GATX (GATX)

We see potential in GATX, but its cash burn shows it only has 16 months of runway left.― StockStory Analyst Team

1. News

2. Summary

Why GATX Is Not Exciting

Originally founded to ship beer, GATX (NYSE:GATX) provides leasing and management services for railcars and other transportation assets globally.

- Cash-burning tendencies make us wonder if it can sustainably generate shareholder value

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

GATX shows some potential. However, we wouldn’t buy the stock until its EBITDA can comfortably service its debt.

Why There Are Better Opportunities Than GATX

High Quality

Investable

Underperform

Why There Are Better Opportunities Than GATX

GATX’s stock price of $183.39 implies a valuation ratio of 19.1x forward P/E. GATX’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. GATX (GATX) Research Report: Q3 CY2025 Update

Leasing services company GATX (NYSE:GATX) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 8.4% year on year to $439.3 million. Its GAAP profit of $2.25 per share was 3.4% below analysts’ consensus estimates.

GATX (GATX) Q3 CY2025 Highlights:

- Revenue: $439.3 million vs analyst estimates of $435.8 million (8.4% year-on-year growth, 0.8% beat)

- EPS (GAAP): $2.25 vs analyst expectations of $2.33 (3.4% miss)

- EPS (GAAP) guidance for the full year is $8.70 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 53.9%, up from 31.5% in the same quarter last year

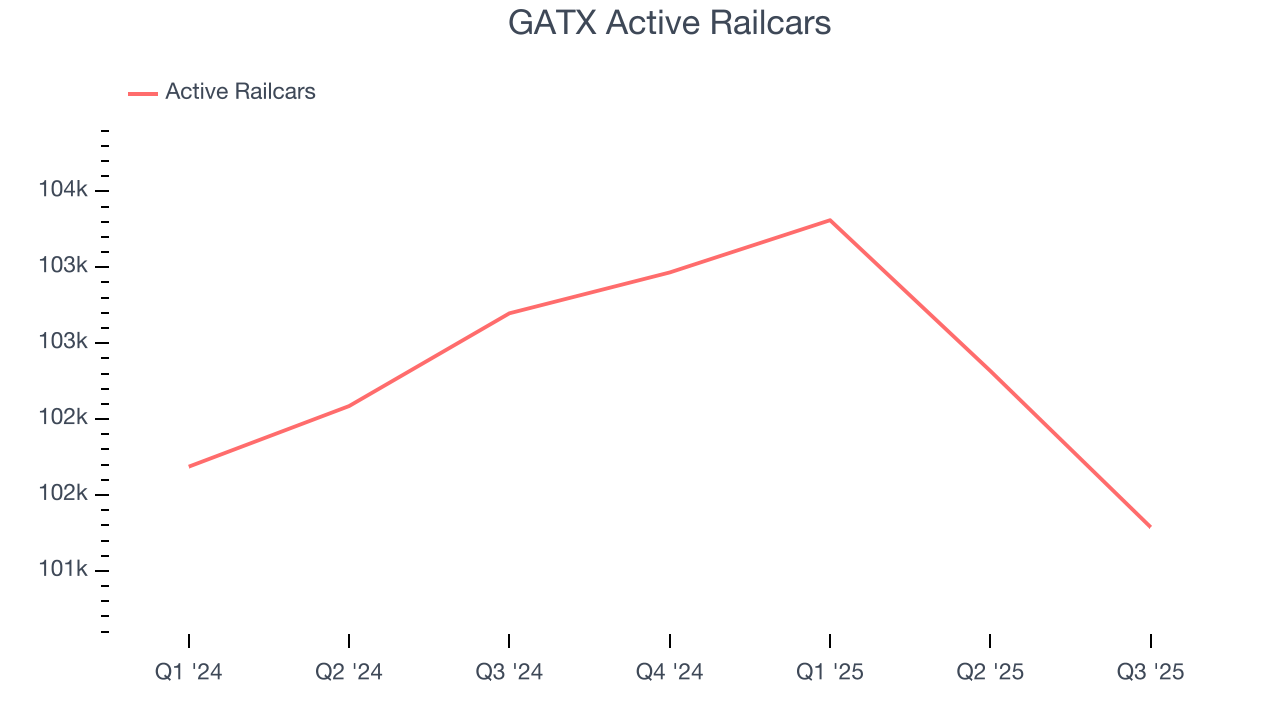

- Active Railcars: 101,288, down 1,409 year on year

- Market Capitalization: $6.16 billion

Company Overview

Originally founded to ship beer, GATX (NYSE:GATX) provides leasing and management services for railcars and other transportation assets globally.

The company was established in 1898 to meet the growing needs of industries requiring efficient and reliable transportation solutions for various goods.

GATX offers services, including railcar leasing, fleet management, and maintenance. The company addresses the logistical challenges faced by businesses by providing access to a fleet of railcars, facilitating safe and efficient transport of products. For example, GATX helps chemical manufacturers transport hazardous materials securely and assists agricultural businesses in moving bulk commodities like grain and fertilizers.

The primary revenue sources for GATX come from leasing fees and asset management services. The company operates on a business model that focuses on acquiring and maintaining a diverse portfolio of transportation assets, which are then leased to customers under long-term contracts. This approach ensures a steady stream of recurring revenue through lease payments, while also offering value-added services such as maintenance and fleet management.

4. Vehicle Parts Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Transportation parts distributors that boast reliable selection in sometimes specialized areas combined and quickly deliver products to customers can benefit from this theme. Additionally, distributors who earn meaningful revenue streams from aftermarket products can enjoy more steady top-line trends and higher margins. But like the broader industrials sector, transportation parts distributors are also at the whim of economic cycles that impact capital spending, transportation volumes, and demand for discretionary parts and components.

Competitors in the rail leasing services industry include Trinity Industries (NYSE:TRN), American Railcar Industries (NASDAQ:ARII), and Greenbrier Companies (NYSE:GBX).

5. Revenue Growth

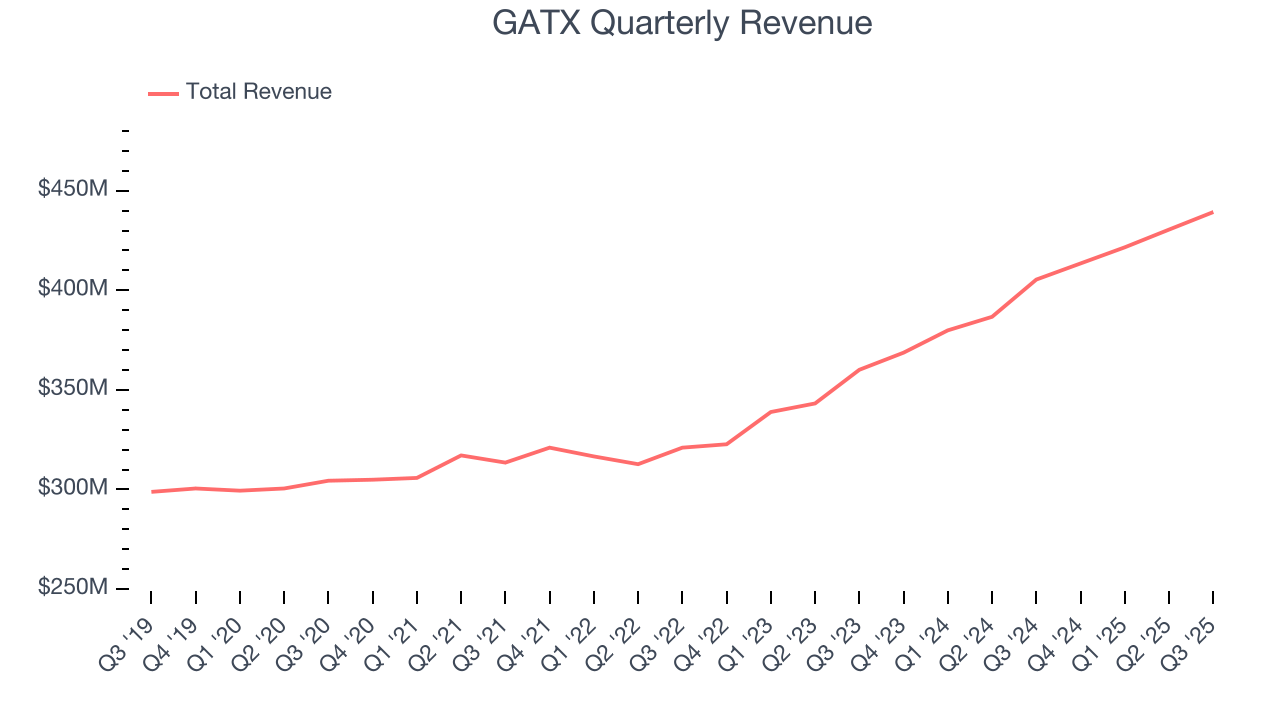

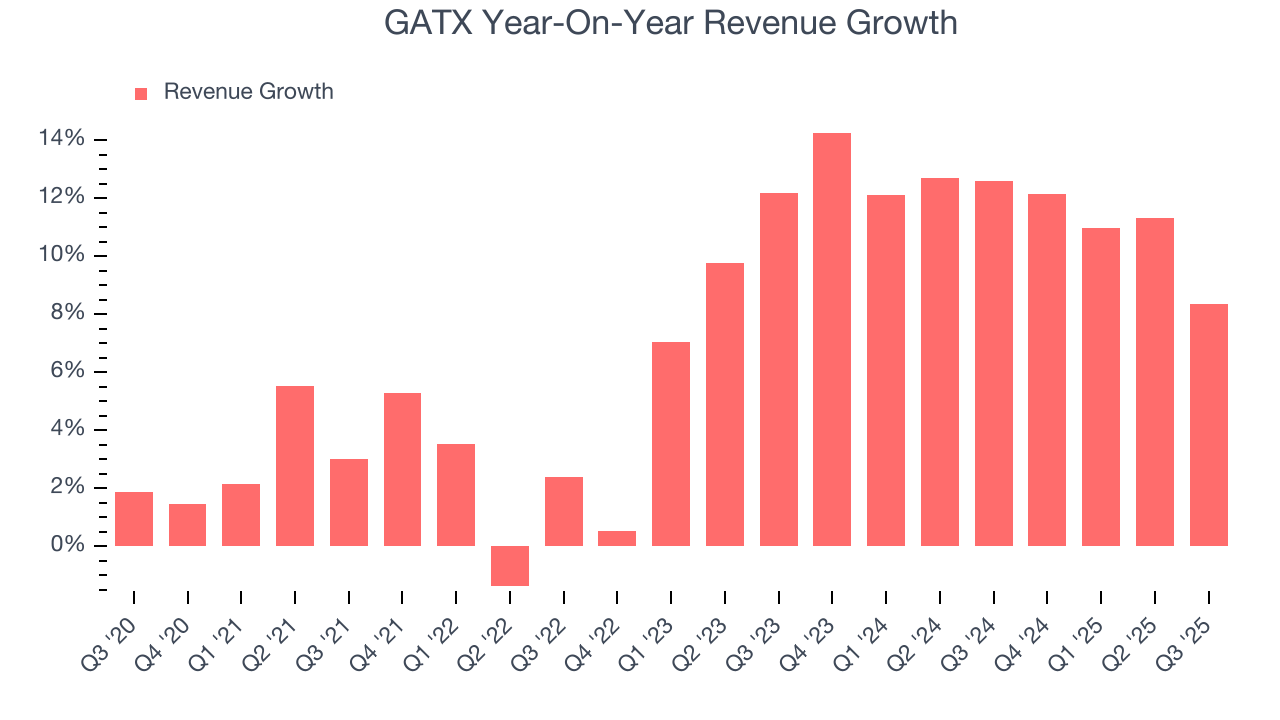

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, GATX’s sales grew at a mediocre 7.2% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. GATX’s annualized revenue growth of 11.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

GATX also discloses its number of active railcars, which reached 101,288 in the latest quarter. Over the last two years, GATX’s active railcars were flat. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, GATX reported year-on-year revenue growth of 8.4%, and its $439.3 million of revenue exceeded Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

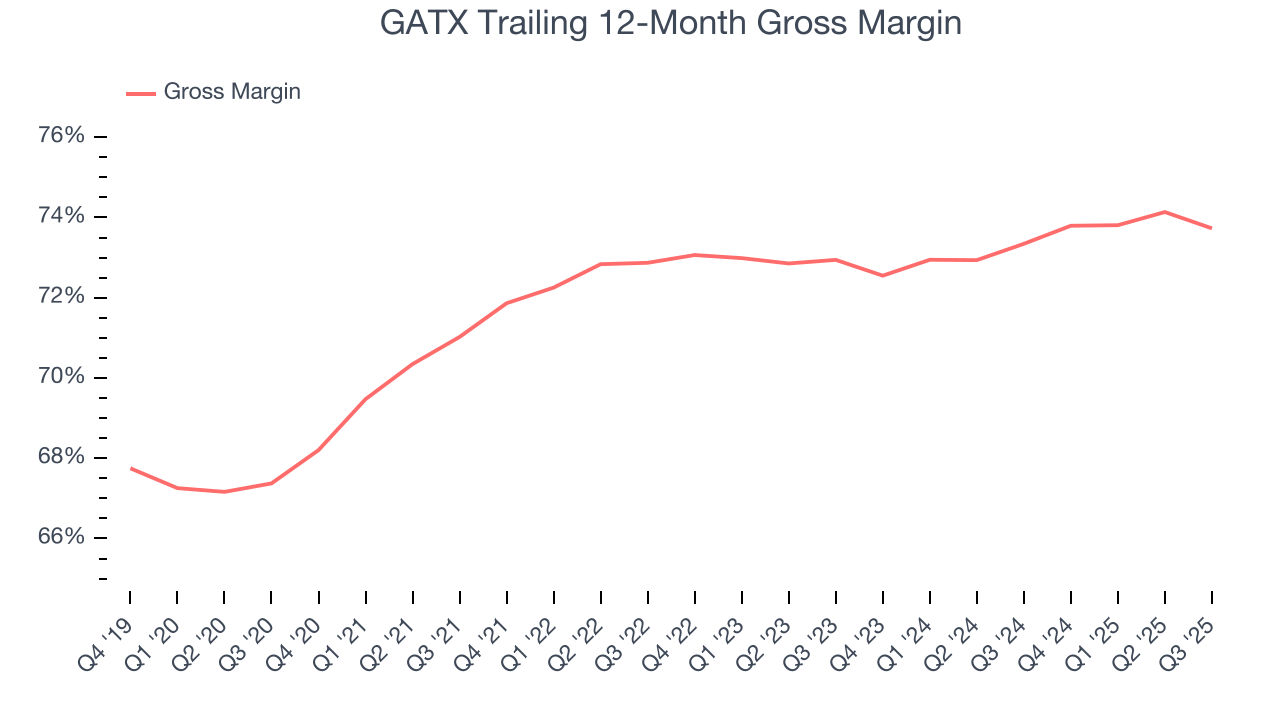

GATX has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 72.9% gross margin over the last five years. Said differently, roughly $72.87 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, GATX’s gross profit margin was 72.8%, marking a 1.6 percentage point decrease from 74.4% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

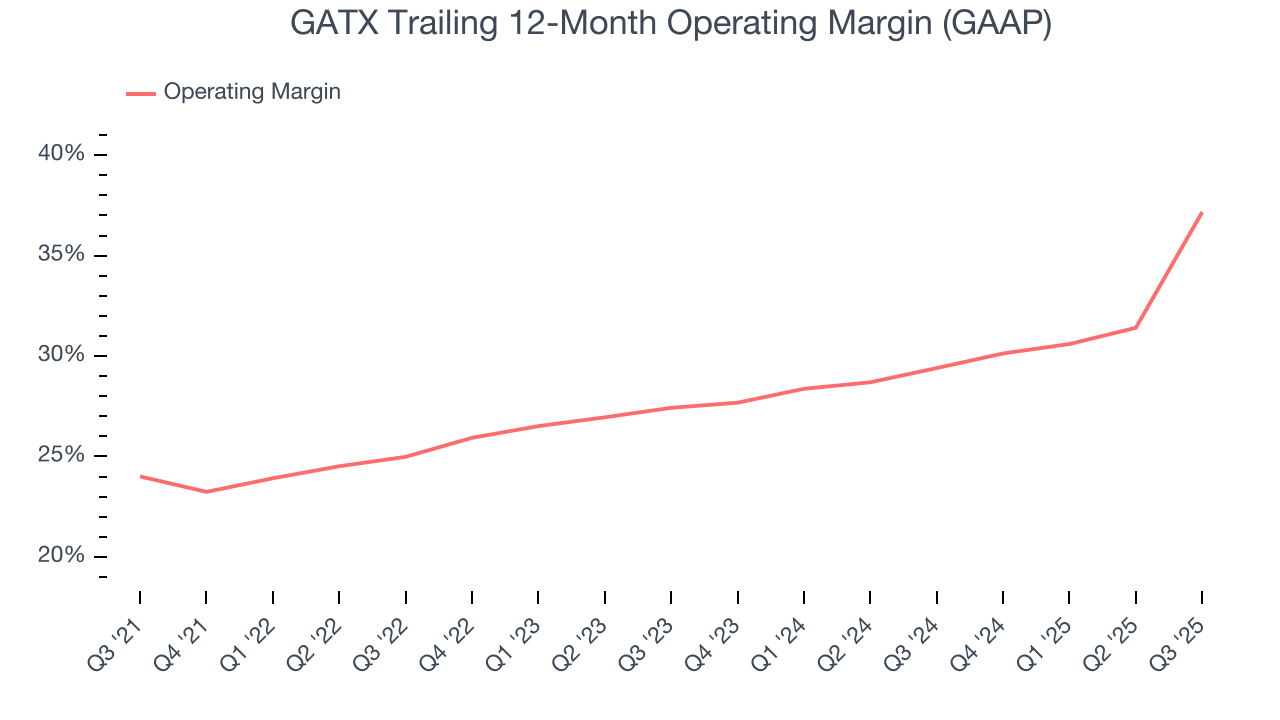

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

GATX has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 29.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, GATX’s operating margin rose by 13.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, GATX generated an operating margin profit margin of 53.9%, up 22.4 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

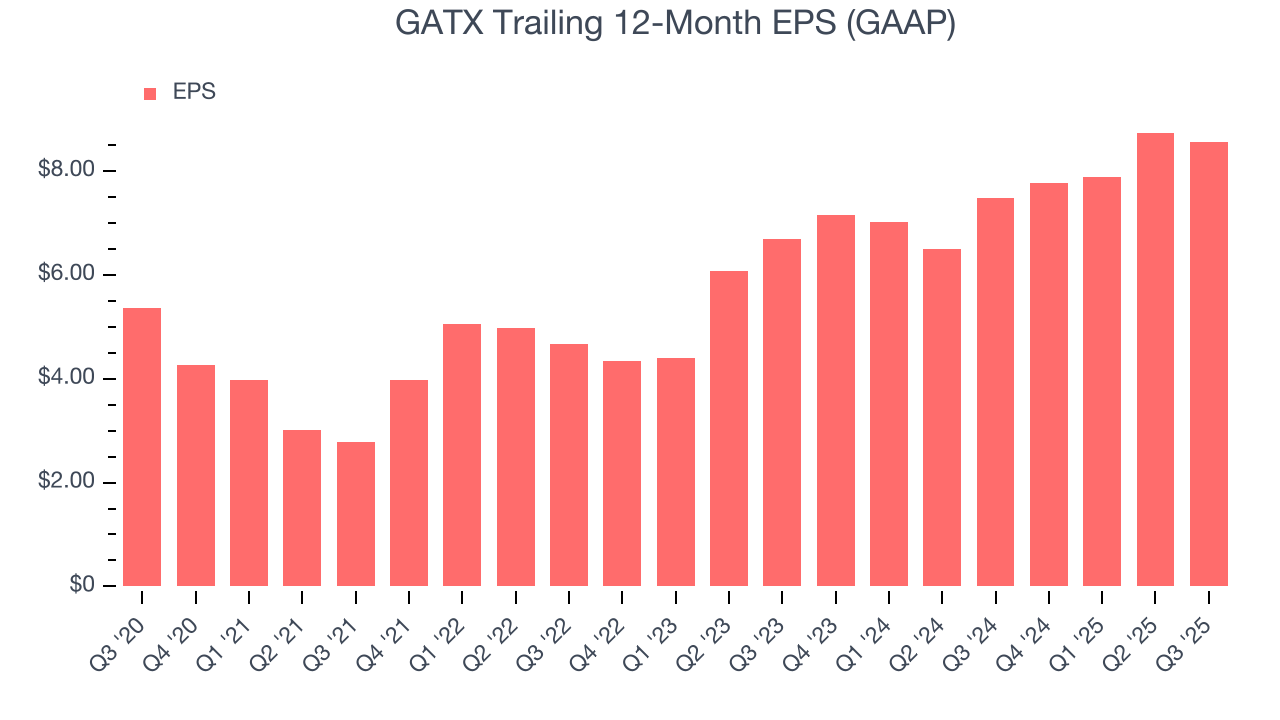

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

GATX’s EPS grew at a decent 9.8% compounded annual growth rate over the last five years, higher than its 7.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into GATX’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, GATX’s operating margin expanded by 13.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For GATX, its two-year annual EPS growth of 13% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, GATX reported EPS of $2.25, down from $2.43 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects GATX’s full-year EPS of $8.56 to grow 11.2%.

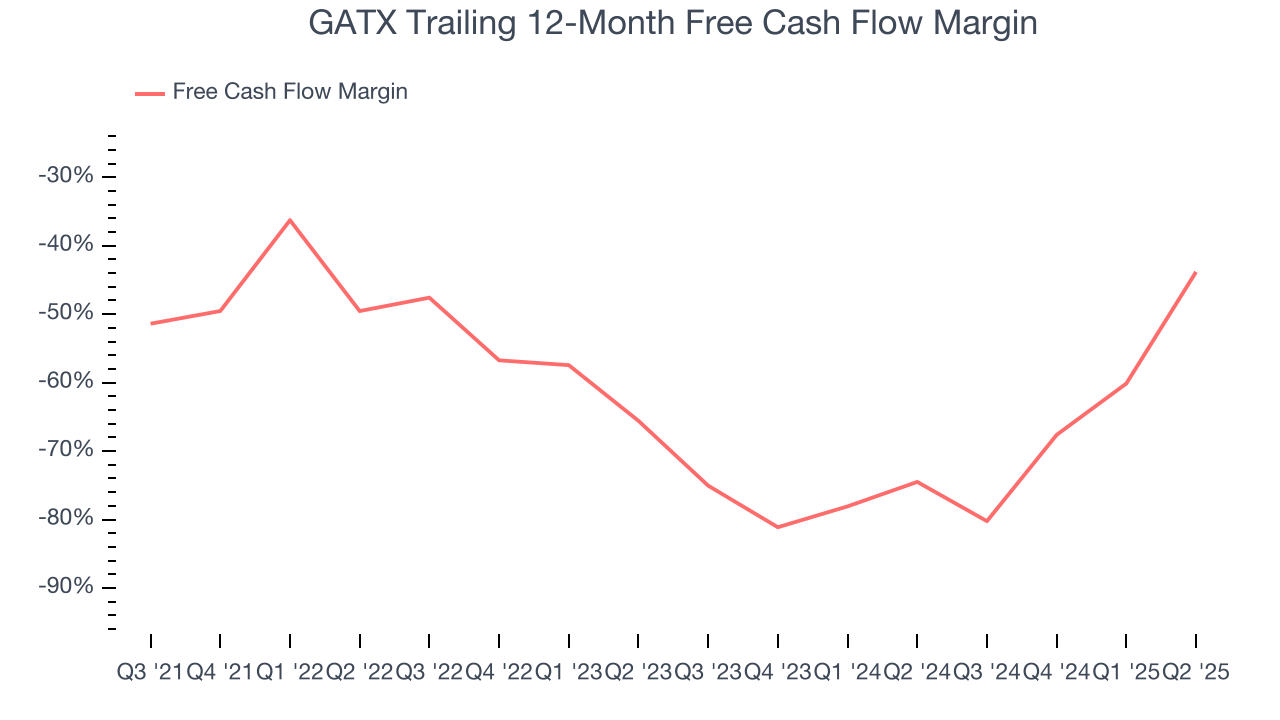

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

GATX’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 58.2%, meaning it lit $58.22 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Taking a step back, an encouraging sign is that GATX’s margin expanded by 28.6 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

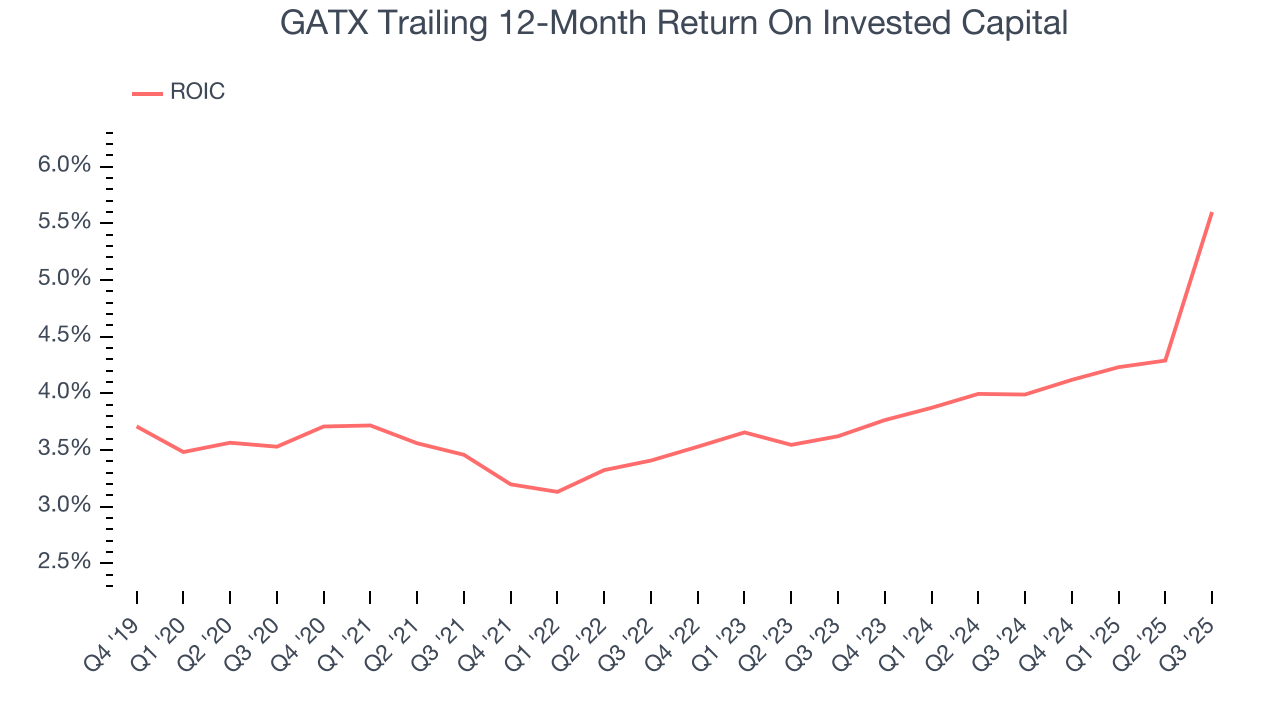

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

GATX historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, GATX’s ROIC averaged 1.4 percentage point increases over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

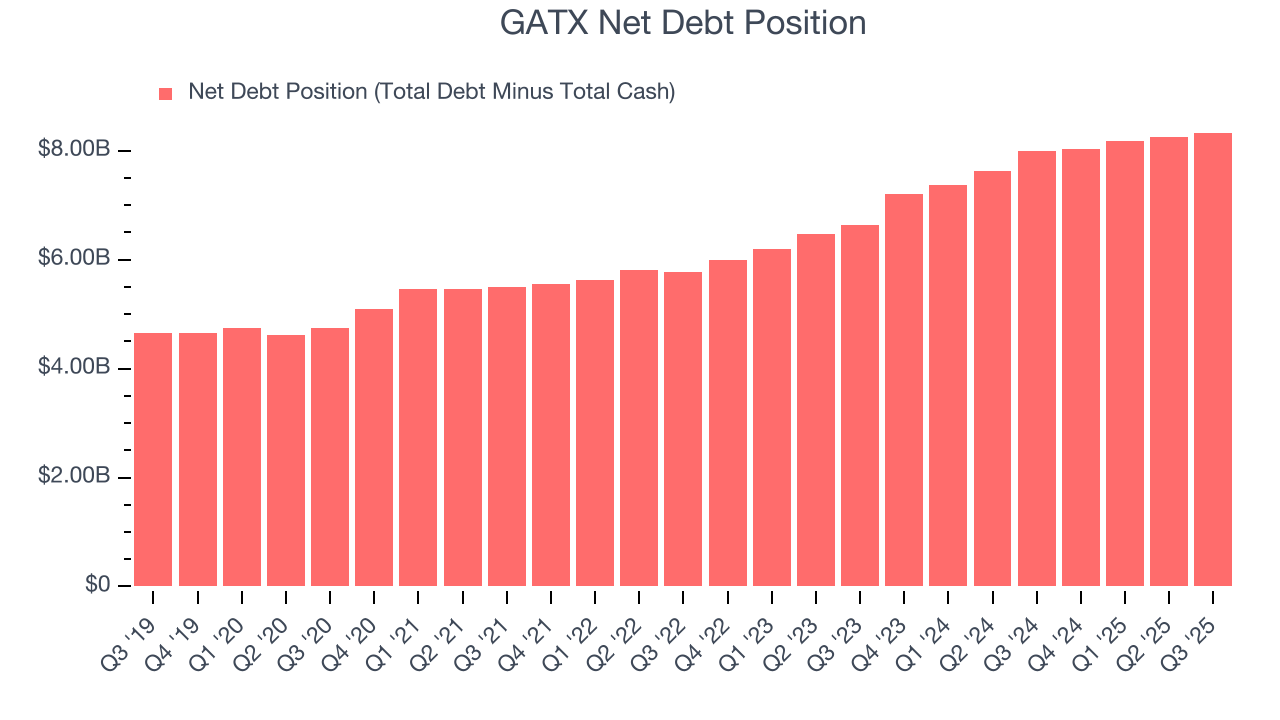

GATX’s $9.03 billion of debt exceeds the $696.1 million of cash on its balance sheet. Furthermore, its 8× net-debt-to-EBITDA ratio (based on its EBITDA of $1.09 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. GATX could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope GATX can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from GATX’s Q3 Results

We liked that GATX's revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed and its full-year EPS guidance fell slightly short of Wall Street’s estimates. Zooming out, we think this was a weaker quarter, and the stock traded down 2.4% to $168.85 immediately after reporting.

13. Is Now The Time To Buy GATX?

Updated: January 24, 2026 at 10:18 PM EST

Before deciding whether to buy GATX or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Aside from its balance sheet, GATX is a pretty decent company. Although its revenue growth was mediocre over the last five years, its growth over the next 12 months is expected to be higher. And while GATX’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its admirable gross margins indicate the mission-critical nature of its offerings. On top of that, its impressive operating margins show it has a highly efficient business model.

GATX’s P/E ratio based on the next 12 months is 19.1x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. We think a potential buyer of the stock should wait until the company’s debt falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $203.50 on the company (compared to the current share price of $183.39).