Montrose (MEG)

We see potential in Montrose. Its robust demand and unit economics make it a fast-growing, asset-lite machine with big upside.― StockStory Analyst Team

1. News

2. Summary

Why Montrose Is Interesting

Founded to protect a tree-lined two-lane road, Montrose (NYSE:MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

- Impressive 23.5% annual revenue growth over the last five years indicates it’s winning market share this cycle

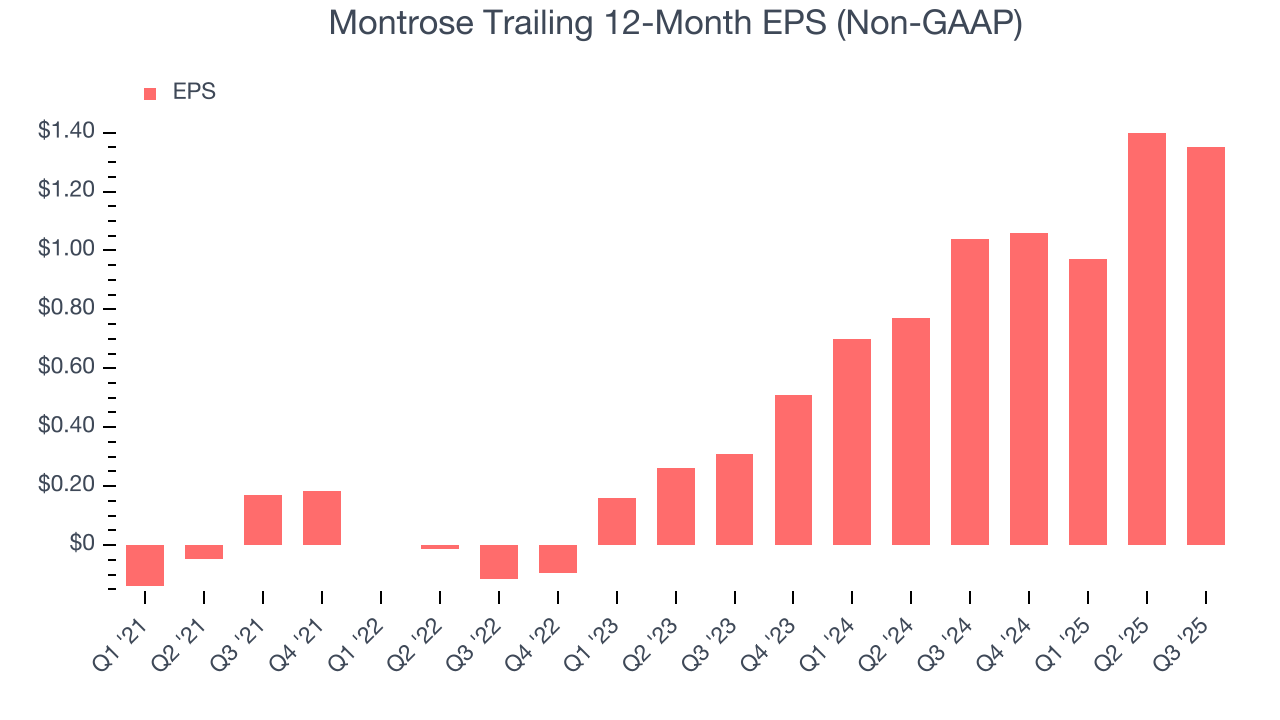

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 71.7% annually

- A drawback is its projected sales are flat for the next 12 months, implying demand will slow from its two-year trend

Montrose has some respectable qualities. If you like the company, the price seems fair.

Why Is Now The Time To Buy Montrose?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Montrose?

Montrose’s stock price of $22.98 implies a valuation ratio of 18.3x forward P/E. This multiple is lower than the broader industrials space, and we think it’s fair given the revenue growth.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Montrose (MEG) Research Report: Q3 CY2025 Update

Environmental services provider Montrose (NYSE:MEG) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 25.9% year on year to $224.9 million. The company’s full-year revenue guidance of $820 million at the midpoint came in 0.6% above analysts’ estimates. Its non-GAAP profit of $0.36 per share was 11.6% above analysts’ consensus estimates.

Montrose (MEG) Q3 CY2025 Highlights:

- Revenue: $224.9 million vs analyst estimates of $202.8 million (25.9% year-on-year growth, 10.9% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.32 (11.6% beat)

- Adjusted EBITDA: $33.66 million vs analyst estimates of $28.92 million (15% margin, 16.4% beat)

- The company slightly lifted its revenue guidance for the full year to $820 million at the midpoint from $815 million

- EBITDA guidance for the full year is $115 million at the midpoint, in line with analyst expectations

- Operating Margin: 4.4%, up from -0.6% in the same quarter last year

- Free Cash Flow Margin: 9.9%, up from 5.7% in the same quarter last year

- Market Capitalization: $885.7 million

Company Overview

Founded to protect a tree-lined two-lane road, Montrose (NYSE:MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Montrose traces its roots back to a community effort to protect local landscapes from a proposed highway. The company has since expanded its service offerings by acquiring environmental consulting and testing firms. Specifically, its acquisition of Enthalpy Analytical, a provider of laboratory testing services for air, water, and soil samples, was crucial for strengthening its environmental lab capabilities. Today, the company’s services help clients manage environmental risks, ensure compliance with regulations, and achieve sustainability goals.

Its expertise includes precise air quality monitoring to measure pollutants and ensure compliance with environmental standards. Through environmental laboratory testing, it analyzes soil, water, and air samples to identify and manage contaminants. Additionally, Montrose guides clients through environmental laws and regulations. Specifically, it helps obtain necessary permits, fulfill reporting requirements, and maintain alignment with federal, state, and local environmental guidelines.

Montrose serves industries such as oil and gas, helping manage emissions and wastewater. It primarily enters into long-term contracts that involve recurring services over several years such as frequent monitoring and testing. Additionally, Montrose provides project-based services for specific environmental challenges or regulatory requirements.

4. Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Montrose Environmental Group competes with environmental divisions of larger engineering and consulting firms such as ERM, Ramboll, WSP, AECOM, and Tetra Tech, as well as specialized environmental testing companies like Eurofins and Pace Analytical.

5. Revenue Growth

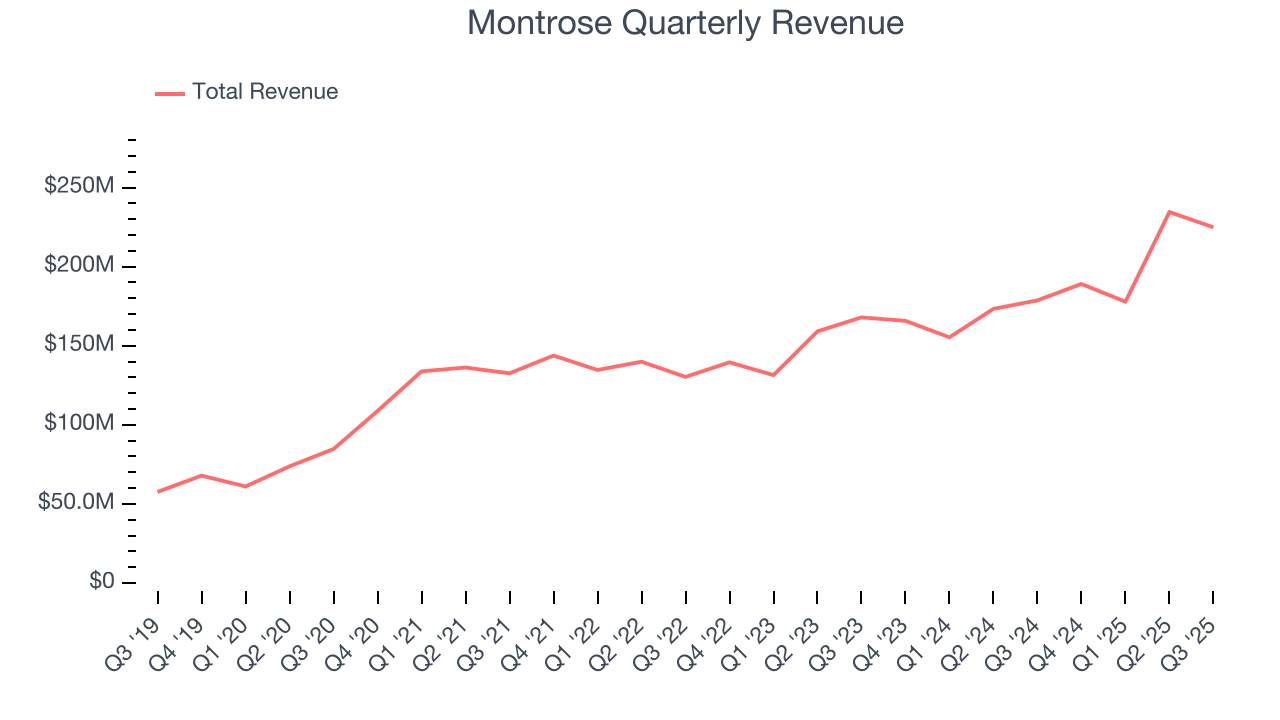

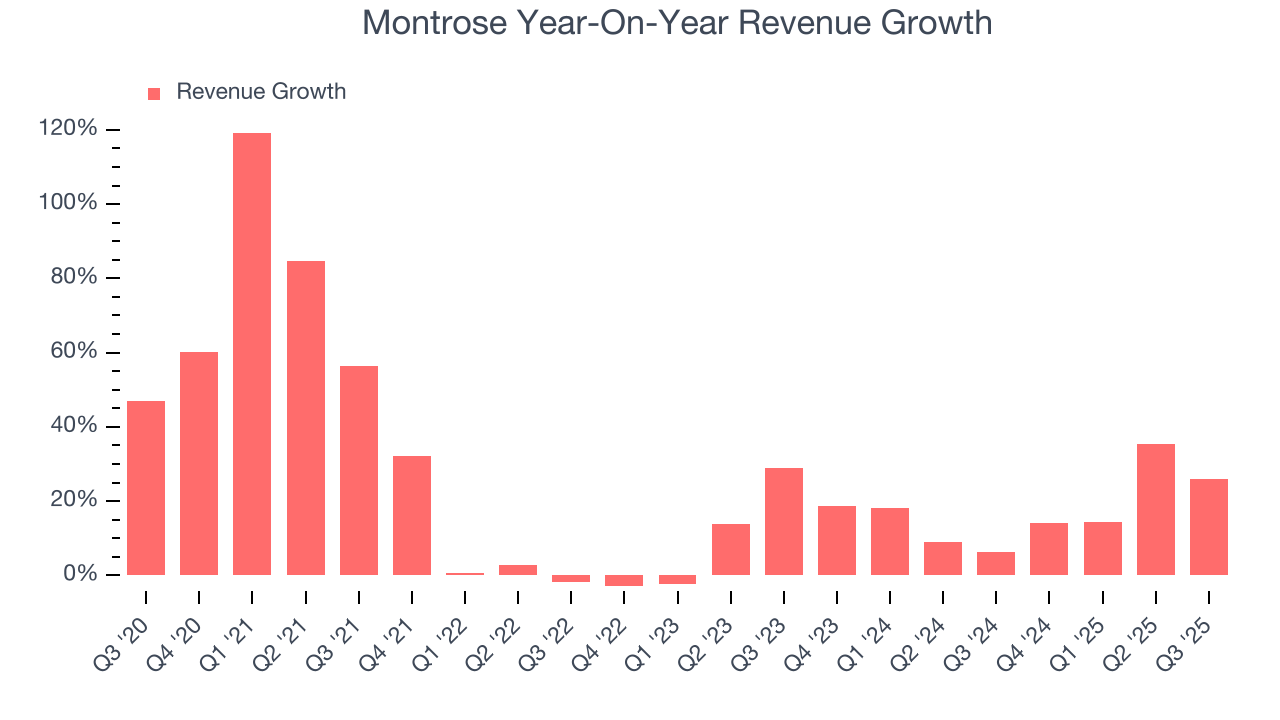

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Montrose’s 23.5% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Montrose’s annualized revenue growth of 17.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Montrose reported robust year-on-year revenue growth of 25.9%, and its $224.9 million of revenue topped Wall Street estimates by 10.9%.

Looking ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

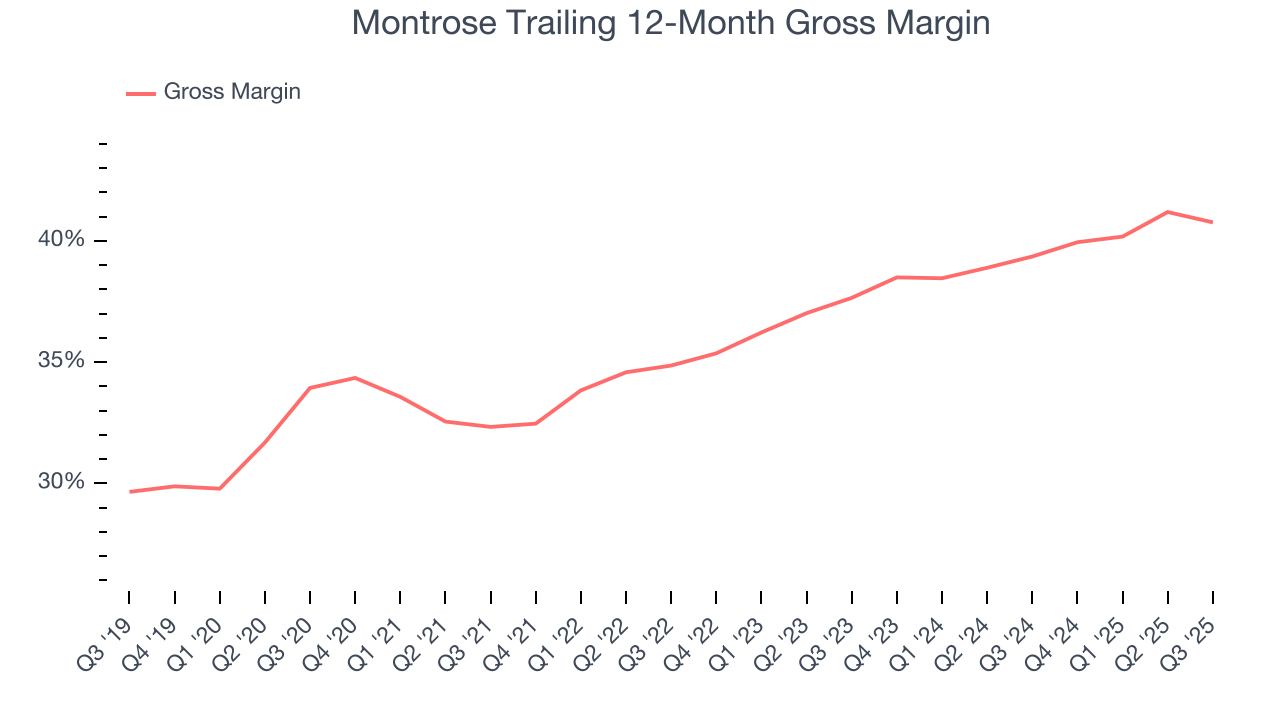

Montrose’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 37.5% gross margin over the last five years. Said differently, roughly $37.48 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, Montrose’s gross profit margin was 39.4%, down 1.5 percentage points year on year. On a wider time horizon, however, Montrose’s full-year margin has been trending up over the past 12 months, increasing by 1.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

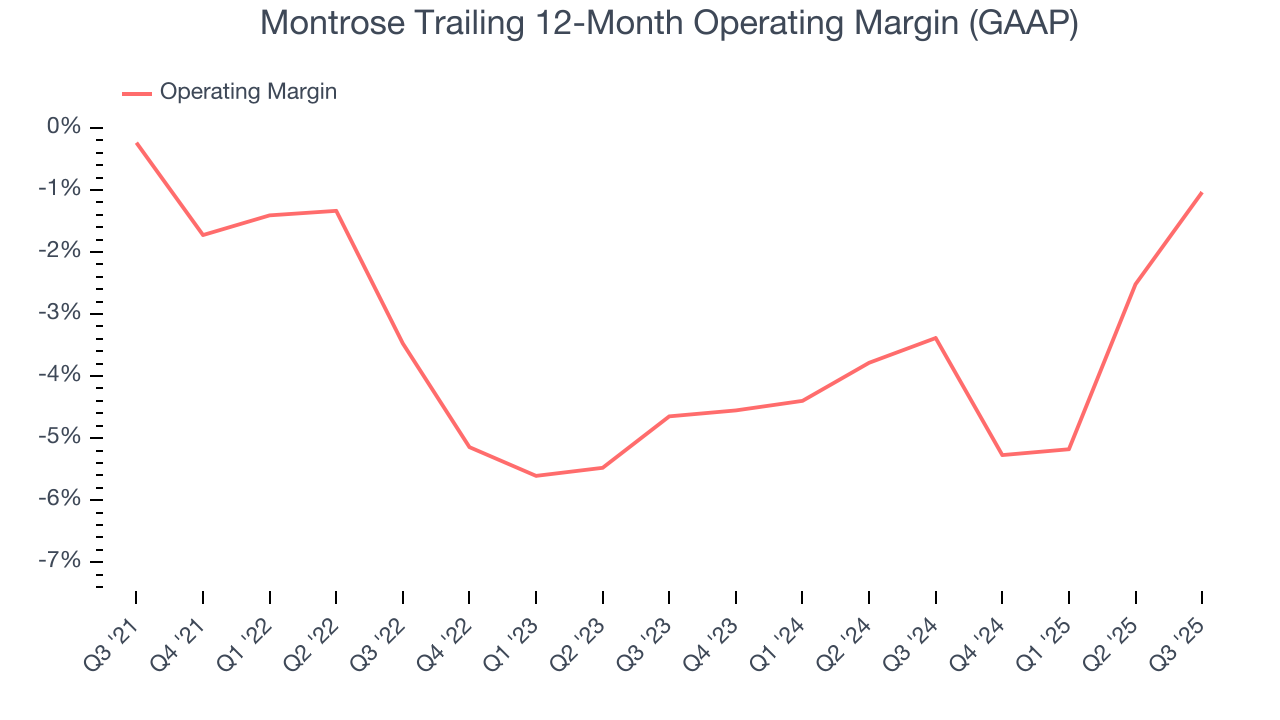

Montrose’s operating margin has been trending up over the last 12 months, but it still averaged negative 2.5% over the last five years. This is due to its large expense base and inefficient cost structure. It might have a shot at long-term profitability if it can scale quickly and gain operating leverage.

Analyzing the trend in its profitability, Montrose’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Montrose generated an operating margin profit margin of 4.4%, up 5.1 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Montrose’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Montrose’s EPS grew at an astounding 109% compounded annual growth rate over the last two years, higher than its 17.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Montrose’s earnings to better understand the drivers of its performance. Montrose’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Montrose reported adjusted EPS of $0.36, down from $0.41 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Montrose’s full-year EPS of $1.35 to shrink by 10.7%.

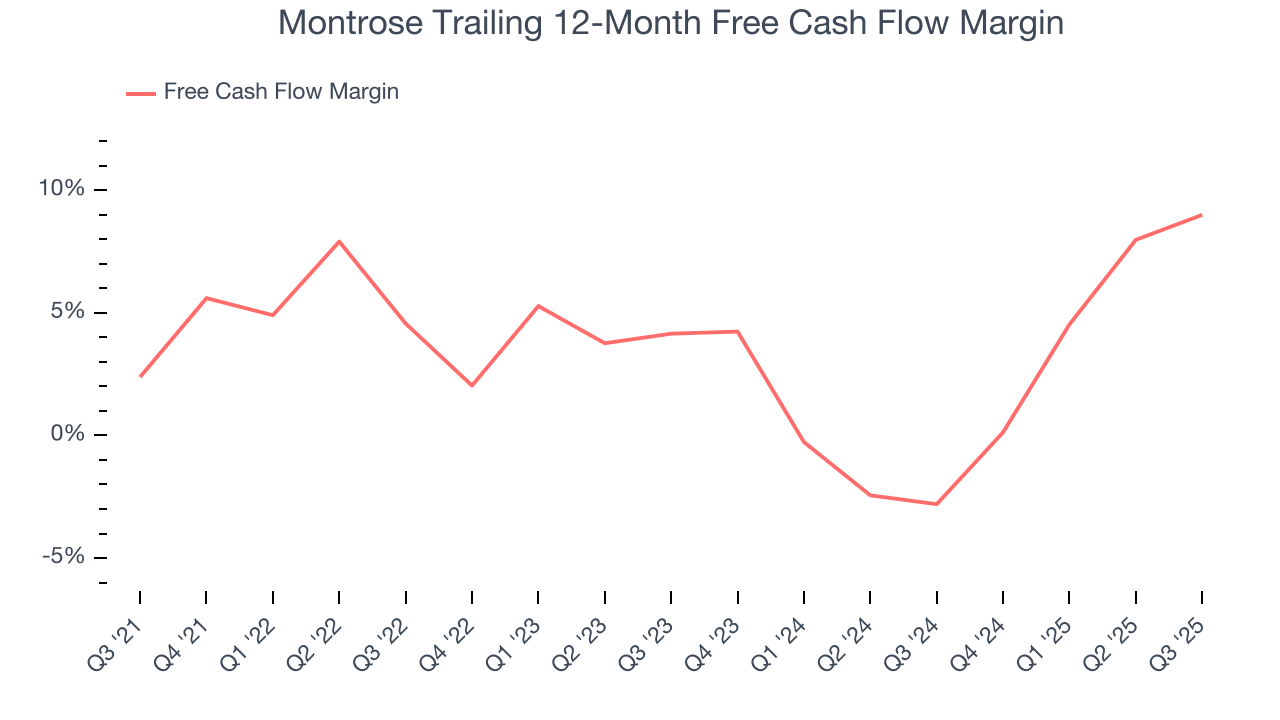

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Montrose has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.7%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Montrose’s margin expanded by 6.6 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Montrose’s free cash flow clocked in at $22.33 million in Q3, equivalent to a 9.9% margin. This result was good as its margin was 4.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

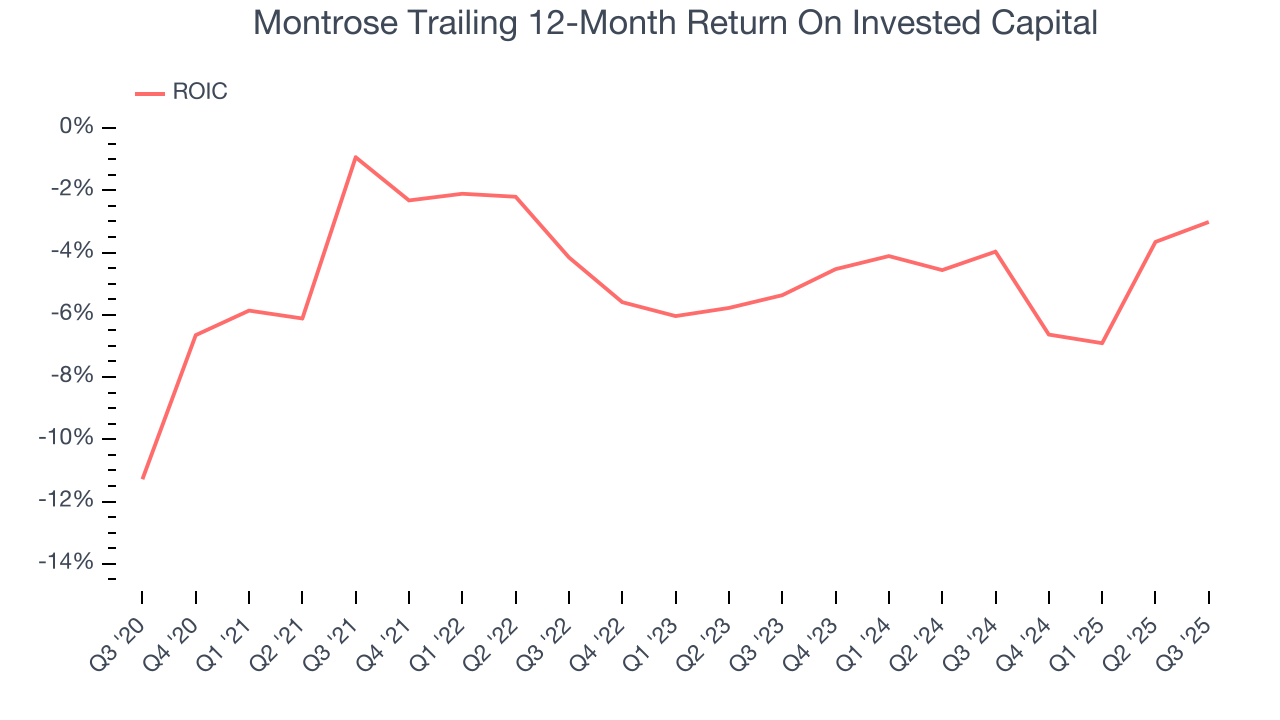

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Montrose has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 3.5%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Montrose’s ROIC has stayed the same over the last few years. We still think it’s a good business, but if the company wants to reach the next level, it must improve its returns.

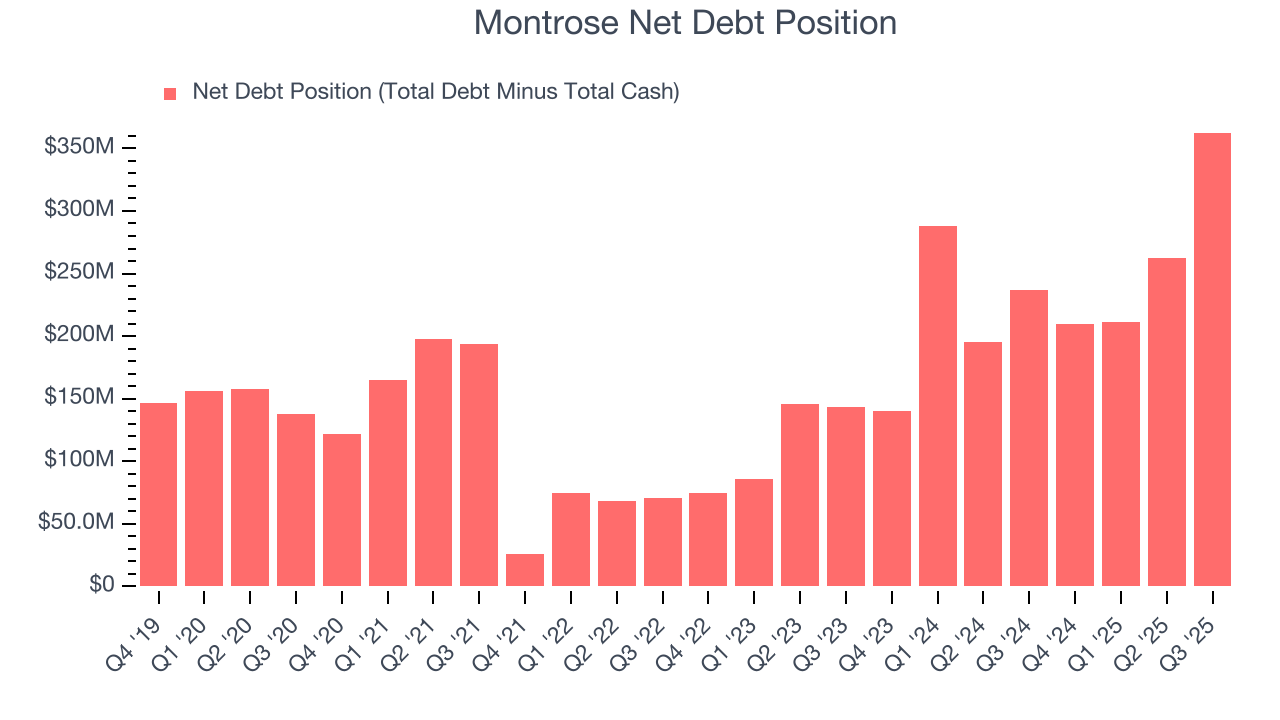

11. Balance Sheet Assessment

Montrose reported $6.74 million of cash and $369.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $119.5 million of EBITDA over the last 12 months, we view Montrose’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $19.02 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Montrose’s Q3 Results

We were impressed by how significantly Montrose blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 14.1% to $28.03 immediately after reporting.

13. Is Now The Time To Buy Montrose?

Updated: January 23, 2026 at 10:22 PM EST

Before making an investment decision, investors should account for Montrose’s business fundamentals and valuation in addition to what happened in the latest quarter.

In our opinion, Montrose is a solid company. First off, its revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising cash profitability gives it more optionality. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Montrose’s P/E ratio based on the next 12 months is 18.3x. When scanning the industrials space, Montrose trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $33.33 on the company (compared to the current share price of $22.98), implying they see 45.1% upside in buying Montrose in the short term.