LiveRamp (RAMP)

LiveRamp doesn’t excite us. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think LiveRamp Will Underperform

Serving as the digital middleman in an increasingly privacy-conscious world, LiveRamp (NYSE:RAMP) provides technology that helps companies securely share and connect their customer data with trusted partners while maintaining privacy compliance.

- Average ARR growth of 7.4% over the last year has disappointed, suggesting it’s had a hard time winning long-term deals and renewals

- Operating profits and efficiency rose over the last year as it benefited from some fixed cost leverage

- A positive is that its user-friendly software enables clients to ramp up spending quickly, leading to the speedy recovery of customer acquisition costs

LiveRamp doesn’t fulfill our quality requirements. Better businesses are for sale in the market.

Why There Are Better Opportunities Than LiveRamp

Why There Are Better Opportunities Than LiveRamp

LiveRamp’s stock price of $25.76 implies a valuation ratio of 2x forward price-to-sales. LiveRamp’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. LiveRamp (RAMP) Research Report: Q3 CY2025 Update

Data collaboration platform LiveRamp (NYSE:RAMP) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.7% year on year to $199.8 million. The company expects next quarter’s revenue to be around $211 million, close to analysts’ estimates. Its non-GAAP profit of $0.55 per share was 13.6% above analysts’ consensus estimates.

LiveRamp (RAMP) Q3 CY2025 Highlights:

- Revenue: $199.8 million vs analyst estimates of $197.8 million (7.7% year-on-year growth, 1% beat)

- Adjusted EPS: $0.55 vs analyst estimates of $0.48 (13.6% beat)

- Adjusted Operating Income: $44.7 million vs analyst estimates of $39.21 million (22.4% margin, 14% beat)

- The company slightly lifted its revenue guidance for the full year to $811 million at the midpoint from $808 million

- Operating Margin: 10.7%, up from 4% in the same quarter last year

- Free Cash Flow was $56.82 million, up from -$16 million in the previous quarter

- Customers: 834

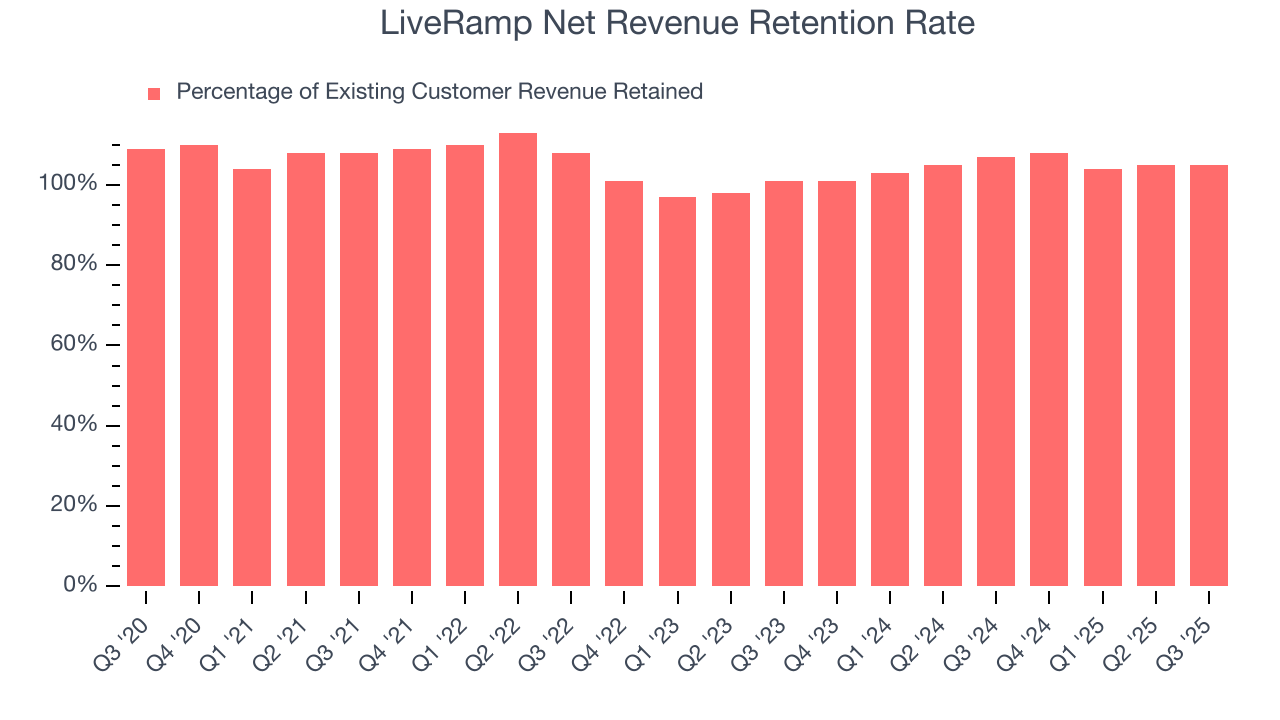

- Net Revenue Retention Rate: 105%, in line with the previous quarter

- Annual Recurring Revenue: $516 million vs analyst estimates of $510.1 million (6.8% year-on-year growth, 1.2% beat)

- Market Capitalization: $1.77 billion

Company Overview

Serving as the digital middleman in an increasingly privacy-conscious world, LiveRamp (NYSE:RAMP) provides technology that helps companies securely share and connect their customer data with trusted partners while maintaining privacy compliance.

At its core, LiveRamp operates as middleware for the customer experience economy, sitting between a company's data and the applications that use it. The platform offers four main capabilities: identity resolution (connecting fragmented consumer identities across systems), data marketplace access (providing third-party data from over 200 providers), connectivity (enabling data to flow across different platforms), and insights (facilitating collaborative analytics between partners).

LiveRamp's technology replaces directly identifiable customer information with pseudonymized "RampIDs" that allow companies to match and activate their data across digital ecosystems without compromising consumer privacy. For example, a retailer might use LiveRamp to securely match its loyalty program data with a consumer packaged goods company's promotional data to create more personalized marketing campaigns.

The company generates revenue primarily through subscription fees from its enterprise customers, which include approximately 25% of Fortune 500 companies. Additional revenue comes from its Data Marketplace, where LiveRamp takes a cut of transactions between data sellers and buyers, and from professional services. The company maintains a global presence with operations in the United States, Europe, and Asia-Pacific regions, serving industries ranging from financial services and retail to healthcare and telecommunications.

4. Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

LiveRamp's competitors include other customer data platforms and identity resolution providers such as Snowflake (NYSE:SNOW), Salesforce (NYSE:CRM), Adobe (NASDAQ:ADBE), and The Trade Desk (NASDAQ:TTD), as well as private companies like Neustar and Zeotap.

5. Revenue Growth

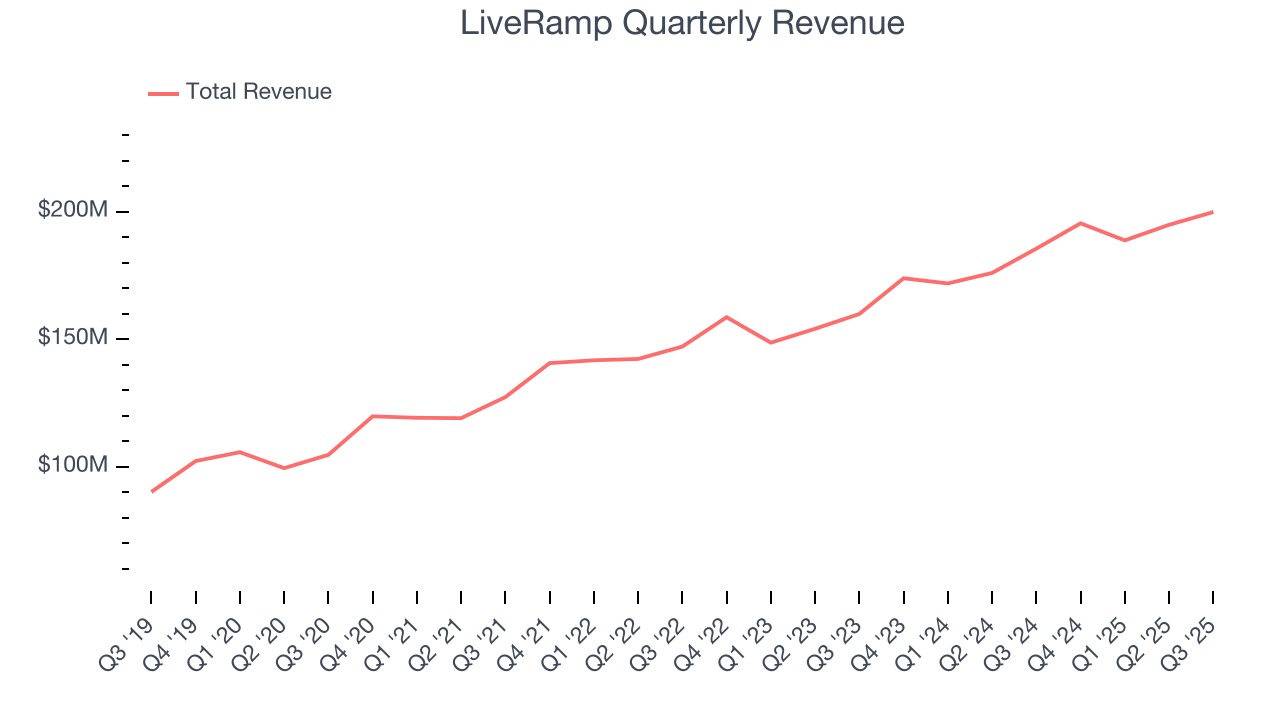

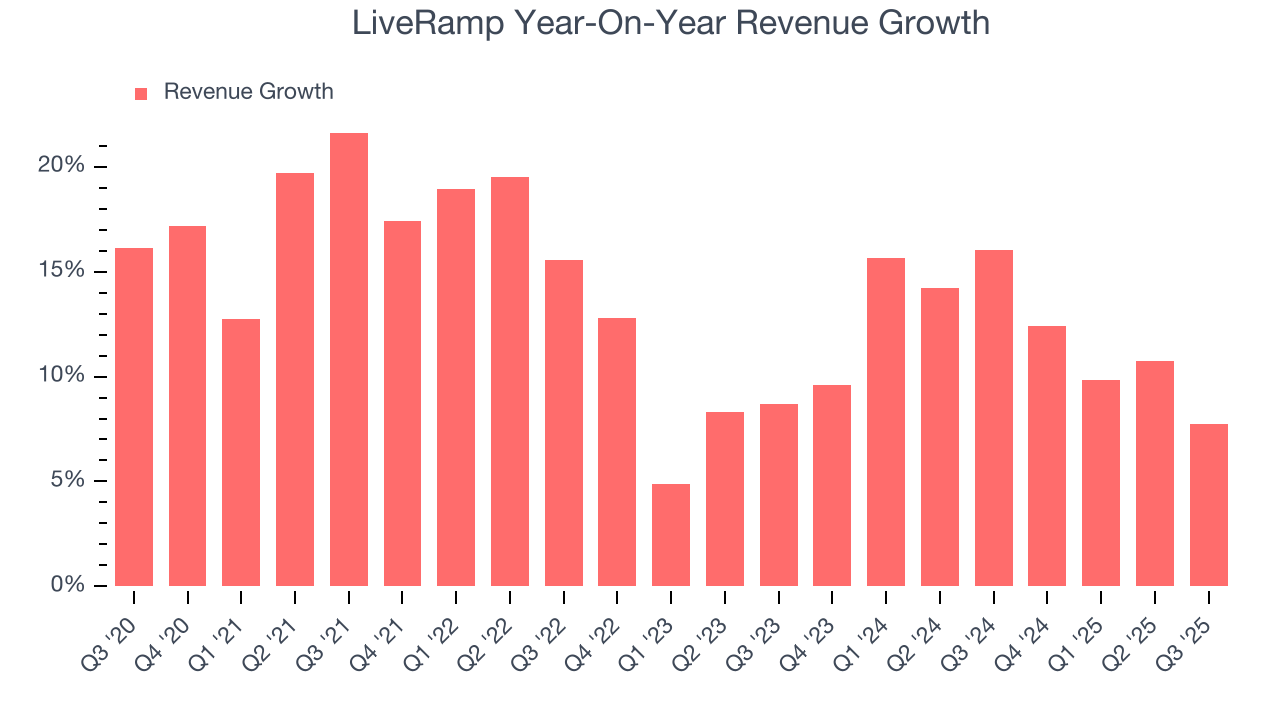

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, LiveRamp grew its sales at a 13.6% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. LiveRamp’s recent performance shows its demand has slowed as its annualized revenue growth of 12% over the last two years was below its five-year trend.

This quarter, LiveRamp reported year-on-year revenue growth of 7.7%, and its $199.8 million of revenue exceeded Wall Street’s estimates by 1%. Company management is currently guiding for a 8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

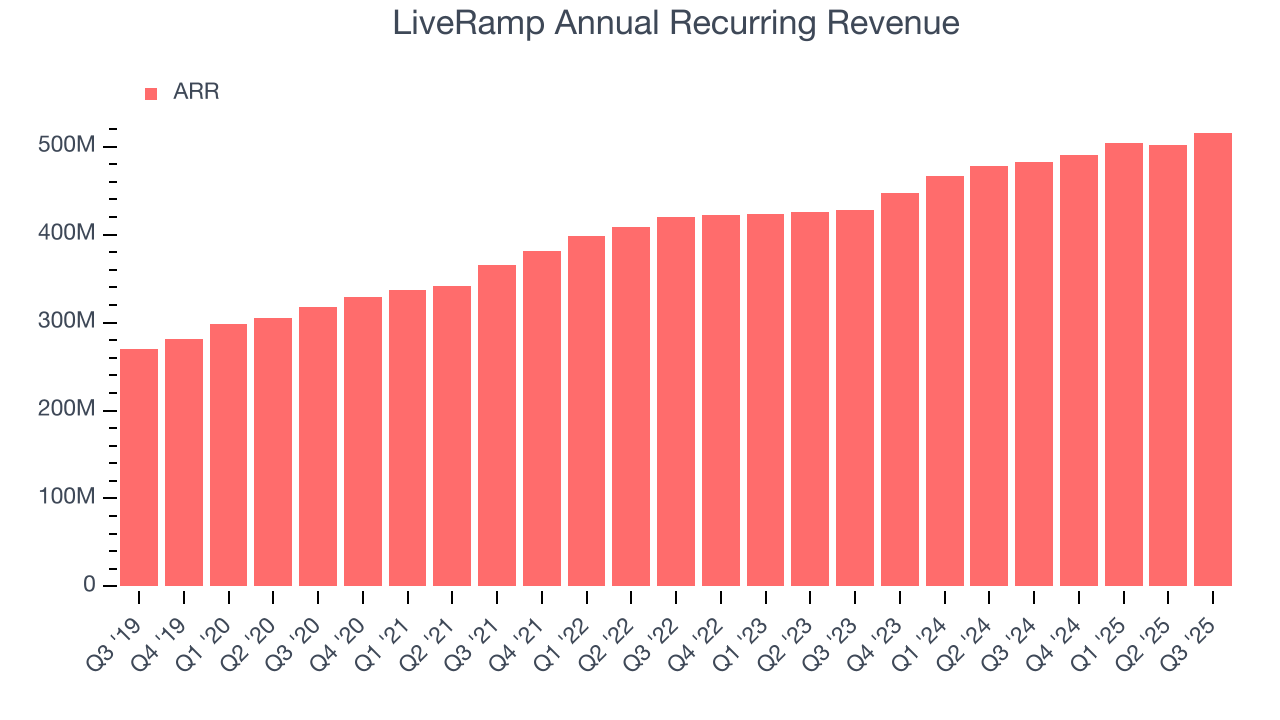

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

LiveRamp’s ARR came in at $516 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 7.4% year-on-year increases. This alternate topline metric grew slower than total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

7. Enterprise Customer Base

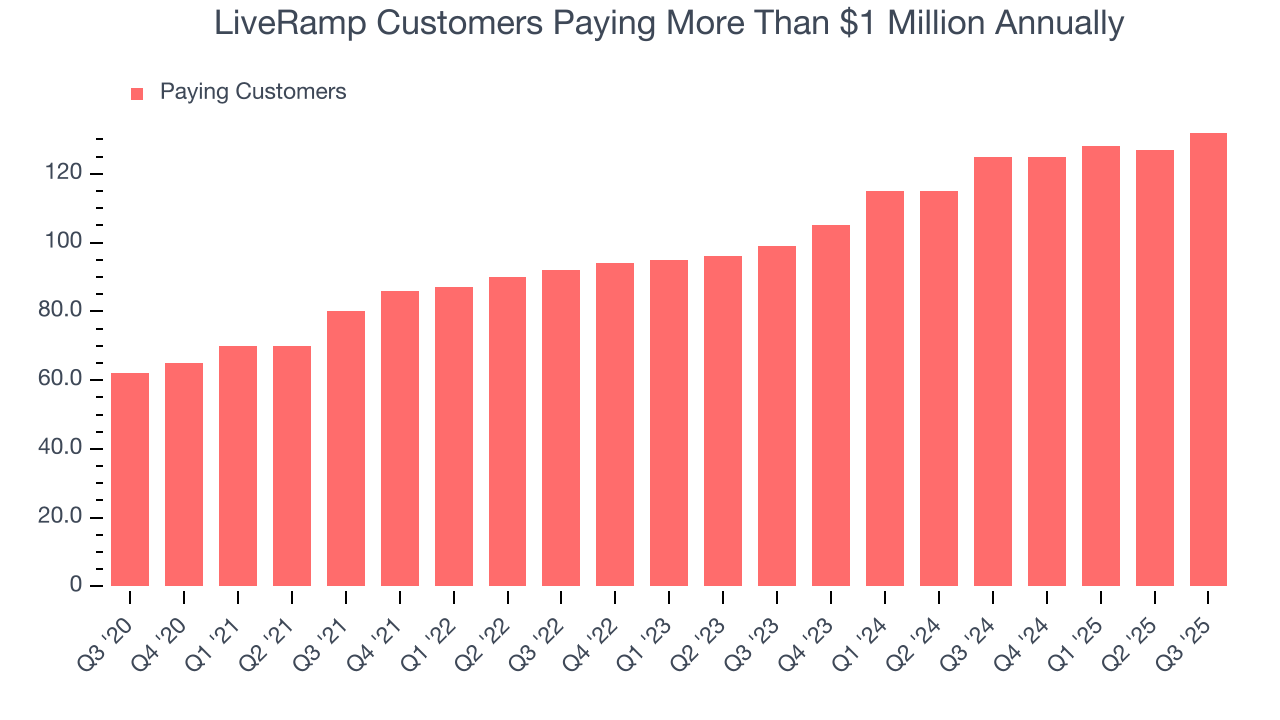

This quarter, LiveRamp reported 132 enterprise customers paying more than $1 million annually, an increase of 5 from the previous quarter. That’s a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that LiveRamp has made some recent improvements to its go-to-market strategy and that they are working well for the time being.

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

LiveRamp is extremely efficient at acquiring new customers, and its CAC payback period checked in at 18.2 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

9. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

LiveRamp’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 106% in Q3. This means LiveRamp would’ve grown its revenue by 5.5% even if it didn’t win any new customers over the last 12 months.

LiveRamp has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

10. Gross Margin & Pricing Power

For software companies like LiveRamp, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

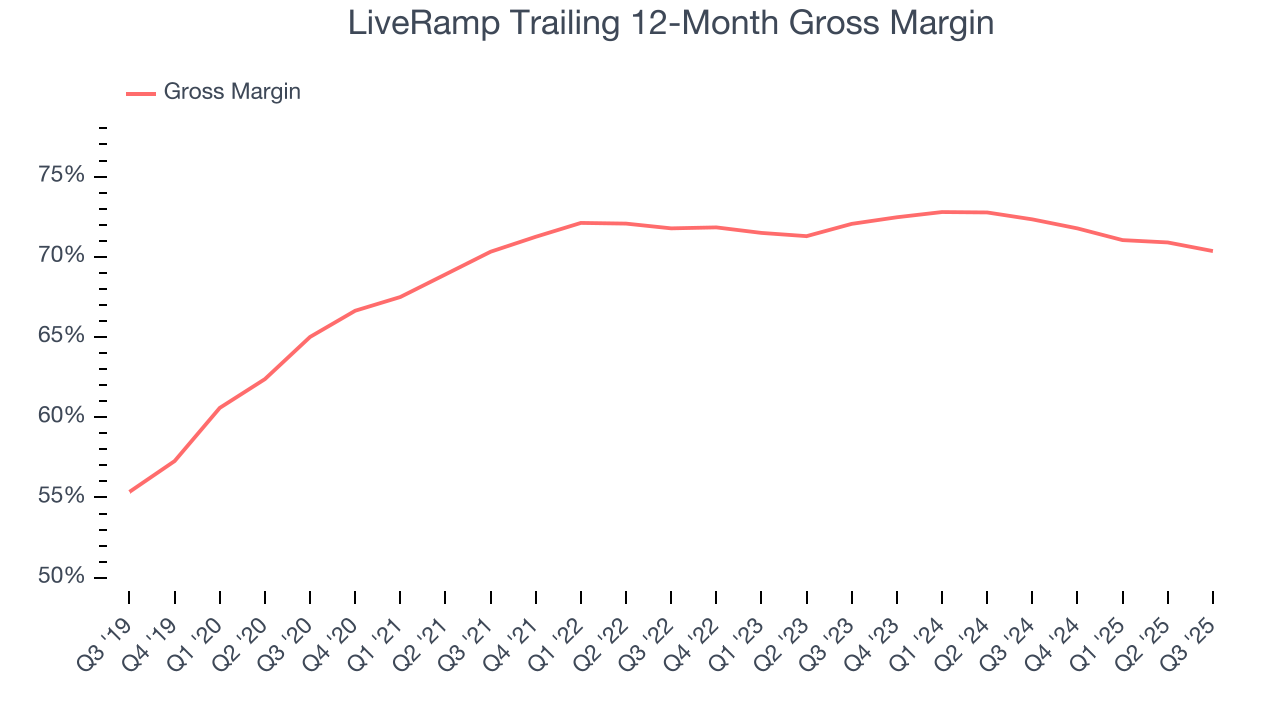

LiveRamp’s gross margin is slightly below the average software company, giving it less room than its competitors to invest in areas such as product and sales. As you can see below, it averaged a 70.4% gross margin over the last year. That means LiveRamp paid its providers a lot of money ($29.64 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. LiveRamp has seen gross margins decline by 1.7 percentage points over the last 2 year, which is poor compared to software peers.

LiveRamp’s gross profit margin came in at 70.2% this quarter, down 2.2 percentage points year on year. LiveRamp’s full-year margin has also been trending down over the past 12 months, decreasing by 2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

11. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

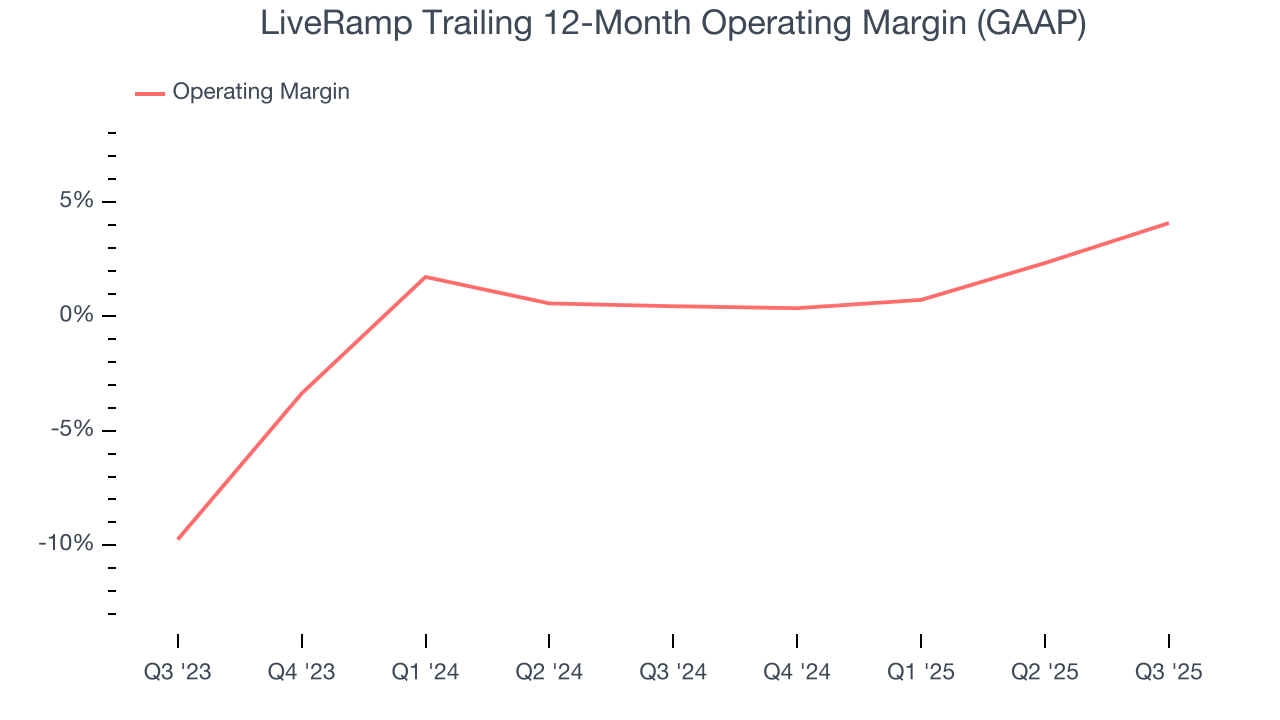

LiveRamp has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 4.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, LiveRamp’s operating margin rose by 3.6 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, LiveRamp generated an operating margin profit margin of 10.7%, up 6.7 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

12. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

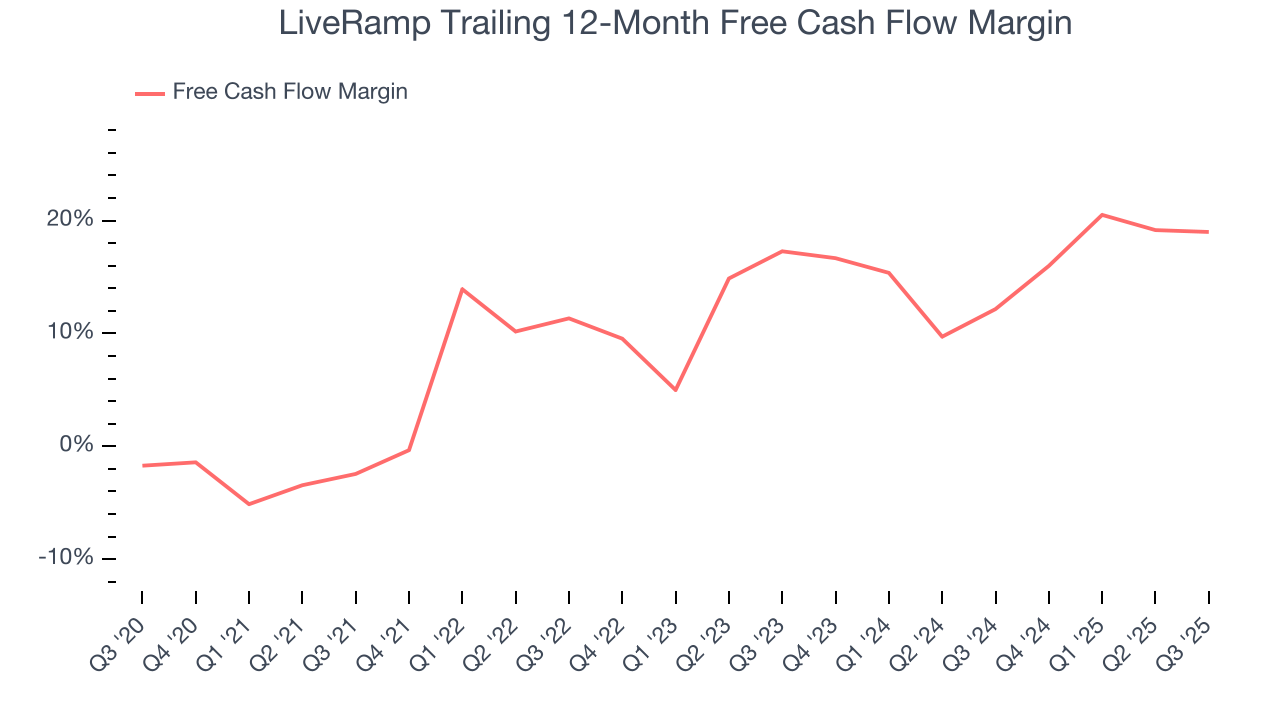

LiveRamp has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 19% over the last year, slightly better than the broader software sector.

LiveRamp’s free cash flow clocked in at $56.82 million in Q3, equivalent to a 28.4% margin. The company’s cash profitability regressed as it was 1.4 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts’ consensus estimates show they’re expecting LiveRamp’s free cash flow margin of 19% for the last 12 months to remain the same.

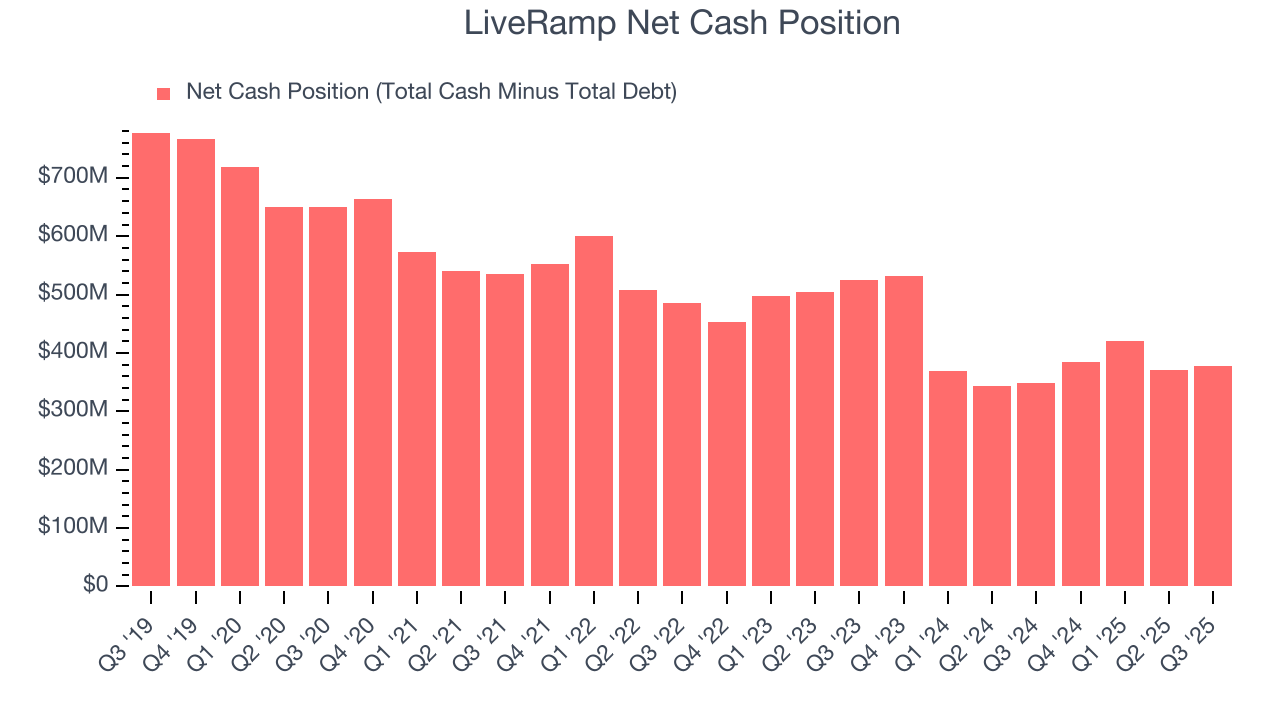

13. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

LiveRamp is a profitable, well-capitalized company with $376.9 million of cash and no debt. This position is 21.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

14. Key Takeaways from LiveRamp’s Q3 Results

It was good to see LiveRamp narrowly top analysts’ annual recurring revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Operating profit outperformed by a more convincing amount. Overall, this quarter was solid. The stock traded up 2.1% to $28.01 immediately following the results.

15. Is Now The Time To Buy LiveRamp?

Updated: January 23, 2026 at 9:34 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

LiveRamp isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its efficient sales strategy allows it to target and onboard new users at scale, the downside is its ARR has disappointed and shows the company is having difficulty retaining customers and their spending. On top of that, its expanding operating margin shows it’s becoming more efficient at building and selling its software.

LiveRamp’s price-to-sales ratio based on the next 12 months is 2x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $40.38 on the company (compared to the current share price of $25.76).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.