Hewlett Packard Enterprise (HPE)

We’re skeptical of Hewlett Packard Enterprise. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why Hewlett Packard Enterprise Is Not Exciting

Born from the 2015 split of the iconic Silicon Valley pioneer Hewlett-Packard, Hewlett Packard Enterprise (NYSE:HPE) provides edge-to-cloud technology solutions that help businesses capture, analyze, and act upon their data across hybrid IT environments.

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- Sizable revenue base leads to growth challenges as its 4.9% annual revenue increases over the last five years fell short of other business services companies

- On the plus side, its dominant market position is represented by its $34.3 billion in revenue and gives it fixed cost leverage when sales grow

Hewlett Packard Enterprise falls short of our expectations. There are more promising prospects in the market.

Why There Are Better Opportunities Than Hewlett Packard Enterprise

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hewlett Packard Enterprise

At $21.38 per share, Hewlett Packard Enterprise trades at 8.9x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Hewlett Packard Enterprise (HPE) Research Report: Q3 CY2025 Update

Enterprise technology company Hewlett Packard Enterprise (NYSE:HPE) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 14.4% year on year to $9.68 billion. Next quarter’s revenue guidance of $9.2 billion underwhelmed, coming in 6.4% below analysts’ estimates. Its non-GAAP profit of $0.62 per share was 6.5% above analysts’ consensus estimates.

Hewlett Packard Enterprise (HPE) Q3 CY2025 Highlights:

- Revenue: $9.68 billion vs analyst estimates of $9.88 billion (14.4% year-on-year growth, 2% miss)

- Adjusted EPS: $0.62 vs analyst estimates of $0.58 (6.5% beat)

- Adjusted EBITDA: $1.07 billion vs analyst estimates of $1.73 billion (11% margin, 38.5% miss)

- Revenue Guidance for Q4 CY2025 is $9.2 billion at the midpoint, below analyst estimates of $9.83 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.35 at the midpoint, missing analyst estimates by 1.1%

- Operating Margin: -0.1%, down from 8.2% in the same quarter last year

- Free Cash Flow Margin: 19.8%, up from 17.9% in the same quarter last year

- Market Capitalization: $29.37 billion

Company Overview

Born from the 2015 split of the iconic Silicon Valley pioneer Hewlett-Packard, Hewlett Packard Enterprise (NYSE:HPE) provides edge-to-cloud technology solutions that help businesses capture, analyze, and act upon their data across hybrid IT environments.

HPE's business spans several key technology domains. Its server segment offers a range of computing solutions from general-purpose ProLiant servers to specialized high-performance systems designed for artificial intelligence and data analytics workloads. For example, a research institution might use HPE's Cray supercomputers to process complex climate models requiring massive computational power.

The company's hybrid cloud segment provides storage, private cloud infrastructure, and software-as-a-service offerings that enable organizations to manage data across on-premises systems and public clouds. A healthcare provider might use HPE's Alletra storage systems to securely store patient records while leveraging HPE GreenLake to access those records through a cloud-like experience.

HPE's intelligent edge portfolio includes networking hardware and software that connect devices and users across campus, branch, and remote locations. A retail chain might deploy HPE Aruba wireless access points and switches to provide connectivity for point-of-sale systems, inventory management devices, and customer Wi-Fi.

The company generates revenue through hardware sales, software licenses, subscription services, and financing options. Its HPE GreenLake platform represents a strategic shift toward consumption-based models, allowing customers to pay for technology as they use it rather than making large upfront investments.

HPE Financial Services provides leasing and financing solutions that help customers acquire technology while managing cash flow. This division enables flexible consumption models, including the ability to return and upgrade equipment as needs change.

With operations spanning the globe, HPE serves organizations ranging from small businesses to large enterprises and government entities through both direct sales and channel partners.

4. Hardware & Infrastructure

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

HPE competes with Dell Technologies (NYSE:DELL) and Cisco Systems (NASDAQ:CSCO) across most of its business segments. In cloud services, it faces competition from public cloud providers like Amazon Web Services (NASDAQ:AMZN), Microsoft Azure (NASDAQ:MSFT), and Google Cloud (NASDAQ:GOOGL). In networking, it competes with Juniper Networks (NYSE:JNPR), which HPE is in the process of acquiring.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $34.3 billion in revenue over the past 12 months, Hewlett Packard Enterprise is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. To accelerate sales, Hewlett Packard Enterprise likely needs to optimize its pricing or lean into new offerings and international expansion.

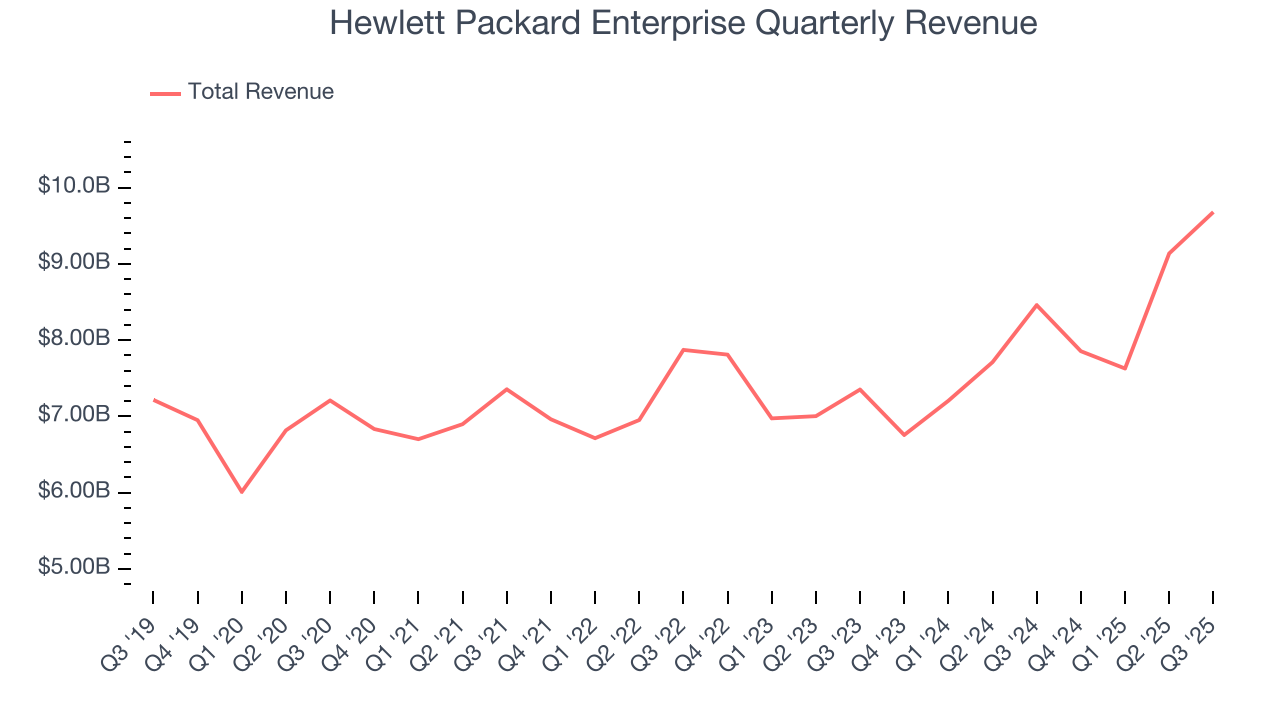

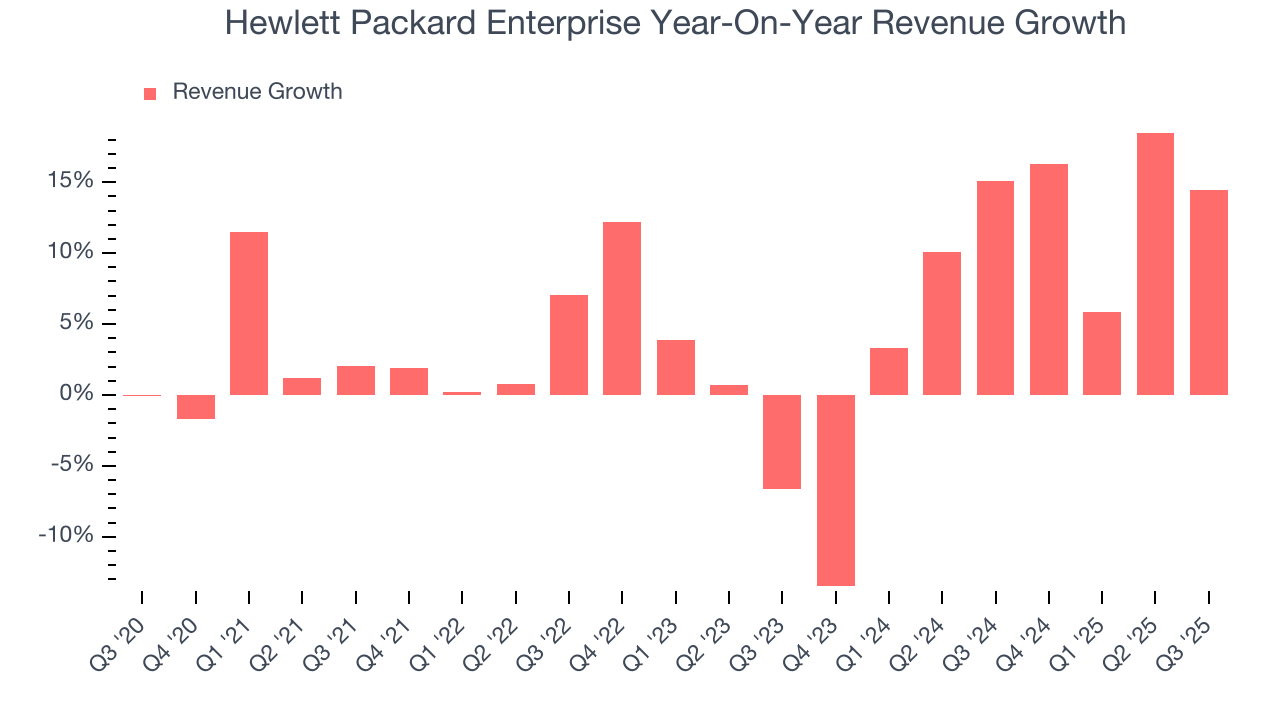

As you can see below, Hewlett Packard Enterprise grew its sales at a mediocre 4.9% compounded annual growth rate over the last five years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Hewlett Packard Enterprise’s annualized revenue growth of 8.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Hewlett Packard Enterprise’s revenue grew by 14.4% year on year to $9.68 billion but fell short of Wall Street’s estimates. Company management is currently guiding for a 17.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping for a company of its scale and implies its newer products and services will spur better top-line performance.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

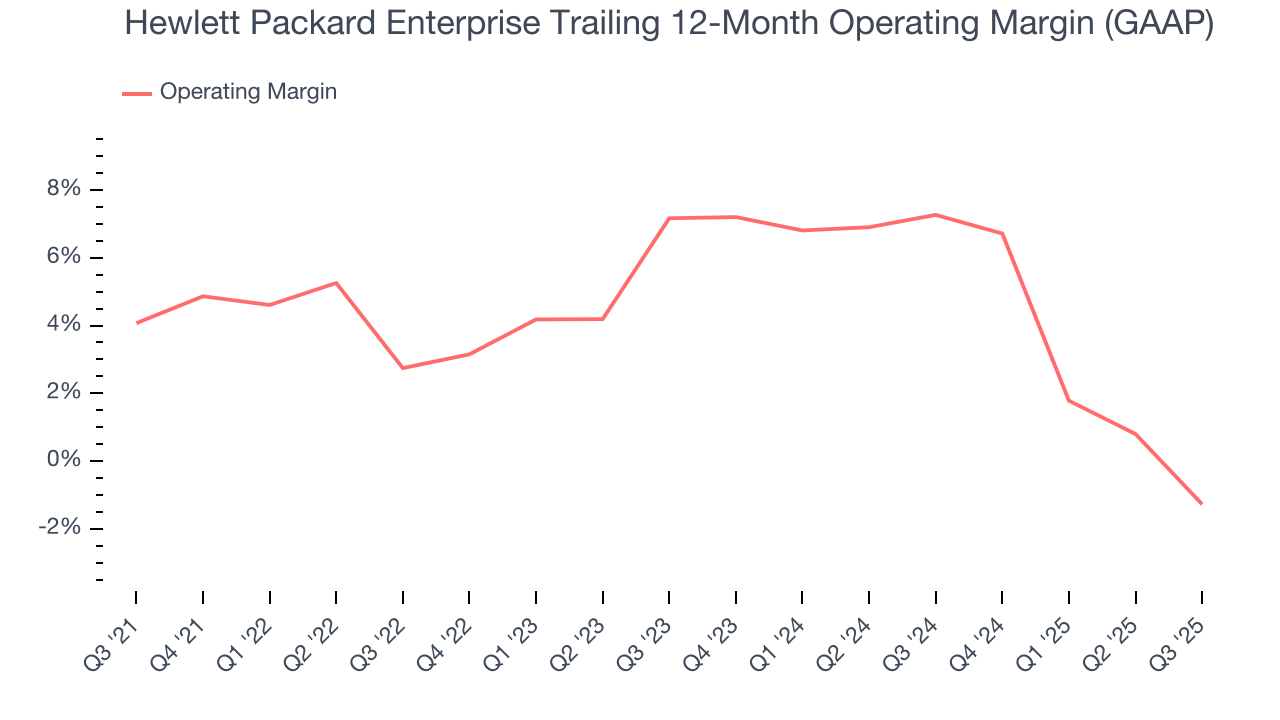

Hewlett Packard Enterprise was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.8% was weak for a business services business.

Analyzing the trend in its profitability, Hewlett Packard Enterprise’s operating margin decreased by 5.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Hewlett Packard Enterprise’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Hewlett Packard Enterprise’s breakeven margin was down 8.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

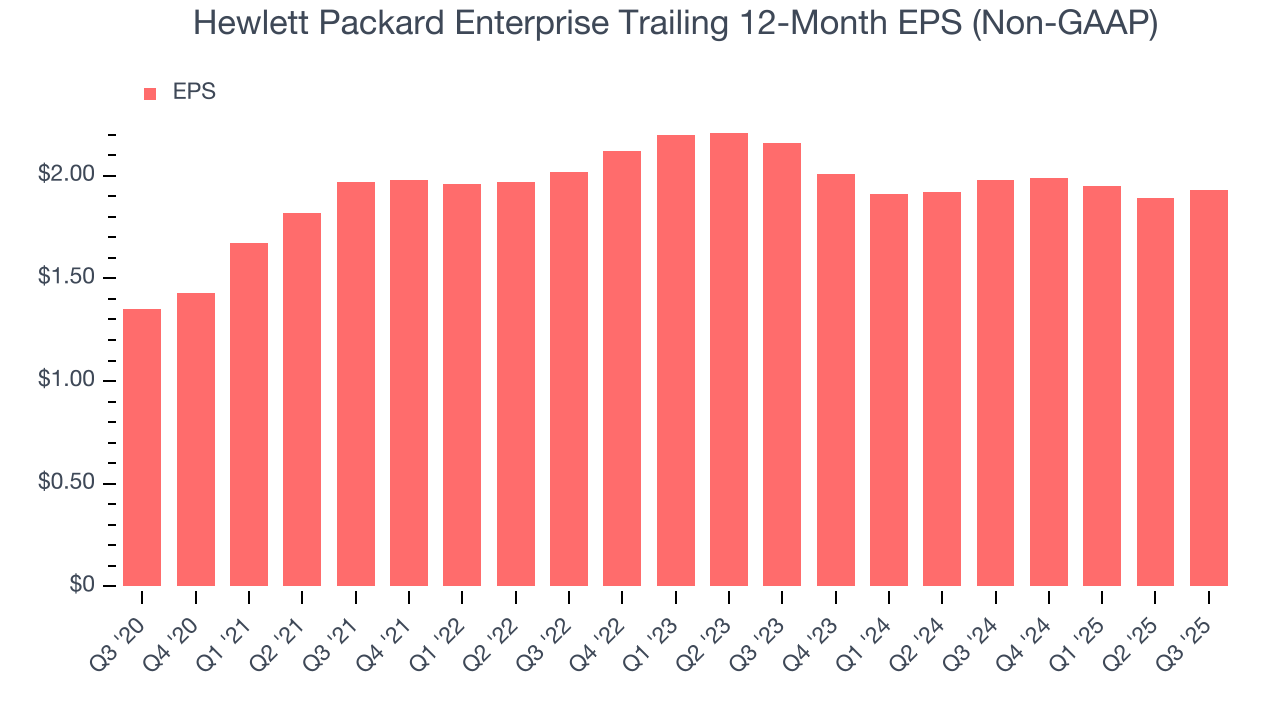

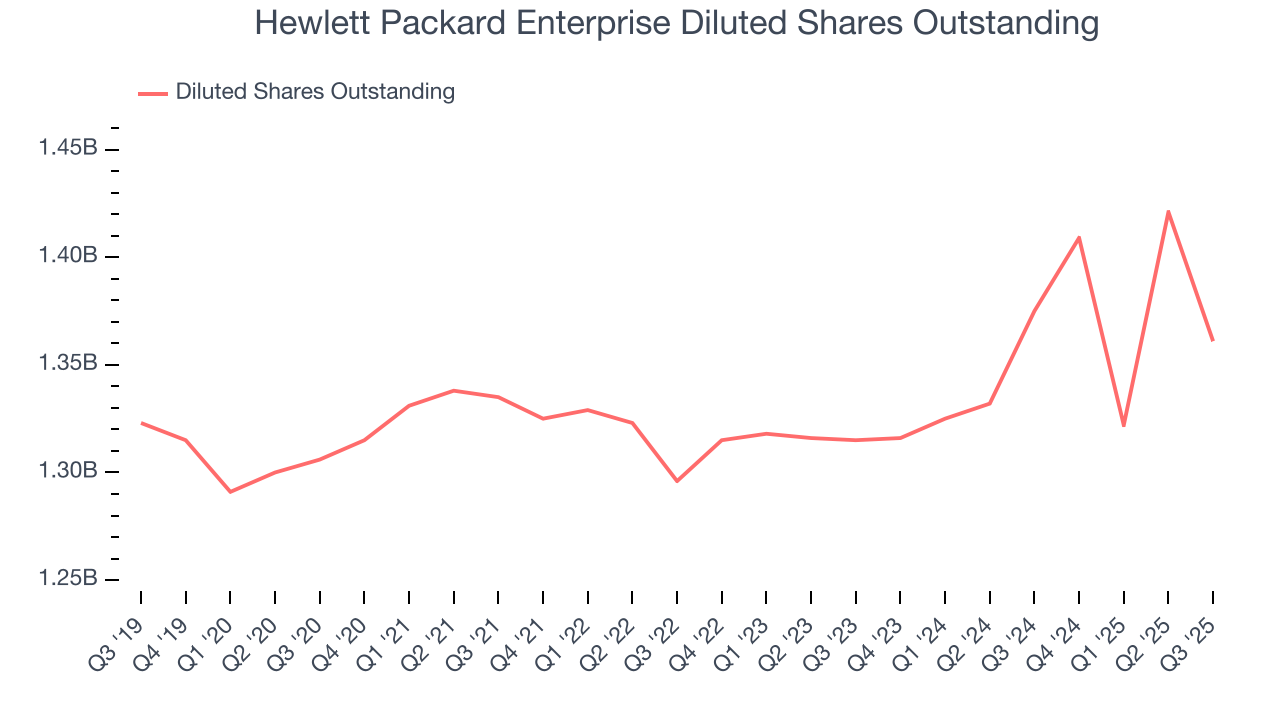

Hewlett Packard Enterprise’s EPS grew at an unimpressive 7.4% compounded annual growth rate over the last five years. This performance was better than its flat revenue, but we take it with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Hewlett Packard Enterprise’s two-year annual EPS declines of 5.5% were bad and lower than its 8.5% two-year revenue growth.

Diving into the nuances of Hewlett Packard Enterprise’s earnings can give us a better understanding of its performance. Hewlett Packard Enterprise’s operating margin has declined over the last two yearswhile its share count has grown 3.5%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Hewlett Packard Enterprise reported adjusted EPS of $0.62, up from $0.58 in the same quarter last year. This print beat analysts’ estimates by 6.5%. Over the next 12 months, Wall Street expects Hewlett Packard Enterprise’s full-year EPS of $1.93 to grow 20.6%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

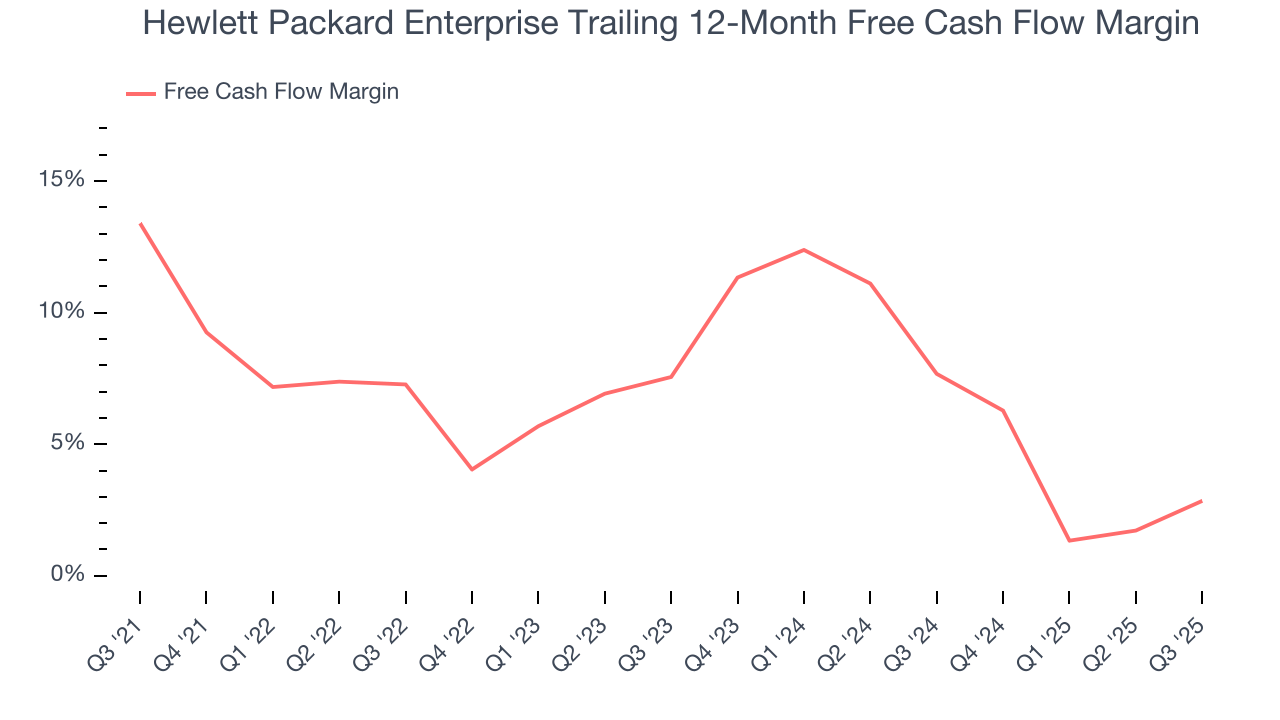

Hewlett Packard Enterprise has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.5% over the last five years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Hewlett Packard Enterprise’s margin dropped by 10.6 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Hewlett Packard Enterprise’s free cash flow clocked in at $1.92 billion in Q3, equivalent to a 19.8% margin. This result was good as its margin was 2 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

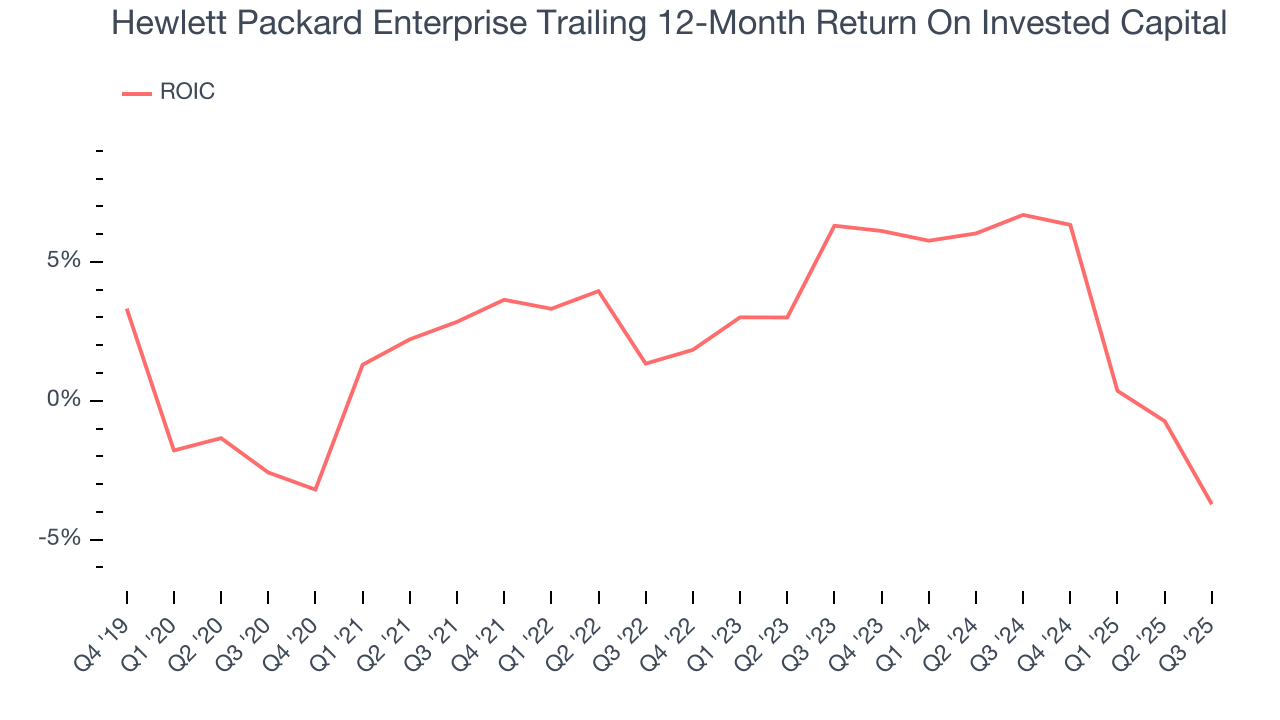

Hewlett Packard Enterprise historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.7%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Hewlett Packard Enterprise’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

10. Balance Sheet Assessment

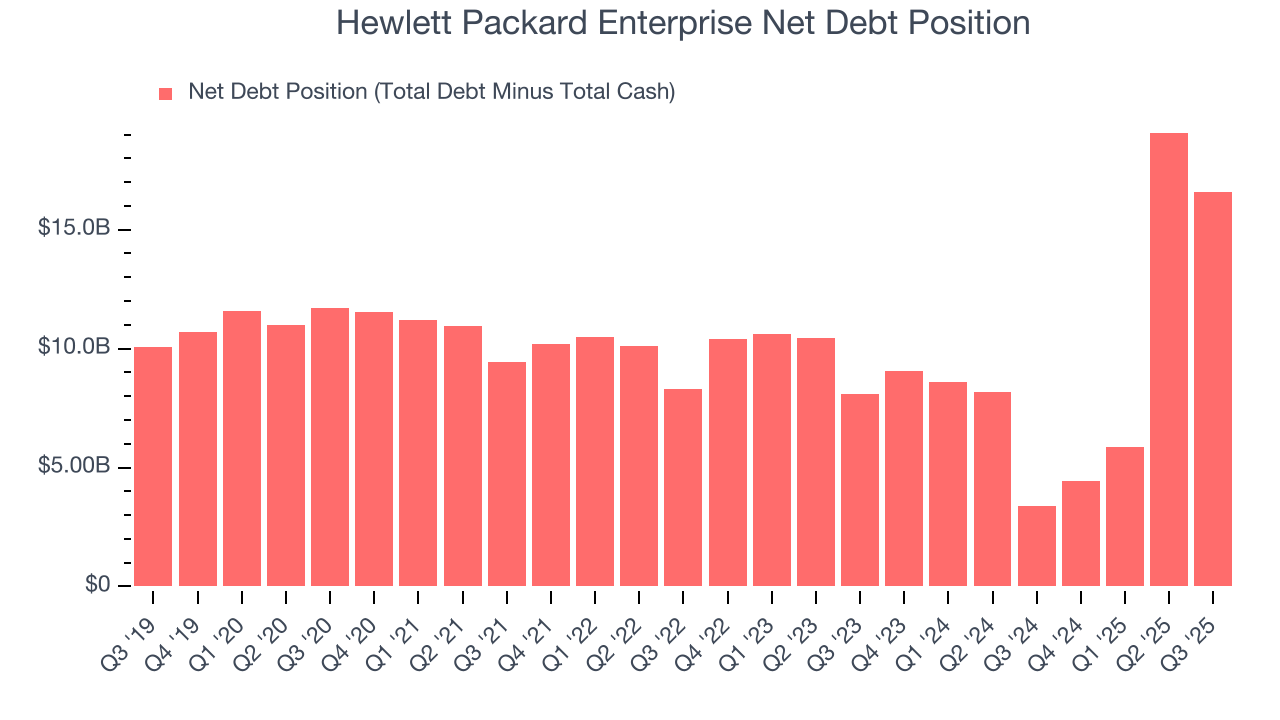

Hewlett Packard Enterprise reported $5.77 billion of cash and $22.37 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $5.1 billion of EBITDA over the last 12 months, we view Hewlett Packard Enterprise’s 3.3× net-debt-to-EBITDA ratio as safe. We also see its $131 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Hewlett Packard Enterprise’s Q3 Results

We were impressed by how significantly Hewlett Packard Enterprise blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.6% to $21.62 immediately following the results.

12. Is Now The Time To Buy Hewlett Packard Enterprise?

Updated: January 22, 2026 at 11:16 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Hewlett Packard Enterprise isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was mediocre over the last five years. And while its scale makes it a trusted partner with negotiating leverage, the downside is its cash profitability fell over the last five years. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Hewlett Packard Enterprise’s P/E ratio based on the next 12 months is 8.9x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $26.44 on the company (compared to the current share price of $21.38).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.