Fortive (FTV)

Fortive keeps us up at night. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Fortive Will Underperform

Taking its name from the Latin root of "strong", Fortive (NYSE:FTV) manufactures products and develops industrial software for numerous industries.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 2.1% annually over the last five years

- Earnings per share were flat over the last five years and fell short of the peer group average

- Projected sales decline of 2.1% over the next 12 months indicates demand will continue deteriorating

Fortive’s quality is insufficient. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Fortive

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Fortive

At $54.60 per share, Fortive trades at 19.1x forward P/E. Fortive’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Fortive (FTV) Research Report: Q3 CY2025 Update

Industrial technology company Fortive (NYSE:FTV) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 2.3% year on year to $1.03 billion. Its non-GAAP profit of $0.68 per share was 19.5% above analysts’ consensus estimates.

Fortive (FTV) Q3 CY2025 Highlights:

- Revenue: $1.03 billion vs analyst estimates of $1.01 billion (2.3% year-on-year growth, 1.8% beat)

- Adjusted EPS: $0.68 vs analyst estimates of $0.57 (19.5% beat)

- Adjusted EBITDA: $309.4 million vs analyst estimates of $279.7 million (30.1% margin, 10.6% beat)

- Management raised its full-year Adjusted EPS guidance to $2.65 at the midpoint, a 3.9% increase

- Operating Margin: 15.5%, down from 17.1% in the same quarter last year

- Free Cash Flow Margin: 25.9%, down from 28.2% in the same quarter last year

- Market Capitalization: $16.63 billion

Company Overview

Taking its name from the Latin root of "strong", Fortive (NYSE:FTV) manufactures products and develops industrial software for numerous industries.

Fortive Corporation was formed through a spin off from Danaher Corporation, a large diversified conglomerate. This move was designed to streamline operations and focus Fortive’s business on areas including instrumentation, transportation, and sensing technologies. From the start, Fortive adopted an aggressive growth strategy, leveraging strategic acquisitions to expand its technological capabilities and market presence. One of its first major acquisitions was the 2016 purchase of Fluke Corporation, an electronic test tools company. This acquisition was followed by several others, including the notable acquisitions of Industrial Scientific in 2017, a gas detection and safety company, and Landauer in 2017, a radiation measurement and monitoring company.

The company develops products and services across three main categories: operating solutions, precision technologies, and healthcare solutions. In terms of operating solutions, Fortive offers instrumentation, software, and services that facilitate critical workflows for industries such as manufacturing, healthcare, and utilities. The company’s precision technologies products address technical challenges in applications ranging from food and beverage production to electric vehicles and clean energy, offering electrical test & measurement, and sensing products. For healthcare, Fortive offers products including sterilization, tracking, biomedical testing, and comprehensive clinical productivity software.

Fortive generates revenue through the sale of its diversified portfolio of engineered products, software, and services. Revenue is also generated by government contracts providing a source of recurring revenue. Fortive remains committed to expanding its capabilities and market reach through acquisitions. In 2023 alone, the company successfully acquired four companies, further strengthening its position in the global market and enhancing its product and service offerings.

4. Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include 3M (NYSE:MMM), Emerson Electric (NYSE:EMR), Stanley Black & Decker (NYSE:SWK), and Parker-Hannifin (NYSE:PH).

5. Revenue Growth

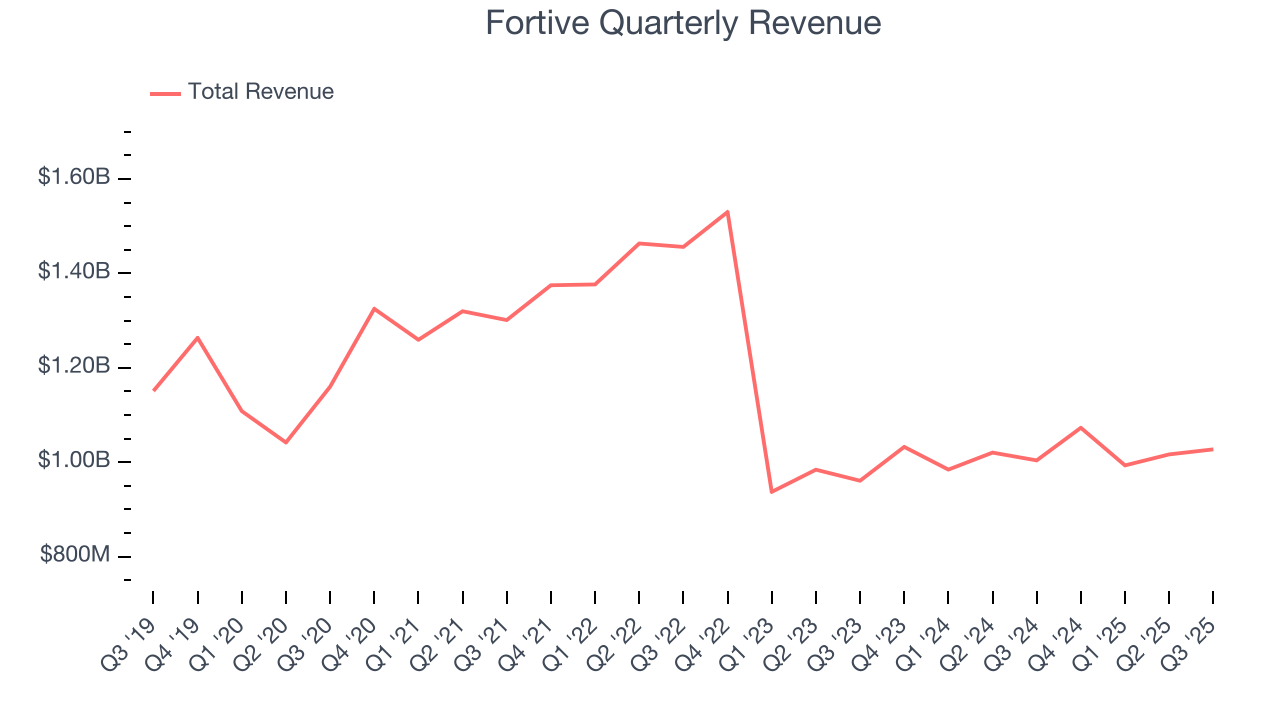

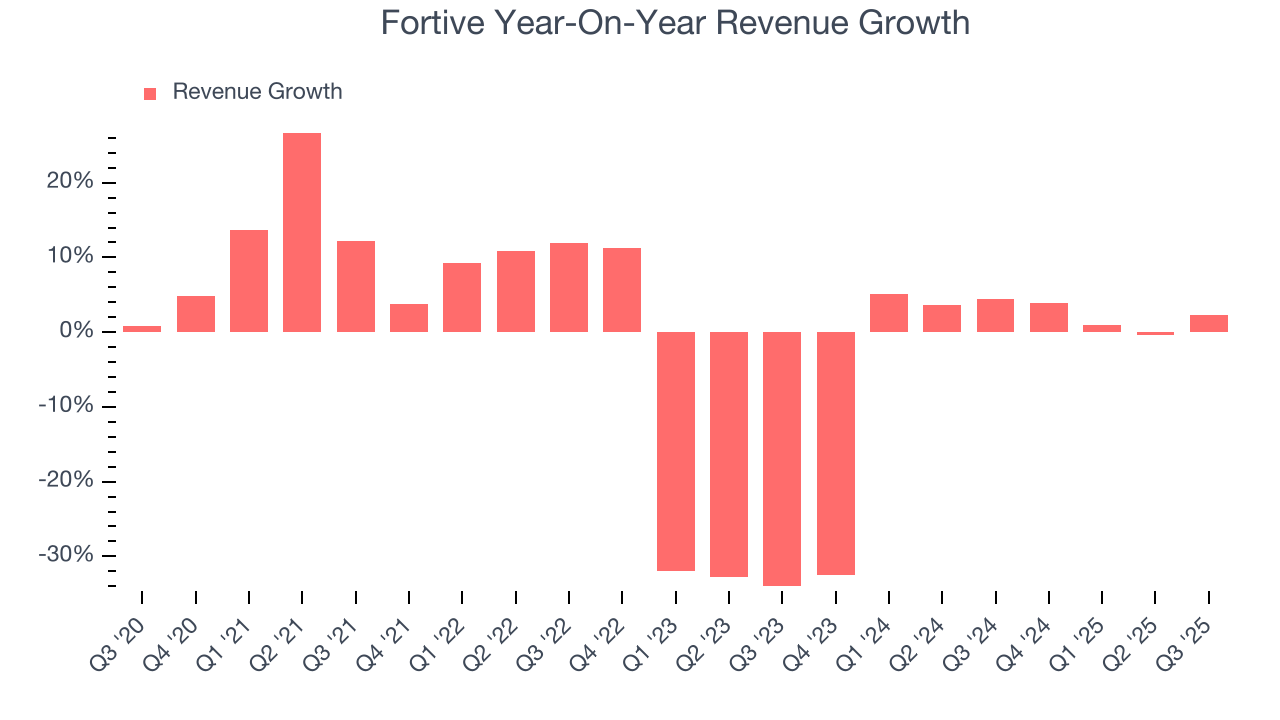

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Fortive’s demand was weak and its revenue declined by 2.1% per year. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Fortive’s recent performance shows its demand remained suppressed as its revenue has declined by 3.5% annually over the last two years.

This quarter, Fortive reported modest year-on-year revenue growth of 2.3% but beat Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

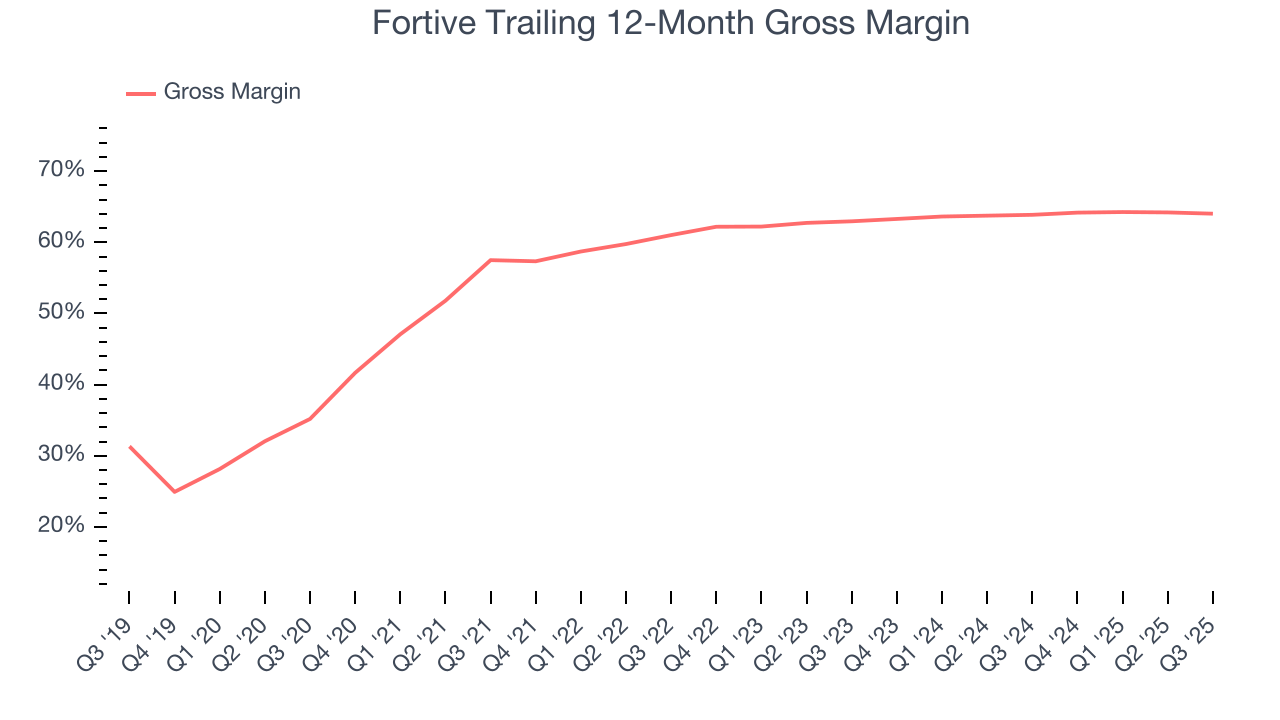

6. Gross Margin & Pricing Power

Fortive has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 61.6% gross margin over the last five years. Said differently, roughly $61.62 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, Fortive’s gross profit margin was 63.2%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

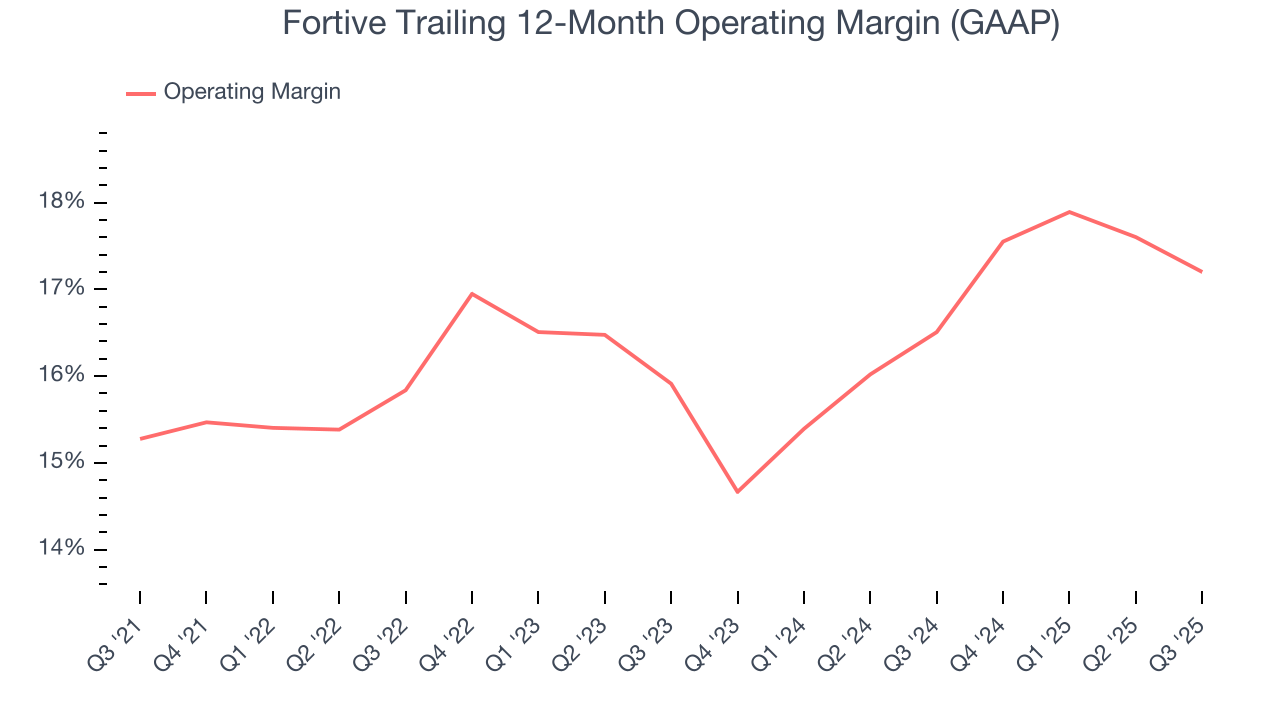

7. Operating Margin

Fortive has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Fortive’s operating margin rose by 1.9 percentage points over the last five years, showing its efficiency has improved.

This quarter, Fortive generated an operating margin profit margin of 15.5%, down 1.6 percentage points year on year. Since Fortive’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

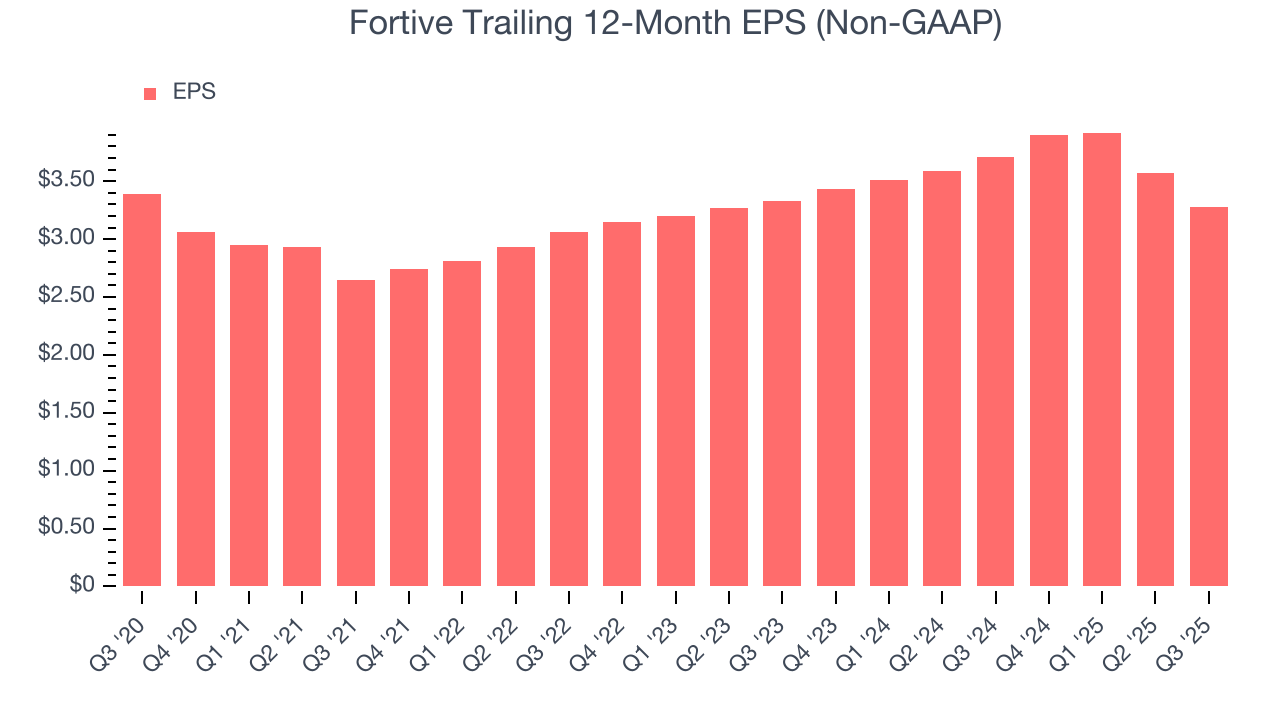

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Fortive’s flat EPS over the last five years was weak but better than its 2.1% annualized revenue declines. This tells us management adapted its cost structure.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Although it wasn’t great, Fortive’s flat two-year EPS topped its two-year revenue performance.

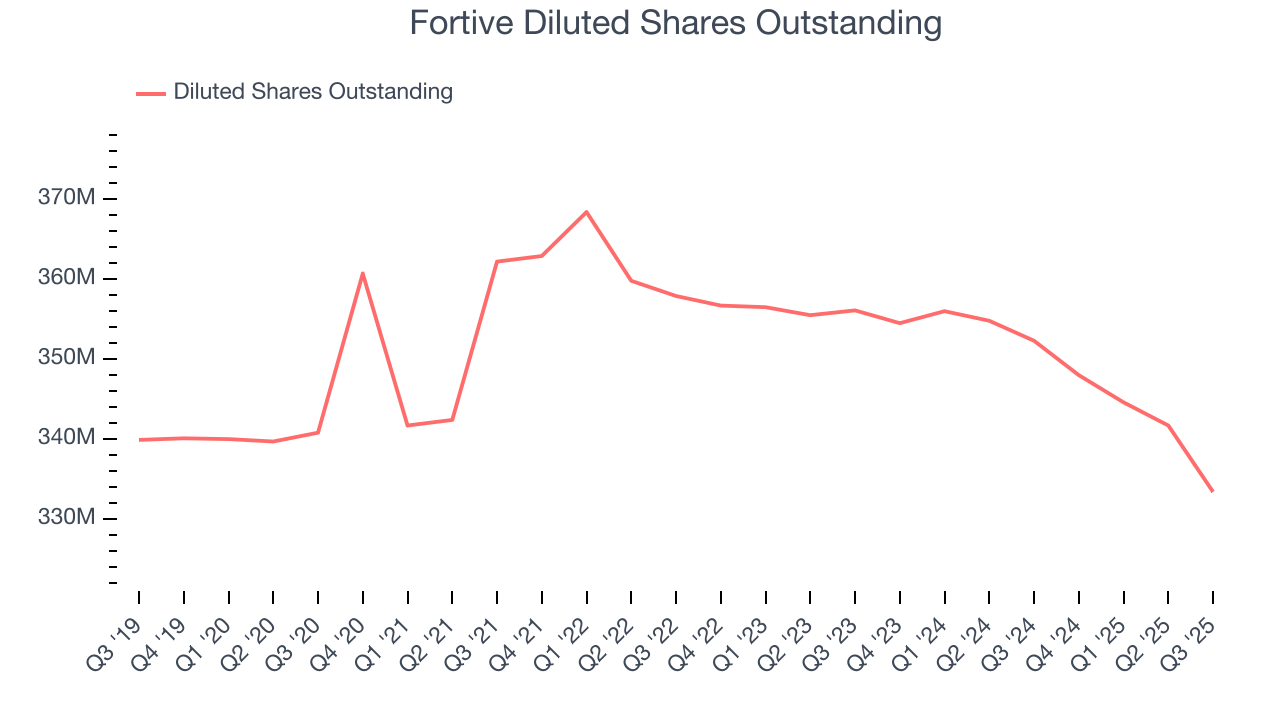

We can take a deeper look into Fortive’s earnings to better understand the drivers of its performance. A two-year view shows that Fortive has repurchased its stock, shrinking its share count by 6.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Fortive reported adjusted EPS of $0.68, down from $0.97 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Fortive’s full-year EPS of $3.28 to shrink by 16.6%.

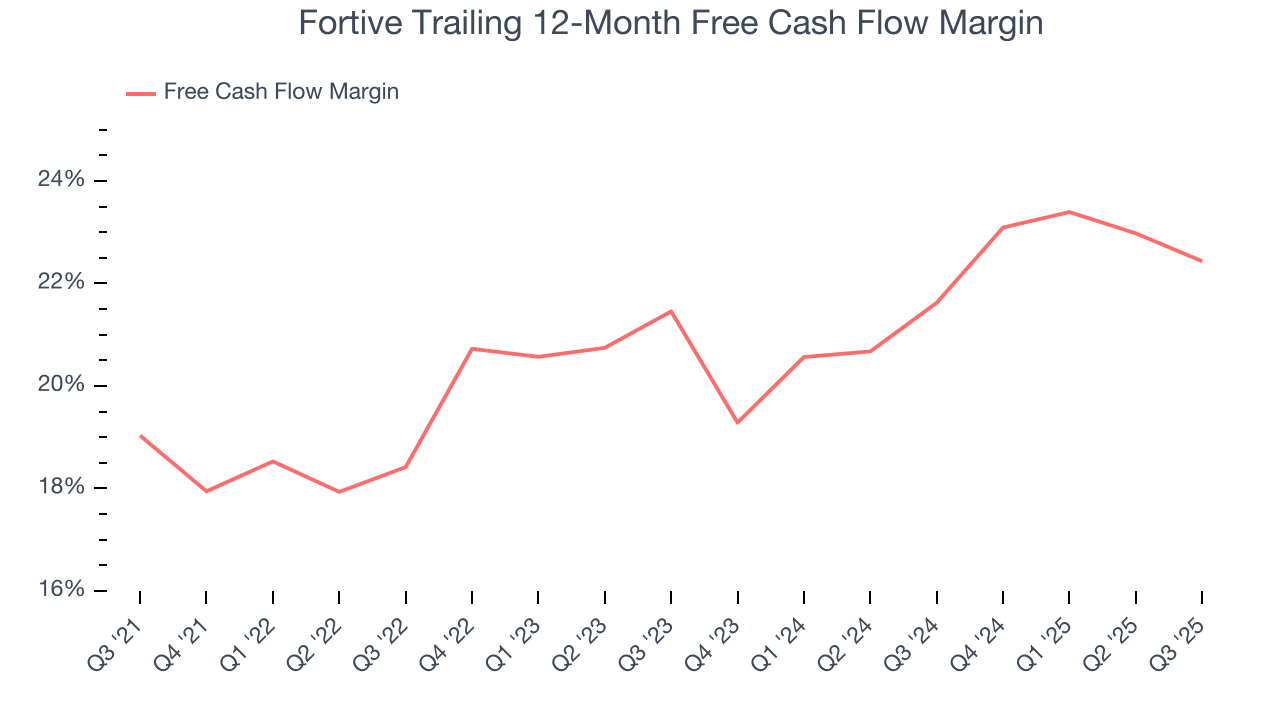

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Fortive has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 20.4% over the last five years.

Taking a step back, we can see that Fortive’s margin expanded by 3.4 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Fortive’s free cash flow clocked in at $266.1 million in Q3, equivalent to a 25.9% margin. The company’s cash profitability regressed as it was 2.3 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

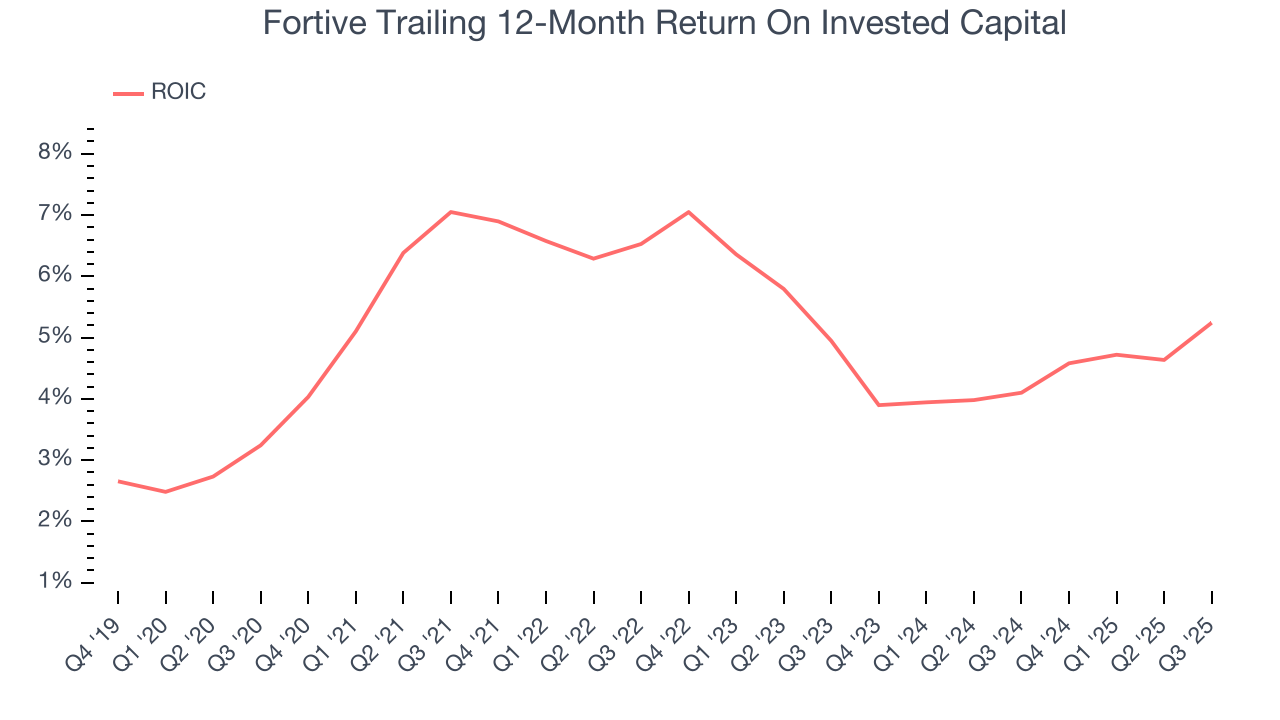

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Fortive historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.6%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Fortive’s ROIC decreased by 2.1 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

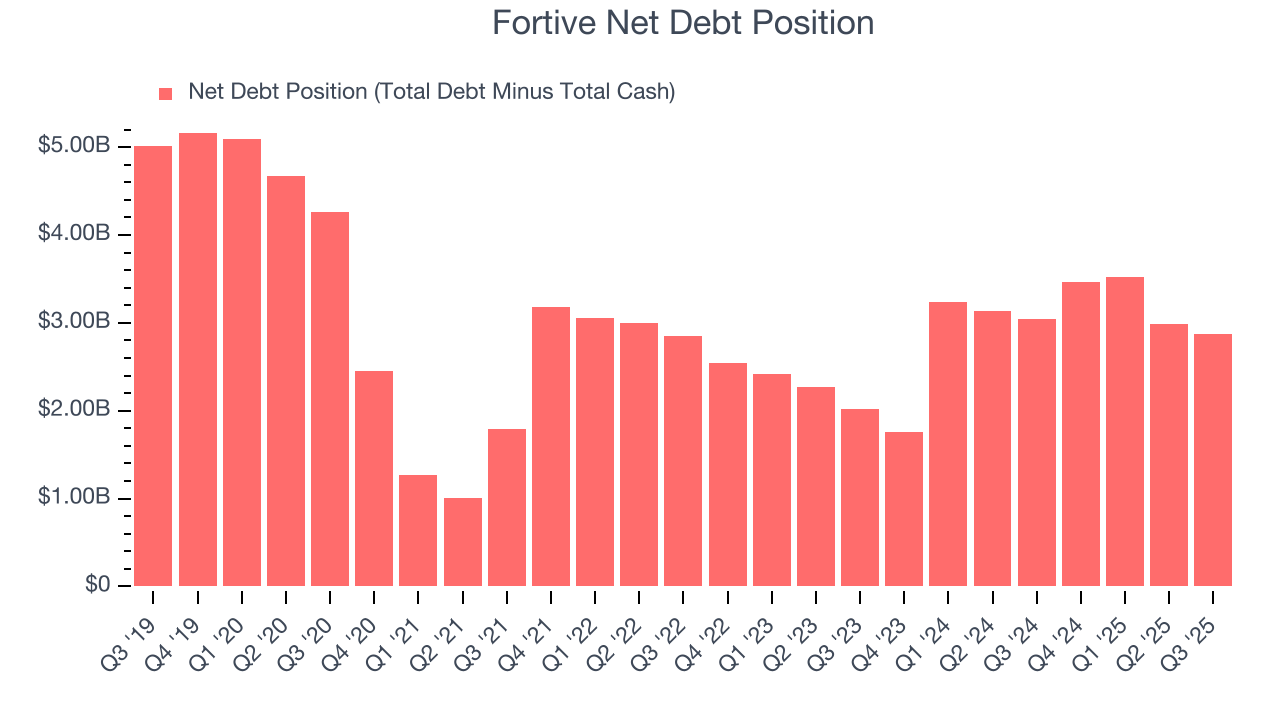

Fortive reported $430.8 million of cash and $3.31 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.21 billion of EBITDA over the last 12 months, we view Fortive’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $122.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Fortive’s Q3 Results

We were impressed by how significantly Fortive blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 9.1% to $53.65 immediately after reporting.

13. Is Now The Time To Buy Fortive?

Updated: January 24, 2026 at 10:54 PM EST

Are you wondering whether to buy Fortive or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies making their customers lives easier, but in the case of Fortive, we’ll be cheering from the sidelines. For starters, its revenue has declined over the last five years, and analysts don’t see anything changing over the next 12 months. And while its admirable gross margins indicate the mission-critical nature of its offerings, the downside is its projected EPS for the next year is lacking. On top of that, its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Fortive’s P/E ratio based on the next 12 months is 19.1x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $58.13 on the company (compared to the current share price of $54.60).