Royal Caribbean (RCL)

Royal Caribbean keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Royal Caribbean Will Underperform

Established in 1968, Royal Caribbean Cruises (NYSE:RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 15.1% for the last two years

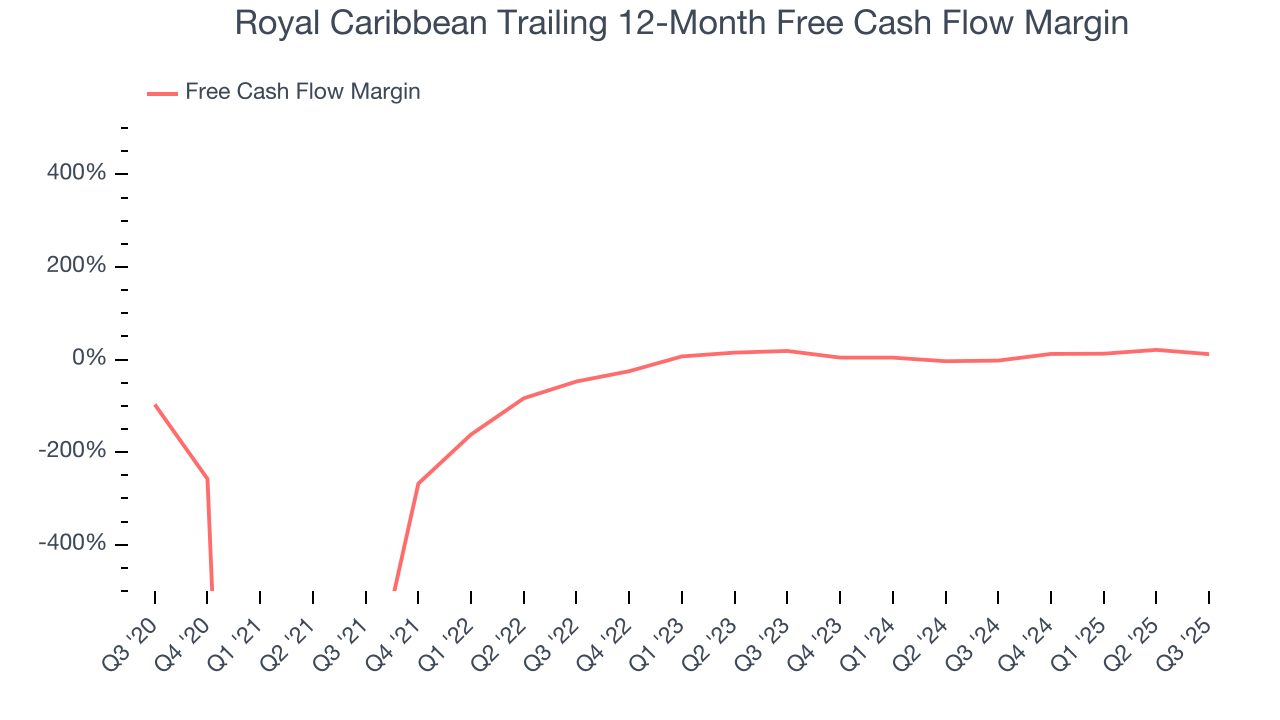

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 5% for the last two years

- Underwhelming 3.3% return on capital reflects management’s difficulties in finding profitable growth opportunities

Royal Caribbean falls below our quality standards. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Royal Caribbean

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Royal Caribbean

At $259.35 per share, Royal Caribbean trades at 15.4x forward P/E. Royal Caribbean’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Royal Caribbean (RCL) Research Report: Q3 CY2025 Update

Cruise vacation company Royal Caribbean (NYSE:RCL) fell short of the market’s revenue expectations in Q3 CY2025, but sales rose 5.2% year on year to $5.14 billion. Its non-GAAP profit of $5.75 per share was 1.2% above analysts’ consensus estimates.

Royal Caribbean (RCL) Q3 CY2025 Highlights:

- Revenue: $5.14 billion vs analyst estimates of $5.16 billion (5.2% year-on-year growth, 0.5% miss)

- Adjusted EPS: $5.75 vs analyst estimates of $5.68 (1.2% beat)

- Adjusted EBITDA: $2.29 billion vs analyst estimates of $2.2 billion (44.6% margin, 4.2% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $15.61 at the midpoint

- Operating Margin: 33.1%, in line with the same quarter last year

- Free Cash Flow was -$989 million, down from $563 million in the same quarter last year

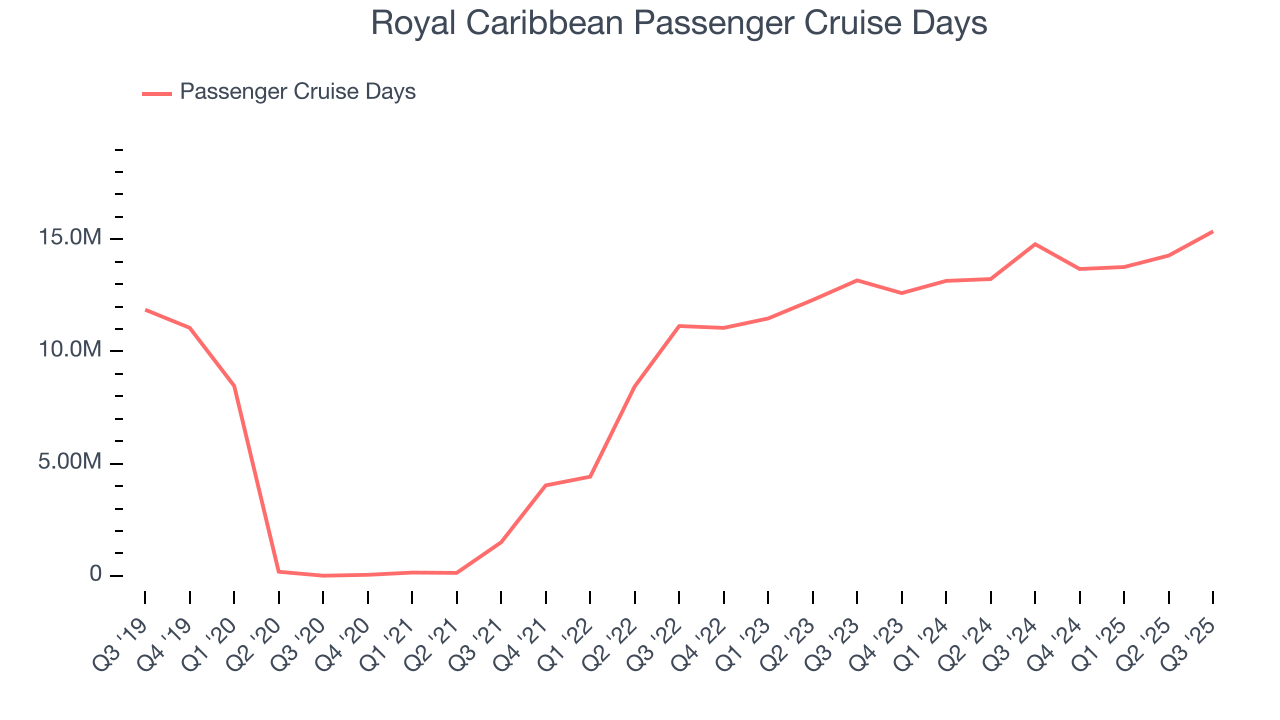

- Passenger Cruise Days: 15.36 million, up 570,443 year on year

- Market Capitalization: $86.99 billion

Company Overview

Established in 1968, Royal Caribbean Cruises (NYSE:RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

With a fleet of more than 60 ships, Royal Caribbean offers a wide array of itineraries to destinations including the Caribbean, Alaska, Europe, South America, Asia, and Australia. The company operates through its various brands, most notably Royal Caribbean International, Celebrity Cruises, and Silversea Cruises.

Royal Caribbean International holds mega-ships and is known for features like robotic bartenders, massive water slides, skydiving simulators, and virtual balconies. Celebrity Cruises offers a more upscale and intimate experience, with an emphasis on fine dining, sophisticated ambiance, and exotic destinations. Silversea Cruises, acquired in 2018, extends Royal Caribbean's reach into the ultra-luxury and expedition cruise sectors.

The company has introduced many firsts at sea, including the first rock-climbing walls, ice-skating rinks, and the 360-degree Promenade on its ships, enhancing the onboard experience for guests. Most of Royal Caribbean's revenues are generated from passenger ticket sales. The balance comes from casino operations as well as onboard sales of food, beverage, retail shopping, and entertainment offerings like land excursions at port destinations.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Royal Caribbean's primary competitors include Carnival (NYSE:CCL), Norwegian Cruise Line (NYSE:NCLH), Disney Cruise Line (owned by Disney NYSE:DIS), and private companies Viking Cruises and MSC Cruises.

5. Revenue Growth

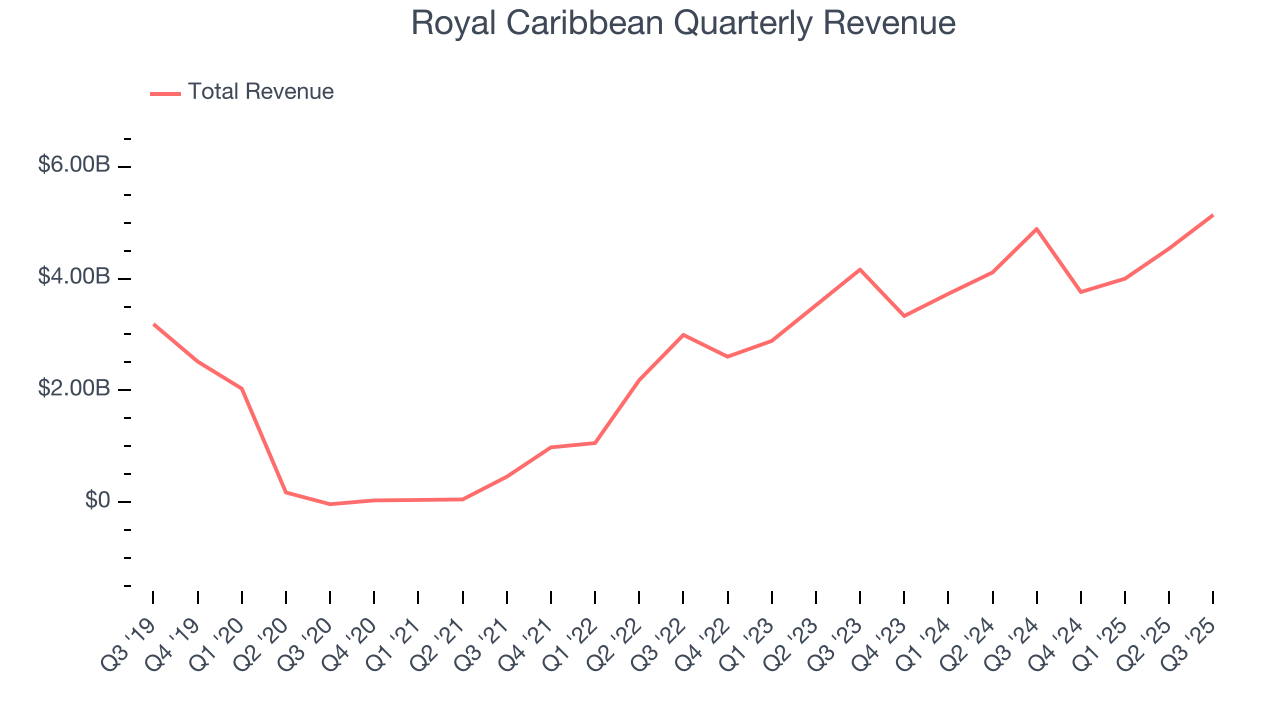

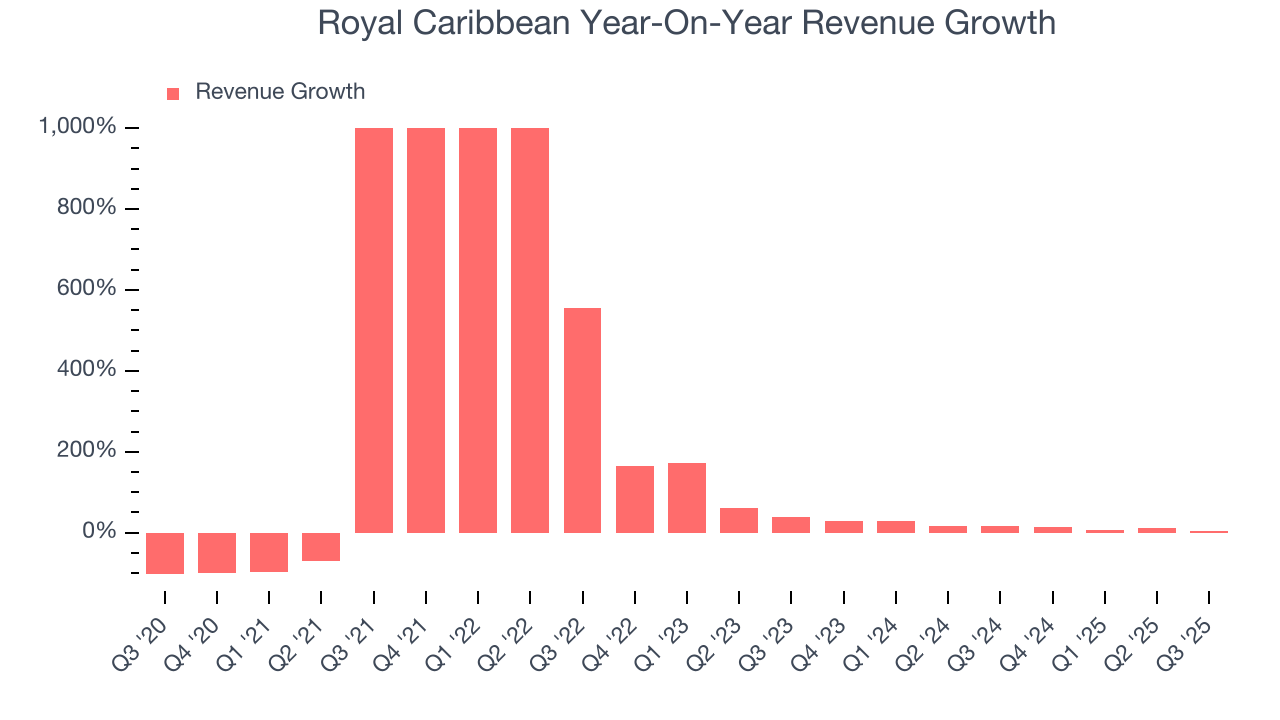

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Royal Caribbean grew its sales at an incredible 30% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Royal Caribbean’s annualized revenue growth of 15.1% over the last two years is below its five-year trend, but we still think the results were respectable.

We can better understand the company’s revenue dynamics by analyzing its number of passenger cruise days, which reached 15.36 million in the latest quarter. Over the last two years, Royal Caribbean’s passenger cruise days averaged 9.2% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Royal Caribbean’s revenue grew by 5.2% year on year to $5.14 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

6. Operating Margin

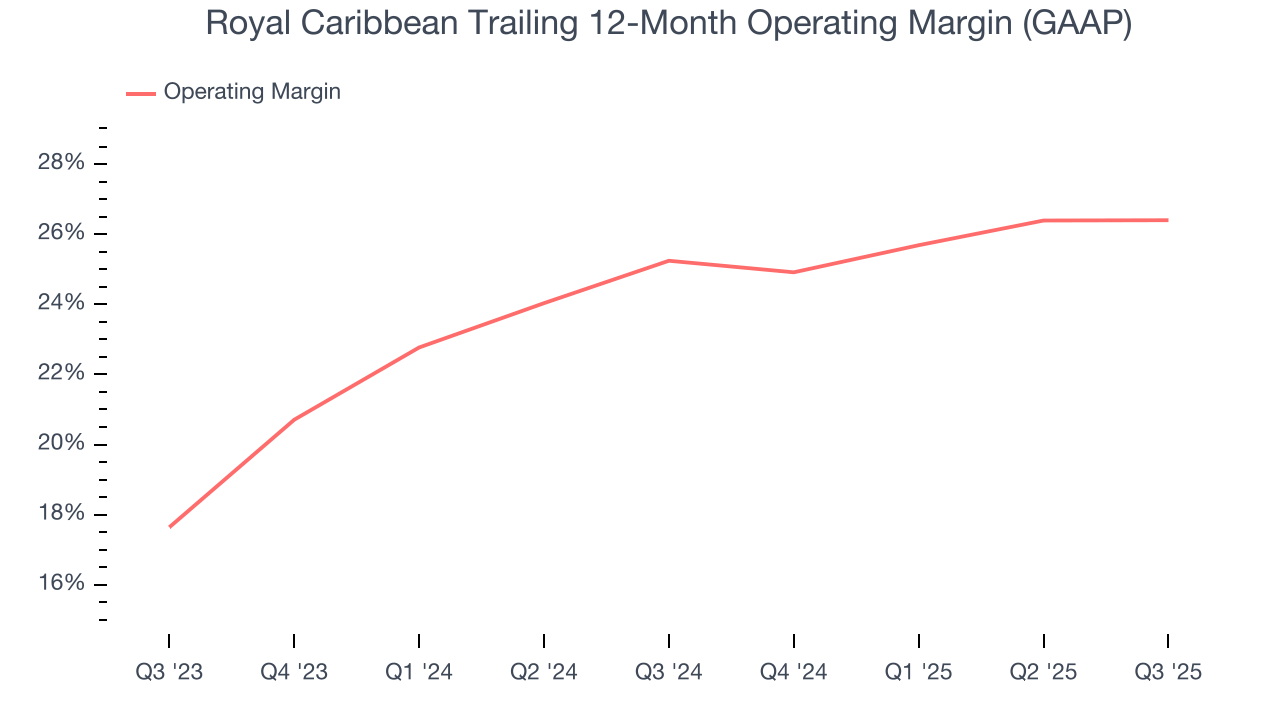

Royal Caribbean’s operating margin has risen over the last 12 months and averaged 25.8% over the last two years. On top of that, its profitability was elite for a consumer discretionary business, showing it’s a well-oiled machine with an efficient cost structure that benefits from immense operating leverage as it scales.

This quarter, Royal Caribbean generated an operating margin profit margin of 33.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

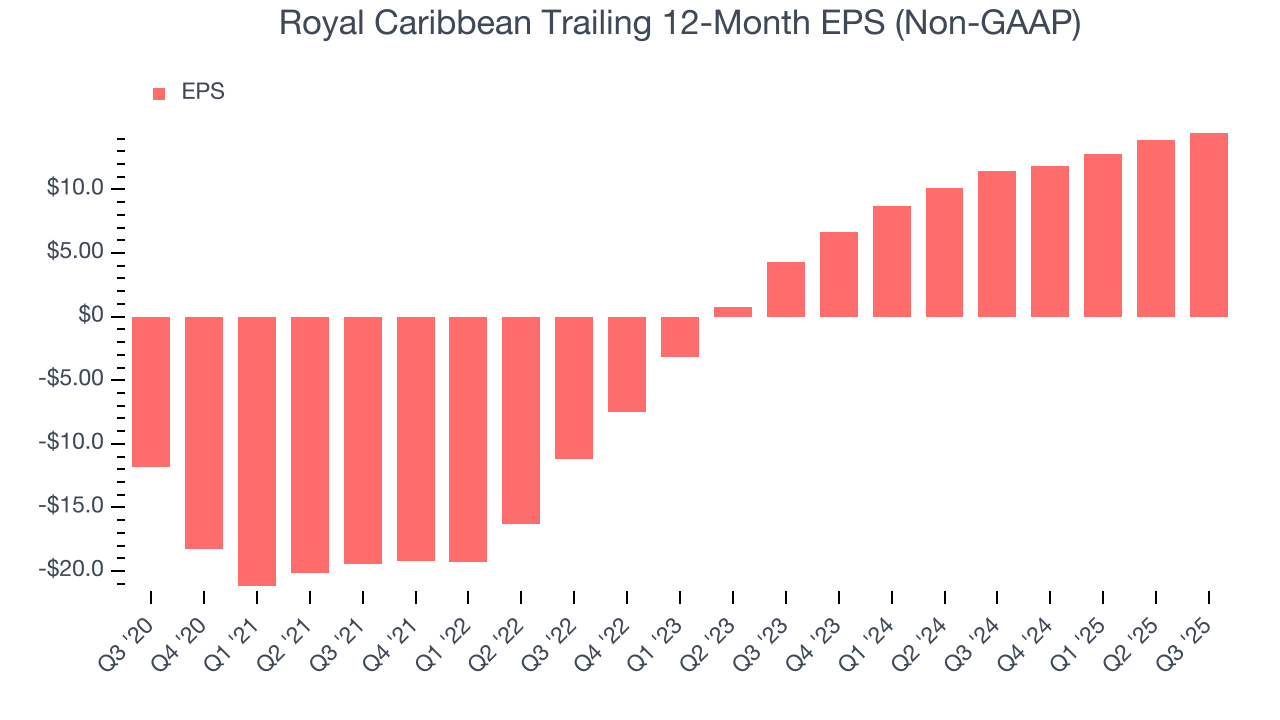

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Royal Caribbean’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q3, Royal Caribbean reported adjusted EPS of $5.75, up from $5.20 in the same quarter last year. This print beat analysts’ estimates by 1.2%. Over the next 12 months, Wall Street expects Royal Caribbean’s full-year EPS of $14.47 to grow 21.5%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Royal Caribbean has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5%, lousy for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Royal Caribbean to make large cash investments in working capital and capital expenditures.

Royal Caribbean burned through $989 million of cash in Q3, equivalent to a negative 19.2% margin. The company’s cash flow turned negative after being positive in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Royal Caribbean’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 11.7% for the last 12 months will increase to 18.3%, it options for capital deployment (investments, share buybacks, etc.).

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Royal Caribbean historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Royal Caribbean’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

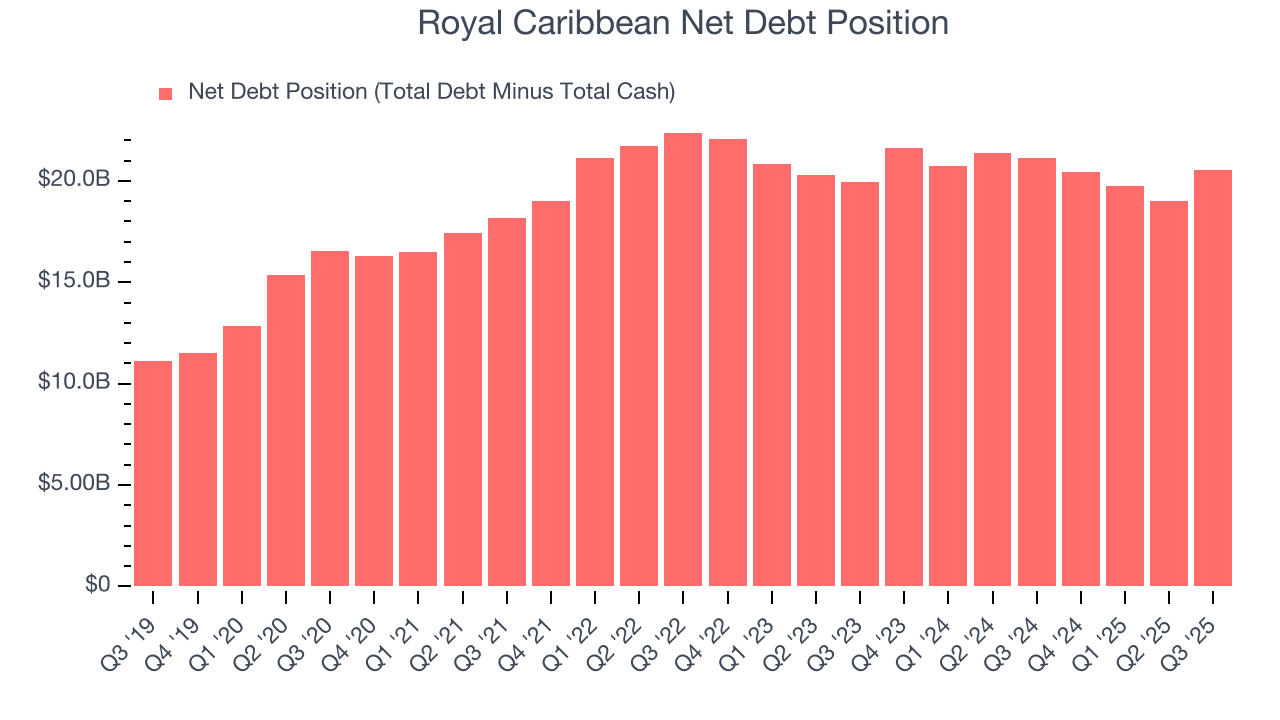

Royal Caribbean reported $432 million of cash and $20.98 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $6.46 billion of EBITDA over the last 12 months, we view Royal Caribbean’s 3.2× net-debt-to-EBITDA ratio as safe. We also see its $8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Royal Caribbean’s Q3 Results

It was encouraging to see Royal Caribbean beat analysts’ EBITDA expectations this quarter. On the other hand, its EPS guidance for next quarter missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 9.5% to $289.83 immediately after reporting.

12. Is Now The Time To Buy Royal Caribbean?

Updated: December 4, 2025 at 10:02 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Royal Caribbean, you should also grasp the company’s longer-term business quality and valuation.

Royal Caribbean falls short of our quality standards. First off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, the downside is its number of passenger cruise days has disappointed. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Royal Caribbean’s P/E ratio based on the next 12 months is 15.4x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $333.50 on the company (compared to the current share price of $259.35).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.