Gartner (IT)

We’re not sold on Gartner. Its decelerating growth and falling profitability suggest it’s struggling to scale down costs as demand fades.― StockStory Analyst Team

1. News

2. Summary

Why Gartner Is Not Exciting

With over 2,500 research experts guiding organizations through complex technology landscapes, Gartner (NYSE:IT) provides research, advisory services, and conferences that help executives make better decisions about technology and other business priorities.

- Estimated sales growth of 2.7% for the next 12 months implies demand will slow from its two-year trend

- A silver lining is that its powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently

Gartner is skating on thin ice. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Gartner

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Gartner

Gartner is trading at $231.70 per share, or 18x forward P/E. This multiple is lower than most business services companies, but for good reason.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Gartner (IT) Research Report: Q3 CY2025 Update

Research and advisory firm Gartner (NYSE:IT) met Wall Streets revenue expectations in Q3 CY2025, with sales up 2.7% year on year to $1.52 billion. Its non-GAAP profit of $2.76 per share was 13.7% above analysts’ consensus estimates.

Gartner (IT) Q3 CY2025 Highlights:

- Revenue: $1.52 billion vs analyst estimates of $1.52 billion (2.7% year-on-year growth, in line)

- Adjusted EPS: $2.76 vs analyst estimates of $2.43 (13.7% beat)

- Operating Margin: 5.7%, down from 16.6% in the same quarter last year

- Free Cash Flow Margin: 17.6%, down from 38.1% in the same quarter last year

- Market Capitalization: $18.62 billion

Company Overview

With over 2,500 research experts guiding organizations through complex technology landscapes, Gartner (NYSE:IT) provides research, advisory services, and conferences that help executives make better decisions about technology and other business priorities.

Gartner serves as a strategic advisor to approximately 14,000 client organizations across 90 countries, spanning virtually every industry and company size. The firm operates through three main business segments: Research, Conferences, and Consulting.

The Research segment forms the foundation of Gartner's business model. It delivers subscription-based services that include access to published research content, data, benchmarks, and direct consultation with research experts. This segment is divided into Global Technology Sales (GTS), which serves technology users and providers, and Global Business Sales (GBS), which targets functional leaders in areas like human resources, supply chain, finance, and marketing.

Gartner's Conferences segment organizes dozens of events annually, including the flagship Gartner Symposium/Xpo series. These gatherings provide forums where thousands of executives can learn from Gartner analysts, participate in workshops, and network with peers. The events range from large symposiums to focused summits and workshops tailored to specific roles or industries.

Through its Consulting segment, Gartner provides customized support for technology initiatives. Consultants leverage the firm's research and benchmarking capabilities to help clients optimize technology investments, guide digital transformation efforts, and improve IT cost management.

Gartner's business model is built on its intellectual capital—the insights generated by its research methodology that combines practitioner experience with data analysis. The company publishes tens of thousands of research pages annually and conducts hundreds of thousands of client interactions, allowing it to identify emerging trends and develop frameworks that help organizations navigate complex decisions.

A typical client might use Gartner's research to evaluate technology vendors for a major purchase, attend a conference to learn about emerging trends, and engage consultants to develop an implementation strategy for a digital transformation initiative.

4. IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

Gartner's main competitors include Forrester Research (NASDAQ:FORR), International Data Corporation (IDC), and Information Services Group (NASDAQ:III), along with specialized research firms like Everest Group and NelsonHall.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $6.46 billion in revenue over the past 12 months, Gartner is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

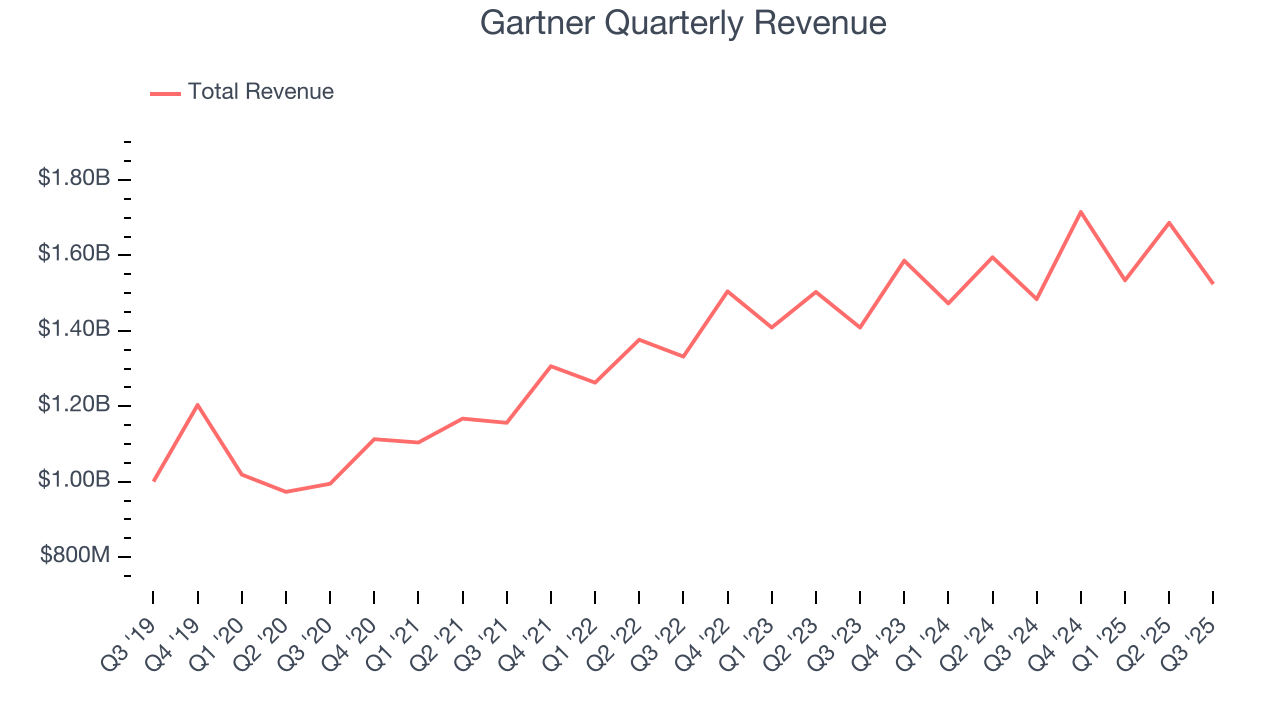

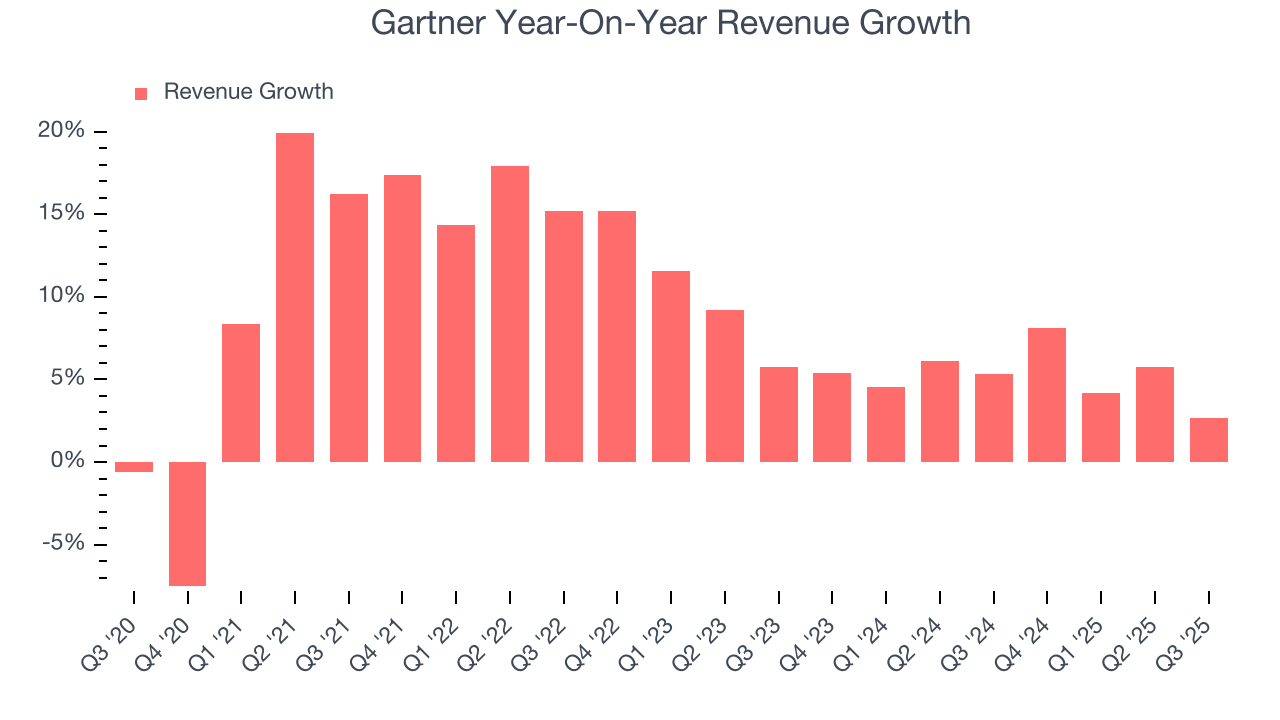

As you can see below, Gartner’s 9% annualized revenue growth over the last five years was impressive. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Gartner’s annualized revenue growth of 5.3% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Gartner grew its revenue by 2.7% year on year, and its $1.52 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

6. Operating Margin

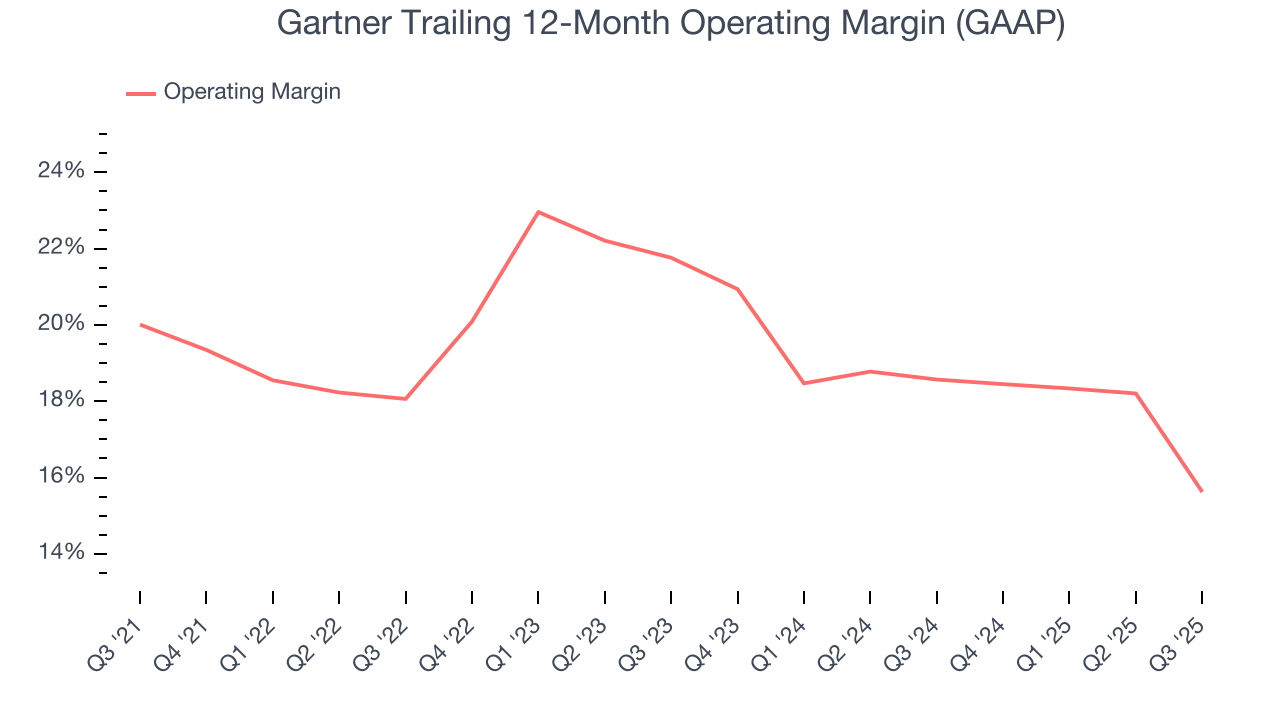

Gartner has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 18.7%.

Analyzing the trend in its profitability, Gartner’s operating margin decreased by 4.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Gartner generated an operating margin profit margin of 5.7%, down 10.9 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

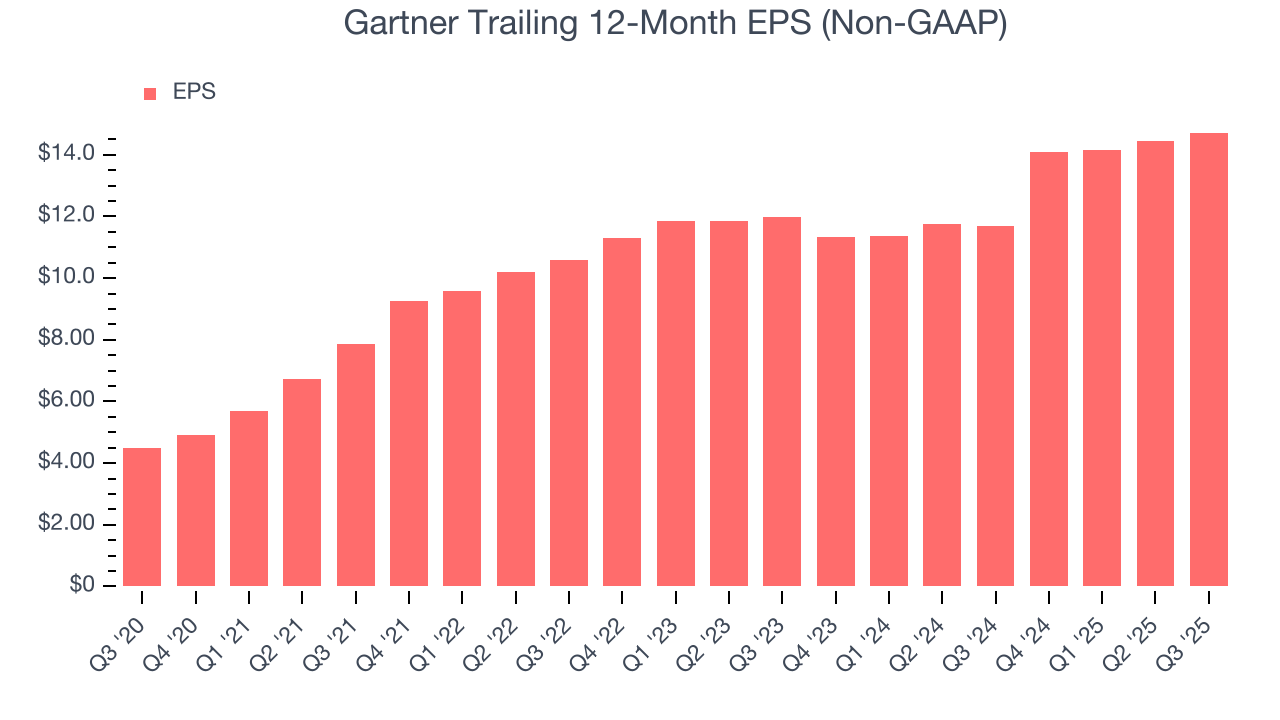

Gartner’s EPS grew at an astounding 26.8% compounded annual growth rate over the last five years, higher than its 9% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

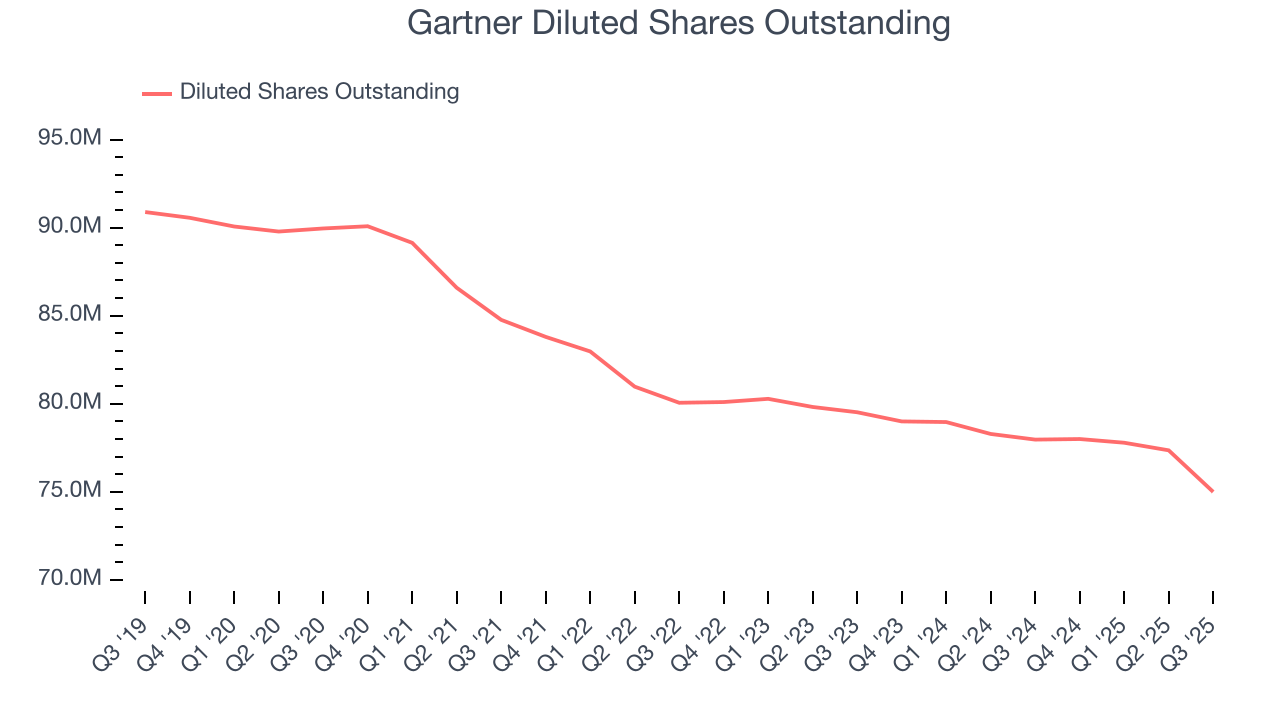

We can take a deeper look into Gartner’s earnings quality to better understand the drivers of its performance. A five-year view shows that Gartner has repurchased its stock, shrinking its share count by 16.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Gartner, its two-year annual EPS growth of 10.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Gartner reported adjusted EPS of $2.76, up from $2.50 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Gartner’s full-year EPS of $14.72 to shrink by 14.2%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

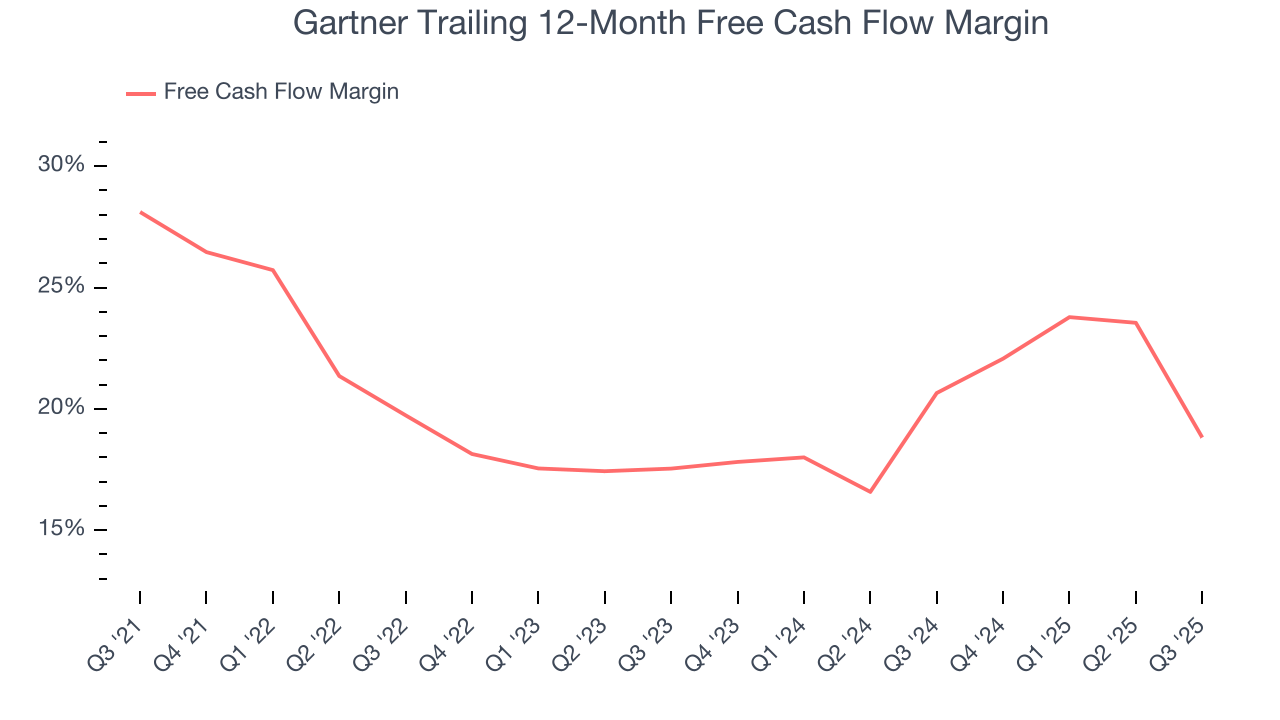

Gartner has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 20.6% over the last five years.

Taking a step back, we can see that Gartner’s margin dropped by 9.3 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Gartner’s free cash flow clocked in at $269 million in Q3, equivalent to a 17.6% margin. The company’s cash profitability regressed as it was 20.4 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Gartner hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 40.3%, splendid for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Gartner’s ROIC has increased significantly. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Assessment

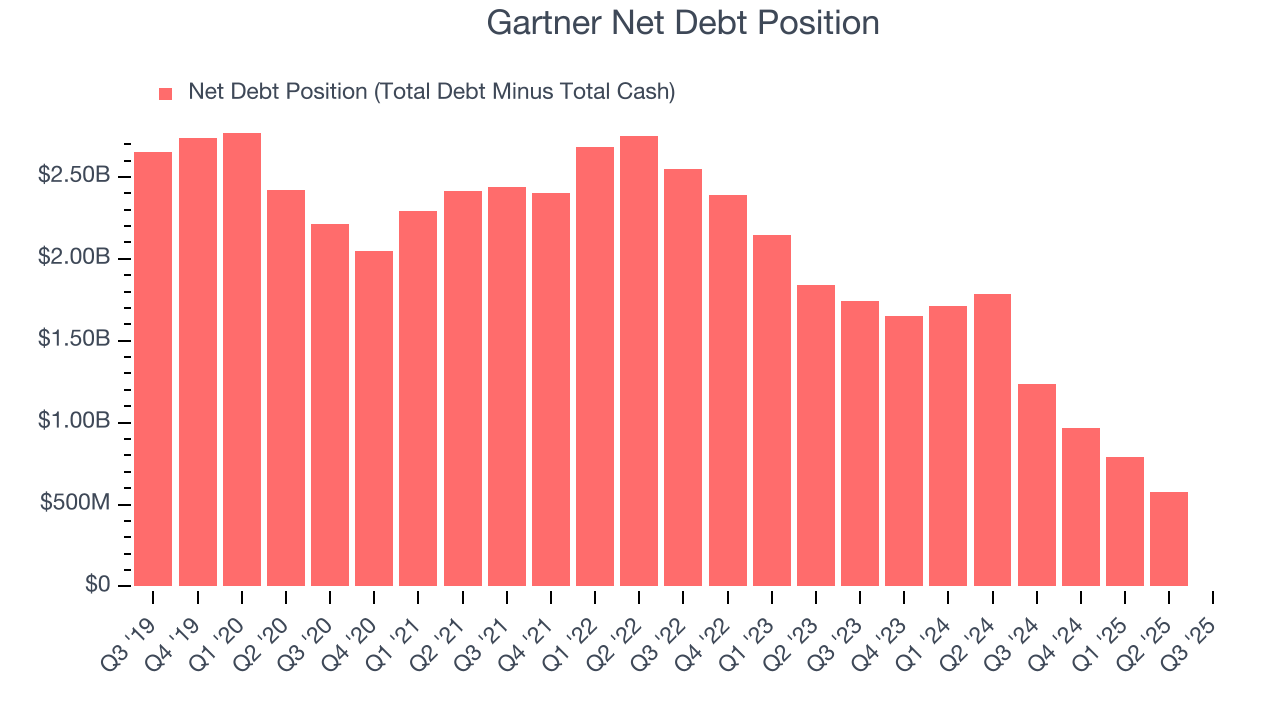

Gartner reported $0 of cash and $0 of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.59 billion of EBITDA over the last 12 months, we view Gartner’s 0.0× net-debt-to-EBITDA ratio as safe. We also see its $19.03 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Gartner’s Q3 Results

It was good to see Gartner beat analysts’ EPS expectations this quarter despite in line revenue. Investors were likely hoping for more, and shares traded down 2.8% to $239.16 immediately following the results.

12. Is Now The Time To Buy Gartner?

Updated: January 24, 2026 at 10:59 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Gartner.

Gartner doesn’t top our investment wishlist, but we understand that it’s not a bad business. To kick things off, its revenue growth was impressive over the last five years. And while Gartner’s projected EPS for the next year is lacking, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Gartner’s P/E ratio based on the next 12 months is 18x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $284.18 on the company (compared to the current share price of $231.70).