Cloudflare (NET)

We see solid potential in Cloudflare. Its financials show it’s a customer acquisition machine that can expand both quickly and organically.― StockStory Analyst Team

1. News

2. Summary

Why We Like Cloudflare

With a massive network spanning more than 310 cities in over 120 countries, Cloudflare (NYSE:NET) provides a global network that delivers security, performance and reliability services to protect websites, applications, and corporate networks.

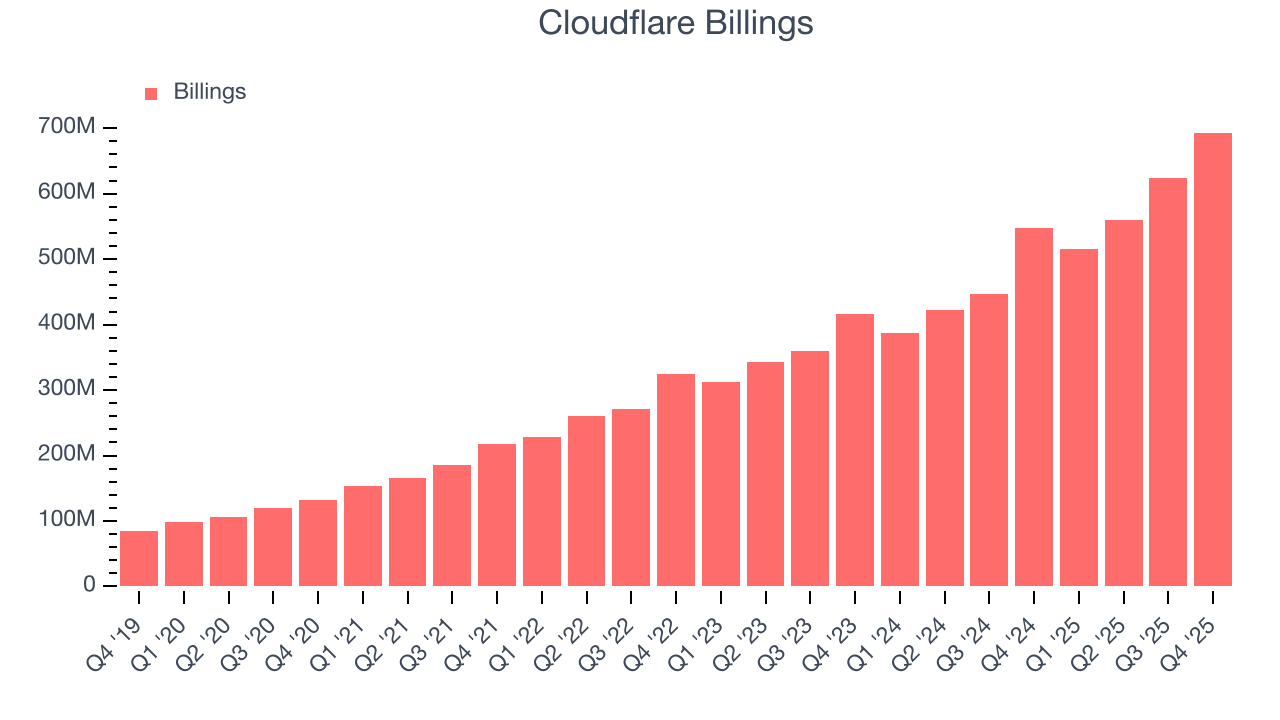

- Billings growth has averaged 34.2% over the last year, indicating a healthy pipeline of new contracts that should drive future revenue increases

- Notable projected revenue growth of 27.7% for the next 12 months hints at market share gains

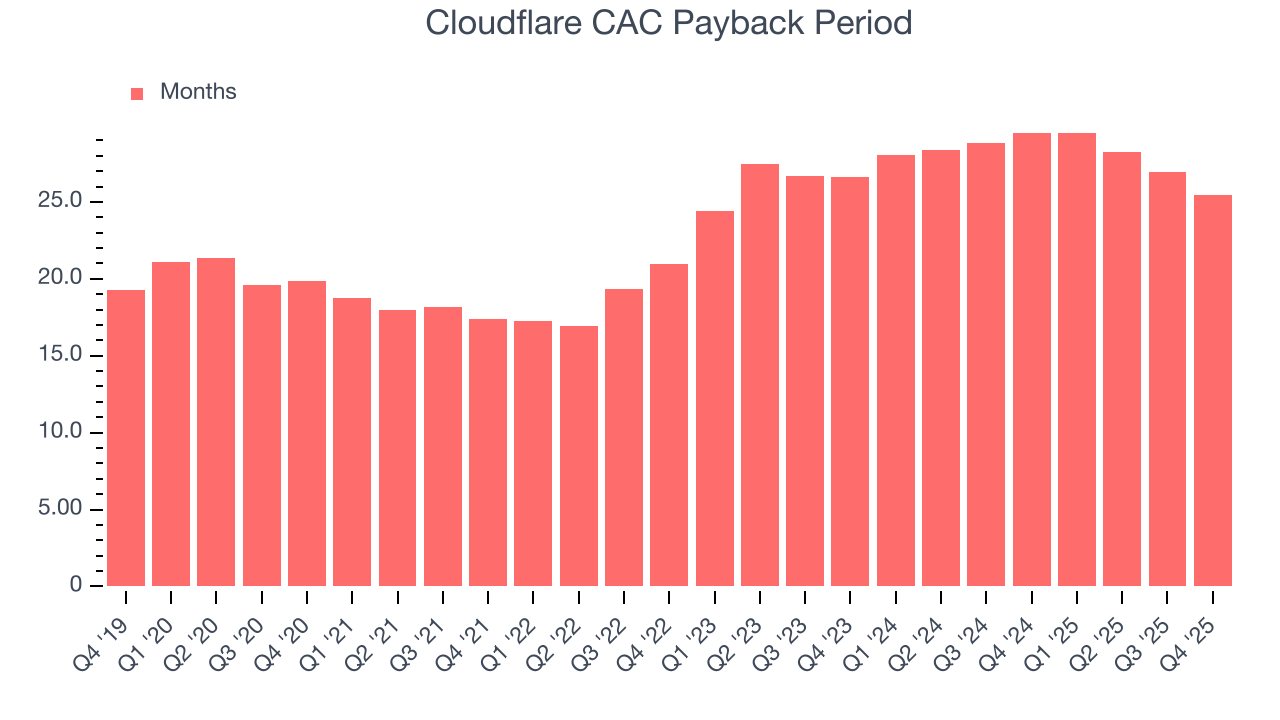

- Well-designed software integrates seamlessly with other workflows, enabling swift payback periods on marketing expenses and customer growth at scale

We have an affinity for Cloudflare. This is one of our top software stocks.

Is Now The Time To Buy Cloudflare?

High Quality

Investable

Underperform

Is Now The Time To Buy Cloudflare?

Cloudflare’s stock price of $174.21 implies a valuation ratio of 23.5x forward price-to-sales. There’s no denying that the lofty valuation means there’s much good news priced into the stock.

If you like the company and believe the bull case, we suggest making it a smaller position as our analysis shows high-quality companies outperform the market over a multi-year period regardless of valuation.

3. Cloudflare (NET) Research Report: Q4 CY2025 Update

Cloud security and performance company Cloudflare (NYSE:NET) announced better-than-expected revenue in Q4 CY2025, with sales up 33.6% year on year to $614.5 million. Guidance for next quarter’s revenue was better than expected at $620.5 million at the midpoint, 1% above analysts’ estimates. Its non-GAAP profit of $0.28 per share was in line with analysts’ consensus estimates.

Cloudflare (NET) Q4 CY2025 Highlights:

- Revenue: $614.5 million vs analyst estimates of $590.6 million (33.6% year-on-year growth, 4.1% beat)

- Adjusted EPS: $0.28 vs analyst estimates of $0.27 (in line)

- Adjusted Operating Income: $89.6 million vs analyst estimates of $83.83 million (14.6% margin, 6.9% beat)

- Revenue Guidance for Q1 CY2026 is $620.5 million at the midpoint, above analyst estimates of $614.1 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.12 at the midpoint, missing analyst estimates by 5.7%

- Operating Margin: -8%, in line with the same quarter last year

- Billings: $693.3 million at quarter end, up 26.5% year on year

- Market Capitalization: $60.86 billion

Company Overview

With a massive network spanning more than 310 cities in over 120 countries, Cloudflare (NYSE:NET) provides a global network that delivers security, performance and reliability services to protect websites, applications, and corporate networks.

Cloudflare's platform acts as a protective layer between its customers' websites or applications and the public internet, defending against cyber threats like DDoS attacks, malicious bots, and data breaches. The company's services are delivered through its extensive global network, which interconnects with over 13,000 networks globally and functions as a unified control plane for customers to manage their online security and performance needs.

The company's product portfolio includes Web Application Firewalls that block malicious traffic, content delivery services that accelerate website performance, Zero Trust security solutions that verify user access, and developer tools that allow building serverless applications directly on Cloudflare's network. A financial analyst might use Cloudflare to protect their investment research website from hackers while simultaneously improving page load times for their global client base.

Cloudflare operates with a "land and expand" business model, where customers often start with a single service before adopting additional products. The company serves both individual developers and small businesses through self-service offerings, as well as large enterprises through direct sales teams. Cloudflare monetizes through subscription-based pricing tiers, from free basic plans to enterprise contracts with advanced features and service levels. The company also maintains consumer products like its 1.1.1.1 DNS resolver, which enhances brand awareness while providing valuable network intelligence.

4. Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

Cloudflare competes with traditional cybersecurity companies like Palo Alto Networks (NASDAQ:PANW) and Zscaler (NASDAQ:ZS), content delivery providers such as Akamai Technologies (NASDAQ:AKAM) and Fastly (NYSE:FSLY), and major cloud providers including Amazon Web Services (NASDAQ:AMZN) and Microsoft Azure (NASDAQ:MSFT).

5. Revenue Growth

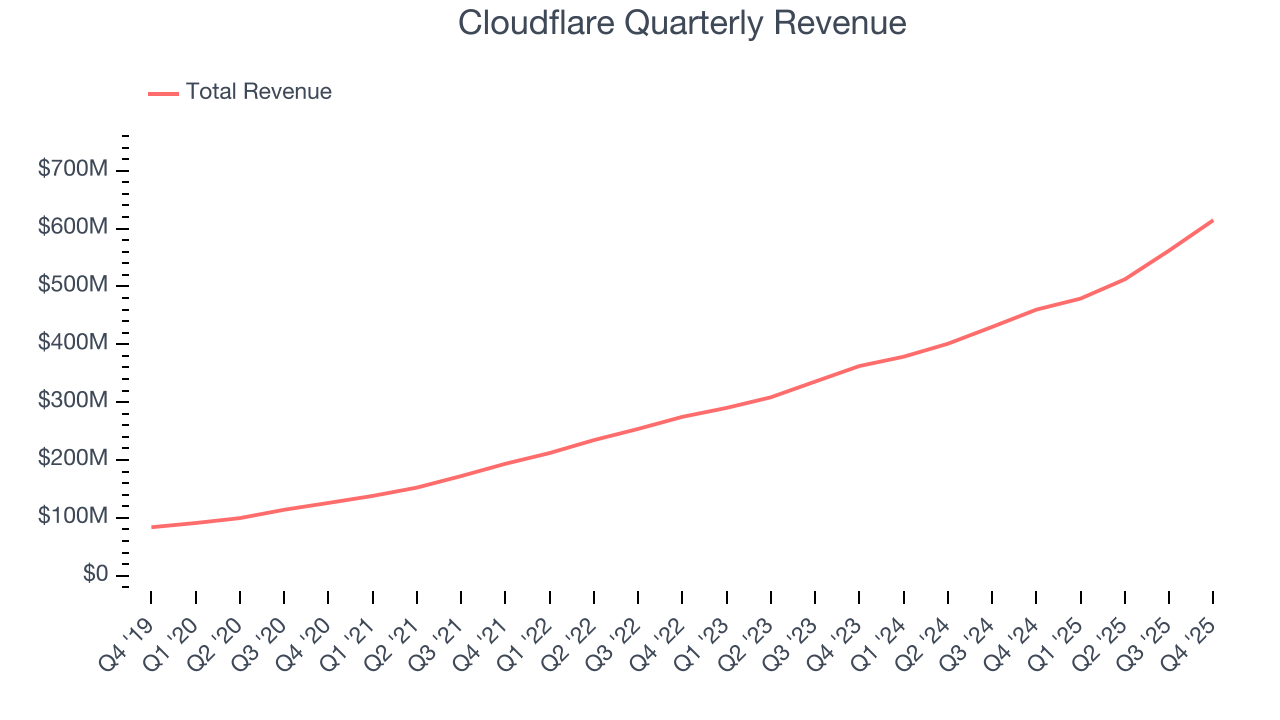

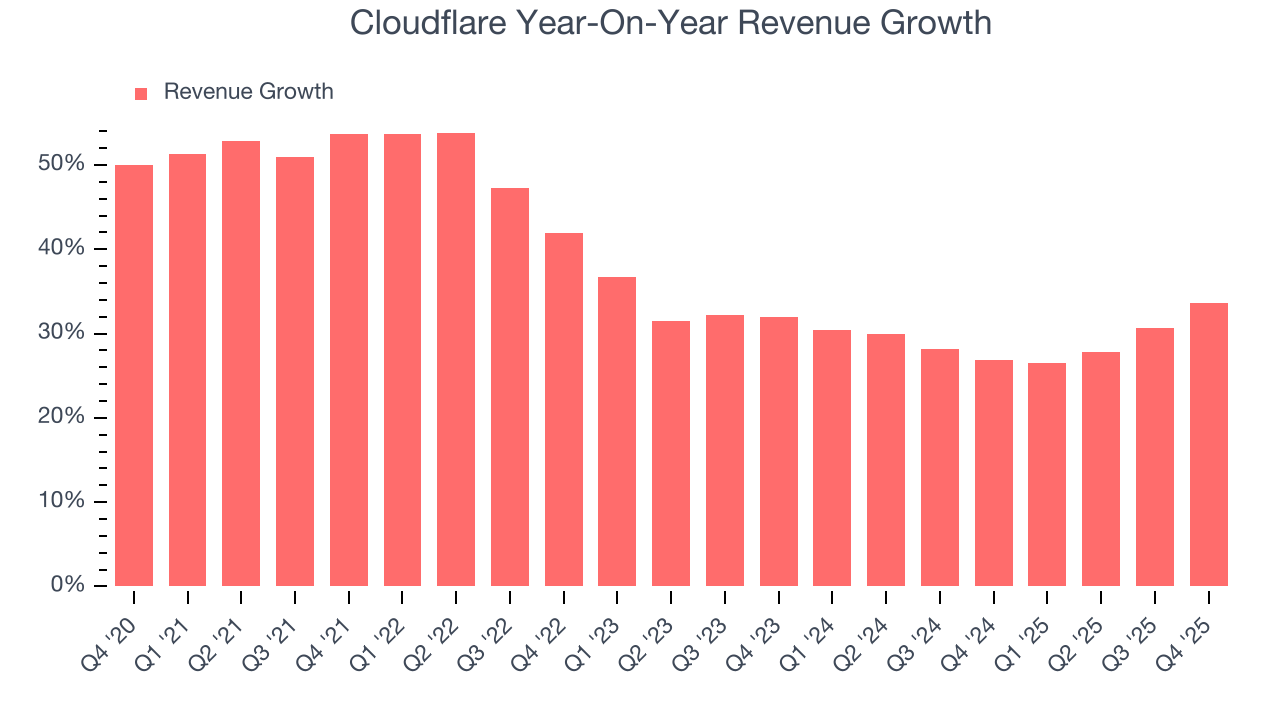

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Cloudflare grew its sales at an exceptional 38.1% compounded annual growth rate. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Cloudflare’s annualized revenue growth of 29.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Cloudflare reported wonderful year-on-year revenue growth of 33.6%, and its $614.5 million of revenue exceeded Wall Street’s estimates by 4.1%. Company management is currently guiding for a 29.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 25.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and suggests the market is forecasting success for its products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Cloudflare’s billings punched in at $693.3 million in Q4, and over the last four quarters, its growth was fantastic as it averaged 32.9% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Cloudflare is very efficient at acquiring new customers, and its CAC payback period checked in at 25.4 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Cloudflare more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

8. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

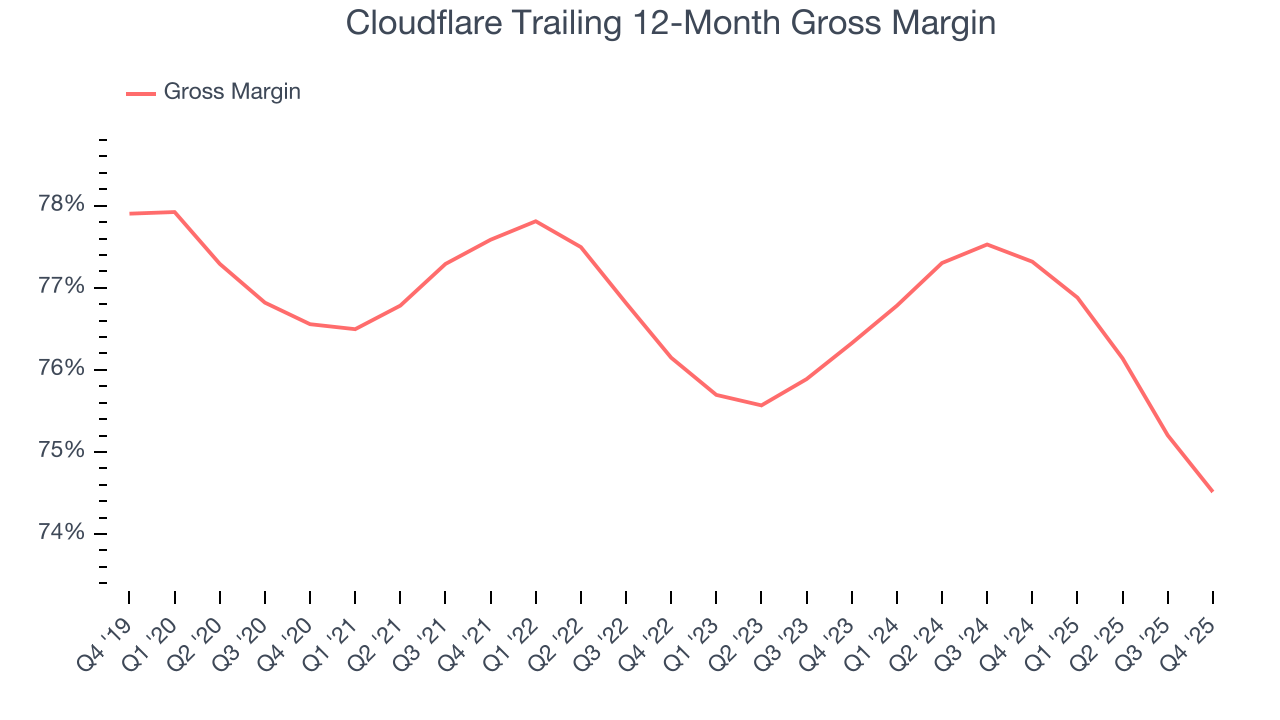

Cloudflare’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 74.5% gross margin over the last year. That means for every $100 in revenue, roughly $74.51 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Cloudflare has seen gross margins decline by 1.8 percentage points over the last 2 year, which is poor compared to software peers.

In Q4, Cloudflare produced a 73.6% gross profit margin, down 2.7 percentage points year on year. Cloudflare’s full-year margin has also been trending down over the past 12 months, decreasing by 2.8 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

9. Operating Margin

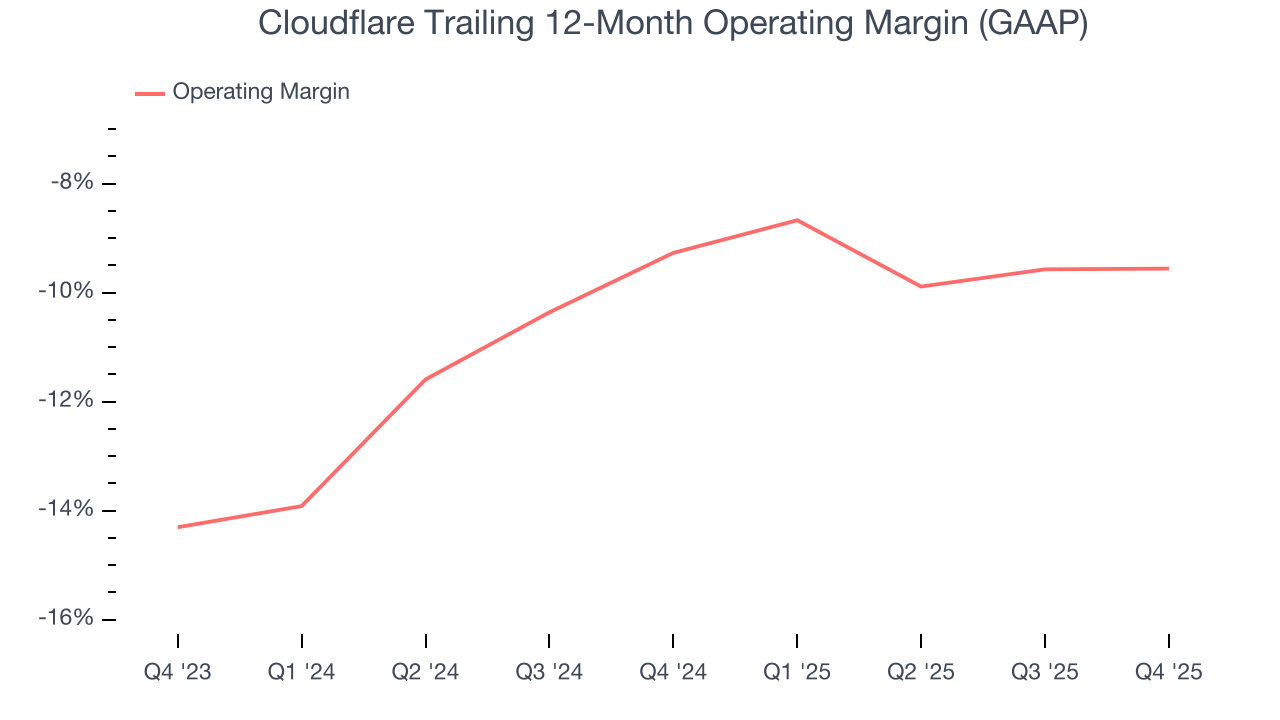

Cloudflare’s expensive cost structure has contributed to an average operating margin of negative 9.6% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Analyzing the trend in its profitability, Cloudflare’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Cloudflare generated a negative 8% operating margin.

10. Cash Is King

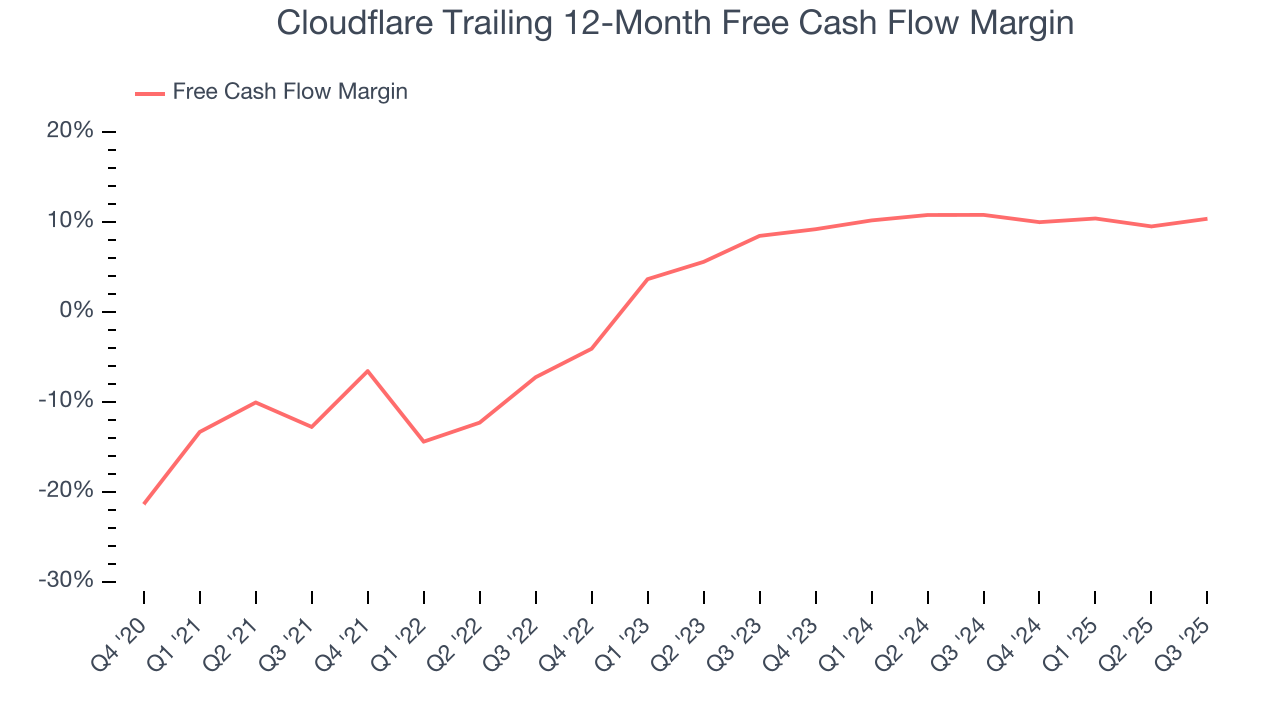

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Cloudflare has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 10.4%, subpar for a software business.

11. Key Takeaways from Cloudflare’s Q4 Results

We enjoyed seeing Cloudflare beat analysts’ billings expectations this quarter. This led convincing beats on the revenue and adjusted operating profit lines. We were also glad next year’s revenue guidance exceeded expectations. On the other hand, its EPS guidance for next quarter fell short of Wall Street’s estimates. While the quarter wasn't perfect, it was still quite solid, especially amidst fears that AI is a net negative to software stocks. The stock traded up 7.3% to $196.38 immediately after reporting.

12. Is Now The Time To Buy Cloudflare?

Updated: February 10, 2026 at 4:26 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Cloudflare, you should also grasp the company’s longer-term business quality and valuation.

Cloudflare is a pretty good company if you ignore its balance sheet. First of all, the company’s revenue growth was exceptional over the last five years. And while its operating margin hasn't moved over the last year, its efficient sales strategy allows it to target and onboard new users at scale. Additionally, Cloudflare’s gross margin suggests it can generate sustainable profits.

Cloudflare’s price-to-sales ratio based on the next 12 months is 23.2x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. We recommend investors interested in the company wait until it reduces its leverage or increases its profits before getting involved.

Wall Street analysts have a consensus one-year price target of $229.59 on the company (compared to the current share price of $196.38).