Manitowoc (MTW)

We wouldn’t buy Manitowoc. Its weak returns on capital suggest it doesn’t generate sufficient profits, a sign of value destruction.― StockStory Analyst Team

1. News

2. Summary

Why We Think Manitowoc Will Underperform

Contracted by the United States Navy during WWII, Manitowoc (NYSE:MTW) provides cranes and lifting equipment.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 2.1% annually over the last two years

- Sales were less profitable over the last two years as its earnings per share fell by 72.8% annually, worse than its revenue declines

- Lacking free cash flow margin got worse over the last five years as its investment needs accelerated

Manitowoc falls short of our quality standards. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Manitowoc

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Manitowoc

Manitowoc is trading at $11.63 per share, or 15.1x forward P/E. Manitowoc’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Manitowoc (MTW) Research Report: Q2 CY2025 Update

Crane and lifting equipment company Manitowoc (NYSE:MTW) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 4% year on year to $539.5 million. Its non-GAAP profit of $2.80 per share was significantly above analysts’ consensus estimates.

Manitowoc (MTW) Q2 CY2025 Highlights:

- Revenue: $539.5 million vs analyst estimates of $577.3 million (4% year-on-year decline, 6.5% miss)

- Adjusted EPS: $2.80 vs analyst estimates of $0.18 (significant beat)

- Adjusted EBITDA: $26.3 million vs analyst estimates of $38.22 million (4.9% margin, 31.2% miss)

- Operating Margin: 2%, down from 3.6% in the same quarter last year

- Free Cash Flow was -$73.7 million compared to -$1.9 million in the same quarter last year

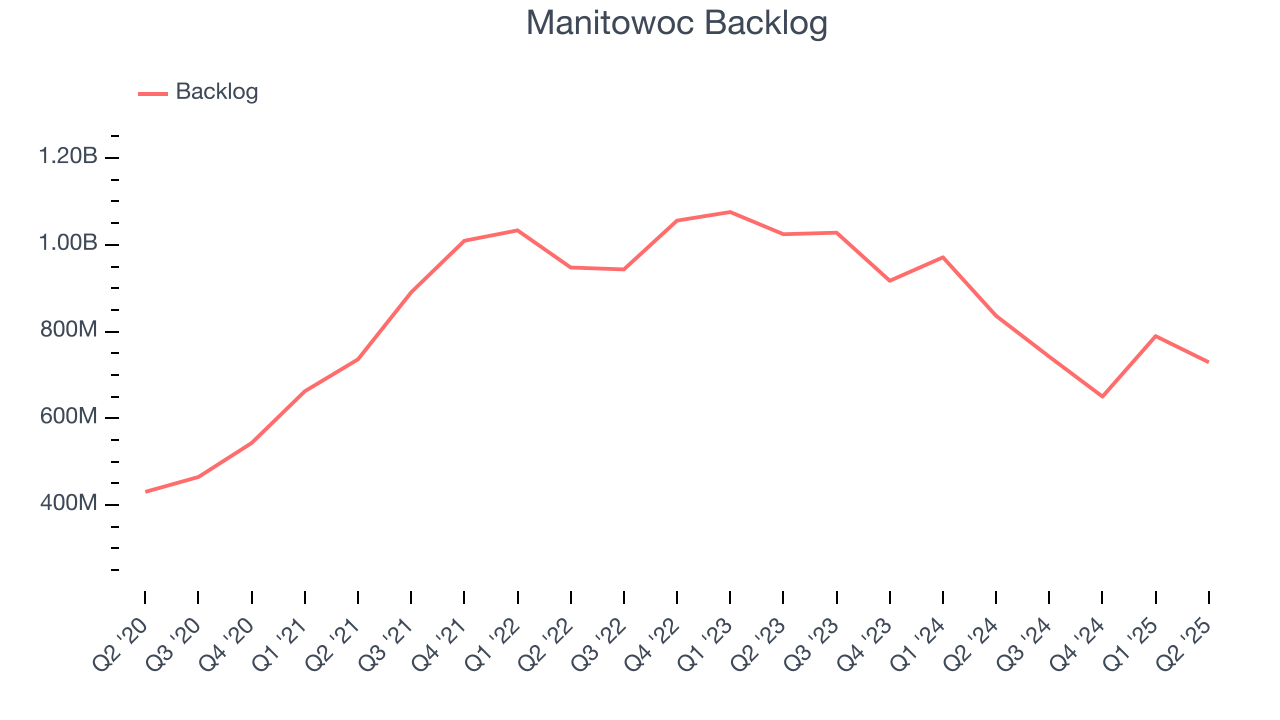

- Backlog: $729.3 million at quarter end, down 12.8% year on year

- Market Capitalization: $443.4 million

Company Overview

Contracted by the United States Navy during WWII, Manitowoc (NYSE:MTW) provides cranes and lifting equipment.

Manitowoc was founded in 1902 and began as a shipbuilding and ship-repairing business. The company leveraged its early expertise in maritime construction to pivot towards heavy machinery, particularly crane manufacturing, which became its primary focus during the mid-20th century. This shift marked a significant expansion for the company into a new product line.

The company’s growth was primarily fueled by the acquisition of specialized equipment manufacturers, new technology providers, or regional companies to expand its geographic reach. Notably, Manitowo acquired Grove in 2002 for $271 million and made Grove a subsidiary offering mobile hydraulic cranes.

Today, Manitowoc offers cranes and lifting equipment designed to facilitate the movement of heavy equipment and materials. These cranes play pivotal roles across a spectrum of industries such as construction, where it is essential for erecting skyscrapers, bridges, and infrastructure projects, and shipping, where its products load and unload cargo ships and containers. It offers options for customers to purchase cranes and lifting equipment outright or to lease equipment for specific projects or periods of time.

The company makes one-time sales of equipment and generates recurring revenue through its leases. For leases, rental pricing is structured around rental duration, equipment type, and additional services like maintenance and training. It offers short-term and long-term contracts (weeks to months) based on project durations and preferences.

4. Construction Machinery

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new sales opportunities for construction machinery companies. On the other hand, construction machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

Competitors offering similar products include Terex (NYSE:TEX), Caterpillar (NYSE:CAT), and Hyster-Yale (NYSE:HY).

5. Revenue Growth

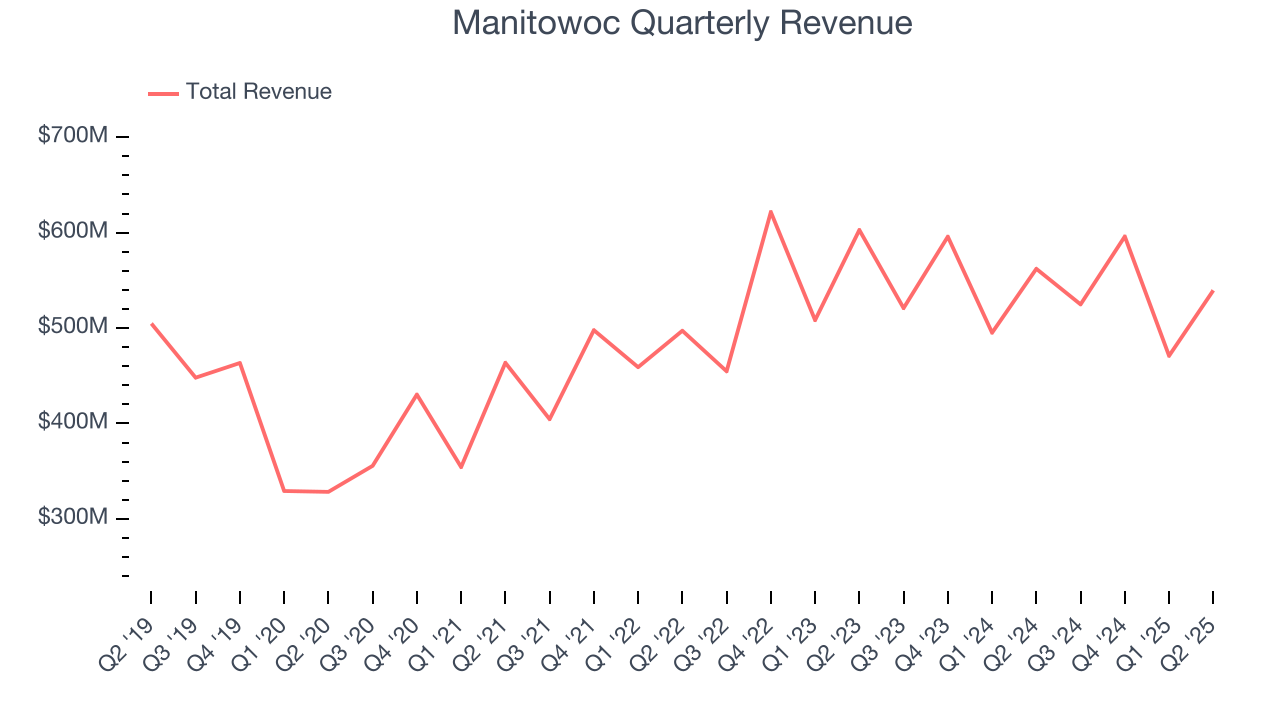

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Manitowoc’s 6.3% annualized revenue growth over the last five years was mediocre. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Manitowoc’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.3% annually. Manitowoc isn’t alone in its struggles as the Construction Machinery industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Manitowoc’s backlog reached $729.3 million in the latest quarter and averaged 15.1% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Manitowoc missed Wall Street’s estimates and reported a rather uninspiring 4% year-on-year revenue decline, generating $539.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

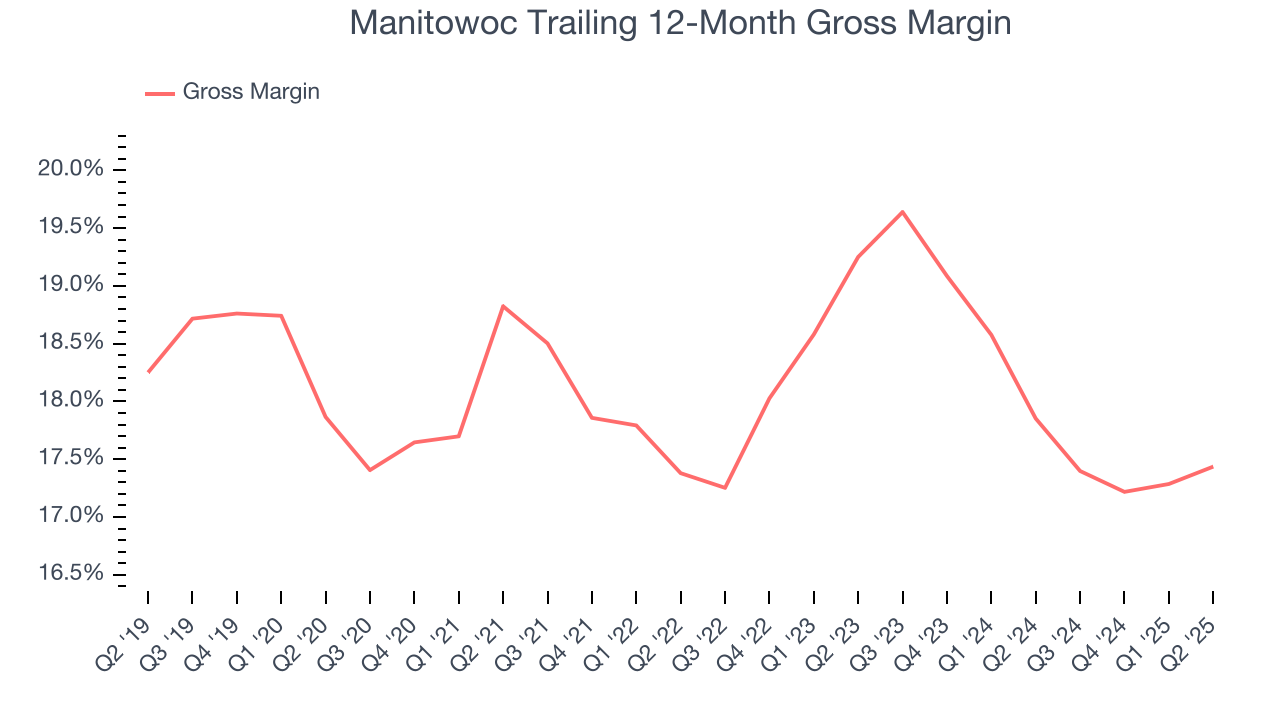

Manitowoc has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 18.1% gross margin over the last five years. That means Manitowoc paid its suppliers a lot of money ($81.86 for every $100 in revenue) to run its business.

This quarter, Manitowoc’s gross profit margin was 18.4%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

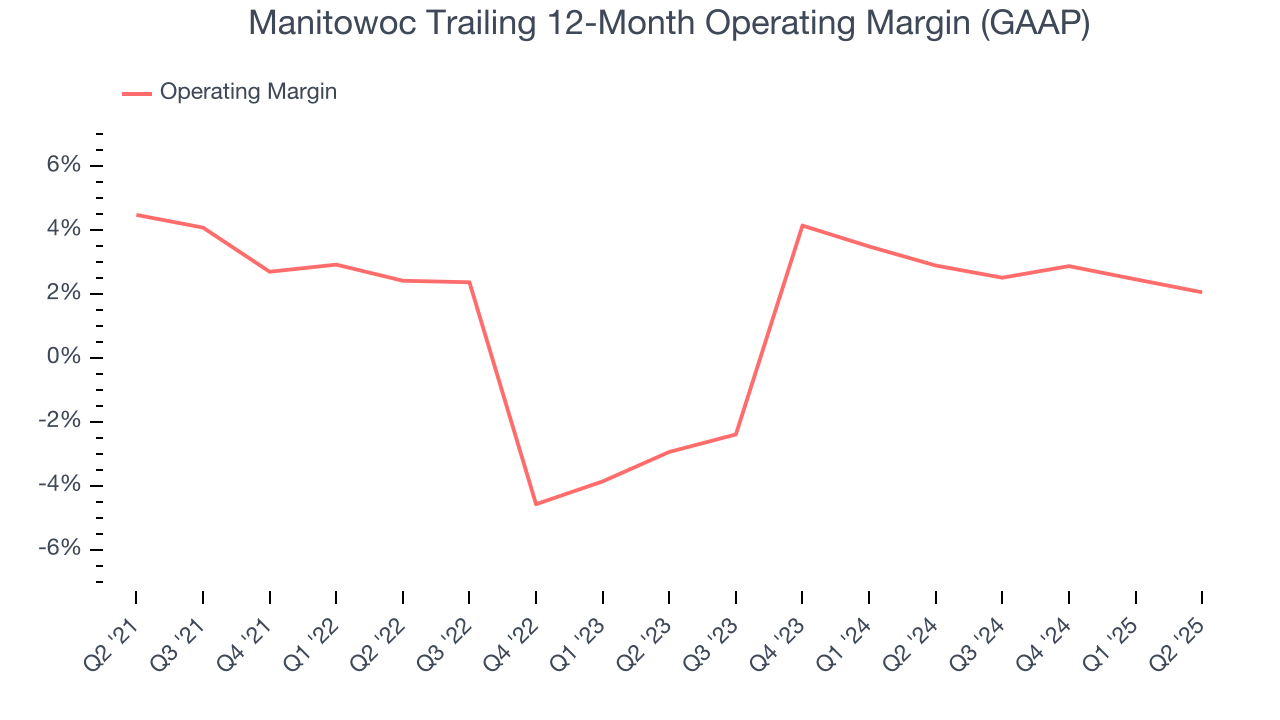

Manitowoc was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Manitowoc’s operating margin decreased by 2.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Manitowoc’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q2, Manitowoc generated an operating margin profit margin of 2%, down 1.6 percentage points year on year. Since Manitowoc’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

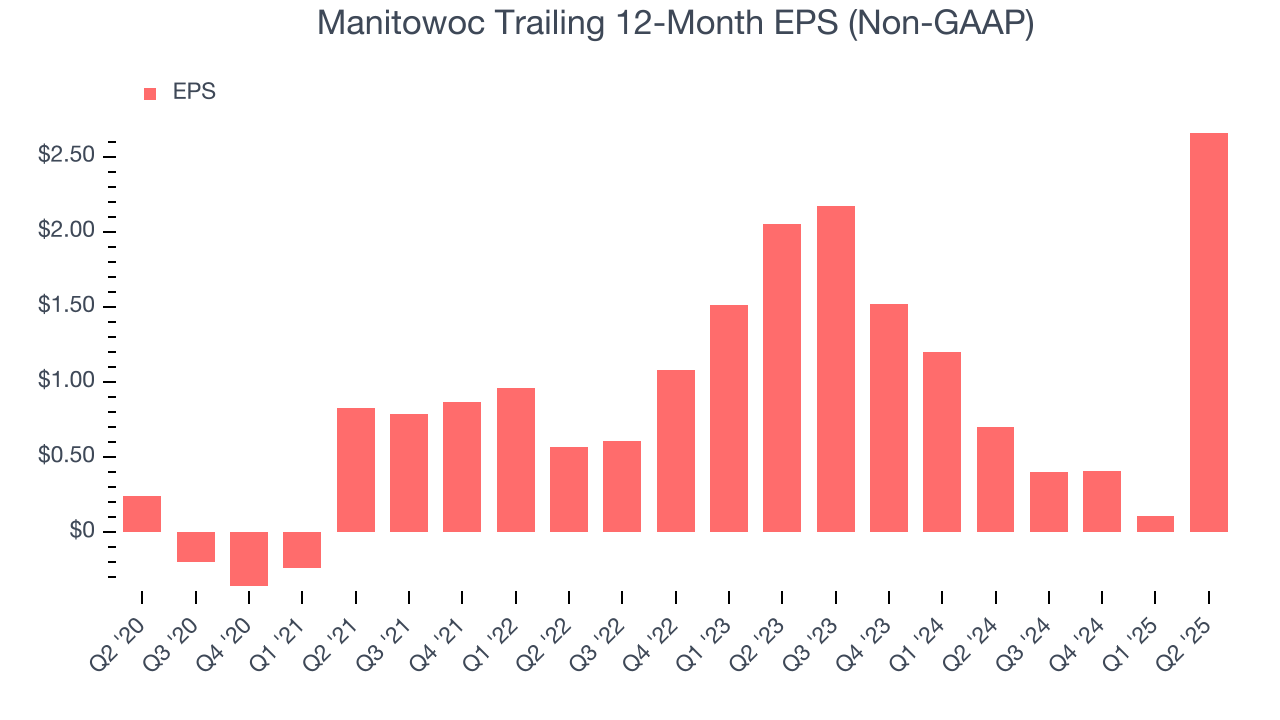

Manitowoc’s EPS grew at an astounding 61.8% compounded annual growth rate over the last five years, higher than its 6.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Manitowoc, its two-year annual EPS growth of 13.9% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q2, Manitowoc reported adjusted EPS at $2.80, up from $0.25 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Manitowoc to perform poorly. Analysts forecast its full-year EPS of $2.66 will hit $0.49.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

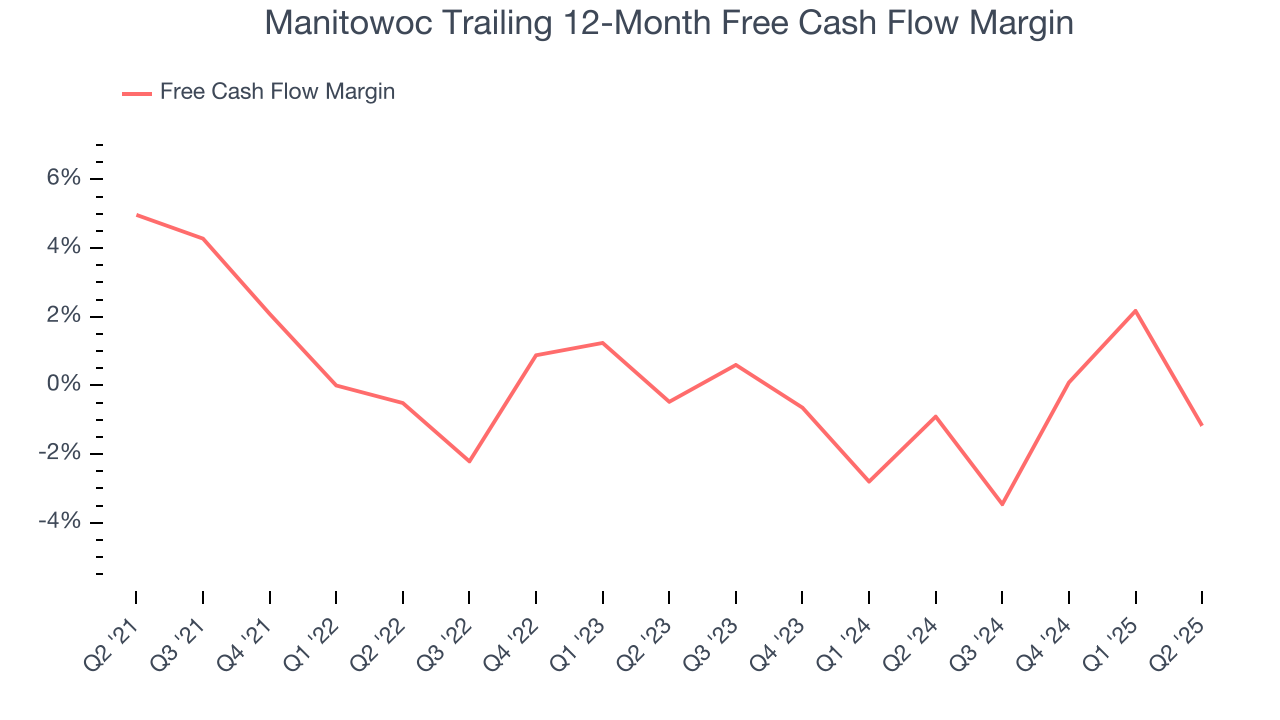

Manitowoc broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that Manitowoc’s margin dropped by 6.1 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Manitowoc burned through $73.7 million of cash in Q2, equivalent to a negative 13.7% margin. The company’s cash burn increased from $1.9 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Manitowoc historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.8%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Manitowoc’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Assessment

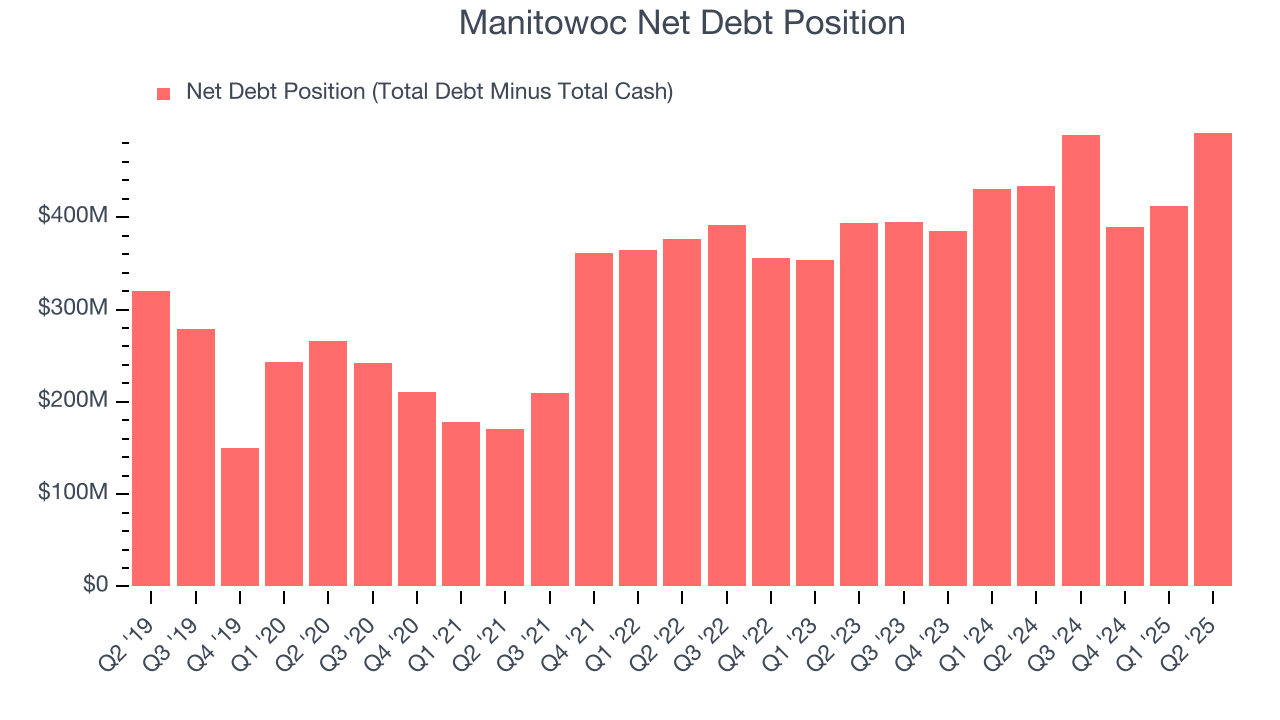

Manitowoc reported $32.9 million of cash and $524.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $109.1 million of EBITDA over the last 12 months, we view Manitowoc’s 4.5× net-debt-to-EBITDA ratio as safe. We also see its $38.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Manitowoc’s Q2 Results

We were impressed by how significantly Manitowoc blew past analysts’ backlog expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue missed and its adjusted operating income fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $12.51 immediately after reporting.

13. Is Now The Time To Buy Manitowoc?

Updated: November 4, 2025 at 10:42 PM EST

Before investing in or passing on Manitowoc, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We cheer for all companies making their customers lives easier, but in the case of Manitowoc, we’ll be cheering from the sidelines. To begin with, its revenue growth was mediocre over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its cash profitability fell over the last five years.

Manitowoc’s price-to-sales ratio based on the trailing 12 months is 0.2x. The market typically values companies like Manitowoc based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $10 on the company (compared to the current share price of $10.02).