Service International (SCI)

We wouldn’t buy Service International. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Service International Will Underperform

Founded in 1962, Service International (NYSE: SCI) is a leading provider of death care products and services in North America.

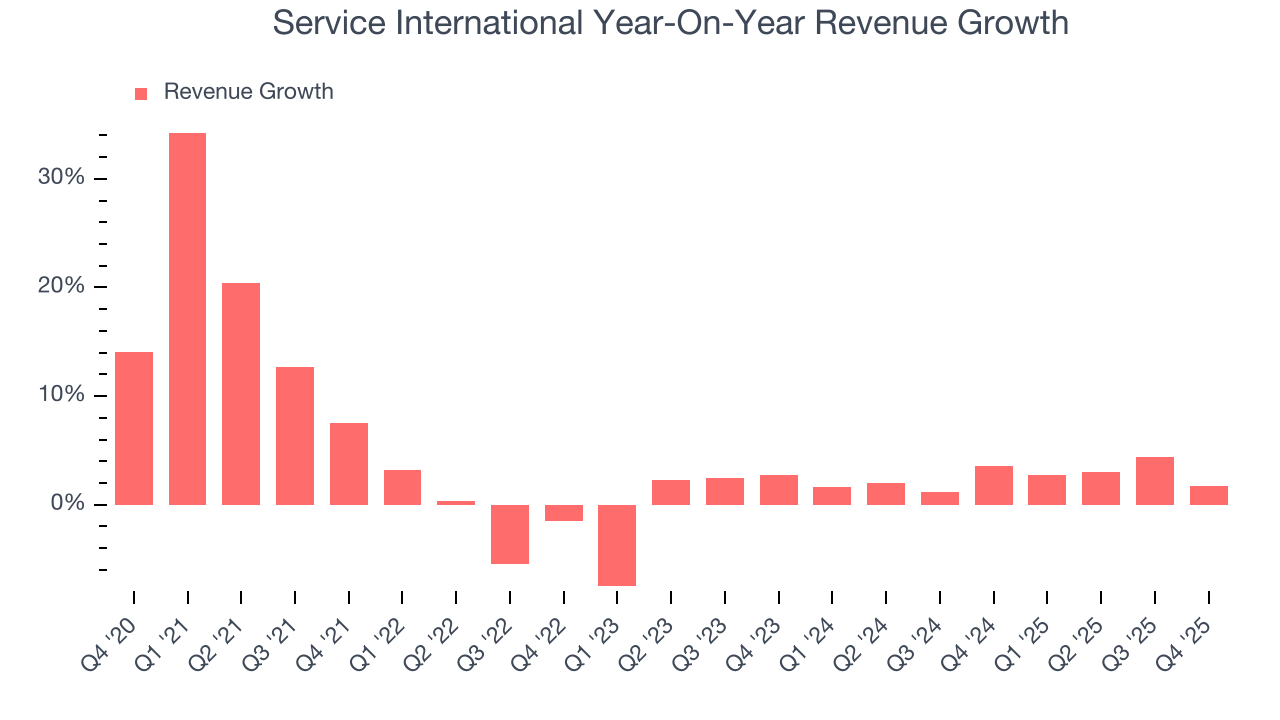

- Sales trends were unexciting over the last five years as its 4.2% annual growth was below the typical consumer discretionary company

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 5.6% annually

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

Service International doesn’t satisfy our quality benchmarks. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Service International

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Service International

Service International’s stock price of $85.39 implies a valuation ratio of 19.6x forward P/E. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Service International (SCI) Research Report: Q4 CY2025 Update

Funeral services company Service International (NYSE:SCI) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 1.7% year on year to $1.11 billion. Its non-GAAP profit of $1.14 per share was in line with analysts’ consensus estimates.

Service International (SCI) Q4 CY2025 Highlights:

- Revenue: $1.11 billion vs analyst estimates of $1.12 billion (1.7% year-on-year growth, in line)

- Adjusted EPS: $1.14 vs analyst estimates of $1.14 (in line)

- Adjusted EBITDA: $331.7 million vs analyst estimates of $365.2 million (29.8% margin, 9.2% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.20 at the midpoint, missing analyst estimates by 1.3%

- Operating Margin: 24.8%, in line with the same quarter last year

- Free Cash Flow Margin: 7.8%, down from 13.9% in the same quarter last year

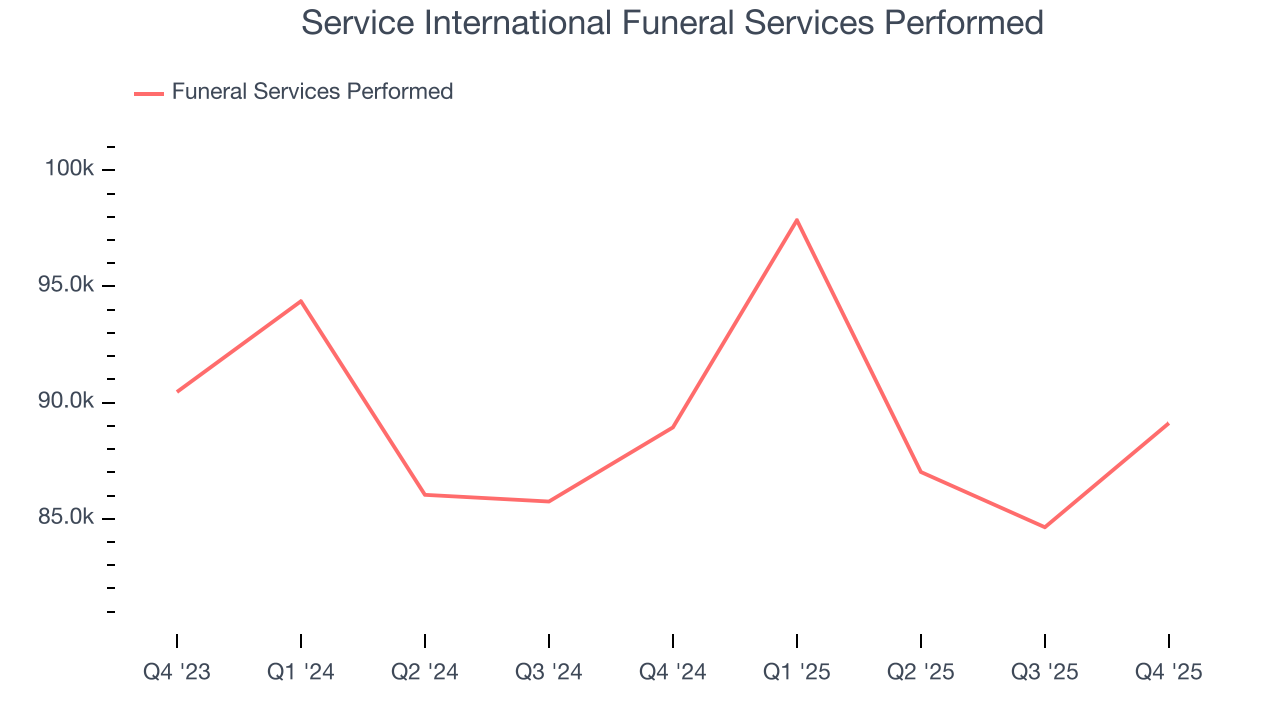

- Funeral Services Performed: 89,117, in line with the same quarter last year

- Market Capitalization: $11.69 billion

Company Overview

Founded in 1962, Service International (NYSE: SCI) is a leading provider of death care products and services in North America.

Service International’s primary business involves owning and operating funeral homes and cemeteries, offering a range of services that cater to the diverse needs of families during difficult times. The company's extensive network includes over 1,500 funeral homes and around 400 cemeteries. These facilities provide traditional funeral, cremation, and cemetery services while selling funeral and cemetery products like caskets, urns, and burial vaults.

Service International allows its customers to customize their funeral and memorial services. This approach extends to pre-planning services, where individuals can arrange their funeral and cemetery needs in advance, providing peace of mind for themselves and their families.

Service International’s Dignity Memorial brand is one of the largest networks of funeral, cremation, and cemetery service providers in North America. Under this brand, it offers the Dignity Planning process, which includes online tools and resources to help families plan and personalize services.

4. Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Service International's primary competitors include Carriage Services (NYSE:CSV), Park Lawn (TSX:PLC), and Matthews International (NASDAQ:MATW).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Service International grew its sales at a weak 4.2% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Service International’s recent performance shows its demand has slowed as its annualized revenue growth of 2.5% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can dig further into the company’s revenue dynamics by analyzing its number of funeral services performed, which reached 89,117 in the latest quarter. Over the last two years, Service International’s funeral services performed were flat. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Service International grew its revenue by 1.7% year on year, and its $1.11 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, similar to its two-year rate. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Service International’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 22.4% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, Service International generated an operating margin profit margin of 24.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

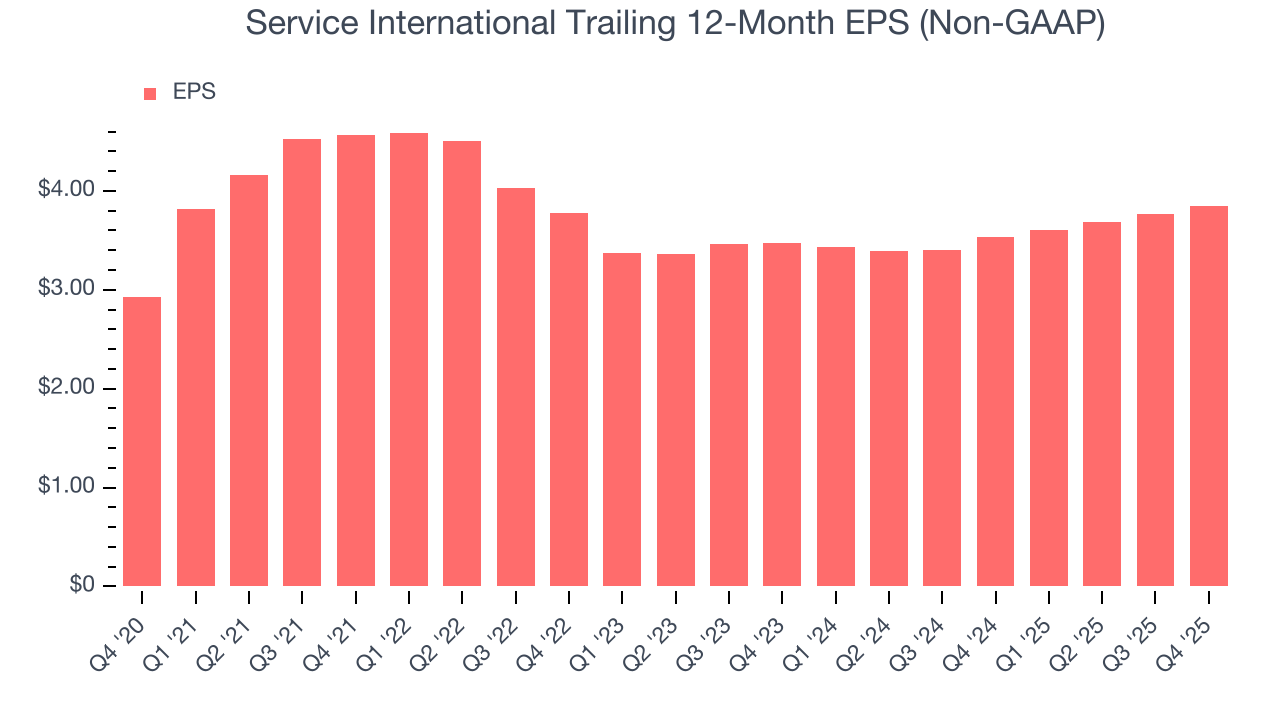

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Service International’s weak 5.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Service International reported adjusted EPS of $1.14, up from $1.06 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Service International’s full-year EPS of $3.85 to grow 10.4%.

8. Cash Is King

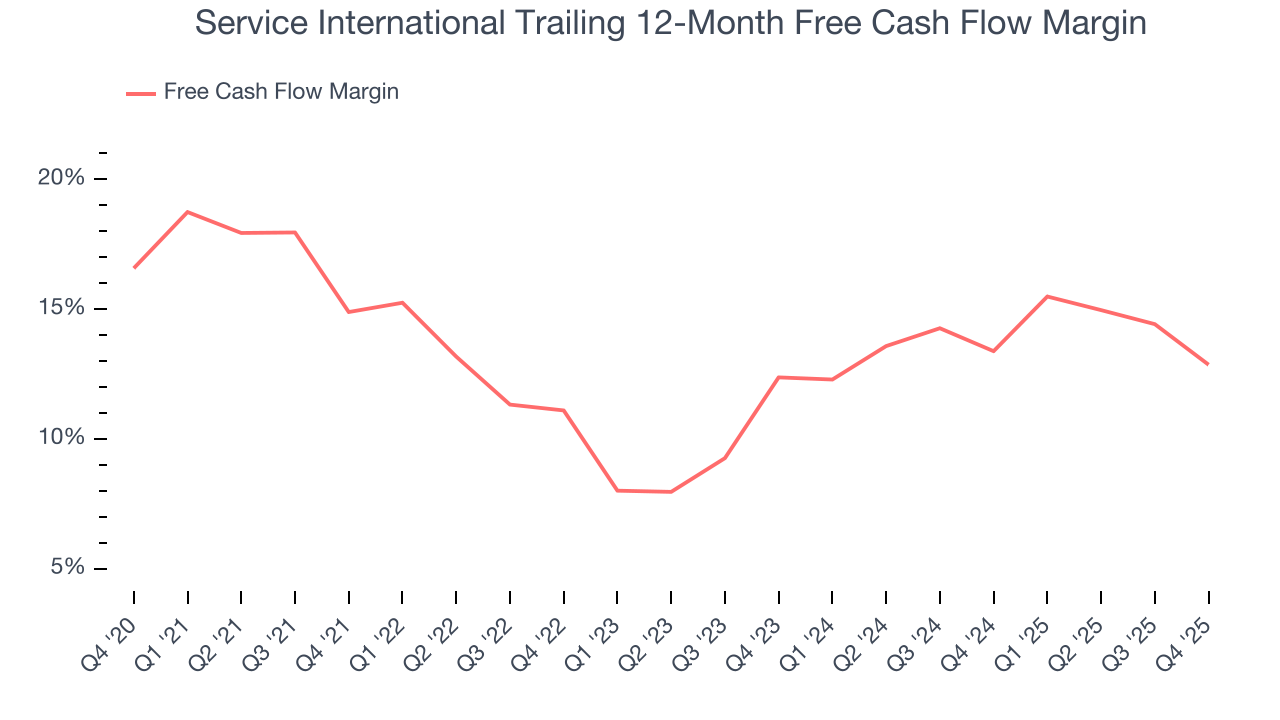

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Service International has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 13.1%, lousy for a consumer discretionary business.

Service International’s free cash flow clocked in at $87.2 million in Q4, equivalent to a 7.8% margin. The company’s cash profitability regressed as it was 6 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Service International historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 14.4%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Service International’s ROIC decreased by 2.2 percentage points annually each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

Service International reported $243.6 million of cash and $5.14 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.28 billion of EBITDA over the last 12 months, we view Service International’s 3.8× net-debt-to-EBITDA ratio as safe. We also see its $127.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Service International’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its full-year EPS guidance fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.6% to $81.42 immediately after reporting.

12. Is Now The Time To Buy Service International?

Updated: February 11, 2026 at 10:10 PM EST

Before making an investment decision, investors should account for Service International’s business fundamentals and valuation in addition to what happened in the latest quarter.

Service International doesn’t pass our quality test. On top of that, Service International’s number of funeral services performed has disappointed, and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Service International’s P/E ratio based on the next 12 months is 19.6x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $97.83 on the company (compared to the current share price of $85.39).