Ryder (R)

Ryder is in for a bumpy ride. Its poor returns on capital indicate it barely generated any profits, a must for high-quality companies.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ryder Will Underperform

As one of the first companies to introduce the idea of leasing trucks, Ryder (NYSE:R) provides rental vehicles to businesses and delivers packages directly to homes or businesses.

- Earnings per share have dipped by 4% annually over the past two years, which is concerning because stock prices follow EPS over the long term

- Cash burn makes us question whether it can achieve sustainable long-term growth

- Estimated sales growth of 1.6% for the next 12 months implies demand will slow from its two-year trend

Ryder doesn’t pass our quality test. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Ryder

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Ryder

At $193 per share, Ryder trades at 14x forward P/E. Ryder’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Ryder (R) Research Report: Q3 CY2025 Update

Commercial rental vehicle and delivery company Ryder (NYSE:R) fell short of the market’s revenue expectations in Q3 CY2025, with sales flat year on year at $3.17 billion. Its GAAP profit of $3.33 per share was 1.5% below analysts’ consensus estimates.

Ryder (R) Q3 CY2025 Highlights:

- Revenue: $3.17 billion vs analyst estimates of $3.19 billion (flat year on year, 0.7% miss)

- EPS (GAAP): $3.33 vs analyst expectations of $3.38 (1.5% miss)

- Adjusted EBITDA: $742 million vs analyst estimates of $728.8 million (23.4% margin, 1.8% beat)

- Operating Margin: 9%, in line with the same quarter last year

- Market Capitalization: $7.46 billion

Company Overview

As one of the first companies to introduce the idea of leasing trucks, Ryder (NYSE:R) provides rental vehicles to businesses and delivers packages directly to homes or businesses.

Ryder was founded in 1933 as a business hauling concrete. What started off with a single truck was able to expand its fleet of vehicles by acquiring various businesses. As its fleet grew, the company began to offer its trucks for other companies to lease in addition to making last-mile deliveries, the last step in the fulfillment process. Specifically, the $120 million acquisition of MXD in 2018 was pivotal for expanding its e-commerce fulfillment and last-mile delivery services.

Ryder’s last-mile delivery service includes everything from loading trucks with packages to delivering items directly to homes or businesses. The company differentiates itself by delivering big and bulky products, and it engages in contracts spanning from a couple of months to multiple years.

In addition to its last-mile delivery service, Ryders’ ChoiceLease program provides vehicles and maintenance services. Clients can either commit to a full-maintenance plan or pay for maintenance service when needed. The business also offers commercial rental service catering for customers needing additional vehicles for up to a year. This helps businesses manage seasonal spikes, special projects, or temporary replacements.

4. Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors offering similar products include U-Haul (NYSE:UHAL), Penske (NYSE:PAG), and Enterprise (private)

5. Revenue Growth

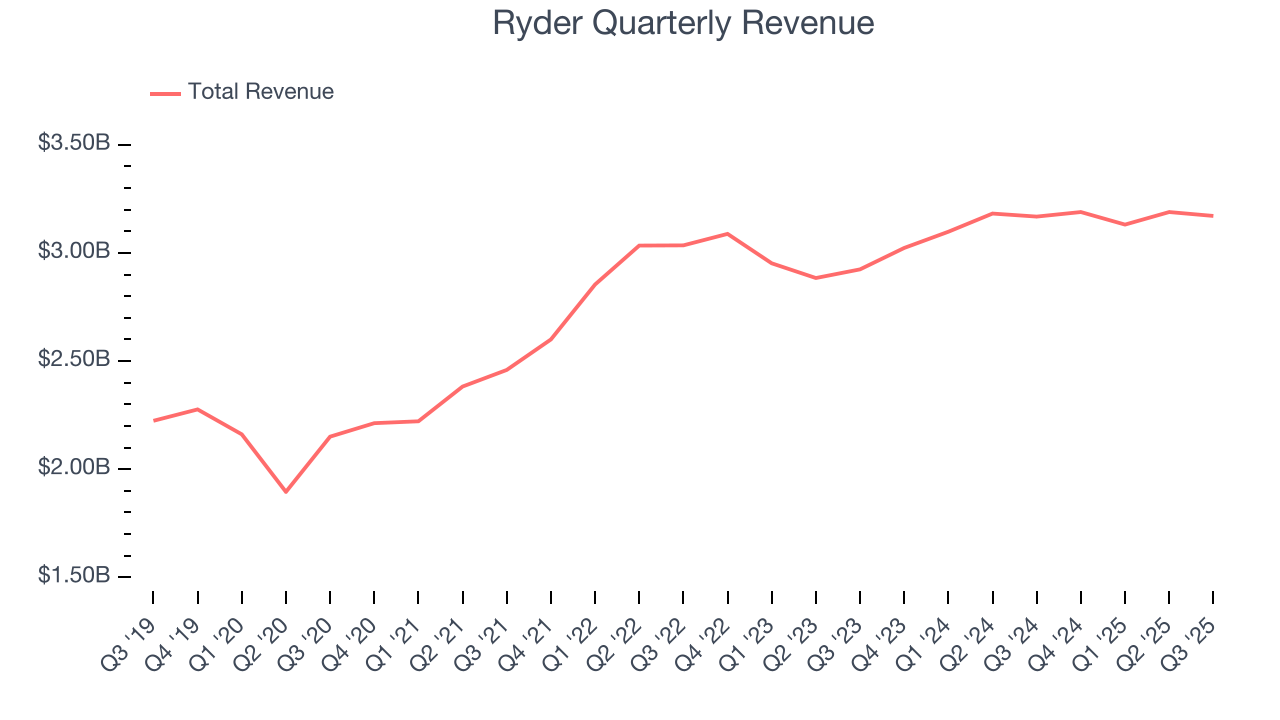

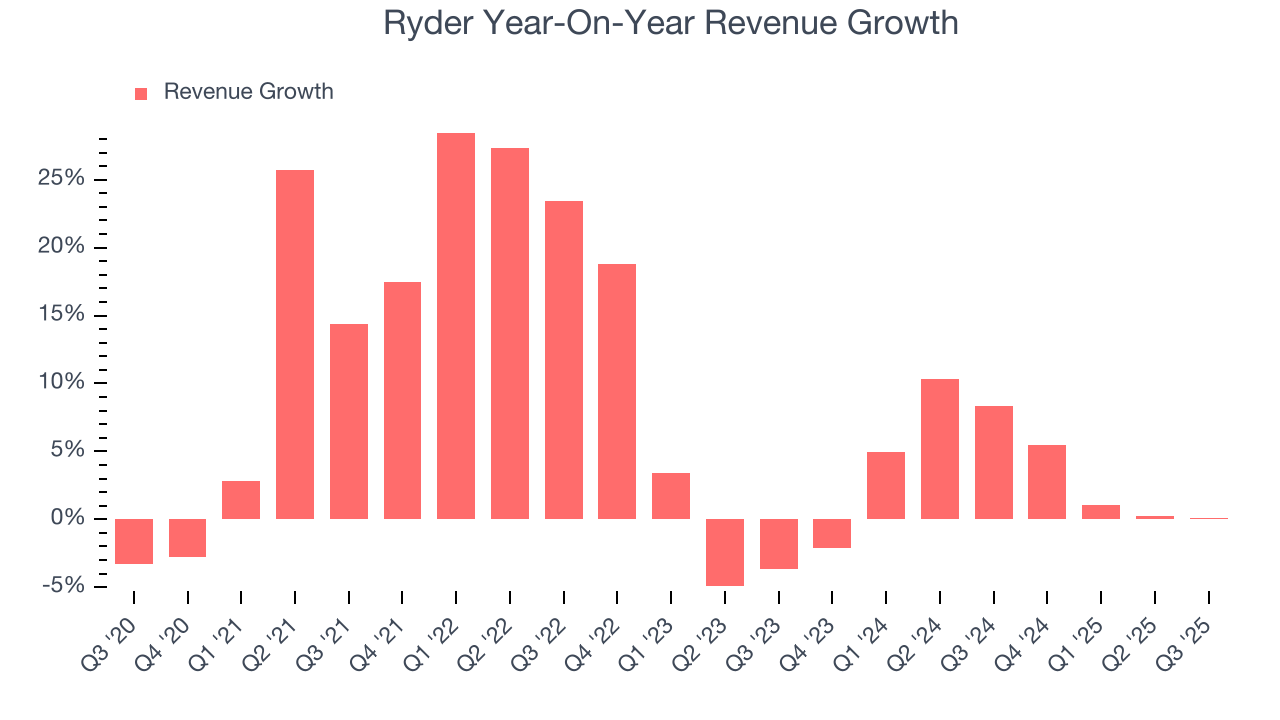

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Ryder grew its sales at a decent 8.4% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Ryder’s recent performance shows its demand has slowed as its annualized revenue growth of 3.5% over the last two years was below its five-year trend. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While Ryder grew slower than we’d like, it did do better than its peers.

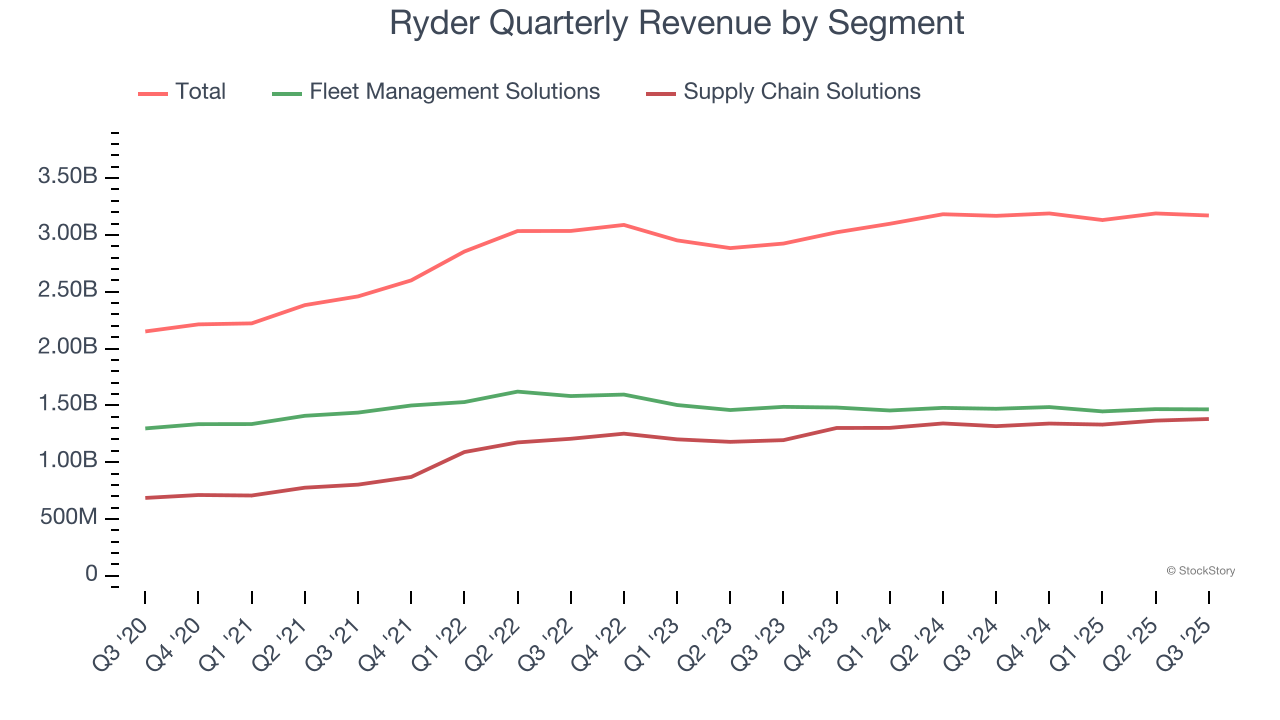

Ryder also breaks out the revenue for its most important segments, Fleet Management Solutions and Supply Chain Solutions, which are 46.2% and 43.5% of revenue. Over the last two years, Ryder’s Fleet Management Solutions revenue (leasing and rental) averaged 1.4% year-on-year declines. On the other hand, its Supply Chain Solutions revenue ( designing and managing customers' distribution) averaged 6% growth.

This quarter, Ryder’s $3.17 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

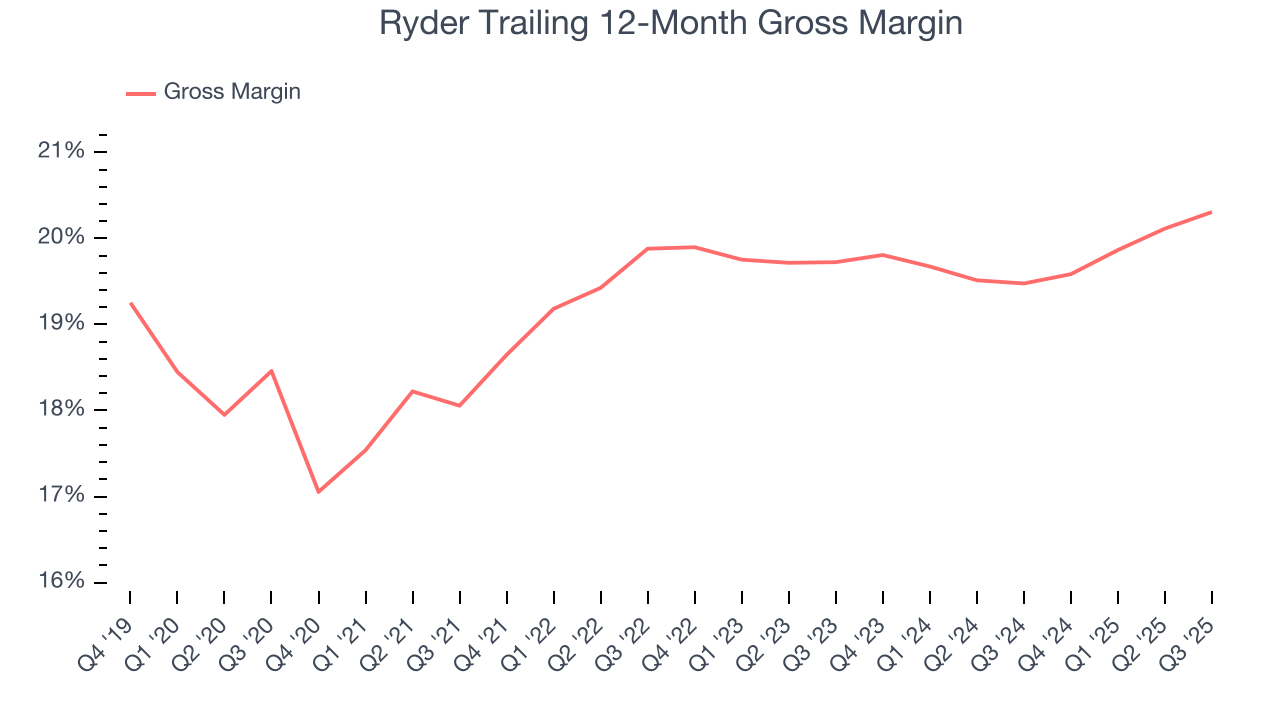

Ryder has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 19.6% gross margin over the last five years. Said differently, Ryder had to pay a chunky $80.44 to its suppliers for every $100 in revenue.

This quarter, Ryder’s gross profit margin was 21%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

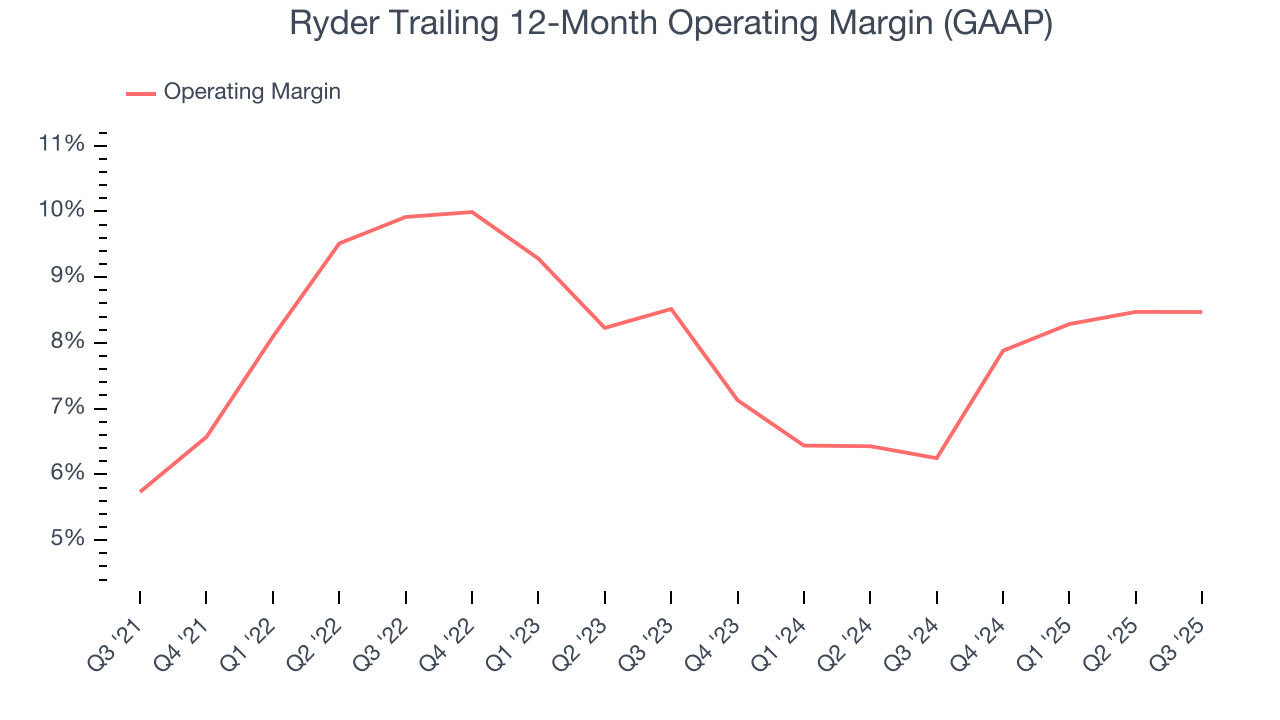

Ryder was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Ryder’s operating margin rose by 2.7 percentage points over the last five years, as its sales growth gave it operating leverage. We’ll take Ryder’s improvement as many Ground Transportation companies saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction.

In Q3, Ryder generated an operating margin profit margin of 9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

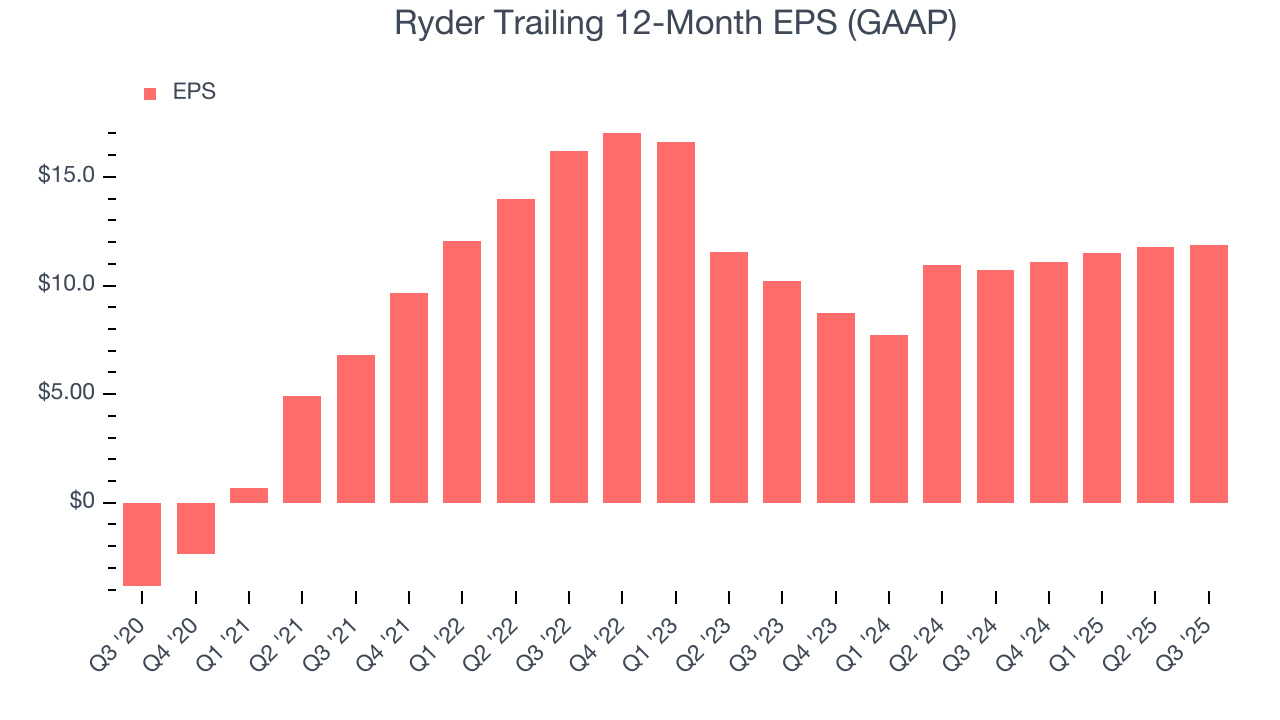

Ryder’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Ryder’s EPS grew at an unimpressive 7.9% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 3.5% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

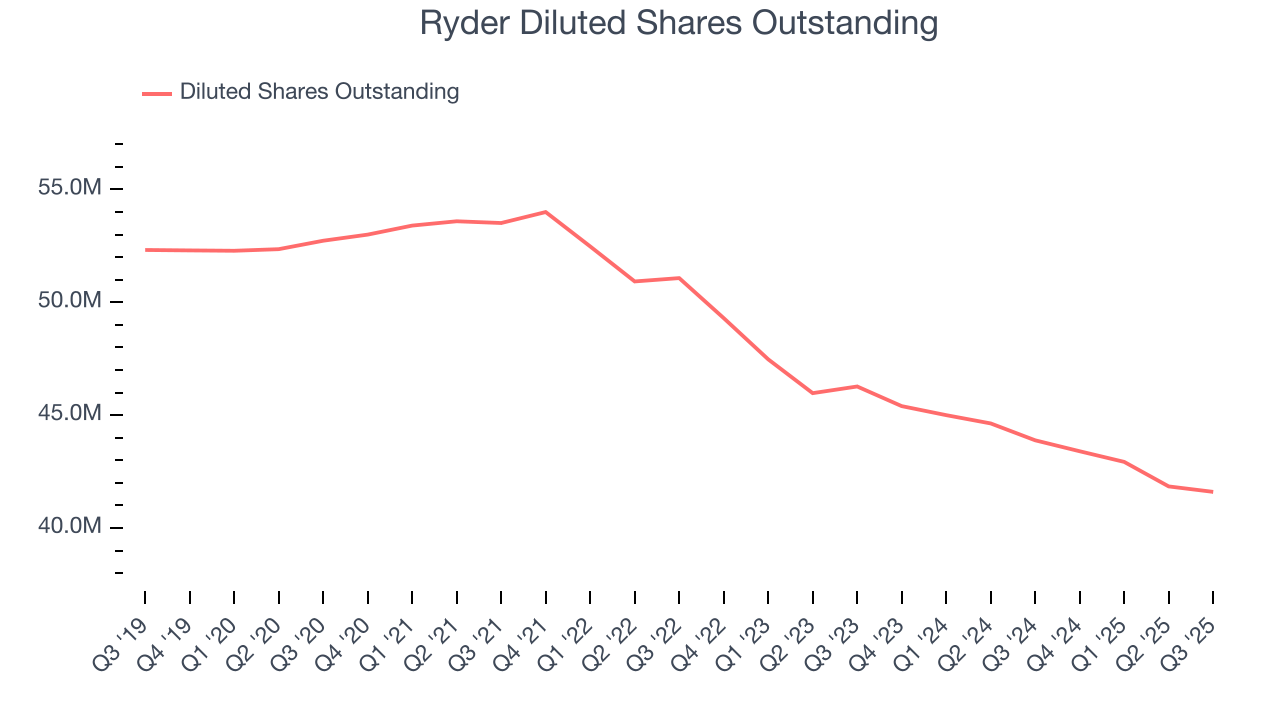

Diving into the nuances of Ryder’s earnings can give us a better understanding of its performance. A two-year view shows that Ryder has repurchased its stock, shrinking its share count by 10.1%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Ryder reported EPS of $3.33, up from $3.23 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

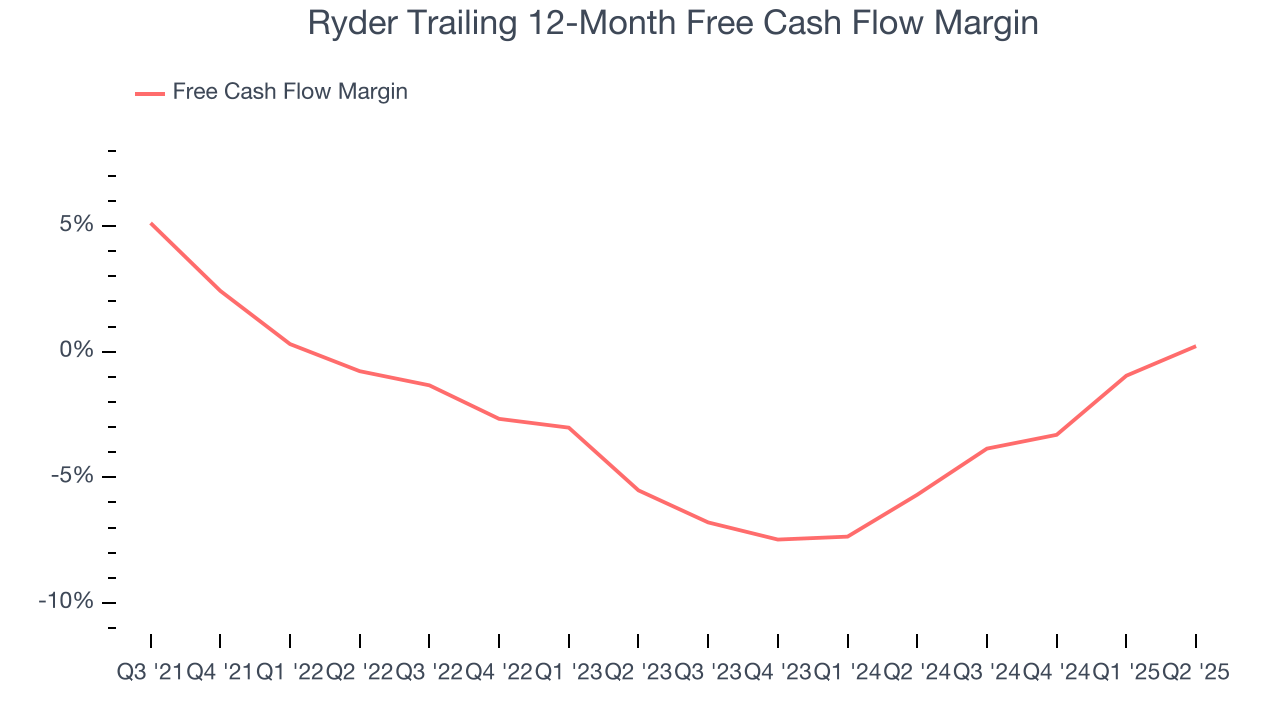

Ryder’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.8%, meaning it lit $1.77 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Ryder’s margin dropped by 6.6 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

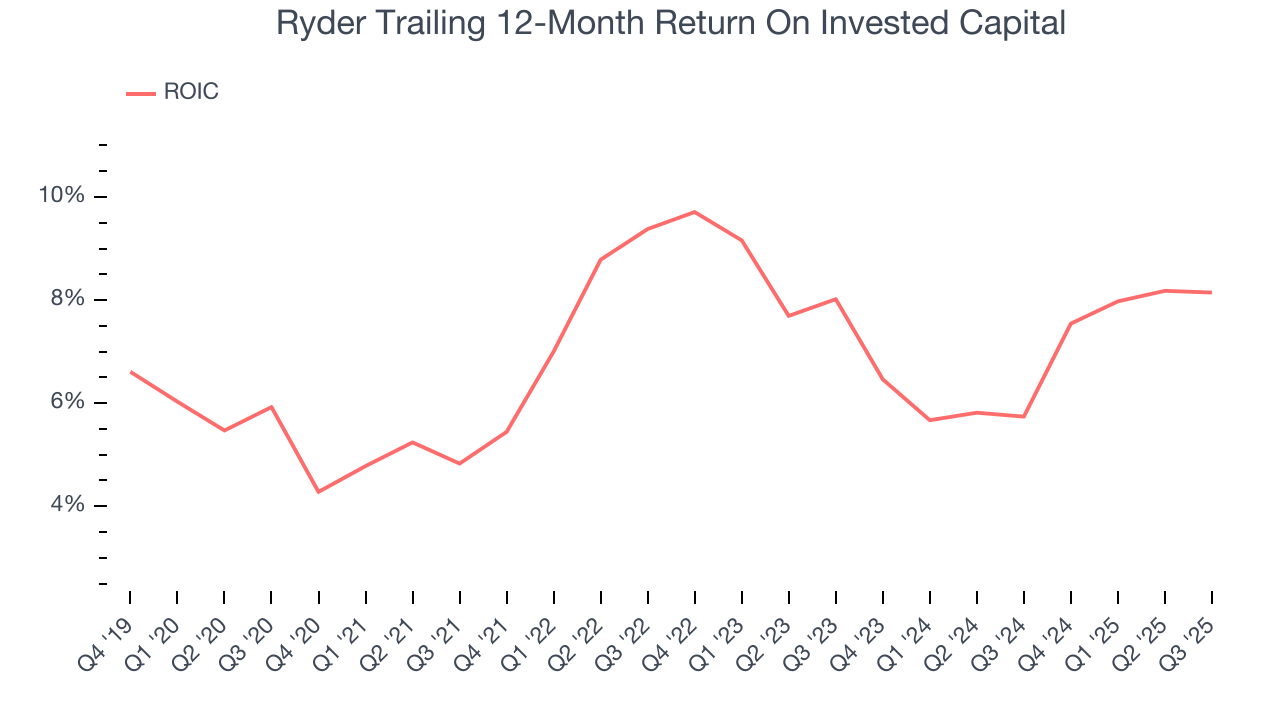

Ryder historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Ryder’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Assessment

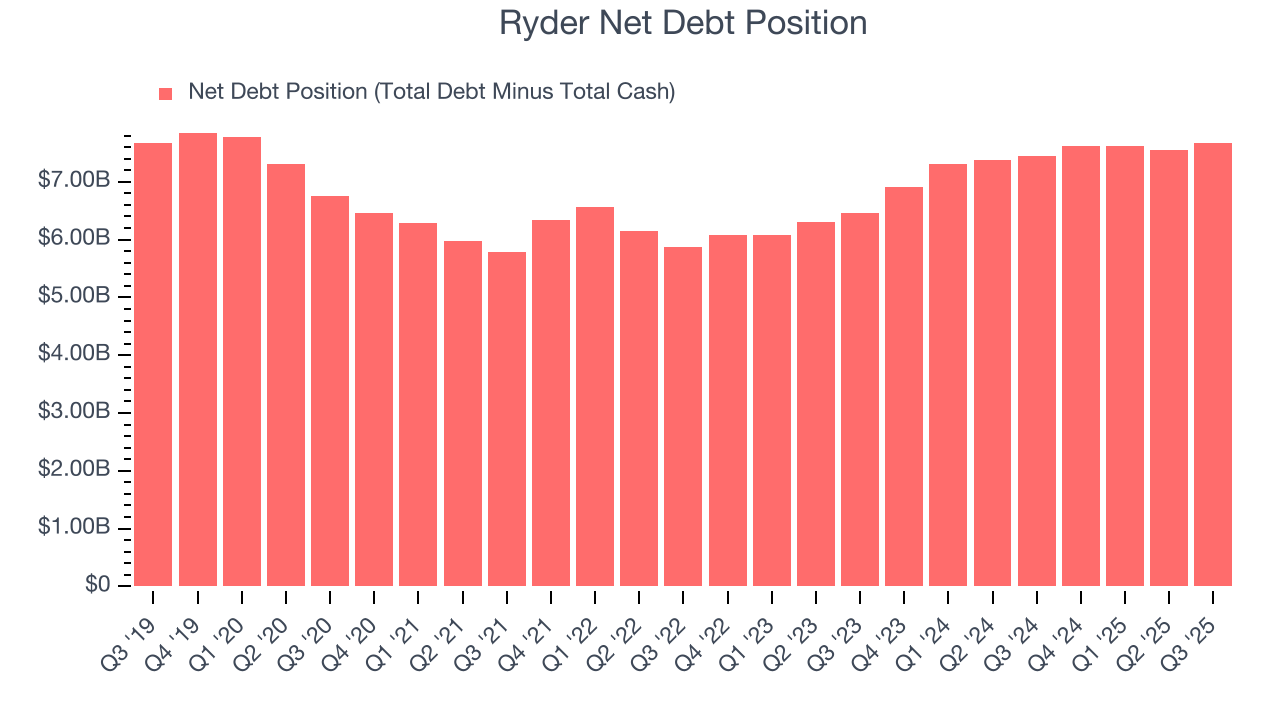

Ryder reported $189 million of cash and $7.86 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.84 billion of EBITDA over the last 12 months, we view Ryder’s 2.7× net-debt-to-EBITDA ratio as safe. We also see its $200 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Ryder’s Q3 Results

It was encouraging to see Ryder beat analysts’ EBITDA expectations this quarter. On the other hand, its revenue slightly missed and its EPS fell a bit short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $183.20 immediately following the results.

13. Is Now The Time To Buy Ryder?

Updated: January 23, 2026 at 9:06 PM EST

Before deciding whether to buy Ryder or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Ryder falls short of our quality standards. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its cash profitability fell over the last five years. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

Ryder’s P/E ratio based on the next 12 months is 14x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $215.44 on the company (compared to the current share price of $193).