Hilton (HLT)

Hilton is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hilton Will Underperform

Founded in 1919, Hilton Worldwide (NYSE:HLT) is a global hospitality company with a portfolio of hotel brands.

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 8.5% over the last two years was below our standards for the consumer discretionary sector

- Weak revenue per room over the past two years indicates challenges in maintaining pricing power and occupancy rates

- Lacking free cash flow limits its freedom to invest in growth initiatives, execute share buybacks, or pay dividends

Hilton doesn’t check our boxes. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Hilton

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hilton

Hilton is trading at $322.96 per share, or 35.4x forward P/E. Not only does Hilton trade at a premium to companies in the consumer discretionary space, but this multiple is also high for its top-line growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Hilton (HLT) Research Report: Q4 CY2025 Update

Hotel company Hilton (NYSE:HLT) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 10.9% year on year to $3.09 billion. Its non-GAAP profit of $2.08 per share was 3.2% above analysts’ consensus estimates.

Hilton (HLT) Q4 CY2025 Highlights:

- Revenue: $3.09 billion vs analyst estimates of $2.99 billion (10.9% year-on-year growth, 3.3% beat)

- Adjusted EPS: $2.08 vs analyst estimates of $2.02 (3.2% beat)

- Adjusted EBITDA: $946 million vs analyst estimates of $925.1 million (30.6% margin, 2.3% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.71 at the midpoint, missing analyst estimates by 4.8%

- EBITDA guidance for the upcoming financial year 2026 is $4.02 billion at the midpoint, in line with analyst expectations

- Operating Margin: 19.5%, up from 17.6% in the same quarter last year

- RevPAR: $110.89 at quarter end, in line with the same quarter last year

- Market Capitalization: $75.24 billion

Company Overview

Founded in 1919, Hilton Worldwide (NYSE:HLT) is a global hospitality company with a portfolio of hotel brands.

As one of the largest hotel companies in the world, Hilton owns, manages, and franchises a portfolio of 18 brands, comprising more than 6,500 properties in 119 countries and territories.

Hilton's diverse portfolio caters to many market segments, from luxury and full-service hotels to extended-stay suites and no-frills hotels. The company’s notable brands include its flagship Hilton, Waldorf Astoria, and DoubleTree hotels. Medium-tier offerings include Embassy Suites while Hilton Garden Inn and Hampton are for more casual stays. Its extended-stay brands include Homewood Suites by Hilton and Home2 Suites by Hilton.

Given its scale, financial resources, and insights about the global traveler, Hilton has adopted technology to enhance the customer journey, from the booking process to the end of a hotel stay. This includes online check-in, room selection, and integration with loyalty programs.

Hilton’s business model is primarily focused on a franchise system, which allows for wide-reaching growth and presence while maintaining high standards across its properties. This model has been pivotal in Hilton’s global expansion and brand recognition.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Hilton’s primary competitors include Marriott International (NASDAQ:MAR), InterContinental Hotels Group (NYSE:IHG), Hyatt Hotels (NYSE:H), Wyndham Hotels & Resorts (NYSE:WH), and Accor (EPA:AC).

5. Revenue Growth

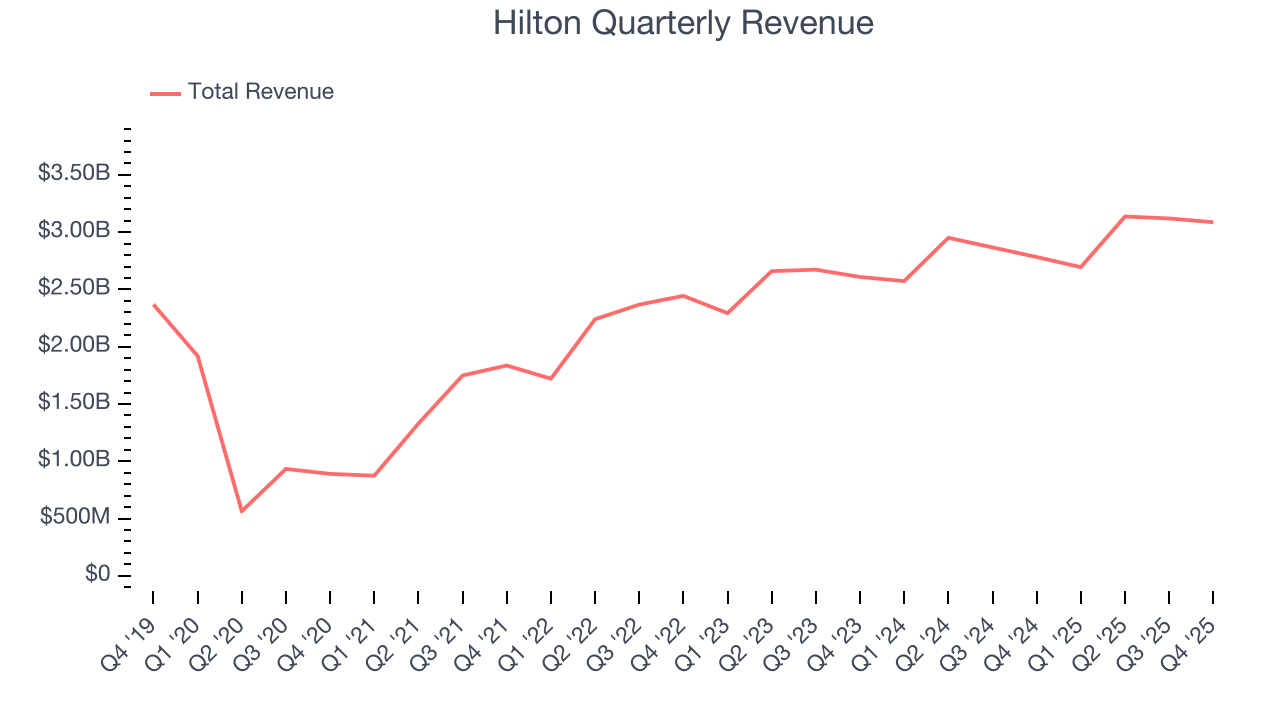

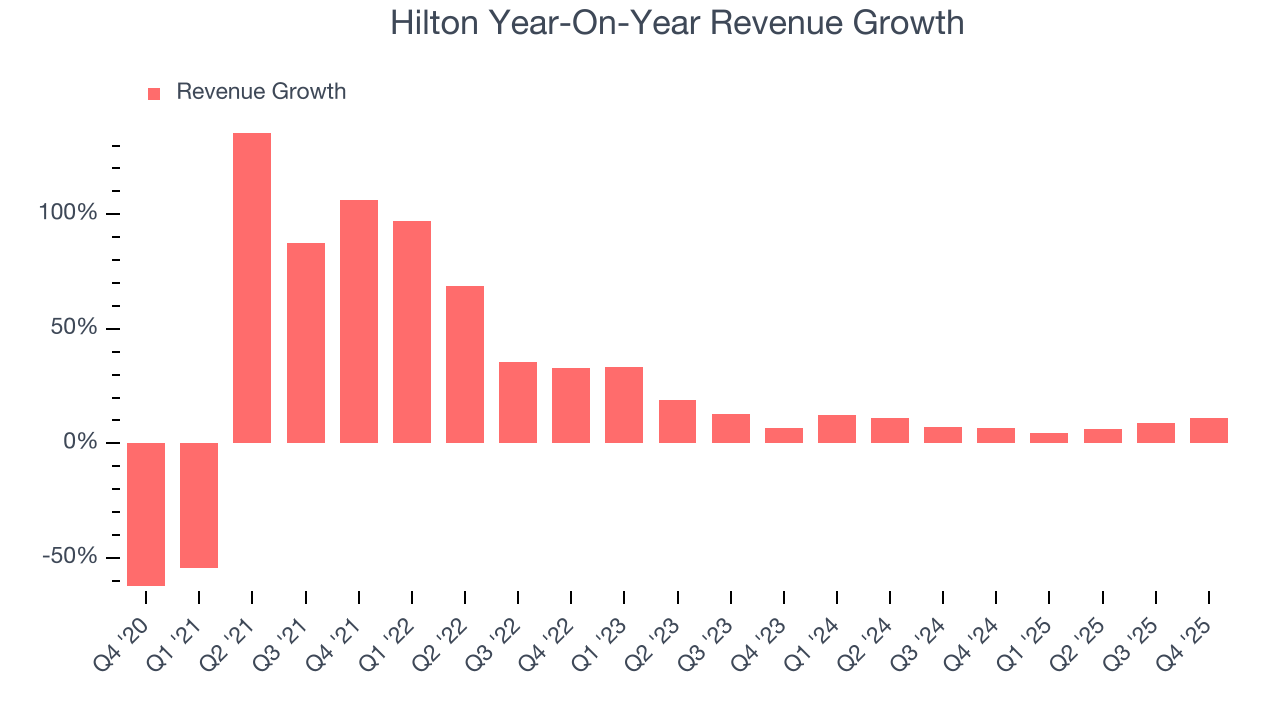

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Hilton grew its sales at a 22.8% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Hilton’s recent performance shows its demand has slowed as its annualized revenue growth of 8.5% over the last two years was below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its revenue per available room, which clocked in at $110.89 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Hilton’s revenue per room was flat. Because this number is lower than its revenue growth, we can see its sales from other areas like restaurants, bars, and amenities outperformed its room bookings.

This quarter, Hilton reported year-on-year revenue growth of 10.9%, and its $3.09 billion of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its products and services will face some demand challenges.

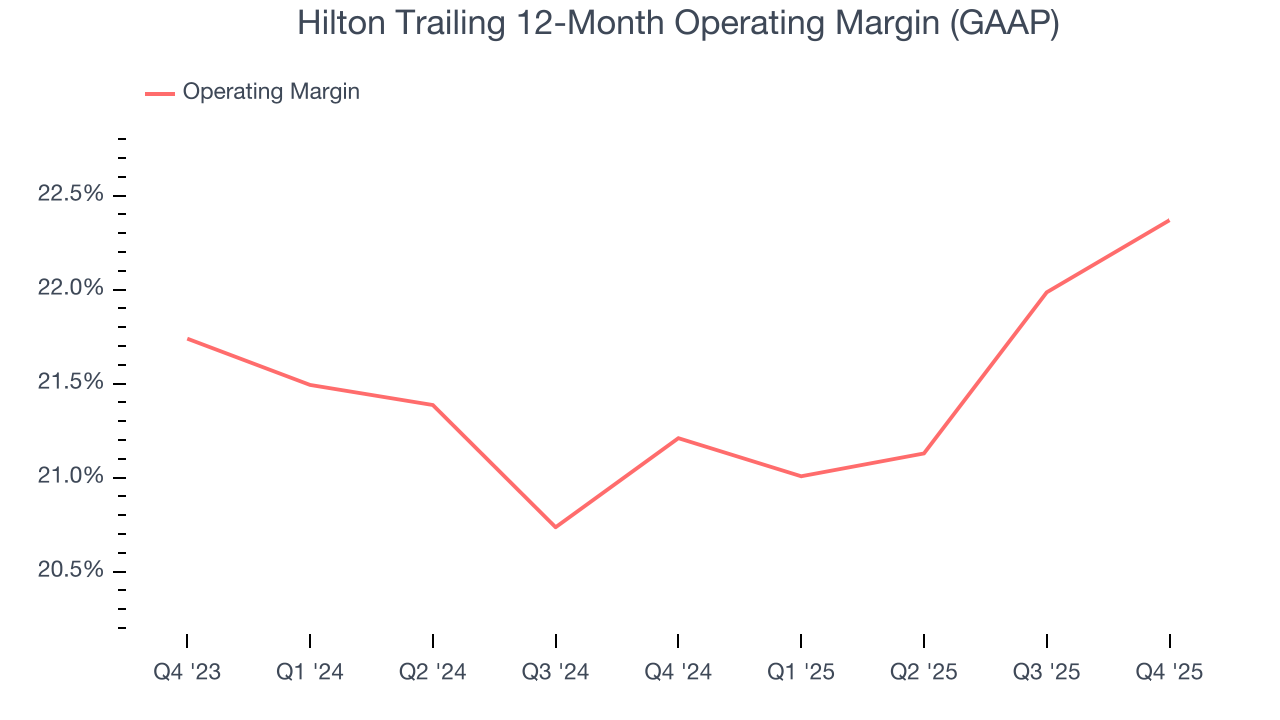

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hilton’s operating margin has been trending up over the last 12 months and averaged 21.8% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q4, Hilton generated an operating margin profit margin of 19.5%, up 1.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

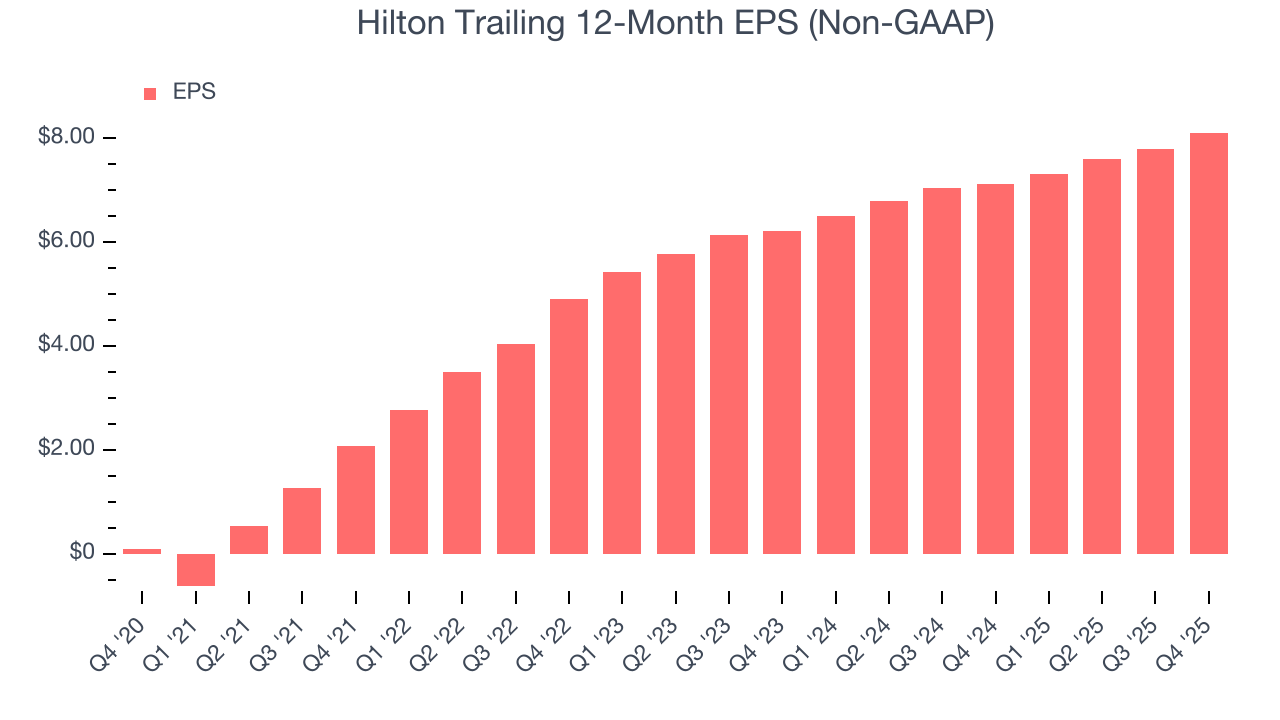

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hilton’s EPS grew at an astounding 146% compounded annual growth rate over the last five years, higher than its 22.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Hilton reported adjusted EPS of $2.08, up from $1.76 in the same quarter last year. This print beat analysts’ estimates by 3.2%. Over the next 12 months, Wall Street expects Hilton’s full-year EPS of $8.11 to grow 12.7%.

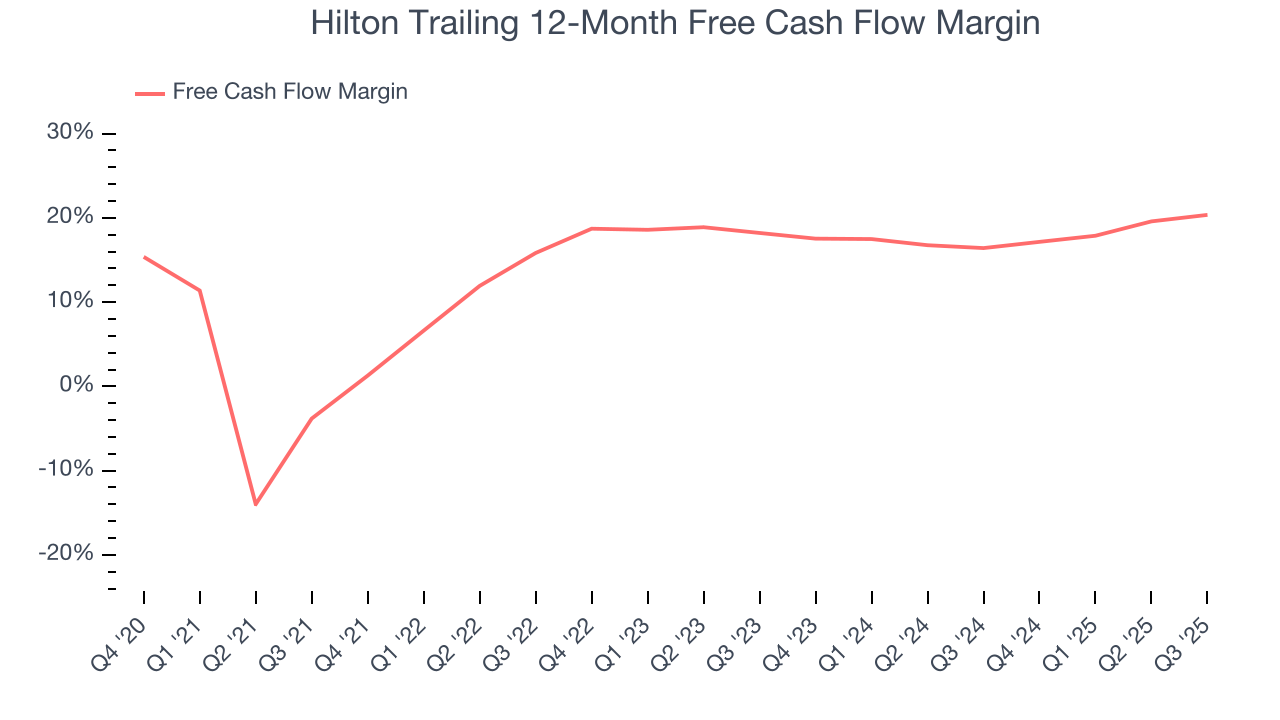

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Hilton has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 18.7%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Hilton historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 27%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hilton’s ROIC has increased significantly. This is a good sign, and we hope the company can continue improving.

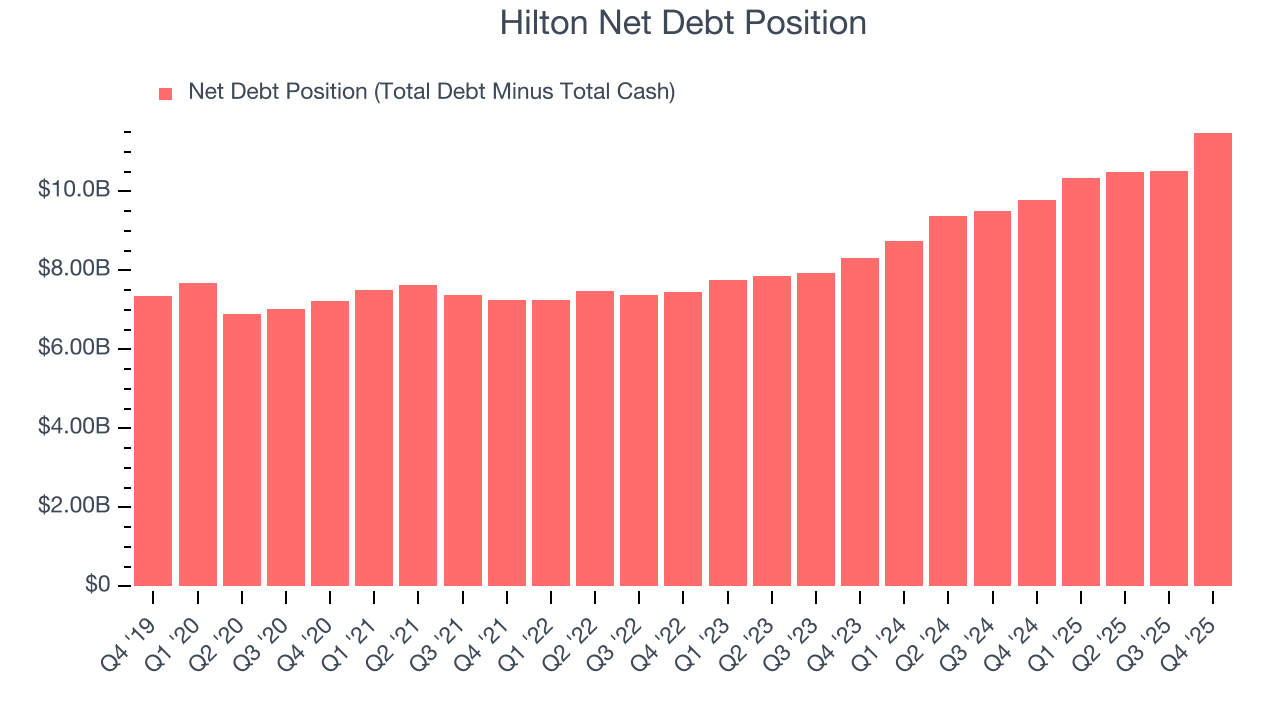

10. Balance Sheet Assessment

Hilton reported $970 million of cash and $12.46 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.73 billion of EBITDA over the last 12 months, we view Hilton’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $620 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Hilton’s Q4 Results

It was great to see Hilton’s revenue and EPS top analysts’ expectations. We were also happy its EBITDA guidance for next quarter outperformed Wall Street’s estimates. On the other hand, EPS guidance missed. Still , this print had some key positives. The stock remained flat at $325.71 immediately after reporting.

12. Is Now The Time To Buy Hilton?

Updated: February 11, 2026 at 9:06 PM EST

Before deciding whether to buy Hilton or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Hilton doesn’t pass our quality test. While its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion. On top of that, its revenue per room has disappointed.

Hilton’s P/E ratio based on the next 12 months is 35.1x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $300.80 on the company (compared to the current share price of $322.96), implying they don’t see much short-term potential in Hilton.