Teleflex (TFX)

We’re skeptical of Teleflex. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Teleflex Will Underperform

With a portfolio spanning from vascular access catheters to minimally invasive surgical tools, Teleflex (NYSE:TFX) designs, manufactures, and supplies single-use medical devices used in critical care and surgical procedures across hospitals worldwide.

- Underwhelming 5% return on capital reflects management’s difficulties in finding profitable growth opportunities, and its decreasing returns suggest its historical profit centers are aging

- Sales trends were unexciting over the last five years as its 4.8% annual growth was below the typical healthcare company

- On the bright side, its healthy adjusted operating margin shows it’s a well-run company with efficient processes

Teleflex’s quality isn’t up to par. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Teleflex

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Teleflex

Teleflex’s stock price of $103.34 implies a valuation ratio of 7.2x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Teleflex (TFX) Research Report: Q3 CY2025 Update

Medical technology company Teleflex (NYSE:TFX) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 19.4% year on year to $913 million. Its non-GAAP profit of $3.67 per share was 8.6% above analysts’ consensus estimates.

Teleflex (TFX) Q3 CY2025 Highlights:

- Revenue: $913 million vs analyst estimates of $892.5 million (19.4% year-on-year growth, 2.3% beat)

- Adjusted EPS: $3.67 vs analyst estimates of $3.38 (8.6% beat)

- Management reiterated its full-year Adjusted EPS guidance of $14.10 at the midpoint

- Operating Margin: -44.8%, down from 19.5% in the same quarter last year

- Free Cash Flow Margin: 8.5%, down from 27.5% in the same quarter last year

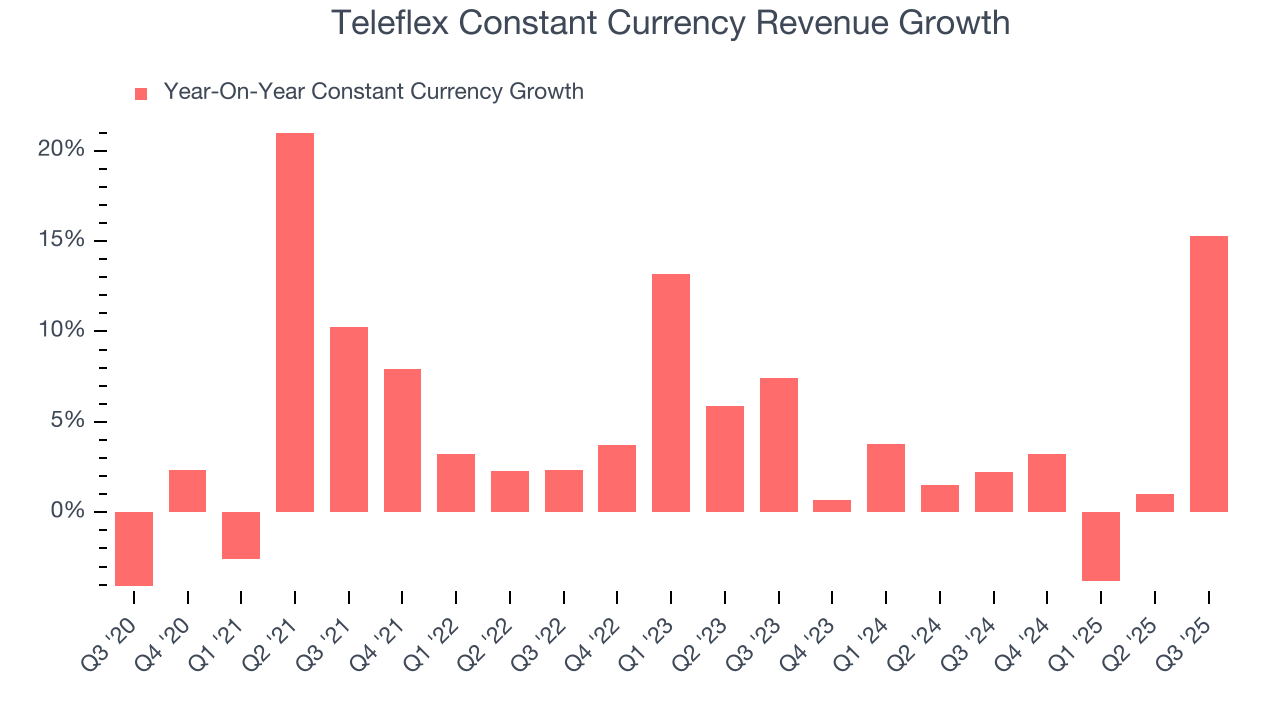

- Constant Currency Revenue rose 15.3% year on year (2.2% in the same quarter last year)

- Market Capitalization: $5.51 billion

Company Overview

With a portfolio spanning from vascular access catheters to minimally invasive surgical tools, Teleflex (NYSE:TFX) designs, manufactures, and supplies single-use medical devices used in critical care and surgical procedures across hospitals worldwide.

Teleflex's product lineup is organized into several key categories that serve different medical specialties. The company's vascular access products include catheters with antimicrobial protection to reduce infection risks and intraosseous access systems for emergency medication delivery when traditional IV access is challenging. Its interventional products help diagnose and treat vascular diseases, while its anesthesia category includes airway management tools, pain management devices, and hemostatic products that accelerate blood clotting in trauma situations.

The company's surgical portfolio features single-use and reusable instruments for laparoscopic and other specialized procedures. A notable offering is the UroLift System, a minimally invasive technology that treats lower urinary tract symptoms due to enlarged prostate without cutting or removing tissue. Teleflex also provides respiratory care products for oxygen therapy and humidification, along with a comprehensive urology line for bladder management in both hospital and home care settings.

Healthcare providers value Teleflex products for their ability to enhance clinical outcomes while reducing procedural costs and improving safety. A hospital might use Teleflex's Arrow catheters during a critical care procedure because their antimicrobial protection helps prevent bloodstream infections, a serious complication that increases patient mortality and healthcare costs. Similarly, a urologist might choose the UroLift System because it can be performed as an outpatient procedure with rapid recovery and fewer side effects than traditional surgical approaches.

Teleflex generates revenue by selling its products directly to hospitals and healthcare providers, through distributors, and to original equipment manufacturers. The company operates globally through four segments: Americas, EMEA (Europe, Middle East, and Africa), Asia Pacific, and OEM (Original Equipment Manufacturer and Development Services).

4. Surgical Equipment & Consumables - Specialty

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

Teleflex competes with major medical device companies including Becton, Dickinson and Company (NYSE:BDX), Boston Scientific (NYSE:BSX), Medtronic (NYSE:MDT), and Baxter International (NYSE:BAX), each offering products that overlap with different segments of Teleflex's diverse medical technology portfolio.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.19 billion in revenue over the past 12 months, Teleflex has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

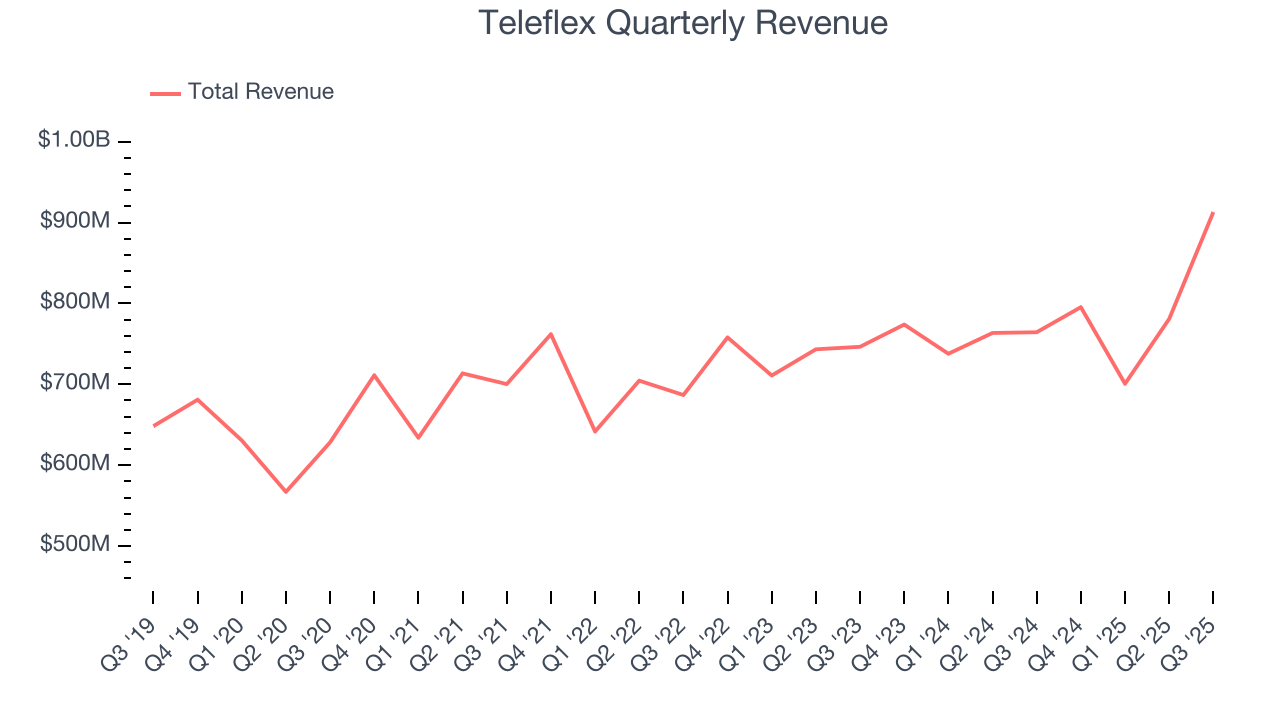

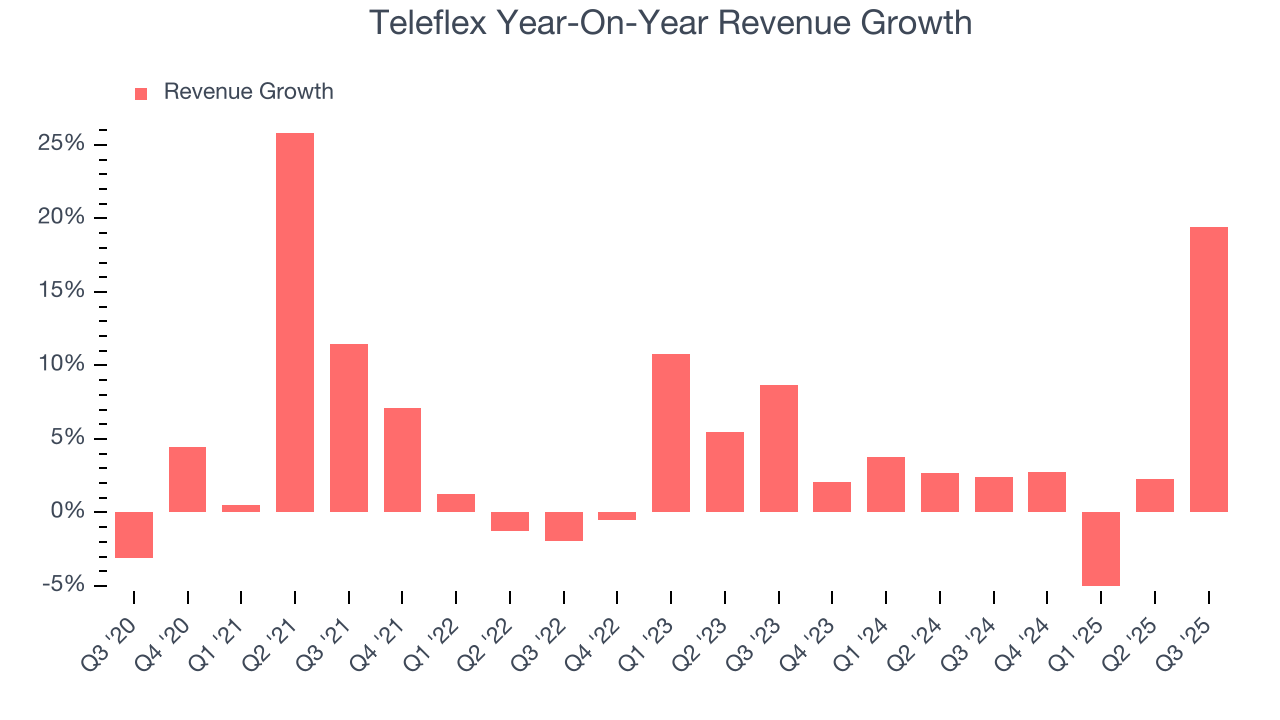

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Teleflex’s sales grew at a mediocre 4.9% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Teleflex’s recent performance shows its demand has slowed as its annualized revenue growth of 3.8% over the last two years was below its five-year trend.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 3% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Teleflex has properly hedged its foreign currency exposure.

This quarter, Teleflex reported year-on-year revenue growth of 19.4%, and its $913 million of revenue exceeded Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 14.1% over the next 12 months, an improvement versus the last two years. This projection is admirable and suggests its newer products and services will catalyze better top-line performance.

7. Operating Margin

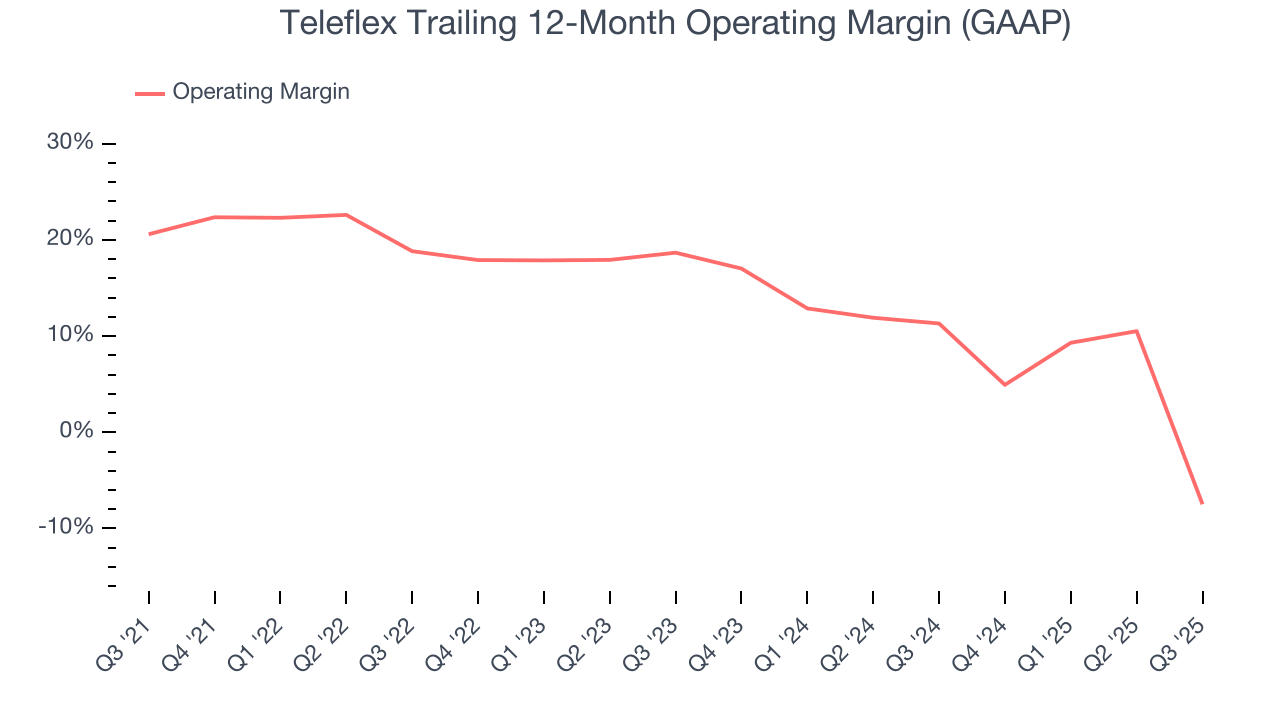

Teleflex has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.9%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Teleflex’s operating margin decreased by 28.1 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 26.1 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Teleflex generated an operating margin profit margin of negative 44.8%, down 64.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

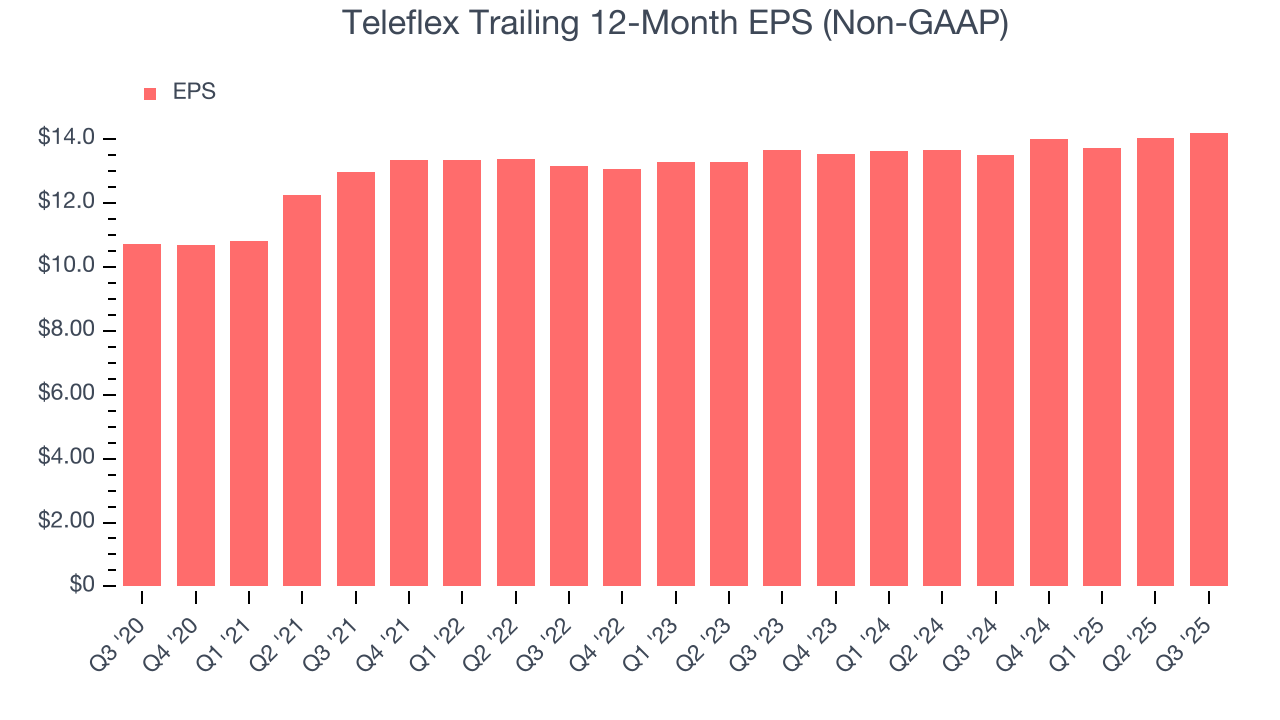

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Teleflex’s decent 5.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q3, Teleflex reported adjusted EPS of $3.67, up from $3.49 in the same quarter last year. This print beat analysts’ estimates by 8.6%. Over the next 12 months, Wall Street expects Teleflex’s full-year EPS of $14.20 to grow 3.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

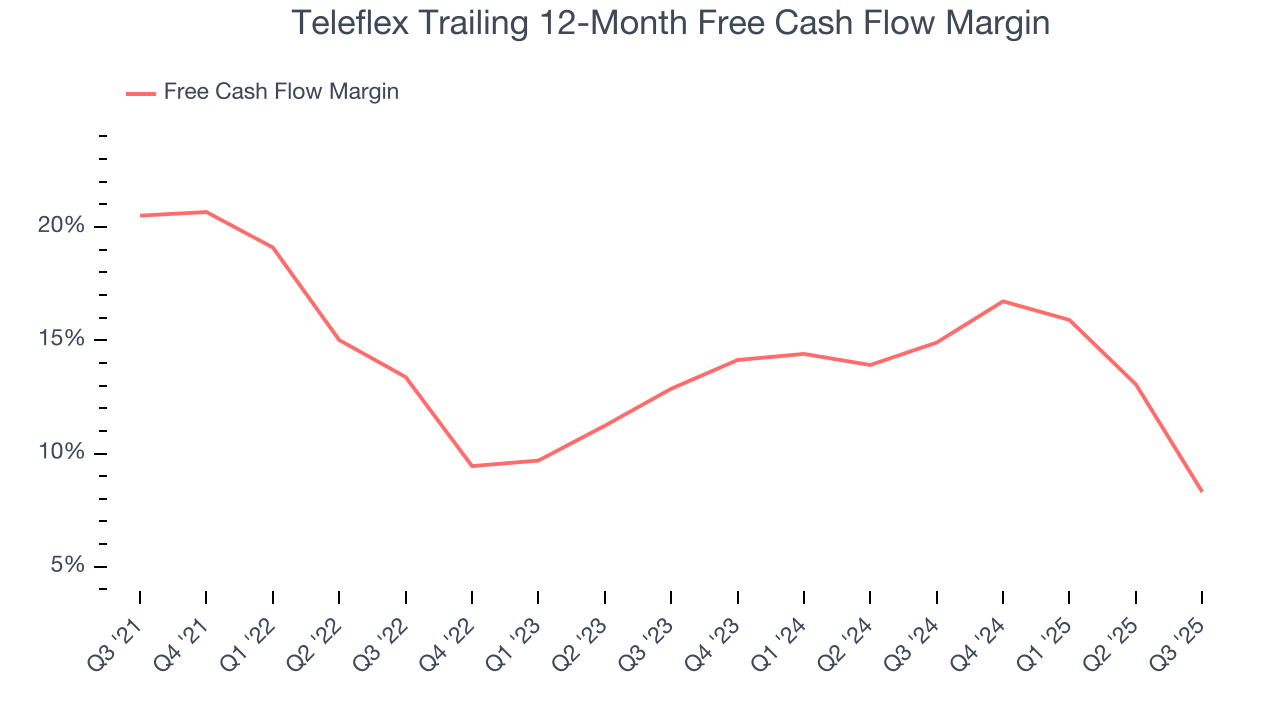

Teleflex has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.8% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that Teleflex’s margin dropped by 12.2 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Teleflex’s free cash flow clocked in at $77.84 million in Q3, equivalent to a 8.5% margin. The company’s cash profitability regressed as it was 18.9 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

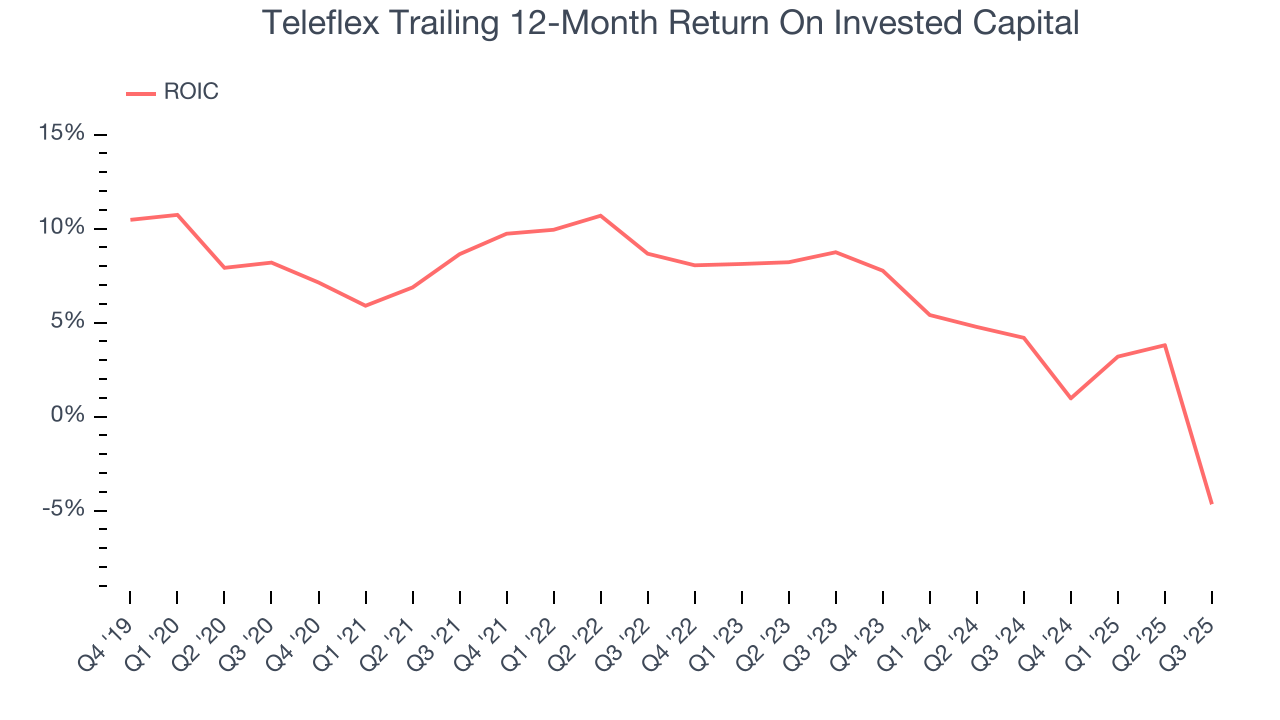

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Teleflex historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.1%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Teleflex’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

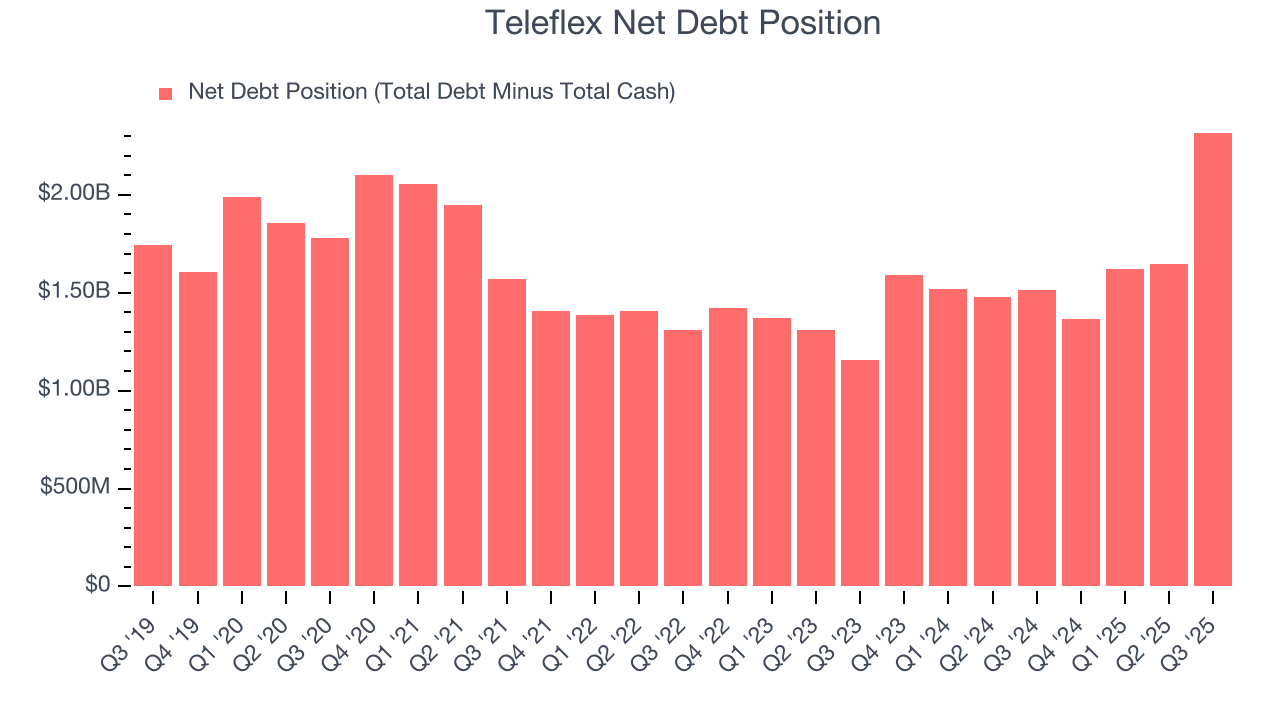

Teleflex reported $354 million of cash and $2.67 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $924.1 million of EBITDA over the last 12 months, we view Teleflex’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $82.75 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Teleflex’s Q3 Results

It was encouraging to see Teleflex beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $125 immediately following the results.

13. Is Now The Time To Buy Teleflex?

Updated: January 23, 2026 at 10:53 PM EST

Are you wondering whether to buy Teleflex or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Teleflex isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue growth was mediocre over the last five years. And while its strong operating margins show it’s a well-run business, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its cash profitability fell over the last five years.

Teleflex’s P/E ratio based on the next 12 months is 7.2x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $131.29 on the company (compared to the current share price of $103.34).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.