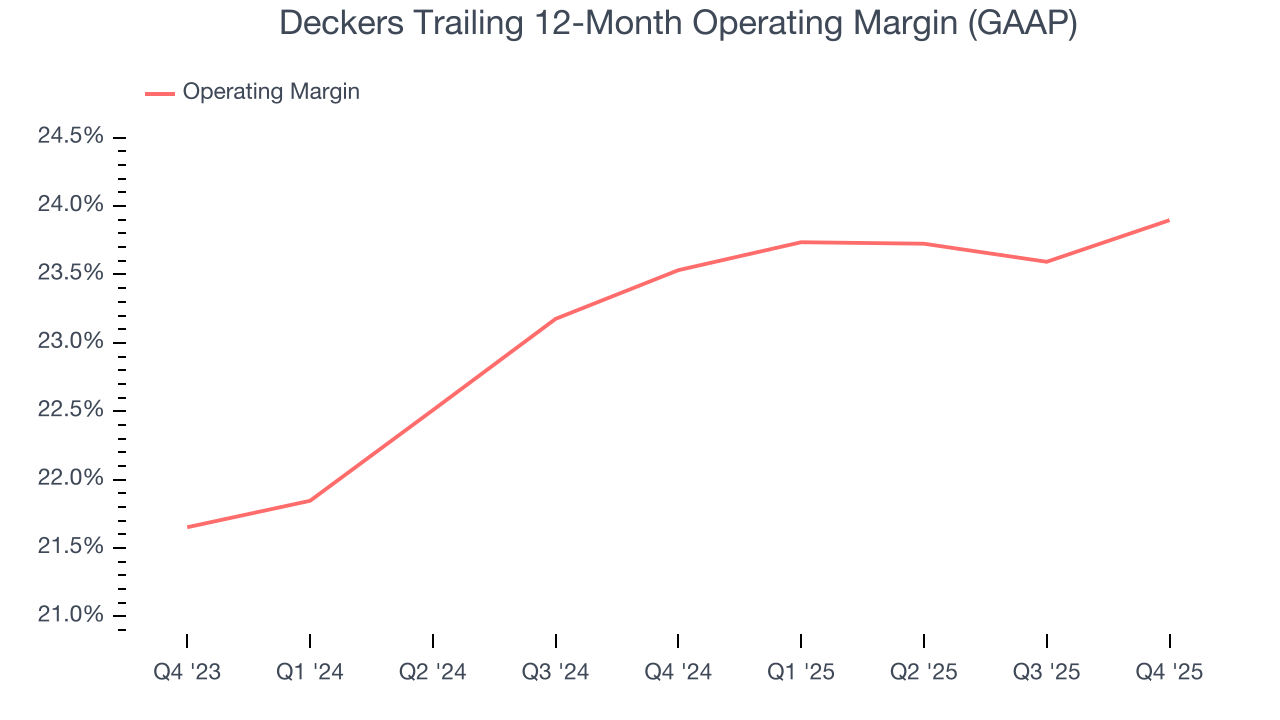

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Deckers’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 23.7% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Deckers generated an operating margin profit margin of 31.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

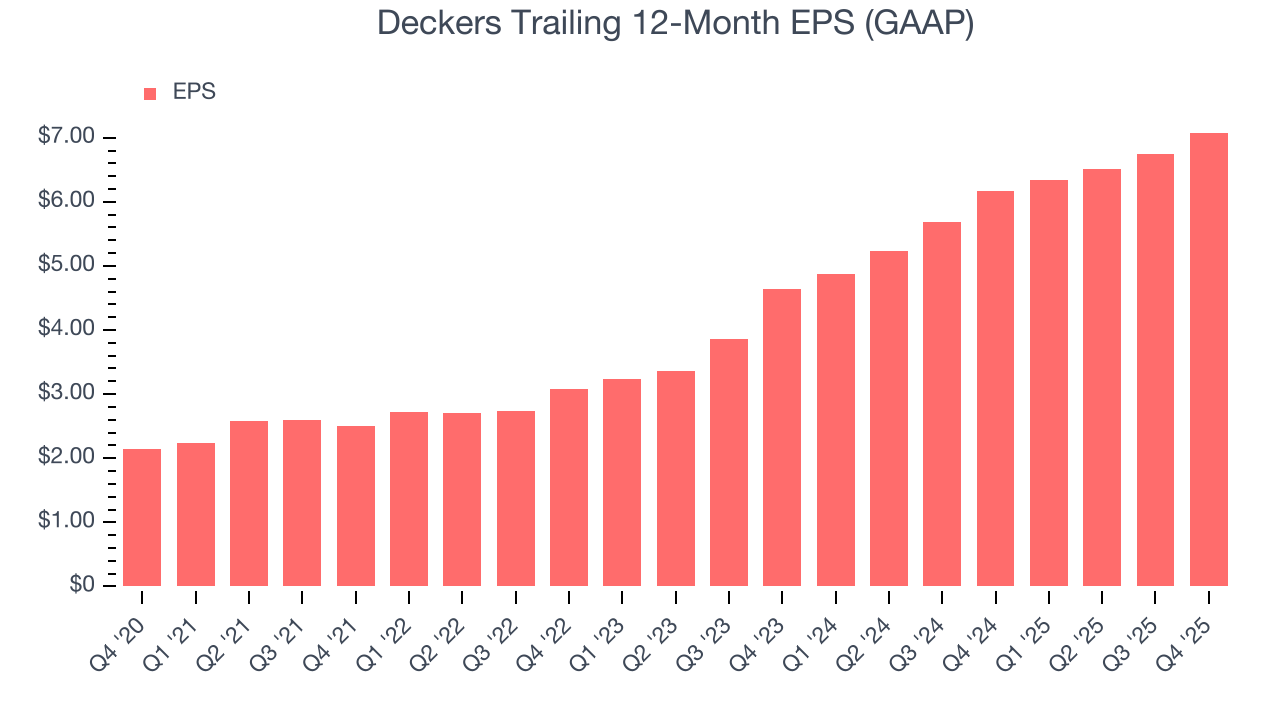

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Deckers’s EPS grew at an unimpressive 27% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Deckers reported EPS of $3.33, up from $3 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Deckers’s full-year EPS of $7.08 to shrink by 5.7%.

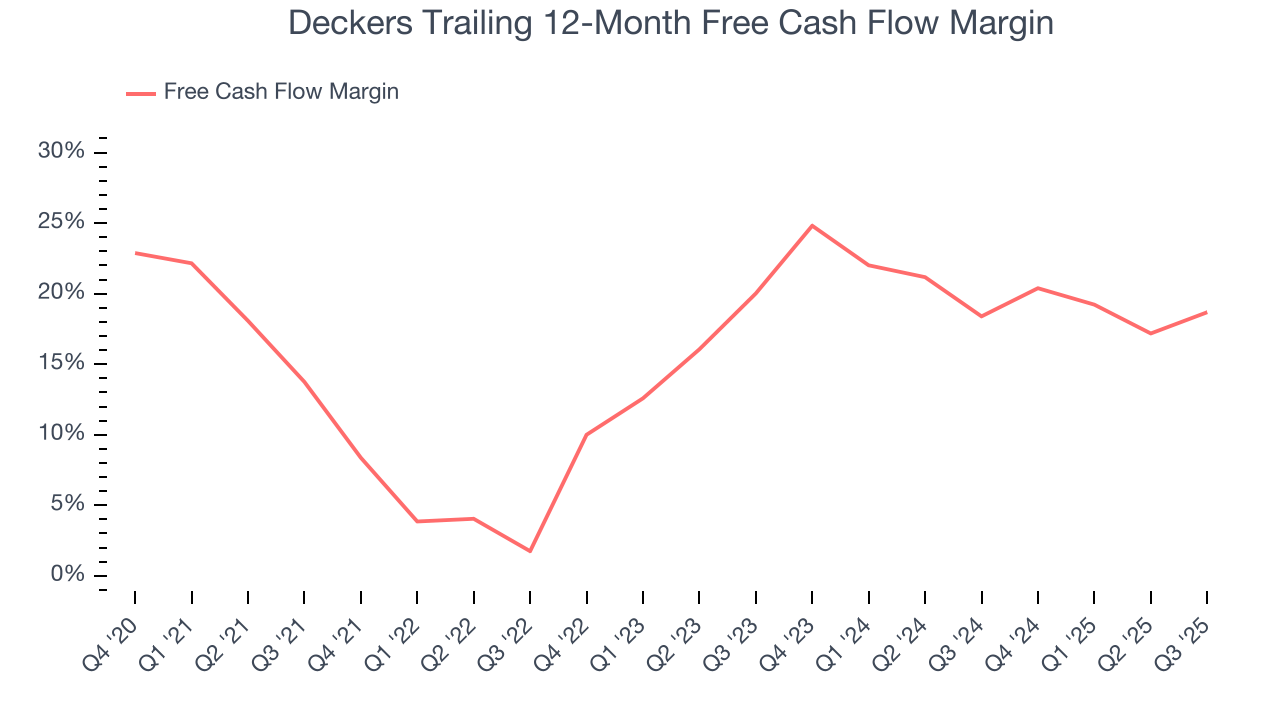

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Deckers has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 10.9%, lousy for a consumer discretionary business.

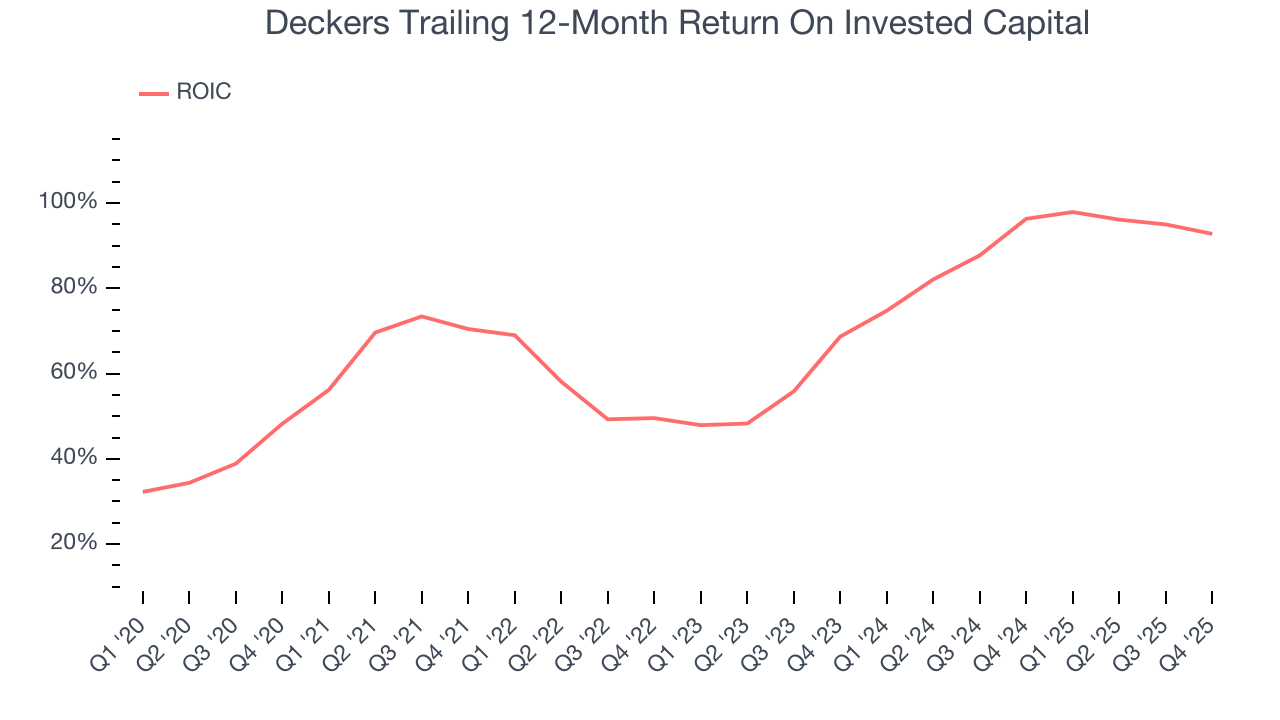

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Deckers hasn’t been the highest-quality company lately because of its poor top-line performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 75.6%, splendid for a consumer discretionary business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Deckers’s ROIC has increased significantly. This is a good sign, and we hope the company can keep improving.

10. Key Takeaways from Deckers’s Q4 Results

We were impressed by how significantly Deckers blew past analysts’ constant currency revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Looking ahead, the company raised full-year revenue guidance, and full-year EPS guidance also beat. Zooming out, we think this quarter featured a lot of important positives. The stock traded up 13.1% to $112.98 immediately following the results.

11. Is Now The Time To Buy Deckers?

Updated: January 29, 2026 at 10:00 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies serving everyday consumers, but in the case of Deckers, we’ll be cheering from the sidelines. To kick things off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its constant currency sales performance has disappointed. On top of that, its projected EPS for the next year is lacking.

Deckers’s P/E ratio based on the next 12 months is 14.6x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $111.40 on the company (compared to the current share price of $113.95).