Getty Images (GETY)

Getty Images doesn’t excite us. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Getty Images Will Underperform

With a vast library of over 562 million visual assets documenting everything from breaking news to iconic historical moments, Getty Images (NYSE:GETY) is a global visual content marketplace that licenses photos, videos, illustrations, and music to businesses, media outlets, and creative professionals.

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 2.4%

- Sales trends were unexciting over the last five years as its 2.7% annual growth was below the typical business services company

- A silver lining is that its ROIC punches in at 25%, illustrating management’s expertise in identifying profitable investments

Getty Images falls short of our quality standards. There are more promising alternatives.

Why There Are Better Opportunities Than Getty Images

Why There Are Better Opportunities Than Getty Images

At $1.27 per share, Getty Images trades at 18.2x forward P/E. This multiple rich for the business quality. Not a great combination.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Getty Images (GETY) Research Report: Q3 CY2025 Update

Visual content marketplace Getty Images (NYSE:GETY) met Wall Streets revenue expectations in Q3 CY2025, but sales were flat year on year at $240 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $946.5 million at the midpoint. Its non-GAAP profit of $0.08 per share was 84.5% above analysts’ consensus estimates.

Getty Images (GETY) Q3 CY2025 Highlights:

- Revenue: $240 million vs analyst estimates of $240 million (flat year on year, in line)

- Adjusted EPS: $0.08 vs analyst estimates of $0.04 (84.5% beat)

- Adjusted EBITDA: $78.71 million vs analyst estimates of $72.37 million (32.8% margin, 8.8% beat)

- The company reconfirmed its revenue guidance for the full year of $946.5 million at the midpoint

- EBITDA guidance for the full year is $292 million at the midpoint, above analyst estimates of $282.3 million

- Operating Margin: 18.8%, down from 23.9% in the same quarter last year

- Free Cash Flow was $7.89 million, up from -$1.84 million in the same quarter last year

- Market Capitalization: $734.2 million

Company Overview

With a vast library of over 562 million visual assets documenting everything from breaking news to iconic historical moments, Getty Images (NYSE:GETY) is a global visual content marketplace that licenses photos, videos, illustrations, and music to businesses, media outlets, and creative professionals.

The company operates through three main brands: Getty Images for premium content, iStock for value-oriented offerings, and Unsplash for both free and subscription-based content. This multi-tiered approach allows Getty Images to serve customers ranging from major corporations and news organizations to small businesses and individual creators.

Getty Images sources its content from a network of over 557,000 contributors worldwide, including more than 110 staff photographers and videographers who cover news, sports, and entertainment events. The company maintains exclusive relationships with over 80,000 contributors and 70 editorial content partners, including major organizations like Disney, Bloomberg, and sports leagues such as Formula One, NBA, and FIFA.

A corporate marketing team might use Getty Images to license professional photography for an advertising campaign, paying either through a single purchase or via a Premium Access subscription that provides broad access to the company's entire library. Meanwhile, a small business owner could turn to iStock for more affordable visual assets, while a blogger might utilize Unsplash's free content collection.

The company has increasingly shifted toward subscription-based revenue models, with annual subscriptions now representing more than half of total revenue. These subscription offerings provide customers with ongoing access to content while giving Getty Images more predictable revenue streams. Beyond simple licensing, the company also offers services like custom content creation, digital asset management, and recently launched AI-generated imagery in partnership with NVIDIA.

Getty Images maintains one of the world's largest private photographic archives, with over 135 million historical images spanning various time periods, geographies, and subject matters. This includes exclusive representation of historically significant collections like Hulton, Bettman, Sygma, and Gamma archives.

4. Digital Media & Content Platforms

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

Getty Images competes with visual content marketplaces like Shutterstock (NYSE:SSTK), Adobe Stock (part of Adobe Inc., NASDAQ:ADBE), and privately-held companies such as Alamy and VCG. The company also faces competition from user-generated content platforms and AI image generation services.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $946.3 million in revenue over the past 12 months, Getty Images is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

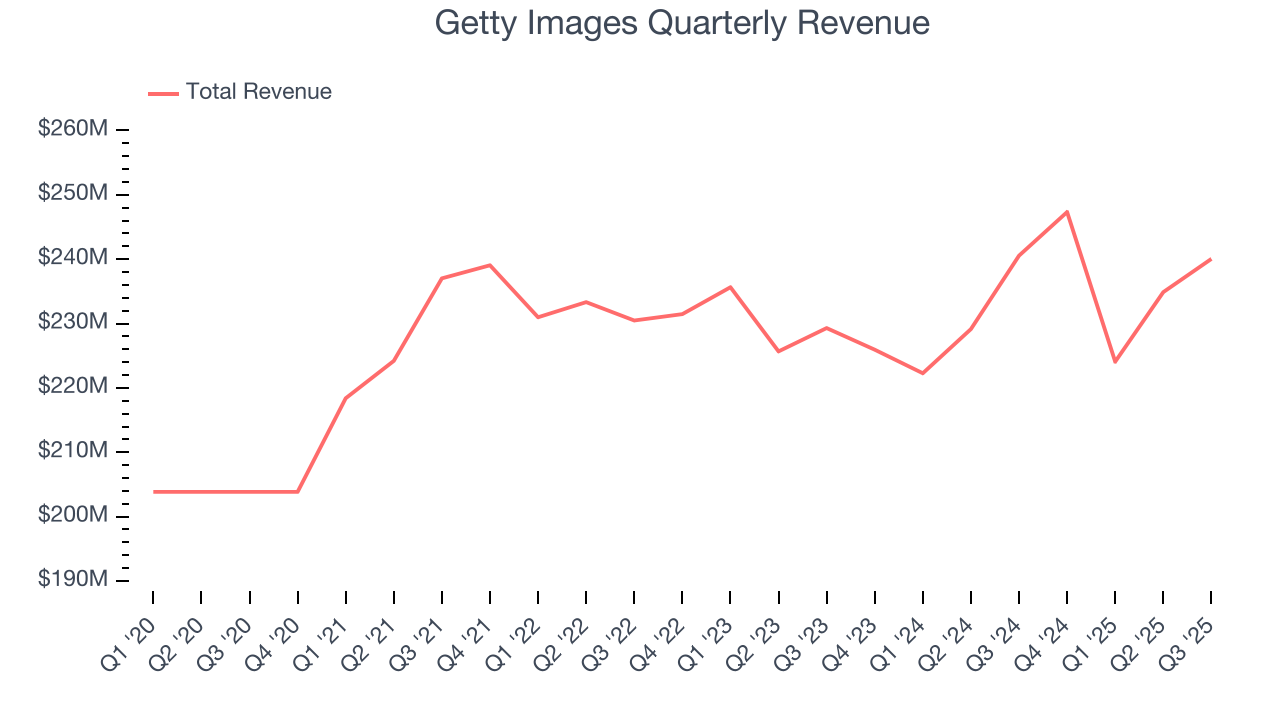

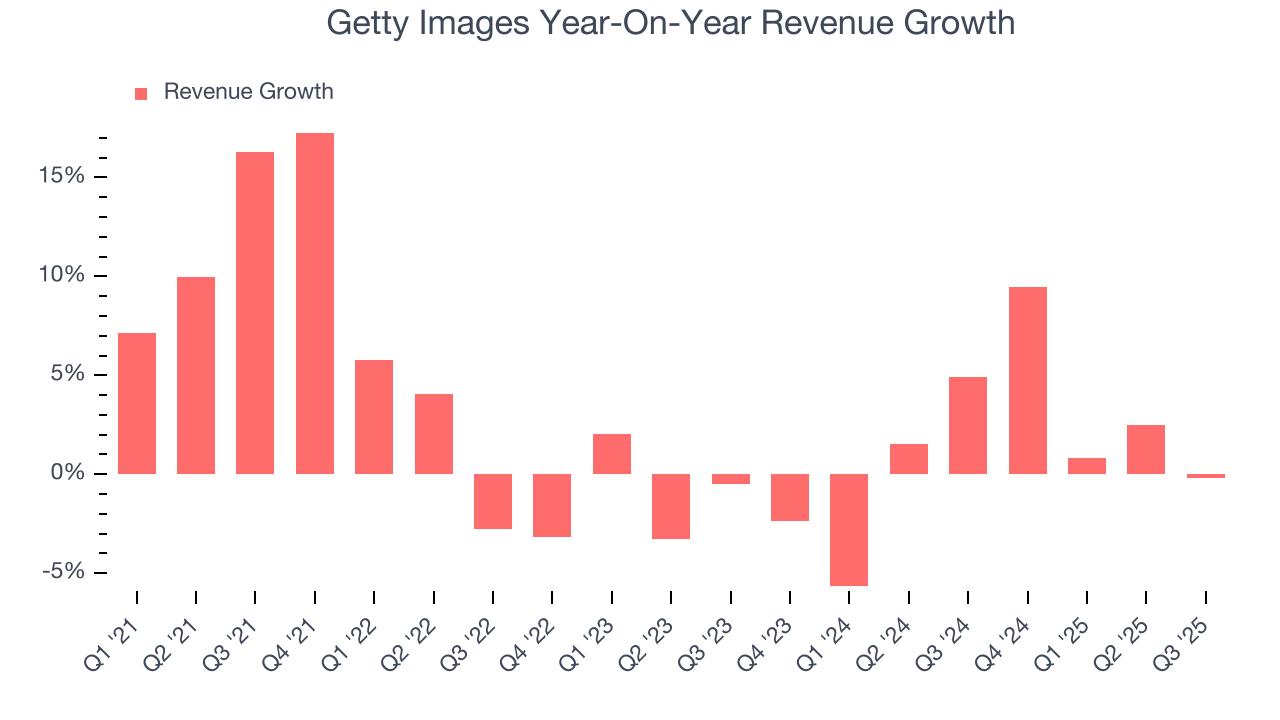

As you can see below, Getty Images grew its sales at a sluggish 2.7% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Getty Images’s recent performance shows its demand has slowed as its annualized revenue growth of 1.3% over the last two years was below its five-year trend.

This quarter, Getty Images’s $240 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not catalyze better top-line performance yet.

6. Operating Margin

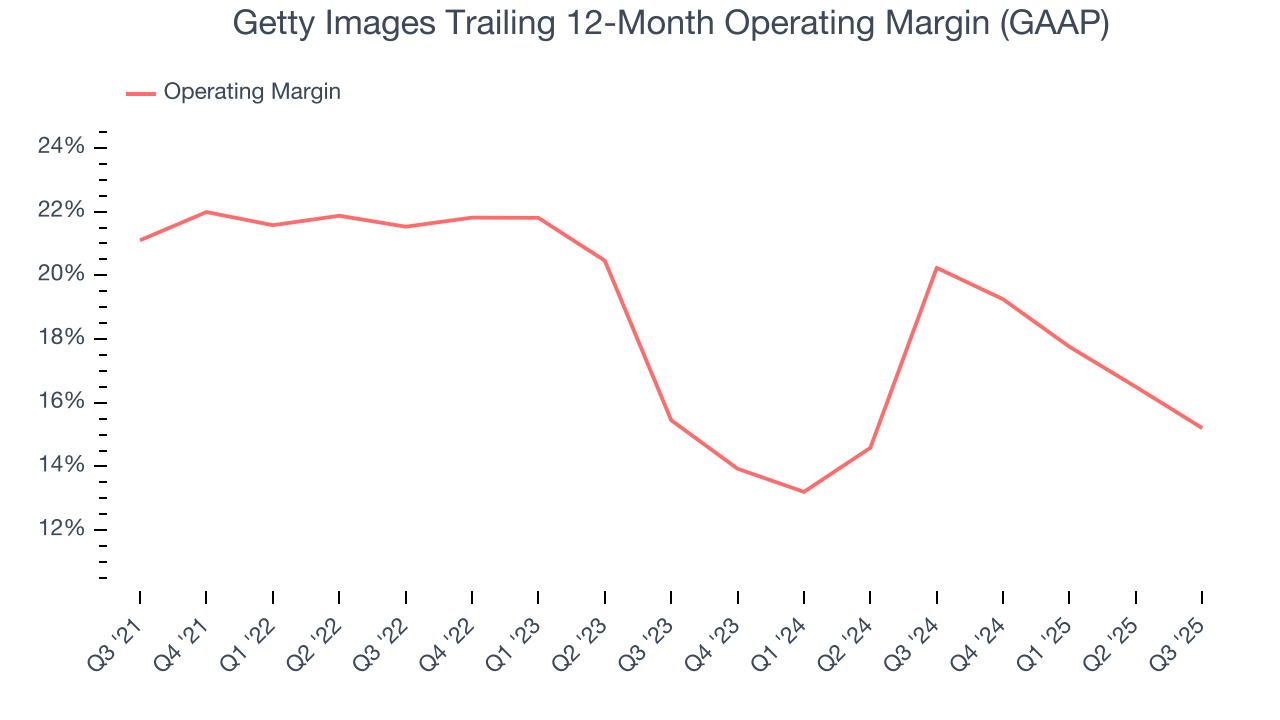

Getty Images has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 18.7%.

Analyzing the trend in its profitability, Getty Images’s operating margin decreased by 5.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Getty Images generated an operating margin profit margin of 18.8%, down 5.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

7. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

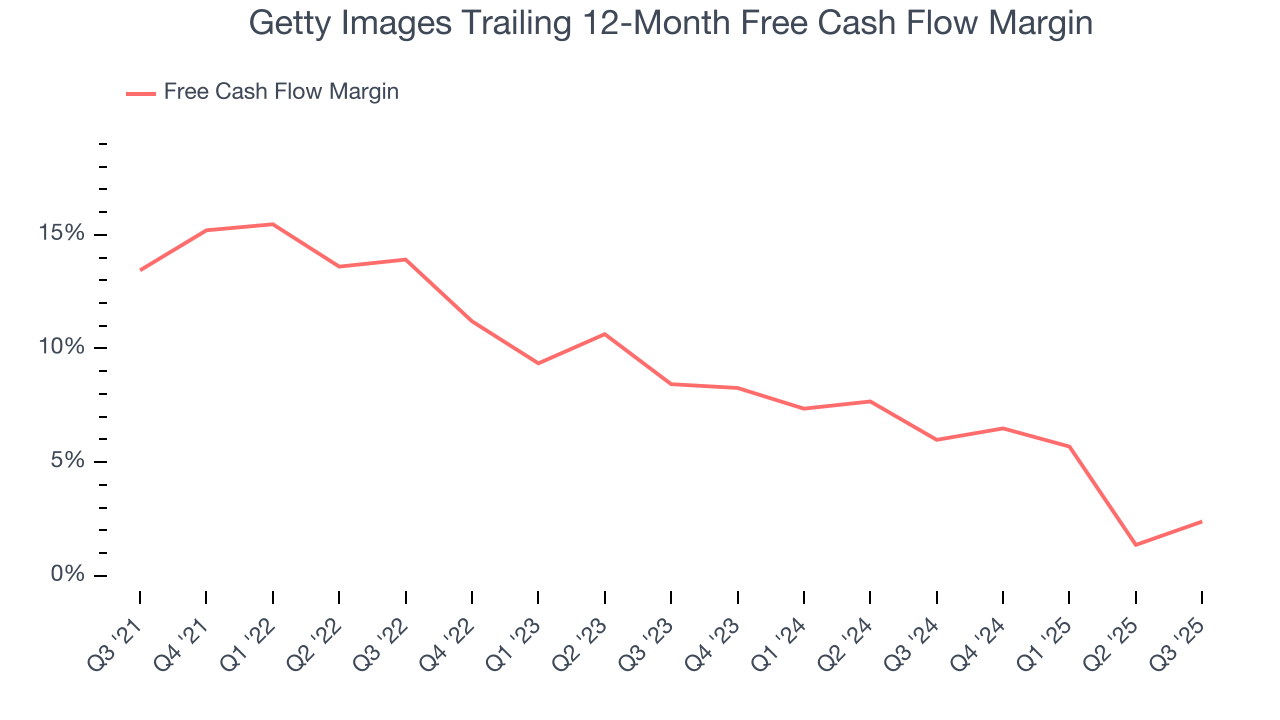

Getty Images has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.8% over the last five years, better than the broader business services sector.

Taking a step back, we can see that Getty Images’s margin dropped by 11.1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Getty Images’s free cash flow clocked in at $7.89 million in Q3, equivalent to a 3.3% margin. This result was good as its margin was 4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

8. Balance Sheet Assessment

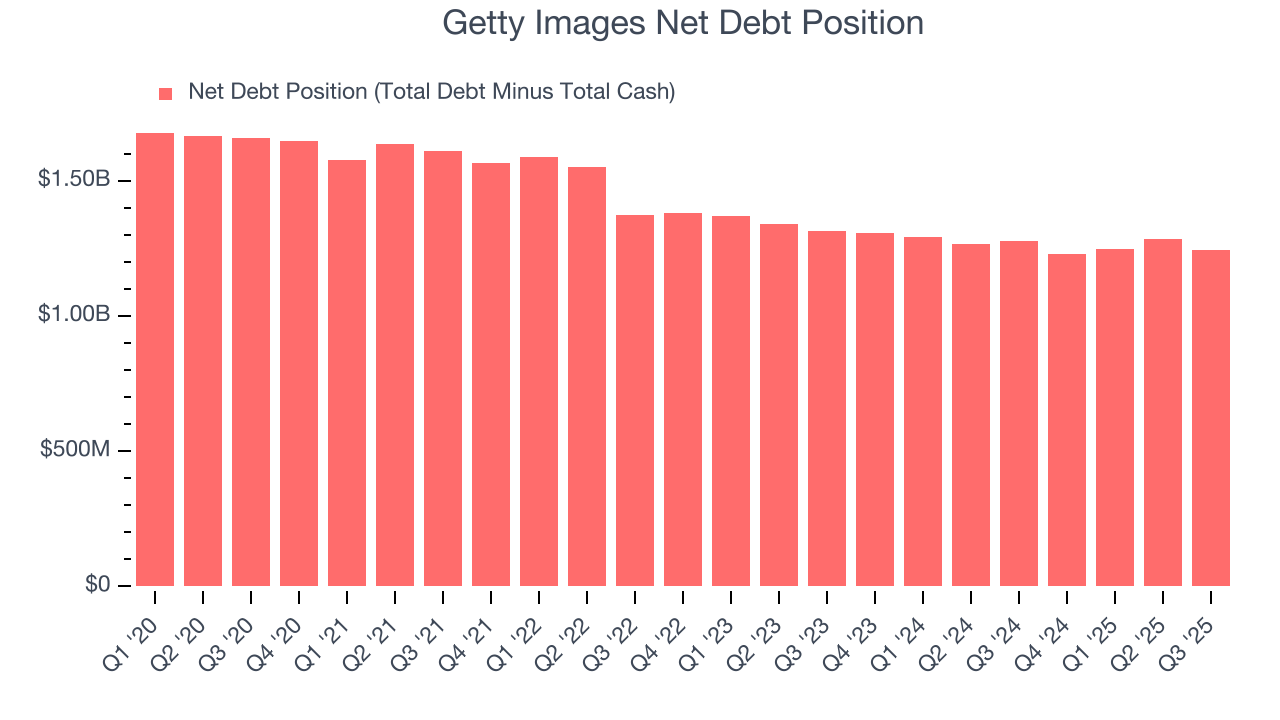

Getty Images reported $113.6 million of cash and $1.36 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $297.4 million of EBITDA over the last 12 months, we view Getty Images’s 4.2× net-debt-to-EBITDA ratio as safe. We also see its $65.78 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

9. Key Takeaways from Getty Images’s Q3 Results

It was good to see Getty Images beat analysts’ EPS expectations this quarter. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 3.2% to $1.78 immediately after reporting.

10. Is Now The Time To Buy Getty Images?

Updated: January 21, 2026 at 9:33 PM EST

Are you wondering whether to buy Getty Images or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Getty Images’s business quality ultimately falls short of our standards. First off, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. And while its astounding EPS growth over the last two years shows its profits are trickling down to shareholders, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining adjusted operating margin shows the business has become less efficient.

Getty Images’s P/E ratio based on the next 12 months is 18.2x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $4.43 on the company (compared to the current share price of $1.27).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.