Fortive (FTV)

Fortive is up against the odds. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Fortive Will Underperform

Taking its name from the Latin root of "strong", Fortive (NYSE:FTV) manufactures products and develops industrial software for numerous industries.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 2.1% annually over the last five years

- Flat earnings per share over the last five years lagged its peers

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

Fortive lacks the business quality we seek. There are more promising prospects in the market.

Why There Are Better Opportunities Than Fortive

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Fortive

At $53.05 per share, Fortive trades at 18.8x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Fortive (FTV) Research Report: Q4 CY2025 Update

Industrial technology company Fortive (NYSE:FTV) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 4.6% year on year to $1.12 billion. Its non-GAAP profit of $0.90 per share was 7.4% above analysts’ consensus estimates.

Fortive (FTV) Q4 CY2025 Highlights:

- Revenue: $1.12 billion vs analyst estimates of $1.09 billion (4.6% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.90 vs analyst estimates of $0.84 (7.4% beat)

- Adjusted EBITDA: $357.9 million vs analyst estimates of $354.8 million (31.9% margin, 0.9% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.95 at the midpoint, beating analyst estimates by 3.8%

- Operating Margin: 20.1%, in line with the same quarter last year

- Free Cash Flow Margin: 28%, similar to the same quarter last year

- Market Capitalization: $17.26 billion

Company Overview

Taking its name from the Latin root of "strong", Fortive (NYSE:FTV) manufactures products and develops industrial software for numerous industries.

Fortive Corporation was formed through a spin off from Danaher Corporation, a large diversified conglomerate. This move was designed to streamline operations and focus Fortive’s business on areas including instrumentation, transportation, and sensing technologies. From the start, Fortive adopted an aggressive growth strategy, leveraging strategic acquisitions to expand its technological capabilities and market presence. One of its first major acquisitions was the 2016 purchase of Fluke Corporation, an electronic test tools company. This acquisition was followed by several others, including the notable acquisitions of Industrial Scientific in 2017, a gas detection and safety company, and Landauer in 2017, a radiation measurement and monitoring company.

The company develops products and services across three main categories: operating solutions, precision technologies, and healthcare solutions. In terms of operating solutions, Fortive offers instrumentation, software, and services that facilitate critical workflows for industries such as manufacturing, healthcare, and utilities. The company’s precision technologies products address technical challenges in applications ranging from food and beverage production to electric vehicles and clean energy, offering electrical test & measurement, and sensing products. For healthcare, Fortive offers products including sterilization, tracking, biomedical testing, and comprehensive clinical productivity software.

Fortive generates revenue through the sale of its diversified portfolio of engineered products, software, and services. Revenue is also generated by government contracts providing a source of recurring revenue. Fortive remains committed to expanding its capabilities and market reach through acquisitions. In 2023 alone, the company successfully acquired four companies, further strengthening its position in the global market and enhancing its product and service offerings.

4. Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include 3M (NYSE:MMM), Emerson Electric (NYSE:EMR), Stanley Black & Decker (NYSE:SWK), and Parker-Hannifin (NYSE:PH).

5. Revenue Growth

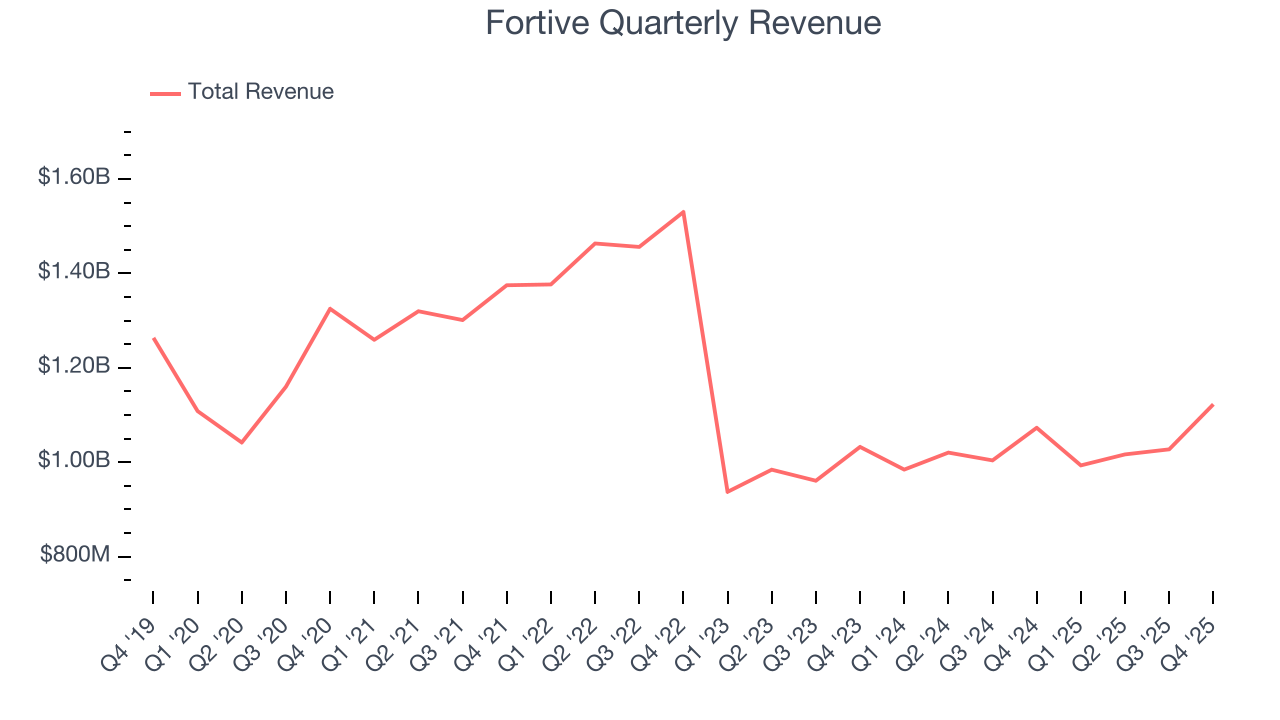

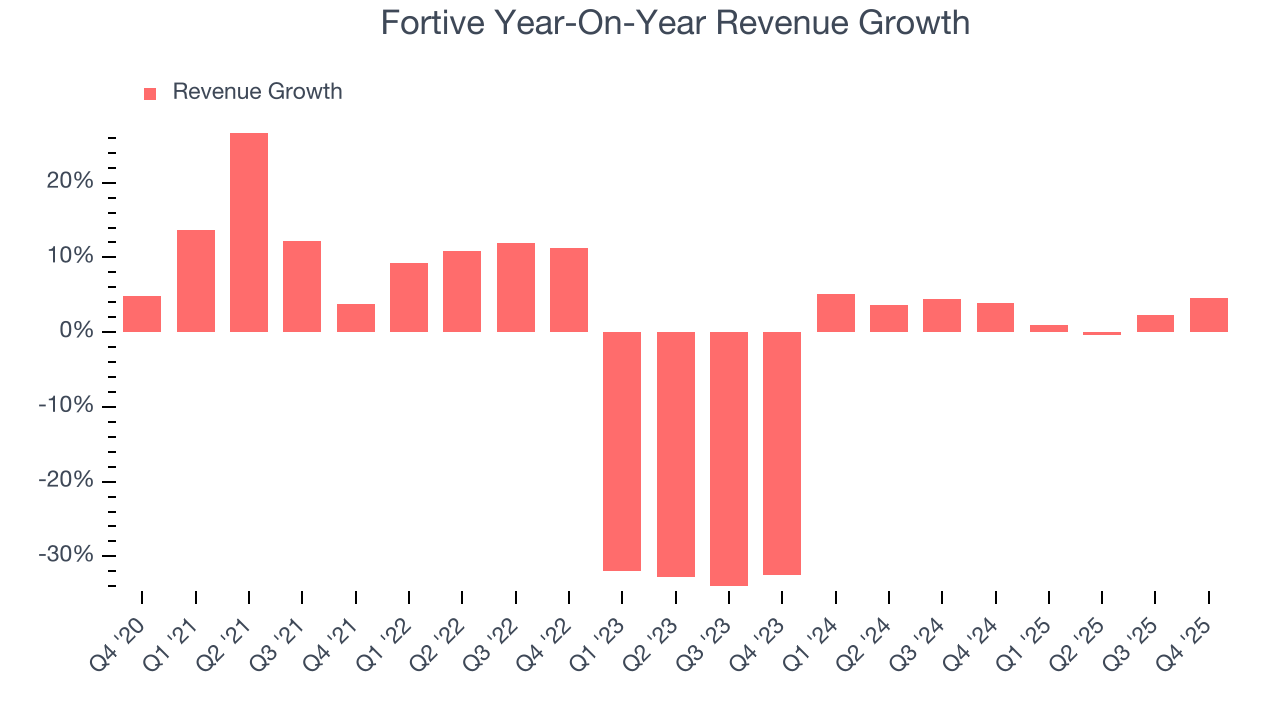

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Fortive struggled to consistently generate demand over the last five years as its sales dropped at a 2.1% annual rate. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Fortive’s annualized revenue growth of 3.1% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Fortive reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to decline by 4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

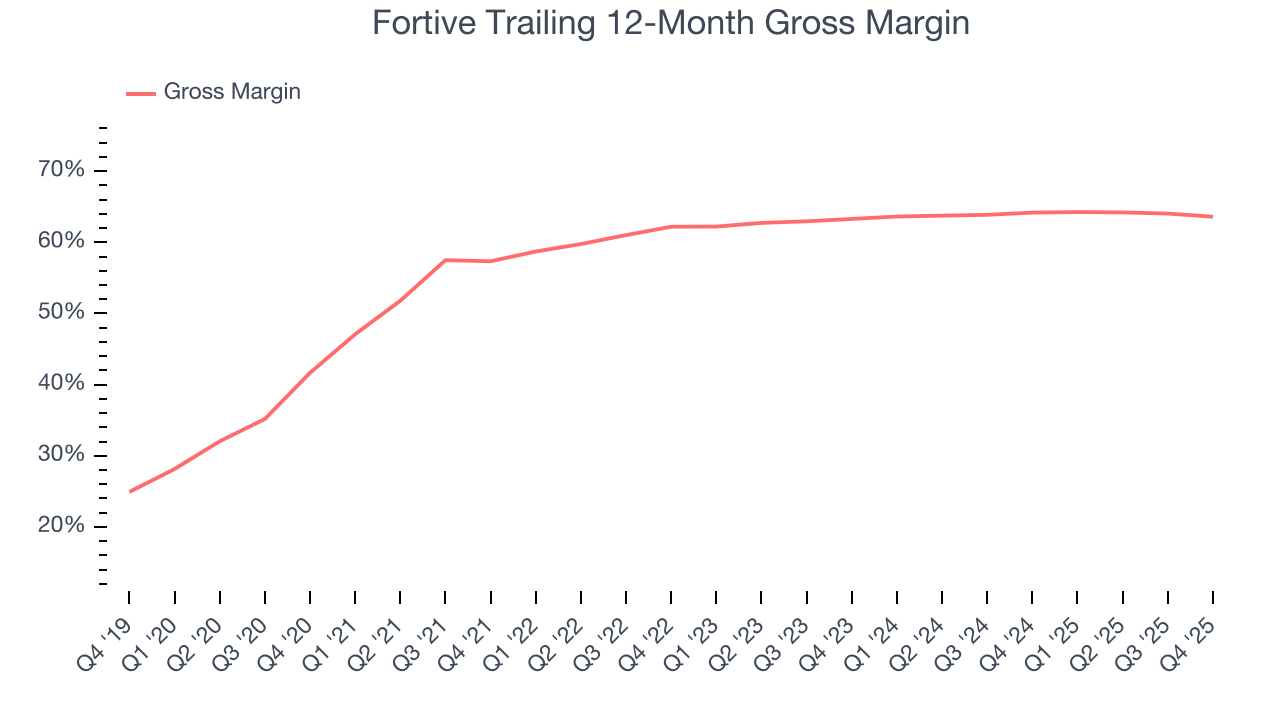

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Fortive has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 61.9% gross margin over the last five years. That means Fortive only paid its suppliers $38.12 for every $100 in revenue.

Fortive’s gross profit margin came in at 63.2% this quarter, marking a 1.7 percentage point decrease from 64.8% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

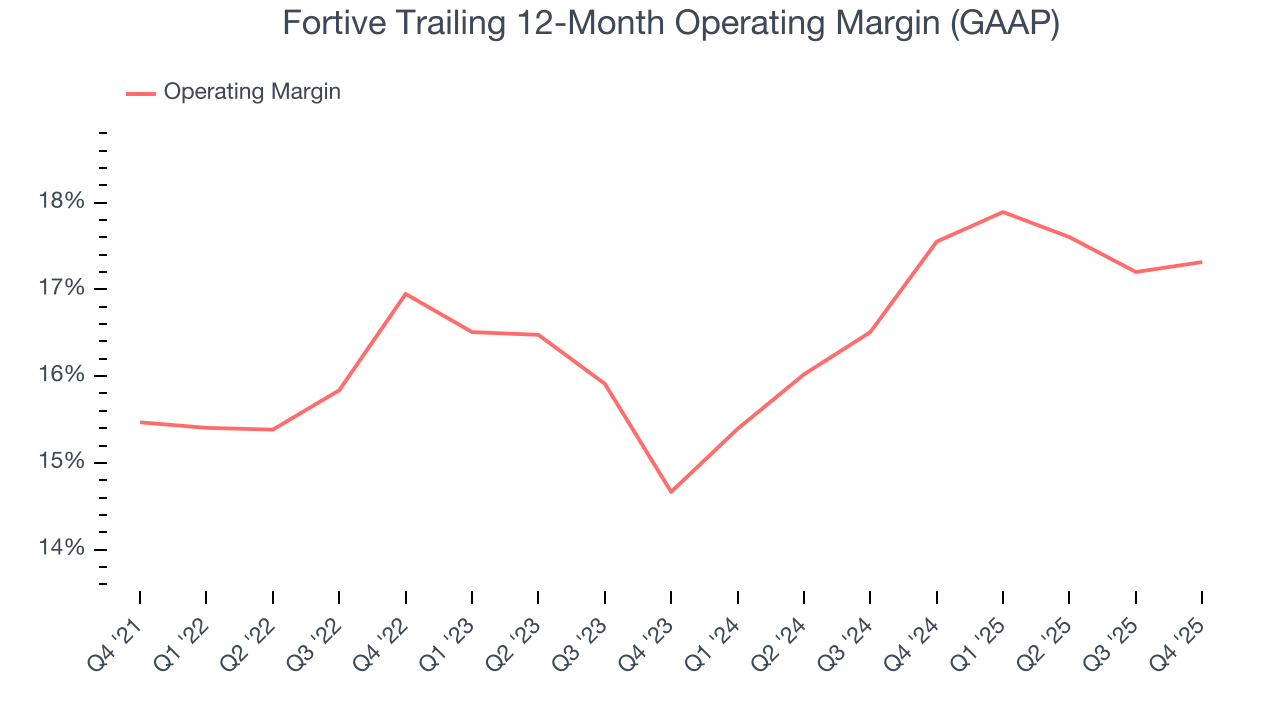

7. Operating Margin

Fortive has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Fortive’s operating margin rose by 1.8 percentage points over the last five years, showing its efficiency has improved.

This quarter, Fortive generated an operating margin profit margin of 20.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

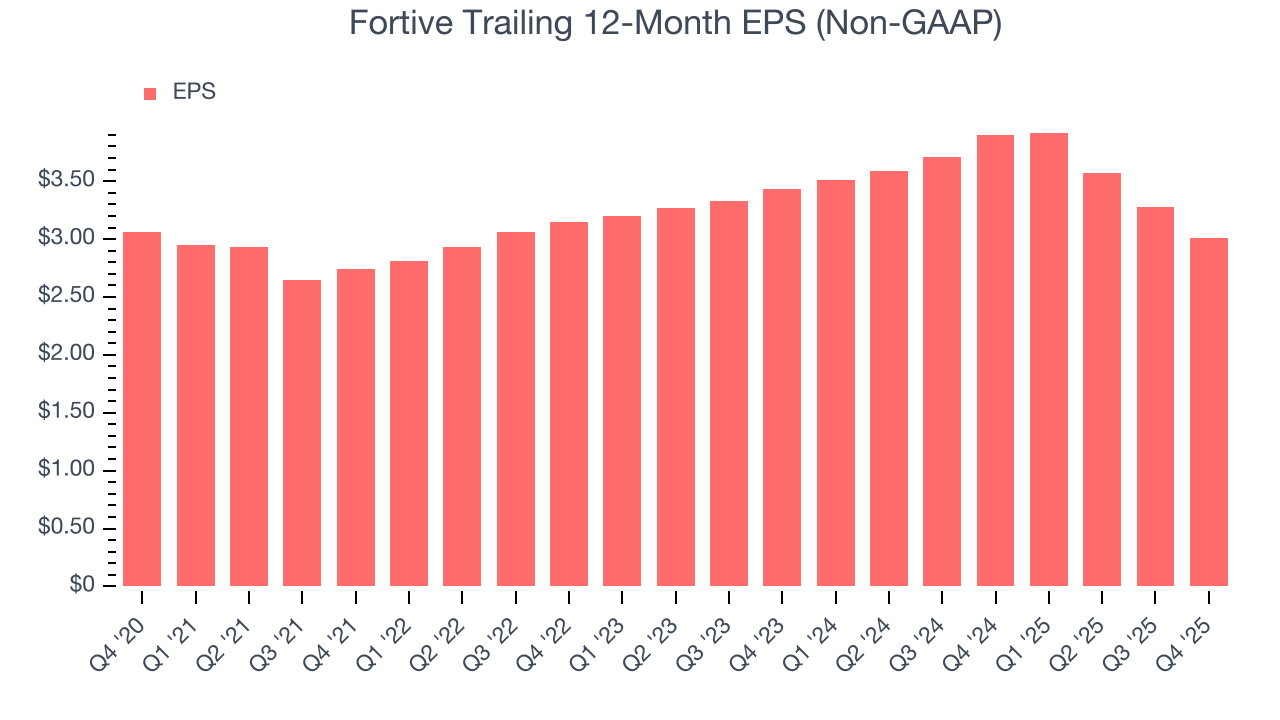

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Fortive’s flat EPS over the last five years was weak but better than its 2.1% annualized revenue declines. This tells us management adapted its cost structure.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Fortive, its two-year annual EPS declines of 6.3% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q4, Fortive reported adjusted EPS of $0.90, down from $1.17 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 7.4%. Over the next 12 months, Wall Street expects Fortive’s full-year EPS of $3.01 to shrink by 5.3%.

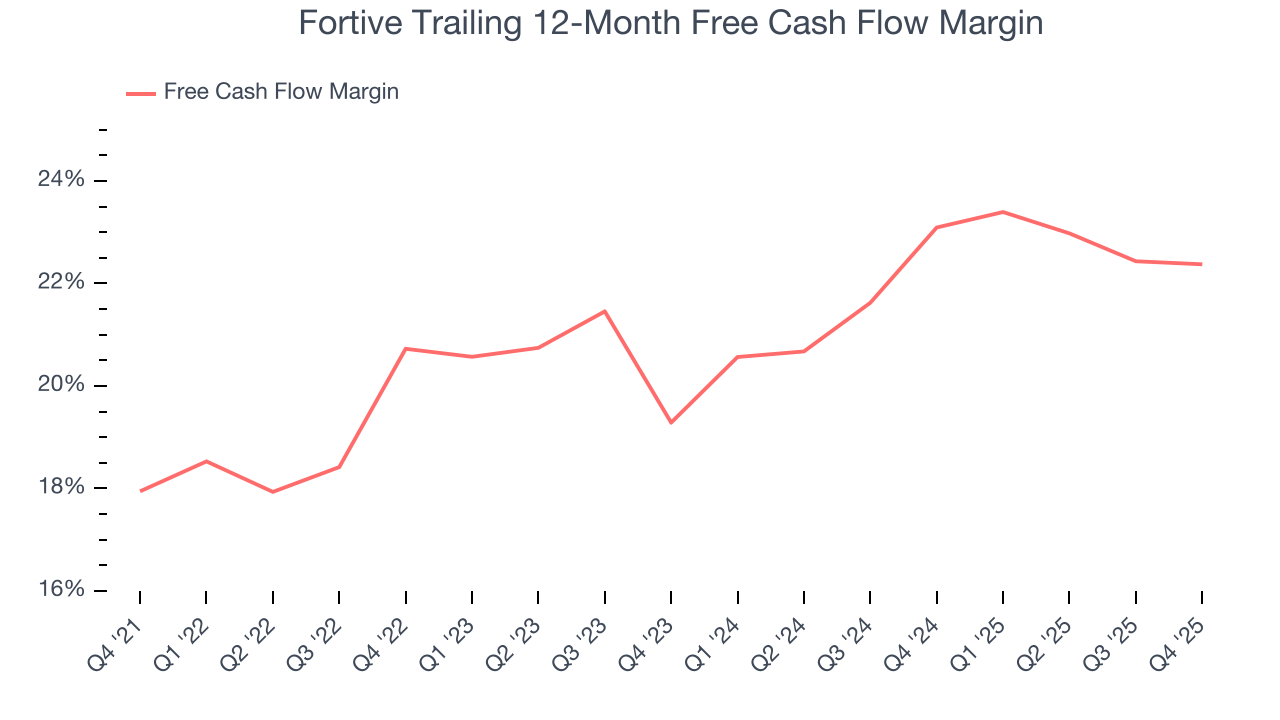

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Fortive has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 20.6% over the last five years.

Taking a step back, we can see that Fortive’s margin expanded by 4.4 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Fortive’s free cash flow clocked in at $313.8 million in Q4, equivalent to a 28% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

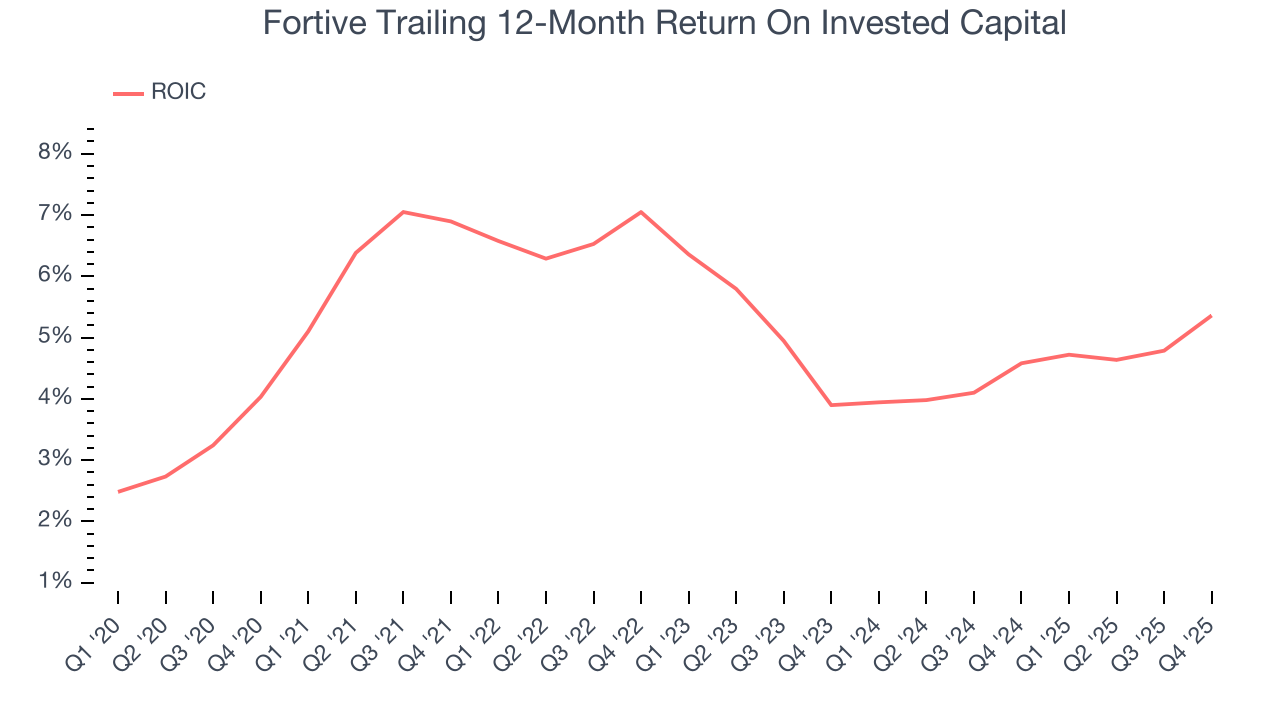

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Fortive historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.6%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Fortive’s ROIC decreased by 2 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

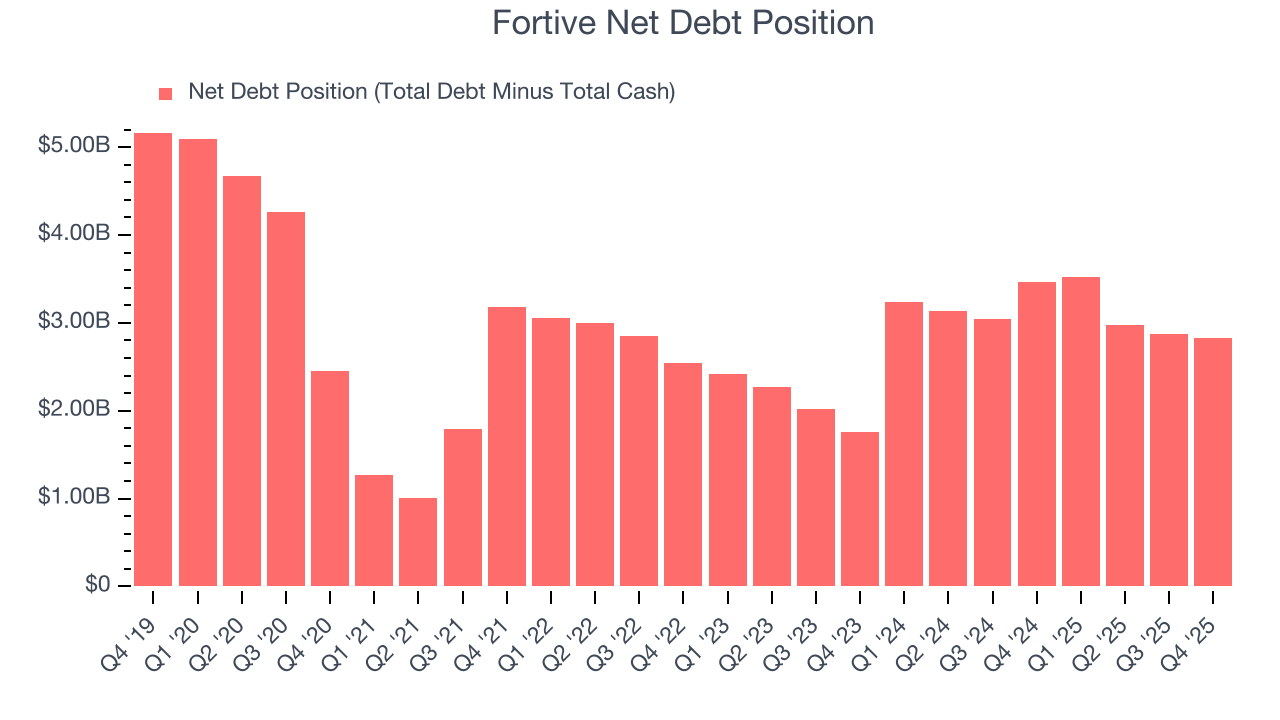

11. Balance Sheet Assessment

Fortive reported $375.5 million of cash and $3.21 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.23 billion of EBITDA over the last 12 months, we view Fortive’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $120.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Fortive’s Q4 Results

We were impressed by Fortive’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 1.7% to $55.30 immediately following the results.

13. Is Now The Time To Buy Fortive?

Updated: February 4, 2026 at 7:59 AM EST

Before making an investment decision, investors should account for Fortive’s business fundamentals and valuation in addition to what happened in the latest quarter.

Fortive falls short of our quality standards. For starters, its revenue has declined over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its admirable gross margins indicate the mission-critical nature of its offerings, the downside is its projected EPS for the next year is lacking. On top of that, its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Fortive’s P/E ratio based on the next 12 months is 19.1x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $58.13 on the company (compared to the current share price of $55.30).