Dell (DELL)

Dell doesn’t impress us. Its weak sales growth shows demand is soft and its low margins are a cause for concern.― StockStory Analyst Team

1. News

2. Summary

Why Dell Is Not Exciting

Founded by Michael Dell in his University of Texas dorm room in 1984 with just $1,000, Dell Technologies (NYSE:DELL) provides hardware, software, and services that help organizations build their IT infrastructure, manage cloud environments, and enable digital transformation.

- Underwhelming ARR growth of 3.6% suggests the company faced challenges in acquiring and retaining long-term customers

- Annual sales growth of 3.8% over the last five years lagged behind its business services peers as its large revenue base made it difficult to generate incremental demand

- A bright spot is that its massive revenue base of $104.1 billion makes it a well-known name that influences purchasing decisions

Dell is in the penalty box. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Dell

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Dell

Dell is trading at $136.83 per share, or 11.5x forward P/E. This multiple is lower than most business services companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Dell (DELL) Research Report: Q3 CY2025 Update

Computer hardware and IT solutions company Dell (NYSE:DELL) met Wall Streets revenue expectations in Q3 CY2025, with sales up 10.8% year on year to $27.01 billion. The company expects next quarter’s revenue to be around $31.5 billion, coming in 14.6% above analysts’ estimates. Its non-GAAP profit of $2.59 per share was 4.5% above analysts’ consensus estimates.

Dell (DELL) Q3 CY2025 Highlights:

- Revenue: $27.01 billion vs analyst estimates of $27.1 billion (10.8% year-on-year growth, in line)

- Adjusted EPS: $2.59 vs analyst estimates of $2.48 (4.5% beat)

- Revenue Guidance for Q4 CY2025 is $31.5 billion at the midpoint, above analyst estimates of $27.49 billion

- Management raised its full-year Adjusted EPS guidance to $9.92 at the midpoint, a 3.9% increase

- Operating Margin: 7.8%, in line with the same quarter last year

- Free Cash Flow Margin: 1.9%, down from 3.8% in the same quarter last year

- Market Capitalization: $85.26 billion

Company Overview

Founded by Michael Dell in his University of Texas dorm room in 1984 with just $1,000, Dell Technologies (NYSE:DELL) provides hardware, software, and services that help organizations build their IT infrastructure, manage cloud environments, and enable digital transformation.

Dell's business spans two main segments: Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG). The ISG division offers enterprise-level products including servers, storage systems, and networking equipment designed for data centers and cloud environments. These solutions help businesses process, store, and manage their data, with recent emphasis on AI-optimized servers for machine learning workloads. The CSG division focuses on personal computing devices like laptops, desktops, and workstations, along with peripherals such as monitors, keyboards, and docking stations.

A healthcare system might use Dell's servers to host patient records and run diagnostic applications, while equipping doctors and administrators with Dell laptops for daily operations. A university could deploy Dell storage systems to manage research data while providing students with access to computer labs filled with Dell workstations.

Dell generates revenue through direct hardware sales and increasingly through subscription-based services and "as-a-service" offerings under its APEX portfolio, which allows customers to pay for technology based on consumption rather than through upfront purchases. This shift reflects the broader industry trend toward recurring revenue models.

Dell Financial Services provides customers with financing options, including leases and loans, making it easier for organizations to acquire technology without large capital expenditures. The company maintains a global presence with operations in over 170 countries, supported by both a direct sales force and a network of channel partners including value-added resellers, system integrators, and retailers.

4. Hardware & Infrastructure

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

Dell Technologies competes with HP Inc. (NYSE:HPQ) and Lenovo Group (OTC:LNVGY) in the personal computing market, while facing competition from Hewlett Packard Enterprise (NYSE:HPE), Cisco Systems (NASDAQ:CSCO), and IBM (NYSE:IBM) in enterprise infrastructure. In cloud and as-a-service offerings, Dell also competes with hyperscalers like Amazon Web Services (NASDAQ:AMZN) and Microsoft Azure (NASDAQ:MSFT).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $104.1 billion in revenue over the past 12 months, Dell is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Dell to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

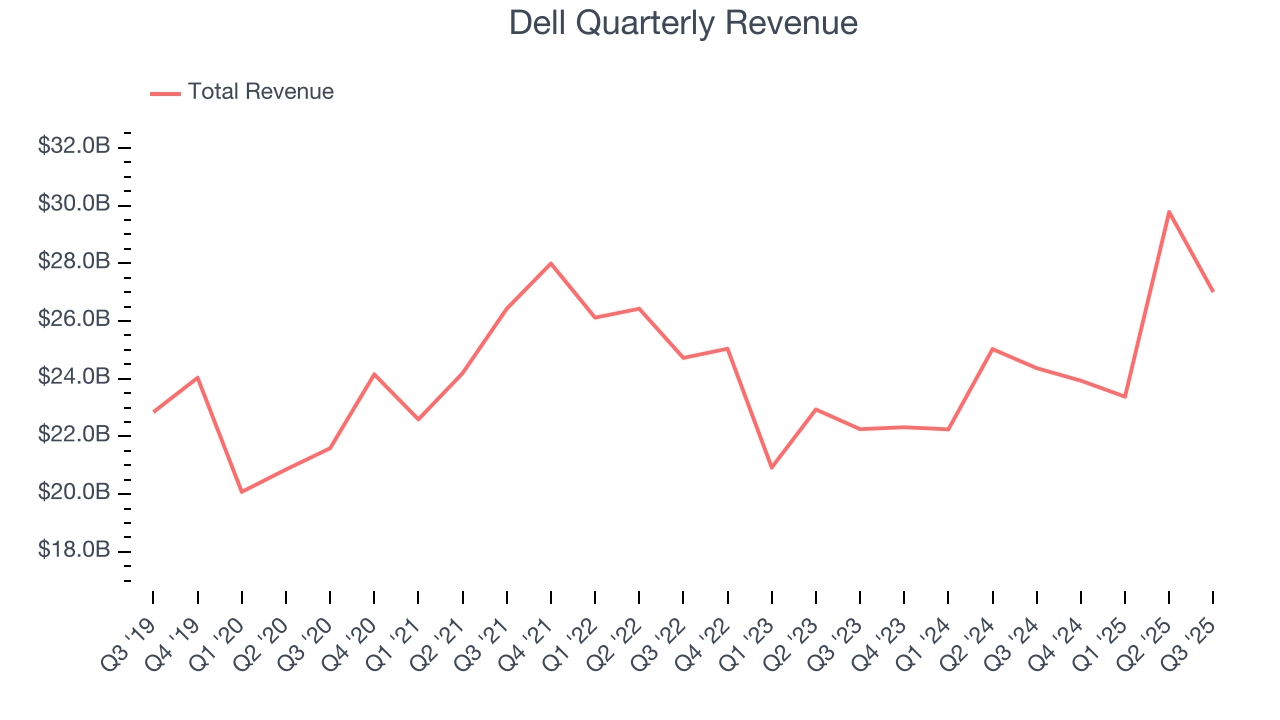

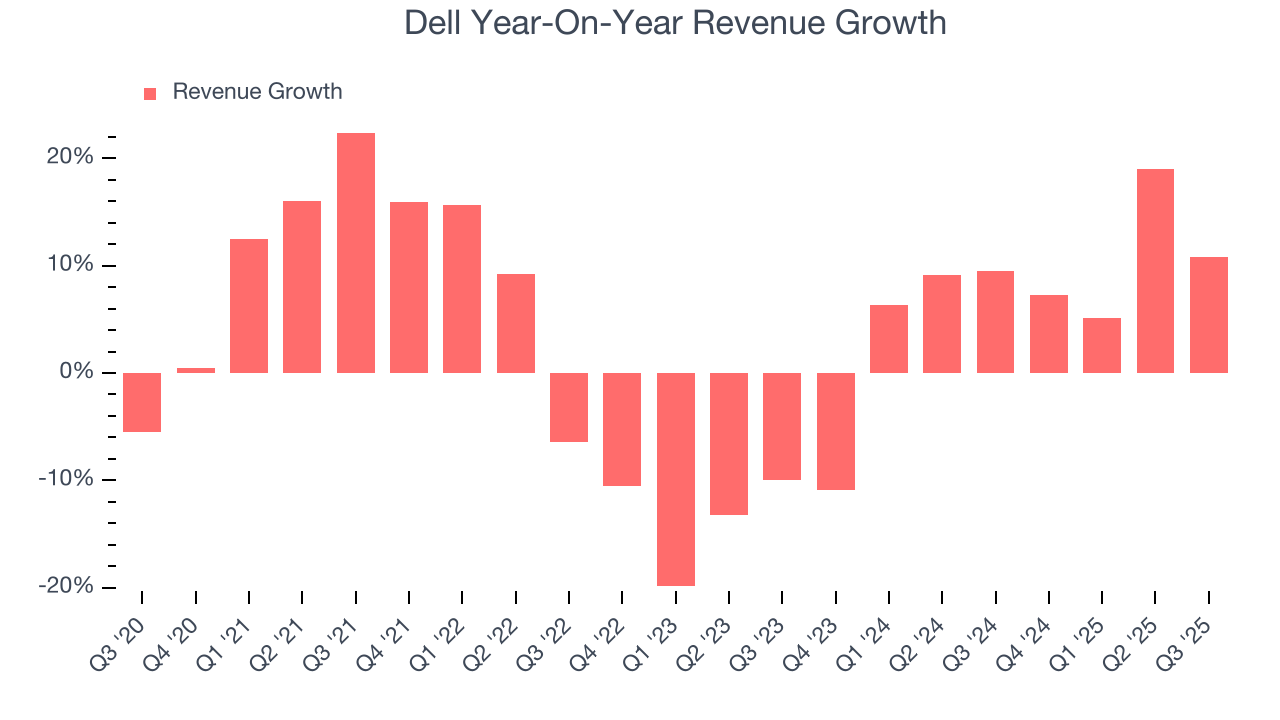

As you can see below, Dell’s sales grew at a tepid 3.8% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Dell’s annualized revenue growth of 6.9% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Dell’s year-on-year revenue growth was 10.8%, and its $27.01 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 31.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, an improvement versus the last two years. This projection is particularly noteworthy for a company of its scale and implies its newer products and services will fuel better top-line performance.

6. Operating Margin

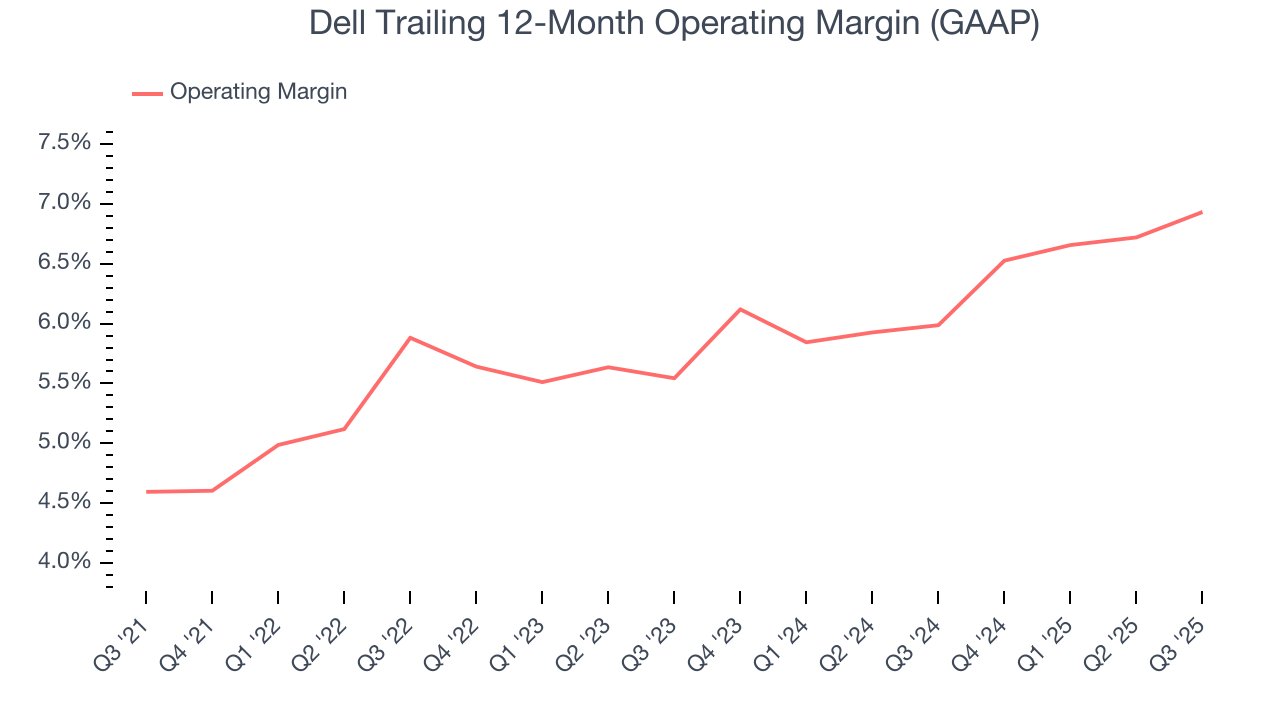

Dell was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.8% was weak for a business services business.

On the plus side, Dell’s operating margin rose by 2.3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Dell generated an operating margin profit margin of 7.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

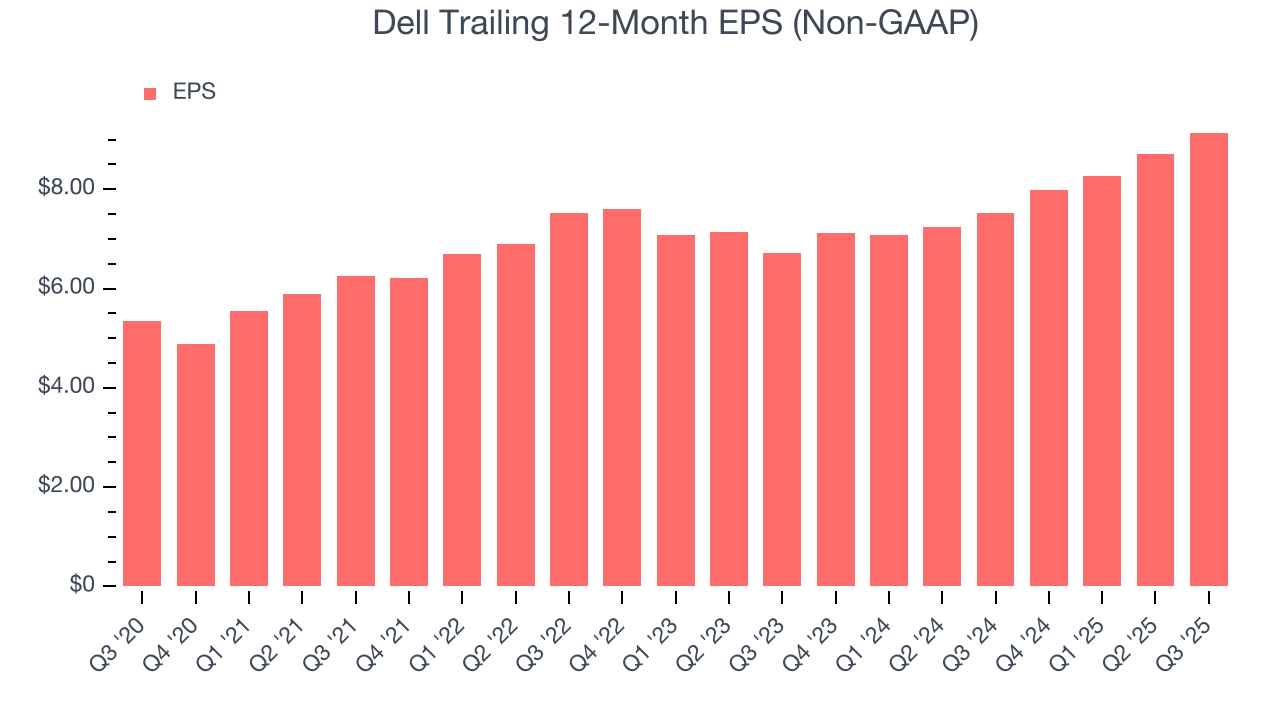

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

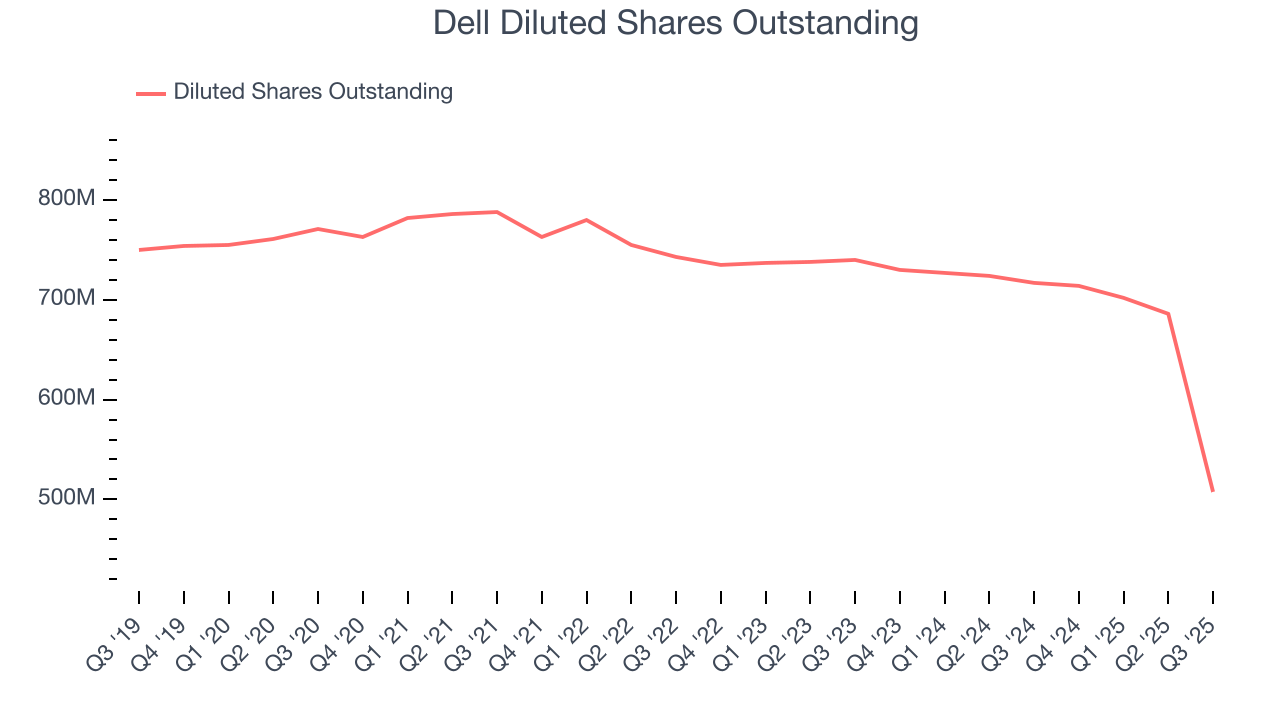

Dell’s EPS grew at a remarkable 11.3% compounded annual growth rate over the last five years, higher than its 3.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Dell’s earnings can give us a better understanding of its performance. As we mentioned earlier, Dell’s operating margin was flat this quarter but expanded by 2.3 percentage points over the last five years. On top of that, its share count shrank by 34.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Dell, its two-year annual EPS growth of 16.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Dell reported adjusted EPS of $2.59, up from $2.15 in the same quarter last year. This print beat analysts’ estimates by 4.5%. Over the next 12 months, Wall Street expects Dell’s full-year EPS of $9.14 to grow 18.4%.

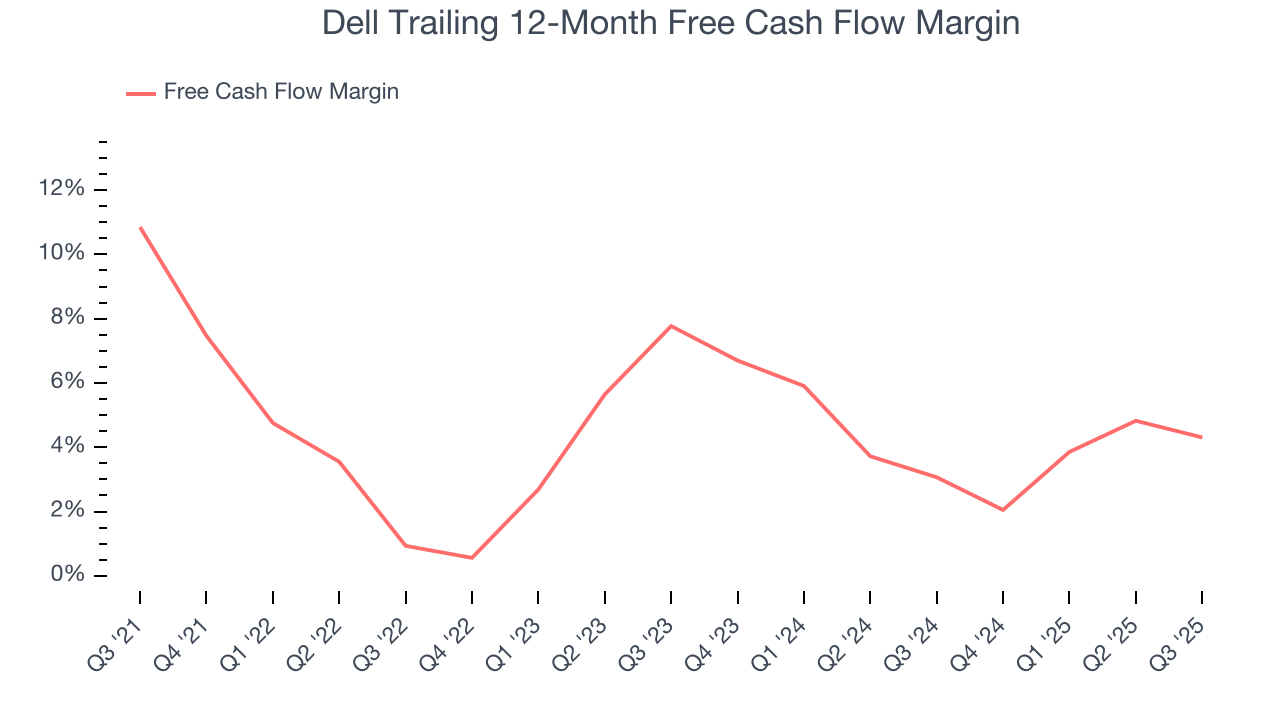

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Dell has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.3% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that Dell’s margin dropped by 6.5 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Dell’s free cash flow clocked in at $503 million in Q3, equivalent to a 1.9% margin. The company’s cash profitability regressed as it was 1.9 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

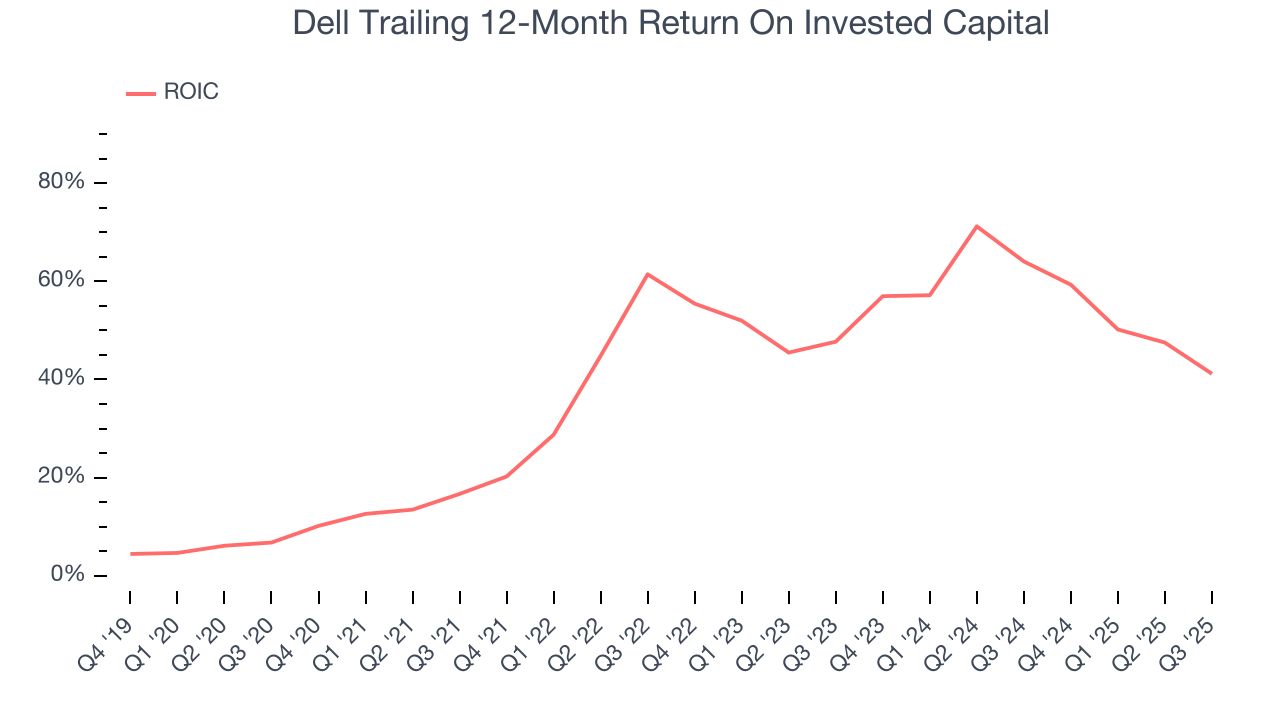

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Dell hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 46.2%, splendid for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Dell’s ROIC has increased significantly over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Assessment

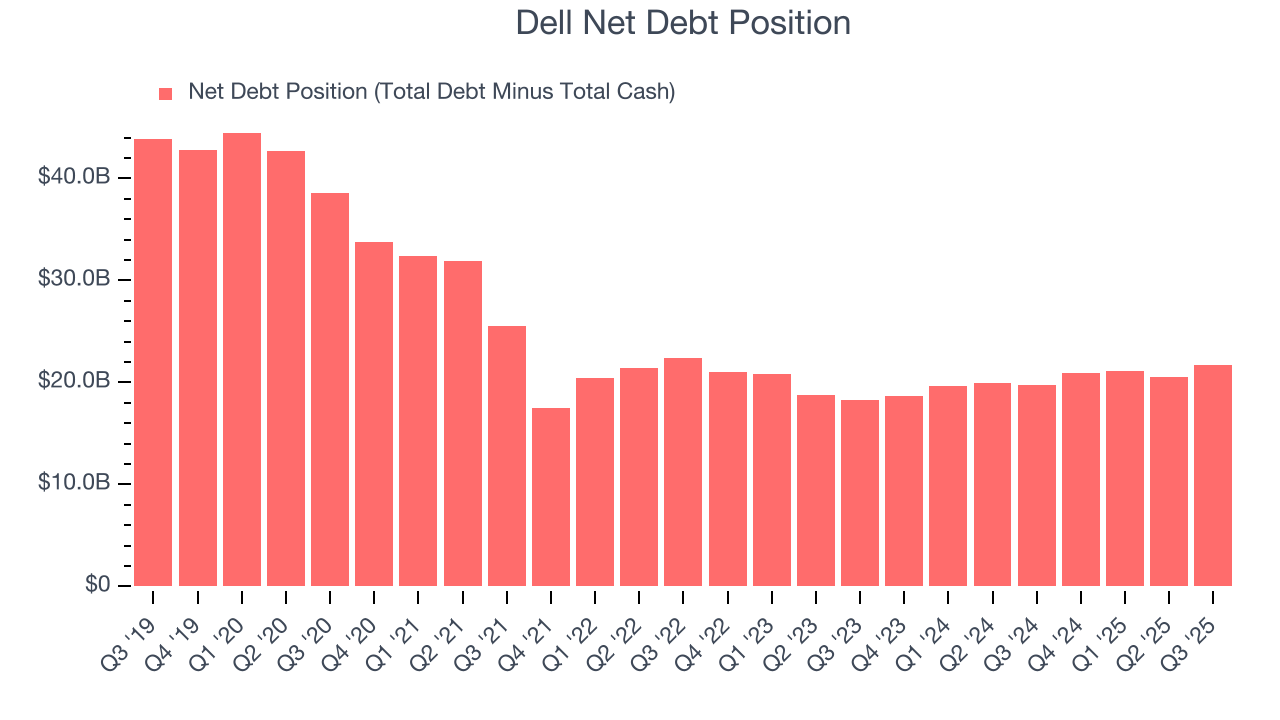

Dell reported $9.57 billion of cash and $31.24 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $11.64 billion of EBITDA over the last 12 months, we view Dell’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $1.15 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Dell’s Q3 Results

We were impressed by how significantly Dell blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. On the other hand, its revenue was in line. Zooming out, we think this was a solid print. The stock remained flat at $125.23 immediately after reporting.

12. Is Now The Time To Buy Dell?

Updated: December 4, 2025 at 10:43 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Dell doesn’t top our investment wishlist, but we understand that it’s not a bad business. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Dell’s cash profitability fell over the last five years, its scale makes it a trusted partner with negotiating leverage.

Dell’s P/E ratio based on the next 12 months is 11.5x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $163.30 on the company (compared to the current share price of $136.83).