Hayward (HAYW)

Hayward doesn’t impress us. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why Hayward Is Not Exciting

Credited with introducing the first variable-speed pool pump, Hayward (NYSE:HAYW) makes residential and commercial pool equipment and accessories.

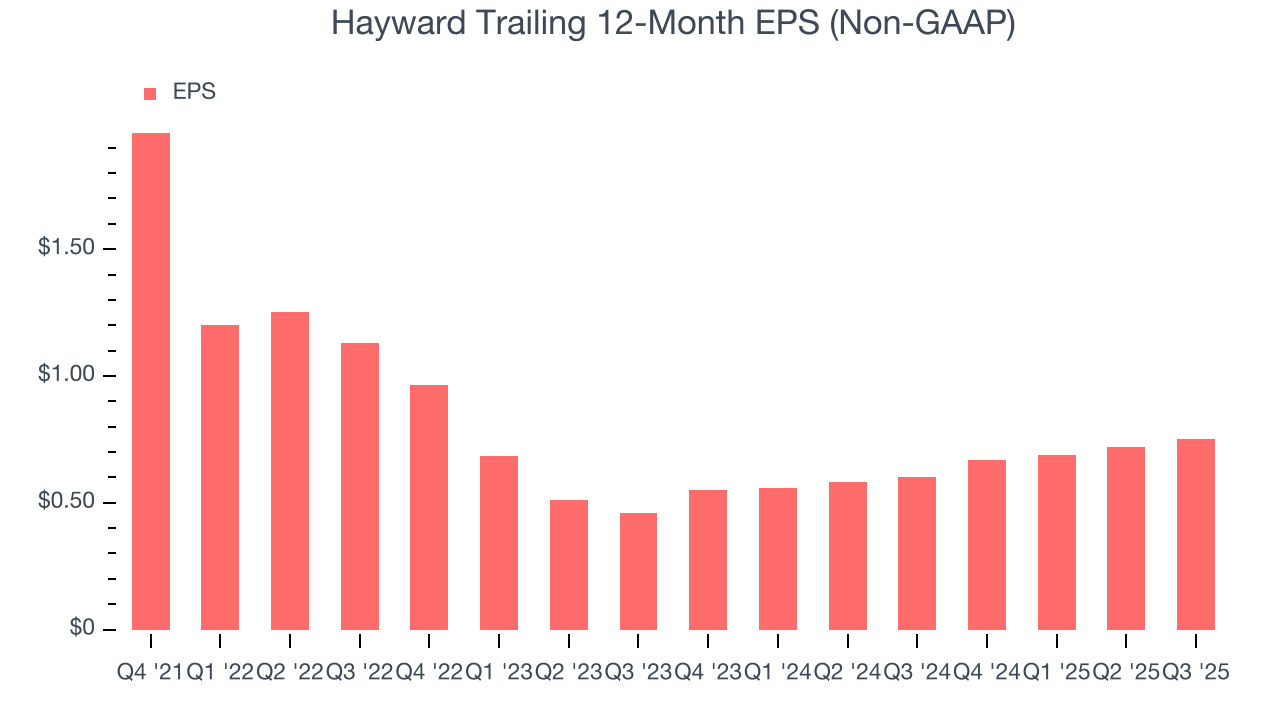

- Earnings per share have contracted by 26.9% annually over the last four years, a headwind for returns as stock prices often echo long-term EPS performance

- Estimated sales growth of 4.5% for the next 12 months implies demand will slow from its two-year trend

- On the bright side, its offerings are difficult to replicate at scale and result in a best-in-class gross margin of 47.9%

Hayward fails to meet our quality criteria. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Hayward

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hayward

At $16.50 per share, Hayward trades at 20.3x forward P/E. Hayward’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Hayward (HAYW) Research Report: Q3 CY2025 Update

Pool equipment and automation systems manufacturer Hayward Holdings (NYSE:HAYW) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 7.4% year on year to $244.3 million. The company’s full-year revenue guidance of $1.10 billion at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $0.14 per share was 15.8% above analysts’ consensus estimates.

Hayward (HAYW) Q3 CY2025 Highlights:

- Revenue: $244.3 million vs analyst estimates of $231.5 million (7.4% year-on-year growth, 5.5% beat)

- Adjusted EPS: $0.14 vs analyst estimates of $0.12 (15.8% beat)

- Adjusted EBITDA: $59.07 million vs analyst estimates of $53.03 million (24.2% margin, 11.4% beat)

- The company lifted its revenue guidance for the full year to $1.10 billion at the midpoint from $1.09 billion, a 1.6% increase

- EBITDA guidance for the full year is $294.5 million at the midpoint, above analyst estimates of $287.1 million

- Operating Margin: 16.8%, up from 14.7% in the same quarter last year

- Free Cash Flow Margin: 35.5%, up from 26% in the same quarter last year

- Market Capitalization: $3.32 billion

Company Overview

Credited with introducing the first variable-speed pool pump, Hayward (NYSE:HAYW) makes residential and commercial pool equipment and accessories.

Founded in 1925, the company has become a leader in the pool industry with one of the largest installed bases of pool equipment worldwide. Hayward operates in two reportable segments: North America (NAM) and Europe & Rest of World (E&RW). The NAM segment, consists of operations in the United States and Canada. The E&RW segment, covers all countries outside of North America, with Europe and Australia making up a significant portion.

The company offers a wide range of pool equipment, including pumps, filters, cleaners, heaters, sanitizers, LED lighting solutions, and automation systems. Hayward's products cater to both in-ground and above-ground pools, serving entry-level to premium markets. A significant portion of the company's sales comes from aftermarket replacements and upgrades, which provides a stable revenue stream.

Hayward sells its products through various channels, of which majority of sales are through specialty distributors, who then sell to pool builders and servicers. The company also sells directly to large retailers, pool builders, and buying groups.

The company maintains relationships with 700+ suppliers, primarily purchasing assembled components and raw materials. The company has long-standing relationships with many of its key suppliers, with an average relationship of over 15 years across its top 30 suppliers.

4. Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Competitors in the pool equipment and accessories industry include Pool Corp (NASDAQ:POOL), Leslie’s (NASDAQ:LESL), and (Pentair (NYSE:PNR).

5. Revenue Growth

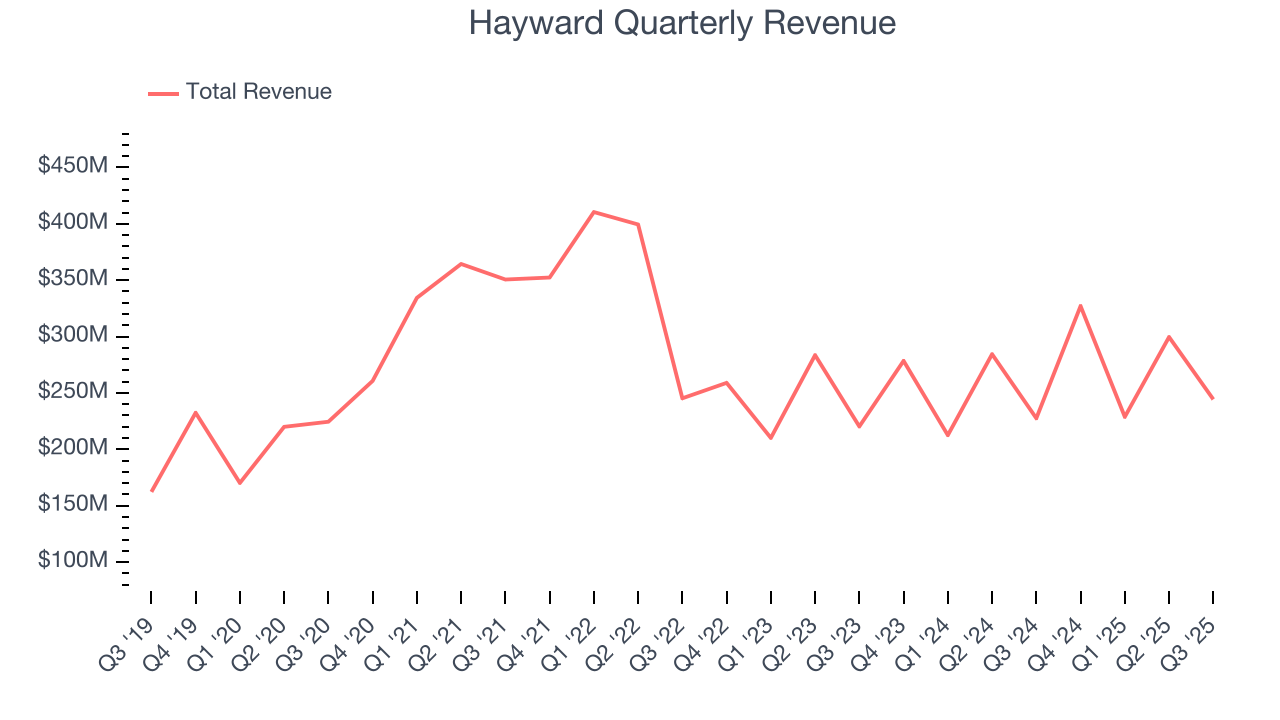

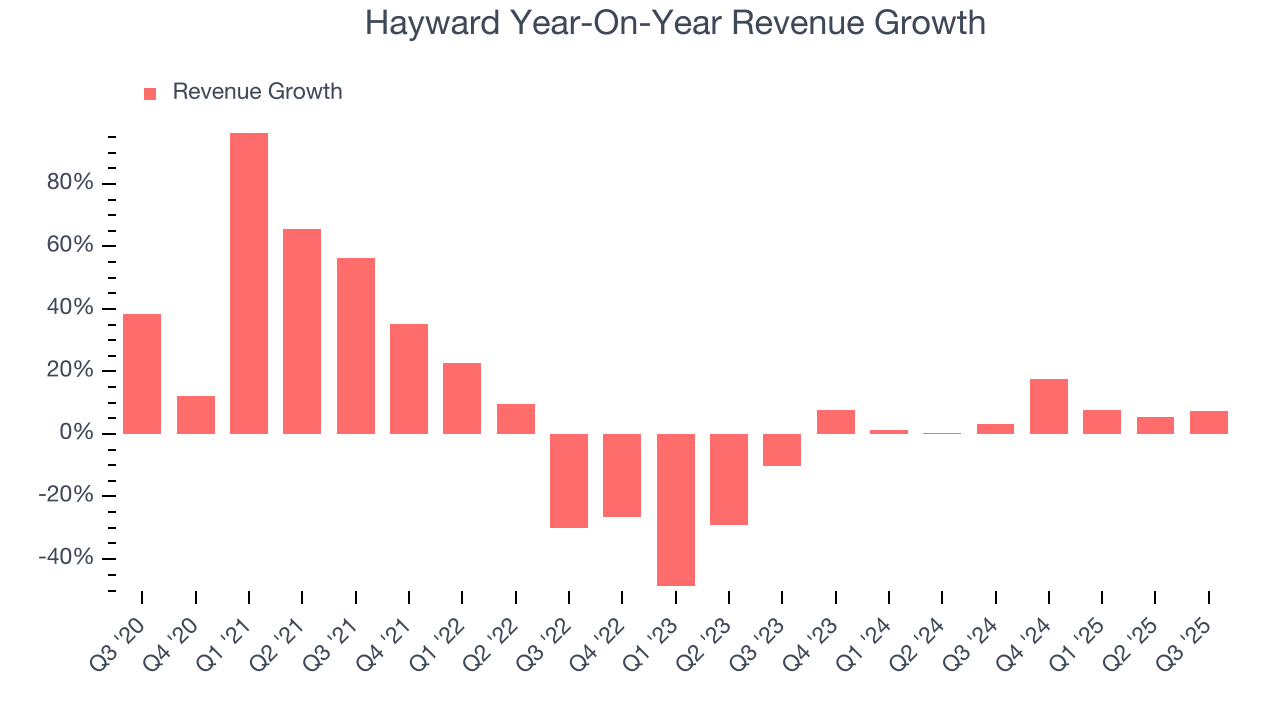

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Hayward grew its sales at a tepid 5.4% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Hayward’s annualized revenue growth of 6.3% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Hayward reported year-on-year revenue growth of 7.4%, and its $244.3 million of revenue exceeded Wall Street’s estimates by 5.5%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

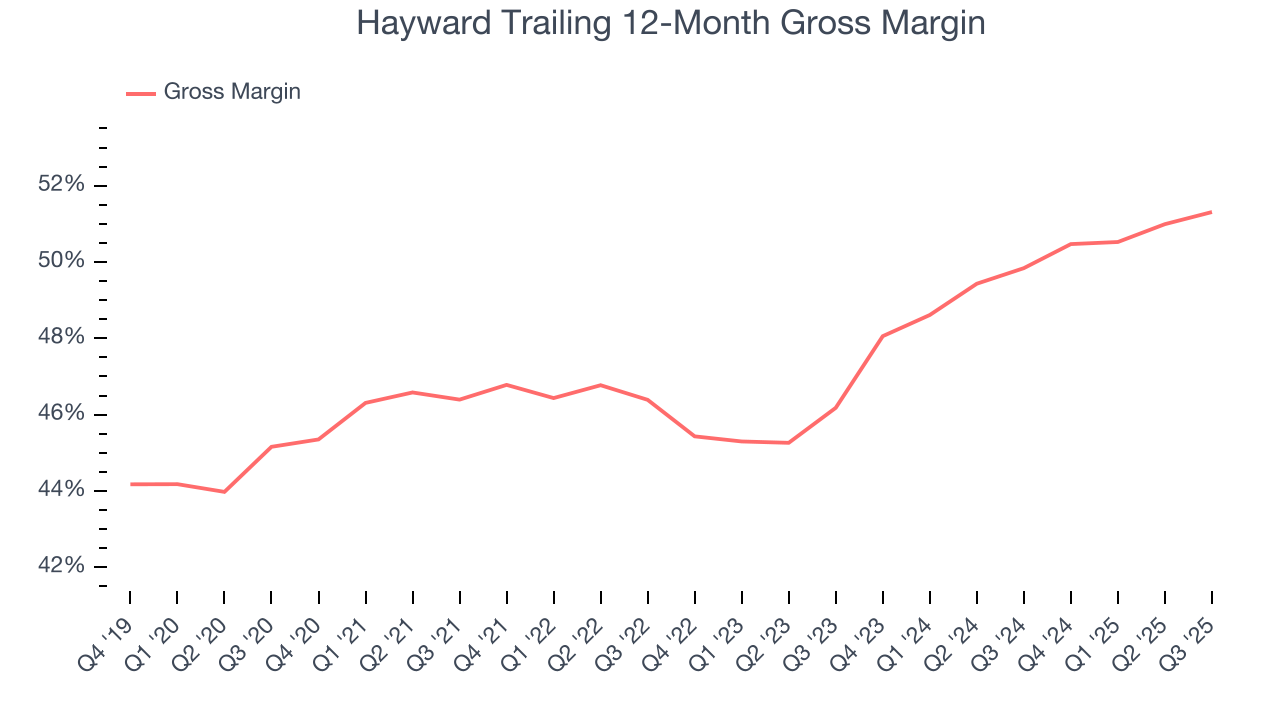

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Hayward has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 47.9% gross margin over the last five years. Said differently, roughly $47.89 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, Hayward’s gross profit margin was 51.2%, marking a 1.5 percentage point increase from 49.7% in the same quarter last year. Hayward’s full-year margin has also been trending up over the past 12 months, increasing by 1.5 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

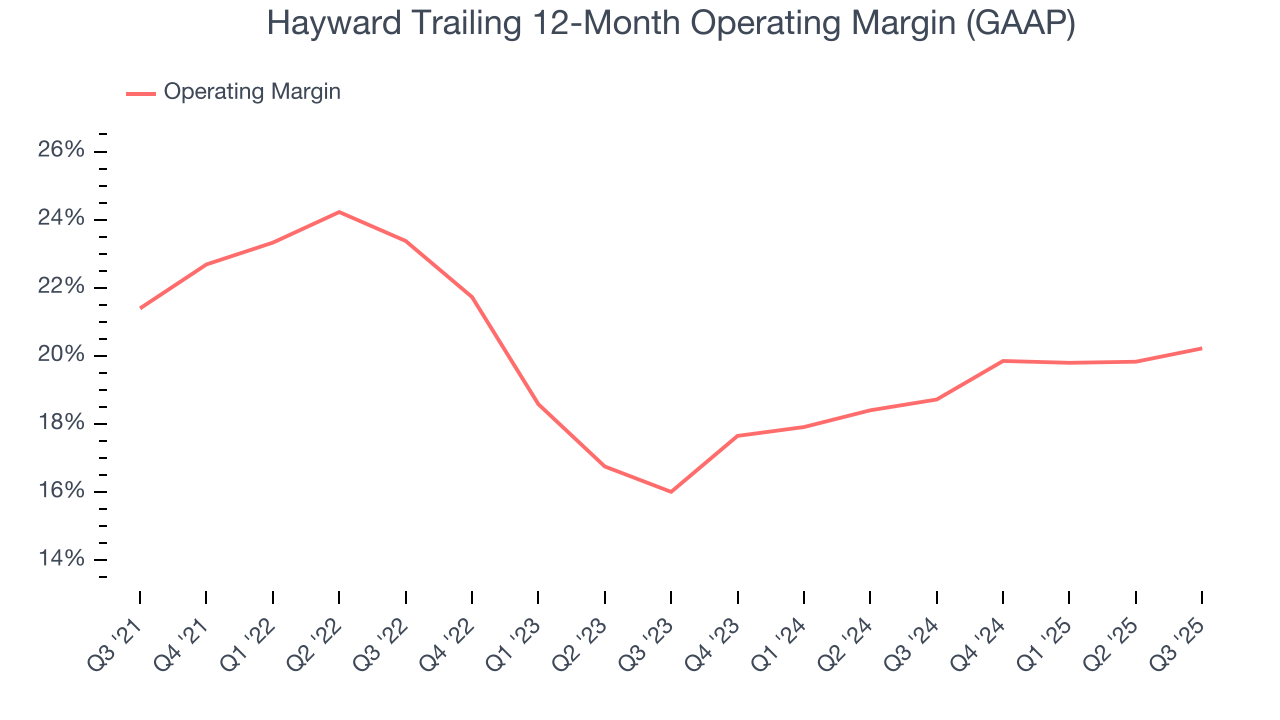

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hayward has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 20.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Hayward’s operating margin decreased by 1.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Hayward generated an operating margin profit margin of 16.8%, up 2.1 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Hayward’s full-year EPS dropped 159%, or 26.9% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Hayward’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Hayward’s EPS grew at an astounding 27.7% compounded annual growth rate over the last two years, higher than its 6.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Hayward’s earnings can give us a better understanding of its performance. Hayward’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Hayward reported adjusted EPS of $0.14, up from $0.11 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Hayward’s full-year EPS of $0.75 to grow 5.8%.

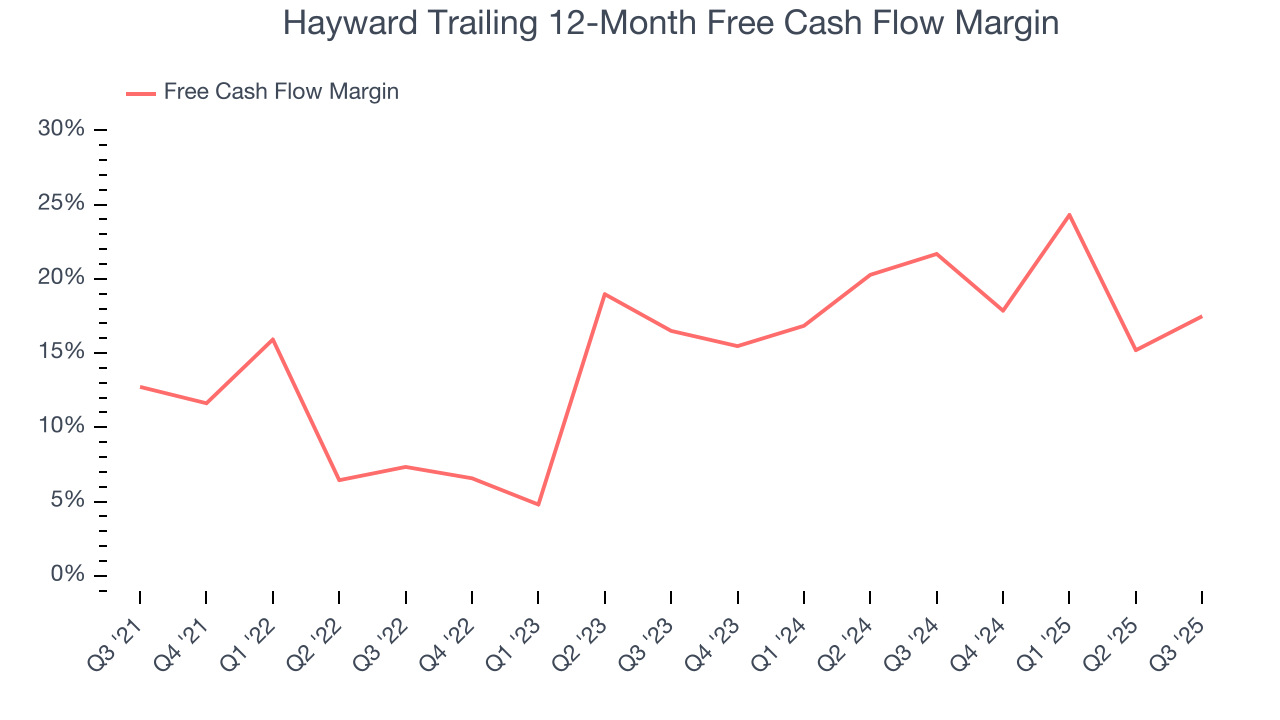

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Hayward has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 14.5% over the last five years.

Taking a step back, we can see that Hayward’s margin expanded by 4.8 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Hayward’s free cash flow clocked in at $86.8 million in Q3, equivalent to a 35.5% margin. This result was good as its margin was 9.6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

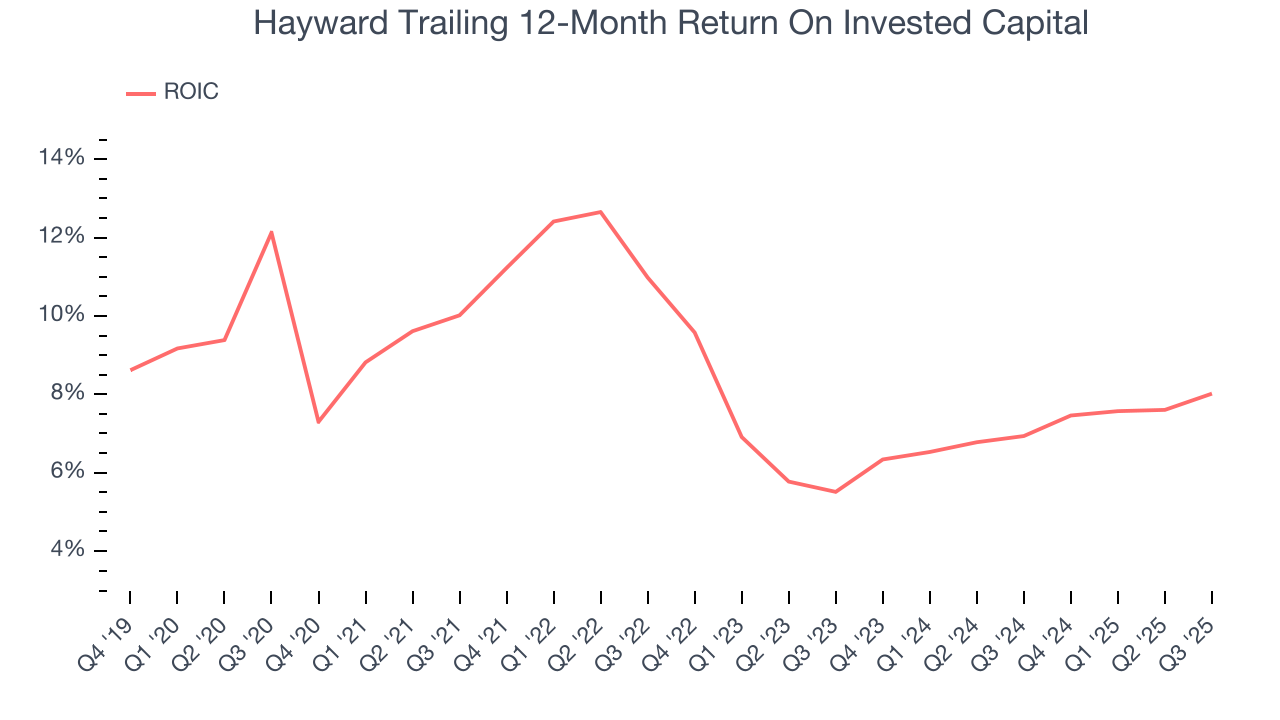

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Hayward historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.3%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Hayward’s ROIC averaged 3 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

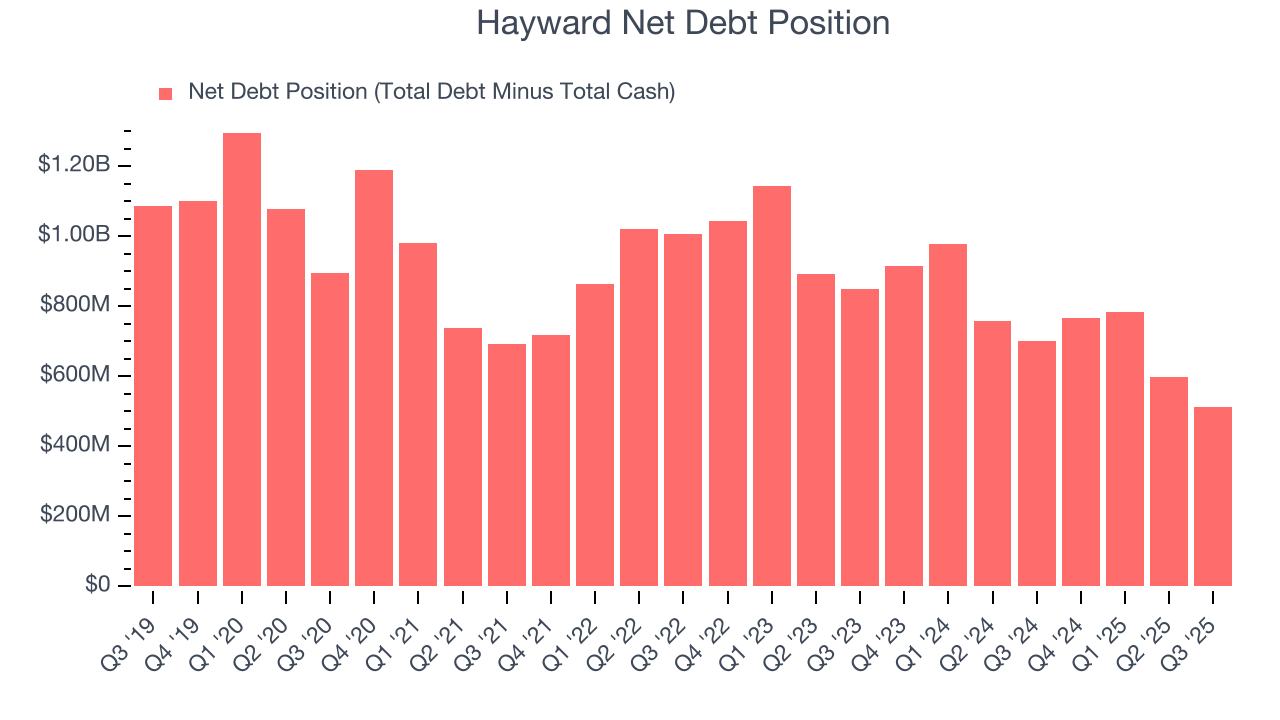

11. Balance Sheet Assessment

Hayward reported $448.3 million of cash and $961.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $295.1 million of EBITDA over the last 12 months, we view Hayward’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $29.55 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Hayward’s Q3 Results

We were impressed by how significantly Hayward blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 9% to $16.73 immediately after reporting.

13. Is Now The Time To Buy Hayward?

Updated: January 25, 2026 at 10:22 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Hayward.

Hayward isn’t a bad business, but we’re not clamoring to buy it here and now. Although its revenue growth was uninspiring over the last five years, its admirable gross margins indicate the mission-critical nature of its offerings. Tread carefully with this one, however, as its declining EPS over the last four years makes it a less attractive asset to the public markets.

Hayward’s P/E ratio based on the next 12 months is 20.3x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $17.86 on the company (compared to the current share price of $16.50).