Oshkosh (OSK)

Oshkosh doesn’t excite us. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think Oshkosh Will Underperform

Oshkosh (NYSE:OSK) manufactures specialty vehicles for the defense, fire, emergency, and commercial industry, operating various brand subsidiaries within each industry.

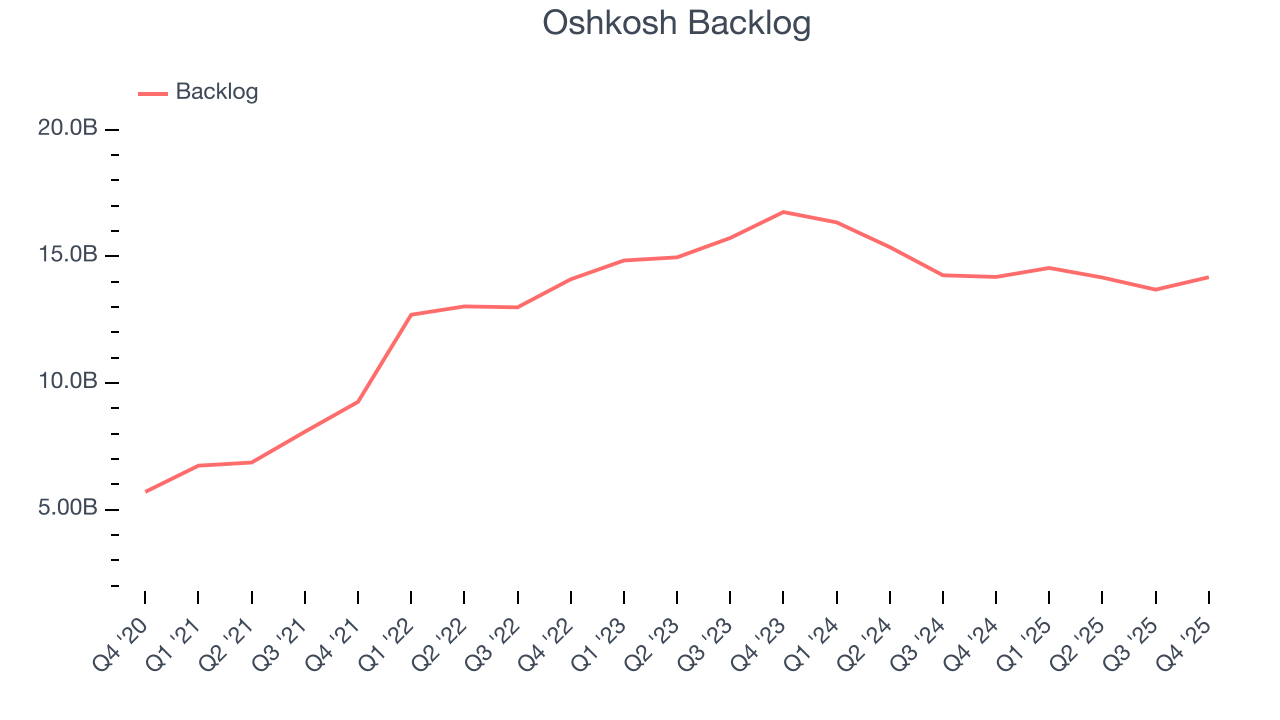

- Backlog has dropped by 2% on average over the past two years, suggesting it’s losing orders as competition picks up

- Gross margin of 16.5% is below its competitors, leaving less money to invest in areas like marketing and R&D

- On the bright side, its earnings growth has outpaced its peers over the last five years as its EPS has compounded at 17.6% annually

Oshkosh falls short of our expectations. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Oshkosh

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Oshkosh

Oshkosh’s stock price of $144.48 implies a valuation ratio of 12.9x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Oshkosh (OSK) Research Report: Q4 CY2025 Update

Specialty vehicles contractor Oshkosh (NYSE:OSK) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 2.5% year on year to $2.69 billion. The company’s full-year revenue guidance of $11 billion at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP profit of $2.26 per share was 2.2% below analysts’ consensus estimates.

Oshkosh (OSK) Q4 CY2025 Highlights:

- Revenue: $2.69 billion vs analyst estimates of $2.62 billion (2.5% year-on-year growth, 2.6% beat)

- Adjusted EPS: $2.26 vs analyst expectations of $2.31 (2.2% miss)

- Adjusted EBITDA: $225.9 million vs analyst estimates of $281.5 million (8.4% margin, 19.7% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $11.50 at the midpoint, missing analyst estimates by 6.7%

- Operating Margin: 7.9%, in line with the same quarter last year

- Free Cash Flow Margin: 20.1%, down from 26.8% in the same quarter last year

- Backlog: $14.18 billion at quarter end, in line with the same quarter last year

- Market Capitalization: $9.25 billion

Company Overview

Oshkosh (NYSE:OSK) manufactures specialty vehicles for the defense, fire, emergency, and commercial industry, operating various brand subsidiaries within each industry.

For the defense industry, Oshkosh manufactures tactical vehicles like its Light Combat Tactical All-Terrain Vehicle and its Heavy Expanded Mobility Tactical Truck, while in the emergency sector the company produces fire engines and ambulances under its Pierce brand. For the commercial industry, the company produces concrete mixers and waste collection vehicles under its brands McNeilus and London Machinery.

Oshkosh generates revenue through the sale of its specialty vehicles and associated equipment to the aforementioned industries, with the most notable customer being the U.S. Department of Defense. Its sales are made through direct contracts with government organizations and through a network of dealers and distributors for the sale of its commercial and industrial vehicles.

Oshkosh also earns revenue from parts, services, and maintenance for its vehicles, along with contracts for defense equipment and support services, making up a stable source of recurring revenue.

4. Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Competitors of Oshkosh include Lockheed Martin (NYSE:LMT), Rev (NYSE:REVG), and Terex (NYSE:TEX).

5. Revenue Growth

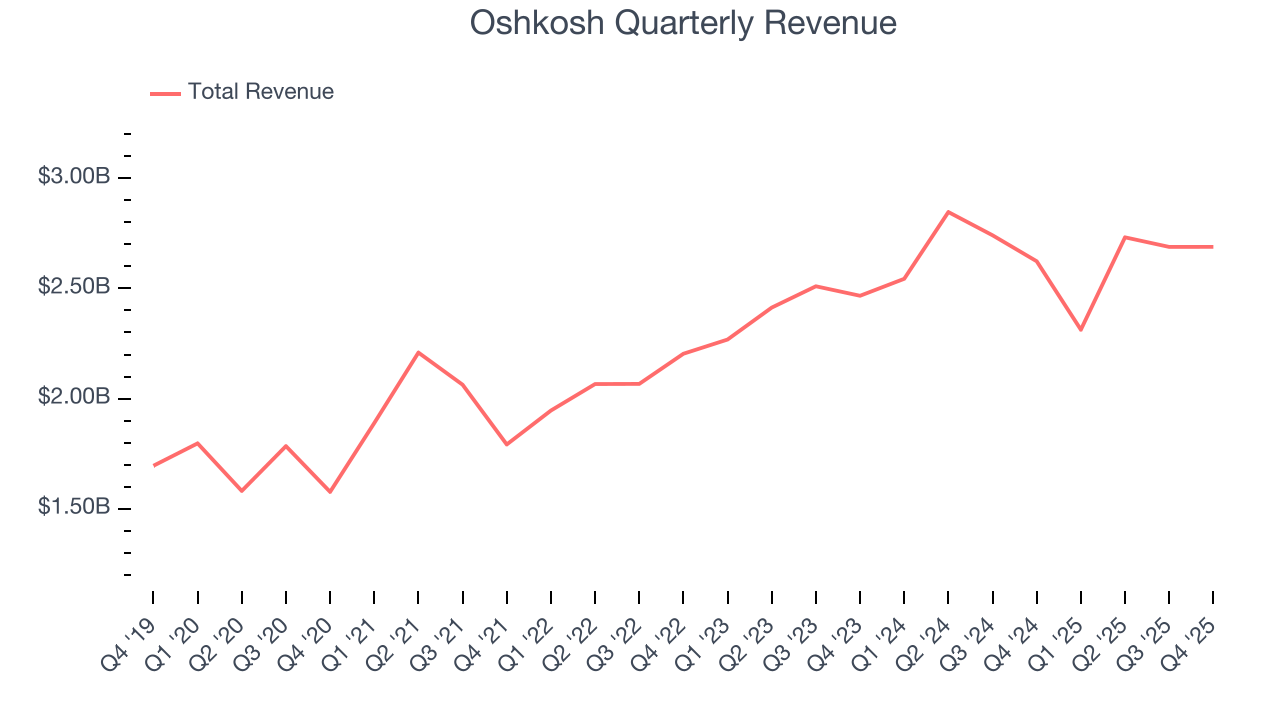

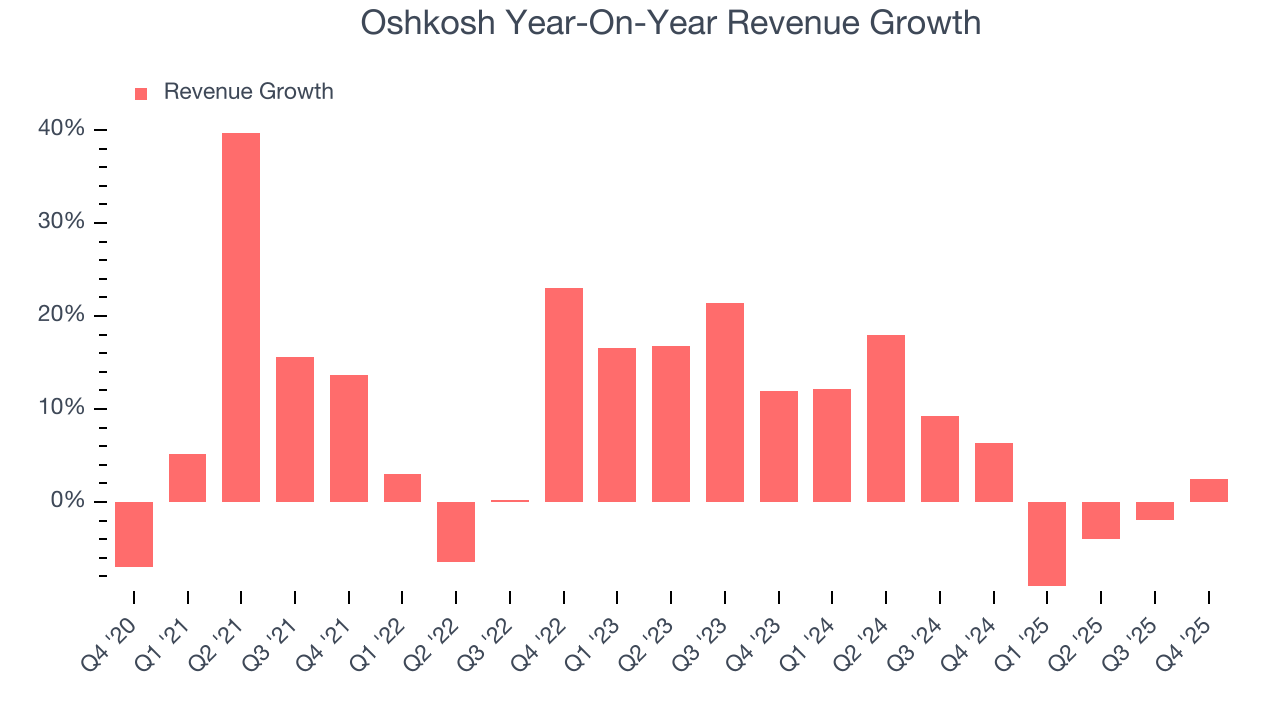

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Oshkosh’s 9.1% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Oshkosh’s recent performance shows its demand has slowed as its annualized revenue growth of 3.9% over the last two years was below its five-year trend. We also note many other Heavy Transportation Equipment businesses have faced declining sales because of cyclical headwinds. While Oshkosh grew slower than we’d like, it did do better than its peers.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Oshkosh’s backlog reached $14.18 billion in the latest quarter and averaged 4.3% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Oshkosh reported modest year-on-year revenue growth of 2.5% but beat Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

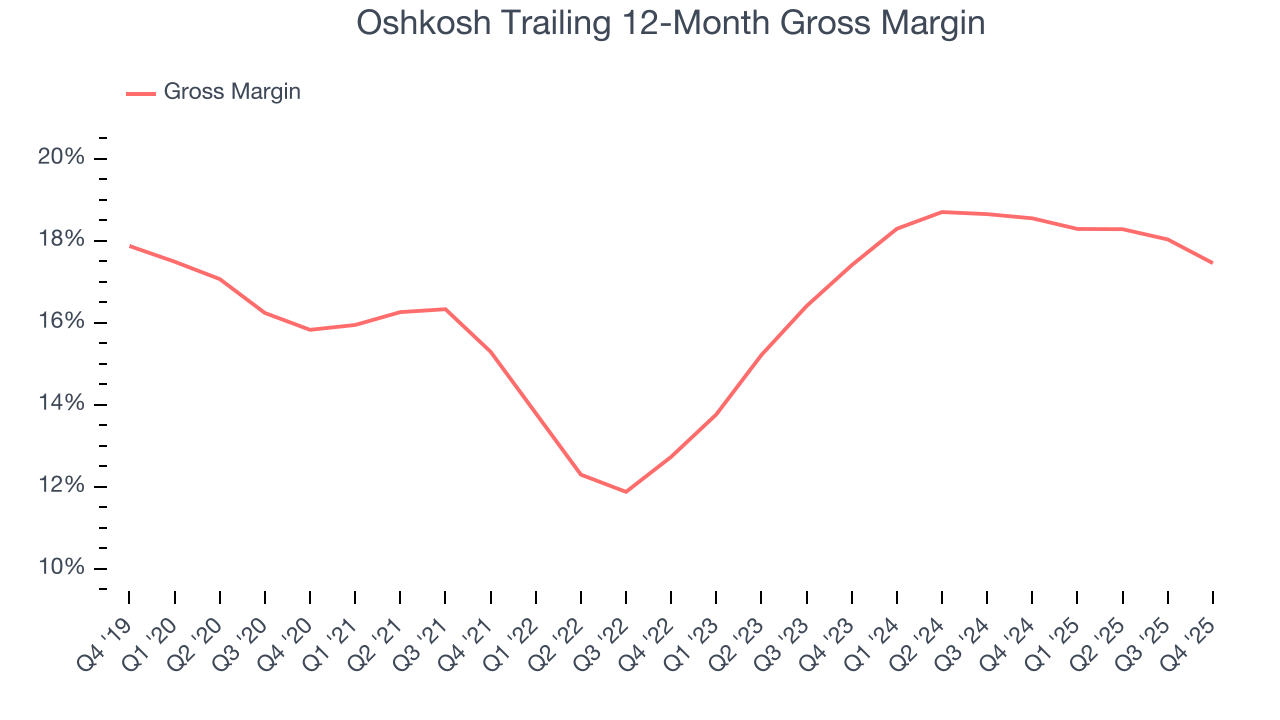

Oshkosh has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 16.5% gross margin over the last five years. Said differently, Oshkosh had to pay a chunky $83.50 to its suppliers for every $100 in revenue.

Oshkosh produced a 15.8% gross profit margin in Q4, marking a 2.2 percentage point decrease from 18% in the same quarter last year. Oshkosh’s full-year margin has also been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

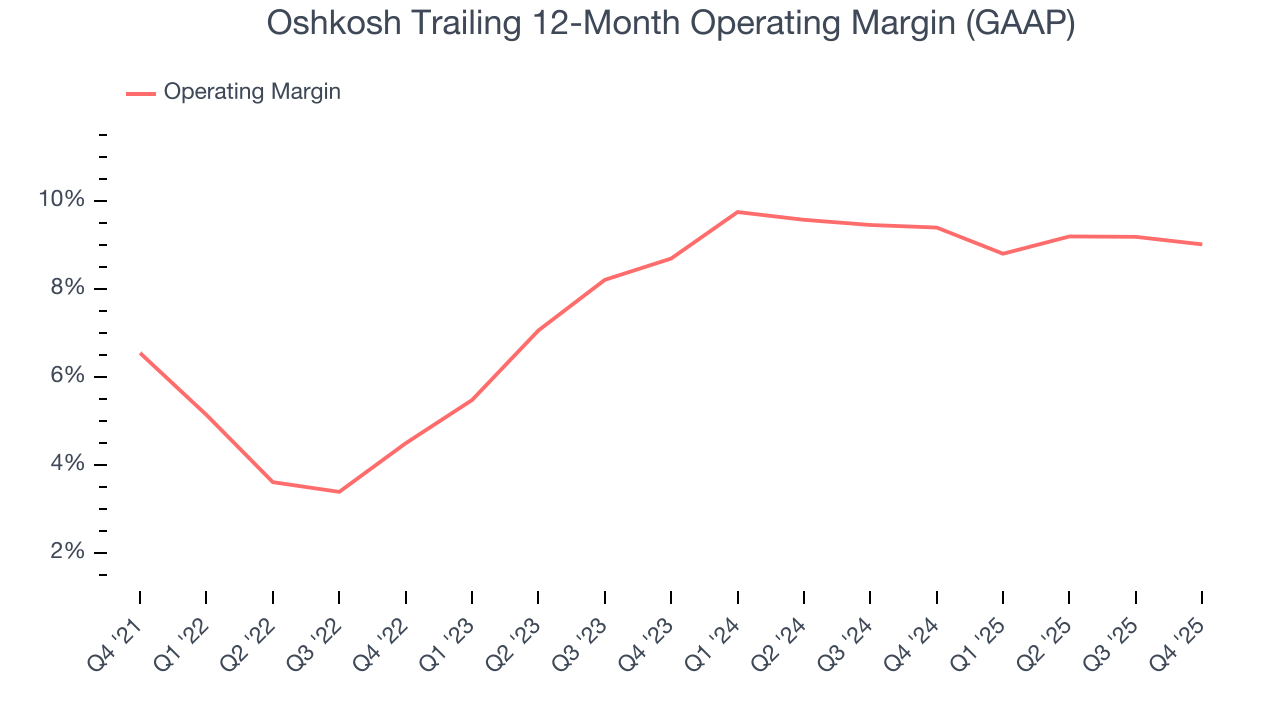

7. Operating Margin

Oshkosh was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Oshkosh’s operating margin rose by 2.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Oshkosh generated an operating margin profit margin of 7.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

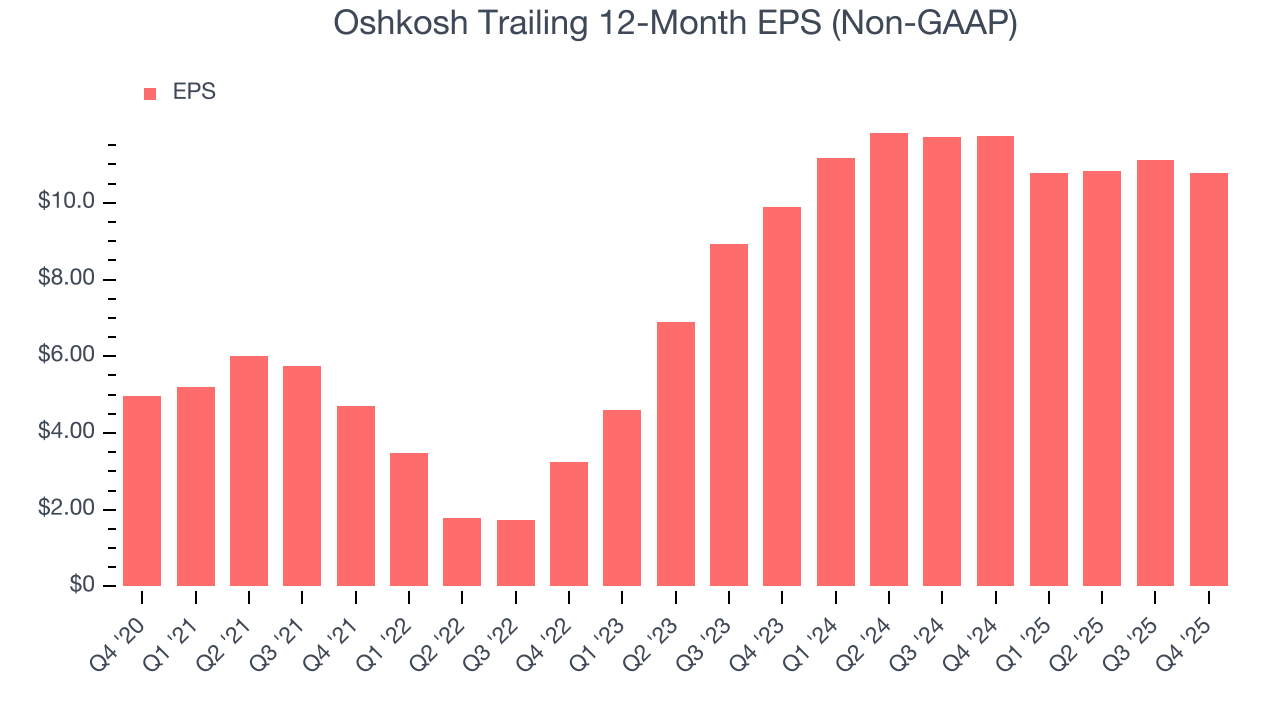

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Oshkosh’s EPS grew at a spectacular 16.8% compounded annual growth rate over the last five years, higher than its 9.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

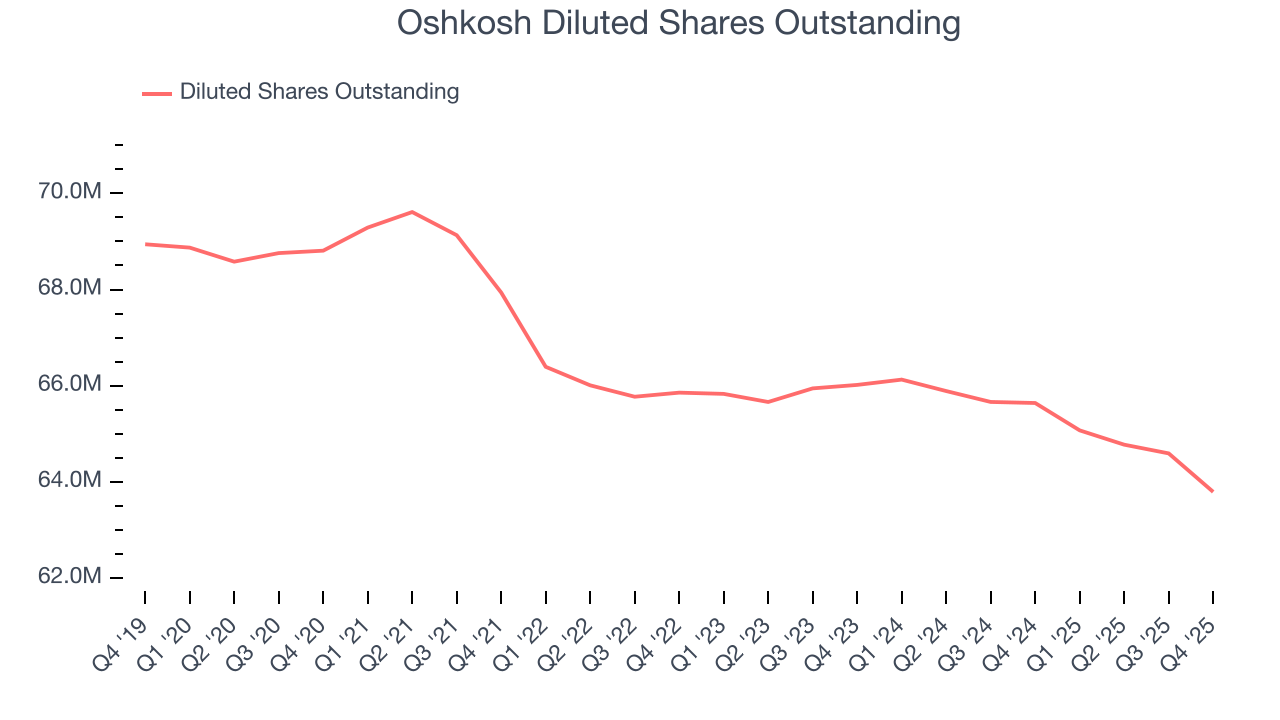

We can take a deeper look into Oshkosh’s earnings to better understand the drivers of its performance. As we mentioned earlier, Oshkosh’s operating margin was flat this quarter but expanded by 2.5 percentage points over the last five years. On top of that, its share count shrank by 7.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Oshkosh, its two-year annual EPS growth of 4.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Oshkosh reported adjusted EPS of $2.26, down from $2.58 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Oshkosh’s full-year EPS of $10.79 to grow 15.4%.

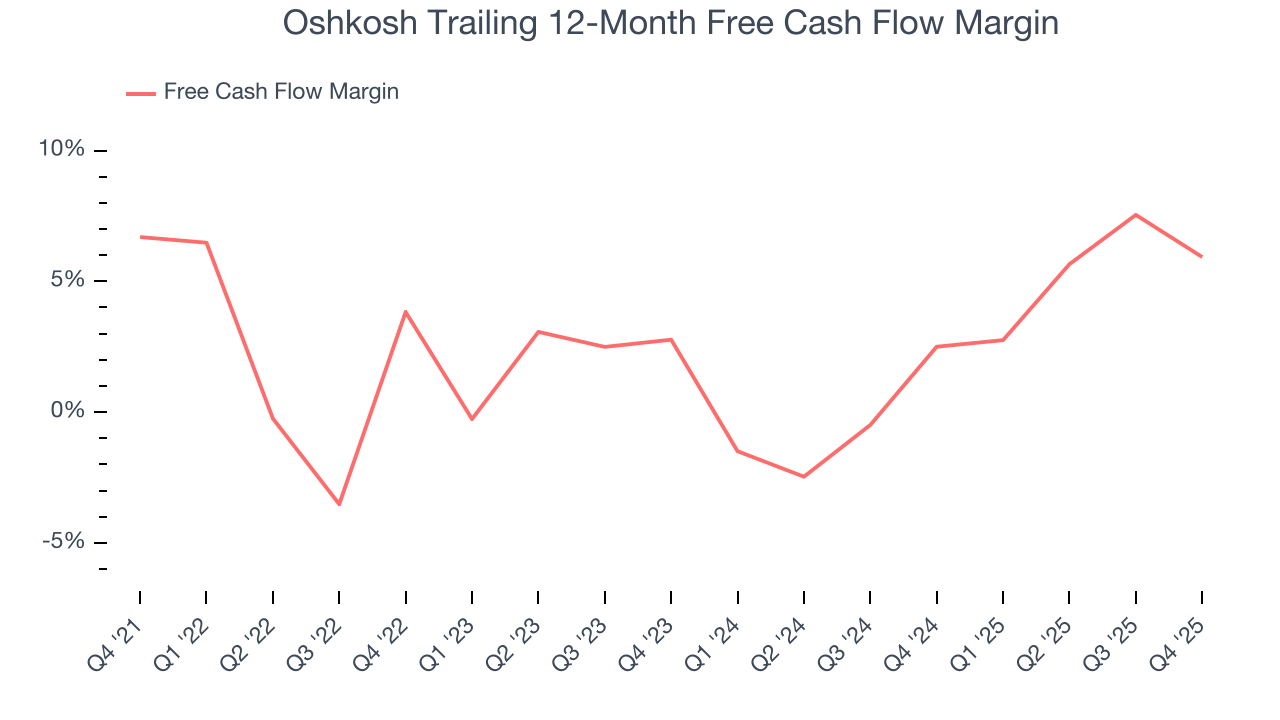

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Oshkosh has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, subpar for an industrials business.

Oshkosh’s free cash flow clocked in at $540.3 million in Q4, equivalent to a 20.1% margin. The company’s cash profitability regressed as it was 6.7 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

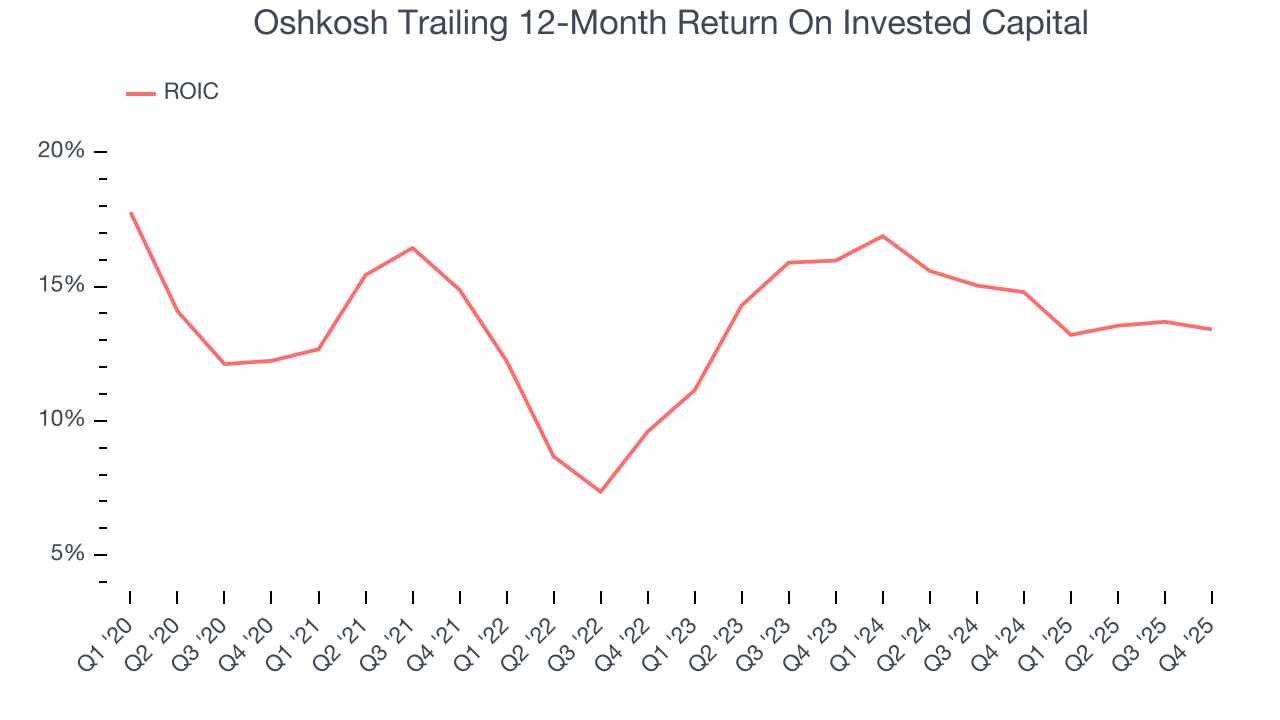

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Oshkosh hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13.7%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Oshkosh’s ROIC increased by 1.9 percentage points annually over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

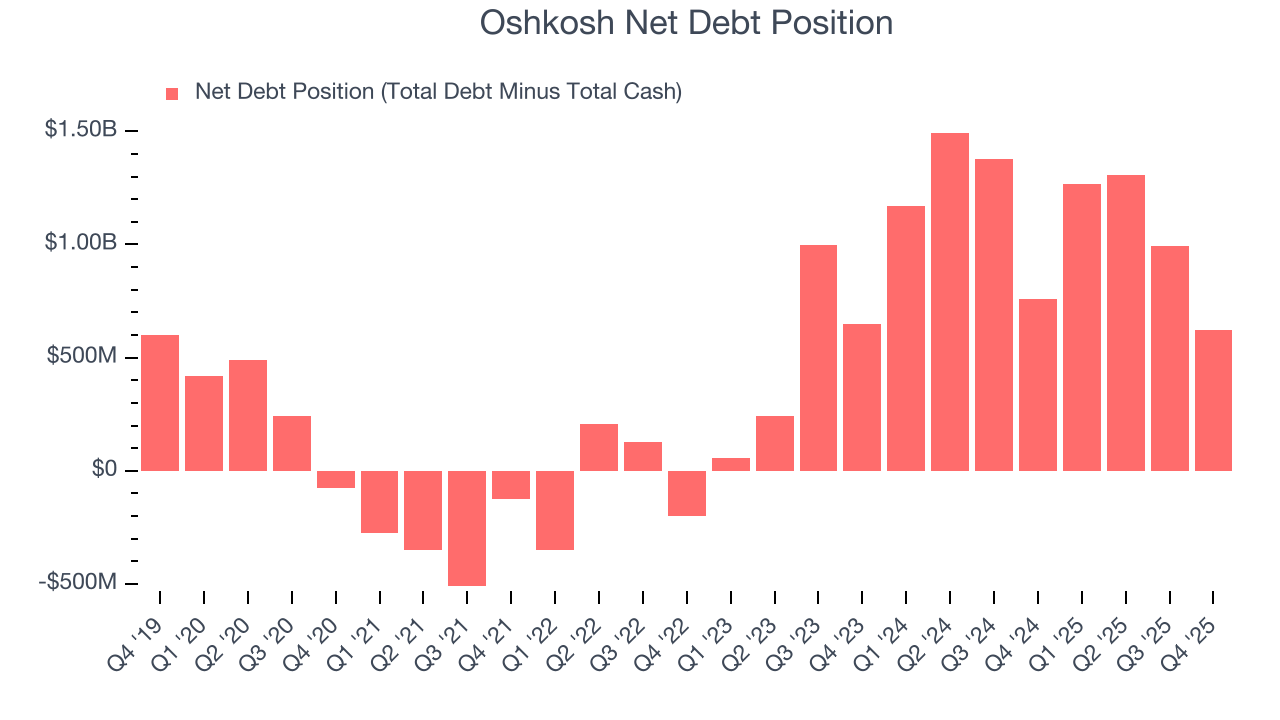

11. Balance Sheet Assessment

Oshkosh reported $479.8 million of cash and $1.10 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.17 billion of EBITDA over the last 12 months, we view Oshkosh’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $53.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Oshkosh’s Q4 Results

We enjoyed seeing Oshkosh beat analysts’ revenue expectations this quarter. We were also glad its backlog outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.5% to $142.49 immediately following the results.

13. Is Now The Time To Buy Oshkosh?

Updated: January 29, 2026 at 8:21 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Oshkosh isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its backlog declined. And while the company’s spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its low gross margins indicate some combination of competitive pressures and high production costs.

Oshkosh’s P/E ratio based on the next 12 months is 11.7x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $157.65 on the company (compared to the current share price of $142.49).