Stride (LRN)

Not many stocks excite us like Stride. Its exceptional revenue growth and returns on capital show it can expand quickly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like Stride

Formerly known as K12, Stride (NYSE:LRN) is an education technology company providing education solutions through digital platforms.

- Annual revenue growth of 16.5% over the last five years was superb and indicates its market share increased during this cycle

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 46.6% annually, topping its revenue gains

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures, and its returns are climbing as it finds even more attractive growth opportunities

Stride sets the bar. The valuation looks reasonable based on its quality, and we think now is a prudent time to invest in the stock.

Why Is Now The Time To Buy Stride?

Why Is Now The Time To Buy Stride?

Stride’s stock price of $73.19 implies a valuation ratio of 8.8x forward P/E. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

Our eyes light up when companies with elite fundamentals trade at bargain prices because shareholders can benefit from both earnings growth and a positive re-rating - a powerful one-two punch.

3. Stride (LRN) Research Report: Q3 CY2025 Update

Online education Stride (NYSE:LRN) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 12.7% year on year to $620.9 million. On the other hand, next quarter’s revenue guidance of $630 million was less impressive, coming in 3.4% below analysts’ estimates. Its non-GAAP profit of $1.52 per share was 20.4% above analysts’ consensus estimates.

Stride (LRN) Q3 CY2025 Highlights:

- Revenue: $620.9 million vs analyst estimates of $616.5 million (12.7% year-on-year growth, 0.7% beat)

- Adjusted EPS: $1.52 vs analyst estimates of $1.26 (20.4% beat)

- Adjusted EBITDA: $108.4 million vs analyst estimates of $94.9 million (17.5% margin, 14.3% beat)

- Revenue Guidance for the full year is $2.52 billion at the midpoint, below analyst estimates of $2.67 billion

- Operating Margin: 11.1%, up from 8.6% in the same quarter last year

- Free Cash Flow was -$217.5 million compared to -$156.8 million in the same quarter last year

- Market Capitalization: $6.57 billion

Company Overview

Formerly known as K12, Stride (NYSE:LRN) is an education technology company providing education solutions through digital platforms.

Stride specializes in high-quality, personalized K-12 education, offering online public and private schooling, curriculum development, and career learning programs. Recognizing the unique needs, talents, and interests of each student, Stride tailors its educational approach to move beyond the limitations of traditional, one-size-fits-all education.

The company collaborates with school districts and charter schools to operate virtual public schools, providing a comprehensive K-12 curriculum, state-certified teachers, and a blend of online and offline coursework. This flexible learning model caters to a variety of students, including advanced learners and those with medical challenges, and is complemented by Stride's private online school options.

A key feature of Stride's offerings is its career learning programs, designed to connect education with the workforce by equipping students with practical skills in fields like IT, business, health science, and manufacturing. These programs align with evolving industry demands, preparing students for future career opportunities.

Stride's expertise also extends to curriculum development, where it creates and supplies innovative, interactive online courses that adhere to high academic standards and accommodate different learning styles. These courses are utilized in Stride's educational institutions and are also available to traditional schools and other online education platforms.

4. Digital Media & Content Platforms

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

Stride’s primary competitors include Pearson PLC (NYSE:PSO), Chegg (NYSE:CHGG), Grand Canyon Education (NASDAQ:LOPE), 2U (NASDAQ:TWOU), and private companies Connections Academy and Edmentum.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.48 billion in revenue over the past 12 months, Stride is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

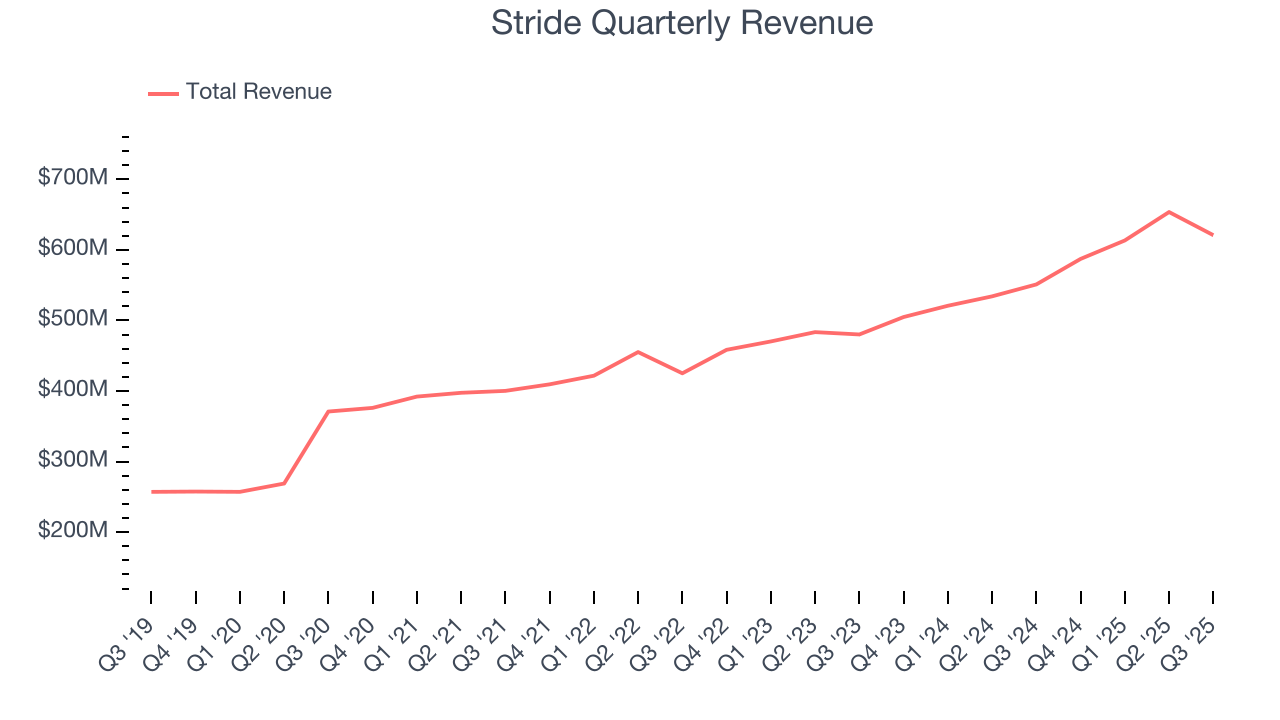

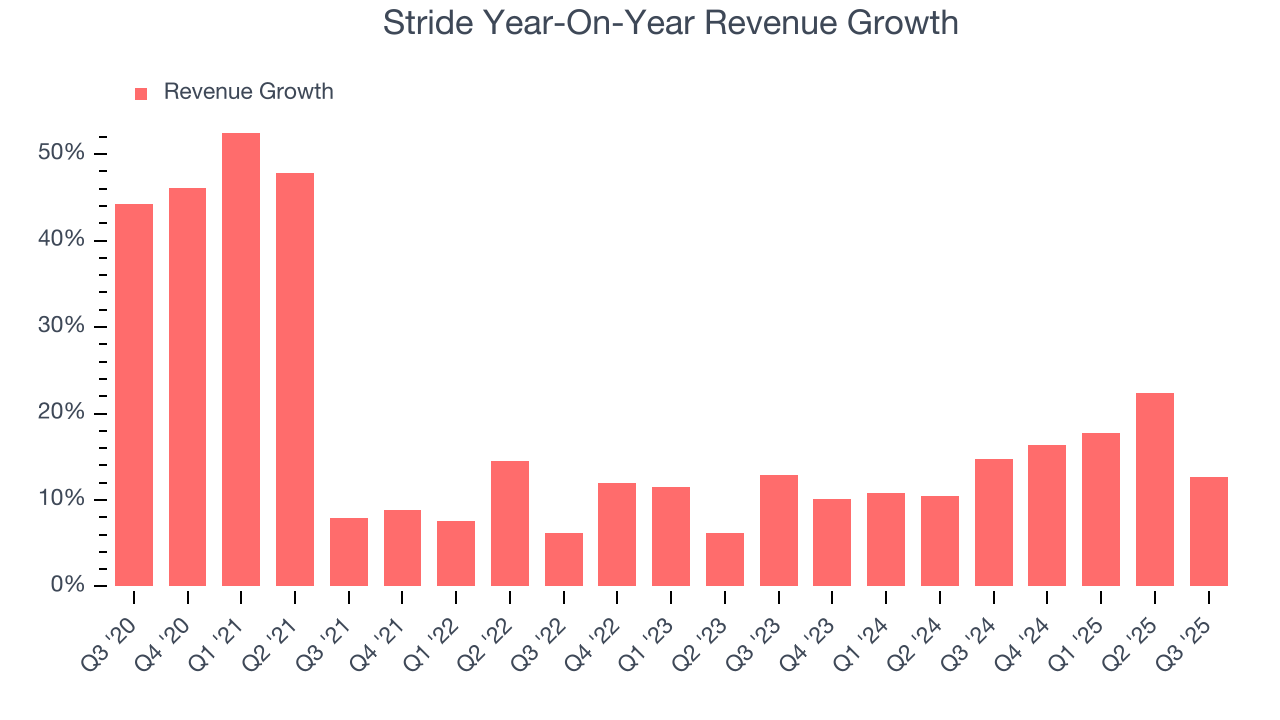

As you can see below, Stride’s 16.5% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows Stride’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Stride’s annualized revenue growth of 14.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Stride reported year-on-year revenue growth of 12.7%, and its $620.9 million of revenue exceeded Wall Street’s estimates by 0.7%. Company management is currently guiding for a 7.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and implies the market is baking in success for its products and services.

6. Operating Margin

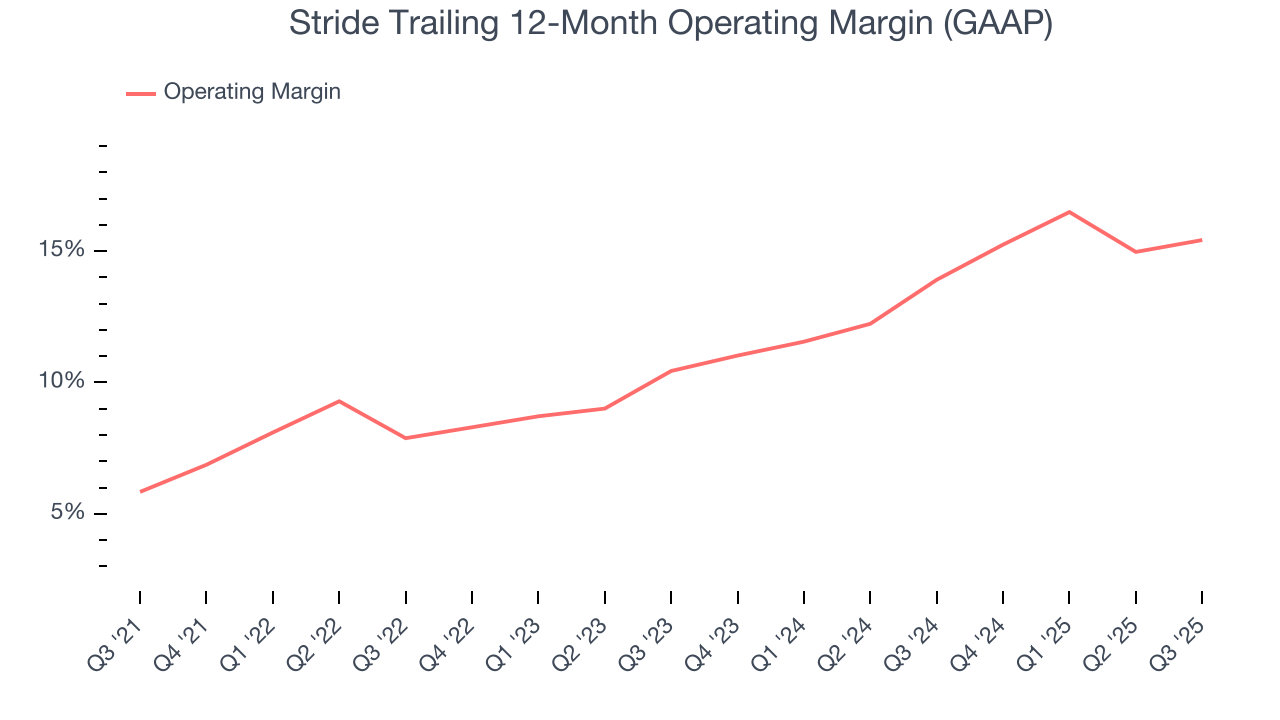

Stride has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.3%, higher than the broader business services sector.

Analyzing the trend in its profitability, Stride’s operating margin rose by 9.6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Stride generated an operating margin profit margin of 11.1%, up 2.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

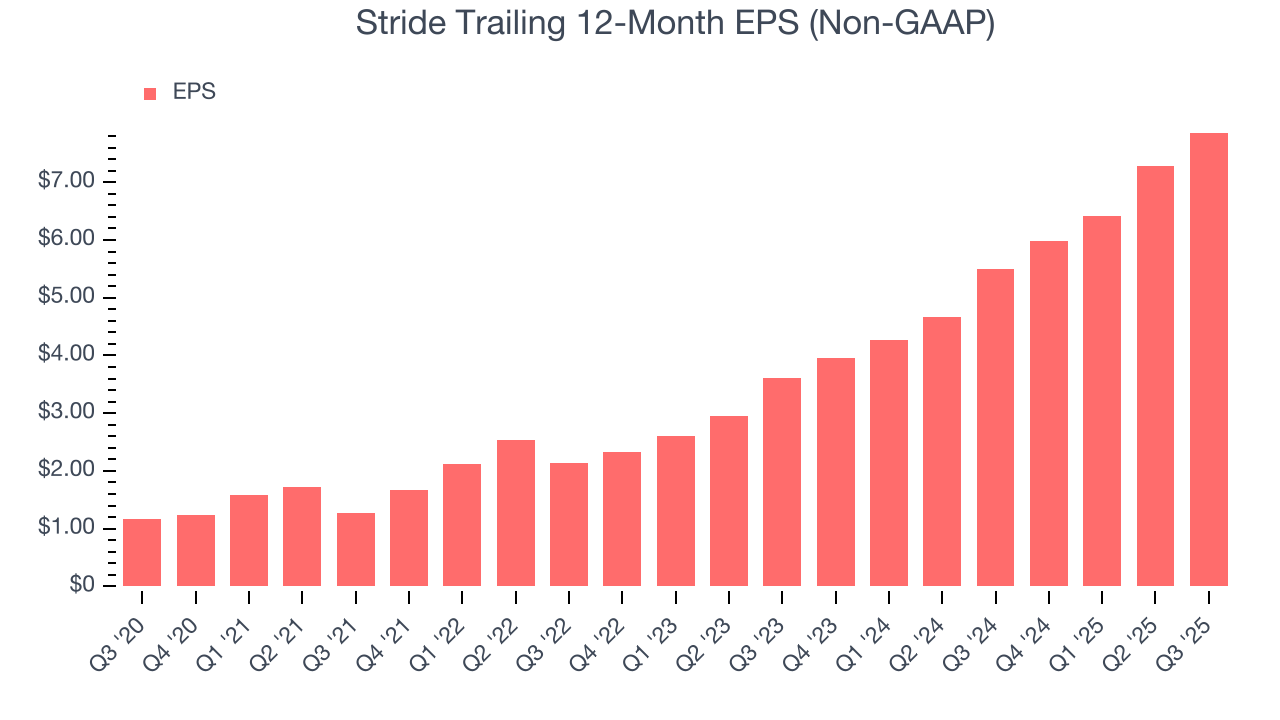

Stride’s EPS grew at an astounding 46.6% compounded annual growth rate over the last five years, higher than its 16.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Stride’s earnings to better understand the drivers of its performance. As we mentioned earlier, Stride’s operating margin expanded by 9.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Stride, its two-year annual EPS growth of 47.6% is similar to its five-year trend, implying strong and stable earnings power.

In Q3, Stride reported adjusted EPS of $1.52, up from $0.94 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Stride’s full-year EPS of $7.86 to grow 16.9%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

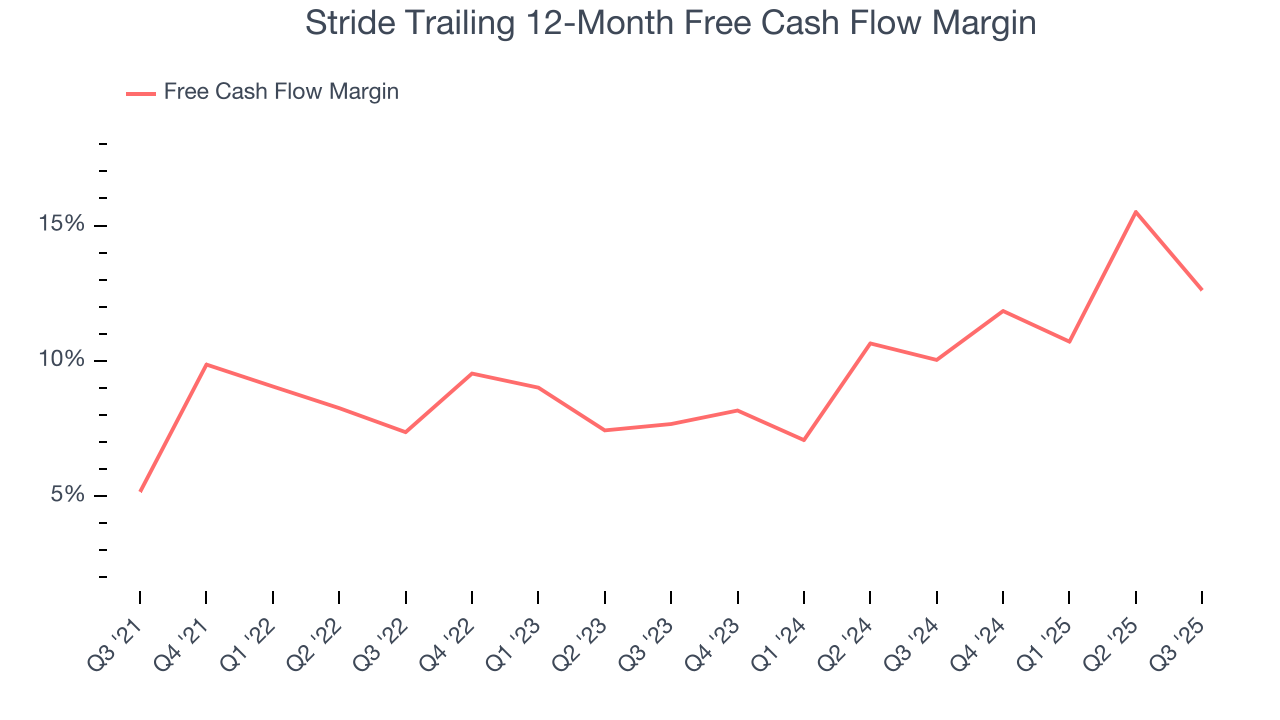

Stride has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 9% over the last five years, better than the broader business services sector.

Taking a step back, we can see that Stride’s margin expanded by 7.4 percentage points during that time. This is encouraging because it gives the company more optionality.

Stride burned through $217.5 million of cash in Q3, equivalent to a negative 35% margin. The company’s cash burn increased from $156.8 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

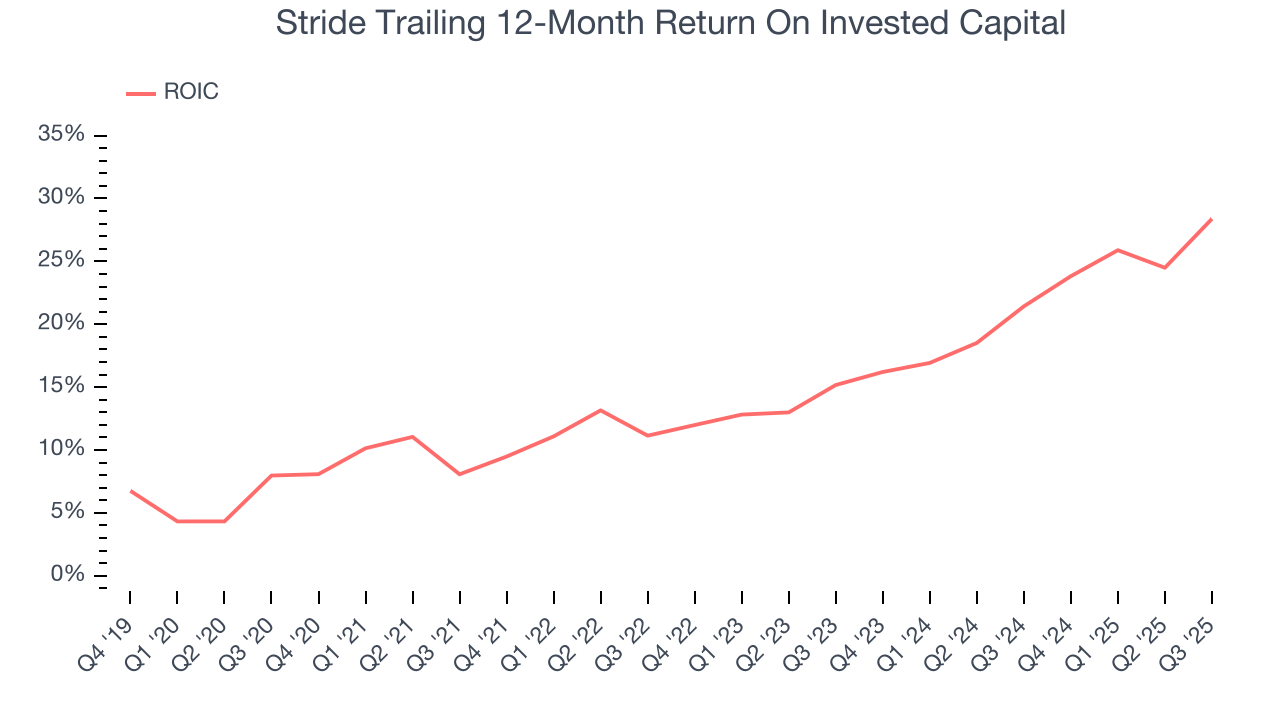

Stride’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 16.8%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Stride’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

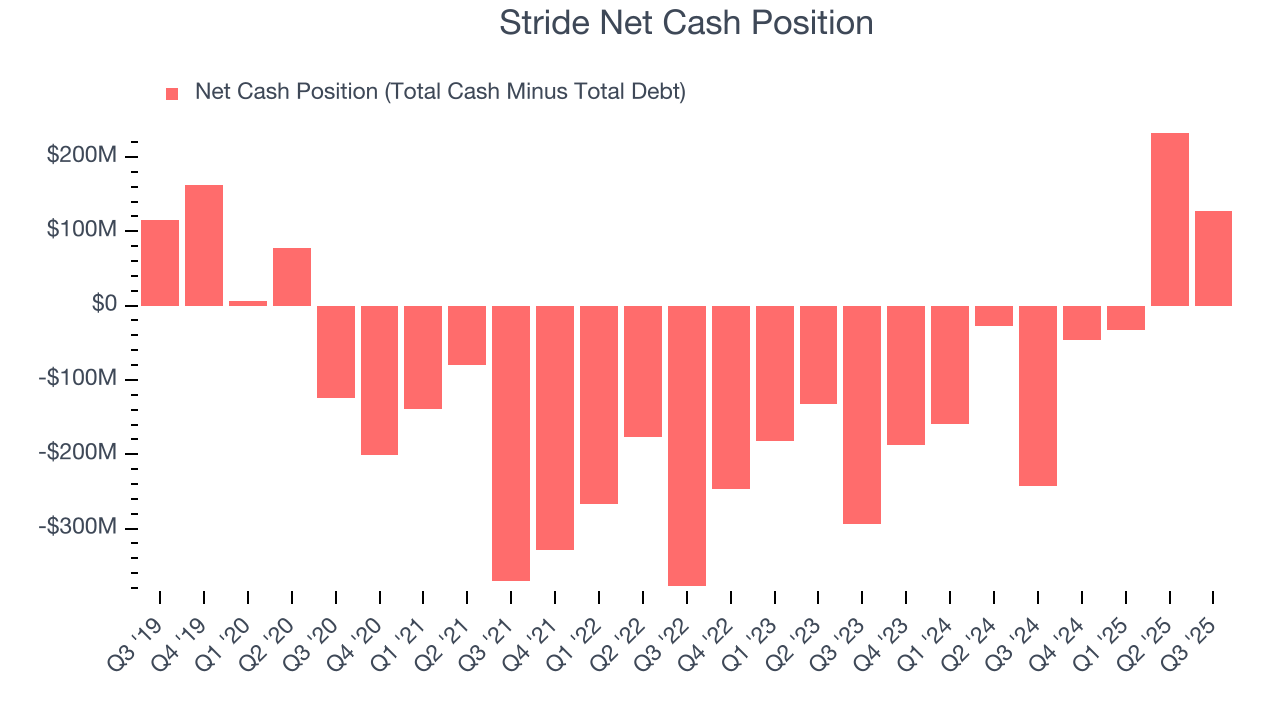

Stride is a profitable, well-capitalized company with $715.1 million of cash and $588 million of debt on its balance sheet. This $127.1 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Stride’s Q3 Results

It was good to see Stride beat analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter, and the outlook is really spooking the market. The stock traded down 35.6% to $98.92 immediately after reporting.

12. Is Now The Time To Buy Stride?

Updated: January 24, 2026 at 10:13 PM EST

Before investing in or passing on Stride, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Stride is a cream-of-the-crop business services company. First of all, the company’s revenue growth was exceptional over the last five years. On top of that, its rising cash profitability gives it more optionality, and its expanding adjusted operating margin shows the business has become more efficient.

Stride’s P/E ratio based on the next 12 months is 8.8x. Looking across the spectrum of business services businesses, Stride’s fundamentals clearly illustrate it’s a special business. We’re pounding the table at this bargain price.

Wall Street analysts have a consensus one-year price target of $105 on the company (compared to the current share price of $73.19), implying they see 43.5% upside in buying Stride in the short term.